The global di-calcium phosphate (DCP) market is experiencing steady growth, driven primarily by rising demand in the animal feed and pharmaceutical industries. According to Grand View Research, the global calcium phosphate market size was valued at USD 4.5 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. This growth is fueled by increasing livestock production, advancements in animal nutrition, and the expanding use of mineral supplements in pharmaceutical formulations. Mordor Intelligence further supports this outlook, citing rising investments in feed additives and growing awareness of animal health as key market drivers. As demand for high-purity, consistent-quality DCP intensifies, a select group of manufacturers have emerged as industry leaders, setting benchmarks in production scale, technological innovation, and global supply chain reliability. Here, we spotlight the top 9 di-calcium phosphate manufacturers shaping the competitive landscape.

Top 9 Di Calcium Phosphate Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 DiCalcium Phosphate Exporter, Manufacturer, Supplier & Producer …

Domain Est. 2015

Website: dicalciumphosphates.com

Key Highlights: In stockHINDUSTAN PHOSPHATES PVT. LTD. – Exporter, Manufacturer, Supplier & Producer of DiCalcium Phosphate based in Indore, India….

#2 Di Calcium Phosphate

Domain Est. 2000

Website: globalcalcium.com

Key Highlights: Global Calcium is one of the leading manufacturers and exporters of Di Calcium Phosphate CAS no. 7757-93-9, Mineral Actives….

#3 Phosphate Chemical,Calcium Carbonates,Limestone Powder …

Domain Est. 2011

Website: rkphosphates.com

Key Highlights: Phosphates Pvt. Ltd is a prime Manufacturer, Supplier and Exporter of Dicalcium Phosphate, Calcite Powder, Limestone Powder, Calcium Carbonate,,Silica Powder, ……

#4 Di Calcium Phosphate (DCP)

Domain Est. 2016

Website: aarti-industries.com

Key Highlights: We are one of India’s leading manufacturers, exporters & suppliers of Di Calcium Phosphate (DCP). Its chemical name is Dicalcium phosphate. The CAS Number of ……

#5 Dicalcium Phosphate Anhydrous

Domain Est. 2017 | Founded: 1982

Website: vijen.in

Key Highlights: Vijay Enterprises, a trusted name since 1982, is a leading Dicalcium Phosphate Anhydrous manufacturer, supplier and export. Renowned for its manufacturing ……

#6 Calcium-Phosphate-Dibasic-Anhydrous-Powder-Reagent

Domain Est. 1995

Website: spectrumchemical.com

Key Highlights: 15-day returnsCalcium Phosphate Dibasic, Anhydrous, Powder, Reagent or Dicalcium phosphate is mainly used as a dietary supplement in prepared breakfast cereals, ……

#7 Dicalcium Phosphate Supplier

Domain Est. 2000

Website: vivion.com

Key Highlights: Looking for a dependable Dicalcium Phosphate supplier? Choose Vivion, your trusted source for high-quality ingredients. Elevate your production today….

#8 Calcium Phosphate Ingredients: MCP, DCP, & TCP

Domain Est. 2004

Website: innophos.com

Key Highlights: Dicalcium Phosphate serves as a nutritional source of calcium and phosphorus in foods, beverages and dietary supplement products. What does TCP stand for?…

#9 Dicalcium Phosphate Supplier

Domain Est. 2004

Website: silverfernchemical.com

Key Highlights: Dicalcium phosphate is mainly used as a dietary supplement in prepared breakfast cereals, dog treats, enriched flour, and noodle products. It is also used as a ……

Expert Sourcing Insights for Di Calcium Phosphate

H2: 2026 Market Trends for Di Calcium Phosphate

The global di calcium phosphate (DCP) market is projected to experience steady growth by 2026, driven primarily by rising demand across the animal feed, food & beverage, and pharmaceutical sectors. As a vital source of bioavailable calcium and phosphorus, DCP continues to play a critical role in nutritional supplementation, especially in livestock and poultry farming, where bone development and overall health are paramount.

