The global barcode scanner market continues to expand at a robust pace, driven by increasing demand for automation, inventory accuracy, and operational efficiency across retail, healthcare, logistics, and manufacturing sectors. According to Grand View Research, the global barcode scanner market size was valued at USD 4.72 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. This growth is fueled by the rising adoption of wireless and image-based scanning technologies, as well as the integration of barcode systems with enterprise resource planning (ERP) and cloud-based platforms.

Mordor Intelligence further supports this trajectory, projecting a CAGR of approximately 7.5% during the forecast period of 2023–2028, citing the surge in e-commerce and the need for real-time data capture as critical market drivers. Within this expanding landscape, desktop barcode scanners remain a cornerstone for point-of-sale (POS) and front-desk operations, offering compact design, reliable performance, and seamless integration with existing systems. As businesses prioritize accuracy and speed, the competition among manufacturers to deliver high-performance, durable, and cost-effective desktop solutions has intensified. The following list highlights the top 10 desktop barcode scanner manufacturers shaping the industry with innovation, global reach, and strong market presence.

Top 10 Desktop Barcode Scanner Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Barcode Scanners

Domain Est. 1995

Website: zebra.com

Key Highlights: Zebra’s desktop, mobile, industrial, and portable printers for barcode labels, receipts, RFID tags and cards give you smarter ways to track and manage assets….

#2 Newland AIDC

Domain Est. 2016

Website: newlandaidc.com

Key Highlights: Barcode Scanner. Superior 1D & 2D barcode scanning performance. · Mobile Terminal. Getting your business boosted with accurate real-time data communication….

#3 Barcode Scanners – Automation

Domain Est. 1988

Website: automation.honeywell.com

Key Highlights: Barcode scanners designed to ensure industry-leading scan performance, making even the most difficult-to-read barcodes look good….

#4 Products

Domain Est. 1994

Website: datalogic.com

Key Highlights: Our full range of barcode scanner products includes Fixed Retail Scanners, Hand Held Scanners, Mobile Computers, Sensors, Laser Marking Systems, Safety, Vision ……

#5 Barcode & Software Readers & Scanning

Domain Est. 1998

Website: codecorp.com

Key Highlights: Scan all barcode types with 99.9995% accuracy to empower exceptional care. Healthcare Barcode Scanners, Printers, Software & ID. Streamline workflows with ……

#6 Barcode Scanner For 2D, Bluetooth Wireless, iPhone & Android

Domain Est. 1998

#7 Smart Data Capture on Smart Devices

Domain Est. 2002

Website: scandit.com

Key Highlights: Data capture. Smarter. Scandit advanced barcode scanning, ID scanning or shelf intelligence software runs on any smart device. Unmatched speed and accuracy….

#8 Dynamsoft

Domain Est. 2004

Website: dynamsoft.com

Key Highlights: Dynamsoft empowers developers with powerful SDKs for capturing barcodes, documents and IDs. Explore our tools and demos to streamline data extraction and ……

#9 Barcode Scanner,Barcode Reader,Barcode Solutions

Domain Est. 2018

Website: syblecode.com

Key Highlights: We are professional manufacture of barcode scanner, to produce Laser ,Linear ,2D barcode scanner,wireless ,Bluetooth barcode scanner etc….

#10 Barcode Scanners and Printers, Mobile Computers

Domain Est. 2021

Website: barcode-usa.com

Key Highlights: Free delivery 30-day returnsBarcode USA provides barcode scanners, label printers, and mobile devices hardware. Great prices, support, and US Employer!…

