The global stainless steel market is witnessing robust expansion, driven by increasing demand across industries such as construction, automotive, healthcare, and consumer goods. According to a 2023 report by Mordor Intelligence, the market was valued at USD 135.6 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2028, reaching an estimated USD 183.7 billion by the end of the forecast period. This growth is fueled by rising urbanization, infrastructure development, and the material’s corrosion resistance and recyclability—key attributes favoring sustainable manufacturing. With Asia Pacific dominating production and consumption—China alone accounting for over half of global stainless steel output—the competitive landscape is shaped by a mix of established giants and regionally focused players innovating in specific stainless steel grades. As demand diversifies across austenitic, ferritic, martensitic, and duplex alloys, manufacturers are increasingly differentiating themselves through process efficiency, product specialization, and R&D investment. In this evolving environment, identifying the top 10 stainless steel types manufacturers provides crucial insight into who is leading innovation, scaling production, and meeting the dynamic needs of global supply chains.

Top 10 Different Stainless Steel Types Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Stainless Steel Manufacturers

Domain Est. 2015

Website: stainlesssteelmanufacturers.org

Key Highlights: Easily find the top stainless steel manufacturers and industrial suppliers who offer complex stainless steel products with years of experience and are ISO ……

#2 North American Stainless

Domain Est. 1999 | Founded: 1990

Website: northamericanstainless.com

Key Highlights: Founded in 1990, North American Stainless (NAS) has undertaken several phases of expansion to become the largest, fully integrated stainless steel producer in ……

#3 Outokumpu

Domain Est. 1996

Website: outokumpu.com

Key Highlights: Outokumpu is a global leader in sustainable stainless steel manufacturing. We manufacture a variety of stainless steel products. Discover our offering….

#4 Specialty Steel

Domain Est. 1999

Website: univstainless.com

Key Highlights: Universal Stainless produces steel in a variety of forms and grades, including specialty bar, plate, forging quality billet and ingot….

#5 of stainless steels

Domain Est. 2000

Website: worldstainless.org

Key Highlights: worldstainless.org is the most comprehensive site for anyone interested in stainless steels. You will find documentation on the properties, ……

#6 Stainless Steel supplier in the US

Domain Est. 2001

Website: usa.myjacquet.com

Key Highlights: JACQUET in the US offers the full range of stainless steel plate and bar in all major types: austenitic, ferritic, martensitic, duplex and precipitation ……

#7 Stainless Steel Grades and Families: Explained

Domain Est. 2002

Website: unifiedalloys.com

Key Highlights: You’ll find various grades that help to describe specific properties of the alloy such as toughness, magnetism, corrosion resistance and alloy composition….

#8 North American Steel Products

Domain Est. 2004

Website: clevelandcliffs.com

Key Highlights: We offer flat-rolled carbon steel, stainless, electrical, plate, long steel products, carbon and stainless steel tubing, and hot and cold stamping and tooling….

#9 Understanding stainless-steel grades

Domain Est. 2012

Website: essentracomponents.com

Key Highlights: What is stainless steel? What are grades of stainless steel? Understand all there is to know with this guide from Essentra Components….

#10 The different grades of stainless steel

Domain Est. 2014

Website: beal-inox.com

Key Highlights: According to their composition, inox steels are classified into 4 families: martensitic (group C), ferritic (group F), austenitic (group A), and austeno- ……

Expert Sourcing Insights for Different Stainless Steel Types

2026 Market Trends for Different Stainless Steel Types

As global industrial demand, sustainability imperatives, and technological advancements converge, the stainless steel market is poised for significant shifts by 2026. Different stainless steel grades are expected to experience divergent growth trajectories influenced by sector-specific demands, raw material dynamics, and environmental regulations. Here’s an analysis of key trends affecting major stainless steel types:

Austenitic Stainless Steels (e.g., 304, 316, 310)

Austenitic stainless steels, particularly grades 304 and 316, will continue to dominate the market in 2026, driven by their excellent corrosion resistance, formability, and versatility. The construction, automotive, and consumer goods sectors will sustain demand, with particular growth in emerging economies. However, rising nickel prices and supply chain volatility may prompt increased interest in nickel-saving alternatives like 200-series (e.g., 201, 202), especially in cost-sensitive applications. Additionally, the push for circularity will boost demand for recycled-content austenitic grades, particularly in Europe and North America under stringent green regulations.

