The global agricultural machinery market has seen steady expansion, driven by rising demand for mechanized farming solutions to enhance productivity and meet growing food demands. According to Mordor Intelligence, the Agricultural Machinery Market was valued at USD 179.57 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2029. With small-scale farming operations accounting for a significant share of global agricultural output, diesel-powered tillers have emerged as essential tools—particularly in emerging economies across Asia, Africa, and Latin America. Their durability, fuel efficiency, and ability to operate under variable field conditions make them a preferred choice among farmers. As adoption increases, so does the competitive landscape. This has led to the rise of prominent manufacturers focusing on innovation, cost-efficiency, and after-sales service. Based on market presence, product range, and technological advancements, the following eight diesel tiller manufacturers stand out in shaping the present and future of soil preparation machinery.

Top 8 Diesel Tiller Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

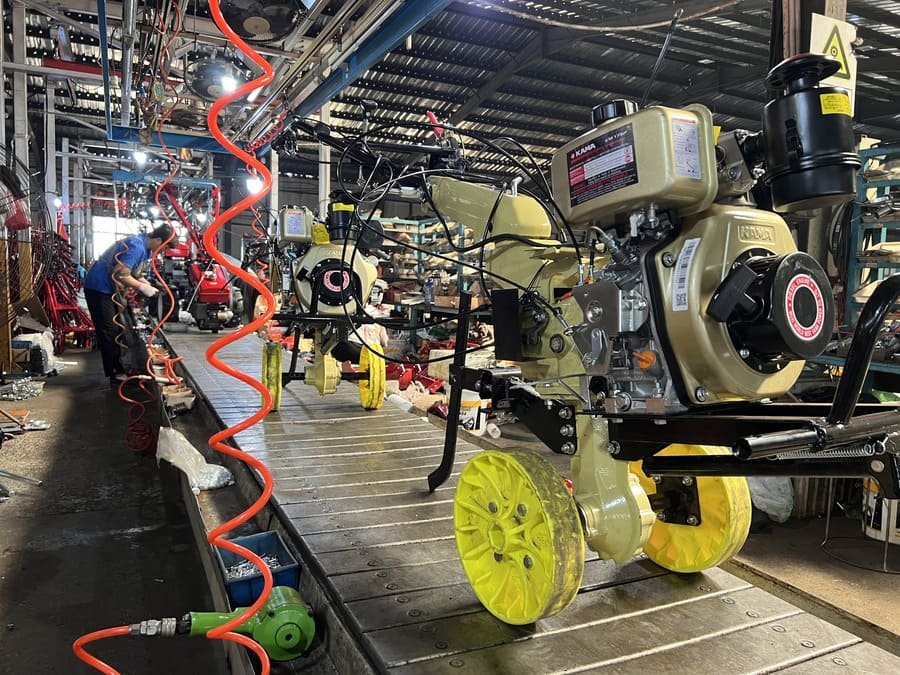

#1 China Diesel Power Tiller Manufacturers, Suppliers, Factory

Domain Est. 2019

Website: originalkama.com

Key Highlights: As one of the leading diesel power tiller manufacturers and suppliers in China, KAMA warmly welcome you to wholesale bulk diesel power ……

#2 Diesel Engine & Genset

Domain Est. 2010

Website: ytocorp.com

Key Highlights: As a diesel engine manufacturer with over 50 years of experience, we at YTO can provide customers with a wide range of diesel engines….

#3 Marine Diesel Engines

Domain Est. 1993

Website: cat.com

Key Highlights: Learn how Caterpillar can be your partner on the water with our marine diesel engines & marine generators to keep your vessels running efficiently ……

#4 Tillers|Agriculture

Domain Est. 1996

Website: yanmar.com

Key Highlights: Yanmar has a wide range of tillers from power tillers used by professional farmers to walk-behind tillers that are used by hobby farmers….