Expert Sourcing Insights for Desktop Barcode Scanner

2026 Market Trends for Desktop Barcode Scanners

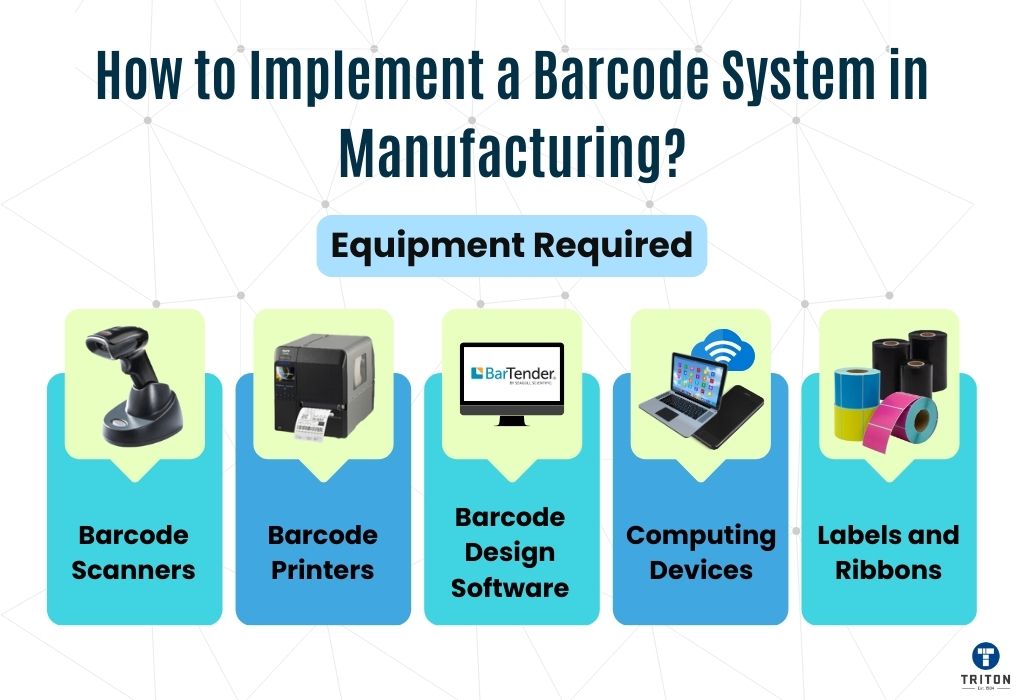

The desktop barcode scanner market in 2026 is poised for steady evolution, driven by technological advancements, shifting retail and logistics landscapes, and growing demand for operational efficiency. While mature, the sector is adapting to new requirements in automation, connectivity, and user experience. Below are the key trends shaping the market.

Increasing Demand for High-Speed and Multi-Directional Scanning

By 2026, businesses across retail, healthcare, and warehouse environments will prioritize speed and accuracy. Desktop scanners featuring omnidirectional laser or 2D imaging technology will dominate point-of-sale (POS) and shipping stations. Enhanced decoding algorithms allow faster reading of damaged, low-contrast, or mobile QR codes, reducing transaction times and improving customer throughput in high-volume environments.

Integration with Cloud-Based and IoT Ecosystems

Desktop barcode scanners are no longer standalone devices. In 2026, seamless integration with cloud-based inventory management, POS systems, and enterprise resource planning (ERP) platforms will be standard. IoT-enabled scanners will provide real-time data analytics, predictive maintenance alerts, and remote device monitoring, enhancing supply chain visibility and operational intelligence.

Rise of Wireless and Hybrid Connectivity

While USB remains common, Bluetooth and Wi-Fi enabled desktop scanners will gain traction, offering greater flexibility in workspace design. Hybrid models that support both wired and wireless connectivity will cater to dynamic environments such as pop-up retail, mobile clinics, and modular warehouse stations, allowing easy reconfiguration without sacrificing reliability.

Focus on Ergonomic Design and User Experience

Retail and logistics workers using scanners for extended periods will drive demand for compact, low-profile designs with intuitive feedback mechanisms (e.g., visual indicators, haptic feedback). Vendors will emphasize durability and ease of cleaning—especially in healthcare and food retail—where hygiene and frequent sanitization are critical.

Growth in Emerging Markets and SME Adoption

Developing economies in Asia-Pacific, Latin America, and Africa will see increased deployment of desktop scanners as small and medium enterprises (SMEs) digitize operations. Affordable, plug-and-play models with minimal setup requirements will fuel adoption in local retail, pharmacies, and logistics startups.

