The global off-road motorcycle market, driven by rising recreational demand and expanding motorsports participation, is projected to grow at a CAGR of 5.8% from 2023 to 2028, according to Mordor Intelligence. With dirt biking gaining traction across North America, Europe, and parts of Asia-Pacific, the demand for high-performance components—particularly gas tanks—has intensified. As durability, fuel capacity, and lightweight design become critical differentiators, a competitive manufacturing landscape has emerged. These top nine dirt bike gas tank manufacturers are leading innovation and market share, leveraging advanced materials like high-density polyethylene (HDPE) and aluminum alloys to meet OEM and aftermarket demands. Backed by increasing investments in R&D and strategic partnerships within the powersports industry, these companies are well-positioned to capitalize on a market poised to exceed USD 14 billion by 2028.

Top 9 Dirt Bike Gas Tanks Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Metal Works Hand Crafted Factory Alloy Works Style Fuel Tanks

Domain Est. 2016

Website: motomandistributing.com

Key Highlights: World largest selection of alloy vintage fuel tanks. Handcrafted in Italy. 8 liter capacity. Comes with gas cap. Uses OEM fuel tap. Petcock not included….

#2 Dirt Bike & Motocross Aftermarket Fuel Tanks

Domain Est. 2012

Website: chapmoto.com

Key Highlights: Free delivery over $49 · 30-day returnsChaparral carries dirt bike fuel tanks from all the top manufacturers like Acerbis and IMS; so you know you will be getting durable and high…

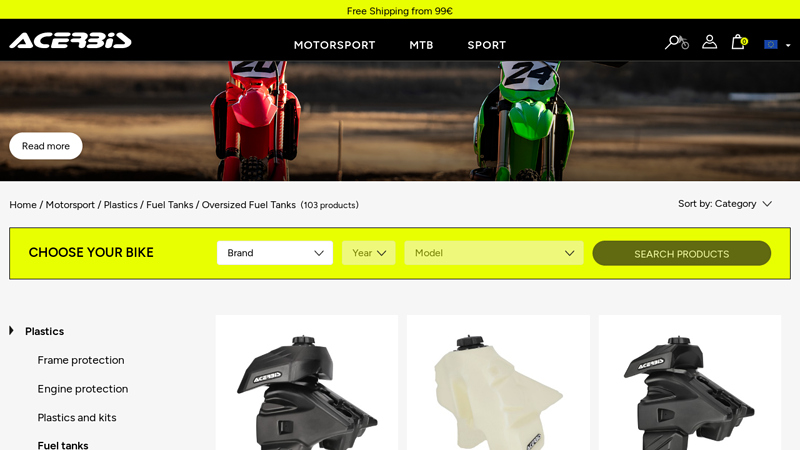

#3 Plastics FUEL TANKS OVERSIZED FUEL TANKS

Domain Est. 1995

Website: acerbis.com

Key Highlights: Discover the Acerbis product catalog of the Plastics FUEL TANKS OVERSIZED FUEL TANKS line: materials, colors and technical details….

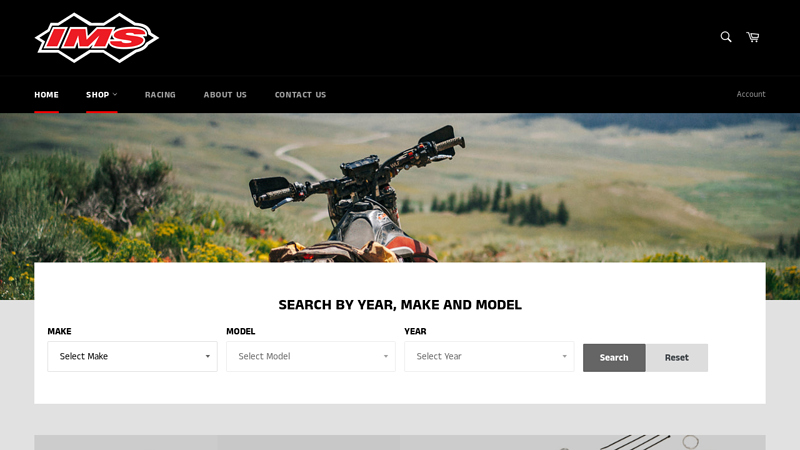

#4 IMS Products

Domain Est. 1995

Website: imsproducts.com

Key Highlights: IMS Products is a premium aftermarket supplier of Fuel Tanks, Foot Pegs, Shift Levers and other off road accessories for Dirt Bikes, ATVs and Side by Sides….

