The global diamond core bits market is experiencing robust growth, driven by rising infrastructure development, increased oil & gas exploration, and advancements in mining technologies. According to Grand View Research, the global diamond tools market was valued at USD 4.3 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030, with diamond core bits representing a significant segment. Similarly, Mordor Intelligence forecasts a CAGR of over 7.5% for the diamond core tools market during the forecast period of 2023–2028, underpinned by growing construction activities and investments in geotechnical drilling across emerging economies. As demand for high-performance, durable drilling solutions intensifies, manufacturers are focusing on innovation, material quality, and application-specific designs. Against this backdrop, the following list highlights the top 10 diamond core bits manufacturers leading the industry through technological expertise, global reach, and consistent performance.

Top 10 Diamond Core Bits Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Diamond Products

Domain Est. 1996

Website: diamondproducts.com

Key Highlights: Diamond Tools Sawing Equipment. Core Bore Bits Coning Equipment. Cutting Wheels, Grinding Wheels, Wire Wheels. Need Financing ……

#2 MASTER DBR

Domain Est. 1997

Website: samedia.com

Key Highlights: The MASTER DBR is a good level diamond wet core bit. A good solution for coring with mounted rigs. In one word: good!…

#3 Diamond Core Drilling and Sawing Company

Domain Est. 1999

Website: diamondcore.com

Key Highlights: Your Source for Replacement Abrasive Discs, Diamond Blades and Bits · Concrete Cutting, Core Drilling, Wall and Flat Sawing, Wire Sawing, In-House Tool Repair, ……

#4 Core Bits Archives

Domain Est. 1999

Website: pearlabrasive.com

Key Highlights: Diamond Accessories · Power Tool Parts · Contact Us · About Us · Locations. Core Bits. Home / Diamonds / Core Bits. Go Back. Showing 1–40 of 112 results….

#5 What We Offer

Domain Est. 2000

Website: hoffmandiamond.com

Key Highlights: Hoffman Diamond Products manufactures saw blades and thin wall coring bits for the sawing and drilling of concrete, asphalt, granite, marble, brick, block, tile ……

#6 Diamond Core Drill Bits

Domain Est. 2007

Website: tmgmfg.com

Key Highlights: TMG Manufacturing offers a full line of diamond impregnated core bits, reamers (reaming shells), and casing shoe’s for the wireline drilling and coring ……

#7 Diamond Core Drill Bits

Domain Est. 2013

Website: corediamtools.com

Key Highlights: Our concrete diamond core drill bits are available in regular sizes from 1 in. (25 mm) to 14 in. (350 mm). However, other sizes are available upon request….

#8 Diamond Core Drill Bits

Domain Est. 2016

Website: guntherdiamondtools.com

Key Highlights: Free deliveryOur drill bits are what make the Gunther Drilling System the World’s best tool for small diameter core drilling in Stone, Ceramic, and Glass….

#9 Diamond Core Bits

Domain Est. 2017 | Founded: 2009

Website: epiroc.com

Key Highlights: Since 2009, HERO brand of core bits have been diamond drillers’ most popular choice of bit, offering the best penetration/lifespan ratio in the ……

#10 Diamond Core Drills

Website: distar.tools

Key Highlights: A diamond drill bit is the most effective tool for making holes in various construction and finishing materials. It easily copes with drilling bricks, concrete, ……

Expert Sourcing Insights for Diamond Core Bits

H2: 2026 Market Trends for Diamond Core Bits

The global diamond core bits market is poised for significant transformation by 2026, driven by evolving construction practices, technological advancements, and increasing demand for precision drilling across multiple industries. Key trends shaping the market include:

-

Growing Infrastructure Development

Rising investments in infrastructure projects—particularly in emerging economies in Asia-Pacific, Africa, and Latin America—are boosting demand for efficient drilling tools. Urbanization and government-led construction initiatives are increasing the need for durable diamond core bits used in concrete, masonry, and reinforced materials. -