Ferritic Stainless Steels (e.g., 430, 409, 444)

Ferritic stainless steels are expected to see strong growth by 2026, primarily due to their lower cost and reduced dependency on nickel and molybdenum. The automotive industry—especially in exhaust systems and under-the-hood components—will remain a major driver. Furthermore, growing investments in renewable energy infrastructure, such as solar thermal systems and biogas plants, will favor ferritic grades like 444 for their chloride resistance and cost-effectiveness. Regulatory support for energy-efficient appliances will also increase their use in white goods and water heaters.

Duplex Stainless Steels (e.g., 2205, 2507)

Duplex stainless steels are projected to experience above-average growth, particularly in demanding industrial and offshore applications. By 2026, increasing exploration in deepwater oil and gas, coupled with the expansion of desalination plants and offshore wind farms, will drive demand for high-strength, corrosion-resistant materials like 2205 and super duplex grades. Their superior performance in chloride-rich environments makes them ideal for infrastructure in coastal and marine settings. However, high alloying costs and complex fabrication requirements may limit penetration into cost-sensitive sectors.

Martensitic Stainless Steels (e.g., 410, 420, 440C)

Martensitic grades will maintain steady demand in niche applications requiring high strength, hardness, and wear resistance. By 2026, key markets will include cutlery, surgical instruments, valves, and industrial tools. Innovations in additive manufacturing (3D printing) may increase utilization of tool-grade martensitic steels in precision components. However, overall market growth will be moderate due to competition from alternative materials and limited expansion into new sectors.

Precipitation-Hardening (PH) Stainless Steels (e.g., 17-4PH, 15-5PH)

PH stainless steels will see targeted growth in high-performance aerospace, defense, and energy sectors. By 2026, increased demand for lightweight, high-strength components in aviation and turbine systems will elevate the use of grades like 17-4PH. Advancements in material science and additive manufacturing techniques will expand design possibilities and reduce production lead times. Nonetheless, high production costs and specialized processing needs will restrict widespread adoption.

Conclusion:

By 2026, the stainless steel market will be characterized by a bifurcation: commodity grades (austenitic and ferritic) will grow steadily on volume and cost-efficiency, while high-performance alloys (duplex and PH) will expand in specialized, high-value applications. Sustainability pressures, raw material availability, and technological innovation will shape investment and adoption patterns across all types, favoring recyclability, leaner chemistries, and advanced manufacturing compatibility.

Common Pitfalls When Sourcing Different Stainless Steel Types (Quality, IP)

Sourcing the correct stainless steel type is critical for performance, safety, and cost-efficiency. However, several pitfalls can compromise quality and lead to project failures, particularly when Intellectual Property (IP) and material authenticity are not properly managed.

Inadequate Specification of Grade and Standards

One of the most frequent issues is vague or incorrect material specifications. Buyers may request “stainless steel” without specifying the exact grade (e.g., 304 vs. 316), leading suppliers to substitute lower-cost or unsuitable variants. Failing to reference international standards (e.g., ASTM, AISI, EN, JIS) increases the risk of receiving non-compliant material. Always define the exact grade, standard, finish, and mechanical properties required.

Confusion Between Similar Grades

Stainless steel grades like 304 and 316 appear similar but differ significantly in corrosion resistance due to molybdenum content. Sourcing 304 instead of 316 in a marine or chemical environment can result in premature failure. Mislabeling or supplier error is common, especially with substandard mills. Third-party material test reports (MTRs) and positive material identification (PMI) testing are essential to verify composition.

Lack of Traceability and Mill Certifications

Reputable sourcing requires full traceability through Mill Test Certificates (MTCs) or Material Test Reports (MTRs) that confirm chemical composition and mechanical properties. Accepting material without proper documentation opens the door to counterfeit or recycled steel of unknown origin. Ensure certificates match heat/lot numbers on physical material and are issued by accredited mills.

Counterfeit or Substandard Materials

In global supply chains, counterfeit stainless steel is a growing issue—especially from regions with lax quality control. Inferior steel may mimic appearance but lack required alloy content (e.g., reduced chromium or nickel). This compromises corrosion resistance and structural integrity. Unverified suppliers may offer attractive prices but deliver material that fails performance tests or regulatory compliance.

Intellectual Property (IP) Risks in Custom Alloys or Processing

When sourcing proprietary or custom-engineered stainless steel grades (e.g., super duplex, lean duplex, or specialty alloys), IP protection becomes critical. Sharing detailed specifications with untrusted suppliers risks reverse engineering or unauthorized replication. Use non-disclosure agreements (NDAs), limit technical disclosure, and work only with vetted partners who respect IP rights.