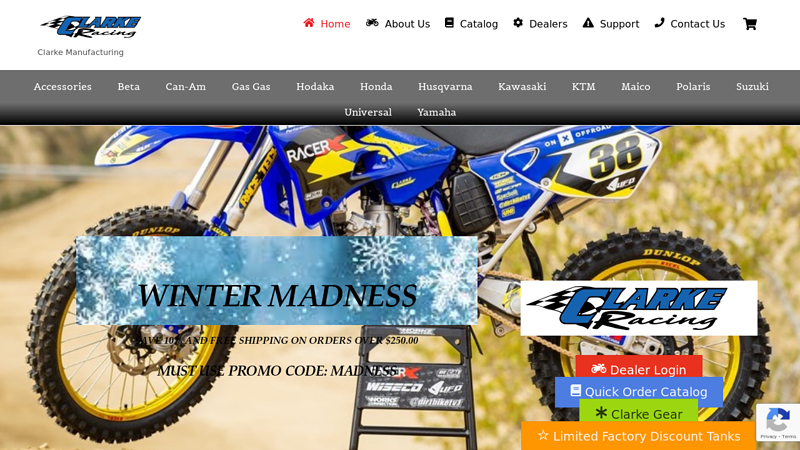

#5 Clarke Racing

Domain Est. 1999

Website: clarkemfg.com

Key Highlights: Shop our online catalog of over 500 motorcycle products….

#6 Dirt Bike Gas Tanks & Accessories

Domain Est. 2000

Website: motosport.com

Key Highlights: Free delivery over $79 · 90-day returnsShop dirt bike gas tanks from brands like Acerbis, P3 & Clarke to replace or upgrade or add larger capacity or an auxiliary tank for a longe…

#7 Clarke Gas Tanks for Dirt Bikes & ATVs

Domain Est. 2005

#8 Fuel Tank

Domain Est. 2017

Website: acerbisusa.com

Key Highlights: UNITED BY DIRT white/black. Part Nr: 2986270001009. Add. $32.95. Clear. Close. Trending Searches. Plastic Kits; Front Fender; Bike Stand; Disc Guards; Gas Tanks ……

#9 Safari Fuel Tanks

Founded: 2001

Website: safaritanks.com.au

Key Highlights: Safari Tanks has been supplying quality, long range motorcycle fuel tanks to riders throughout Australia and across the world since 2001….

Expert Sourcing Insights for Dirt Bike Gas Tanks

H2: 2026 Market Trends for Dirt Bike Gas Tanks

The global market for dirt bike gas tanks is poised for notable transformation by 2026, driven by technological advancements, shifting consumer preferences, and evolving environmental regulations. As the off-road motorcycle industry continues to grow—particularly in emerging markets and among recreational riders—the demand for high-performance, durable, and lightweight fuel storage solutions is increasing. Manufacturers are responding with innovations in materials, design, and integration of fuel systems, positioning gas tanks as more than just functional components but as critical elements of overall bike performance.

1. Material Innovation: Shift Toward Lightweight Composites

One of the most significant trends in the 2026 dirt bike gas tank market is the accelerated transition from traditional steel to advanced materials such as high-density polyethylene (HDPE) and carbon fiber-reinforced polymers. These materials offer substantial weight reduction, improved corrosion resistance, and greater design flexibility. OEMs and aftermarket suppliers are increasingly adopting polymer tanks, especially in high-end motocross and enduro bikes, where weight savings directly impact handling and agility.

2. Design Optimization for Ergonomics and Performance

Gas tank designs are evolving to support enhanced rider ergonomics and bike dynamics. By 2026, tanks are being shaped to lower the bike’s center of gravity, improve fuel slosh control, and provide better knee grip for riders. Computational fluid dynamics (CFD) and 3D modeling are being widely used to optimize fuel flow and structural integrity. Additionally, seamless integration with frame geometry and bodywork has become a key selling point for premium models.

3. Growth in the Aftermarket Segment

The aftermarket for dirt bike gas tanks is expanding rapidly, fueled by customization trends and the popularity of endurance racing and trail modifications. Riders are increasingly investing in replacement tanks that offer increased fuel capacity, improved aesthetics, or specialized finishes (e.g., textured coatings, branded decals). Online retail platforms and direct-to-consumer brands are capitalizing on this demand, offering modular and universal-fit tanks compatible with popular models from Honda, Yamaha, KTM, and Husqvarna.

