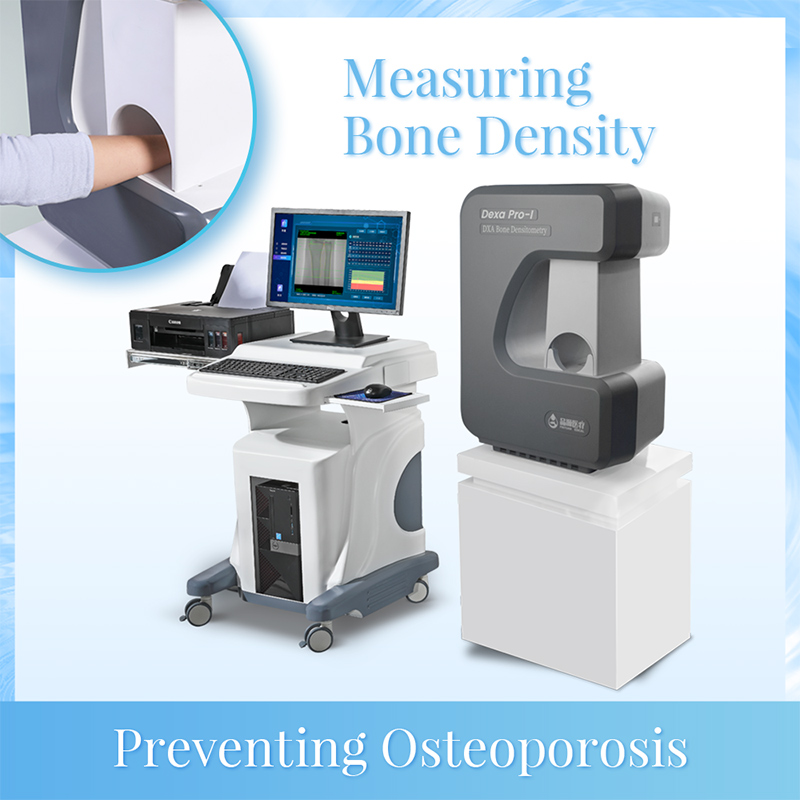

The global bone density scanning market, driven by rising osteoporosis prevalence and an aging population, is projected to grow at a CAGR of 7.3% from 2023 to 2030, according to Grand View Research. With dual-energy X-ray absorptiometry (DEXA) remaining the gold standard for bone mineral density assessment, demand for cost-effective and reliable DEXA scanners has surged across hospitals, outpatient clinics, and diagnostic centers. As healthcare providers seek to balance performance with affordability, manufacturers offering competitively priced systems without compromising diagnostic accuracy are gaining market traction. Based on market analysis and pricing benchmarks, the following nine manufacturers have emerged as key players delivering DEXA scanners at strategic price points, combining innovation, accessibility, and value in a rapidly expanding diagnostic landscape.

Top 9 Dexa Scanner Cost Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Lunar Idxa for Bone and Metabolic Health

Domain Est. 1999

Website: gehealthcare.com

Key Highlights: Lunar iDXA offers the latest generation of DXA technology from GE HealthCare. It’s vertebral assessment is comparable to radiographs in identifying and ……

#2 BeamMed Bone Density

Domain Est. 2005

Website: beammed.com

Key Highlights: BeamMed is a leader in the market for advanced ultrasound technology & portable bone density devices that allow physicians early assessment of osteoporosis….

#3 Get DexaFit

Domain Est. 2011

Website: dexafit.com

Key Highlights: Unlock precise health insights with DexaFit’s AI-enhanced DEXA scans, the gold standard for accurate body composition and skeletal health assessments.Missing: cost manufacturer…

#4 DEXA (DXA) Scan Machines

Domain Est. 1995

Website: henryschein.com

Key Highlights: Shop from a selection of our featured DEXA (DXA) Scan Machines and Bone Density Scanners. Fill out the form to contact a sales rep and get started!…

#5 BodySpec: Full

Domain Est. 2011

Website: bodyspec.com

Key Highlights: … cost of DEXA scans from $300 to as low as $39. Learn more about pricing here or discover the real cost of DEXA scans and why we’re the most affordable option….