One of the key trends shaping the 2026 landscape is the increasing global focus on animal health and productivity, particularly in emerging economies across Asia-Pacific and Latin America. Expanding livestock operations in countries such as India, China, and Brazil are boosting DCP consumption, as feed manufacturers prioritize high-quality mineral supplements to meet protein demand from growing populations.

Additionally, regulatory shifts favoring food-grade additives and clean-label ingredients are influencing DCP usage in the human nutrition segment. Food manufacturers are increasingly incorporating food-grade DCP as a leavening agent, nutritional fortifier, and texturizer in baked goods and processed foods, aligning with consumer demand for fortified, functional foods.

Sustainability and supply chain resilience are also emerging as critical factors. By 2026, leading producers are expected to invest in greener production processes, including improved waste management and energy efficiency in DCP synthesis—often derived from phosphate rock and purified acids. Rising scrutiny over phosphate mining practices is prompting companies to explore alternative sourcing and recycling methods to mitigate environmental impact.

Moreover, technological advancements in precision nutrition—especially in animal feed formulation—are enhancing the efficiency of DCP utilization. Customized feed premixes that optimize calcium-to-phosphorus ratios are gaining traction, reducing waste and improving animal performance.

In conclusion, the 2026 di calcium phosphate market is characterized by robust demand from feed and food industries, regulatory support for fortified nutrition, and a growing emphasis on sustainable production. Market players who innovate in product quality, environmental stewardship, and supply chain transparency are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing Di Calcium Phosphate (Quality & Intellectual Property)

Sourcing Di Calcium Phosphate (DCP), especially for regulated industries like pharmaceuticals, nutraceuticals, or food, involves navigating significant quality and intellectual property (IP) risks. Overlooking these pitfalls can lead to product failures, regulatory non-compliance, supply chain disruptions, and legal liabilities.

Quality-Related Pitfalls

- Inadequate Specification Verification: Relying solely on a supplier’s Certificate of Analysis (CoA) without independent testing or rigorous audit of their quality control processes. DCP properties like particle size, bulk density, reactivity, and purity (especially for heavy metals, fluorides, arsenic) are critical for functionality and safety. Assuming all DCP is equal can lead to formulation issues or regulatory rejection.

