The global outboard motor market is undergoing a significant transformation, driven by increasing demand for fuel-efficient and environmentally sustainable marine propulsion systems. According to a 2023 report by Grand View Research, the global outboard motors market was valued at USD 5.8 billion and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is partly fueled by the rising adoption of diesel outboard engines, which offer superior torque, longer engine life, and improved fuel economy—especially in commercial, offshore, and larger recreational vessels. Mordor Intelligence further projects steady growth in marine propulsion technologies, with diesel outboards gaining traction due to stringent emissions regulations and advancements in compact diesel engine design. As the market evolves, nine key manufacturers have emerged at the forefront, combining innovation, durability, and performance to lead the diesel outboard revolution.

Top 9 Diesel Outboard Boat Motor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Mercury Marine

Domain Est. 1995

Website: mercurymarine.com

Key Highlights: Mercury Marine is the world’s leading manufacturer of recreational marine propulsion engines. Get sales, service and parts info, and find a local dealer ……

#2 Marine engines & boat motors for power

Domain Est. 1997

Website: volvopenta.com

Key Highlights: We offer state-of-the-art marine engines that deliver outstanding performance, reliability, and durability. Volvo Penta’s marine engines are designed to ……

#3 Yamaha Outboards

Domain Est. 2002

Website: yamahaoutboards.com

Key Highlights: Yamaha Outboards provides industry-leading innovation, outstanding performance, incredible power, unequalled customer satisfaction and legendary ……

#4 Cox Marine Diesel Outboards

Domain Est. 2014

Website: coxmarine.com

Key Highlights: Cox Marine’s powerful diesel outboard engines. Engineered for durability, fuel savings, and reduced emissions. Power your fleet with next-gen marine ……

#5 OXE Diesel Models

Domain Est. 2019

Website: oxemarine.com

Key Highlights: The OXE300 is a bi-turbo modern inline 6 cylinder diesel engine, smooth and quiet while delivering 945Nm (697ft-lb) of torque and 300HP at a maximum of 67lph ( ……

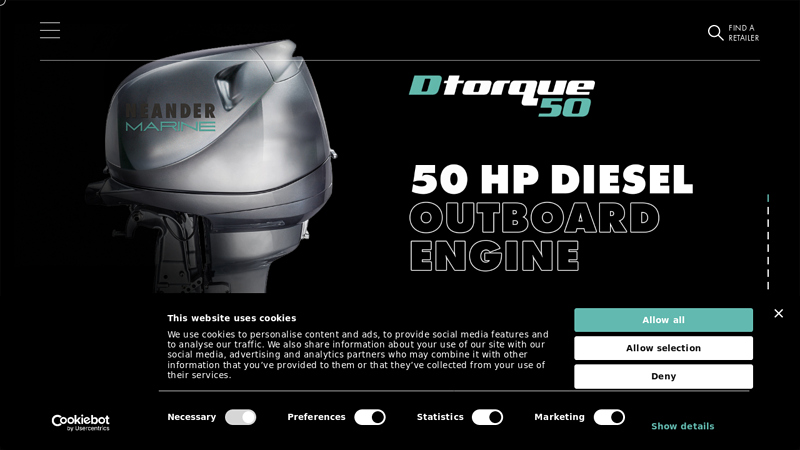

#6 Neander Marine

Domain Est. 2023

Website: neandermarine.com

Key Highlights: Introducing the Dtorque 50, the world’s only 50 hp turbo marine diesel outboard engine. Made by marine professionals, for marine professionals….

#7 OXE Diesel

Domain Est. 2023

Website: outboardglobalstore.com

Key Highlights: A high-performance diesel outboard engine that delivers exceptional power and fuel efficiency. With 200 horsepower, 900Nm of torque on the propeller shaft….

#8 Caudwell Marine

Website: caudwellmarine.com

Key Highlights: Discover the AX300 Diesel Outboard – engineered in the UK for endurance, reliability, and efficiency in commercial and military marine propulsion….

#9 Reliable Marine Engines and Power Solutions

Website: cummins.com

Key Highlights: Industry-leading marine power solutions with over 100 years of experience. Discover Cummins marine engines fit for every application and a more sustainable ……

Expert Sourcing Insights for Diesel Outboard Boat Motor

H2: 2026 Market Trends for Diesel Outboard Boat Motors

The global marine propulsion industry is undergoing a significant transformation, with diesel outboard boat motors emerging as a niche yet increasingly important segment by 2026. Driven by demand for fuel efficiency, durability, and environmental compliance, diesel outboards are gaining traction in commercial, offshore, and recreational marine markets. Below is an analysis of key trends shaping the diesel outboard motor market in 2026.

