The global diode laser market is experiencing robust growth, driven by rising demand across medical aesthetics, industrial processing, and dental applications. According to Mordor Intelligence, the diode laser market was valued at USD 1.78 billion in 2023 and is projected to reach USD 2.84 billion by 2029, growing at a CAGR of 8.1% during the forecast period. Factors such as technological advancements, increasing adoption of minimally invasive procedures, and expanding applications in hair removal, skin treatments, and material processing are accelerating market expansion. As demand surges, manufacturers are investing heavily in R&D to enhance power efficiency, cooling systems, and treatment precision. This growth momentum has intensified competition, positioning a select group of companies at the forefront of innovation and market share. Based on production scale, technological capabilities, and global reach, the following nine manufacturers have emerged as key leaders in the diode laser machine industry.

Top 9 Diode Laser Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 BVLASER

Domain Est. 2016 | Founded: 2010

Website: bvlaser.com

Key Highlights: Established in 2010, BVLASER is a China’s and the world’s first-class medical aesthetic equipment manufacturer that provides ODM&OEM service. Quick Links….

#2 Award-Winning Dental Laser Company

Domain Est. 2008

Website: amdlasers.com

Key Highlights: Leading manufacturers of affordable medical diode laser technology and innovative dental solutions to ensure every dental professional the best technology….

#3 No.1 ENDOLASER TECHNOLOGY MANUFACTURER

Domain Est. 2020

Website: triangelmed.com

Key Highlights: Triangel is a global leader in Endolaser and medical aesthetic device innovation. Driven by independent R&D and supported by clinical collaborations with ……

#4 Laser Company for Industrial Laser Solutions

Domain Est. 1996

Website: laserline.com

Key Highlights: The leading laser company for integrated & customized diode laser manufacturing solutions for various industries & applications….

#5 Dimed Laser

Domain Est. 2016

Website: dimedlaser.com

Key Highlights: Dimed Laser is a professional manufacturer of advanced surgical and medical diode laser systems, providing a wide range of feature-rich laser treatment ……

#6 Candela Medical

Domain Est. 2018

Website: candelamedical.com

Key Highlights: Candela Medical is a leader in medical aesthetic and cosmetic lasers, a respected US-based manufacturer of other energy-based equipment such as intense ……

#7 Diode Laser Hair Removal Machines [FDA Manufacturer]

Domain Est. 2018

Website: diode-laser.com

Key Highlights: We are manufacturer for diode laser hair removal machines. Our diode lasers are US FDA + TUV Medical CE approved! We are very professional in diode lasers….

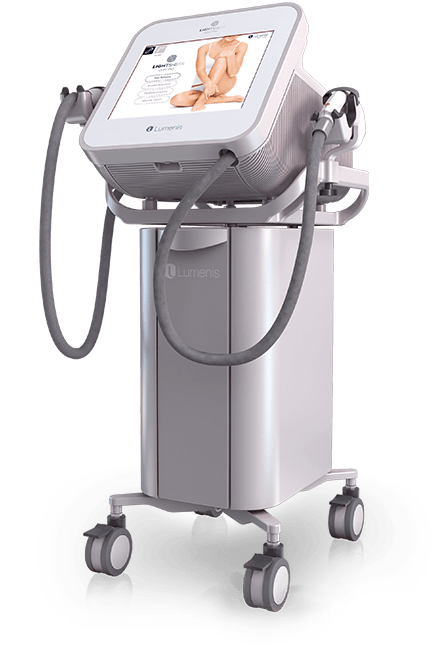

#8 LightSheer QUATTRO: Diode Laser Hair Removal Machine

Domain Est. 1999

Website: lumenis.com

Key Highlights: Lightsheer QUATTRO utilizes two wavelengths to treat every skin tone and type to accommodate more patients for a safer laser hair removal process….

#9 IPG Photonics

Domain Est. 1999

Website: ipgphotonics.com

Key Highlights: IPG Photonics manufactures high-performance fiber lasers, amplifiers, and laser systems for diverse applications and industries. Discover your solution….

Expert Sourcing Insights for Diode Laser Machine

H2: 2026 Market Trends for Diode Laser Machines

The diode laser machine market is poised for substantial transformation by 2026, driven by technological advancements, expanding applications, and shifting industrial demands. Analysis of key trends reveals a dynamic landscape characterized by increased adoption, performance improvements, and market diversification.

1. Surge in Industrial Material Processing Dominance

By 2026, diode lasers are expected to solidify their position in industrial manufacturing, particularly in welding, brazing, and surface treatment. Their high electrical efficiency (often exceeding 50%), compact footprint, and low maintenance compared to CO₂ or fiber lasers make them ideal for integration into automated production lines. Growth will be fueled by demand in automotive (e.g., battery welding for EVs), aerospace, and precision engineering sectors seeking cost-effective, reliable solutions.

2. Advancements in Power and Beam Quality

A critical trend is the rapid improvement in output power and beam quality of direct diode lasers. Continuous-wave (CW) systems are reaching multi-kilowatt levels (5–10 kW+) with increasingly focusable beams, enabling them to compete directly with fiber lasers in cutting and high-precision welding. Innovations in beam shaping, wavelength stabilization, and cooling technologies will enhance process stability and broaden application scope.

