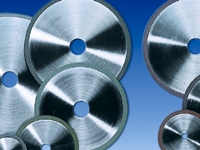

The global diamond wheel market is experiencing robust expansion, driven by increasing demand for precision machining across industries such as automotive, aerospace, and electronics. According to a 2023 report by Mordor Intelligence, the market was valued at approximately USD 1.3 billion in 2022 and is projected to grow at a CAGR of over 6.5% from 2023 to 2028. This growth is fueled by the rising adoption of advanced grinding technologies and the need for high-performance abrasive tools capable of working with hard materials like ceramics, carbide, and composites. As industrial automation accelerates and manufacturing standards become more stringent, diamond wheel manufacturers are innovating to deliver superior durability, accuracy, and efficiency. In this competitive landscape, a select group of global leaders has emerged, combining R&D investment, technological expertise, and broad product portfolios to capture significant market share. Based on market presence, product quality, innovation, and customer reviews, the following are the top 10 diamond wheel manufacturers shaping the future of precision grinding.

Top 10 Diamond Wheel Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 North Jersey Diamond Wheel, diamond wheels, superabrasives …

Domain Est. 1996

Website: diamondwheels.com

Key Highlights: North Jersey Diamond Wheel manufacturers a comprehensive array of superabrasive wheels using state-of-the-art techniques for all branches of industry….

#2 Diamond Wheels

Domain Est. 1999

Website: diamondwheelinc.com

Key Highlights: Diamond Wheel Inc. offers a complete line of diamond wheels, C.B.N. wheels, precision grinding supplies, super abrasive products; as well as diamond plating ……

#3 BGSUSA

Domain Est. 1999

Website: bgsusa.com

Key Highlights: Braemar USA is a trusted manufacturer of precision diamond and CBN tools for industries requiring high-performance grinding, drilling, and cutting solutions….

#4 Grinding Wheels

Domain Est. 1999

Website: toolgal.com

Key Highlights: Toolgal Diamond Wheels is an experienced manufacturer of High Quality Diamond and CBN grinding wheels. Toolgal supplies the wheels for several applications….

#5 Diamond Tool and Abrasives

Domain Est. 2000

Website: dtabrasives.com

Key Highlights: Welcome to Diamond Tool and Abrasives Inc. We are your technical abrasive source for Bonded, Coated and Superabrasive products….

#6 Diamond Products

Domain Est. 1996

Website: diamondproducts.com

Key Highlights: Diamond Products Limited Toll Free: 1-800-321-5336 Fax: 1-800-634-4035 333 Prospect St, Elyria, OH 44035…

#7 Diamond Racing Wheels

Domain Est. 1999

Website: diamondracingwheels.com

Key Highlights: We manufacture and retail race car wheels for stock car, circle track, road race, autocross, solo and truck applications….

#8 Precision Grinding Products by Continental DIamond Tool

Domain Est. 2002

Website: cdtusa.net

Key Highlights: Continental Diamond Tool specializes in the design, manufacture and application diamond, CBN, and conventional abrasive grinding products and custom tools….

#9 EDiamondTools

Domain Est. 2015

#10 CBN Grinding Wheels Manufacturer

Domain Est. 2007

Website: besdia.com

Key Highlights: The diamond grinding wheel and CBN grinding wheel are mainly used for grinding extremely hard materials like carbide cutting tips, gemstones, or concrete….

Expert Sourcing Insights for Diamond Wheel

H2: Market Trends for Diamond Wheels in 2026

The global diamond wheel market is poised for significant transformation by 2026, driven by evolving industrial demands, technological innovation, and shifts in manufacturing practices. As industries increasingly prioritize precision, efficiency, and sustainability, diamond wheels—renowned for their durability and superior cutting, grinding, and polishing performance—are becoming essential tools across multiple sectors. This analysis explores the key trends expected to shape the diamond wheel market in 2026.

1. Rising Demand from Advanced Manufacturing Sectors

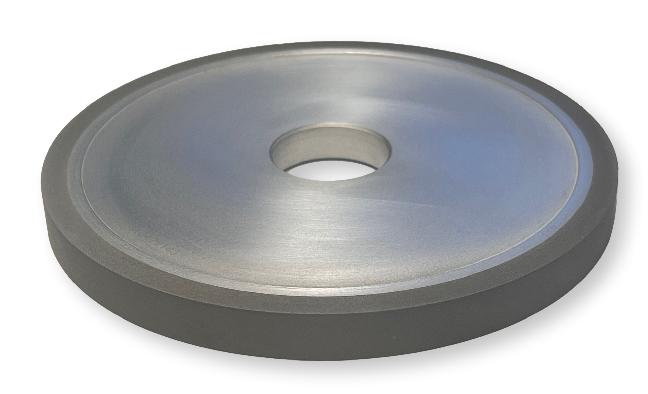

By 2026, the aerospace, automotive, and semiconductor industries will remain primary drivers of diamond wheel adoption. The push for lightweight materials in automotive and aerospace, such as carbon fiber composites and advanced ceramics, necessitates high-precision machining tools. Diamond wheels, especially metal-bonded and resin-bonded variants, are uniquely suited for these applications. Similarly, the semiconductor industry’s ongoing miniaturization and the expansion of 3D IC packaging will increase the need for ultra-precision diamond grinding and dicing wheels.