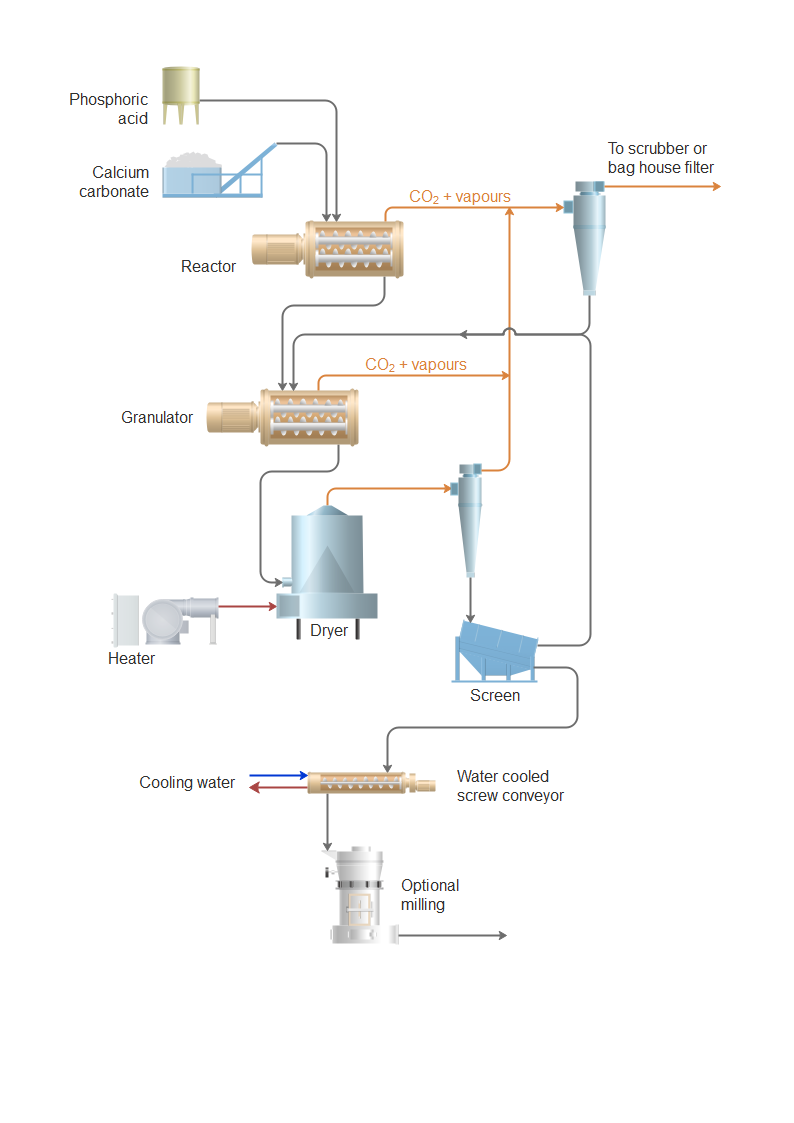

- Inconsistent Manufacturing Processes: Sourcing from suppliers using different production methods (e.g., acidulation vs. neutralization processes) without understanding the impact. This can result in batch-to-batch variability in crystal structure (e.g., anhydrous vs. dihydrate), solubility, flow characteristics, and reactivity, affecting final product performance.

- Contamination Risks: Failing to assess the supplier’s raw material sourcing (e.g., phosphate rock origin, purity of acids) and manufacturing environment. Contamination with heavy metals (lead, cadmium, arsenic), fluorides, or other impurities exceeding regulatory limits (e.g., USP, Ph. Eur., FCC, food-grade standards) is a major concern, particularly for sensitive applications.

- Unverified Regulatory Compliance: Not confirming the DCP meets the specific required pharmacopoeial (USP, Ph. Eur., JP), food-grade (FCC), or industrial standard for the intended application. Assuming a “pharmaceutical grade” material automatically meets all requirements for a specific formulation can be dangerous.

- Poor Supply Chain Transparency: Inability to trace the DCP back to its origin (phosphate rock mine) due to opaque supply chains. This lack of traceability makes it difficult to assess environmental, ethical, and quality risks associated with the raw materials.

Intellectual Property (IP)-Related Pitfalls

- Infringement of Process Patents: Sourcing DCP produced using a patented manufacturing process without a license. Even if the final DCP compound itself is generic, the specific method used to produce it (e.g., a novel crystallization technique, purification method, or particle engineering process) might be protected. Using such material can expose the buyer to indirect infringement claims.

- Unintentional Use of Patented Forms: Utilizing DCP with a specific, protected physical form (e.g., a particular particle size distribution, crystal modification, or surface treatment) claimed in a patent, even if the chemical composition is standard. This is common in patents related to improved flow, compressibility, or bioavailability.

- Lack of Freedom-to-Operate (FTO) Analysis: Failing to conduct a thorough FTO analysis before selecting a supplier or DCP grade. This analysis is crucial to identify any active patents (process, composition of matter, use) that could be infringed by sourcing or using the DCP in the buyer’s specific application.

- Insufficient Supplier Warranties and Indemnification: Contracts lacking strong clauses where the supplier warrants they do not infringe third-party IP rights in their manufacturing process and agrees to indemnify the buyer against any resulting infringement claims. Without this, the buyer bears the full legal and financial risk.

- Ambiguity in Specifications Leading to IP Issues: Poorly defined specifications in the purchase agreement that inadvertently describe a patented characteristic of the DCP, making the buyer’s purchase an act of infringement based on the requested attributes.

Mitigation: To avoid these pitfalls, implement rigorous due diligence: conduct independent quality testing, audit supplier facilities, demand full traceability, perform thorough FTO analyses, secure strong contractual IP protections, and clearly define specifications based on functional needs rather than potentially patented attributes.

H2: Logistics & Compliance Guide for Di Calcium Phosphate (DCP)

Di Calcium Phosphate (DCP), with the chemical formula CaHPO₄, is widely used in animal feed, fertilizers, food additives, and pharmaceuticals. Safe and compliant handling, transportation, and storage are essential due to its physical properties and regulatory status. This guide outlines key logistics and compliance considerations.