Inconsistent Surface Finishes and Tolerances

Stainless steel performance and aesthetics depend heavily on surface finish (e.g., 2B, BA, No. 4). Sourcing without clear finish specifications can result in material that doesn’t meet functional or visual requirements. Similarly, dimensional tolerances affect fit and weldability. Ensure purchase orders explicitly define surface and dimensional requirements per relevant standards.

Overlooking Supply Chain Transparency

Many buyers source indirectly through distributors or traders without knowing the original mill. This lack of transparency increases the risk of material substitution and supply disruptions. Establish direct relationships with certified mills or use trusted, audited distributors who provide full chain-of-custody documentation.

Failure to Conduct Independent Verification

Relying solely on supplier-provided documentation is risky. Conduct independent verification through PMI testing, spectrographic analysis, or third-party inspection services—especially for critical applications in pharmaceuticals, food processing, or offshore industries. Budget for quality assurance steps during procurement planning.

Avoiding these pitfalls requires clear specifications, rigorous supplier vetting, robust documentation, and proactive quality control. Protecting IP and ensuring material authenticity are just as important as meeting technical requirements when sourcing stainless steel.

Logistics & Compliance Guide for Different Stainless Steel Types

Stainless steel is a critical material across industries such as construction, food processing, healthcare, and energy due to its corrosion resistance, strength, and hygiene. However, the logistics and compliance requirements vary significantly between different stainless steel types. Understanding these distinctions ensures regulatory adherence, safe handling, and efficient supply chain management.

