The global carbon fiber market is experiencing robust expansion, driven by rising demand across aerospace, automotive, renewable energy, and sports equipment sectors. According to Grand View Research, the market was valued at USD 3.45 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.3% from 2023 to 2030. This surge is fueled by the material’s high strength-to-weight ratio, corrosion resistance, and performance under extreme conditions. As industries pivot toward lightweight and sustainable materials, custom carbon fiber manufacturers are playing a pivotal role in meeting specialized engineering and design requirements. With Asia Pacific emerging as a key growth region due to increased aerospace and automotive production, the competitive landscape is evolving rapidly. The following list highlights the top 10 custom carbon fiber manufacturers shaping innovation, scalability, and precision in this high-performance materials space.

Top 10 Custom Carbon Fiber Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

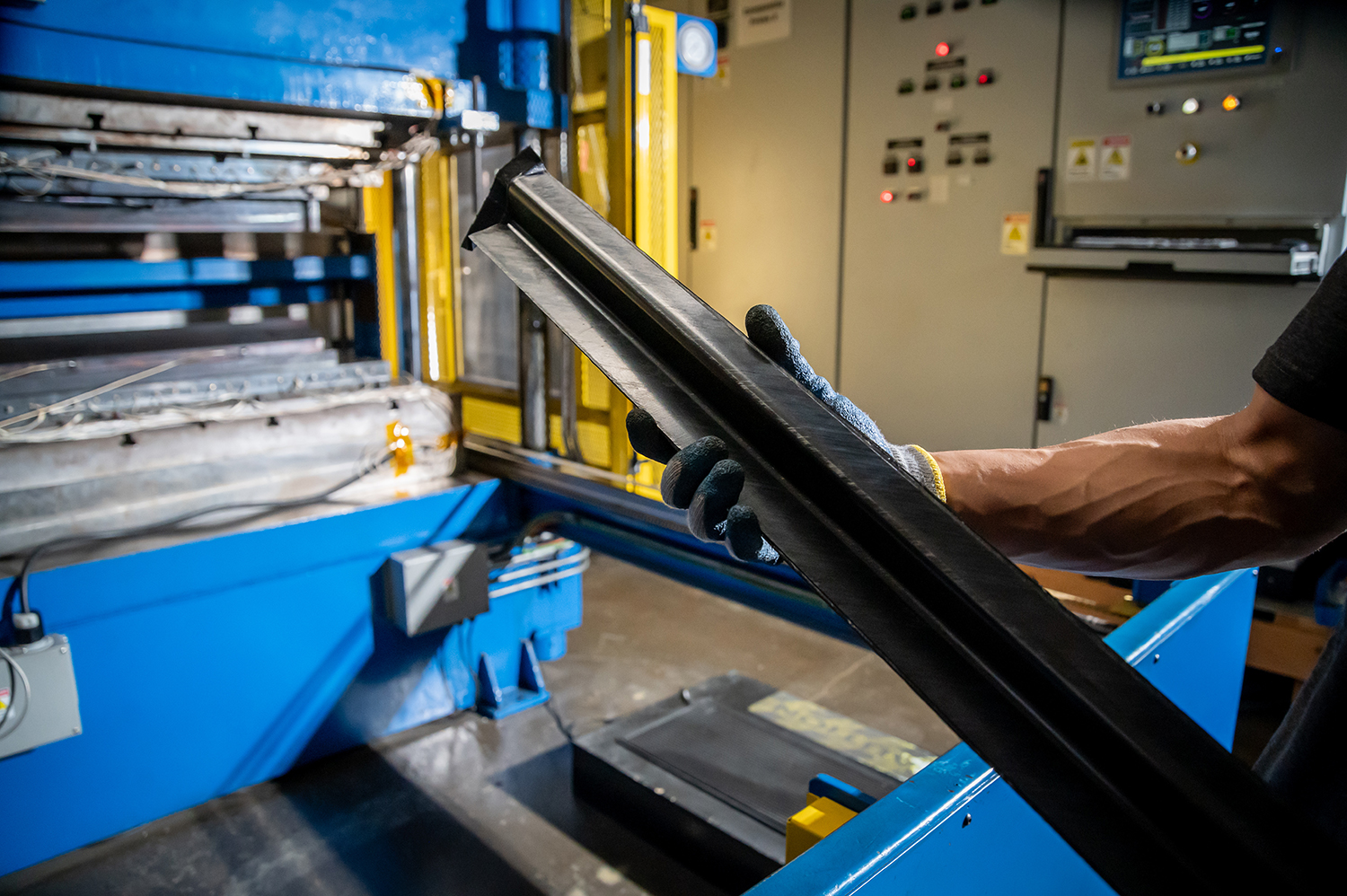

#1 ADVANCED COMPOSITES INC – Filament

Domain Est. 1997

Website: advancedcomposites.com

Key Highlights: Advanced Composites Inc. is an award-winning manufacturer of composite structures for defense, carbon fiber tubing, and commercial carbon and fiberglass ……

#2 Composite Manufacturing Inc.