#5 Kubota Global Site

Domain Est. 1997

Website: kubota.com

Key Highlights: Kubota Corporation’s global site offers an overview of our group and our products and solutions. Under the slogan of ‘For Earth, For Life,’ Kubota works on ……

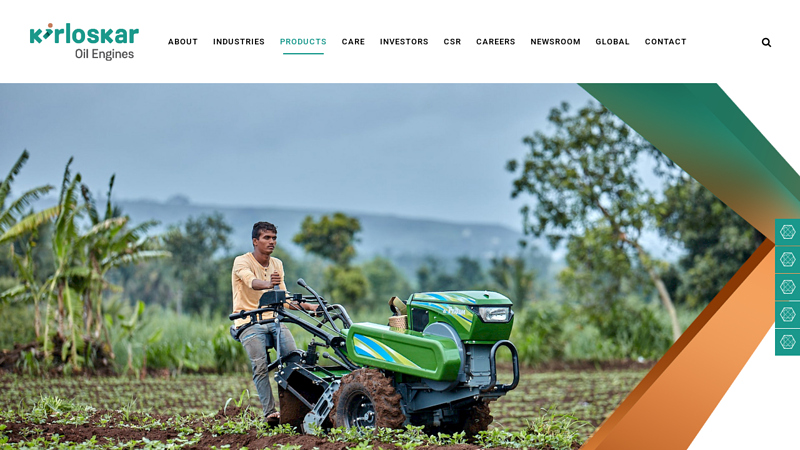

#6 Power Tillers

Domain Est. 2013

Website: kirloskaroilengines.com

Key Highlights: Kirloskar’s power tillers are powerful and designed to work efficiently in both wet and dry fields. It offers the versatility of a tiller & the comfort & ……

#7 Selection of diesel and gasoline rotary tillers

Domain Est. 2021

Website: bullpower.com.cn

Key Highlights: Rotary tillers are usually used for tillage, sowing, furrowing, furrowing, etc. You need to choose the corresponding rotary tiller according to actual needs….

#8 Diesel Engines & Power Tillers

Website: siamkubota.co.th

Key Highlights: Be a diesel engine and power tiller distributor in Africa as well as other countries in the world. “Jointly distribute with a successful company of KUBOTA ……

Expert Sourcing Insights for Diesel Tiller

H2: 2026 Market Trends for Diesel Tiller

The global diesel tiller market is anticipated to undergo significant transformation by 2026, driven by evolving agricultural practices, technological advancements, and regional economic dynamics. As mechanization continues to expand in emerging economies and sustainability concerns shape equipment design, several key trends are expected to define the industry landscape.

1. Rising Demand in Developing Agricultural Economies

A major driver for diesel tillers by 2026 will be increasing adoption across Asia-Pacific, Sub-Saharan Africa, and parts of Latin America. Countries such as India, Indonesia, Nigeria, and Brazil are witnessing a shift from traditional hand tilling to mechanized farming due to labor shortages and the need for higher productivity. Diesel tillers, known for their durability and fuel efficiency, are becoming preferred tools for small- to mid-scale farmers who rely on cost-effective and robust equipment.

2. Technological Integration and Efficiency Improvements

By 2026, manufacturers are expected to incorporate advanced features into diesel tillers, including improved engine efficiency, lower emissions, and user-friendly designs. Innovations such as cold-start technology, vibration reduction systems, and ergonomic handles will enhance operator comfort and performance. Additionally, some models may feature compatibility with precision farming tools, enabling better soil preparation and data-driven agriculture.

3. Emission Regulations and Environmental Considerations

Stricter emission norms—particularly in regions like Europe and parts of Asia—are prompting manufacturers to upgrade diesel engines to meet Tier 4 or equivalent standards. This shift is expected to increase the cost of production slightly but will also improve the environmental footprint of diesel tillers. As a result, companies are investing in cleaner combustion technologies and exploring hybrid options, although full electrification remains limited due to power and infrastructure constraints in rural areas.

4. Competitive Pricing and Local Manufacturing

The price sensitivity of rural farming communities continues to influence the market. By 2026, localized production hubs in countries like India and China are expected to dominate global supply, offering competitively priced diesel tillers with region-specific adaptations. This trend supports affordability and after-sales service accessibility, strengthening market penetration in remote areas.

5. Shift Toward Multi-Purpose and Attachable Implements

Farmers are increasingly demanding versatile machinery. Diesel tillers are being designed to support a range of attachments—such as seeders, harvesters, and sprayers—transforming them into multi-functional platforms. This trend enhances return on investment and reduces the need for multiple machines, particularly among smallholder farmers.