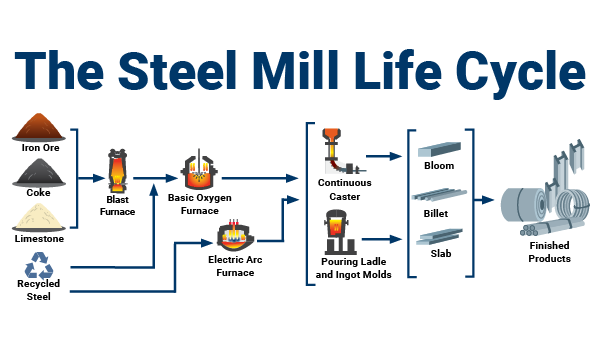

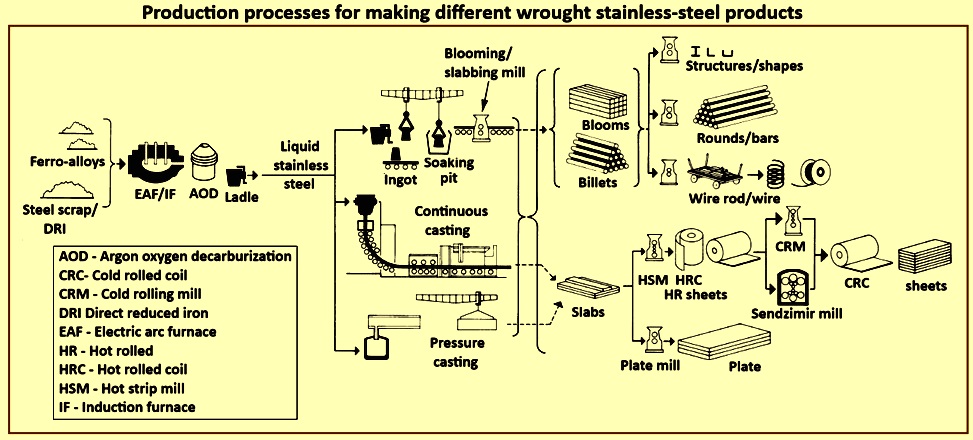

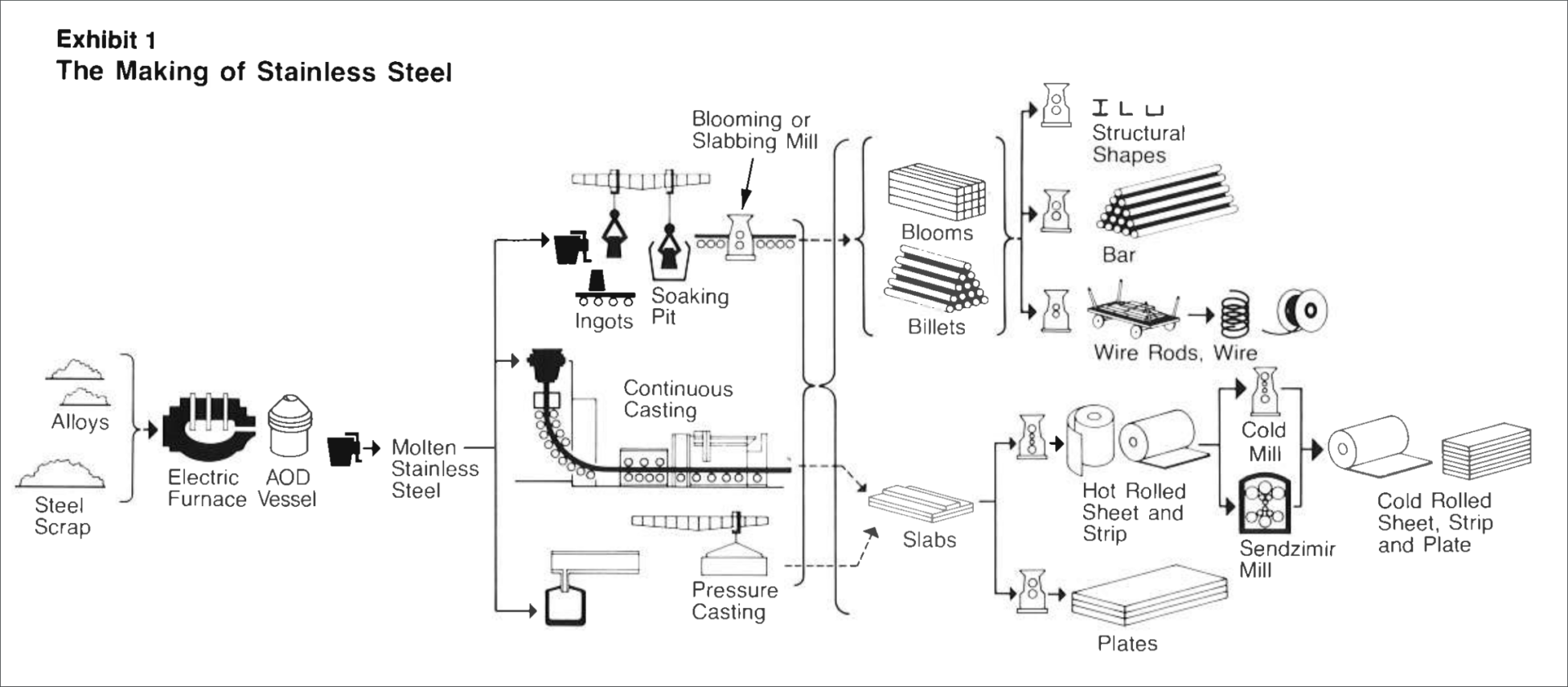

Overview of Major Stainless Steel Types

Stainless steels are categorized into five primary families based on their crystalline microstructure: Austenitic, Ferritic, Martensitic, Duplex, and Precipitation Hardening. Each group has unique chemical compositions and mechanical properties, influencing their handling, transportation, and regulatory compliance.

- Austenitic (e.g., 304, 316) – Most common; high corrosion resistance; non-magnetic

- Ferritic (e.g., 430, 409) – Moderate corrosion resistance; magnetic; lower cost

- Martensitic (e.g., 410, 420) – High strength and hardness; magnetic; lower corrosion resistance

- Duplex (e.g., 2205) – High strength and excellent corrosion resistance; mixed microstructure

- Precipitation Hardening (e.g., 17-4 PH) – High strength with good corrosion resistance; heat-treatable

Material Handling and Storage Requirements

Proper handling and storage are crucial to prevent contamination, surface damage, and corrosion—especially for high-grade stainless steels.

- Segregation by Grade and Finish: Stainless steel types must be stored separately to avoid cross-contamination, particularly from carbon steel. Use dedicated racks, pads, or areas labeled by alloy type.

- Moisture Control: Store in dry, well-ventilated areas to prevent chloride-induced pitting and crevice corrosion—especially critical for 316 and duplex grades in marine environments.

- Protection of Surface Finishes: Austenitic grades used in architectural or food-grade applications (e.g., 304L, 316L with #4 finish) require protective films and careful stacking to avoid scratches.

- Handling Equipment: Use non-ferrous tools, lifting slings, and transport vehicles to prevent iron contamination (“rouging”), which can initiate corrosion.

Transportation and Packaging Standards

Transportation protocols depend on product form (sheet, coil, pipe, bar) and destination regulations.

- Packaging:

- Coils and sheets: Wrapped in moisture-resistant paper and plastic, with edge protectors.

