The global cord types market—encompassing electrical cords, fiber optic cables, USB cables, and industrial-grade cords—is experiencing robust expansion, driven by increasing demand across consumer electronics, automotive, healthcare, and industrial automation sectors. According to Grand View Research, the global cable and wire market was valued at USD 199.3 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. Mordor Intelligence reinforces this outlook, citing rising infrastructure investments, smart device proliferation, and the shift toward electric vehicles as key growth accelerators. In this evolving landscape, manufacturers that deliver innovation in material efficiency, signal integrity, durability, and sustainability are emerging as leaders. This data-driven analysis highlights the top 10 cord types manufacturers shaping the industry, combining market presence, product diversification, R&D investment, and geographic reach to meet the world’s expanding connectivity needs.

Top 10 Different Cord Types Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Belden

Domain Est. 1997

Website: belden.com

Key Highlights: We design, manufacture and market networking, connectivity, cable products and solutions for industrial automation, smart buildings and broadcast markets….

#2 Power Cord & Electrical Cords

Domain Est. 1999

Website: americord.com

Key Highlights: Free delivery 30-day returnsWe offer a wide variety of power cords online, ranging from electronics power cords to cords for industrial machinery and everything in between….

#3 Types of Electrical Connectors and Wire Connectors

Domain Est. 1992

Website: te.com

Key Highlights: From USB connectors and RJ45 connectors to TE’s DEUTSCH connectors and AMP connectors, we design and manufacture the electrical connectors and wire connectors ……

#4 Power Cord Types and Standards Explained

Domain Est. 1992

Website: fs.com

Key Highlights: Learn the main power cord types, including IEC, NEMA, and CEE standards. Compare connectors and choose the right cord for data centers, IT, ……

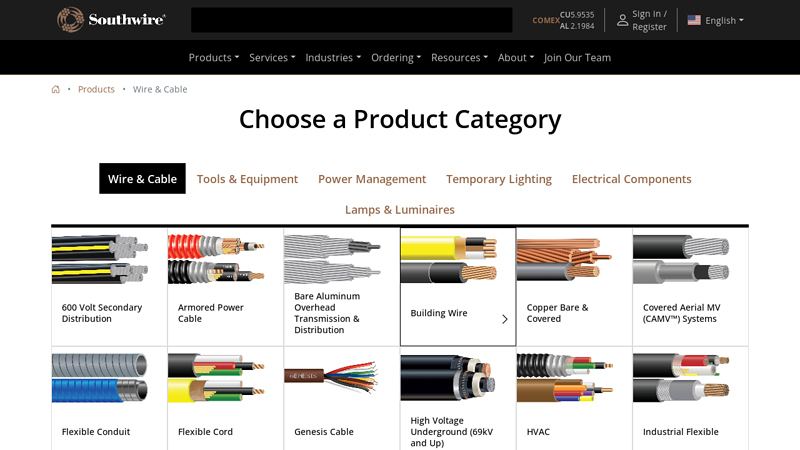

#5 Wire & Cable

Domain Est. 1994

Website: southwire.com

Key Highlights: Choose a Product Category: Wire & Cable, Tools & Equipment, Power Management, Temporary Lighting, Electrical Components, Lamps & Luminaires….

#6 Cables

Domain Est. 1994

Website: commscope.com

Key Highlights: CommScope Cables for Superior Connectivity. CommScope offers an extensive range of high-performance cables to meet your connectivity needs….

#7 Cables

Domain Est. 1998

Website: cables.com

Key Highlights: Buy cables, fiber optic cables, Cat6 cables, Cat5 Cables, ethernet cables, power cords, patch cables, HDMI and custom cables. Shop for cables….

#8 LEMO – The Original Push-Pull Connector

Domain Est. 1998

Website: lemo.com

Key Highlights: LEMO offers complete connectivity services for high-performance solutions such as cable assembly, customised solutions and signal integrity services….

