The global diamond rough market continues to gain momentum, driven by rising demand across jewelry, industrial, and technology sectors. According to a 2023 report by Grand View Research, the global diamond market size was valued at USD 86.5 billion and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030, with rough diamond production forming the foundational segment. Mordor Intelligence projects similar growth, citing increased mining activities in Africa, Canada, and Russia, along with advancements in diamond recovery technologies. As demand for high-quality rough diamonds intensifies, a handful of manufacturers have emerged as industry leaders due to their scale, geological access, and operational efficiency. These top eight diamond rough manufacturers collectively account for a significant share of global production, shaping supply chains and influencing pricing trends worldwide.

Top 8 Diamond Rough Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Rough Diamonds

Domain Est. 1998

Website: diamondrough.net

Key Highlights: DiamondRough.net has a broad inventory of Cuttables, Industrials, Specimens, and Unique Rough Diamonds from many localities around the world….

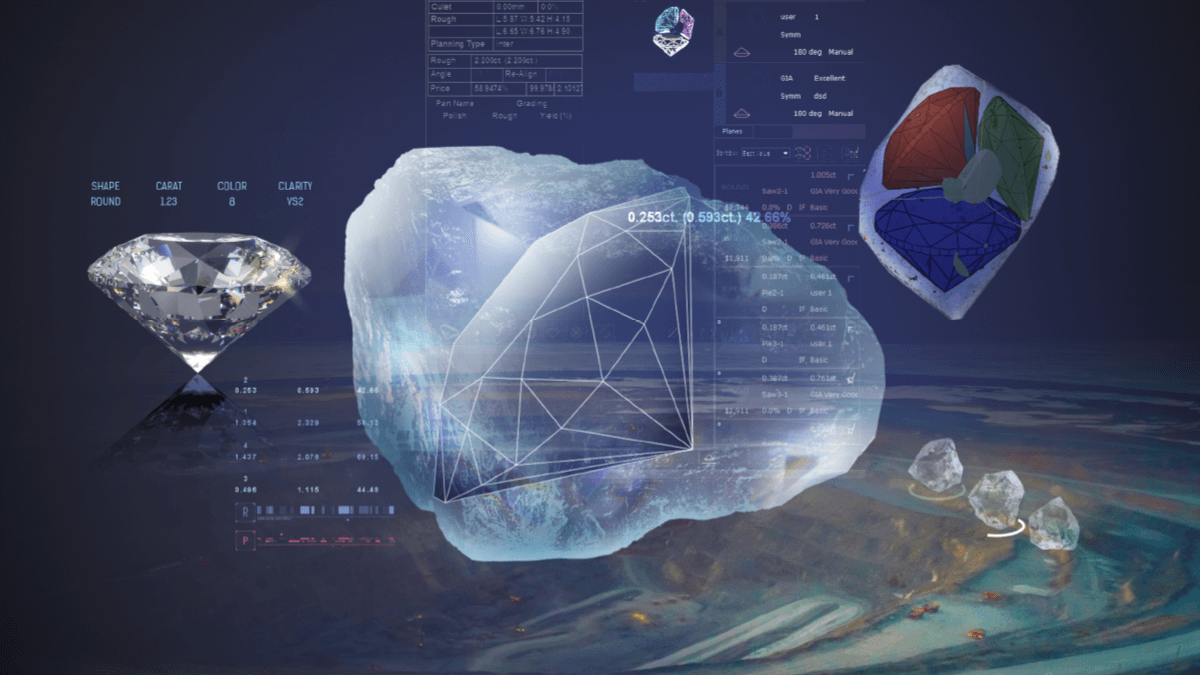

#2 Sarine Tech

Domain Est. 2002

Website: sarine.com

Key Highlights: Sarine’s technologies create value for everyone in the diamond industry: unlocking the value of rough diamonds for manufacturers….

#3 IGC Group

Domain Est. 2004

Website: igcgroup.com

Key Highlights: At IGC, you are offered natural diamonds of the finest make combined with a personal service. This makes us the preferred supplier to high-end retailers….

#4 Diamond Foundry

Domain Est. 1993

Website: df.com

Key Highlights: We accelerate today’s most exciting mega tech industries with the ultimate new tech component that can do so: single-crystal diamond wafers….

#5 DIAMOND ROUGH

Domain Est. 1997

Website: diamondrough.com

Key Highlights: We sell Rough Diamonds, Diamond Testers, Diamond Rough Education, the Diamond Math Book, and more. Over 40 years of flawless service to the industry!…

#6 Diamonds

Domain Est. 1997

Website: riotinto.com

Key Highlights: Rio Tinto operates a fully integrated global diamond exploration, mining and sales and marketing business, with a strong and trusted profile in both ……

#7 Kimberley Process

Domain Est. 2001

Website: kimberleyprocess.com

Key Highlights: Dedicated to a conflict-free diamond trade for over two decades. Supported by the UN to enhance global peace and security by preventing conflict diamonds….

