The global high power DC power supply market is experiencing robust growth, driven by rising demand across industries such as renewable energy, electric vehicles, telecommunications, and advanced manufacturing. According to a report by Mordor Intelligence, the DC power supply market was valued at USD 3.8 billion in 2023 and is projected to grow at a CAGR of approximately 6.2% from 2024 to 2029. Another analysis by Grand View Research reinforces this trend, estimating the broader power supply market to expand at a CAGR of over 5.8% through 2030, with DC power systems gaining traction due to their efficiency in powering modern electronic infrastructure. This growth is further amplified by advancements in semiconductor technology and the increasing deployment of automated test equipment (ATE) in R&D and production environments. As demand intensifies, a select group of manufacturers has emerged as leaders in innovation, reliability, and scalability. The following list highlights the top 10 DC high power supply manufacturers shaping the future of power electronics.

Top 10 Dc High Power Supply Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

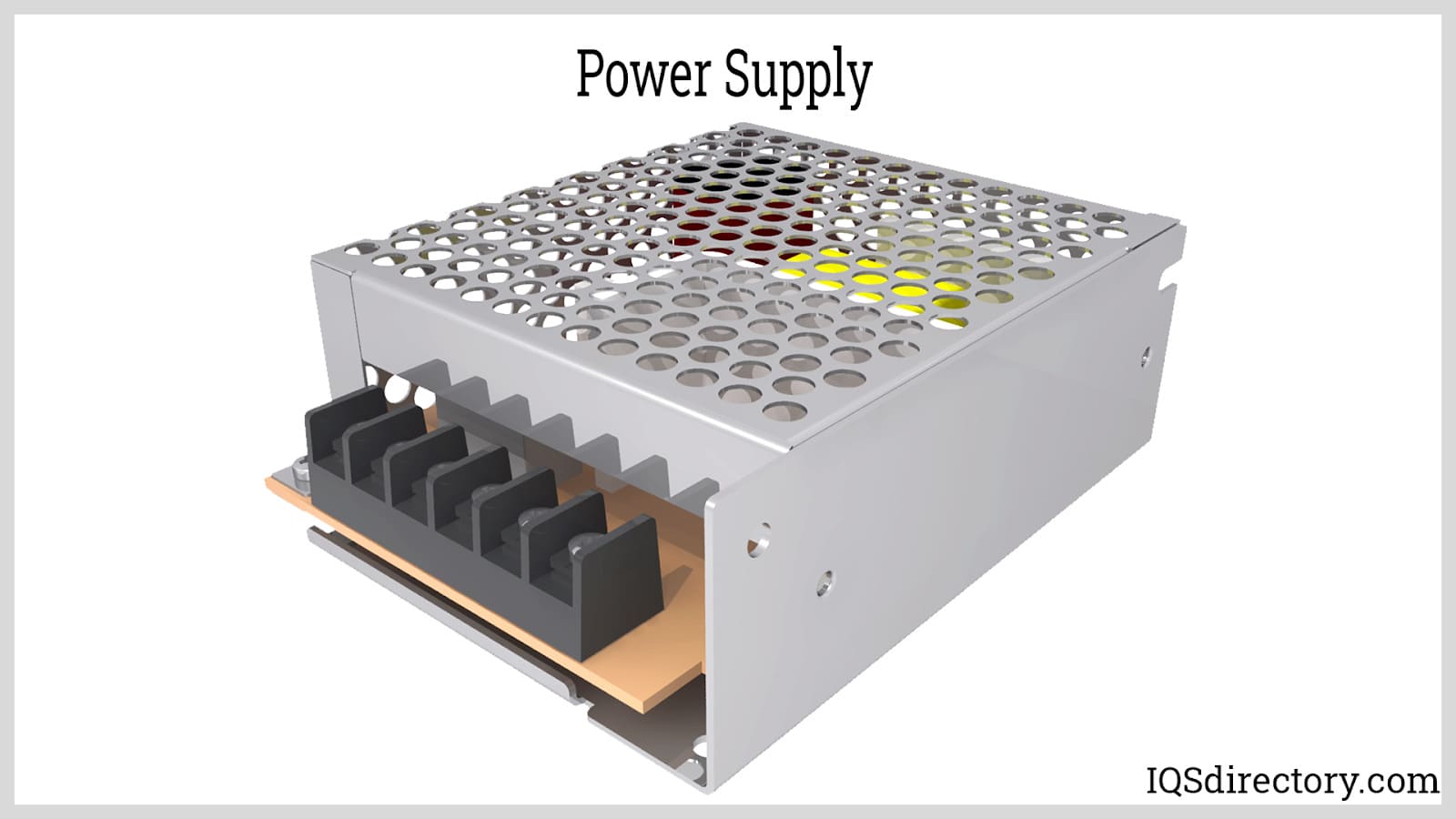

#1 AC-DC Switching Power Supplies

Domain Est. 1997

Website: technologydynamicsinc.com

Key Highlights: Technology Dynamics Inc. is the leading designer and manufacturer of Switching Power Supplies, DC-DC Converters and DC-UPS Systems for Military, Industrial and ……

#2 AC/DC Power Supplies Catalog

Domain Est. 1998

Website: fsp-group.com

Key Highlights: FSP Group offers a wide selection of AC/DC power supplies selection, including personal computer power supply, industrial power supply, medical power supply….