H2: Product Identification & Classification

- Chemical Name: Dibasic Calcium Phosphate (Di Calcium Phosphate, DCP)

- CAS Number: 7758-87-4 (anhydrous), 13776-88-0 (dihydrate)

- UN Number: Not classified as hazardous for transport under ADR/RID/IMDG/ICAO (typically UN3077, ENVIRONMENTALLY HAZARDOUS SUBSTANCE, SOLID, N.O.S., Class 9, if applicable based on formulation). Always verify with SDS.

- GHS Classification:

- Hazard Statement(s): Generally considered non-hazardous. May be classified as:

- H319: Causes serious eye irritation (common)

- H413: May cause long lasting harmful effects to aquatic life (if significant impurities present)

- Precautionary Statements: P264 (wash skin thoroughly after handling), P280 (wear protective gloves/eye protection), P305+P351+P338 (IF IN EYES: Rinse cautiously with water for several minutes).

- Hazard Statement(s): Generally considered non-hazardous. May be classified as:

- Physical Form: White crystalline powder or granules.

- pH (1% solution): ~6.0 – 7.5 (near neutral).

H2: Regulatory Compliance

- REACH (EU): Registered under REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals). Ensure your supplier provides a valid Safety Data Sheet (SDS) and, if required, an Exposure Scenario.

- FDA (USA): Approved as a food additive (GRAS – Generally Recognized As Safe) and in animal feed. Verify compliance with 21 CFR (e.g., 182.1217, 582.1217, 573.320).

- Fertilizer Regulations: Subject to national and regional fertilizer regulations regarding nutrient content (P, Ca), heavy metal limits (e.g., Cd, As, Pb, Hg), and labeling (e.g., EC Fertilising Products Regulation (EU) 2019/1009, US state regulations).

- Feed Additive Regulations: Must comply with specific animal feed regulations (e.g., EU Regulation (EC) No 1831/2003, FDA CVM guidelines) regarding purity, maximum inclusion levels, and labeling.

- Food Additive Regulations: Must meet food-grade specifications (e.g., FCC, USP, Ph. Eur.) if used in food or pharmaceuticals.

- Customs & Import/Export: Accurate HS Code declaration is critical. Common codes include:

- 2835.25.00: Phosphates of calcium (excl. di- or tri-basic calcium phosphate of a purity > 98% by weight).

- 2835.26.00: Dibasic calcium phosphate (purity > 98% by weight).

- 2309.90.90: Preparations of a kind used in animal feeding, n.e.s. (if in feed premixes).

- 3824.90.92: Other chemical products, n.e.s. (e.g., fertilizers).

- Verify exact code with local customs authority.

- Environmental Regulations: Comply with local regulations on disposal and potential environmental impact (especially aquatic toxicity – H413).

H2: Packaging & Labeling

- Packaging:

- Use moisture-resistant packaging (e.g., multi-wall paper bags with polyethylene liner, woven polypropylene bags with liner, bulk containers).

- Ensure packaging is intact, undamaged, and sealed to prevent dust generation and moisture uptake.

- For food/pharma grades, use packaging compliant with relevant standards (e.g., food-grade materials, tamper-evident seals).

- Labeling (GHS & Transport):

- Primary Container (Bag/Drum): Must display:

- Product identifier (Di Calcium Phosphate)

- GHS Pictograms (e.g., Eye Irritation)

- Signal Word (e.g., Warning)

- Hazard Statements (H319, H413 if applicable)

- Precautionary Statements

- Supplier identification (name, address, phone)

- Batch/Lot number

- Net weight

- For fertilizers: Nutrient content (P₂O₅, CaO), grade, heavy metal limits (if regulated).

- For feed/food: Compliance statements (e.g., “Feed Grade,” “Food Grade,” “USP,” “FCC”).

- Outer Packaging (Pallet/Container): Label with product name, net weight, handling instructions (e.g., “Keep Dry,” “Protect from Moisture,” “Fragile”), and any required transport marks.

- Transport Documents: Include accurate description, UN number (if applicable), proper shipping name, hazard class (if applicable), packing group (if applicable), and emergency contact information.