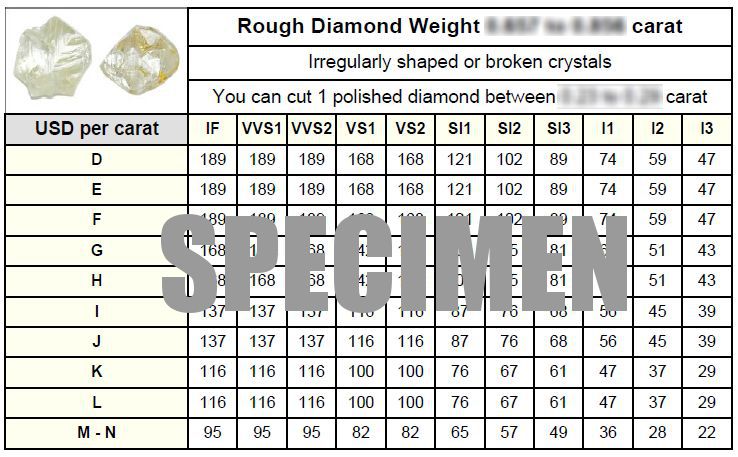

#8 Rough Diamond Prices Guide

Domain Est. 2005

Website: info-diamond.com

Key Highlights: We offer lists which give the price of rough diamonds per carat according to various criteria, such as: the crystalline shape, the rough weight, the color and ……

Expert Sourcing Insights for Diamond Rough

H2: 2026 Market Trends for Rough Diamonds

The global rough diamond market is expected to undergo significant shifts by 2026, shaped by evolving supply dynamics, shifting consumer preferences, technological advancements, and macroeconomic factors. This analysis outlines the key trends anticipated in the second half (H2) of 2026 that will influence the rough diamond sector.

-

Supply Constraints and Geopolitical Influences

By H2 2026, major diamond-producing nations such as Russia, Botswana, and Canada continue to face production challenges. Russia’s diamond output remains under pressure due to ongoing sanctions and logistical restrictions following the Ukraine conflict, impacting Alrosa’s ability to distribute rough diamonds globally. Meanwhile, Botswana is leveraging its strategic partnerships with De Beers to enhance local beneficiation, potentially reducing raw material exports. New production from smaller sources in West Africa and Canada’s Gahcho Kue and Victor mines may help offset declines, but overall supply growth is expected to remain flat or slightly negative. -

Demand Recovery in Key Markets

Consumer demand for diamonds, particularly in China and India, is projected to rebound moderately in H2 2026. In China, government stimulus measures and a stabilization of the luxury goods market are expected to boost jewelry purchases ahead of key gifting seasons. India remains a critical hub for diamond cutting and polishing, with local demand rising due to urbanization and increasing disposable incomes. The U.S. market shows steady demand, supported by strong consumer confidence and the continued popularity of diamond engagement rings. -

Rise of Lab-Grown Competition

The lab-grown diamond sector continues to expand rapidly, capturing an estimated 15–20% of the global diamond jewelry market by H2 2026. This puts downward pressure on rough natural diamond prices, especially in the small-stone and commercial-quality segments. Major retailers are increasingly offering both lab-grown and natural diamonds, forcing mining companies to emphasize the rarity, sustainability, and ethical sourcing of natural rough diamonds to differentiate their products. -

Pricing and Inventory Adjustments

After a period of inventory overhang in 2023–2024, diamond miners and traders have rebalanced their stocks. In H2 2026, rough diamond prices are stabilizing, with premium stones (large, high-clarity, and colored diamonds) showing resilience or modest gains. However, prices for small, industrial-grade stones remain under pressure due to substitution by lab-grown alternatives. De Beers and Alrosa have adjusted their sales models, adopting more flexible tenders and direct-to-manufacturer agreements to maintain market share. -

Sustainability and Traceability Focus

Environmental, Social, and Governance (ESG) considerations remain a dominant theme. By H2 2026, blockchain-based traceability systems such as De Beers’ Tracr are widely adopted across the supply chain, enabling full provenance tracking from mine to polished stone. Consumers and regulators alike demand transparency, pushing miners to invest in carbon-neutral operations and community development programs. Diamonds with certified ethical origins are commanding price premiums. -