2. Growth in Renewable Energy and EV Production

The global transition toward renewable energy and electric vehicles (EVs) will significantly influence diamond wheel demand. Solar panel manufacturing requires precise wafer slicing—a process dominated by diamond wire saws and grinding wheels. Likewise, EV production involves machining hard materials like silicon carbide (SiC) and sintered magnets, which are best processed using diamond tools. By 2026, continued investment in EV infrastructure and green technologies will sustain robust market growth in this segment.

3. Technological Advancements in Bonding and Design

Innovation in bonding technologies—metal, resin, vitrified, and electroplated—will enhance performance and application versatility. Vitrified diamond wheels, for example, are gaining traction due to their thermal stability and precision in high-speed grinding. Additionally, the integration of AI and machine learning in wheel design and performance monitoring will enable predictive maintenance and optimized tool life, improving cost-efficiency for industrial users.

4. Expansion in Asia-Pacific Markets

The Asia-Pacific region, particularly China, India, Japan, and South Korea, will continue to dominate the diamond wheel market by 2026. This growth is fueled by rapid industrialization, government initiatives to boost domestic manufacturing (e.g., “Make in India,” “China Manufacturing 2025”), and the region’s role as a global hub for electronics and automotive production. Local production of diamond tools is also rising, supported by advancements in synthetic diamond manufacturing.

5. Sustainability and Recycling Initiatives

Environmental regulations and corporate sustainability goals are prompting manufacturers to develop recyclable and eco-friendly diamond tools. By 2026, companies are expected to adopt closed-loop recycling systems for diamond grit and metal bonds, reducing waste and raw material dependency. Water-based cooling systems and dry grinding technologies will also gain popularity, aligning with green manufacturing standards.

6. Consolidation and Competitive Dynamics

The market will likely see increased consolidation as leading players acquire niche innovators to expand their product portfolios and geographic reach. Companies such as Bosch, Tyrolit, and Saint-Gobain are expected to strengthen their R&D investments to differentiate through smart tools and customized solutions. At the same time, emerging players in Asia will challenge established brands with cost-effective, high-performance alternatives.

Conclusion

By 2026, the diamond wheel market will be shaped by a confluence of technological innovation, sector-specific demands, and sustainability imperatives. With growing applications in high-tech manufacturing and green energy, diamond wheels will remain indispensable tools in modern industry. Stakeholders who invest in advanced materials, smart manufacturing integration, and regional market expansion will be best positioned to capitalize on these trends.

Common Pitfalls Sourcing Diamond Wheels (Quality, IP)

Sourcing diamond wheels—especially for precision grinding applications—requires careful due diligence. Overlooking key factors can lead to performance issues, safety risks, or intellectual property (IP) concerns. Below are common pitfalls to avoid:

Poor Quality Control and Inconsistent Performance

Many suppliers, particularly low-cost manufacturers, lack rigorous quality control processes. This can result in inconsistent diamond concentration, bond strength, or concentricity, leading to subpar grinding performance, excessive wear, or even wheel failure during operation. Always verify certifications (e.g., ISO, ANSI, or DIN standards) and request test reports or samples before large orders.

Misrepresentation of Diamond Specifications

Suppliers may exaggerate diamond grit size, concentration, or type (natural vs. synthetic). Some may claim “industrial-grade” diamonds without providing verifiable data. Ensure specifications are backed by lab reports or third-party verification, and consider independent testing upon receipt.

Inadequate Bonding Technology

The bond (metal, resin, vitrified) significantly affects wheel life and application suitability. Low-quality bonds can lead to premature diamond shedding or clogging. Confirm the bond type matches your specific material and grinding conditions—don’t rely solely on marketing claims.

Lack of Traceability and Documentation

Reputable suppliers provide batch traceability, material certifications, and compliance documentation. Absence of these raises red flags about quality control and ethical sourcing. This is especially important in regulated industries like aerospace or medical device manufacturing.

Intellectual Property (IP) Infringement Risks

Some manufacturers reverse-engineer proprietary wheel designs protected by patents or trade secrets. Sourcing from such suppliers—even unknowingly—can expose your company to legal liability. Conduct IP due diligence: verify the supplier’s design rights, check patent databases, and include IP indemnity clauses in contracts.

Counterfeit or Recycled Diamond Content

Unscrupulous suppliers may use recycled or lower-grade diamonds passed off as premium. This undermines performance and durability. Request sourcing documentation for diamond materials and consider spectrographic analysis for high-volume purchases.

Insufficient Technical Support and Application Matching

Diamond wheels are application-specific. Choosing the wrong specification due to lack of technical guidance can result in poor outcomes. Partner with suppliers that offer engineering support and application expertise—not just catalog sales.

