The global surgical retractors market is experiencing steady expansion, driven by rising surgical volumes, advancements in minimally invasive procedures, and increasing demand for specialized surgical instruments. According to Grand View Research, the global surgical instruments market was valued at USD 15.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. Within this landscape, Darrach retractors—commonly used in orthopedic and hand surgeries—have become essential tools, fueling demand for high-quality, precision-engineered models. As healthcare facilities prioritize instrument reliability and durability, manufacturers specializing in Darrach retractors are scaling innovation and compliance with international standards. This growing market momentum underscores the importance of identifying leading suppliers who combine engineering excellence with rigorous quality control. Based on market presence, product consistency, and adherence to surgical standards, the following are six of the top Darrach retractor manufacturers shaping the industry today.

Top 6 Darrach Retractor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

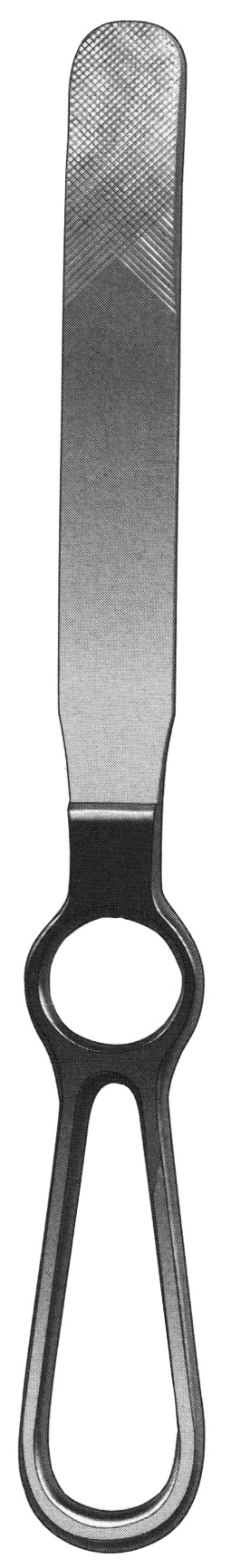

#1 Darrach retractor, 10 1/4”long x 1/2”wide blade 71

Domain Est. 2003

Website: amblersurgical.com

Key Highlights: Darrach retractor, 10 1/4”long x 1/2”wide blade, finger grip handle. Additional Information. More Information. Manufacturer, Ambler Surgical….

#2 Darrach Elevator, 10″ Long x 5/8″ Wide, Blunt with Serrations

Domain Est. 1997

Website: arthrex.com

Key Highlights: Darrach Elevator, 10″ Long x 5/8″ Wide, Blunt with Serrations. AR-9260-36. Request Product InfoView eDFU. AR-9260-36 is a Set Item Of (1)….

#3 elevators

Domain Est. 1998

Website: innomed.net

Key Highlights: Designed to retract and protect the humeral head during resection of the inferior acromial surface · Available in narrow and wide sizes. · Available in small and ……

#4 Darrach

Domain Est. 1998

Website: georgetiemann.com

Key Highlights: … Site Map | phone: 1-631-273-0005. As … Item #: 080-1712-2. Hercules Aufranc Anterior Hip retractor (designed not to bend while retracting) $580.45….