#3 Cincon

Domain Est. 1998

Website: cincon.com

Key Highlights: Cincon Electronics is a leading manufacturer of DC/DC converters and AC/DC power supplies offering the high-quality and reliable power module solutions….

#4 Wall Industries

Domain Est. 1998

Website: wallindustries.com

Key Highlights: Wall Industries manufactures and markets a full line of DC DC converters and AC DC power supplies. Browse our standard and customized power solutions ……

#5 Power Supply Manufacturer

Domain Est. 1998

Website: synqor.com

Key Highlights: SynQor designs and manufactures high-efficiency, high-reliability DC-DC power converters, AC-DC power converters, EMI filters and power systems….

#6 XP Power

Domain Est. 2000

Website: xppower.com

Key Highlights: Looking for the leading manufacturer of AC-DC power supplies, DC-DC converters, high voltage, RF & custom power products? Discover our extensive range….

#7 DC/DC & AC/DC Converter – Power Supply Manufacturer

Domain Est. 2006

Website: recom-power.com

Key Highlights: RECOM Power is a leading manufacturer of AC/DC electronic power supplies and DC/DC converters, with over 30,000 compact standard power supplies alongside ……

#8 High-Power DC Power Supply

Domain Est. 1986

Website: tek.com

Key Highlights: A high power power supply delivers stable, high-wattage output for applications requiring precision, efficiency, and scalability….

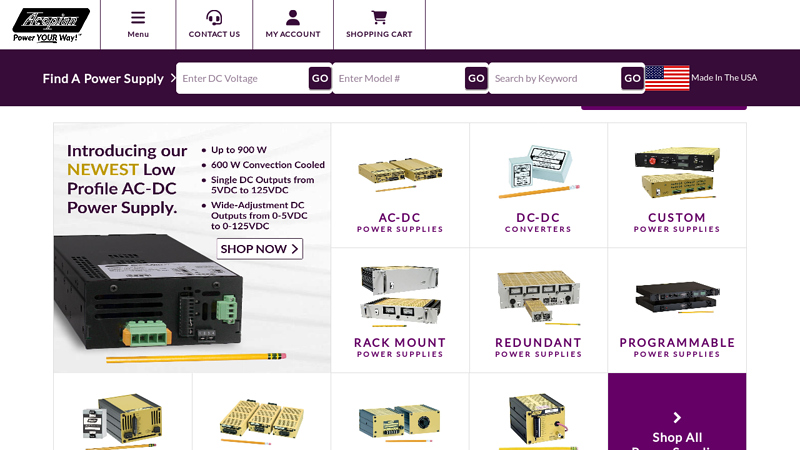

#9 Power Supplies

Domain Est. 1996

Website: acopian.com

Key Highlights: Millions of Reliable Power Supplies. Acopian can design, build and ship the power supply that meets your needs. The possibilities are endless….