Domain Est. 1997

Website: carbonfiber.com

Key Highlights: we deliver custom carbon fiber and composite solutions tailored to your application — with in-house design, tooling, and manufacturing expertise ……

#3 Seibon Carbon

Domain Est. 2003

Website: seiboncarbon.com

Key Highlights: Manufacturer of high-quality carbon fiber automotive body components such as hoods, trunks, fenders, and aerodynamic body additions such as rear spoilers ……

#4 Custom Carbon Fiber Solutions & Engineering

Domain Est. 2003

Website: dragonplate.com

Key Highlights: Need a custom carbon fiber solution? As an ISO 9001:2008 certified manufacturer, we provide high-quality custom engineering and fabrication for any project….

#5 Anderson Composites

Domain Est. 2014

Website: andersoncomposites.com

Key Highlights: Manufacturer of high-quality carbon fiber automotive body components such as hoods, trunks, fenders, and aerodynamic body additions such as rear spoilers ……

#6 SpeedKore Performance Group

Domain Est. 2015

Website: speedkore.com

Key Highlights: Custom car builder, designer & manufacturer of carbon fiber parts, Mercury Racing crate engines. Located near Milwaukee in Grafton, WI….

#7 Fibre Glast Developments Corp LLC

Domain Est. 1995

Website: fibreglast.com

Key Highlights: Fibre Glast is a leading supplier of fiberglass & composite materials. A source for Carbon Fiber, Kevlar, Fiberglass, Resin, Gel Coat & much more….

#8 Custom Carbon Fiber Parts

Domain Est. 2007

Website: protechcomposites.com

Key Highlights: Have a custom project or idea? Call us today! We will be happy to work with you to create custom carbon fiber sheets or parts to meet your specifications….