Sustainability and Energy Efficiency

Environmental concerns will influence product design. By 2026, manufacturers will emphasize energy-efficient components, recyclable materials, and longer product lifecycles. Some vendors may introduce take-back programs or modular designs to reduce e-waste, aligning with global sustainability goals.

Competition from Mobile and Smart Devices

Despite growth, the desktop scanner market will face pressure from smartphone-based scanning apps and rugged handheld devices. However, high-volume and mission-critical applications will continue to favor dedicated desktop units due to superior durability, consistent ergonomics, and optimized scanning performance.

In summary, the 2026 desktop barcode scanner market will reflect a blend of innovation and practicality. Growth will be moderate but steady, supported by digital transformation across industries and the enduring need for reliable, high-performance data capture at fixed points of operation.

Common Pitfalls When Sourcing Desktop Barcode Scanners (Quality and IP)

Sourcing desktop barcode scanners involves more than just finding the lowest price. Overlooking key factors related to quality and intellectual property (IP) can lead to operational inefficiencies, security risks, and legal complications. Being aware of these common pitfalls helps ensure a reliable and compliant procurement process.

Poor Build Quality and Durability

Many low-cost scanners on the market use substandard materials and components, leading to frequent failures, misreads, and shorter lifespans. Units without proper drop or scratch resistance may not withstand daily use in demanding environments like warehouses or retail checkouts, increasing total cost of ownership due to replacements and downtime.

Inconsistent Scanning Performance

Low-quality scanners may struggle with damaged, faded, or poorly printed barcodes. They often lack advanced decoding algorithms or adequate illumination, resulting in slow or failed scans. This reduces productivity and can frustrate both staff and customers.

Lack of Environmental Protection (IP Rating Misrepresentation)

Many suppliers claim their scanners have a certain IP (Ingress Protection) rating (e.g., IP54 for dust and splash resistance), but these claims are often unverified or exaggerated. Without independent certification, scanners may fail in dusty or wet environments, leading to malfunctions and costly repairs. Always verify test reports from accredited third-party labs.

Non-Compliance with Industry Standards

Some scanners do not meet critical regulatory standards such as FCC, CE, or RoHS. This can result in legal issues, import restrictions, or safety hazards. Additionally, lack of USB-IF certification may cause compatibility problems with host systems.

Firmware and Software Vulnerabilities

Cheaply sourced scanners may run outdated or unpatched firmware with known security flaws. These devices can become entry points for malware, especially if they emulate keyboard inputs (HID mode), making them susceptible to malicious code injection.

Intellectual Property (IP) Infringement Risks

OEMs or suppliers may use cloned firmware, counterfeit chips, or replicate patented designs without authorization. Sourcing such devices exposes your organization to IP litigation, supply chain disruptions, and reputational damage. Always work with reputable manufacturers and request proof of IP ownership or licensing.

Limited or No Firmware Updates and Support

Many low-cost suppliers offer little to no technical support or firmware updates. This means scanners cannot adapt to new barcode types or security patches, reducing long-term usability and increasing obsolescence risk.

Counterfeit or Gray Market Products

Some suppliers distribute counterfeit scanners that mimic well-known brands. These units often fail prematurely and lack warranty coverage. Sourcing through unofficial channels increases the risk of receiving non-genuine products with no recourse.

Absence of Long-Term Supply Guarantee

Unreliable suppliers may discontinue models without notice, making it difficult to maintain consistency across locations or replace failed units. This disrupts operations and complicates inventory management.

Avoiding these pitfalls requires due diligence—evaluating product certifications, verifying IP claims, testing units in real-world conditions, and sourcing from trusted, transparent suppliers with a track record of quality and compliance.