- Pipes and tubes: End caps installed; banded and crated for overseas shipping.

- High-purity grades (e.g., 316L for pharma): Vacuum or nitrogen-purged packaging may be required.

- Labeling: Packages must be clearly labeled with ASTM/EN standard, grade, heat number, dimensions, and mill test certificate (MTC) reference.

- International Shipping: Comply with IMDG Code for sea freight (non-hazardous but subject to stowage rules); avoid saltwater exposure during transit.

Regulatory and Compliance Frameworks

Global compliance is essential for legal import/export and end-use suitability.

- REACH (EU): Register substances of very high concern (SVHCs); chromium, nickel, and molybdenum in stainless steel must be declared if above thresholds.

- RoHS (EU): Applies to electronic components; most stainless steels are compliant, but coatings or additives must be checked.

- FDA 21 CFR (USA): For food-contact applications (e.g., 304, 316 in processing equipment), materials must meet non-toxicity and cleanability standards.

- ASME & ASTM Standards (USA): Ensure grades meet pressure vessel (BPVC) or structural code requirements (e.g., ASTM A240 for plate).

- PED (Pressure Equipment Directive – EU): Requires CE marking and notified body involvement for stainless steel components in pressurized systems.

- NORSOK (Norway): Strict requirements for duplex and super duplex steels in offshore oil & gas; includes testing for sulfide stress cracking (SSC).

Traceability and Documentation

Full traceability from melt to final product is mandatory in high-integrity sectors.

- Mill Test Certificates (MTCs): Provide chemical composition, mechanical properties, and heat treatment data per EN 10204 Type 3.1 or 3.2.

- Heat Number Tracking: Each batch must be traceable; essential for aerospace, nuclear, and medical applications.

- Dual Certification: Some grades (e.g., 304/304L) may carry dual certs to meet multiple standards.

- Digital Traceability Systems: Increasingly used via QR codes or blockchain to ensure audit readiness.

Corrosion and Environmental Considerations

Different grades respond uniquely to environmental exposure, impacting logistics planning.

- Chloride Environments: Avoid transporting or storing 304 near coastal areas; 316 or duplex grades preferred.

- Galvanic Corrosion: Isolate stainless steel from dissimilar metals (e.g., aluminum, carbon steel) during storage and transport.

- Passivation Requirements: Post-fabrication passivation may be needed—especially for 316L in pharmaceutical systems—before shipment.

Industry-Specific Compliance

- Food & Beverage: 304 and 316 must comply with EHEDG or 3-A Sanitary Standards; surface roughness and weld quality are critical.

- Pharmaceutical: Requires electropolishing, low endotoxin levels, and validation per USP <791> or ASME BPE.

- Oil & Gas: Duplex (2205) and super duplex must meet NACE MR0175/ISO 15156 for sour service environments.

- Construction: Must conform to local building codes (e.g., Eurocode 3) and fire resistance standards.

Conclusion

Effective logistics and compliance for stainless steel require a nuanced understanding of alloy-specific properties and regulatory landscapes. Proper segregation, documentation, and adherence to international standards ensure material integrity and legal market access. As global supply chains grow more complex, proactive compliance management—not just for the material but for every stage of transport and storage—remains essential for quality assurance and risk mitigation.

Conclusion on Sourcing Different Stainless Steel Types

Sourcing the appropriate type of stainless steel is crucial to ensuring performance, durability, and cost-effectiveness across various applications. With multiple grades available—such as the widely used austenitic (e.g., 304, 316), ferritic, martensitic, and duplex stainless steels—selection must be guided by specific environmental conditions, mechanical requirements, and corrosion resistance needs.

Austenitic steels offer excellent formability and corrosion resistance, making them ideal for food processing, pharmaceuticals, and architectural uses. Ferritic and martensitic grades provide higher strength and resistance to stress corrosion cracking, suitable for automotive components and cutlery. Duplex stainless steels, combining strength and corrosion resistance, are increasingly favored in aggressive environments like offshore and chemical processing.

When sourcing, factors such as supply chain reliability, material certification, compliance with international standards (e.g., ASTM, ISO), and cost-efficiency must be balanced. Partnering with reputable suppliers who offer consistent quality, traceability, and technical support ensures long-term success.

In conclusion, a strategic, application-driven approach to sourcing stainless steel types enhances product reliability, reduces lifecycle costs, and supports sustainable manufacturing practices. Understanding the trade-offs between performance, availability, and price enables organizations to make informed procurement decisions that align with both technical and commercial objectives.