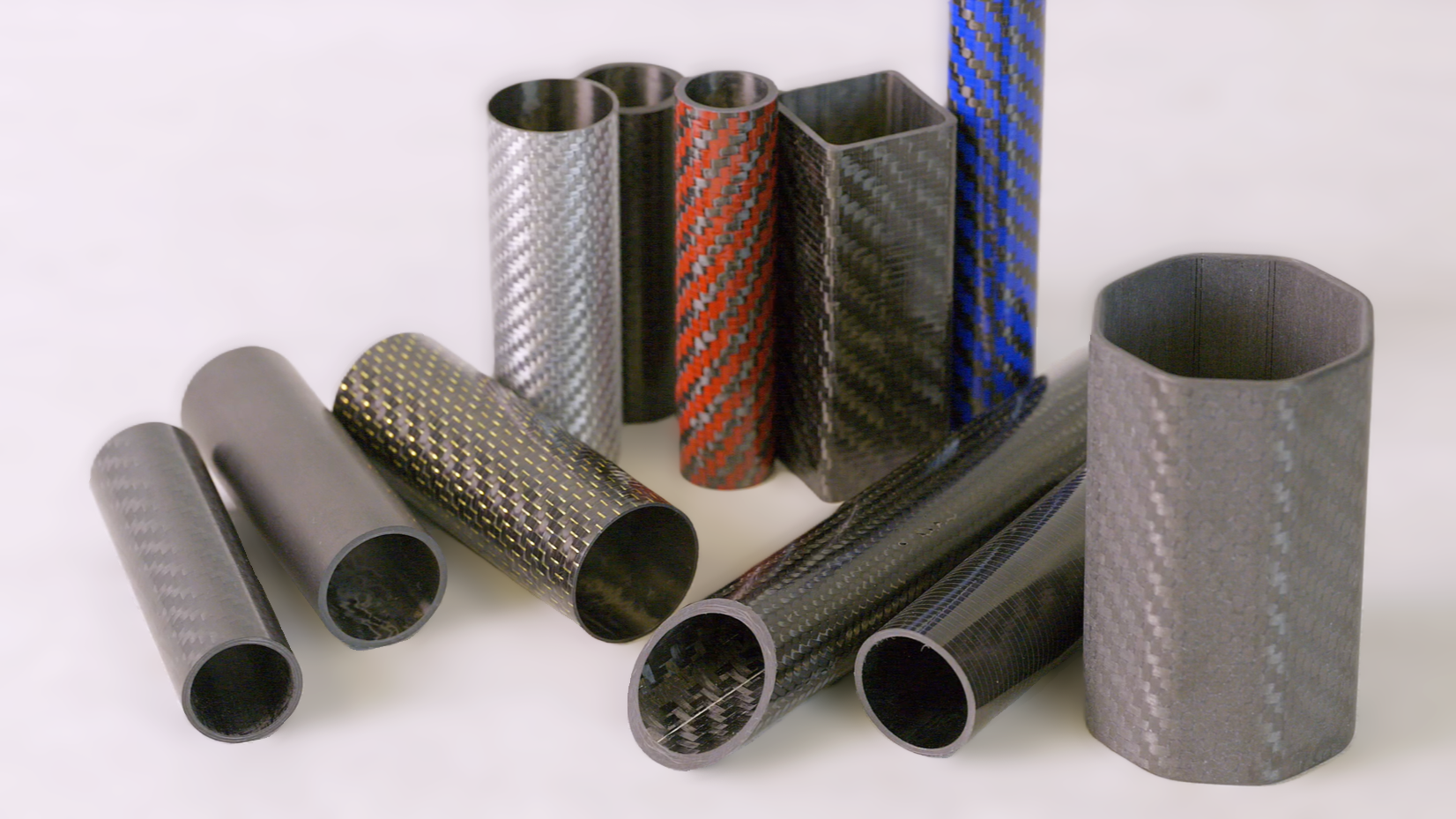

#9 Rock West Composites Page

Domain Est. 2009

Website: rockwestcomposites.com

Key Highlights: Shop Tubes By Shape · Carbon Fiber Tubes · Fiberglass Tubes · Kevlar Tubes · Telescoping Tubes · Tube Samples · Build Your Own Tube. Shop Tubes By Shape….

#10 Carbon Fiber Composite Materials

Domain Est. 2021

Website: cf-composites.toray

Key Highlights: Toray group supplies the most comprehensive range of carbon fiber materials in the market, from high-performance premium fiber for aircraft applications….

Expert Sourcing Insights for Custom Carbon Fiber

H2: Market Trends for Custom Carbon Fiber in 2026

The custom carbon fiber market is poised for significant transformation and growth by 2026, driven by advancements in materials science, increasing demand across high-performance industries, and evolving sustainability priorities. Below is an analysis of key market trends shaping the custom carbon fiber sector in 2026:

1. Expanding Applications in Automotive and Aerospace

By 2026, the automotive and aerospace industries remain the largest consumers of custom carbon fiber. Automakers are increasingly adopting carbon fiber composites to meet stringent fuel efficiency and emissions regulations, especially in electric vehicles (EVs) where weight reduction directly enhances battery range. Custom carbon fiber components—such as chassis, body panels, and interior trims—are being tailored for performance, safety, and luxury segments.

In aerospace, the demand for lightweight, durable materials continues to rise. Aircraft manufacturers are using custom-molded carbon fiber parts for fuselages, wings, and interior components to improve fuel efficiency and reduce lifecycle costs. The growing production of commercial and private jets, including next-generation sustainable aircraft, is accelerating demand for bespoke carbon fiber solutions.

2. Growth in Consumer and Lifestyle Products

The consumer goods sector is witnessing a surge in demand for custom carbon fiber in high-end products. Luxury watches, eyewear, furniture, and sporting goods (e.g., bicycles, golf clubs, tennis rackets) increasingly feature custom carbon fiber for its aesthetic appeal, strength, and lightweight properties. By 2026, personalized and limited-edition carbon fiber items are becoming popular among affluent consumers, driven by trends in customization and premium branding.

3. Advancements in Additive Manufacturing and Automation

Custom carbon fiber production is being revolutionized by innovations in 3D printing and automated layup technologies. By 2026, additive manufacturing enables rapid prototyping and small-batch production of complex carbon fiber parts with minimal waste. Automated fiber placement (AFP) and robotic systems are improving precision and scalability, reducing lead times and costs for custom orders. These technologies are making custom carbon fiber more accessible to mid-tier manufacturers and niche markets.

