The global cut-in tool and paint accessories market has experienced steady growth, driven by rising demand in residential and commercial construction, coupled with increased DIY painting activities. According to Mordor Intelligence, the paint and coating additives market was valued at USD 23.6 billion in 2023 and is projected to grow at a CAGR of over 5.8% through 2029, reflecting broader momentum in paint application tools and precision instruments like cut-in tools. As precision painting becomes essential for clean edges and professional finishes, manufacturers specializing in high-performance cut-in tools and innovative paint applicators are gaining prominence. This growth is further supported by advancements in ergonomic design, material durability, and user efficiency—key factors shaping competitive differentiation among leading brands. In this evolving landscape, the top 10 cut-in tool paint manufacturers are distinguished by their ability to combine technological innovation, customer-centric design, and scalable manufacturing—positioning them at the forefront of a maturing and increasingly quality-focused market.

Top 10 Cut In Tool Paint Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Professional Paint Tools Manufacturer & Wholesale

Domain Est. 2017

Website: rollingdogtools.com

Key Highlights: ROLLINGDOG Tools is a leading manufacturer of paint tools and equipment with products reaching more than 60 countries around the world….

#2 Shur

Domain Est. 1996

Website: shurline.com

Key Highlights: We offer a full product line of brushes, roller covers, mini rollers, paint trays, poles, frames, surface prep, edging and convenience tools….

#3 BEHR™ Trim Painter

Domain Est. 1996

Website: behr.com

Key Highlights: Free deliveryBEHR™ Trim Painter is the perfect size for touch ups, small detail work, and trimming windows, doors, and shutters. It is compatible to use with all paints, ……

#4 Hyde Tools

Domain Est. 1996

#5 Products

Domain Est. 1996

Website: woosterbrush.com

Key Highlights: CUT-IN CONTROL; DURABILITY; EASY TO CLEAN; ALL-PURPOSE. Where are you painting? INTERIOR; EXTERIOR. Paint Type. ALL PAINTS; OIL-BASED PAINTS & STAINS. Filament ……

#6 The Purdy® Difference

Domain Est. 1996

Website: purdy.com

Key Highlights: Here’s how Purdy became Purdy. Since day one, every Purdy tool has been thoughtfully designed, crafted, and tested to deliver unsurpassed performance….

#7 Painter’s Tools

Domain Est. 1998

Website: sherwin-williams.com

Key Highlights: Paint brushes, roller covers and frames, patching and repair tools, masking tape, paint drop cloths, paint trays, buckets and liners….

