The global molded plastics market is projected to grow at a CAGR of approximately 4.8% from 2023 to 2028, driven by increasing demand in automotive, consumer goods, and healthcare sectors, according to Mordor Intelligence. As regional manufacturing ecosystems strengthen, Macedonia has emerged as a growing hub for design and precision molded plastics, benefiting from strategic EU proximity, skilled labor, and favorable production costs. This upsurge aligns with broader Southeast European trends in industrial outsourcing and advanced manufacturing adoption. Here, we spotlight the top three design molded plastics manufacturers in Macedonia—companies leveraging innovation, engineering expertise, and scalable production to meet international standards and capture expanding market opportunities.

Top 3 Design Molded Plastics Macedonia Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Design Molded Plastics enters acquisition mode with new owner

Domain Est. 1996

Website: plasticsnews.com

Key Highlights: The once financially distressed Macedonia, Ohio-based Design Molded Plastics LLC (DMP) has acquired the majority of the assets of two ……

#2 Design Molded Plastics

Domain Est. 2000

Website: designmolded.com

Key Highlights: Trusted for 30+ years, Design Molded Plastics delivers precision plastic injection molding solutions across various industries….

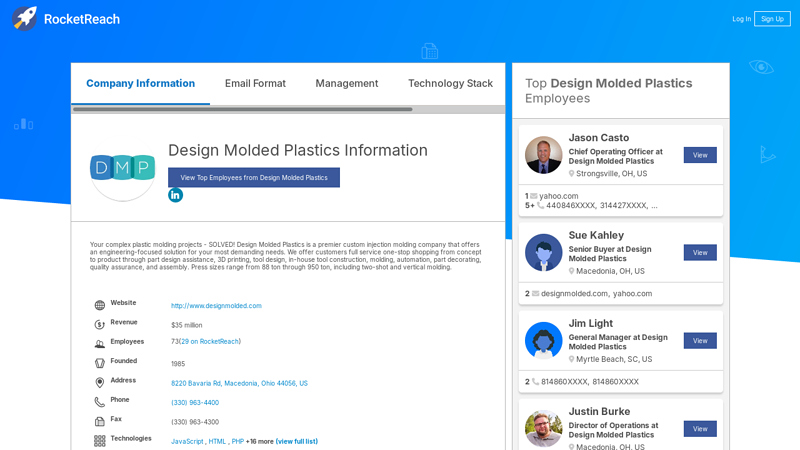

#3 Design Molded Plastics Information

Domain Est. 2015

Website: rocketreach.co

Key Highlights: Design Molded Plastics is a Plastics Manufacturing, Manufacturing General, and Injection Molding company located in Macedonia, Ohio with $35 million in revenue…

Expert Sourcing Insights for Design Molded Plastics Macedonia

H2: 2026 Market Trends for Design Molded Plastics in Macedonia

The market for design molded plastics in Macedonia is poised for notable transformation by 2026, shaped by evolving industrial demands, sustainability imperatives, technological advancements, and integration into regional and global supply chains. This section analyzes key trends expected to influence the sector over the next few years.

-

Increased Demand from Automotive and Electronics Sectors

Macedonia’s growing automotive components industry, particularly in the production of wiring systems, interior parts, and connectors, is driving demand for precision-molded plastic components. As European automakers expand nearshoring initiatives, Macedonian manufacturers are likely to benefit from increased outsourcing. Additionally, the electronics sector—boosted by investments in smart devices and consumer electronics assembly—will require high-quality, miniaturized plastic parts, accelerating innovation in injection and overmolding technologies. -

Emphasis on Sustainable and Recyclable Materials

By 2026, regulatory pressures and consumer awareness will push Macedonian plastic processors to adopt eco-friendly materials. The EU’s Circular Economy Action Plan and upcoming packaging regulations will influence local producers to shift toward bio-based polymers, recycled plastics (rPET, rPP), and biodegradable alternatives. Companies investing in closed-loop recycling systems and lightweight, recyclable designs will gain a competitive edge, especially in export markets. -

Adoption of Advanced Manufacturing Technologies

The integration of Industry 4.0 technologies—such as automated molding machines, real-time quality monitoring, and AI-driven design optimization—will become more widespread among Macedonian plastic molders. These advancements improve precision, reduce waste, and lower production costs, enabling smaller firms to compete in high-value markets. Additionally, 3D printing for rapid prototyping will shorten product development cycles, facilitating customization for niche applications. -