1. Growing Demand in Commercial and Workboat Sectors

By 2026, diesel outboards are seeing accelerated adoption in commercial applications such as fishing vessels, patrol boats, pilot boats, and utility workboats. Their superior torque, longer operational range, and lower fuel consumption compared to gasoline outboards make them ideal for extended missions and harsh marine environments. Regions like Southeast Asia, Northern Europe, and the Gulf Coast of the U.S. are leading in commercial fleet modernization, favoring diesel for operational cost savings.

2. Technological Advancements and Engine Efficiency

Manufacturers such as Cox Powertrain (UK) and other emerging players are investing heavily in refining diesel outboard technology. By 2026, next-generation models feature common rail direct injection, turbocharging, advanced cooling systems, and digital engine management—improving power-to-weight ratios and reducing emissions. These innovations are closing the performance gap with gasoline equivalents while enhancing reliability and service intervals.

3. Environmental Regulations and Emissions Compliance

Stringent international emissions standards, including IMO Tier III and EPA Tier 4, are pushing operators toward cleaner propulsion. Diesel outboards equipped with selective catalytic reduction (SCR) and diesel particulate filters (DPF) are becoming compliant with these regulations. As emissions scrutiny increases, especially in ecologically sensitive regions, diesel’s lower CO₂ emissions per unit of power make it a more sustainable option than traditional gasoline outboards.

4. Shift Toward Hybrid and Dual-Fuel Systems

Although fully electric outboards are gaining attention, their limited range and power restrict widespread use in larger vessels. As a result, hybrid diesel-electric outboard systems are emerging as a practical solution by 2026. These systems allow vessels to switch between diesel power for open-water travel and electric mode for low-speed maneuvering or zero-emission zones, offering flexibility and fuel savings.

5. Market Expansion in Emerging Economies

Developing maritime economies in Africa, Latin America, and parts of Asia are investing in modern fishing and transport fleets. Governments and NGOs are supporting the adoption of fuel-efficient, durable propulsion systems—creating new opportunities for diesel outboards. Infrastructure improvements and access to marine financing are further enabling market penetration in these regions.

6. High Initial Cost vs. Long-Term ROI

Despite higher upfront costs and limited model availability compared to gasoline outboards, diesel units offer a better total cost of ownership due to longer engine life, lower fuel consumption (up to 30–40% more efficient), and reduced maintenance. By 2026, more buyers are recognizing this long-term value, especially in commercial operations where downtime and fuel costs are critical.

7. Limited Competition and Niche Market Position

The diesel outboard market remains relatively niche, with few manufacturers compared to the saturated gasoline outboard sector. Cox Powertrain’s 300SDi remains a leading model, but new entrants are expected by 2026, fostering innovation and competition. This limited supply, however, keeps prices elevated and may slow mass-market adoption.

8. Integration with Smart Navigation and IoT

Modern diesel outboards in 2026 increasingly feature IoT connectivity, remote diagnostics, and integration with onboard navigation systems. This enables predictive maintenance, real-time performance monitoring, and enhanced vessel management—particularly valuable for fleet operators seeking operational efficiency.

Conclusion

By 2026, the diesel outboard boat motor market is poised for steady growth, primarily in commercial and high-performance sectors. While challenges such as cost, weight, and market awareness persist, technological innovation, regulatory support, and operational advantages are driving adoption. As marine industries prioritize efficiency and sustainability, diesel outboards are establishing themselves as a reliable, future-ready propulsion solution.

Common Pitfalls When Sourcing Diesel Outboard Boat Motors (Quality and Intellectual Property)

Sourcing diesel outboard boat motors presents unique challenges, particularly concerning product quality and intellectual property (IP) risks. Being aware of these pitfalls is essential to avoid costly mistakes, legal issues, and performance failures.

Poor Build Quality and Reliability Issues

One of the most significant pitfalls is encountering substandard build quality. Many manufacturers, especially in regions with less stringent regulatory oversight, produce diesel outboards using inferior materials and inconsistent manufacturing processes. This can lead to premature engine failure, frequent maintenance needs, and safety hazards. Buyers may find motors with poor corrosion resistance, inadequate sealing leading to water ingress, or underperforming fuel systems. Without proper certification or third-party verification (such as CE, ISO, or marine classification society approvals), there is little assurance of durability in harsh marine environments.

