The custom fabrication and supplies manufacturing industry is experiencing robust growth, driven by increasing demand across sectors such as automotive, aerospace, construction, and industrial equipment. According to a 2023 report by Grand View Research, the global custom metal fabrication market was valued at USD 356.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This expansion is fueled by rising industrial automation, advancements in precision fabrication technologies, and a growing emphasis on lightweight, customized components. Additionally, Mordor Intelligence forecasts similar momentum, citing increased infrastructure development and the adoption of computer numerical control (CNC) machining as key growth catalysts. As demand for tailored engineering solutions intensifies, a select group of manufacturers have emerged as leaders in innovation, scalability, and industry expertise—setting the standard in a rapidly evolving market.

Top 7 Custom Fabrication And Supplies Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Custom Fabricating & Supplies

Domain Est. 2001

Website: customfabricate.com

Key Highlights: We’re an ISO 9001:2015 supplier of masking caps, plugs, tapes, and flexible die cuts. Choose from thousands of in-stock items, ready to ship….

#2 PBZ Manufacturing

Domain Est. 2006

Website: pbzmfg.com

Key Highlights: PBZ Manufacturing is a full service contract manufacturer located in Lititz, PA. We offer one-stop shop capabilities. Contact us to start your project!…

#3 Wehrli Custom Fabrication Inc. High Performance Diesel and …

Domain Est. 2011

Website: wcfab.com

Key Highlights: 2-day deliveryWehrli Custom Fabrication Inc. specializes in High-Performance Diesel and Custom Metal Fabrication. At WCFab we take great pride in our reputation for ……

#4 Woodward Fab: Sheet Metal Fabrication Tools

Domain Est. 2003

Website: woodwardfab.com

Key Highlights: As a full-line supplier of metal fabrication tools and equipment, Woodward Fab offers solutions for nearly every fabrication need. We also provide custom dies ……

#5 Fictiv

Domain Est. 2007

Website: fictiv.com

Key Highlights: Custom parts for prototypes to full scale production, for CNC machining, 3D printing, injection molding, and more. Get an instant quote….

#6 Advanced Custom Manufacturing

Domain Est. 2012

Website: acmfg.com

Key Highlights: Manufacturing composite panels, complex laminates, mechanical and bonded assemblies for defense, avionics, aerospace, sporting goods, marine and green energy….

#7 SendCutSend

Domain Est. 2015

Website: sendcutsend.com

Key Highlights: Online sheet metal fabrication service. Get custom parts delivered in just a few days—upload STEP or DXF files for instant pricing!…

Expert Sourcing Insights for Custom Fabrication And Supplies

2026 Market Trends for Custom Fabrication and Supplies

As the global industrial landscape evolves, the custom fabrication and supplies sector is poised for significant transformation by 2026. Driven by technological innovation, shifting supply chain dynamics, and rising demand for sustainability, the industry will adapt to meet increasingly complex customer needs across diverse sectors such as construction, energy, transportation, and advanced manufacturing.

Increased Adoption of Advanced Manufacturing Technologies

By 2026, automation, robotics, and digital fabrication tools will become standard in leading custom fabrication shops. Technologies such as AI-driven design optimization, real-time production monitoring, and integrated IoT systems will enhance precision, reduce waste, and shorten lead times. Additive manufacturing (3D printing) will expand beyond prototyping into small-batch production of complex metal and composite components, enabling greater design freedom and on-demand supply capabilities.

Supply Chain Resilience and Regionalization

Ongoing geopolitical uncertainties and past disruptions have prompted a strategic shift toward regionalized and nearshored fabrication services. By 2026, many businesses will prioritize local suppliers to reduce dependency on global logistics and ensure faster delivery. This trend will drive growth in regional fabrication hubs, especially in North America, Europe, and parts of Asia, where manufacturers invest in agile, responsive supply networks.