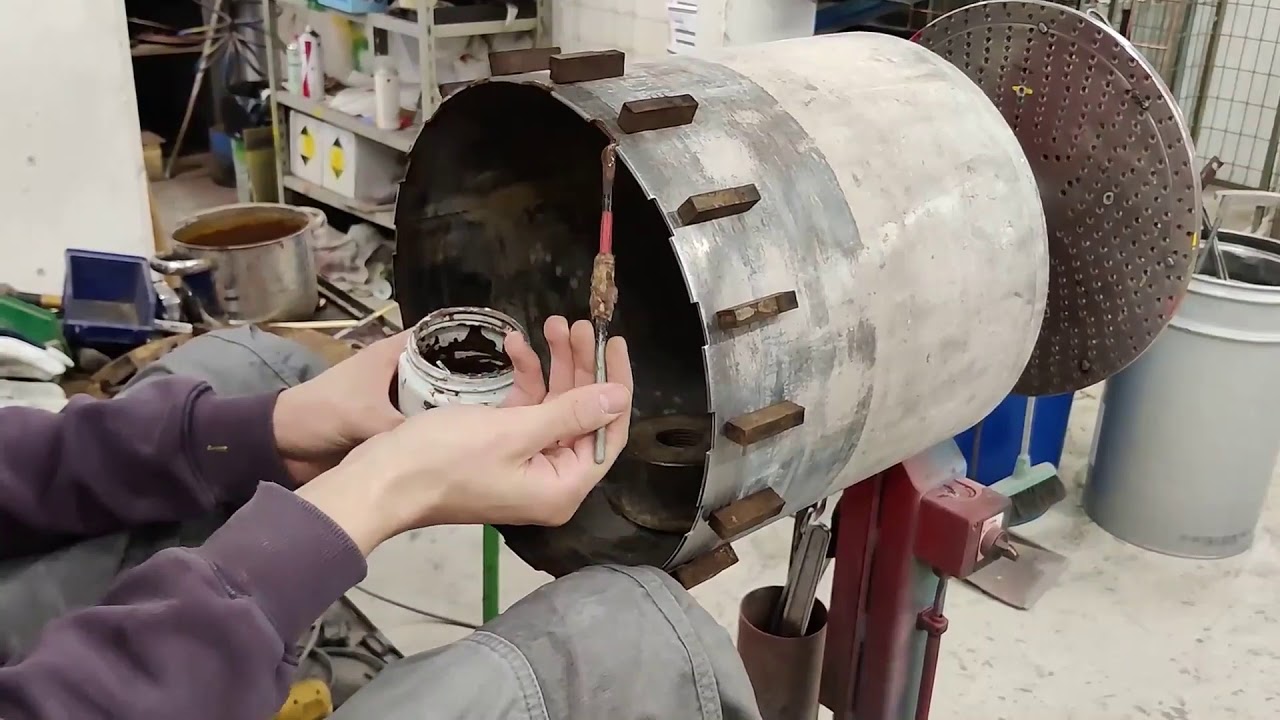

Adoption of Advanced Materials and Manufacturing Techniques

Manufacturers are increasingly integrating synthetic diamond grit with enhanced bonding technologies (e.g., laser welding and sintered matrix designs) to improve bit lifespan and drilling efficiency. These innovations reduce downtime and operational costs, making diamond core bits more attractive in industrial and commercial applications. -

Shift Toward Cordless and High-Performance Power Tools

The surge in portable, high-torque electric and battery-powered drills is influencing the design of diamond core bits. Compatibility with cordless systems requires optimized bit geometry and heat dissipation features. This trend supports broader adoption in fieldwork and hard-to-reach locations. -

Expansion in Renewable Energy and Utility Sectors

The construction of solar farms, wind turbine foundations, and geothermal installations requires precision drilling in hard substrates. Diamond core bits are essential for installing conduits, anchor points, and sensor housings, positioning them as critical tools in the clean energy transition. -

Sustainability and Recycling Initiatives

Environmental regulations and corporate sustainability goals are prompting manufacturers to develop recyclable core bits and reduce waste in production. Some companies are introducing take-back programs for worn bits, focusing on re-tipping and reconditioning to extend product life cycles. -

Regional Market Dynamics

While North America and Europe maintain strong demand due to retrofitting and seismic retrofitting projects, the Asia-Pacific region is expected to witness the highest growth rate. Countries like India, China, and Indonesia are investing heavily in smart cities and transportation networks, directly benefiting the diamond core bit market. -

Digital Integration and Smart Tools

By 2026, integration with IoT-enabled drilling systems is anticipated to grow. Sensors embedded in drilling rigs can monitor bit wear, temperature, and torque in real time—data that helps optimize performance and prevent tool failure. This trend supports predictive maintenance and improves overall job site efficiency. -

Competitive Landscape and Innovation

The market is becoming increasingly competitive, with key players such as Bosch, Husqvarna, and DeWalt focusing on product differentiation through R&D. Smaller manufacturers are leveraging niche innovations, such as segmented rim designs and hybrid diamond matrices, to capture market share.

