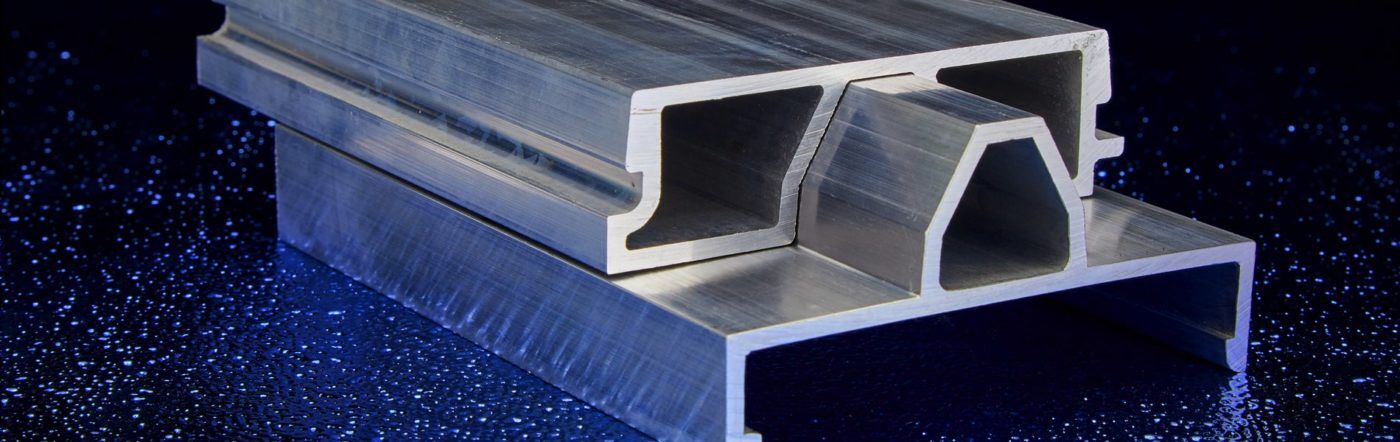

The global custom aluminum fabrication market is experiencing robust growth, driven by increasing demand across aerospace, automotive, construction, and renewable energy sectors. According to Grand View Research, the global aluminum fabrication market size was valued at USD 109.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by aluminum’s high strength-to-weight ratio, corrosion resistance, and recyclability—making it a preferred material in lightweighting initiatives and sustainable manufacturing. Additionally, Mordor Intelligence projects continued regional expansion, particularly in Asia-Pacific, due to rising industrialization and infrastructure development. As demand for precision-engineered aluminum components intensifies, selecting reliable manufacturing partners has become critical. The following list highlights the top 10 custom aluminum fabrication manufacturers leading the industry in innovation, capacity, and technical expertise.

Top 10 Custom Aluminum Fabrication Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Tredegar

Domain Est. 1994

Website: tredegar.com

Key Highlights: Tredegar is an industrial manufacturer with two primary businesses: custom aluminum extrusions for the North American building & construction….

#2 Custom Aluminum Fabrication Company

Domain Est. 2008

Website: tfgusa.com

Key Highlights: Discover expert custom fabricated aluminum services, delivering durable, precise components. Ideal for various industrial uses. Contact us!…

#3 Alexandria Industries: US

Domain Est. 2009

Website: alexandriaindustries.com

Key Highlights: Alexandria Industries is a multifaceted manufacturer of custom aluminum extrusions, machining, stretch forming, bending, heatsinks, and injection molding….

#4 SAF

Domain Est. 1992

Website: saf.com

Key Highlights: SAF is the leader in metals fabrication, finishing, and distribution around the world. Learn more about how we can turn your ideas into reality….

#5 Small Custom Aluminum Extrusions

Domain Est. 1996

Website: minalex.com

Key Highlights: Minalex delivers high quality custom aluminum extrusions starting from concept and delivering a finished product that incorporates secondary operations….

#6 Custom Sheet Metal, Stainless Steel & Aluminum Fabrication

Domain Est. 1997

Website: nobleindustries.com

Key Highlights: Noble Industries is a leader in custom sheet metal, stainless steel and aluminum fabrication services, offering precision and quality….