#10 High Voltage Power Supplies for Demanding Applications

Domain Est. 1996

Website: advancedenergy.com

Key Highlights: Our portfolio includes High Power DC-DC and AC-DC power supplies, with output power ratings up to 10 kW. These products are designed for semiconductor, ……

Expert Sourcing Insights for Dc High Power Supply

H2: 2026 Market Trends for DC High Power Supply

The global DC high power supply market is poised for significant transformation by 2026, driven by evolving industrial demands, advancements in renewable energy systems, and the rapid expansion of electric vehicle (EV) infrastructure. This analysis explores key trends shaping the market under the H2 framework—highlighting Hydrogen Economy Integration and High-Efficiency Power Demands—as two pivotal drivers influencing growth, innovation, and adoption.

Hydrogen Economy Integration (First H2)

The accelerating global shift toward a hydrogen-based economy is one of the most influential trends affecting the DC high power supply sector. As governments and industries invest heavily in green hydrogen production via electrolysis, the need for high-power, stable DC power supplies has surged. Electrolyzers—particularly proton exchange membrane (PEM) and alkaline systems—require precise, high-current DC power (often in the range of hundreds of kilowatts to megawatts) to efficiently split water into hydrogen and oxygen.

By 2026, the integration of DC power supplies into hydrogen generation plants is expected to grow at a compound annual growth rate (CAGR) of over 18%. Key developments include:

- Modular and Scalable DC Systems: Manufacturers are focusing on modular designs that allow easy scaling of power systems to match the size of hydrogen production facilities.

- Grid Resilience and Renewable Coupling: DC power supplies are increasingly being paired with solar and wind farms to provide direct DC-to-electrolyzer power conversion, minimizing AC/DC losses and improving overall system efficiency.

- Smart Control Integration: Advanced digital control systems allow real-time monitoring, load balancing, and adaptive voltage/current regulation to optimize hydrogen output and energy consumption.

Countries such as Germany, Japan, South Korea, and Australia are leading in hydrogen infrastructure investment, directly boosting demand for industrial-grade DC power supplies.

High-Efficiency Power Demands (Second H2)

Energy efficiency remains a critical concern across data centers, semiconductor manufacturing, EV charging, and telecom infrastructure. In 2026, the demand for high-efficiency, high-reliability DC power supplies will intensify due to:

- Data Center Expansion: Hyperscale data centers require efficient -48V DC or 380V DC power distribution systems to support AI servers, 5G infrastructure, and edge computing. High-power DC supplies with >96% efficiency are becoming standard to reduce cooling loads and operational costs.

- Electric Vehicle Fast Charging: The proliferation of 350 kW+ DC fast chargers necessitates robust, compact, and thermally efficient DC power modules. Silicon Carbide (SiC) and Gallium Nitride (GaN) semiconductors are being adopted to minimize energy loss and improve power density.

- Industrial Automation and Testing: Sectors such as aerospace, defense, and R&D rely on programmable DC power supplies for testing batteries, fuel cells, and power electronics. Precision, stability, and low ripple are essential—driving innovation in digital power management and remote monitoring.

By 2026, the market for high-efficiency DC power supplies is projected to exceed $4.2 billion, with Asia-Pacific emerging as the fastest-growing region due to strong manufacturing bases and government-led electrification programs.

Conclusion

The dual forces of Hydrogen Economy Integration and High-Efficiency Power Demands—the two H2s—are reshaping the DC high power supply landscape in 2026. As industries pivot toward sustainable energy and digital transformation, DC power supply manufacturers must innovate in modularity, efficiency, and smart integration to meet these evolving requirements. Companies that align their R&D and product strategies with these H2-driven trends will be best positioned to capture market share in this dynamic sector.

Common Pitfalls When Sourcing High Power DC Power Supplies: Quality and Intellectual Property Risks

Sourcing high power DC power supplies involves significant technical, financial, and legal considerations. While performance and cost are primary concerns, overlooking quality assurance and intellectual property (IP) aspects can lead to long-term operational and legal challenges. Below are key pitfalls to avoid.