Sustainability and Circular Economy Integration

Environmental regulations and corporate ESG (Environmental, Social, and Governance) goals will push custom fabricators to adopt greener practices. In 2026, expect wider use of recycled metals, energy-efficient machinery, and low-emission welding processes. Fabrication suppliers will increasingly offer services such as material lifecycle tracking, modular design for disassembly, and take-back programs to support circular economy models.

Customization and On-Demand Production Demand

Industries ranging from renewable energy to smart infrastructure will demand highly specialized, one-off, or low-volume fabricated components. The ability to offer rapid prototyping, just-in-time fabrication, and digital twin integration will differentiate market leaders. Cloud-based platforms linking customers directly to fabrication capabilities will streamline quoting, design validation, and order fulfillment.

Workforce Transformation and Skills Development

As technology advances, the demand for skilled labor in custom fabrication will shift toward digital literacy, robotics operation, and data analysis. By 2026, companies investing in continuous workforce training and partnerships with technical institutions will gain a competitive edge. Remote monitoring and augmented reality (AR) tools will also support expert guidance and troubleshooting in real time.

Growth in High-Performance and Composite Materials

Beyond traditional steel and aluminum, demand for lightweight, corrosion-resistant, and high-strength materials—such as titanium alloys, composites, and engineered polymers—will rise. Fabricators capable of handling these advanced materials, particularly for aerospace, medical, and clean energy applications, will see increased market opportunities.

In conclusion, the 2026 custom fabrication and supplies market will be defined by agility, technological integration, and sustainability. Companies that embrace digital transformation, strengthen local supply chains, and align with environmental goals will lead the next phase of industrial innovation.

Common Pitfalls in Sourcing Custom Fabrication and Supplies: Quality and Intellectual Property Risks

Sourcing custom fabrication and specialized supplies introduces unique challenges, particularly concerning quality control and intellectual property (IP) protection. Overlooking these areas can lead to project delays, increased costs, legal disputes, and reputational damage. Below are critical pitfalls to avoid.

Quality Inconsistencies and Lack of Standards

One of the most frequent issues in custom fabrication is inconsistent product quality. Suppliers may use substandard materials, employ untrained labor, or lack robust quality assurance processes. Without clear specifications and inspection protocols, delivered parts may deviate from design requirements, leading to assembly failures or safety risks. Relying solely on supplier claims without third-party verification or on-site audits increases the likelihood of receiving non-conforming products.

Inadequate Supplier Qualification and Due Diligence

Failing to thoroughly vet suppliers can result in partnering with vendors lacking the necessary certifications, technical capabilities, or production capacity. Some suppliers may overpromise to win contracts but underdeliver on performance. Skipping due diligence—such as reviewing quality management systems (e.g., ISO 9001), past client references, or facility audits—exposes buyers to significant operational and compliance risks.

Poorly Defined Specifications and Communication Gaps

Ambiguous or incomplete technical drawings, material specifications, or fabrication tolerances can lead to misunderstandings and incorrect outputs. Miscommunication between engineering teams and suppliers—especially across language or cultural barriers—can result in costly rework. Clear, detailed documentation and regular technical reviews are essential to align expectations and prevent deviations.

Insufficient Prototyping and Testing

Rushing into full-scale production without proper prototyping increases the risk of discovering design or manufacturing flaws too late. Skipping functional testing, environmental stress tests, or material validation can result in field failures. Investing in iterative prototyping and validation phases helps identify issues early and ensures the final product meets performance and durability standards.

Intellectual Property Exposure and Theft

Custom designs, proprietary processes, and technical data shared with suppliers may be vulnerable to unauthorized use or replication. In regions with weak IP enforcement, suppliers might reverse-engineer designs, produce counterfeit parts, or sell information to competitors. Without proper legal safeguards, companies risk losing competitive advantage and facing market saturation from knock-offs.

Weak Contractual Protections and IP Clauses

Many sourcing agreements lack robust IP clauses, failing to clearly define ownership of designs, tooling, and modifications. Contracts may not include confidentiality agreements, non-compete clauses, or restrictions on subcontracting. Without explicit terms, suppliers may claim co-ownership or reuse designs for other clients, undermining the buyer’s exclusive rights.