#7 BTD Manufacturing

Domain Est. 1997

Website: btdmfg.com

Key Highlights: Your full-service partner for welding, tool & die, CNC and more. We do it right and we do it fast. Ensure high-quality, on-time results with your next project….

#8 Fabrication

Domain Est. 2000

Website: custom-aluminum.com

Key Highlights: We specialize in three volume levels: High volume, medium volume, and prototype runs. We have multiple tooling manufacturing areas and we build all of our own ……

#9 Bonnell Aluminum

Domain Est. 2007

Website: bonnellaluminum.com

Key Highlights: Bonnell Aluminum extrudes a variety of shapes used in architectural systems such as storefront, curtain walls and other flushed glazed projects. Learn More….

#10 Metal Fabrication Excellence

Domain Est. 2018

Website: sscmetalfabrication.com

Key Highlights: Metal fabrication is our true passion. Aluminum fabrication, steel fabrication, and stainless steel fabrication is the core of our capabilities….

Expert Sourcing Insights for Custom Aluminum Fabrication

2026 Market Trends for Custom Aluminum Fabrication

The custom aluminum fabrication industry is poised for significant transformation by 2026, driven by technological advancements, evolving consumer demands, and global sustainability initiatives. As industries ranging from construction and transportation to renewable energy and aerospace continue to prioritize lightweight, durable, and eco-friendly materials, aluminum remains at the forefront. This analysis explores key market trends expected to shape the custom aluminum fabrication sector in 2026.

Rising Demand Across Key Industries

Custom aluminum fabrication is experiencing accelerated demand from several high-growth sectors. In the automotive industry, the shift toward electric vehicles (EVs) is a major catalyst. Aluminum’s high strength-to-weight ratio improves energy efficiency and extends battery range, making it indispensable for EV frames, battery enclosures, and structural components. By 2026, analysts project that over 40% of new EVs will incorporate custom-fabricated aluminum parts, up from 28% in 2022.

Similarly, the aerospace and defense sectors are increasing their reliance on custom aluminum solutions. With a focus on fuel efficiency and performance, manufacturers are adopting advanced aluminum alloys and precision fabrication techniques. The commercial aviation recovery post-pandemic, coupled with rising defense budgets globally, will further fuel demand.

In construction, sustainable building practices are driving the adoption of aluminum for curtain walls, roofing, and modular structures. Green building certifications like LEED and BREEAM incentivize the use of recyclable materials such as aluminum, boosting custom fabrication contracts in both residential and commercial projects.

Technological Innovations and Automation

By 2026, digital transformation will be deeply embedded in custom aluminum fabrication. Automation, powered by robotics and AI-driven design software, will enhance precision, reduce waste, and improve production speed. Computer Numerical Control (CNC) machines with real-time monitoring and adaptive feedback systems will become standard, enabling manufacturers to handle complex geometries and tight tolerances more efficiently.

Additive manufacturing (3D printing) of aluminum is also expected to gain traction, particularly for low-volume, high-complexity components in aerospace and medical devices. Though still in its early stages for large-scale production, hybrid manufacturing—combining 3D printing with traditional fabrication—will grow in popularity.

Moreover, the integration of digital twins and Building Information Modeling (BIM) will allow fabricators to simulate entire fabrication processes, improving accuracy and reducing rework. These technologies will streamline collaboration between architects, engineers, and fabricators, especially in large infrastructure projects.

Sustainability and Circular Economy

Environmental concerns are reshaping the aluminum fabrication landscape. Aluminum is 100% recyclable and requires only 5% of the energy to recycle compared to primary production. By 2026, regulatory pressures and corporate ESG (Environmental, Social, and Governance) goals will push fabricators to adopt closed-loop recycling systems and source more post-consumer recycled aluminum.

Governments in North America and Europe are expected to enforce stricter carbon emission standards, making low-carbon aluminum more valuable. Fabricators who invest in renewable-powered facilities and partner with certified green smelters will gain a competitive edge.