6. Government Subsidies and Agricultural Mechanization Programs

Supportive government policies, including subsidies and low-interest financing for farm equipment, will play a crucial role in market growth. In countries like India and Vietnam, agricultural extension programs promoting mechanization are expected to significantly boost diesel tiller sales by 2026.

Conclusion

By 2026, the diesel tiller market will be characterized by stronger demand in developing regions, enhanced technological features, and a focus on sustainability and versatility. While competition from electric and battery-powered alternatives may grow, diesel tillers will remain dominant in areas with limited grid access and high torque requirements. Manufacturers who invest in innovation, localization, and farmer-centric design will be best positioned to capitalize on these evolving trends.

Common Pitfalls When Sourcing a Diesel Tiller: Quality and Intellectual Property (IP) Concerns

Sourcing diesel tillers, especially from international manufacturers or lesser-known suppliers, can present several risks related to product quality and intellectual property (IP). Being aware of these pitfalls helps buyers make informed decisions and avoid costly mistakes.

Quality-Related Pitfalls

Inconsistent Build and Performance Standards

One of the most common issues when sourcing diesel tillers is inconsistent build quality. Low-cost manufacturers may cut corners by using substandard materials (e.g., inferior steel, low-grade bearings, or weak gearboxes), leading to premature wear and mechanical failure. Without adherence to recognized international standards (such as ISO or CE), performance and reliability can vary significantly between units.

Lack of Proper Testing and Certification

Many suppliers, especially those without established reputations, may not conduct rigorous testing for durability, safety, or emissions compliance. Diesel engines must meet specific environmental regulations (e.g., EU Stage V or EPA Tier 4), and tillers lacking proper certification may be illegal to operate in certain markets or fail to pass customs inspection.

Poor After-Sales Support and Spare Parts Availability

Even if a diesel tiller initially performs well, poor after-sales service and limited availability of spare parts can render the equipment unusable after a breakdown. Many budget suppliers do not maintain spare parts inventories or technical support, leading to extended downtime and higher long-term costs.

Intellectual Property (IP) Risks

Counterfeit or Cloned Designs

Some manufacturers produce diesel tillers that closely mimic the design and branding of well-known, reputable brands without authorization. These counterfeit or cloned products not only violate IP rights but often lack the engineering integrity of the original, increasing the risk of failure and safety hazards.

Use of Unlicensed Technology or Components

Suppliers may incorporate patented technologies—such as specific engine designs, transmission systems, or fuel injection mechanisms—without proper licensing. Purchasing such equipment could expose the buyer to legal liability, especially if the product is imported into a jurisdiction that enforces IP laws strictly.

Branding and Trademark Infringement

Be cautious of suppliers using logos, model names, or packaging that resemble established brands. Even if unintentional, sourcing such products could lead to customs seizures or legal action, particularly in markets with strong IP protections like the EU or North America.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct thorough due diligence on suppliers, including site visits and third-party audits.

– Request documentation for certifications, test reports, and compliance with emissions standards.

– Verify the originality of designs and ensure suppliers can provide IP clearance if required.

– Establish clear contracts that include quality assurance clauses and warranties.

By addressing quality and IP concerns proactively, businesses can reduce risk and ensure they source reliable, compliant, and legally sound diesel tillers.

Logistics & Compliance Guide for Diesel Tiller

This guide outlines the essential logistics and compliance considerations for the transportation, storage, import/export, and safe handling of diesel-powered tillers. Adhering to these guidelines ensures regulatory compliance, operational safety, and environmental protection.

Regulatory Compliance

Ensure adherence to all applicable local, national, and international regulations governing the sale, transport, and use of diesel-powered equipment.

Environmental Regulations

Comply with emissions standards such as EPA Tier 4 (U.S.), EU Stage V (Europe), or equivalent regulations in your region. Verify that the diesel tiller model meets required emission control specifications. Maintain documentation of emissions certification for each unit.

Noise and Vibration Standards

Ensure the equipment complies with noise and hand-arm vibration limits (e.g., ISO 2710, EU Directive 2002/44/EC). Provide operators with relevant safety data and usage limitations to mitigate health risks.