4. Environmental and Regulatory Pressures

Stricter emissions and fuel vapor regulations—especially in North America and Europe—are pushing manufacturers to adopt sealed, low-permeation fuel systems. By 2026, most new dirt bike gas tanks are expected to comply with EPA and EU standards for evaporative emissions, incorporating integrated carbon canisters and advanced venting systems. This regulatory shift is accelerating R&D in fuel system sealing technologies and influencing material choices.

5. Electrification and Hybridization: A Looming Disruptor

While still in early stages, the rise of electric dirt bikes presents a long-term challenge to the traditional gas tank market. However, for the 2026 timeframe, internal combustion engine (ICE) dirt bikes are expected to maintain dominance, particularly in professional racing and regions with limited charging infrastructure. As such, demand for gas tanks remains robust, though manufacturers are beginning to diversify into hybrid-compatible fuel systems or dual-purpose designs that may accommodate future powertrain transitions.

6. Regional Market Dynamics

North America and Europe remain the largest markets for premium and performance-oriented gas tanks, driven by strong off-road riding cultures and high disposable income. Meanwhile, Asia-Pacific—especially India, Indonesia, and Thailand—is witnessing rising demand due to expanding middle-class access to recreational vehicles and government support for motorsports. Localized manufacturing and cost-effective polymer tanks are gaining traction in these regions.

Conclusion

By 2026, the dirt bike gas tank market will be characterized by innovation in materials and design, regulatory adaptation, and strong aftermarket growth. While electrification looms on the horizon, the continued popularity of ICE-powered off-road bikes ensures sustained demand. Companies that invest in lightweight, compliant, and customizable fuel tank solutions will be best positioned to lead the market in this dynamic landscape.

Common Pitfalls Sourcing Dirt Bike Gas Tanks (Quality, IP)

Sourcing dirt bike gas tanks, especially from third-party or overseas suppliers, presents several critical challenges related to quality control and intellectual property (IP) rights. Being aware of these pitfalls is essential for distributors, resellers, and even informed riders to avoid legal, safety, and reputational risks.

Poor Manufacturing Quality and Material Defects

One of the most prevalent issues when sourcing dirt bike gas tanks is inconsistent or substandard manufacturing quality. Many third-party suppliers, particularly those offering low-cost alternatives, cut corners during production. This can result in:

- Thin or uneven wall thickness: Tanks may be prone to dents, punctures, or leaks under normal riding conditions.

- Poor welds or seams: Inadequate welding compromises structural integrity, increasing the risk of fuel leaks—a serious safety hazard.

- Use of low-grade materials: Non-OEM tanks may use inferior steel or plastic that corrodes easily or degrades when exposed to modern ethanol-blended fuels.

- Improper sealing surfaces: Issues with the fuel cap, petcock, or mounting points can lead to fuel spillage or difficulty during installation.

These defects not only reduce the lifespan of the tank but can also pose fire and environmental risks, potentially leading to liability claims.

Lack of Compatibility and Fitment Issues

Even if a gas tank appears visually similar to the OEM part, dimensional inaccuracies are common. Poor fitment can lead to:

- Misalignment with frame mounts, fuel lines, or vent hoses.

- Interference with other components such as the seat, airbox, or suspension.

- Incompatibility with fuel gauges or sensors (on models so equipped).

Such issues increase labor costs for end users and damage the reputation of the supplier due to customer dissatisfaction and return rates.

Intellectual Property (IP) Infringement

Many aftermarket or imitation gas tanks are direct copies of original equipment manufactured (OEM) designs from major brands like Honda, Yamaha, KTM, or Kawasaki. This raises significant IP concerns:

- Design Patent Infringement: OEM gas tanks often feature protected shapes and contours. Unauthorized replication can violate design patents.

- Trademark Violations: Fake tanks may include unauthorized use of manufacturer logos, emblems, or branding, misleading consumers and infringing on trademark rights.

- Copyright Issues: The unique design elements of a tank may be protected under copyright law, especially if they are artistic in nature.

Sourcing such infringing products—even unknowingly—can expose buyers and resellers to legal action, customs seizures (especially in the EU and U.S.), and costly product recalls.