Additionally, life cycle assessment (LCA) tools will become standard in quoting and project planning, allowing customers to evaluate the environmental footprint of custom aluminum components. Transparency in sourcing and manufacturing processes will increasingly influence procurement decisions.

Regional Market Dynamics

The North American market will remain a leader in custom aluminum fabrication, driven by strong industrial demand and reshoring trends. The U.S. Inflation Reduction Act and investments in infrastructure will stimulate demand for domestically produced aluminum components, especially in clean energy projects such as solar panel frames and wind turbine structures.

Asia-Pacific, particularly China and India, will see rapid growth due to urbanization and industrial expansion. However, competition will be intense, with price pressures pushing mid-tier fabricators to innovate or consolidate.

In Europe, green regulations and the push for carbon neutrality will favor high-precision, sustainable fabricators. The EU’s Circular Economy Action Plan will drive demand for modular, recyclable aluminum systems in construction and transportation.

Supply Chain Resilience and Raw Material Volatility

Aluminum prices, influenced by energy costs and geopolitical factors, are expected to remain volatile through 2026. Fabricators will increasingly adopt hedging strategies and long-term supply agreements to mitigate risk. Nearshoring and regional supply chain networks will grow in importance, reducing reliance on single-source imports.

Moreover, advancements in scrap sorting and remelting technologies will improve the quality and consistency of recycled aluminum, reducing dependence on virgin material and enhancing supply chain sustainability.

Conclusion

By 2026, the custom aluminum fabrication market will be defined by innovation, sustainability, and responsiveness to sector-specific needs. Companies that embrace automation, prioritize environmental stewardship, and adapt to shifting regional dynamics will be best positioned to capture growth. As aluminum continues to serve as a cornerstone material for modern infrastructure and technology, the custom fabrication sector will play a critical role in enabling the transition to a lighter, cleaner, and more efficient future.

Common Pitfalls in Sourcing Custom Aluminum Fabrication: Quality and Intellectual Property Risks

Sourcing custom aluminum fabrication can offer significant benefits in terms of performance, weight reduction, and design flexibility. However, overlooking critical quality and intellectual property (IP) considerations can lead to costly delays, compromised products, and legal exposure. Here are key pitfalls to avoid:

Inadequate Quality Assurance Processes

One of the most frequent issues is partnering with suppliers lacking robust, documented quality management systems. Without certifications like ISO 9001 or industry-specific standards (e.g., AS9100 for aerospace), there’s no assurance of consistent process control. Hidden defects such as inconsistent weld penetration, improper heat treatment, or dimensional inaccuracies may not surface until after delivery, resulting in rework, scrap, or field failures.

Poor Material Traceability

Aluminum alloys vary significantly in strength, corrosion resistance, and machinability. A major risk is receiving materials that do not match the specified alloy or temper (e.g., 6061-T6 vs. 6061-O). Without proper material certifications (mill test reports) and traceability from raw stock to finished part, you risk structural failures or non-compliance with regulatory requirements, especially in industries like medical or transportation.

Inconsistent Dimensional Accuracy and Tolerances

Custom aluminum parts often require tight tolerances for fit, function, or assembly. Suppliers without advanced CNC capabilities or regular calibration of equipment may produce parts that fall outside acceptable tolerances. Relying solely on supplier claims without reviewing first-article inspection (FAI) reports or conducting periodic audits can result in assembly issues and increased downtime.

Lack of Intellectual Property Protection

Sharing detailed CAD models, engineering drawings, or proprietary designs exposes your IP to risk—especially when sourcing internationally. Without a comprehensive, legally binding Non-Disclosure Agreement (NDA) and clear contractual clauses defining IP ownership, there’s potential for design theft, reverse engineering, or unauthorized production and sale of your components by the fabricator or their subcontractors.

Insufficient Control Over Subcontracting

Many fabrication shops outsource processes like anodizing, welding, or precision machining. If subcontractors are used without your approval or oversight, quality consistency and IP security can be compromised. Unvetted subcontractors may lack the necessary expertise or safeguards, increasing the risk of defects and unauthorized access to sensitive design information.