4. Sustainability and Recycling Initiatives

Environmental concerns are prompting the industry to focus on sustainable practices. In 2026, there is growing emphasis on recycling carbon fiber and using bio-based resins. Closed-loop recycling systems are being adopted by leading manufacturers to reclaim carbon fiber from production scrap and end-of-life products. Regulatory pressures and corporate ESG (Environmental, Social, and Governance) goals are accelerating investments in eco-friendly custom carbon fiber solutions.

5. Regional Market Shifts

Asia-Pacific, particularly China and Japan, is emerging as a major hub for custom carbon fiber production and consumption due to strong manufacturing capabilities and rising domestic demand in EVs and electronics. Meanwhile, North America and Europe are focusing on high-value, precision-engineered applications in aerospace, defense, and medical devices. Supply chain localization trends are encouraging regional production to reduce dependency on global logistics.

6. Digitalization and Industry 4.0 Integration

Digital platforms are streamlining the custom carbon fiber value chain. In 2026, cloud-based design tools, AI-driven simulation software, and IoT-enabled production monitoring systems allow clients to co-create and visualize custom parts in real time. Digital twins are used to optimize performance and reduce testing cycles, improving time-to-market for bespoke components.

7. Cost Reduction and Market Democratization

While carbon fiber remains a premium material, cost barriers are decreasing due to process optimization, economies of scale, and new manufacturing techniques. By 2026, the cost of custom carbon fiber is becoming more competitive, enabling broader adoption in mid-range industrial applications and small-to-medium enterprises (SMEs) that previously could not afford bespoke solutions.

Conclusion:

By 2026, the custom carbon fiber market is characterized by technological innovation, sustainability integration, and expanded application across industries. As customization becomes a competitive differentiator, manufacturers who leverage digital tools, automation, and circular economy principles will lead the market. The convergence of performance, personalization, and environmental responsibility defines the future trajectory of custom carbon fiber.

Common Pitfalls in Sourcing Custom Carbon Fiber (Quality, IP)

Sourcing custom carbon fiber components can offer significant performance advantages, but it also introduces unique challenges related to quality consistency and intellectual property (IP) protection. Overlooking these pitfalls can lead to costly delays, compromised product performance, or legal disputes.

Quality Inconsistencies and Lack of Standardization

Custom carbon fiber parts are often manufactured in low volumes using hand-laid or semi-automated processes, increasing the risk of inconsistencies in fiber alignment, resin distribution, and curing. Without rigorous quality control protocols, minor variations in layup, vacuum pressure, or cure cycles can lead to weak spots, delamination, or dimensional inaccuracies. Many suppliers—especially smaller or overseas shops—may lack certified processes (e.g., ISO 9001, AS9100) or fail to provide traceable material certifications, making it difficult to ensure repeatable quality across production runs.

Inadequate Material and Process Transparency

Suppliers may not fully disclose the type of carbon fiber (e.g., T300 vs. T800), resin system (epoxy, vinyl ester), or manufacturing method (pre-preg, wet layup, RTM). This lack of transparency makes it difficult to validate performance claims or ensure compatibility with end-use requirements such as temperature resistance, UV stability, or structural load. Without access to detailed process documentation, buyers risk receiving parts that do not meet mechanical or environmental specifications.

Intellectual Property Exposure and Misappropriation

Custom tooling, molds, and design files (CAD, ply books) are often required to produce carbon fiber components, creating significant IP risks. When sourcing overseas or through third-party manufacturers, there is a heightened risk of design replication or unauthorized production. Non-disclosure agreements (NDAs) may be poorly enforced, and some jurisdictions offer limited IP protection. Additionally, mold ownership terms are often ambiguous—unless explicitly stated in the contract, the supplier may retain rights to replicate or resell tooling.

Poor Communication and Design for Manufacturability (DFM) Gaps

Carbon fiber fabrication has unique constraints—such as demolding angles, minimum wall thickness, and ply drop-off requirements—that are often overlooked in initial designs. Without early collaboration between designers and fabricators, designs may be unfeasible or require costly revisions. Miscommunication about lead times, tooling costs, or inspection methods can further delay projects and inflate budgets.

Insufficient Testing and Validation Protocols

Many suppliers provide only visual or dimensional inspections, omitting critical mechanical or non-destructive testing (NDT) such as ultrasonic scanning, X-ray, or tensile testing. Without proper validation, hidden defects like voids, dry fibers, or resin-rich zones may go undetected until failure occurs in the field. Buyers must specify required testing standards and ensure the supplier has the capability and willingness to comply.