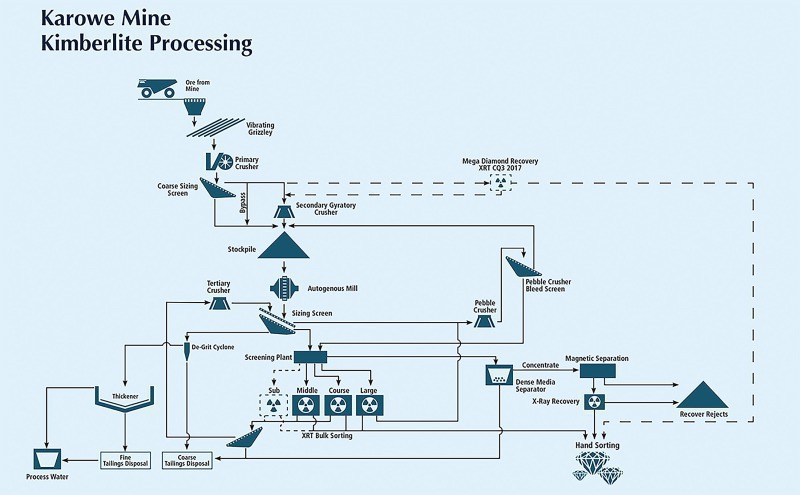

Technological Innovation in Exploration and Processing

Mining companies are increasingly deploying AI, remote sensing, and automated sorting technologies to improve recovery rates and reduce operational costs. In H2 2026, these innovations are helping extend the life of existing mines and improve the economic viability of lower-grade deposits, partially offsetting declining production volumes.

Conclusion

The H2 2026 rough diamond market reflects a maturing industry adapting to structural changes. While natural diamonds maintain their position in the luxury and investment segments, competition from lab-grown alternatives and supply-side constraints necessitate strategic innovation. Success will depend on miners’ ability to emphasize sustainability, ensure ethical sourcing, and align production with evolving consumer values. The market is expected to stabilize in the second half of 2026, setting the stage for cautious growth in the coming years.

Common Pitfalls in Sourcing Diamond Rough: Quality and Intellectual Property (IP) Concerns

Sourcing diamond rough presents unique challenges, particularly concerning quality assessment and intellectual property (IP) considerations. Without proper due diligence, companies and traders can face significant financial, legal, and reputational risks. Below are key pitfalls to avoid in both areas.

Quality-Related Pitfalls

Misjudging Carat Weight and Clarity Potential

One of the most frequent issues is overestimating the potential yield of rough diamonds. Rough stones often contain inclusions, fractures, or impurities that only become apparent after cutting. Buyers may pay a premium based on initial appearance, only to discover the polished output is significantly lower in carat weight or clarity grade.

Inconsistent Grading Standards

Unlike polished diamonds, rough diamonds lack universally standardized grading systems. Different suppliers or grading labs may use varying criteria, leading to discrepancies in quality evaluation. Relying on inconsistent or non-accredited assessments can result in overpayment or acquisition of subpar material.

Lack of Inclusion Mapping and 3D Scanning

Advanced technologies like 3D scanning and inclusion mapping are critical for predicting the cut and clarity of a polished stone. Skipping these steps can lead to poor planning during the cutting process, reducing yield and value. Failing to invest in proper analysis tools increases the risk of financial loss.

Overreliance on Visual Inspection

Judging rough diamonds solely by visual appearance is misleading. Surface characteristics may mask internal flaws, or a dull exterior may conceal high-potential stone. Relying on subjective visual assessment without technological support often leads to inaccurate quality assumptions.

Intellectual Property (IP) and Legal Pitfalls

Unauthorized Use of Cutting Designs and Techniques

Some diamond cutting methods, laser technologies, and proprietary polishing techniques are protected by patents or trade secrets. Sourcing rough with the intent to use patented processes without licensing can expose businesses to IP litigation, especially when producing high-value, branded cuts.

Brand-Specific Rough Allocation Agreements

Major diamond producers (e.g., De Beers, Alrosa) often allocate rough diamonds under strict agreements that include marketing and branding rights. Violating these terms—such as reselling allocated parcels to unauthorized parties or using them in unapproved product lines—can lead to contract breaches and IP disputes.

Misrepresentation of Origin and Ethical Claims

False claims about a diamond’s origin (e.g., “Canadian,” “conflict-free”) may infringe on certification trademarks or geographical indications. Misusing terms protected by industry bodies or national programs can result in legal action and damage to brand reputation.

Data Ownership and Digital Models

With the rise of digital twins and scanned rough models, questions arise over who owns the digital data generated during sorting and planning. Using or sharing 3D models without clear agreements may violate IP rights, especially if the data was created by a third-party service provider under exclusive terms.