Lack of Control Over Subcontracting

Suppliers often subcontract portions of work to third parties without buyer approval. This can lead to unknown quality standards, loss of IP control, and supply chain opacity. Without contractual provisions prohibiting unauthorized subcontracting or requiring disclosure, buyers lose visibility and accountability over critical fabrication stages.

Inadequate Monitoring and Ongoing Oversight

Once production begins, disengagement from the fabrication process can be detrimental. Without regular progress checks, quality audits, or milestone reviews, issues may go undetected until final delivery. Establishing continuous oversight—through on-site visits, real-time reporting, or embedded quality inspectors—helps ensure adherence to specifications and timelines.

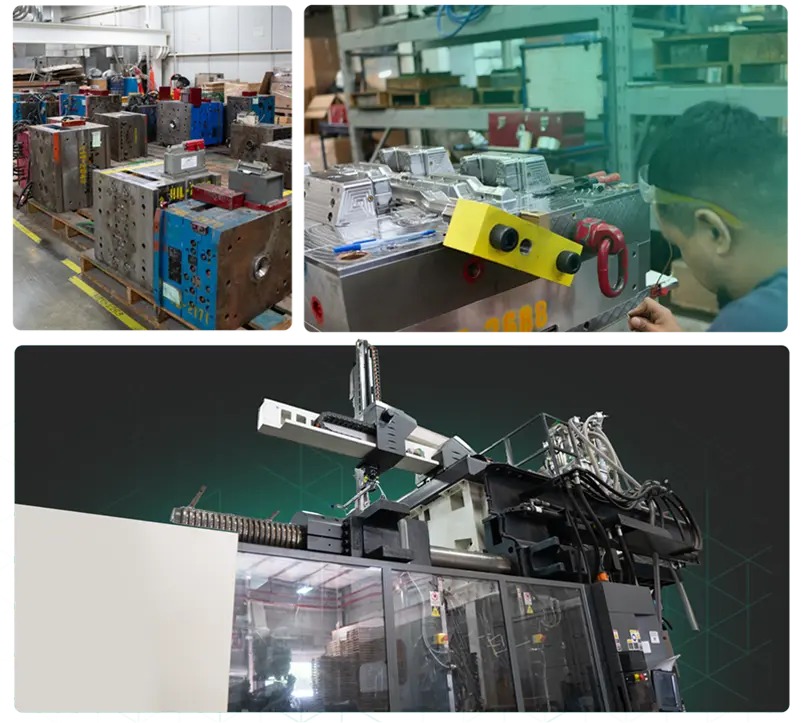

Failure to Secure Tooling and Fixtures

Custom tooling, molds, or jigs developed for a specific project are valuable assets. If ownership is not explicitly transferred or secured in the contract, suppliers may retain control and charge excessive fees for future use or deny access altogether. Clearly defining tooling ownership and storage terms is crucial for long-term supply continuity.

Overlooking Export Controls and Compliance

Certain fabricated components—especially in aerospace, defense, or medical sectors—may be subject to export regulations (e.g., ITAR, EAR). Sharing technical data with overseas suppliers without verifying compliance can result in legal penalties. Ensuring suppliers understand and adhere to relevant regulatory frameworks is essential to avoid sanctions and shipment delays.

By proactively addressing these pitfalls through rigorous supplier selection, detailed contracts, strong IP protections, and continuous quality oversight, organizations can mitigate risks and ensure successful outcomes in custom fabrication and supply sourcing.

Logistics & Compliance Guide for Custom Fabrication and Supplies

Effective logistics and regulatory compliance are critical for the success of any custom fabrication and supply business. This guide outlines key practices to ensure smooth operations, timely deliveries, and adherence to legal and industry standards.