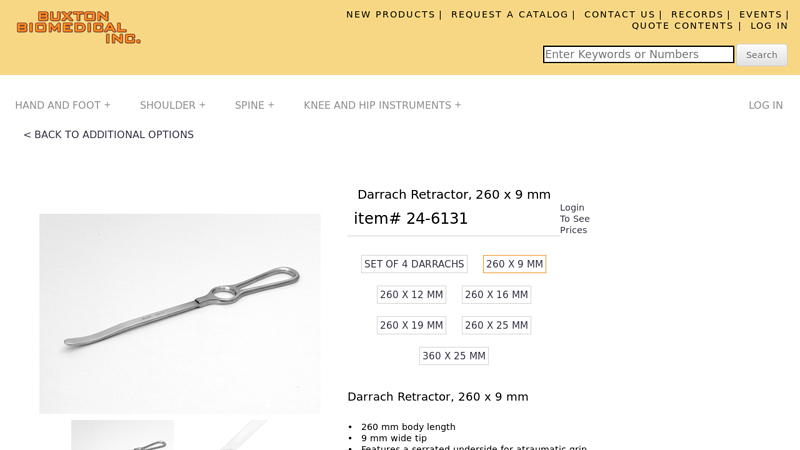

#5 Darrach Retractor, 260 x 9 mm 24

Domain Est. 1999

Website: buxtonbio.com

Key Highlights: Darrach Retractor, 260 x 9 mm 24-6131 : Buxton Biomedical. The blunt tips of these versatile instruments may be used to lever the humeral head distally, ……

#6 Modified Darrach-Type Retractor-1In

Domain Est. 2001

Website: surgicalinstruments.com

Key Highlights: Modified Darrach-Type Retractor-1In … For more information request a quote, email us at [email protected], or call us at 800-600-0428 from 7:30am to 5 ……

Expert Sourcing Insights for Darrach Retractor

H2: 2026 Market Trends for Darrach Retractors

While the Darrach retractor—a specialized surgical instrument primarily used in orthopedic, particularly hand and wrist, procedures—does not constitute a large standalone market, its usage and demand are closely tied to broader surgical, demographic, and technological trends. By 2026, several key factors are expected to shape the landscape for instruments like the Darrach retractor:

1. Rising Prevalence of Musculoskeletal Disorders

The global incidence of osteoarthritis, rheumatoid arthritis, and trauma-related hand and wrist injuries is increasing due to aging populations and higher rates of sports-related injuries. According to the World Health Organization, musculoskeletal conditions affect more than 1.7 billion people worldwide. This growing patient pool will drive demand for orthopedic surgical interventions—including distal radioulnar joint (DRUJ) surgeries, where the Darrach retractor is commonly used—supporting steady utilization of the instrument through 2026.

2. Expansion of Minimally Invasive and Precision Surgery

There is a strong industry shift toward minimally invasive surgical (MIS) techniques across orthopedics. While the traditional Darrach retractor is used in open procedures, advancements are encouraging the development of smaller, more ergonomic, or specialized versions compatible with limited-incision approaches. By 2026, manufacturers may adapt retractor designs to support MIS workflows, enhancing visibility and tissue protection with reduced trauma.

3. Growth in Ambulatory Surgery Centers (ASCs)

The migration of orthopedic procedures—especially upper extremity surgeries—to outpatient and ASC settings is accelerating due to cost-efficiency and patient preference. This trend increases demand for reliable, reusable surgical instrumentation like the Darrach retractor in non-hospital environments. As ASC volumes grow, so will the need for durable, sterilizable tools, reinforcing the retractor’s role in routine surgical kits.

4. Innovation in Surgical Instrument Materials and Design

By 2026, materials innovation—such as antimicrobial coatings, lightweight titanium alloys, or enhanced ergonomics—may influence retractor design. While the core function of the Darrach retractor remains unchanged, manufacturers could introduce versions with improved grip, reduced tissue trauma, or better compatibility with imaging systems (e.g., intraoperative fluoroscopy). These enhancements may increase adoption in high-volume surgical centers.

5. Market Consolidation and OEM Partnerships

The surgical instrument market is experiencing consolidation, with larger medical device companies acquiring or partnering with specialized manufacturers. This may lead to broader distribution of traditional instruments like the Darrach retractor under well-known brands, improving accessibility and standardization in global markets, particularly in emerging economies.

6. Regional Market Growth in Asia-Pacific and Latin America

Healthcare infrastructure expansion in regions like India, China, and Brazil is increasing access to orthopedic surgery. As surgical volumes rise in these areas, demand for essential instruments—including retractors—will grow. By 2026, the Darrach retractor may see increased penetration in teaching hospitals and surgical training programs across these regions.