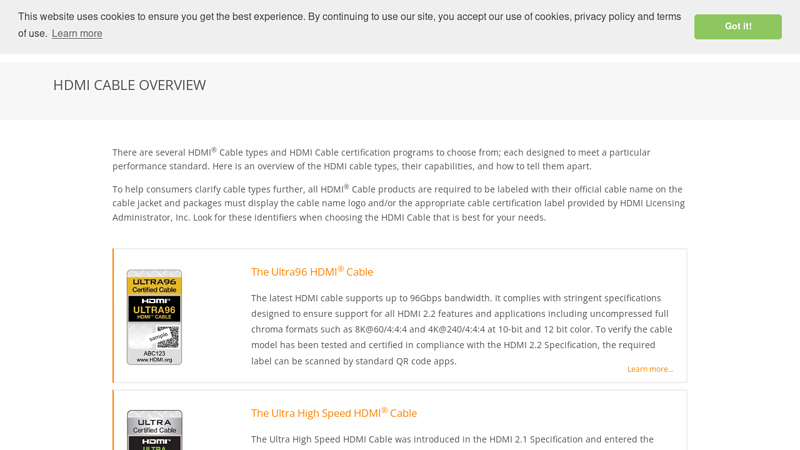

#9 HDMI Cables

Domain Est. 2001

Website: hdmi.org

Key Highlights: HDMI cable overview with the different HDMI cable types, their port capabilities, and how to tell the HDMI connector types apart. HDMI 2.1b….

#10 I

Domain Est. 2005

Website: i-pex.com

Key Highlights: I-PEX manufactures high-precision Micro-Coax, FPC, FFC, RF, and Board to Board commercial connector products….

Expert Sourcing Insights for Different Cord Types

H2: 2026 Market Trends for Different Cord Types

The global market for cord types—encompassing electrical cords, fiber optic cables, extension cords, USB cables, and specialized industrial cords—is poised for significant transformation by 2026. Driven by technological innovation, evolving consumer demands, and regulatory shifts, the cord industry is undergoing a renaissance in materials, design, and functionality. Below is an analysis of key cord types and their projected market trends through 2026.

-

USB-C and High-Speed Data Cords

The dominance of USB-C is expected to solidify by 2026, becoming the de facto standard for consumer electronics across smartphones, laptops, tablets, and peripherals. With the European Union mandating USB-C as a universal charging port by 2024, global adoption will accelerate. Growth will be fueled by increased demand for faster data transfer (USB4 and Thunderbolt 4 support) and higher power delivery (up to 240W under the USB PD 3.1 standard). The market will see a surge in premium, durable, and braided USB-C cables, while wireless alternatives will complement but not replace wired solutions for high-speed needs. -

Fiber Optic Cords

Fiber optic cords are projected to experience robust growth, especially in telecom, data centers, and 5G infrastructure. As global internet traffic continues to rise, driven by streaming, cloud computing, and IoT, high-bandwidth fiber solutions will be essential. By 2026, advancements in bend-insensitive fibers and reduced production costs will expand their use into residential broadband (FTTH—Fiber to the Home) and enterprise networks. Additionally, the integration of fiber into consumer audio (TOSLINK) and specialized industrial applications will contribute to market expansion. -

Extension and Power Cords

The extension and power cord segment will evolve toward smarter, safer, and more energy-efficient designs. By 2026, smart extension cords with built-in surge protection, energy monitoring, and app connectivity are expected to gain traction, particularly in smart homes and offices. Regulatory emphasis on fire safety and energy standards will push manufacturers toward flame-retardant materials and improved insulation. Outdoor and industrial-grade cords will see increased demand due to infrastructure development and renewable energy projects. -

Audio and Headphone Cords

Although wireless headphones dominate the audio market, high-fidelity audio enthusiasts and professional users will sustain demand for premium audio cords (e.g., balanced XLR, TRS, and coaxial cables). By 2026, there will be a niche but growing market for audiophile-grade cords made with oxygen-free copper (OFC) and advanced shielding. However, overall unit sales may decline as wireless technology improves, pushing manufacturers to focus on quality over quantity. -

Industrial and Specialty Cords

Industrial cords—such as those used in automation, robotics, medical devices, and aerospace—will grow due to rising industrial automation and smart manufacturing (Industry 4.0). These cords require high durability, flexibility, and resistance to extreme temperatures or electromagnetic interference. By 2026, demand will increase for hybrid cords (combining power and data transmission) and miniaturized solutions. Additionally, sustainability initiatives will drive adoption of halogen-free, recyclable materials in industrial cord manufacturing. -

Sustainable and Eco-Friendly Cord Materials

A major cross-cutting trend by 2026 will be the shift toward environmentally sustainable cord production. Consumers and regulators are demanding reduced plastic use, longer product lifespans, and recyclable components. Leading manufacturers will invest in bioplastics, recycled jackets, modular designs, and take-back programs. Certifications like RoHS, REACH, and EPEAT will become standard, influencing procurement decisions in both B2B and B2C markets.