3. Expansion into New Markets and Applications

Beyond traditional manufacturing, diode laser machines are penetrating emerging sectors:

– Additive Manufacturing: Use in directed energy deposition (DED) and selective laser sintering (SLS) for metal 3D printing due to efficiency and wavelength advantages.

– Medical and Aesthetic Devices: Growth in compact, portable systems for dermatology, surgery, and dental procedures, leveraging precise wavelength targeting.

– Defense and Sensing: Increased adoption in LiDAR, infrared countermeasures, and directed energy systems due to reliability and power scalability.

4. Integration of Smart Manufacturing and IIoT

By 2026, diode laser systems will increasingly feature embedded sensors, real-time monitoring, and connectivity to Industrial Internet of Things (IIoT) platforms. Predictive maintenance, adaptive process control, and data-driven optimization will become standard, enhancing operational efficiency and reducing downtime in smart factories.

5. Regional Market Shifts and Competitive Landscape

Asia-Pacific (especially China, Japan, and South Korea) will remain a dominant force in both production and consumption, driven by electronics and automotive manufacturing. North America and Europe will see growth in high-precision and R&D applications. Competition will intensify, with established players (e.g., Coherent, nLIGHT, TRUMPF) innovating alongside emerging regional manufacturers, leading to price optimization and faster technology diffusion.

6. Sustainability and Energy Efficiency as Key Drivers

With global focus on carbon reduction, the inherent energy efficiency of diode lasers will be a major selling point. Their lower power consumption and reduced cooling requirements align with corporate sustainability goals, making them a preferred choice in green manufacturing initiatives.

Conclusion

By 2026, the diode laser machine market will be defined by higher performance, broader applicability, and deeper integration into intelligent production ecosystems. As technological barriers continue to fall, diode lasers will displace legacy laser types in many applications, driving market expansion and innovation across multiple high-growth industries.

Common Pitfalls When Sourcing Diode Laser Machines: Quality and Intellectual Property Concerns

Sourcing a diode laser machine, especially from international or less-established suppliers, carries significant risks related to both product quality and intellectual property (IP). Being aware of these pitfalls is crucial for making a sound investment and protecting your business.

Poor Build Quality and Component Selection

Many low-cost diode laser machines, particularly those from uncertified manufacturers, use substandard materials and components. This includes cheap optics, under-specification laser diodes, and inadequate cooling systems. These compromises lead to inconsistent beam quality, shorter operational lifespans, and frequent breakdowns, ultimately increasing total cost of ownership through repairs and downtime.

Inaccurate Power Ratings and Performance Claims

A widespread issue is the misrepresentation of laser power. Some suppliers advertise “peak” or “pulse” power rather than continuous wave (CW) output, making machines appear more powerful than they are. Additionally, inflated wattage claims are common—machines labeled as 2000W may deliver significantly less actual cutting or engraving power due to poor engineering or component inefficiencies.

Lack of Quality Control and Testing

Reputable manufacturers implement strict quality control (QC) processes, including burn-in testing and beam profiling. However, many budget suppliers skip these steps or perform minimal checks. As a result, units may arrive with misaligned optics, unstable drivers, or defective diodes, leading to poor performance right out of the box.

Use of Counterfeit or Non-Compliant Components

To reduce costs, some manufacturers use counterfeit or non-industry-standard laser diodes and electronic components. These components often lack proper certifications (such as FDA, CE, or RoHS compliance), fail prematurely, and may pose safety hazards. Furthermore, they can void warranties and create reliability issues.

Intellectual Property (IP) Infringement Risks

Sourcing from certain regions may expose buyers to IP infringement risks. Some manufacturers reverse-engineer or copy designs, software, and control systems from established brands without licensing. Purchasing such machines could inadvertently involve your business in legal disputes, especially if the machine is used commercially in regulated markets.

Proprietary Software and Locked Systems

Many budget machines run on closed-source, proprietary software that cannot be modified or integrated with third-party tools. This limits customization, creates dependency on the supplier for updates, and may include hidden data collection or licensing restrictions that compromise operational control.

Inadequate Documentation and Support

Poor-quality machines often come with incomplete or poorly translated manuals, schematics, and safety information. This lack of documentation makes troubleshooting, maintenance, and regulatory compliance difficult. Combined with limited technical support, this can result in prolonged downtime and operational inefficiencies.

Mitigation Strategies

To avoid these pitfalls, conduct thorough due diligence: verify supplier credentials, request third-party test reports, inspect sample units, and consult legal counsel regarding IP risks. Prioritize suppliers with transparent manufacturing practices, component traceability, and compliance certifications to ensure long-term reliability and legal safety.

Logistics & Compliance Guide for Diode Laser Machine

This guide outlines the essential logistics and compliance considerations for the safe and legal transportation, import/export, and operation of diode laser machines. Adherence to these guidelines ensures regulatory compliance, minimizes risks, and facilitates smooth supply chain operations.