Lack of Genuine Certification and Compliance

A common issue when sourcing diesel outboards is the misrepresentation of compliance with international marine standards. Some suppliers may falsely claim their motors meet emissions regulations (e.g., EU Stage V or EPA Tier 4) or safety standards. This not only poses environmental and legal risks but can also result in the motor being unusable in regulated waters. Always verify certifications through official channels and request test reports or documentation directly from accredited bodies.

Intellectual Property Infringement

Diesel outboard technology involves complex engineering and patented innovations. A major IP risk arises when sourcing from manufacturers who replicate or reverse-engineer established designs without proper licensing. Purchasing such motors can expose your business to legal liability, especially if the products are imported into jurisdictions with strong IP enforcement (e.g., the U.S., EU, or Japan). Infringing products may be seized at customs, and your company could face lawsuits or reputational damage.

Inadequate After-Sales Support and Spare Parts Availability

Many low-cost suppliers lack a reliable global support network. This becomes a critical pitfall when technical issues arise or spare parts are needed. Without access to genuine parts, service manuals, or trained technicians, downtime can be extensive. Some suppliers may also discontinue models quickly, leaving buyers without long-term support. Ensure the supplier offers a comprehensive service network and guarantees parts availability for a minimum of 10 years.

Misleading Performance Specifications

Some suppliers exaggerate horsepower, fuel efficiency, or torque figures to make their products more attractive. Without independent verification or access to performance test data, buyers may end up with motors that underperform in real-world conditions. Always request third-party test results or conduct on-site performance evaluations before finalizing procurement.

Hidden Costs from Warranty and Return Limitations

While initial pricing may appear competitive, hidden pitfalls often emerge in warranty terms. Some manufacturers impose restrictive conditions—such as mandatory use of proprietary parts or servicing only through authorized agents—that can void coverage. Others may offer warranties that are difficult to enforce internationally. Clarify warranty scope, duration, and claim procedures before purchase.

Counterfeit or Rebranded Products

A growing concern is the sale of counterfeit or rebranded diesel outboards. These are often older models or knock-offs passed off as new or from reputable brands. Buyers should verify the manufacturer’s legitimacy, inspect production facilities if possible, and use trusted distribution channels to mitigate this risk.

By carefully evaluating quality assurance processes, verifying intellectual property rights, and confirming regulatory compliance, businesses can avoid these common sourcing pitfalls and ensure reliable, legal, and high-performing diesel outboard motors.

Logistics & Compliance Guide for Diesel Outboard Boat Motors

Overview

Diesel outboard boat motors are specialized propulsion systems that offer enhanced fuel efficiency, durability, and safety compared to gasoline counterparts. However, their international shipping, handling, and operation are subject to a range of logistical considerations and regulatory compliance requirements. This guide outlines key aspects for businesses and operators involved in the transportation, import/export, installation, and use of diesel outboard motors.

International Shipping & Transportation

Shipping diesel outboard motors across borders involves adherence to international transport regulations due to the presence of fuel systems, lubricants, and potentially hazardous components.

-

UN Number & Hazard Classification

Diesel outboard motors may be classified under UN3528, “Engine, internal combustion, flammable liquid powered,” when shipped with fuel residue or fuel systems containing flammable liquid. Even if drained, residual fuel can trigger classification as a hazardous good. -

IMDG Code Compliance (Maritime Transport)

When shipped by sea, compliance with the International Maritime Dangerous Goods (IMDG) Code is mandatory. Proper packaging, labeling (Class 3 Flammable Liquid labels), documentation (Dangerous Goods Declaration), and stowage are required. -

IATA Regulations (Air Transport)

Air shipment is highly restricted due to flammability risks. Most airlines prohibit engines with fuel systems unless completely drained, cleaned, and certified as non-hazardous. Pre-approval and specific packaging are essential. -

Packaging & Securing

Motors must be securely crated with protective padding to prevent damage. Fuel tanks must be completely drained and sealed. Desiccants should be used to prevent internal condensation during transit.

Import/Export Regulations

Cross-border movement involves customs documentation and adherence to trade laws.

- Harmonized System (HS) Codes

Use the appropriate HS code for classification. Typical codes include: - 8407.21: Internal combustion engines, marine, diesel-powered

-

8908.00: Outboard motors (check country-specific tariff schedules)

-

Export Controls

Verify if the motor or associated technologies (e.g., advanced fuel injection systems) are subject to export control regimes (e.g., EAR in the U.S. or dual-use controls in the EU). Licensing may be required for certain destinations. -

Import Duties & Taxes

Duties vary by country. Some jurisdictions offer reduced tariffs for marine equipment. Importers must provide commercial invoices, packing lists, and certificates of origin. -

Certification Requirements

Many countries require proof of conformity to local standards (e.g., CE marking in the EU, EPA certification in the U.S., or Transport Canada approval).