Product Safety Certification

Confirm that the tiller is certified by recognized bodies (e.g., CE marking in Europe, UL or ETL in North America). Keep technical files and declarations of conformity accessible for audits.

Transportation Requirements

Proper handling during transit prevents damage and mitigates risks associated with fuel and mechanical components.

Fuel Management

Drain all diesel fuel from the engine and fuel tank prior to shipment unless otherwise permitted by carrier regulations. Residual fuel increases fire risk and may violate hazardous materials transport laws.

Packaging and Securing

Use robust, weather-resistant packaging with protective corner boards and strapping. Secure the tiller to pallets or within shipping containers using straps or braces to prevent movement during transit.

Hazardous Materials Classification

Even with drained fuel, parts of the tiller (e.g., oil residues, batteries) may require classification under hazardous materials regulations (e.g., IATA/IMDG for air/sea, DOT 49 CFR for road/rail in the U.S.). Consult SDS (Safety Data Sheets) for components to determine classification.

Import and Export Procedures

Cross-border movement of diesel tillers requires strict adherence to customs and trade regulations.

Customs Documentation

Prepare accurate documentation including commercial invoice, packing list, bill of lading/airway bill, and certificate of origin. Include HS (Harmonized System) code—typically 8433.11 or 8433.12 for mechanical soil-working machinery.

Import Duties and Taxes

Research applicable tariffs, VAT, or GST based on destination country. Some regions may impose additional environmental or energy efficiency levies on internal combustion machinery.

Import Restrictions

Check for import bans or restrictions on diesel equipment in certain countries or regions due to environmental policies. Some jurisdictions may require special permits or pre-approval.

Storage and Handling

Safe storage preserves equipment integrity and protects personnel and facilities.

Fuel-Free Storage

Store units with empty fuel tanks and clean air filters. Stabilized fuel left in the system can degrade and cause engine damage.

Indoor, Dry Environment

Keep tillers in a covered, well-ventilated warehouse free from moisture and extreme temperatures. Elevate units off the floor to prevent corrosion.

Battery Management

Remove lead-acid batteries if present; store separately in a cool, dry place. Check charge levels periodically to prevent sulfation.

Operator Safety and Training

Ensure end users operate diesel tillers in compliance with safety standards.

Mandatory Training

Provide or require operator training covering startup procedures, safe operation, shutdown, and emergency response. Include instruction on handling fuel and recognizing equipment faults.

Personal Protective Equipment (PPE)

Specify required PPE: hearing protection, gloves, safety footwear, and eye protection. Include these requirements in user manuals and training materials.

Maintenance Compliance

Instruct users to follow manufacturer-recommended maintenance schedules. Emphasize proper disposal of used oil, filters, and other waste in accordance with local environmental laws.

Environmental and Disposal Compliance

Manage end-of-life equipment responsibly.

End-of-Life Disposal

Follow WEEE (Waste Electrical and Electronic Equipment) directives or equivalent for separating recyclable components. Coordinate with certified e-waste or machinery recycling facilities.

Fluid Disposal

Ensure used diesel, engine oil, and hydraulic fluids are collected and disposed of via licensed hazardous waste handlers. Maintain disposal records for compliance audits.

By following this guide, businesses can ensure the safe, legal, and environmentally responsible logistics and deployment of diesel tillers across their operational lifecycle.

Conclusion for Sourcing Diesel Tiller:

After evaluating various suppliers, pricing models, product specifications, and after-sales support, sourcing diesel tillers from reliable manufacturers or distributors is a strategic decision that can significantly enhance agricultural productivity and operational efficiency. Diesel-powered tillers offer superior durability, higher torque, and better fuel efficiency compared to their gasoline or electric counterparts, making them ideal for heavy-duty and large-scale farming operations.

By partnering with reputable suppliers that provide quality certifications, warranty coverage, spare parts availability, and technical support, farms and agribusinesses can ensure long-term performance and reduced downtime. Additionally, bulk purchasing agreements and timely delivery options further contribute to cost savings and operational continuity.

In conclusion, sourcing diesel tillers from trusted vendors—after thorough market analysis and due diligence—represents a sound investment in sustainable and efficient agricultural mechanization. Continuous monitoring of market trends, technological advancements, and supplier performance will further optimize future procurement decisions.