Logistics & Compliance Guide for Custom Carbon Fiber

Overview of Custom Carbon Fiber in Global Trade

Custom carbon fiber products, including tailored components for aerospace, automotive, and sports industries, present unique logistical and compliance challenges due to material properties, manufacturing specifications, and international regulations. Proper handling, documentation, and adherence to regulatory standards are critical to ensure timely delivery and legal compliance.

Material Classification and HS Codes

Carbon fiber and its composite products are typically classified under the Harmonized System (HS) for international trade. Common HS codes include:

– 3916.90: Monofilament of plastics, including carbon fiber filaments

– 7019.90: Glass wool and similar non-wovens, sometimes applicable to carbon fiber preforms

– 8803.30: Parts of aircraft, when carbon fiber is used in aerospace components

Note: Final classification depends on form (e.g., raw fiber, fabric, finished part) and end use. Consult local customs authorities for precise code assignment.

Export Controls and Dual-Use Regulations

Carbon fiber, especially high-strength grades used in defense and aerospace, may be subject to export controls:

– ITAR (International Traffic in Arms Regulations): Applies if carbon fiber components are designed for military or space applications listed on the U.S. Munitions List (USML).

– EAR (Export Administration Regulations): Most carbon fiber falls under EAR, specifically ECCN 1C010, which controls composite materials usable in missile systems.

– Licensing Requirements: Exports to certain countries or end-users may require a license from the Bureau of Industry and Security (BIS).

Packaging and Handling Requirements

Due to the sensitivity of carbon fiber materials:

– Moisture Protection: Carbon fiber prepregs must be stored and shipped under temperature-controlled, dry conditions.

– Temperature Control: Prepregs often require cold chain logistics (e.g., shipment at -18°C or lower in insulated containers with dry ice).

– Physical Protection: Finished parts should be packaged to prevent impact, deformation, or abrasion using custom crating and cushioning.

Transportation and Shipping Considerations

- Air Freight: Preferred for time-sensitive or high-value shipments; requires compliance with IATA Dangerous Goods Regulations if dry ice is used (UN 1845).

- Sea Freight: Suitable for large or non-urgent orders; ensure proper ventilation and humidity control in containers.

- Labeling: Packages must include proper UN labels for dry ice, handling instructions (e.g., “Fragile,” “This Side Up”), and compliance markings.

Customs Documentation

Essential documents for international shipping include:

– Commercial Invoice (with detailed product description, HS code, value)

– Packing List

– Certificate of Origin

– Export License (if applicable)

– Technical Data Package (for controlled items)

– Air Waybill or Bill of Lading

Country-Specific Compliance

Regulatory requirements vary by destination:

– European Union: REACH and RoHS compliance may apply depending on chemical treatments.

– China: Requires CCC certification for certain end products; carbon fiber itself may need import permits.

– Canada: Controlled under the Export and Import Permits Act (EIPA) for strategic goods.

Recordkeeping and Audit Readiness

Maintain comprehensive records for at least five years, including:

– Export licenses and applications

– Technical specifications and end-use statements

– Shipping documents and compliance certifications

– Internal classification decisions and legal reviews

Best Practices for Compliance

- Conduct regular screening of customers against denied parties lists (e.g., U.S. Denied Persons List).

- Implement a robust export management system (EMS).

- Train logistics and sales teams on EAR/ITAR obligations.

- Engage legal counsel or trade compliance consultants for high-risk shipments.

By adhering to this guide, businesses can mitigate risks, avoid penalties, and ensure smooth international transactions involving custom carbon fiber products.

In conclusion, sourcing custom carbon fiber components requires careful consideration of several key factors including material specifications, manufacturing capabilities, quality control standards, supplier reliability, and cost-efficiency. Partnering with experienced and reputable manufacturers—whether domestic or international—is crucial to ensuring high-performance, durable, and precise end products tailored to your application needs. Advances in fabrication technologies, such as CNC machining, vacuum infusion, and autoclave curing, enable greater customization and consistency. Ultimately, a strategic sourcing approach that balances quality, lead time, scalability, and technical expertise will maximize the benefits of carbon fiber’s strength-to-weight ratio and contribute to successful project outcomes across industries such as aerospace, automotive, robotics, and consumer products.