Environmental & Emissions Compliance

Diesel outboards must meet environmental regulations governing emissions and pollution.

-

EPA Certification (United States)

All diesel marine engines sold in the U.S. must comply with Environmental Protection Agency (EPA) standards under 40 CFR Part 1042. This includes Tier 4 emission requirements for nitrogen oxides (NOx) and particulate matter (PM). -

EU Stage V Regulations

In the European Union, diesel engines must meet EU Stage V emissions standards, which limit NOx, PM, hydrocarbons, and carbon monoxide. -

IMO Tier III (Applicable for Larger Vessels)

While primarily for larger marine diesel engines, understanding International Maritime Organization (IMO) standards is important for commercial applications or integration into larger systems. -

Oil & Fluid Management

Ensure compliance with MARPOL Annex I for prevention of oil pollution. Used engine oil and filters must be disposed of according to local hazardous waste regulations.

Safety & Operational Standards

Proper handling and operation are critical for safety and regulatory adherence.

-

CE Marking (Europe)

Diesel outboards placed on the EU market must comply with the Recreational Craft Directive (RCD) and Machinery Directive, including safety, noise, and emission requirements. -

ABYC Standards (U.S.)

The American Boat and Yacht Council (ABYC) provides voluntary standards for marine electrical systems, fuel systems, and engine installation. Compliance enhances safety and may be required by insurers. -

Noise Regulations

Some regions regulate engine noise. Ensure the motor meets local sound level requirements (e.g., EU limits under RCD, or state-level rules in the U.S.). -

Installation Guidelines

Installers must follow manufacturer instructions and local marine codes to ensure safe operation, including vibration isolation, exhaust routing, and fuel system integrity.

Documentation & Recordkeeping

Maintain accurate records to support compliance and traceability.

-

Technical File (for CE Marking)

Includes design specifications, test reports, risk assessments, and user manuals. -

Certificate of Conformity (CoC)

Required for customs clearance and registration in many countries. Issued by the manufacturer to confirm compliance with applicable standards. -

Bill of Lading & Commercial Invoice

Essential for customs declaration and duty assessment. -

Maintenance Logs

Required for commercial vessels to demonstrate adherence to safety and environmental regulations.

End-of-Life & Recycling

Compliance extends to the disposal phase.

-

WEEE & RoHS (EU)

If the motor contains electronic components, it may fall under the Waste Electrical and Electronic Equipment (WEEE) and Restriction of Hazardous Substances (RoHS) directives. -

Proper Disposal of Fluids

Engine oil, coolant, and fuel must be recycled or disposed of at certified facilities. -

Hull & Equipment Recycling

Coordinate with certified marine recyclers for responsible dismantling and material recovery.

Conclusion

Transporting and operating diesel outboard boat motors requires careful attention to international logistics, environmental standards, and regulatory frameworks. Businesses must ensure full compliance with shipping regulations, customs requirements, and environmental laws throughout the product lifecycle. Partnering with experienced freight forwarders, legal advisors, and marine certification bodies is recommended to mitigate risks and ensure smooth operations.

Conclusion: Sourcing a Diesel Outboard Boat Motor

Sourcing a diesel outboard boat motor presents a unique set of challenges and advantages. While diesel outboards are significantly less common than their gasoline counterparts, they offer superior fuel efficiency, enhanced safety due to diesel’s lower flammability, greater torque, and longer engine life—making them ideal for commercial, heavy-duty, or long-range marine applications.

Currently, options in the diesel outboard market are limited, with manufacturers like British Diesel (BDI) being among the few offering reliable models. This scarcity can lead to higher initial costs and potentially longer lead times. Additionally, maintenance and servicing may require specialized knowledge and parts, which can affect operational readiness in remote areas.

However, for operators prioritizing fuel security, durability, and operational safety—especially in regions where diesel fuel is more readily available and less expensive than gasoline—the investment in a diesel outboard can be justified. As maritime industries move toward more sustainable and resilient solutions, continued innovation may expand the availability and performance of diesel outboard motors in the future.

In conclusion, sourcing a diesel outboard motor is a strategic decision best suited for specific operational needs. Careful consideration of availability, total cost of ownership, and support infrastructure is essential. For the right application, a diesel outboard offers a robust and efficient propulsion solution with long-term benefits.