The global agricultural machinery market, valued at USD 188.7 billion in 2023, is projected to grow at a CAGR of 6.2% through 2030, driven by rising demand for precision farming equipment and increased farm mechanization—according to Grand View Research. Within this expanding sector, planter technology has become a critical enabler of yield optimization, with manufacturers specializing in high-performance systems compatible with leading platforms like the John Deere 7000. As farmers seek to upgrade legacy equipment for improved seed placement and operational efficiency, a niche but competitive market has emerged around 7000-compatible planters. Here are the top five manufacturers leveraging innovation, durability, and data integration to lead this segment.

Top 5 Deere 7000 Planter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

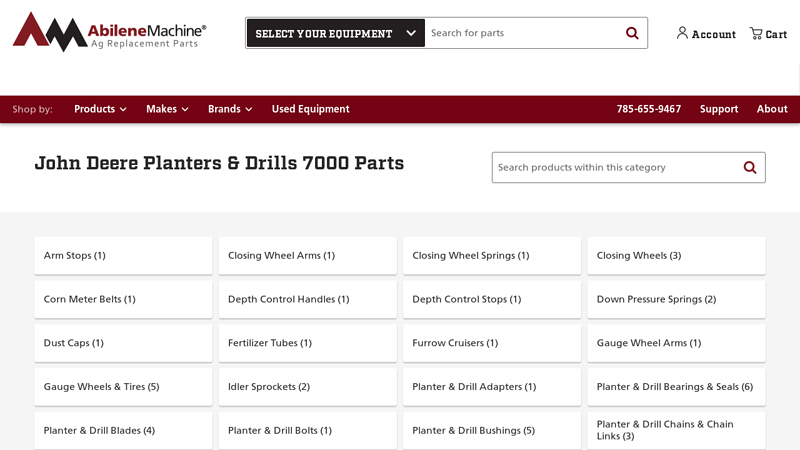

#1 John Deere Planters & Drills 7000 Parts

Domain Est. 1997

Website: abilenemachine.com

Key Highlights: Abilene Machine is the best place to buy affordable and dependable parts for John Deere® tractors and other most other types of agricultural and industrial ……

#2 Corn Planter Parts & Attachments

Domain Est. 2019

Website: pequeaplanter.com

Key Highlights: Premium-Quality Corn Planters & Equipment Plus Custom Parts & Attachments that Match or Exceed John Deere OEM at a Fraction of the Price!…

#3 Planting Equipment

Domain Est. 1990

Website: deere.com

Key Highlights: Explore planting equipment and row units from John Deere, including drawn and mounted planters. Visit today to see how to maximize your yield potential….

#4 Precision Planting

Domain Est. 1997

Website: precisionplanting.com

Key Highlights: A Premier Dealer installs Precision Planting upgrades on a John Deere planter. Upgrade & Install. Your Premier Dealer will provide you with the best options to ……

#5 JD 7000 4RW Planter

Domain Est. 1997

Website: yesterdaystractors.com

Key Highlights: We sell tractor parts! We have the parts you need to repair your tractor – the right parts. Our low prices and years of research make us your best choice….

Expert Sourcing Insights for Deere 7000 Planter

H2: Projected 2026 Market Trends for the Deere 7000 Planter

The Deere 7000 Planter, a legacy row-crop planter platform from John Deere, presents a unique case for market analysis in 2026. While no longer in active production, its secondary market and support ecosystem will be shaped by several key trends:

-

Dominance of the Secondary Market:

- Primary Channel: By 2026, the only market for a 7000 Planter will be the used equipment market. New sales effectively ceased years ago, replaced by the 8000 Series and now the advanced ExactEmerge and MaxEmerge 5e platforms.

- Value Trajectory: Expect continued gradual depreciation, but at a slower rate than newer models due to its established reputation for durability. Prices will be highly dependent on specific model year, configuration (row count, units, drills), and verified condition. Well-maintained, later-model 7000s (especially those retrofitted) may hold value better.

- Demand Drivers: Demand will be driven by small-to-mid-sized farms, custom operators seeking reliable backup/secondary planters, or operations in regions with lower land values where the upfront cost of a new planter is prohibitive. Simplicity and ease of repair remain key selling points.

-

Parts and Service Ecosystem Evolution:

- Deere Support: John Deere will maintain core parts support for the 7000 platform through its extensive parts network, but availability of specific, less-common components may become more challenging over time. Deere will increasingly focus resources on supporting newer, tech-integrated models.

- Aftermarket & Third-Party Growth: The 2026 market will see a continued rise in the importance of aftermarket parts suppliers, specialized rebuild shops, and third-party service providers familiar with the 7000. This ecosystem will be crucial for keeping older units operational cost-effectively.