Conclusion

The market for the Darrach retractor in 2026 will not be defined by explosive growth but by sustained demand driven by demographic trends, procedural volume increases, and incremental innovation. While not a high-tech device, its role in essential orthopedic surgeries ensures continued relevance. The instrument’s future lies in adaptation—through design refinement, material advances, and integration into evolving surgical workflows—ensuring its place in the modern operating room.

Common Pitfalls When Sourcing a Darrach Retractor: Quality and Intellectual Property Concerns

Sourcing a Darrach Retractor—commonly used in orthopedic and hand surgery—can present significant challenges, particularly related to product quality and intellectual property (IP) compliance. Being aware of these pitfalls is essential to ensure patient safety, regulatory adherence, and legal protection.

Quality-Related Pitfalls

1. Substandard Materials and Manufacturing

Many suppliers, especially those from unverified manufacturers, may use inferior-grade stainless steel or fail to meet ASTM or ISO standards for surgical instruments. This can lead to corrosion, pitting, or breakage during use, increasing the risk of patient harm and instrument failure.

2. Inconsistent Dimensions and Functionality

The Darrach Retractor has precise anatomical specifications for effective use in procedures like the Darrach procedure (distal ulna excision). Poorly manufactured versions may have incorrect angles, inadequate tooth design, or weak ratchets, compromising surgical efficiency and safety.

3. Lack of Sterilization and Biocompatibility Certification

Some low-cost suppliers may not provide documentation proving the device is sterilization-compatible (e.g., autoclave-safe) or compliant with biocompatibility standards such as ISO 10993. This raises infection risks and non-compliance with healthcare facility protocols.

4. Absence of Quality Management Systems

Suppliers without ISO 13485 certification may lack rigorous quality control processes. This increases the likelihood of defects, batch inconsistencies, and non-conformance to medical device regulations.

Intellectual Property-Related Pitfalls

1. Infringement of Patented Designs

While the original Darrach technique dates back to the early 20th century, modern retractors may incorporate patented features (e.g., ergonomic handles, locking mechanisms, or specific geometries). Sourcing from manufacturers that replicate these protected designs without authorization can expose buyers to legal liability.

2. Misrepresentation of Brand and Origin

Some suppliers falsely claim their retractors are “original” or “premium” versions, or imply affiliation with well-known surgical instrument brands. This not only misleads buyers but may constitute trademark infringement.

3. Insufficient Regulatory Documentation

Reputable medical devices require proper technical files, 510(k) clearances (if applicable), or CE marking documentation. Sourcing from vendors who cannot provide evidence of regulatory compliance may indicate IP infringement or illegal manufacturing practices.

4. Grey Market and Unauthorized Distribution

Purchasing from unauthorized distributors may result in counterfeit or diverted products. These instruments might not meet the original manufacturer’s quality standards and could violate distribution agreements or IP rights.

Conclusion

To mitigate these risks, healthcare providers and procurement teams should source Darrach retractors only from reputable, certified suppliers with transparent manufacturing and regulatory documentation. Conducting due diligence on both product specifications and IP compliance is critical to ensuring patient safety and legal integrity.

Logistics & Compliance Guide for Darrach Retractor

Product Overview

The Darrach Retractor is a sterile, single-use surgical instrument designed for use in orthopedic and hand surgery procedures. It is intended to provide optimal tissue retraction during surgical exposure, particularly in wrist and forearm operations. The device is manufactured in compliance with international medical device standards and must be handled, stored, and used in accordance with regulatory and clinical requirements.

Regulatory Classification

The Darrach Retractor is classified as a Class I (or Class IIa, depending on jurisdiction) medical device under applicable regulatory frameworks:

– United States (FDA): 510(k)-exempt Class I device, compliant with 21 CFR Part 888 (Orthopedic Surgery Devices).