Conclusion

By 2026, the cord market will be defined by convergence—between digital and physical connectivity, performance and sustainability, and standardization and specialization. While wireless technologies continue to advance, physical cords remain indispensable across industries. The most successful players will be those that innovate in materials, integrate smart features, and align with global environmental and regulatory trends. Ultimately, the future of cords lies not in obsolescence, but in evolution.

Common Pitfalls When Sourcing Different Cord Types (Quality, IP Rating)

Sourcing the right cord types for electrical, industrial, or consumer applications requires careful attention to both quality and Ingress Protection (IP) ratings. Overlooking key factors can lead to safety hazards, product failure, or non-compliance. Below are common pitfalls to avoid:

1. Overlooking IP Rating Requirements for the Environment

Many buyers assume standard cords are sufficient without considering environmental exposure. Using a cord with an inadequate IP rating in wet, dusty, or outdoor environments can result in short circuits, corrosion, or electric shock. Always match the cord’s IP rating (e.g., IP65 for dust-tight and water jet resistance) to the intended operating conditions.

2. Prioritizing Cost Over Build Quality

Choosing the cheapest option often leads to substandard materials such as thin insulation, poor shielding, or undersized conductors. Low-quality cords degrade faster, overheat under load, and increase fire risk. Invest in cords from reputable manufacturers with certifications (e.g., UL, CE, CSA) to ensure durability and safety.

3. Misunderstanding Cord Specifications (AWG, Jacket Material, Flex Life)

Not all cords of the same type are equal. Buyers may overlook critical specs like wire gauge (AWG), which affects current capacity, or jacket material (e.g., PVC vs. PUR), which determines resistance to oil, UV, or abrasion. Flexible applications require high-flex cables; using standard cords in robotic or moving systems leads to premature failure.

4. Assuming All Suppliers Provide Accurate IP and Quality Claims

Some suppliers, especially on online marketplaces, exaggerate IP ratings or use misleading terminology. Always request test reports or certification documentation. Verify that the IP rating applies to the entire cord assembly, including connectors, not just the cable.

5. Ignoring Regulatory and Regional Compliance

Electrical cords must meet regional safety standards (e.g., NEC in the U.S., IEC in Europe). Sourcing non-compliant cords can result in failed inspections, product recalls, or liability issues. Ensure cords meet local codes and have the required markings and approvals.

6. Failing to Consider Application-Specific Needs

Using general-purpose cords in industrial or medical environments can be dangerous. For example, medical devices require cords with higher isolation and biocompatible materials, while industrial settings may need high-temperature or EMI-shielded cables. Match cord type precisely to the application.

7. Inadequate Testing and Sampling Before Bulk Orders

Skipping pre-production samples or third-party testing increases the risk of receiving defective batches. Always test a sample for flexibility, insulation integrity, and actual IP performance (e.g., water/dust resistance) before full-scale procurement.

By recognizing and avoiding these pitfalls, businesses can ensure reliable, safe, and compliant cord sourcing that supports long-term performance and user safety.

Logistics & Compliance Guide for Different Cord Types

Understanding the logistics and compliance requirements for various cord types is essential for safe handling, transportation, storage, and regulatory adherence across industries. Whether used in manufacturing, construction, consumer goods, or industrial applications, each cord type presents unique considerations. Below is a guide outlining key logistics and compliance factors for common cord types.

Electrical Cords

Logistics Considerations:

– Storage: Store coiled but not tightly wound to prevent insulation damage; keep in dry, temperature-controlled environments.

– Transportation: Protect from crushing and abrasion during transit; use protective packaging or reels.

– Handling: Avoid sharp bends or kinking; inspect cords regularly for fraying or exposed wires.

Compliance Requirements:

– Must meet regional electrical safety standards such as UL (Underwriters Laboratories) in the U.S., CE in Europe, or CSA in Canada.

– Compliance with OSHA (Occupational Safety and Health Administration) standards for workplace use.