Poor Quality Control and Substandard Components

One of the most frequent issues when sourcing high power DC supplies—especially from low-cost manufacturers—is inconsistent quality control. Suppliers may use inferior components such as low-grade capacitors, undersized transformers, or subpar cooling systems to reduce costs. These compromises can result in premature failures, unstable output, or safety hazards like overheating and fire risks. Always verify that suppliers adhere to international standards (e.g., IEC, UL, CE) and request independent test reports or certifications.

Lack of Traceability and Documentation

Inadequate documentation, including missing schematics, BOMs (Bill of Materials), or compliance reports, complicates maintenance, repairs, and regulatory approvals. Without traceability, diagnosing failures becomes difficult, and replacing or upgrading systems may require reverse engineering. Insist on complete technical documentation and ensure it is provided in your required language and format before finalizing procurement.

Counterfeit or Recycled Components

Some suppliers, particularly in less-regulated markets, may incorporate counterfeit or salvaged (recycled) components to cut costs. These parts often fail under high-stress conditions typical of high power applications. Conduct factory audits or use third-party inspection services to verify component authenticity and manufacturing processes.

Inadequate Thermal and Electrical Design

High power DC supplies generate substantial heat and electromagnetic interference (EMI). Poor thermal design leads to reduced lifespan and reliability, while insufficient EMI shielding can disrupt nearby equipment. Evaluate the supplier’s design practices, including thermal management (e.g., heatsink design, fan control) and EMI compliance. Request full test data under load conditions similar to your application.

Intellectual Property Infringement

Purchasing from suppliers who replicate patented designs or use proprietary technology without authorization exposes your organization to legal liability. Even if unintentional, using infringing equipment can result in cease-and-desist orders, recalls, or lawsuits. Conduct due diligence by reviewing the supplier’s IP portfolio, checking for design patents, and including IP indemnification clauses in contracts.

Reverse Engineering Risks and IP Theft

When customizing or modifying power supplies, especially with OEMs, there is a risk that your design improvements or proprietary configurations could be copied and sold to competitors. Protect your IP by using non-disclosure agreements (NDAs), limiting access to critical design details, and choosing partners with a strong reputation for IP protection.

Dependency on Proprietary Interfaces or Firmware

Some suppliers lock customers into their ecosystem by using proprietary communication protocols, firmware, or control software. This limits interoperability and creates vendor lock-in, making future upgrades or replacements costly and complex. Opt for supplies with open, industry-standard interfaces (e.g., Modbus, CANopen) and ensure firmware is upgradable and not cryptographically restricted.

Incomplete or Misleading Specifications

Exaggerated performance claims—such as overrated output power, efficiency, or ripple current—are common. Always demand real-world test data, preferably from accredited labs, and verify specifications under continuous load and varying input conditions. Be cautious of “marketing specs” that don’t reflect actual performance.

Avoiding these pitfalls requires thorough supplier vetting, clear contractual terms, and ongoing quality monitoring. Prioritize long-term reliability and legal safety over initial cost savings to ensure a secure and sustainable power solution.

Logistics & Compliance Guide for DC High Power Supply

Product Classification and Regulatory Overview

DC High Power Supplies are specialized electrical devices designed to convert input power (typically AC) into regulated DC output at higher voltage or current levels. Due to their electrical nature and potential safety risks, they are subject to international, regional, and local regulations. Proper classification under Harmonized System (HS) codes, adherence to safety standards, and compliance with environmental directives are essential for global trade.

International Shipping and Packaging Requirements

Ensure DC High Power Supplies are securely packed in anti-static, shock-absorbent materials to prevent damage during transit. Use robust outer packaging with clear labeling indicating “Fragile,” “This Side Up,” and “Do Not Stack.” Include internal bracing to minimize movement. For international shipments, declare accurate product details, including model number, input/output specifications (voltage, current, power rating), and weight. Confirm packaging meets ISTA or ASTM standards where required.

Import/Export Controls and Documentation

Verify export compliance with relevant authorities such as the U.S. Department of Commerce (EAR) or equivalent national bodies. DC High Power Supplies may be subject to export controls if they meet specific performance thresholds (e.g., high voltage or specialized applications). Required documentation includes a Commercial Invoice, Packing List, Bill of Lading/Air Waybill, and potentially an Export License. For imports, ensure correct HS code classification (e.g., 8504.40 for power supply units) and provide certificates of origin if claiming preferential tariff treatment.