Supply Chain Management

Establish strong relationships with trusted suppliers of raw materials such as metals, plastics, and specialty components. Implement vendor qualification processes to verify quality, delivery performance, and compliance with material specifications. Use just-in-time (JIT) or lean inventory strategies to minimize excess stock while maintaining production continuity. Regularly audit supplier performance and maintain alternative sourcing options to mitigate supply disruptions.

Inventory Control & Warehousing

Maintain accurate inventory tracking using barcode systems or an integrated inventory management software. Store materials according to type, size, and sensitivity—separating hazardous or moisture-prone items. Clearly label all stock with part numbers, material grades, and fabrication status. Conduct periodic cycle counts and annual physical inventories to reconcile records and identify discrepancies.

Production & Work-in-Progress Logistics

Coordinate fabrication workflows to minimize bottlenecks and material handling. Designate clear areas for cutting, welding, machining, and finishing. Use work orders and digital tracking tools to monitor job progress through each production stage. Ensure proper handling and protection of work-in-progress (WIP) items to prevent damage or delays.

Packaging & Shipping Procedures

Develop customized packaging standards based on product dimensions, fragility, and transport requirements. Use protective materials such as foam, edge protectors, and moisture barriers. Secure loads appropriately for truck, rail, or overseas shipping. Clearly label packages with customer information, handling instructions, and tracking numbers. Partner with reliable freight carriers and verify insurance coverage for high-value shipments.

Domestic & International Trade Compliance

For domestic shipments, ensure compliance with Department of Transportation (DOT) regulations, including proper load securement and hazardous material handling (if applicable). For international trade, understand and adhere to export controls, including:

– Export Administration Regulations (EAR) and International Traffic in Arms Regulations (ITAR), if applicable

– Accurate Harmonized System (HS) codes for customs declarations

– Required documentation such as commercial invoices, packing lists, and certificates of origin

– Sanctions screening of customers and partners via OFAC and other regulatory databases

Quality Assurance & Regulatory Standards

Maintain certifications such as ISO 9001 to demonstrate commitment to quality. Implement inspection checkpoints at key fabrication stages—material receipt, in-process, and final product. Keep detailed records of material test reports (MTRs), weld procedures (WPS/PQR), and non-destructive testing (NDT) results. Ensure all products meet industry-specific standards (e.g., ASME, ASTM, AWS).

Environmental, Health, and Safety (EHS) Compliance

Adhere to OSHA regulations for workplace safety, including proper machine guarding, ventilation, and employee training. Manage hazardous waste (e.g., metal shavings, solvents) in accordance with EPA and local environmental regulations. Maintain Safety Data Sheets (SDS) for all chemicals used and conduct regular safety audits.

Documentation & Recordkeeping

Maintain a centralized digital system for all logistics and compliance records, including:

– Purchase orders and delivery receipts

– Customs documentation and export licenses

– Quality inspection reports

– Equipment maintenance logs

– Employee training certifications

Retain records for the required period as per industry and regulatory standards (typically 5–7 years).

Risk Management & Continuous Improvement

Conduct regular risk assessments for supply chain vulnerabilities, compliance gaps, and logistics failures. Develop contingency plans for disruptions such as natural disasters or port delays. Solicit customer feedback and analyze delivery performance metrics (on-time delivery rate, damage claims) to identify areas for improvement.

By following this guide, Custom Fabrication and Supplies can enhance operational efficiency, reduce compliance risks, and build trust with clients and regulators.

In conclusion, sourcing custom fabrication and supplies requires a strategic approach that balances quality, cost, lead time, and supplier reliability. Establishing clear specifications, conducting thorough supplier evaluations, and fostering strong communication are critical to ensuring that the final products meet project requirements and performance standards. Leveraging both local and global manufacturing capabilities can provide flexibility and competitive advantages, while building long-term relationships with trusted partners promotes consistency and innovation. Ultimately, effective sourcing not only supports operational efficiency but also contributes to the overall success and scalability of your projects or business initiatives.