Logistics & Compliance Guide for Desktop Barcode Scanner

Product Classification & Regulatory Requirements

Desktop barcode scanners are typically classified as electronic data capture devices under international trade and regulatory frameworks. Ensure compliance with relevant regulations such as:

– FCC Part 15 (USA): Electromagnetic interference standards for digital devices.

– CE Marking (EU): Compliance with EMC Directive (2014/30/EU) and RoHS (2011/65/EU) for hazardous substances.

– ISED Certification (Canada): Equivalent to FCC for Canadian market access.

– KC Mark (South Korea) and PSE Mark (Japan): Required for local market entry.

Verify that the scanner model has necessary certifications before shipment.

Packaging & Labeling Standards

Proper packaging ensures product integrity and regulatory compliance during transit:

– Use anti-static and shock-absorbent materials to protect sensitive components.

– Include required labels: product identifier, model number, serial number, power requirements, and compliance marks (e.g., CE, FCC).

– Attach multilingual user manuals and safety warnings per destination country regulations.

– Clearly mark packaging with “Fragile,” “This Side Up,” and “Do Not Stack” as needed.

Import & Export Documentation

Accurate documentation is essential for customs clearance:

– Commercial Invoice: Includes buyer/seller details, item description, value, and harmonized system (HS) code (typically 8471.90 or 8470.50 for scanning devices).

– Packing List: Details quantity, weight, and dimensions per package.

– Certificate of Origin: May be required for preferential tariff treatment under trade agreements.

– Bill of Lading / Air Waybill: Contract between shipper and carrier.

Ensure all documents are consistent and declared in the local language if required.

Shipping & Handling

Optimize logistics for timely and secure delivery:

– Choose carriers with experience in electronics logistics and tracking capabilities.

– Maintain appropriate temperature and humidity conditions during transport.

– Comply with IATA regulations if shipping lithium batteries (if applicable).

– Insure high-value shipments against damage or loss.

Environmental & Disposal Compliance

Adhere to environmental directives for end-of-life management:

– Follow WEEE (Waste Electrical and Electronic Equipment) guidelines in the EU for take-back and recycling.

– Provide information on proper disposal methods in user documentation.

– Avoid restricted substances per RoHS and REACH regulations.

Quality Assurance & Traceability

Implement controls to ensure product integrity:

– Conduct pre-shipment inspections to verify functionality and labeling accuracy.

– Maintain batch/lot traceability through serial numbers or QR codes.

– Keep records of compliance certifications and test reports for audit purposes.

Post-Import Compliance Monitoring

After delivery, ensure ongoing compliance:

– Monitor for product safety recalls or regulatory updates in target markets.

– Provide customer support for compliance-related inquiries (e.g., certification copies).

– Update documentation and certifications as standards evolve.

Adhering to this guide ensures smooth logistics operations and full regulatory compliance for desktop barcode scanners across global markets.

Conclusion for Sourcing Desktop Barcode Scanner

After a thorough evaluation of available desktop barcode scanners, it is evident that selecting the right device requires balancing performance, reliability, compatibility, and cost. Desktop barcode scanners play a crucial role in enhancing operational efficiency across various industries, including retail, healthcare, logistics, and warehousing. Key factors such as scanning speed, compatibility with existing systems (e.g., Windows, Mac, POS software), connectivity options (USB, Bluetooth, RS-232), and durability must be carefully assessed to ensure seamless integration and long-term functionality.

Based on the analysis, reputable brands like Honeywell, Zebra, Datalogic, and Socket Mobile offer reliable, high-performance desktop scanners with features tailored to different operational needs. While premium models provide advanced capabilities such as omnidirectional scanning and robust build quality, cost-effective options remain viable for small businesses or low-volume environments.

In conclusion, the ideal desktop barcode scanner should align with the organization’s specific workflow requirements, scalability goals, and budget constraints. Investing in a high-quality scanner not only improves data accuracy and transaction speed but also contributes to improved customer satisfaction and operational excellence. Therefore, a strategic sourcing approach—incorporating user feedback, vendor support, and total cost of ownership—will ensure a successful implementation and long-term value.