Absence of Safety and Environmental Certifications

OEM manufacturers adhere to strict safety and emissions standards (e.g., EPA, DOT, or regional equivalents). Many aftermarket tanks, however, are not certified and may:

- Lack proper fuel vapor seals or venting systems, contributing to emissions non-compliance.

- Fail to meet flammability or crash safety standards.

- Not be tested for long-term durability or fuel compatibility.

Using or selling non-compliant tanks may violate local regulations and expose the seller to regulatory penalties.

Inadequate Documentation and Traceability

Low-cost suppliers often provide little to no documentation, making it difficult to:

- Verify material specifications or manufacturing standards.

- Trace the origin of the product in case of defects or recalls.

- Provide warranty support or technical data to customers.

This lack of transparency increases risk and complicates post-sale support.

Conclusion

When sourcing dirt bike gas tanks, prioritizing reputable suppliers who ensure quality control, proper fitment, and IP compliance is crucial. Avoiding the temptation of low-cost, unverified alternatives helps prevent safety hazards, legal exposure, and damage to brand reputation. Always request certifications, verify design rights, and conduct thorough product testing before large-scale procurement.

H2: Logistics & Compliance Guide for Dirt Bike Gas Tanks

Ensuring the safe, legal, and efficient movement of dirt bike gas tanks—from manufacturing to end-user—requires strict adherence to logistics protocols and regulatory compliance. This guide outlines key considerations under the H2 (UN 1048, Hydrogen) hazard class, addressing potential misclassification risks and best practices.

H2: Understanding the Hazard Classification Misconception

- Critical Clarification: Dirt bike gas tanks themselves (the physical metal or plastic containers) are NOT classified as H2 (Hydrogen) under transportation regulations (e.g., UN/DOT, ADR, IMDG). H2 refers specifically to gaseous hydrogen as a hazardous material.

- Relevant Hazard: The primary hazardous material associated with dirt bike gas tanks is UN 1203, Gasoline (Petrol), Class 3, PG II (Flammable Liquid). Empty tanks pose minimal hazard, but residual fuel vapors can be significant.

- Why H2 is Mentioned: This section addresses the confusion that can arise, especially if tanks are labeled or marketed for alternative fuels (like hydrogen, though extremely rare for consumer dirt bikes), or if there’s a misunderstanding of hazard codes. Never ship a dirt bike gas tank under H2 classification unless it definitively contains gaseous hydrogen, which is highly atypical.

H2: Logistics Requirements for Dirt Bike Gas Tanks

-

Pre-Shipment Preparation:

- Depressurization & Draining: Ensure all tanks are completely drained of fuel and any pressure is fully released. Follow manufacturer procedures.

- Vapor Purging (Critical for Flammable Vapors): For tanks previously containing gasoline, especially if being shipped via air or in large quantities, purging residual flammable vapors with an inert gas (like Nitrogen) may be mandatory (e.g., IATA PI 903, Packing Instruction 903 for “Empty Receptacles, Residue Last Contained”). Consult specific regulations.

- Securing Openings: Cap all filler necks, vent lines, and fuel line connections securely to prevent leaks, contamination, and ingress of moisture/dirt. Use protective caps.

- Cleaning (If Required): For compliance with “empty” definitions or customs, interior cleaning might be necessary to remove sludge or significant residue.

-

Packaging:

- Robust Outer Packaging: Use strong, undamaged boxes or crates capable of protecting the tank from impact, crushing, and punctures during handling and transit.

- Internal Protection: Secure the tank within the packaging using cushioning material (foam, bubble wrap, cardboard dividers) to prevent movement and protect fittings and the tank surface. Prevent contact with other hard items.

- Ventilation (For Vapors): If residual flammable vapors are present and not purged, packaging may need ventilation as per specific Packing Instructions (e.g., PI 903). This is often avoided by proper purging.

- Labeling: Clearly label the package with:

- “EMPTY FUEL TANK – RESIDUE LAST CONTAINED GASOLINE” or similar.

- Handling labels (Fragile, This Way Up).

- NO H2/UN1048 LABELS.

- Recipient/Shipper information.

-

Transportation Modes:

- Ground (Road/Rail): Follow national regulations (e.g., 49 CFR in the US). “Empty” tanks meeting criteria (drained, purged, secured) are often exempt from full hazardous materials shipping requirements, but documentation may still be needed. Check ADR for Europe.