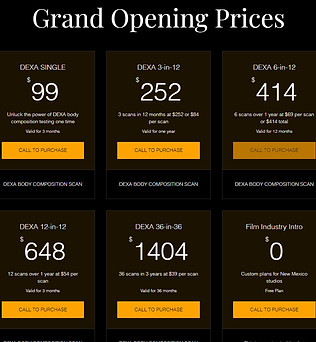

#6 Plans & Pricing

Domain Est. 2015

Website: dexabody.com

Key Highlights: … Test. Dexa Scan Multiple Test Package Pricing. 2 Scan Package: $125. *All packages have a 1-Year Expiration Date. Please only purchase the amount of scans you ……

#7 Stratos Series

Domain Est. 2016

Website: dms-imaging.com

Key Highlights: STRATOS has established itself as the complete DXA solution for bone health specialists seeking a cost effective and powerful solution….

#8 DEXA Plus

Domain Est. 2018

Website: dexaplus.com

Key Highlights: $999 /Month* No other company will give you the level of service, care, and guidance that DEXA Plus provides. *Hurry to qualify! Rates are subject to change….

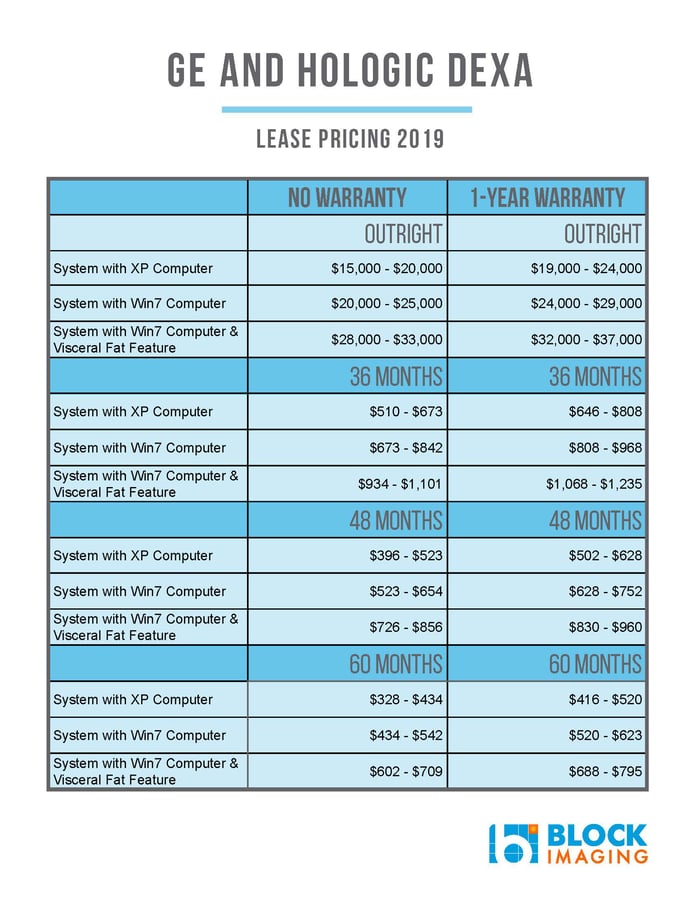

#9 2025 DEXA Bone Densitometer Price Guide

Domain Est. 1998

Website: blockimaging.com

Key Highlights: Discover the cost range for refurbished DEXA scanners, from economic models at $16000 to advanced scanners at $45000. Find the best option for your practice ……

Expert Sourcing Insights for Dexa Scanner Cost

2026 Market Trends for DEXA Scanner Cost

As the global healthcare landscape evolves with increasing emphasis on preventive medicine and precision diagnostics, the market for Dual-Energy X-ray Absorptiometry (DEXA) scanners is poised for notable shifts by 2026. These changes are expected to influence the cost structure of DEXA scanners across various segments, driven by technological innovation, expanded clinical applications, and shifting healthcare economics.

Technological Advancements and Cost Dynamics

By 2026, DEXA scanner costs are likely to reflect substantial integration of artificial intelligence (AI) and machine learning algorithms. Manufacturers are investing heavily in AI-powered image analysis to improve diagnostic accuracy, reduce scan times, and automate body composition reports. While these high-end, AI-integrated systems may command premium prices—potentially ranging from $120,000 to $180,000 for advanced models—economies of scale and competition are expected to moderate price increases. Additionally, innovations in detector technology and software platforms will enhance portability and usability, especially in compact or point-of-care models, which could stabilize or even reduce entry-level costs.

Market Expansion and Competitive Pressure

The growing recognition of DEXA beyond osteoporosis screening—into areas such as body composition analysis for sports medicine, obesity management, and metabolic health—is broadening the customer base. This expansion is attracting new entrants and increasing competition, particularly in emerging markets. As a result, mid-tier DEXA systems (priced between $60,000 and $100,000) may see downward price pressure due to competitive pricing strategies. Moreover, the rise of leasing models, refurbished equipment, and service-based pricing (pay-per-scan) could lower the effective cost of ownership, making DEXA technology more accessible to smaller clinics and private practices.