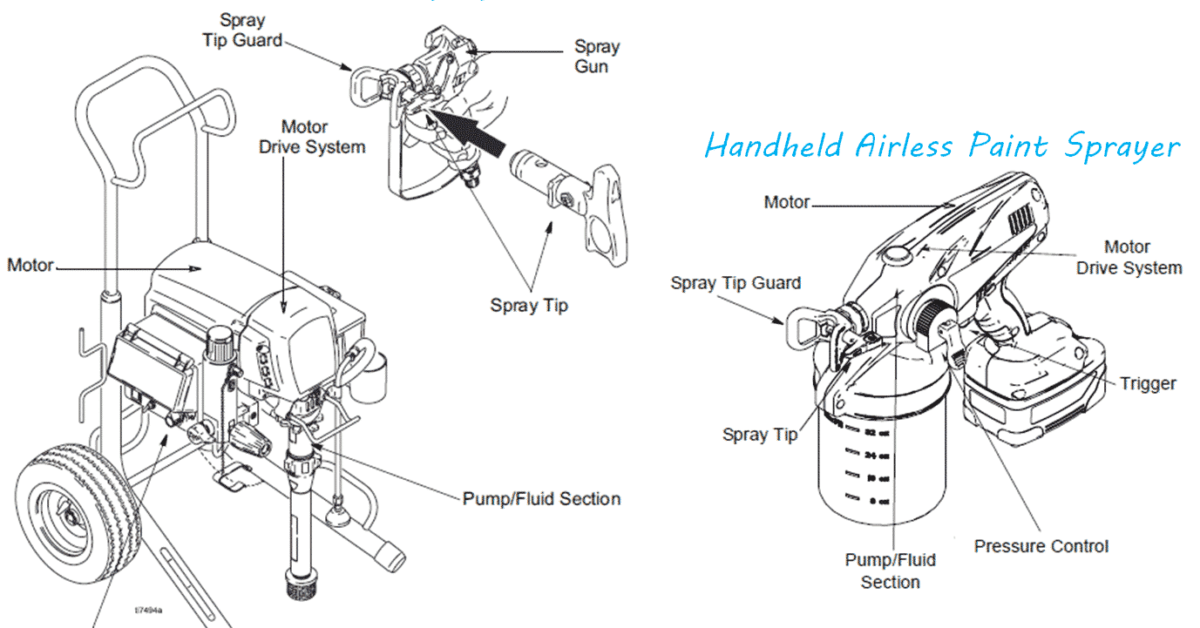

#8 Professional Paint Sprayers, Parts, & Accessories

Domain Est. 1998

Website: titantool.com

Key Highlights: Titan paint sprayers and paint sprayer accessories give you industry-leading power and control over every painting and coating project. Shop Titan paint ……

#9 Monarch’s Premium Paint Accessories

Website: monarchpainting.com.au

Key Highlights: Discover Monarch Premium Paint Accessories range of top-quality brushes, accessories, and paint supplies, all at great prices….

#10 Zibra

Domain Est. 2005

Website: enjoyzibra.com

Key Highlights: Zibra’s professional paintbrushes are designed specifically for your application and constructed to last. Our unique brush shapes deliver incredible paint ……

Expert Sourcing Insights for Cut In Tool Paint

2026 Market Trends for Cut In Tool Paint

The Cut In Tool Paint market is poised for significant transformation by 2026, driven by technological innovation, increasing demand for DIY (Do-It-Yourself) home improvement solutions, and a growing emphasis on efficiency in professional painting applications. As homeowners and contractors seek faster, cleaner, and more precise painting methods, the cut-in tool paint segment—comprising specialized brushes, edging tools, and paint applicators designed for clean lines around walls, ceilings, and trim—is expected to see robust growth and evolution.

Rising Demand for Precision Painting Tools

One of the dominant trends shaping the 2026 market is the increasing consumer demand for precision without the need for masking tape. Modern cut in tools now feature advanced bristle configurations, ergonomic designs, and built-in paint reservoirs that allow for consistent paint flow and sharp edge definition. As consumers prioritize clean finishes and time-saving solutions, tools like paint edgers and angle-cut brushes are gaining popularity. The integration of adjustable guide systems allows users to set specific line widths, boosting accuracy and reducing rework.

Growth in the DIY Home Improvement Sector

The DIY home improvement market continues to expand, fueled by social media platforms like TikTok, Instagram, and YouTube, where tutorials on painting techniques frequently highlight the use of cut in tools. By 2026, a significant portion of product innovation will cater to novice painters seeking professional-looking results. Manufacturers are responding with user-friendly designs, simplified cleanup features, and starter kits that bundle cut in tools with compatible paints and rollers.

Technological Integration and Smart Tools

By 2026, smart technology is expected to make inroads into the cut in tool paint market. Early prototypes of connected painting tools with pressure sensors and motion tracking are being tested to help users maintain consistent stroke pressure and speed. While still in nascent stages, these innovations could lead to app-integrated tools that provide real-time feedback on technique, potentially reducing paint waste and improving finish quality—especially appealing to both DIYers and training-focused professional contractors.

Sustainable and Eco-Friendly Product Development

Environmental concerns are shaping product development, with a noticeable shift toward sustainable materials. By 2026, leading brands are expected to offer cut in tools made from recycled plastics, biodegradable bristles, and sustainably sourced wood handles. Additionally, packaging is being redesigned to minimize plastic use, aligning with consumer preferences for eco-conscious brands. This trend is further supported by the rise in water-based and low-VOC (volatile organic compound) paints, which pair well with high-performance cut in tools designed for easy cleaning and reuse.