- Air (IATA): Strictest regulations. Tanks must be thoroughly drained, purged of flammable vapors (usually by inert gas), and securely capped. They typically fall under IATA PI 903 (Empty Receptacles, Residue Last Contained). This is NOT H2. Requires specific declaration if shipping as “Dangerous Goods” or may be shipped as “Not Restricted” if meeting all PI 903 conditions. H2 (UN 1048) has completely different, highly restrictive air transport rules.

- Sea (IMDG): Follow IMDG Code. Similar principles to air and ground. Use appropriate packing instruction (e.g., 903 for empty receptacles). Requires Dangerous Goods Declaration if applicable.

-

Documentation:

- Commercial Invoice: Essential for international shipments, detailing contents (e.g., “Empty Aluminum Dirt Bike Fuel Tank – Residue Last Contained Gasoline”), value, parties.

- Packing List: Itemizes contents per package.

- Dangerous Goods Declaration (If Required): Only if shipping under PI 903 or if tanks contain residual fuel above thresholds. Must classify under UN 1203/Class 3 or PI 903, NEVER UN 1048/H2.

- Certificate of Conformity (If Applicable): For regulated markets (e.g., EPA, CARB, EU type-approval) if the tank meets specific emissions or safety standards.

H2: Compliance & Regulatory Oversight

-

Key Regulatory Bodies:

- Transportation: DOT (PHMSA) – USA, ECHA/ADR – Europe, IATA – Air, IMDG – Sea, Transport Canada.

- Environmental: EPA (USA), Environment and Climate Change Canada, European Commission (End-of-Life Vehicles Directive).

- Safety/Standards: ANSI, SAE, ISO, FMVSS (USA), UNECE Regulations (e.g., R122).

- Customs: CBP (USA), HMRC (UK), etc.

-

Critical Compliance Points:

- Correct Classification: ABSOLUTELY DO NOT CLASSIFY OR SHIP DIRT BIKE GAS TANKS AS H2 (UN 1048). Use UN 1203/Class 3 for fuel, or PI 903/Empty Receptacles for drained/emptied tanks. Misclassification is a serious violation.

- “Empty” Definition: Regulations define “empty” based on residue. A drained tank with flammable vapor is often not considered empty for dangerous goods purposes. Purging may be required.

- Country-Specific Modifications: Tanks designed for specific markets (e.g., CARB-compliant in California) must meet those requirements. Shipping non-compliant tanks may be illegal.

- End-of-Life (EOL) & Recycling: Tanks are typically classified as Universal Waste (USA) or under WEEE (Europe) when discarded. Proper recycling channels must be used; landfill disposal is often prohibited. H2 compliance is irrelevant here.

- Labeling & Marking: Tanks themselves may bear manufacturer, capacity, material, and safety warnings. Ensure these are present and legible. Shipping labels are for the package.

-

Best Practices to Avoid H2 Confusion:

- Training: Ensure all logistics and warehouse staff understand hazard class distinctions. Emphasize that H2 means hydrogen gas, not a category for fuel tanks.

- Clear Internal Procedures: Document steps for preparing, packaging, and declaring fuel tanks. Explicitly state the correct UN number (e.g., 1203 or PI 903) and prohibit use of UN 1048.

- Supplier/Vendor Communication: Clearly specify preparation requirements (drained, purged, capped) in purchase orders and shipping instructions.

- Regulatory Updates: Regularly monitor changes in IATA, IMDG, 49 CFR, ADR, etc., regarding empty receptacles and flammable liquid residues.

Summary: The logistics of dirt bike gas tanks revolves around managing the flammable liquid hazard (UN 1203, Class 3) of residual gasoline, not hydrogen (H2/UN 1048). Success depends on proper draining, potential purging, secure packaging, accurate documentation using the correct hazard class (never H2), and adherence to mode-specific regulations for “empty” or residue-containing receptacles. Vigilance against misclassification is paramount.

In conclusion, sourcing dirt bike gas tanks requires careful consideration of compatibility, material quality, brand reputation, and cost. Whether purchasing OEM (original equipment manufacturer) tanks for guaranteed fit and finish or opting for aftermarket alternatives for customization and potential cost savings, it’s essential to ensure the tank matches your bike’s make, model, and year. Aluminum and high-density plastic are common materials, each offering distinct advantages in durability and weight. Additionally, evaluating seller credibility, warranty options, and customer reviews can significantly impact satisfaction and long-term reliability. By conducting thorough research and prioritizing quality and compatibility, riders can find a dependable gas tank that enhances both performance and aesthetics of their dirt bike.