Safety and Electromagnetic Compliance Standards

DC High Power Supplies must comply with regional safety and EMC standards prior to market entry. Key certifications include:

– UL/CSA 62368-1 (North America): Safety of Audio/Video, Information and Communication Technology Equipment.

– IEC 62368-1 (International): Equivalent to UL/CSA, often adopted in Europe and Asia.

– CE Marking (European Union): Requires compliance with Low Voltage Directive (LVD), Electromagnetic Compatibility (EMC) Directive, and RoHS.

– FCC Part 15 Subpart B (USA): Regulates electromagnetic emissions for digital devices.

– PSE Mark (Japan): Required for electrical safety under the DENAN Law.

Ensure units are tested and certified by an accredited laboratory, and retain technical documentation per regulatory requirements.

Environmental and Chemical Compliance

Adhere to environmental regulations restricting hazardous substances in electrical equipment:

– RoHS (EU Directive 2011/65/EU): Limits lead, mercury, cadmium, hexavalent chromium, PBB, and PBDE in electronic components.

– REACH (EU Regulation EC 1907/2006): Requires communication of SVHCs (Substances of Very High Concern) in articles.

– China RoHS: Similar substance restrictions with labeling requirements.

Maintain a full material declaration (FMD) and ensure suppliers provide compliance documentation for all components.

Labeling and User Documentation

Affix permanent labels on each unit containing:

– Manufacturer name and address

– Model and serial number

– Input/output electrical ratings (voltage, current, power)

– Safety certification marks (e.g., CE, UL, CCC)

– Warning symbols as required by IEC 60417

Include user manuals in the local language(s) of the destination market, detailing installation, operation, safety precautions, and disposal instructions. Manuals must reference compliance with applicable standards.

Customs Clearance and Duties

Prepare for customs inspections by having all compliance certificates, test reports, and import licenses readily available. Classify the product correctly under the destination country’s tariff schedule to determine applicable duties and taxes. Consider using an Authorized Economic Operator (AEO) or bonded carrier to expedite clearance. Be aware of anti-dumping or countervailing duties that may apply in certain jurisdictions.

End-of-Life and WEEE Compliance

In markets such as the European Union, DC High Power Supplies are subject to the WEEE Directive (2012/19/EU). Producers must register with national WEEE authorities, affix the crossed-out wheeled bin symbol on products, and finance the collection and recycling of end-of-life equipment. Establish take-back programs or partner with authorized recycling schemes to meet obligations.

Summary and Best Practices

To ensure seamless logistics and compliance for DC High Power Supplies:

– Confirm product classification and obtain necessary certifications before shipment.

– Use compliant packaging and accurate documentation for customs.

– Maintain detailed technical files and supply chain compliance records.

– Stay updated on regulatory changes in target markets.

– Partner with experienced freight forwarders and compliance consultants for complex regions.

Proactive adherence to these guidelines minimizes delays, avoids penalties, and supports market access and customer trust.

Conclusion for Sourcing a DC High-Power Supply

Sourcing a DC high-power supply requires a comprehensive evaluation of technical specifications, application requirements, reliability, and total cost of ownership. Key factors such as output voltage and current stability, efficiency, thermal management, protection features (e.g., over-voltage, over-current, and short-circuit protection), and compliance with industry standards must be carefully assessed to ensure optimal performance and safety.

When selecting a supplier, prioritizing proven quality, technical support, and scalability is essential—especially for critical applications in industries such as renewable energy, industrial manufacturing, electric vehicle charging, or advanced research. Whether choosing between in-house development, standard off-the-shelf units, or custom-engineered solutions, the decision should align with long-term operational needs and future expansion plans.

Ultimately, partnering with a reputable manufacturer or vendor that offers robust warranties, responsive service, and a track record of innovation ensures reliability and reduces downtime. A strategic sourcing approach not only secures a high-performance power supply but also contributes to system efficiency, regulatory compliance, and overall project success.