– European Union (EU): Conforms to the Medical Device Regulation (MDR) (EU) 2017/745, bearing the CE mark.

– Other Regions: Registered with local authorities (e.g., Health Canada, TGA, PMDA) as required.

Always verify the regulatory status in the destination country prior to distribution.

Sterility and Packaging

- The Darrach Retractor is supplied sterile via ethylene oxide (EtO) sterilization.

- Packaging consists of a double-layer peel pouch compliant with ISO 11607 standards.

- Do not use if the sterile barrier is damaged, punctured, or compromised.

- Shelf life: 5 years from the date of manufacture when stored under recommended conditions.

Storage and Handling

- Store in a clean, dry environment with temperatures between 15°C and 30°C (59°F–86°F) and relative humidity below 60%.

- Protect from direct sunlight, moisture, and extreme temperature fluctuations.

- Handle packages with clean, dry hands to maintain sterility.

- Do not restack or compress packages during storage to prevent damage.

Shipping and Distribution

- Ship in sealed, tamper-evident secondary packaging with temperature monitoring if required.

- Use validated cold chain logistics only if specified (not typically required for this device).

- Include required labeling: product name, lot number, expiration date, CE/FDA marking, and UDI (Unique Device Identifier).

- Maintain a distribution log for traceability and recall readiness.

Import and Customs Compliance

- Provide commercial invoice, packing list, Certificate of Conformity (CoC), and Declaration of Conformity (DoC) for customs clearance.

- Include UDI in shipment documentation for traceability under EU MDR and FDA requirements.

- Verify import license or authorization is in place for destination country (e.g., ANVISA in Brazil, CFDA in China).

- Labeling must be in the official language(s) of the destination country where required.

Clinical Use and Disposal

- For single-use only—do not reuse or reprocess.

- Use only by trained healthcare professionals in a sterile surgical environment.

- Inspect device for integrity and correct size prior to use.

- Discard used retractors in accordance with local biohazard waste regulations (e.g., ISO 24901, OSHA standards).

Post-Market Surveillance & Incident Reporting

- Report any adverse events, device malfunctions, or complaints through the manufacturer’s Quality Management System (QMS).

- Distributors and healthcare facilities must comply with Vigilance reporting timelines:

- EU: Report serious incidents within 15 days (MDR Article 87).

- US: Report to FDA via MedWatch within 30 days (MDR reporting requirements).

- Maintain records for a minimum of 10 years post-device withdrawal (per ISO 13485).

Quality Management System

This product is manufactured under an ISO 13485:2016-certified Quality Management System. All logistics and compliance activities are documented and auditable to ensure ongoing conformity with regulatory requirements.

Contact Information

For compliance inquiries, product complaints, or recall coordination:

Quality & Regulatory Affairs Department

[Manufacturer Name]

Email: [email protected]

Phone: +1 (800) XXX-XXXX

Website: www.manufacturer.com/compliance

Conclusion for Sourcing Darrach Retractor:

After a thorough evaluation of supplier options, quality standards, cost considerations, and compliance with medical device regulations, sourcing the Darrach retractor requires a strategic approach to ensure both clinical efficacy and supply chain reliability. It is recommended to partner with ISO 13485-certified manufacturers with a proven track record in surgical instrument production to guarantee precision, durability, and biocompatibility. Both domestic and international suppliers should be assessed based on quality control, lead times, customization capabilities, and post-sales support.

Procurement should prioritize suppliers offering transparent documentation, including material certifications and sterilization compatibility, to meet regulatory requirements such as FDA or CE marking. While cost is an important factor, long-term value—through instrument longevity, warranty, and service—should take precedence over initial price. Establishing long-term contracts with reliable vendors can enhance supply stability and potentially reduce total cost of ownership.

In conclusion, the successful sourcing of Darrach retractors hinges on balancing quality, compliance, and cost-efficiency, ensuring that healthcare providers receive high-performing surgical tools that support optimal patient outcomes and operational reliability.