Regulatory and Reimbursement Influences

Regulatory approvals and reimbursement policies, especially in the U.S. and Europe, will continue to impact scanner demand and, indirectly, pricing. Favorable reimbursement for body composition assessments in metabolic and bariatric care could stimulate demand, encouraging manufacturers to offer cost-competitive packages. Conversely, stringent regulatory requirements for AI integration may temporarily increase development and compliance costs, potentially reflected in higher initial unit prices.

Supply Chain and Manufacturing Efficiency

Post-pandemic supply chain stabilization and the localization of manufacturing components are expected to reduce production costs by 2026. This efficiency, combined with increased automation in assembly processes, could contribute to a 5–10% reduction in manufacturing overhead, potentially lowering end-user prices—especially for standardized models.

Regional Cost Variations

Geographic disparities in pricing will persist, with North America and Western Europe commanding higher prices due to advanced features and service support, while Asia-Pacific and Latin America may see lower effective costs through government subsidies, local production, and competitive bidding. Average global DEXA scanner prices are projected to grow at a CAGR of 3.5% through 2026, but with significant variation based on features and region.

In conclusion, the DEXA scanner market in 2026 will likely reflect a bifurcated cost structure: premium pricing for AI-enhanced, multi-functional systems and more affordable options for basic diagnostic needs. Overall, technological diffusion, competition, and innovative financing models are expected to improve affordability and adoption, even as high-end capabilities drive select price increases.

Common Pitfalls When Sourcing Dexa Scanner Cost (Quality, IP)

Sourcing a DEXA (Dual-Energy X-ray Absorptiometry) scanner involves more than just comparing upfront prices. Focusing solely on cost can lead to significant long-term issues related to quality, performance, and intellectual property (IP) risks. Below are key pitfalls to avoid:

Overlooking Build Quality and Component Reliability

Choosing the lowest-cost DEXA scanner often means sacrificing build quality. Inferior materials, substandard detectors, or poorly calibrated X-ray tubes can result in inconsistent scan results, higher maintenance needs, and shorter equipment lifespan. Low-cost manufacturers may cut corners on quality control, leading to devices that fail prematurely or require frequent recalibration, ultimately increasing the total cost of ownership.

Compromising on Accuracy and Clinical Validity

Cost-driven decisions may lead to scanners with lower precision or outdated software algorithms. Inaccurate bone density or body composition measurements can compromise patient diagnosis and treatment plans. Ensure the device meets international standards (e.g., FDA, CE, ISO) and has published clinical validation studies. Scanners lacking traceable accuracy can undermine clinical credibility and expose providers to liability.

Ignoring Software and Intellectual Property Risks

Some low-cost DEXA scanners use software that may infringe on proprietary algorithms or lack proper licensing. Using such systems poses legal risks related to IP violations, especially if the software replicates features from established brands without authorization. Additionally, poorly documented or reverse-engineered software may lack updates, support, or integration capabilities with electronic medical records (EMR), limiting functionality and compliance.

Underestimating Service, Support, and Calibration Needs

Budget scanners often come with limited or no service networks, leading to prolonged downtimes and expensive third-party repairs. Reliable calibration is critical for DEXA accuracy, and some low-cost suppliers may not offer regular calibration services or certified technicians. Factor in the cost and availability of maintenance contracts, spare parts, and technical support when evaluating total cost.

Falling for Hidden Costs and Upgrades

Low initial pricing may exclude essential accessories, software modules, or upgrade paths. Over time, needed features—such as advanced body composition analysis or pediatric scanning—may require costly add-ons. Ensure the quoted price includes all necessary components and that future upgrades are transparently priced and technically feasible.

Neglecting Regulatory and Compliance Verification

Sourcing from unverified suppliers, especially in international markets, increases the risk of receiving non-compliant equipment. Verify that the DEXA scanner has the appropriate regulatory clearances for your region. Devices lacking proper certification may be seized by customs or banned from clinical use, resulting in financial loss and operational delays.

Conclusion

When sourcing a DEXA scanner, prioritize long-term value over initial cost. Evaluate each option for build quality, clinical accuracy, software legitimacy, IP compliance, and total cost of ownership. Engaging reputable suppliers with verifiable credentials and robust support ensures reliable performance and protects your investment and patient care standards.