Growth in Medical and Packaging Applications

The healthcare sector’s demand for sterile, single-use plastic components (e.g., syringes, diagnostic housings) is expected to rise, supported by regional healthcare modernization. Simultaneously, the food and beverage packaging segment will see increased need for durable, lightweight, and tamper-evident molded containers. Compliance with EU safety standards will drive investments in cleanroom production and quality certification (e.g., ISO 13485, ISO 22000). -

Challenges in Energy Costs and Raw Material Supply

Despite positive trends, Macedonian producers face challenges related to energy price volatility and dependency on imported polymers. Fluctuations in global oil prices and supply chain disruptions may affect profitability. However, government incentives for energy efficiency and potential partnerships with Balkan polymer distributors could mitigate these risks. -

Export-Oriented Growth and Regional Integration

Macedonia’s strategic location and trade agreements with the EU, CEFTA, and Turkey will support export growth in molded plastics. By 2026, companies specializing in custom design and low-volume, high-mix production are expected to capture market share in niche industrial and consumer goods sectors across Southeast Europe.

In conclusion, the 2026 outlook for design molded plastics in Macedonia is cautiously optimistic, with innovation, sustainability, and export diversification serving as primary growth drivers. Success will depend on the sector’s ability to modernize infrastructure, comply with international standards, and adapt to dynamic global market demands.

Common Pitfalls Sourcing Molded Plastics from Macedonia: Quality and Intellectual Property Risks

When sourcing molded plastics from Macedonia, businesses may encounter several challenges related to quality control and intellectual property (IP) protection. Being aware of these pitfalls can help mitigate risks and ensure a successful supply chain partnership.

Quality Consistency and Standards Compliance

One of the primary concerns when sourcing molded plastics from Macedonia is maintaining consistent product quality across production batches. While some Macedonian manufacturers offer high-quality tooling and production capabilities, others may lack standardized quality management systems. Variability in raw material sourcing, outdated machinery, or insufficient process controls can result in defects such as warping, flash, sink marks, or dimensional inaccuracies. Additionally, not all suppliers may be certified to international standards like ISO 9001 or IATF 16949 (for automotive), which increases the risk of non-compliance with industry-specific requirements. Conducting thorough supplier audits and implementing clear quality specifications in contracts are essential to avoid these issues.

Intellectual Property Protection and Design Security

Protecting intellectual property (IP) is another significant challenge when sourcing from Macedonia. Although North Macedonia is a member of the World Intellectual Property Organization (WIPO) and has made strides in aligning its IP laws with EU standards, enforcement can still be inconsistent. There is a risk that molds, product designs, or technical specifications could be replicated or shared with third parties without authorization. Some suppliers may not fully understand or respect IP rights, particularly if confidentiality agreements are not properly established and enforced. To safeguard against IP theft, buyers should register designs in relevant jurisdictions, use strong non-disclosure agreements (NDAs), limit access to sensitive information, and consider watermarking or traceability features in molds and parts.

Logistics & Compliance Guide for Design Molded Plastics Macedonia

This guide outlines key logistics and compliance considerations for operating or conducting business with Design Molded Plastics in Macedonia (officially the Republic of North Macedonia). It covers regulatory requirements, transportation, customs procedures, and best practices to ensure smooth operations.

Regulatory Framework and Standards Compliance

The Republic of North Macedonia follows EU-aligned regulations in many industrial sectors, including plastics manufacturing. Compliance with national and international standards is essential.

- National Regulations: Businesses must adhere to the Law on Environmental Protection, the Law on Occupational Health and Safety, and the Law on Waste Management. These govern emissions, workplace safety, and disposal of plastic waste, including recyclable and hazardous materials.

- Product Standards: Plastic components must comply with relevant European standards (EN standards), particularly if intended for export to the EU. Key standards include EN ISO 9001 (Quality Management) and EN ISO 14001 (Environmental Management), which are commonly adopted by manufacturers.

- REACH and RoHS Compliance: For export to the EU market, compliance with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) is mandatory. Design Molded Plastics must ensure raw materials and finished products do not contain restricted substances above permitted thresholds.

Customs and Import/Export Procedures

Macedonia is a candidate country for EU accession and maintains a customs union with several European Free Trade Association (EFTA) countries. Understanding customs protocols is crucial for timely shipments.