In summary, the 2026 diamond core bits market will be defined by innovation, sustainability, and expanding applications across construction, energy, and industrial sectors. Companies that invest in advanced materials, digital compatibility, and regional market strategies are likely to lead the next phase of growth.

Common Pitfalls When Sourcing Diamond Core Bits (Quality and Intellectual Property)

Sourcing diamond core bits—especially for demanding applications in construction, mining, or geological drilling—can be fraught with challenges. Buyers often face issues related to inconsistent quality and potential intellectual property (IP) infringement. Being aware of these pitfalls is essential to ensure performance, safety, and legal compliance.

Poor Quality Control and Inconsistent Performance

Many suppliers, particularly low-cost manufacturers, lack rigorous quality control processes. This results in diamond core bits with uneven diamond distribution, weak bond matrices, or substandard steel bodies. Such inconsistencies can lead to premature bit failure, inefficient drilling, increased downtime, and higher long-term costs despite lower initial prices.

Misrepresentation of Diamond Type and Concentration

Suppliers may exaggerate the quality or concentration of synthetic diamonds used in the segments. For example, claiming “high-grade” diamonds without certification or industry-standard grading can mislead buyers. Lower-quality diamonds wear faster, reducing cutting efficiency and bit lifespan.

Substandard Bond Formulation

The bond that holds the diamonds in place is critical. A poorly formulated bond—either too hard or too soft for the target material—leads to inefficient cutting, glazing, or excessive wear. Some suppliers use generic or untested bond recipes, which undermine performance in specific applications.

Lack of Application-Specific Design

Not all core bits are suitable for every material or drilling condition. Generic or one-size-fits-all designs from unqualified suppliers can result in poor performance in hard rock, rebar-reinforced concrete, or abrasive soils. Buyers often overlook the need for engineered solutions tailored to their specific use case.

Counterfeit or IP-Infringing Products

Some manufacturers produce core bits that mimic the design, branding, or patented technology of established brands without authorization. These counterfeit products may look identical but perform poorly and expose buyers to legal risks, especially in regulated industries. Using such products can also void warranties on drilling equipment.

Inadequate or Falsified Certifications

Suppliers may provide fake or misleading ISO, CE, or other certifications to appear compliant with international standards. Without third-party verification, buyers cannot trust claims about material quality, safety, or performance testing.

Insufficient Technical Support and Documentation

Reputable manufacturers provide detailed technical data, application guidelines, and performance metrics. Low-tier suppliers often lack this support, leaving users guessing about proper usage, compatible equipment, or optimal drilling parameters.

Hidden Costs from Shorter Lifespan and Downtime

While some diamond core bits appear cost-effective upfront, poor quality leads to frequent replacements, slower drilling speeds, and unplanned downtime. The total cost of ownership often exceeds that of higher-quality, properly sourced bits.

Supply Chain Transparency Issues

Opaque supply chains make it difficult to trace the origin of materials or verify manufacturing practices. This lack of transparency increases the risk of receiving non-compliant or unethical products and complicates recourse in case of defects.

Neglecting IP Protection During Customization

When working with suppliers to develop custom core bits, companies may fail to secure proper IP agreements. This can result in the supplier replicating or selling the design to competitors, undermining competitive advantage.

By recognizing these pitfalls, buyers can implement better sourcing strategies—such as vetting suppliers, demanding verifiable certifications, conducting performance trials, and protecting IP through legal agreements—to ensure reliable, high-quality, and legally sound procurement of diamond core bits.

Logistics & Compliance Guide for Diamond Core Bits

Diamond core bits are specialized cutting tools used in construction, mining, geological exploration, and other industries for drilling through hard materials like concrete, rock, and masonry. Due to their composition and potential international use, their logistics and compliance requirements can be complex. This guide outlines key considerations for the safe, legal, and efficient transportation and handling of diamond core bits.

Classification and HS Code

Correct classification is essential for customs clearance and duty assessment. Diamond core bits are typically classified under the following Harmonized System (HS) codes:

- 8207.40: Tools for working in the hand, power-operated, for drilling, of base metal, whether or not combined.

- 8207.50: Parts and accessories of the tools of heading 8207, including cutting elements.