Logistics & Compliance Guide for DEXA Scanner Cost

Understanding the logistics and compliance factors influencing the cost of a DEXA (Dual-Energy X-ray Absorptiometry) scanner is essential for healthcare providers, clinics, and purchasing departments. These elements significantly impact both the initial investment and long-term operational expenses. Below is a comprehensive guide outlining key considerations.

Acquisition and Shipping Logistics

Transporting a DEXA scanner involves specialized handling due to its sensitive imaging components and heavy weight. Shipping costs vary depending on origin, destination, and freight method (air, ground, or sea). Crating, insurance, and white-glove delivery services add to the expense. International shipments may require customs brokerage fees and import duties, further increasing total cost. Proper planning and coordination with the vendor or third-party logistics provider are crucial to avoid damage and delays.

Installation and Site Preparation

DEXA scanners require specific site conditions for safe and accurate operation. Costs include room shielding (if required), electrical upgrades, flooring reinforcement, climate control, and network integration. Compliance with facility radiation safety standards may necessitate structural modifications. Installation by certified biomedical engineers or manufacturer technicians ensures proper setup and calibration, typically billed as a separate service.

Regulatory Compliance and Licensing

Operating a DEXA scanner involves meeting multiple regulatory requirements. In the U.S., the FDA classifies DEXA devices as medical radiation-emitting products, requiring registration and compliance with 21 CFR Subchapter J. Facilities must obtain state-specific radiation machine licenses and adhere to regulations from agencies such as the Nuclear Regulatory Commission (NRC) or Agreement States. Non-compliance risks fines, operational shutdowns, and legal liability, making ongoing regulatory adherence a cost factor.

Personnel Certification and Training

Technologists operating DEXA scanners must be certified in bone densitometry (e.g., through the International Society for Clinical Densitometry – ISCD or ARRT). Initial and continuing education, certification exams, and training programs represent significant staffing costs. Vendors often provide on-site training, which may be included in the purchase price or billed separately.

Quality Assurance and Maintenance

Routine quality control (QC) testing is mandatory to ensure scanner accuracy and regulatory compliance. This includes daily, weekly, and monthly phantom scans and calibration checks. Preventive maintenance contracts with OEMs or third-party service providers typically range from 8% to 12% of the scanner’s purchase price annually. Unexpected repairs, parts replacement, and service call fees can also contribute to long-term costs.

Data Security and HIPAA Compliance

DEXA scanners generate and store protected health information (PHI), requiring compliance with HIPAA regulations. Secure data transmission, encrypted storage, audit logs, and access controls must be implemented. Integration with PACS and EHR systems must meet cybersecurity standards, potentially requiring additional IT infrastructure investments.

Reimbursement and Billing Compliance

Accurate coding and documentation are essential for Medicare and private insurance reimbursement. Using correct CPT codes (e.g., 77075, 77078) and meeting medical necessity criteria prevent claim denials. Facilities must stay updated on Local Coverage Determinations (LCDs) and National Coverage Determinations (NCDs). Non-compliant billing practices may lead to audits, recoupments, and penalties.

Disposal and Decommissioning

At end-of-life, proper disposal of the DEXA scanner—particularly its X-ray tube and electronic components—is regulated by environmental and radiation safety agencies. Decommissioning may require certification of data erasure, radiation surveys, and adherence to hazardous waste disposal protocols. Costs for professional decommissioning services should be factored into the total lifecycle expense.

By addressing these logistics and compliance considerations proactively, organizations can better manage the true cost of DEXA scanner ownership and ensure safe, legal, and efficient operation.

Conclusion on Sourcing DEXA Scanner Costs:

Sourcing a DEXA (Dual-Energy X-ray Absorptiometry) scanner involves a careful evaluation of several cost factors, including equipment type, new vs. refurbished options, brand reputation, installation, maintenance, and regulatory compliance. New DEXA scanners typically range from $80,000 to $150,000 or more, depending on features and manufacturer, while certified refurbished units can offer significant savings—often between $40,000 and $80,000—without compromising on performance, provided they are sourced from reputable vendors with service support.

Key considerations in cost-effective sourcing include evaluating vendor warranties, service agreements, software compatibility, and training. Additionally, total cost of ownership should account for site preparation, shielding, technician training, and ongoing maintenance, which can add 10–20% to the initial investment annually.

Ultimately, balancing upfront costs with long-term reliability, clinical accuracy, and support services is essential. Institutions should conduct thorough market research, obtain multiple quotes, and consider leasing or financing options to align the acquisition with budgetary constraints and clinical needs. By strategically sourcing a DEXA scanner, healthcare providers can ensure access to high-quality bone density and body composition analysis while maintaining fiscal responsibility.