- Retrofitting & Modernization: A significant trend will be the retrofitting of older 7000s with modern components. Expect increased availability and demand for:

- Precision Agriculture Upgrades: Integration with 3rd party or Deere Gen 4/Gen 5 displays for basic section control, rate control (via compatible aftermarket drives), and data collection.

- Row Unit Upgrades: Replacement of worn seed meters with modern vacuum or belt meters (if compatible), or even conversion kits to newer meter types where possible.

- Hydraulic & Electrical Upgrades: Improvements to hydraulic systems for faster response and more reliable electrical harnesses.

-

Competitive Landscape & Technological Pressure:

- Obsolescence of Core Technology: The 7000’s mechanical and basic hydraulic control systems will be starkly contrasted against the dominance of high-speed, electric-drive, data-rich planters like Deere’s own ExactEmerge, Case IH Precision Planting systems, and Kinze’s offerings. Features like individual row control, advanced downforce systems (DeltaForce), and real-time seed singulation monitoring will be standard on new equipment.

- Niche Survival: The 7000’s market in 2026 relies entirely on its niche: proven mechanical reliability, lower initial acquisition cost (used), and simpler operation/maintenance. It will not compete on performance, speed, or data capabilities.

- Impact of Newer Used Equipment: The influx of 5-10 year old 8000 Series planters (or even early ExactEmerge models) into the used market as farms upgrade will create downward pressure on 7000 values and increase competition for buyers seeking a “modern” used planter.

-

Economic and Operational Factors:

- Input Cost Sensitivity: If commodity prices remain volatile or input costs (fuel, fertilizer) are high in 2026, the lower total cost of ownership (TCO) proposition of a well-maintained 7000 could see a temporary boost in demand from cost-conscious operators.

- Labor Availability: The relative simplicity of the 7000 could be an advantage on operations struggling to find technicians skilled in complex electronics and software, though this advantage is diminishing as tech skills become more widespread.

Conclusion for 2026:

The Deere 7000 Planter market in 2026 will be a mature, secondary market defined by legacy support and incremental modernization. Its value proposition rests solely on ruggedness, low upfront cost, and mechanical simplicity. While core parts support will persist, reliance on the aftermarket and third-party services for maintenance and upgrades will be significant. The relentless advance of precision planting technology will ensure the 7000 remains a niche, lower-tier option, primarily appealing to budget-focused or smaller-scale operations. Its market presence will be sustained by the enduring quality of its build and the ingenuity of the aftermarket in keeping these workhorses viable, but it will operate far outside the technological mainstream of row-crop planting.

Common Pitfalls Sourcing a Deere 7000 Planter: Quality and Intellectual Property Concerns

Sourcing a John Deere 7000 Planter, especially from third-party suppliers, international markets, or used equipment dealers, presents significant risks related to both quality and intellectual property (IP). Being aware of these pitfalls is crucial to avoid costly repairs, downtime, and potential legal issues.

Quality Concerns with Non-OEM or Used 7000 Planters

- Wear and Fatigue in Critical Components: The 7000 Planter is a robust but aging design. Key components like row units, parallel arms, seed meters, and closing wheels are prone to significant wear. Sourcing a used planter often means inheriting metal fatigue, worn bushings, cracked frames, and degraded hydraulic hoses, leading to inconsistent seed placement and increased breakdowns.

- Inconsistent Performance from Repaired/Refurbished Units: While “refurbished” sounds appealing, the quality varies drastically. Poorly executed repairs, use of substandard replacement parts (even if they look similar), or inadequate calibration can result in planter performance far below original specifications, impacting stand establishment and yield potential.

- Lack of Traceability and Service History: When sourcing from non-authorized dealers or private sellers, obtaining a complete maintenance and repair history is often impossible. This lack of traceability makes it difficult to assess true condition and anticipate future failure points.

- Compatibility and Calibration Issues: Aftermarket or third-party replacement parts (e.g., seed meters, row cleaners) may not integrate perfectly with the original 7000 system. This can lead to calibration errors, seed tube blockages, or improper downforce application, compromising planting accuracy.

Intellectual Property (IP) and Counterfeit Parts Risks

- Prevalence of Counterfeit or “Pattern” Parts: The 7000 Planter, despite its age, remains popular, creating a market for counterfeit or “pattern” parts. These are illegal copies of genuine John Deere components, often bearing deceptively similar logos or part numbers. They are typically made from inferior materials and lack rigorous quality control.

- Performance and Reliability Deficiencies: Counterfeit parts frequently fail prematurely under field conditions. A fake seed meter might not deliver seeds accurately, a counterfeit hydraulic cylinder could leak or burst, and imitation closing wheels might not provide adequate soil compaction, directly impacting planting success and potentially damaging the planter further.

- Voiding Warranties and Support: Using non-genuine, especially counterfeit, parts almost always voids any remaining warranty on the planter or related components. John Deere will not provide technical support or warranty coverage for failures caused by or involving counterfeit parts.