Overlooking Export Controls and Trade Compliance

High-performance diamond tools may be subject to export regulations (e.g., ITAR, EAR) due to their use in advanced manufacturing. Ensure your supplier complies with international trade laws to avoid shipment delays or legal penalties.

Avoiding these pitfalls requires due diligence, clear specifications, and partnerships with trustworthy, transparent suppliers. Always prioritize long-term performance and compliance over short-term cost savings.

Logistics & Compliance Guide for Diamond Wheel

Diamond wheels, due to their specialized composition and industrial applications, require careful handling throughout the supply chain. This guide outlines key logistics and compliance considerations to ensure safe, efficient, and legally compliant transportation and storage.

Regulatory Compliance

Diamond wheels may be subject to various international, national, and industry-specific regulations depending on their composition (e.g., presence of synthetic diamonds, bonding materials, or coatings). Key compliance areas include:

- HS Code Classification: Accurately classify diamond wheels using the appropriate Harmonized System (HS) code for customs declaration. Misclassification can lead to delays, fines, or seizures.

- Import/Export Controls: Verify if any export licenses or import permits are required, especially when shipping to or from regulated regions. Some components may fall under dual-use or strategic goods controls.

- REACH and RoHS (EU): Ensure compliance with EU regulations regarding chemical substances (REACH) and restriction of hazardous substances (RoHS), particularly if wheels contain metals or resins of concern.

- Safety Data Sheets (SDS): Maintain and provide SDS for any hazardous components used in manufacturing or coating the wheels, even if the final product is non-hazardous.

Packaging & Handling

Proper packaging is essential to prevent damage during transit and ensure worker safety:

- Protective Packaging: Use rigid, cushioned packaging (e.g., corrugated cardboard with foam inserts or wooden crates) to prevent chipping, cracking, or warping.

- Moisture Protection: Include moisture barriers (e.g., vacuum sealing or desiccants) if wheels are sensitive to humidity.

- Labeling: Clearly label packages with:

- Product name and part number

- Handling instructions (e.g., “Fragile,” “This Side Up”)

- Weight and dimensions

- Manufacturer and destination details

- Stacking & Weight Limits: Adhere to stacking guidelines to prevent crushing under heavy loads. Use pallets that meet ISPM 15 standards for international shipments.

Transportation Requirements

Choose transportation methods that minimize risk of damage and comply with regulations:

- Mode of Transport: Use road, air, or sea freight based on urgency, cost, and destination. Air freight requires stricter packaging due to pressure and vibration.

- Temperature & Humidity Control: Avoid extreme temperatures and high humidity during transit, which can degrade bonding agents or cause condensation.

- Vibration & Shock Mitigation: Secure loads to minimize movement. Use shock-absorbing pallets or suspension systems for sensitive shipments.

- Hazardous Material Considerations: While diamond wheels are typically non-hazardous, confirm with local authorities if bonded materials (e.g., certain resins or metals) require special handling.

Storage Guidelines

Proper storage preserves product integrity and ensures workplace safety:

- Environment: Store in a dry, climate-controlled area with stable temperature (15–25°C) and low humidity (<60% RH).

- Shelving: Place on flat, level surfaces. Avoid direct contact with the floor; use pallets or shelves.

- Orientation: Store wheels vertically when possible to prevent warping. If horizontal storage is necessary, limit stack height and use spacers.

- Expiry & Rotation: Follow FIFO (First In, First Out) inventory practices. Monitor shelf life, especially for resin-bonded or coated wheels.

Quality & Traceability

Maintain documentation to support compliance and quality assurance:

- Batch Tracking: Implement a system to track production batches, including date, materials used, and quality checks.

- Certifications: Retain certificates of compliance, test reports, and conformity statements (e.g., ISO 9001, CE marking if applicable).

- Audit Readiness: Keep records of shipping manifests, customs documents, and SDS accessible for regulatory audits.

Returns & Reverse Logistics

Establish procedures for handling returned or defective products:

- Inspection Protocol: Inspect returned wheels for damage or wear and document findings.

- Disposal Compliance: Dispose of damaged or expired wheels in accordance with local environmental regulations. Do not landfill if hazardous components are present.

- Recycling Options: Explore recycling programs for metal or abrasive components where available.

Adhering to this logistics and compliance guide ensures the safe, legal, and efficient handling of diamond wheels across the supply chain, minimizing risk and maintaining product quality.

Conclusion for Sourcing Diamond Wheels

In conclusion, sourcing high-quality diamond wheels requires a strategic approach that balances performance, durability, cost-efficiency, and supplier reliability. It is essential to evaluate key factors such as the type of diamond grit, bond material, wheel specifications, and application requirements to ensure optimal cutting, grinding, or polishing results. Partnering with reputable suppliers who offer technical support, consistent quality control, and customization options can significantly enhance operational efficiency and reduce long-term costs. Additionally, considering total cost of ownership—rather than initial purchase price—helps in making informed decisions that support productivity and tool longevity. By conducting thorough market research, requesting samples, and verifying certifications, organizations can establish a reliable supply chain for diamond wheels that meets their precision and performance standards.