- Primary Container (Bag/Drum): Must display:

H2: Storage

- Location: Store in a cool, dry, well-ventilated area. Protect from direct sunlight, rain, and moisture.

- Conditions: Maintain low humidity to prevent caking and degradation. Avoid temperature extremes.

- Segregation: Store away from strong acids, strong bases, and incompatible materials. Keep separate from foodstuffs, feed, and pharmaceuticals unless specifically approved for that use.

- Containers: Keep containers closed when not in use. Store on pallets off the floor to allow for cleaning and prevent moisture absorption from the ground.

- Shelf Life: Typically stable for several years if stored correctly. Rotate stock (FIFO – First In, First Out).

H2: Handling & Personal Protection

- Dust Control: Minimize dust generation during handling (e.g., use closed systems, local exhaust ventilation). Avoid creating airborne dust.

- Personal Protective Equipment (PPE):

- Eyes: Wear safety goggles or a face shield.

- Skin: Wear protective gloves (e.g., nitrile) and protective clothing (e.g., long sleeves, apron) to prevent prolonged contact.

- Respiratory: Use a NIOSH-approved dust mask (e.g., N95) if dust levels are significant and ventilation is inadequate. In high-dust environments, a half-face respirator with P100 filters may be needed.

- Hygiene: Wash hands thoroughly after handling. Do not eat, drink, or smoke in handling areas.

- Spills: Sweep up carefully. Avoid creating dust. Collect spillage in a suitable, dry, closed container for disposal. Ventilate the area.

H2: Transportation

- Mode: Suitable for road (ADR), rail (RID), sea (IMDG), and air (ICAO/IATA) transport.

- Classification: Typically NOT classified as dangerous goods for transport if meeting purity standards and lacking significant hazardous impurities. Always confirm classification using the current SDS. If classified as UN3077 (Class 9), follow Class 9 packing instructions (e.g., P002, IBC04, LP02).

- Packaging: Use packaging certified for the intended mode of transport if classified as dangerous goods. For non-hazardous, use commercially suitable, moisture-resistant packaging secured on pallets.

- Loading/Unloading: Handle bags/drums carefully to avoid damage. Use appropriate equipment (forklifts, pallet jacks). Protect from weather during transfer.

- Documentation: Provide accurate commercial invoice, packing list, and SDS. If classified as dangerous goods, provide a completed Dangerous Goods Declaration (DGD).

H2: Disposal

- Waste Classification: Generally considered non-hazardous waste. Confirm via waste analysis and local regulations.

- Disposal Methods:

- Dispose of in accordance with local, regional, national, and international regulations.

- Can often be disposed of in a licensed sanitary landfill.

- May be suitable for use as a soil amendment in agriculture (check local regulations and heavy metal content).

- Spills: Follow spill procedures above. Dispose of contaminated absorbent material as waste.

- Contaminated Packaging: Empty containers may retain product residue. Dispose of as product waste or according to local regulations. Do not re-use.

Note: This guide provides general information. Always consult the specific Safety Data Sheet (SDS) provided by your supplier and adhere to all local, national, and international regulations applicable to your location and intended use. Regulations and classifications can change.

Conclusion on Sourcing Di-Calcium Phosphate (DCP):

Sourcing di-calcium phosphate (DCP) requires a strategic approach that balances quality, cost, regulatory compliance, and supply chain reliability. As a critical ingredient in animal feed, pharmaceuticals, and food fortification, DCP must meet stringent purity and safety standards. After evaluating various suppliers and regions, it is evident that sourcing from manufacturers with certified production processes (such as GMP, FAMI-QS, or ISO certifications) ensures consistent product quality and regulatory adherence.

While regions like China and India offer competitive pricing due to large-scale production capabilities, potential risks related to quality control, logistics, and geopolitical factors must be carefully managed. Establishing long-term partnerships with reliable suppliers, conducting regular audits, and securing supply diversification can mitigate these risks.

In conclusion, successful sourcing of di-calcium phosphate depends on a comprehensive supplier evaluation, prioritizing both cost-efficiency and compliance. Investing in transparent, sustainable, and quality-focused supply chains will ultimately support product integrity and operational resilience across industries.