- Safety Hazards: Inferior materials and poor manufacturing in counterfeit parts can pose safety risks. Failures of critical components like hydraulic lines, linkages, or structural elements during operation can endanger the operator and bystanders.

- Legal and Ethical Implications: Sourcing and using counterfeit parts infringes on John Deere’s intellectual property rights. Purchasers, especially large operations or dealers, can face legal liability. Supporting counterfeit markets also undermines innovation and legitimate businesses.

Mitigation Strategy: Prioritize sourcing from authorized John Deere dealers, who guarantee genuine parts and provide proper documentation. For used planters, conduct thorough pre-purchase inspections by qualified technicians focusing on critical wear points. Be highly skeptical of significantly lower prices, which often signal counterfeit parts or severe underlying issues. Always verify part authenticity through official channels when possible.

Logistics & Compliance Guide for John Deere 7000 Planter

This guide outlines key logistics considerations and compliance requirements for transporting, operating, and maintaining the John Deere 7000 Planter. Adherence to these guidelines ensures safe handling, regulatory compliance, and optimal equipment performance.

Transportation & Handling

- Dimensions and Weight: Verify the planter’s transport width, height, and total weight (including frame, units, and seed/fertilizer tanks). The 7000 Planter may exceed standard road width limits; folding wings and adjusting transport position are required for legal hauling.

- Permits: Obtain oversize/overweight transport permits if applicable based on state or regional regulations. Confirm route restrictions (e.g., bridges, low-clearance areas) prior to movement.

- Towing Requirements: Use a compatible John Deere tractor with sufficient hydraulic, electrical, and hitch capacity (e.g., Category III or IV hitch). Ensure the drawbar and safety chains are securely fastened.

- Securing the Planter: Lock transport locks, ensure wings are fully folded and pinned, and verify all components are latched before road travel. Use reflective markers and signage per DOT regulations for wide loads.

Regulatory Compliance

- DOT Regulations: Comply with U.S. Department of Transportation (DOT) and local laws regarding lighting, reflectors, slow-moving vehicle (SMV) emblems, and braking systems (if equipped). Maintain operational turn signals, brake lights, and hazard flashers.

- State Agricultural Regulations: Adhere to state-specific planting and seed distribution laws, especially when operating across jurisdictions. Maintain records if required for seed traceability or chemical use.

- Environmental Compliance: Follow EPA and local guidelines for handling and storage of fertilizers or seed treatments. Prevent spillage during transport and operation. Dispose of waste materials properly.

Operational Safety & Standards

- Operator Certification: Ensure operators are trained on the 7000 Planter’s functions, safety protocols, and emergency procedures. Review the Operator’s Manual (OML117388 or equivalent) prior to use.

- Roll-Over Protection: Operate only with tractors equipped with ROPS (Roll-Over Protective Structure) and wear seatbelts. Never bypass safety interlocks.

- Hydraulic and Electrical Systems: Inspect hoses, fittings, and wiring harnesses regularly. Use only approved connectors and fuses. Comply with NFPA 79 (electrical standards for industrial machinery).

Maintenance & Documentation

- Service Intervals: Follow the maintenance schedule in the official John Deere service manual. Keep records of inspections, lubrication, and part replacements.

- Emissions Compliance: While the planter itself is non-powered, ensure the towing tractor meets current emissions standards (e.g., Tier 4 Final) where applicable.

- Recordkeeping: Maintain logs of transport permits, operator training, maintenance, and safety inspections for audit or compliance verification.

Additional Notes

- Always reference the latest John Deere technical publications and consult your local dealer for model-specific updates or regional compliance requirements.

- When upgrading or modifying the planter (e.g., adding GPS or row cleaners), ensure modifications do not void compliance or safety certifications.

By following this guide, operators and fleet managers can ensure safe, legal, and efficient use of the John Deere 7000 Planter across all phases of operation.

Conclusion for Sourcing a John Deere 7000 Planter:

Sourcing a John Deere 7000 planter presents a strategic opportunity for growers and agricultural operations seeking reliable, durable, and time-tested seeding equipment. As a proven model in the agricultural sector, the 7000 planter offers consistent seed placement, strong field performance, and compatibility with a wide range of row units and attachments. Its widespread availability in the used market makes it a cost-effective choice, particularly for mid-sized farms or those looking to expand planting capacity without investing in newer high-tech models.

However, buyers should conduct thorough inspections or consider professional evaluations to ensure the planter’s structural integrity, hydraulic systems, and row units are in good working condition, as these machines are often several decades old. Availability of parts and technical support should also be considered, although the popularity of the 7000 series helps maintain a strong aftermarket network.

In summary, sourcing a John Deere 7000 planter is a practical decision for operators prioritizing dependability, value, and performance in conventional planting operations. With proper maintenance and potential upgrades, the 7000 series can remain a productive asset in modern farming systems.