- Customs Documentation: Standard documentation includes commercial invoices, packing lists, certificates of origin, and transport documents (e.g., CMR for road freight). For exports to the EU, EUR.1 or EUR-MED certificates may be required to benefit from preferential tariffs.

- Tariff Classifications: Plastics products are classified under HS codes 3918–3926 (e.g., 3926.30 for plastic tableware and kitchenware). Accurate classification ensures correct duty rates and avoids customs delays.

- Import of Raw Materials: Common plastic resins (e.g., PP, PE, ABS) imported into North Macedonia may be subject to customs duties unless covered under trade agreements. Suppliers should provide full material declarations (IMDS or SCIP database entries) for traceability and compliance.

Transportation and Freight Logistics

Efficient transportation networks connect North Macedonia to major European markets, primarily via road and rail.

- Primary Transport Modes:

- Road Freight: The dominant mode, with access via Corridor X (connecting Central Europe to Greece) and Corridor VIII (linking Albania to Bulgaria). Major logistics hubs include Skopje and Gevgelija.

- Rail: Offers cost-effective bulk transport but with longer lead times. Limited intermodal connectivity may require transloading.

- Air Freight: Available through Skopje International Airport (SKP) for urgent, high-value shipments.

- Carrier Selection: Partner with licensed freight forwarders experienced in Balkan logistics. Ensure vehicles meet ADR regulations for transporting polymers and chemical additives, if applicable.

Environmental and Waste Management Requirements

Plastic manufacturing generates process waste, scrap, and packaging materials, all subject to environmental regulation.

- Waste Classification: Segregate production waste into recyclable plastics, non-hazardous industrial waste, and, if applicable, hazardous waste (e.g., contaminated molds or cleaning agents).

- Waste Disposal: Only licensed waste management companies may collect and process industrial waste. Maintain records of waste transfer notes (akin to waste manifests) for audit purposes.

- Extended Producer Responsibility (EPR): While not fully implemented for all plastic products, producers may be required to participate in future EPR schemes. Staying informed on policy developments is advised.

Quality and Traceability Systems

Robust internal systems support compliance and customer trust.

- Batch Tracking: Implement lot numbering and traceability systems for raw materials and finished goods to facilitate recalls and quality investigations.

- Supplier Compliance: Audit suppliers of resins and additives for compliance with REACH, FDA (if applicable for food-contact items), and other relevant regulations.

- Documentation Retention: Maintain records of certifications, test reports, and compliance declarations for a minimum of 10 years, especially for export markets.

Recommended Best Practices

- Engage Local Legal and Compliance Experts: Retain consultants familiar with North Macedonian industrial regulations and EU alignment processes.

- Leverage Free Trade Agreements: Utilize preferential access under CEFTA (Central European Free Trade Agreement) and potential EU-GSP (Generalized Scheme of Preferences) benefits.

- Invest in Certifications: Obtain ISO 9001, ISO 14001, and IATF 16949 (if serving automotive clients) to enhance marketability and compliance posture.

- Monitor Regulatory Updates: Subscribe to notifications from the Ministry of Environment and Physical Planning and the Macedonian Standards Institute (MAK).

By adhering to this guide, Design Molded Plastics Macedonia can ensure efficient logistics operations and full compliance with national and international requirements, supporting sustainable growth and market access.

Conclusion: Sourcing Design and Molded Plastics in North Macedonia

Sourcing design and molded plastics in North Macedonia presents a compelling opportunity for businesses seeking cost-effective, high-quality manufacturing solutions. The country offers a strategic combination of skilled labor, competitive production costs, and proximity to major European markets, making it an attractive destination within the broader European supply chain.

North Macedonia has developed a growing plastics manufacturing sector supported by advancements in mold design, injection molding technologies, and adherence to international quality standards. Local manufacturers are increasingly capable of handling complex design requirements and custom tooling, enabling scalable production for industries such as automotive, healthcare, electronics, and consumer goods.

Additionally, favorable business conditions—including government incentives, EU trade agreements, and a stable regulatory environment—further enhance the country’s appeal. However, companies should conduct thorough due diligence when selecting partners, focusing on technical capabilities, certifications, and experience with international clients.

In conclusion, North Macedonia stands out as a reliable and emerging hub for sourcing molded plastic components. With the right partner and clear design specifications, businesses can leverage the country’s manufacturing strengths to achieve efficiency, innovation, and competitive advantage in their product development and supply chain strategies.