Expansion of E-Commerce and Direct-to-Consumer Sales

The distribution landscape for cut in tool paint products is shifting rapidly. Online retail platforms and brand-owned e-commerce sites are becoming primary sales channels, offering detailed product comparisons, customer reviews, and instructional videos. By 2026, personalized digital marketing and AI-driven product recommendations will enhance customer engagement, helping users choose the right tool for their specific project—whether they’re painting a bathroom or renovating an entire home.

Professional Contractor Adoption and Training Programs

While DIYers drive volume, professional painters remain a key market segment. Contractors are increasingly adopting advanced cut in tools to improve job efficiency and reduce labor costs. In response, manufacturers are launching certification programs and training workshops to demonstrate tool effectiveness, often in partnership with paint brands. These initiatives not only boost product credibility but also strengthen brand loyalty in the professional sector.

Conclusion

By 2026, the Cut In Tool Paint market will be characterized by innovation, sustainability, and accessibility. With advancements in tool design, growing DIY enthusiasm, and increasing professional adoption, the market is set for steady growth. Companies that focus on user-centric design, environmental responsibility, and digital engagement will be best positioned to lead in this evolving landscape.

Common Pitfalls When Sourcing Cut In Tool Paint (Quality, IP)

Sourcing paint specifically marketed as “Cut In Tool Paint” can present several challenges, particularly concerning quality consistency and intellectual property (IP) concerns. Being aware of these pitfalls helps ensure you select a reliable product that meets performance expectations without legal or reputational risks.

Inconsistent or Misleading Quality Claims

Many products labeled as “cut in tool paint” promise quick-drying, sharp-edge, no-bleed performance, but actual quality varies significantly. Suppliers may exaggerate drying times or edge definition capabilities without standardized testing. Low-cost or unbranded paints often lack the rheological properties needed for clean lines, leading to bleeding or streaking. Without third-party verification or technical data sheets (TDS), it’s difficult to assess real-world performance, risking rework and customer dissatisfaction.

Use of Proprietary Formulations Without Licensing (IP Risk)

Some suppliers produce paints that closely mimic well-known branded cut-in paints (e.g., those with patented formulations from major manufacturers). Copying these formulations without proper licensing infringes on intellectual property rights, including trade secrets and patents. Sourcing such products—knowingly or unknowingly—can expose your business to legal liability, supply chain disruptions, and reputational damage, especially if the supplier is later found to be producing counterfeit or imitation goods.

Lack of Transparency in Ingredient Sourcing

Reputable cut in tool paints often rely on specific resins, additives, and pigments to achieve controlled flow and fast drying. However, some suppliers do not disclose full formulations or source raw materials from inconsistent or unverified vendors. This lack of transparency can result in batch-to-batch variability, compromised performance, and potential compliance issues with environmental or safety regulations (e.g., VOC content).

Overreliance on Branding Without Verification

Products may be labeled as “professional-grade” or “exclusive formulation” without substantiating evidence. Buyers can be misled by marketing language rather than verifiable performance data. Always request lab results, application trials, or samples before committing to large orders to avoid investing in underperforming paint.

Supply Chain Instability Due to Unproven Manufacturers

Smaller or new manufacturers offering cut in tool paint may lack the production capacity, quality control systems, or long-term stability to support consistent supply. This increases the risk of delays, reformulations without notice, or business closure, disrupting your operations and customer commitments.

To mitigate these risks, conduct thorough due diligence on suppliers, verify IP compliance, request performance testing, and prioritize transparency and consistency over cost alone.

Logistics & Compliance Guide for Cut In Tool Paint

Product Overview

Cut In Tool Paint is a specialized coating formulated for precision edge painting and trim work. It is designed for use with cut-in tools or edgers to achieve clean lines along walls, ceilings, trim, and corners. This guide outlines the logistics handling, transportation, storage, and regulatory compliance requirements for this product.

Regulatory Classification

Cut In Tool Paint is classified as a consumer chemical product under relevant regulations. It typically contains acrylic or alkyd resins, water or solvent carriers, pigments, and additives. Depending on formulation, it may be subject to VOC (Volatile Organic Compound) regulations under EPA or local air quality rules. Always verify the SDS (Safety Data Sheet) for exact classification.