– Labeling must include voltage rating, wire gauge, temperature rating, and manufacturer information.

Extension Cords

Logistics Considerations:

– Packaged to avoid tangling; often sold on reels or in compact boxes.

– Weight and length affect shipping costs; heavier gauges require sturdier packaging.

– Outdoor-rated cords must be stored to prevent moisture damage.

Compliance Requirements:

– Must comply with UL 817 (U.S.) or IEC 60245/60227 (international) standards.

– Grounding requirements (3-prong vs. 2-prong) must match application needs.

– Outdoor extension cords require GFCI (Ground Fault Circuit Interrupter) compatibility and weather-resistant jackets.

Fiber Optic Cords

Logistics Considerations:

– Highly sensitive to bending; minimum bend radius must be maintained.

– Require anti-static and shock-resistant packaging.

– Climate-controlled transport to prevent condensation or thermal damage.

Compliance Requirements:

– Must meet ITU-T or IEEE standards for data transmission and durability.

– RoHS (Restriction of Hazardous Substances) compliance for material content.

– Fiber optic cables used in telecommunications must comply with FCC Part 68 (U.S.).

Rope and Utility Cords (e.g., Nylon, Polyester, Polypropylene)

Logistics Considerations:

– Store away from UV exposure and moisture to prevent degradation.

– Use spools or coils for bulk transport; secure to prevent unwinding.

– Weight and tensile strength affect load distribution in shipping.

Compliance Requirements:

– Must meet ANSI/ASSE Z359.1 for fall protection applications (if used in safety gear).

– Maritime and industrial applications may require compliance with ISO 2307 or OSHA 1910.140.

– Flame-resistant cords in industrial settings may need NFPA 701 or CAL OSHA certification.

USB and Data Cords

Logistics Considerations:

– Small size allows high-density packaging; prone to tangling if not organized.

– Sensitive to electromagnetic interference; may require shielding in bulk shipments.

– Frequent handling increases risk of connector damage.

Compliance Requirements:

– Must comply with USB-IF (USB Implementers Forum) certification standards.

– RoHS and REACH compliance for hazardous material restrictions (EU).

– FCC Part 15 compliance for electromagnetic interference in the U.S.

Audio/Video Cables (e.g., HDMI, Coaxial)

Logistics Considerations:

– Shielding must be preserved; avoid sharp bends or crushing.

– Packaged with protective ends or caps to prevent connector damage.

– Climate-controlled storage prevents degradation of conductive materials.

Compliance Requirements:

– HDMI cables require HDMI Licensing Administrator certification.

– Signal integrity standards such as SMPTE for broadcast applications.

– FCC and CE compliance for electromagnetic compatibility.

General Best Practices for All Cord Types

- Labeling: Clearly identify cord type, gauge, rating, and compliance marks.

- Inspection: Conduct regular inspections during storage and before deployment.

- Training: Ensure staff are trained in proper handling, coiling techniques, and safety procedures.

- Documentation: Maintain compliance certificates, safety data sheets (SDS), and shipping records.

Adhering to these logistics and compliance guidelines ensures operational safety, regulatory approval, and product longevity across supply chains and end-use environments. Always consult local regulations and industry-specific standards for full compliance.

Conclusion: Sourcing Different Cord Types

Sourcing different cord types requires a strategic approach that balances material properties, application requirements, cost, availability, and sustainability. Each cord type—whether polyester, nylon, paracord, cotton, or specialized variants like elastic or braided cords—offers unique advantages in terms of strength, flexibility, durability, and aesthetic appeal. The selection process should begin with a clear understanding of the intended use, environmental conditions, load requirements, and regulatory standards.

Suppliers should be evaluated not only on price but also on consistency, quality control, and ability to meet volume and customization needs. Building relationships with multiple suppliers can mitigate risks related to supply chain disruptions and ensure access to niche or high-performance cordage when needed. Additionally, considering eco-friendly materials and ethical sourcing practices supports long-term sustainability goals and aligns with increasing consumer and regulatory demands.

In conclusion, effective sourcing of cord types involves a comprehensive evaluation of technical specifications, supplier reliability, and market trends. By adopting a thoughtful and informed procurement strategy, organizations can ensure they select the optimal cord for their specific needs while maintaining efficiency, quality, and responsibility across the supply chain.