Note: Specific sub-codes may vary by country and depend on materials (e.g., synthetic vs. natural diamonds), design, and intended use. Confirm with local customs authorities or a licensed customs broker before shipping.

Export Controls & Licensing

Most diamond core bits are not subject to strict export controls, especially if they use synthetic diamonds and are not designed for military or dual-use applications. However:

- Dual-Use Considerations: If core bits are designed for high-precision drilling in aerospace, defense, or nuclear applications, they may fall under dual-use regulations (e.g., EU Dual-Use Regulation or U.S. EAR).

- Country-Specific Restrictions: Export to embargoed or sanctioned countries (e.g., Iran, North Korea, Syria) may require licenses or be prohibited entirely.

- Natural Diamonds: If bits incorporate natural diamonds, additional regulations such as the Kimberley Process may apply, though this is rare in industrial bits.

Always conduct an export screening based on destination, end-user, and product specifications.

Packaging and Labeling Requirements

Proper packaging ensures product integrity and compliance with transport regulations:

- Protective Packaging: Use robust containers (cardboard, wood, or plastic) with internal cushioning (foam, bubble wrap) to prevent damage to the diamond segments and shank.

- Labeling:

- Clearly mark contents (e.g., “Diamond Core Bits – Industrial Use”).

- Include product specifications (diameter, thread type, wet/dry use).

- Add handling labels (e.g., “Fragile,” “This Side Up”).

- Include supplier/exporter contact information and batch/lot numbers.

Transportation & Shipping

Diamond core bits are generally non-hazardous and can be shipped via air, sea, or ground freight. Key considerations:

- Air Freight: Allowed without restrictions under IATA guidelines (non-dangerous goods). Ensure packaging meets airline drop-test and stacking standards.

- Sea Freight: Standard container shipping applies. Use moisture-resistant packaging to prevent rust, especially for steel components.

- Ground Transport: Comply with national road transport regulations. No special permits required in most cases.

Import Requirements by Region

Compliance varies by destination country:

- United States (CBP):

- Provide a commercial invoice, packing list, and bill of lading/air waybill.

- Declare correct HTSUS code (e.g., 8207.40.60 for core bits).

-

No special import license typically required.

-

European Union (EU):

- Use correct CN code (e.g., 8207 40 80).

- Ensure compliance with REACH and RoHS if applicable (e.g., regarding metals or coatings).

-

Importers must register in the EU’s Import Control System (ICS2) for pre-arrival notifications.

-

Canada (CBSA):

- Declare under tariff item 8207.40.00.

-

No import permit required for standard industrial tools.

-

Australia (ABF):

- Classify under 8207 40 000.

- Importers may need an Australian Business Number (ABN) and must pay applicable GST.

Safety & Workplace Compliance

When used on job sites, diamond core bits must comply with occupational health and safety standards:

- Dust Control: Wet drilling or use of HEPA-filtered vacuum systems to minimize silica dust (OSHA, EU Directive 2009/148/EC).

- Personal Protective Equipment (PPE): Operators must wear safety goggles, gloves, hearing protection, and respiratory protection as needed.

- Tool Maintenance: Follow manufacturer guidelines for inspection, cleaning, and replacement to prevent accidents.

Warranty and Returns Logistics

- Clearly define warranty terms (e.g., 6–12 months against manufacturing defects).

- Establish return procedures, including RMA (Return Merchandise Authorization) numbers and approved packaging.

- Note: Used or damaged bits may not be returnable due to safety and hygiene concerns.

Summary

Efficient logistics and compliance for diamond core bits depend on accurate classification, adherence to export/import rules, proper packaging, and attention to regional regulations. By following this guide, suppliers and distributors can ensure smooth cross-border movement and safe product handling worldwide. Always consult local legal and customs experts for jurisdiction-specific requirements.

In conclusion, sourcing diamond core bits requires careful consideration of several key factors to ensure optimal performance, durability, and cost-efficiency. The choice of diamond concentration, bond type, and core bit design must align with the specific application and material being drilled—whether concrete, masonry, stone, or reinforced materials. Sourcing from reputable suppliers who provide high-quality, ISO-certified products ensures reliability and safety on the job site. Additionally, evaluating total cost of ownership—factoring in lifespan, drilling speed, and maintenance—rather than focusing solely on upfront price can lead to significant long-term savings. By prioritizing quality, compatibility, and supplier credibility, professionals can enhance productivity and achieve precise, clean core drilling results across diverse project requirements.