Safety Data Sheet (SDS) Compliance

A current, GHS-compliant SDS must accompany every shipment and be accessible to handlers, distributors, and end-users. The SDS includes hazard identification, first aid measures, fire-fighting instructions, accidental release procedures, handling and storage guidance, and disposal considerations.

Hazard Communication

- Labeling must comply with OSHA Hazard Communication Standard (29 CFR 1910.1200) in the U.S. or CLP Regulation in the EU.

- Primary containers must display pictograms, signal words (e.g., “Warning”), hazard statements, and precautionary statements.

- Ensure all downstream users receive proper training on hazard communication.

Transportation Requirements

- Ground transport within the U.S. follows DOT regulations (49 CFR). Paints are typically classified as ORM-D or “Consumer Commodity” when shipped in small quantities, or as flammable/non-flammable liquids depending on flash point.

- If flash point is below 60°C (140°F), it may be regulated as a flammable liquid (UN1263, Class 3).

- International shipments must comply with IMDG (sea), IATA (air), or ADR (road in Europe) regulations. Air transport may require special packaging and hazard declarations.

- Use UN-certified packaging for regulated shipments.

Storage Guidelines

- Store in a cool, dry, well-ventilated area away from direct sunlight and heat sources.

- Maintain temperatures between 50°F and 80°F (10°C–27°C) to prevent freezing or premature curing.

- Keep containers tightly closed when not in use to minimize evaporation and contamination.

- Segregate from oxidizers, strong acids, and bases.

Shelf Life & Handling

- Typical shelf life: 24 months from date of manufacture when unopened and stored properly.

- Rotate stock using FIFO (First In, First Out) inventory practice.

- Use appropriate PPE (gloves, safety glasses) when handling. Avoid prolonged skin contact.

Environmental & Disposal Compliance

- Do not pour into drains or onto soil. Follow local, state, and federal disposal regulations.

- Empty containers should be disposed of as hazardous or non-hazardous waste based on residue levels and local laws.

- Participate in paint stewardship programs where available (e.g., PaintCare in the U.S.).

VOC & Environmental Regulations

- Ensure product formulation complies with regional VOC limits (e.g., SCAQMD, OTC, EU Directive 2004/42/EC).

- Provide VOC content information on product labeling and technical data sheets.

- Use low-VOC formulations where possible to meet sustainability goals.

Import/Export Documentation

- For international trade, provide accurate HS (Harmonized System) codes—typically 3208 or 3209 for paints.

- Include commercial invoices, packing lists, and certificates of origin as needed.

- Confirm compliance with destination country’s chemical registration requirements (e.g., REACH in EU, TSCA in U.S.).

Training & Recordkeeping

- Train logistics personnel on hazardous material handling, spill response, and emergency procedures.

- Maintain records of SDS, training logs, shipping manifests, and regulatory compliance documentation for minimum of 3–5 years.

Emergency Response

- In case of spill: Contain with absorbent material (e.g., spill socks, kitty litter), avoid runoff, and dispose of as hazardous waste.

- In case of fire: Use dry chemical, CO₂, or foam extinguishers. Water may be ineffective on solvent-based paints.

- Emergency contact: Include manufacturer’s 24-hour hotline on SDS and shipping documents.

Conclusion:

After a thorough evaluation of sourcing options for cutting tool paint, it is evident that selecting the right supplier and product formulation is critical to ensuring durability, performance, and cost-efficiency in industrial applications. Factors such as paint adhesion, heat resistance, chemical stability, and compatibility with cutting tool materials must be prioritized. Sourcing from reputable suppliers who offer technically advanced, consistent, and well-tested coatings can significantly enhance tool life and machining precision. Additionally, considering total cost of ownership—beyond initial purchase price—allows for smarter procurement decisions that support long-term operational efficiency. Ultimately, strategic sourcing of cutting tool paint, supported by technical specifications and supplier reliability, contributes to improved productivity and reduced downtime in manufacturing environments.