Conclusion

Successfully sourcing diamond rough requires more than just evaluating price and size. Attention to quality assessment methodologies and awareness of IP constraints are essential to avoid costly mistakes. Engaging accredited graders, investing in technology, and ensuring legal compliance with IP and contractual obligations will mitigate risks and support sustainable, ethical sourcing practices.

Logistics & Compliance Guide for Rough Diamonds

This guide outlines key considerations and best practices for the legal and secure transportation, handling, and documentation of rough diamonds across international borders. Adherence to global standards and national regulations is critical to ensure ethical sourcing, prevent conflict financing, and maintain market integrity.

Kimberley Process Certification Scheme (KPCS)

The Kimberley Process Certification Scheme is the cornerstone of international rough diamond trade regulation. All shipments of rough diamonds between participating countries must comply with KPCS requirements.

- Mandatory Certification: Each shipment must be accompanied by a government-issued Kimberley Process (KP) Certificate, validating that the diamonds are conflict-free.

- Sealed Containers: Rough diamonds must be transported in tamper-resistant, sealed containers to prevent substitution or contamination.

- Authorized Participants: Only KP-certified companies registered with their national authority may import or export rough diamonds.

- Record Keeping: Detailed records of all purchases, sales, and shipments must be maintained for a minimum of five years and made available for audit.

National Regulatory Compliance

In addition to the Kimberley Process, exporters and importers must comply with the laws and regulations of both origin and destination countries.

- Export Licenses: Many countries require an export license for rough diamonds, often contingent on proof of legal origin and KP certification.

- Import Declarations: Importers must file accurate customs declarations, including value, weight (carats), and country of origin.

- Anti-Money Laundering (AML) Regulations: Financial transactions involving rough diamonds may be subject to AML reporting, especially for high-value shipments.

- Customs Valuation: Ensure declared values align with market benchmarks to avoid delays or penalties during customs clearance.

Secure Transportation and Chain of Custody

Given the high value and security risks associated with rough diamonds, robust logistics protocols are essential.

- Use of Reputable Carriers: Engage specialized logistics providers with experience in high-value cargo and secure handling procedures.

- Insurance: Insure shipments for their full market value against loss, theft, and damage during transit.

- Tracking and Monitoring: Utilize real-time GPS tracking and 24/7 monitoring for high-value consignments.

- Chain of Custody Documentation: Maintain a clear, auditable trail documenting every transfer of possession, including timestamps and responsible parties.

Due Diligence and Ethical Sourcing

Beyond legal compliance, industry best practices emphasize proactive due diligence to ensure ethical supply chains.

- Supplier Vetting: Conduct background checks on suppliers to confirm their KP compliance status and reputation.

- Origin Verification: Obtain documentation tracing diamonds to mines or aggregators, ensuring they originate from conflict-free zones.

- Third-Party Audits: Consider independent audits of supply chain practices to verify compliance and ethical standards.

- Internal Compliance Programs: Establish company-wide policies and training to ensure staff understand and follow regulatory requirements.

Recordkeeping and Reporting

Accurate and comprehensive documentation is critical for compliance and audit readiness.

- Shipment Logs: Record details of every shipment, including certificate numbers, weights, values, dates, and counterparties.

- Certificate Validation: Verify the authenticity of KP certificates with issuing authorities when in doubt.

- Annual Reporting: Submit required reports to national KP authorities, summarizing annual trade volumes and values.

- Data Retention: Store all compliance-related documents securely for the required retention period (typically five years or more).

Penalties for Non-Compliance

Failure to comply with rough diamond regulations can result in severe consequences.

- Seizure of Goods: Non-compliant shipments may be confiscated by customs authorities.

- Fines and Sanctions: Companies and individuals may face significant financial penalties.

- Loss of Certification: Violations can lead to suspension or revocation of KP participant status.

- Reputational Damage: Non-compliance can harm business relationships and brand integrity.

Adhering to this guide ensures that your rough diamond operations remain lawful, secure, and aligned with global ethical standards. Regular consultation with legal advisors and national KP authorities is recommended to stay updated on evolving requirements.

In conclusion, sourcing diamond rough requires a strategic and responsible approach that balances economic efficiency, ethical considerations, and long-term sustainability. Establishing transparent supply chains, adhering to industry standards such as the Kimberley Process, and prioritizing partnerships with reputable mining operations—whether large-scale producers or artisanal cooperatives—are essential steps in ensuring the integrity of rough diamonds. Additionally, increasing consumer demand for traceability and ethical sourcing necessitates investment in technology and certification systems that provide verifiable origin and responsible practices. Ultimately, successful rough diamond sourcing is not only about securing quality material at competitive prices, but also about fostering environmental stewardship, social responsibility, and compliance with global regulations to support a more sustainable and trustworthy diamond industry.