Regulatory Classification and Documentation

Diode laser machines are subject to multiple regulatory frameworks depending on their power, application, and destination. Proper classification and documentation are critical.

- Laser Safety Classification (IEC 60825-1 / FDA 21 CFR 1040.10): Identify the laser class (typically Class 3B or Class 4 for industrial diode lasers). This determines safety requirements, labeling, and user training needs.

- Harmonized System (HS) Code: Accurately determine the HS code (e.g., 8515.21 or 8543.70 depending on function) for customs clearance and duty assessment.

- Export Controls: Check if the laser falls under dual-use regulations (e.g., EU Dual-Use Regulation, U.S. EAR). High-power lasers may require export licenses.

- Required Documentation: Prepare commercial invoice, packing list, bill of lading/air waybill, certificate of origin, and laser safety compliance certificate (e.g., IEC report).

Packaging and Handling Requirements

Proper packaging ensures device integrity and personnel safety during transit.

- Shock and Vibration Protection: Use custom-fitted foam or molded packaging to prevent internal damage. Secure all components.

- Environmental Protection: Seal packaging to prevent moisture, dust, or condensation, especially for international shipping.

- Laser Safety Precautions: Disable or secure the laser head. Cover apertures with protective caps. Include clear “Laser Radiation” warning labels on the exterior.

- Orientation Labels: Apply “This Side Up” and “Fragile” labels to prevent improper handling.

Transportation and Shipping

Choose appropriate carriers and modes based on regulations and delivery timelines.

- Carrier Selection: Use freight forwarders experienced with laser or sensitive equipment. Verify carrier compliance with hazardous material regulations if applicable.

- Mode of Transport: Air freight may require additional IATA Dangerous Goods Regulations review if batteries (e.g., for portable units) are included. Ground and sea freight must comply with IMDG or ADR as relevant.

- Insurance: Obtain all-risk insurance covering damage, loss, and delays, particularly for high-value units.

Import/Export Compliance

Ensure adherence to national and international trade laws.

- Customs Clearance: Submit accurate documentation to customs authorities. Be prepared for inspections, especially for high-power lasers.

- Import Permits/Licenses: Verify if the destination country requires specific permits for laser equipment (e.g., Russia, China, India may have additional requirements).

- Duties and Taxes: Calculate and prepare for import VAT, customs duties, and any anti-dumping fees.

- Restricted Destinations: Screen against denied party lists (e.g., OFAC, EU Consolidated List) to avoid shipping to embargoed regions.

Safety and Regulatory Compliance at Destination

Ensure the end-user can legally and safely operate the machine.

- Local Regulations: Confirm compliance with local laser safety standards (e.g., OSHA in the U.S., HSE in the UK, DGUV in Germany).

- User Training and Manuals: Provide operation, safety, and maintenance manuals in the local language. Include laser safety procedures and emergency protocols.

- Installation and Certification: Some jurisdictions require on-site safety checks or third-party certification before operation.

- Warranty and Service Compliance: Ensure service technicians are trained and equipped to follow local safety protocols.

Environmental and Disposal Compliance

Plan for end-of-life management in accordance with environmental laws.

- WEEE Compliance (EU): Register the product under Waste Electrical and Electronic Equipment directives if applicable.

- Battery Disposal: If the unit contains batteries, comply with local battery recycling regulations (e.g., EPA guidelines in the U.S.).

- Hazardous Materials: Identify any hazardous components (e.g., certain optics, coolants) and provide disposal guidance.

Recordkeeping and Audits

Maintain comprehensive records to support compliance.

- Retention Period: Keep shipping documents, compliance certificates, export licenses, and safety test reports for at least 5 years.

- Audit Preparedness: Ensure records are organized and accessible for regulatory audits or customer inquiries.

By following this guide, stakeholders can ensure the lawful, safe, and efficient movement and deployment of diode laser machines across global markets.

Conclusion for Sourcing a Diode Laser Machine

After a thorough evaluation of available options, technical specifications, supplier reliability, cost considerations, and intended applications, sourcing a diode laser machine proves to be a strategic investment for enhancing precision, efficiency, and productivity in processes such as cutting, engraving, welding, or medical treatments—depending on the specific use case.

Diode laser machines offer key advantages including high energy efficiency, compact design, long operational lifespan, and low maintenance requirements compared to traditional laser technologies. When selecting a supplier, it is crucial to consider factors such as laser power output, wavelength suitability, beam quality, cooling systems, software compatibility, and after-sales support.

The selected diode laser machine aligns well with operational needs, providing a balance between performance and cost-effectiveness. Additionally, partnering with a reputable manufacturer ensures product quality, compliance with safety standards, and access to technical training and service support.

In conclusion, sourcing the diode laser machine will significantly improve process accuracy and throughput, support scalability, and contribute to long-term operational savings. With proper implementation and maintenance, this technology will deliver a strong return on investment and position the organization at the forefront of technological advancement in its field.

![Diode Laser Hair Removal Machines [FDA Manufacturer]](https://www.sohoinchina.com/wp-content/uploads/2026/01/diode-laser-hair-removal-machines-fda-manufacturer-347.jpg)