Incomplete or Ambiguous Documentation

Poorly defined specifications, missing Geometric Dimensioning and Tolerancing (GD&T), or unclear finishing requirements (e.g., surface roughness, anodizing thickness) lead to misinterpretation. This often results in parts that technically meet a vague spec but fail in actual application. Clear, detailed technical documentation is essential to align expectations and ensure quality.

Failure to Conduct On-Site Audits

Relying solely on certifications or samples without visiting the supplier’s facility can be a critical oversight. On-site audits allow you to assess equipment condition, operator skill, process controls, and overall production environment—factors that directly impact quality and IP handling but are invisible on paper.

By proactively addressing these pitfalls through thorough supplier vetting, enforceable contracts, and ongoing quality monitoring, companies can mitigate risks and ensure successful outcomes in custom aluminum fabrication projects.

Logistics & Compliance Guide for Custom Aluminum Fabrication

Overview

Custom aluminum fabrication involves designing, cutting, bending, welding, and finishing aluminum components to meet specific client requirements. Efficient logistics and strict compliance are critical to ensuring on-time delivery, product quality, and adherence to legal and safety standards across the supply chain.

Material Sourcing & Procurement

Ensure aluminum materials are sourced from certified suppliers meeting industry standards such as ASTM B209 (Standard Specification for Aluminum and Aluminum-Alloy Sheet and Plate). Maintain documentation for material traceability, including mill test reports (MTRs) and certificates of conformance (CoC). Establish long-term vendor agreements to stabilize pricing and secure supply continuity.

International Trade Compliance

For cross-border operations, comply with export control regulations such as the Export Administration Regulations (EAR) and International Traffic in Arms Regulations (ITAR), if applicable. Classify aluminum products using the correct Harmonized System (HS) codes and determine any required export licenses. Monitor trade sanctions and embargoes through government databases (e.g., U.S. Bureau of Industry and Security).

Environmental Regulations

Adhere to environmental standards including the EPA’s National Emission Standards for Hazardous Air Pollutants (NESHAP) for metal fabrication. Properly manage waste generated during cutting, deburring, and finishing processes. Recycle aluminum scrap in accordance with local and federal regulations to support sustainability goals and reduce material costs.

Workplace Safety & OSHA Compliance

Comply with Occupational Safety and Health Administration (OSHA) standards, including 29 CFR 1910 for general industry. Implement safety protocols for handling aluminum dust (combustible dust hazards), welding fumes, and machinery operations. Provide appropriate personal protective equipment (PPE) and conduct regular employee training on hazard communication (HazCom) and lockout/tagout (LOTO) procedures.

Transportation & Shipping Logistics

Use secure packaging methods to protect fabricated parts from scratches, deformation, and corrosion during transit. For international shipments, obtain necessary documentation such as commercial invoices, packing lists, and bills of lading. Partner with freight carriers experienced in handling metal goods and ensure compliance with International Maritime Dangerous Goods (IMDG) Code if shipping hazardous materials (e.g., treated aluminum with certain coatings).

Quality Assurance & Industry Standards

Maintain a certified quality management system (e.g., ISO 9001) to standardize production and inspection processes. Conduct in-process and final inspections using calibrated measurement tools. Follow welding standards such as AWS D1.2 (Structural Welding Code – Aluminum) and ensure welders are certified accordingly.

Recordkeeping & Audit Preparedness

Maintain comprehensive records of material certifications, inspection reports, shipping logs, compliance training, and environmental monitoring. Conduct regular internal audits to verify regulatory adherence and operational efficiency. Prepare for third-party audits from clients or certification bodies by organizing documentation in a centralized digital system.

Conclusion

Effective logistics and compliance in custom aluminum fabrication ensure product integrity, regulatory adherence, and customer satisfaction. By integrating standardized processes, safety protocols, and documentation practices, fabricators can minimize risks, enhance operational reliability, and maintain a competitive edge in domestic and global markets.

In conclusion, sourcing custom aluminum fabrication requires a strategic approach that balances quality, cost, lead time, and supplier reliability. Aluminum’s lightweight, corrosion-resistant, and highly formable properties make it an ideal choice for a wide range of industries, from aerospace and automotive to architecture and electronics. To ensure project success, it is essential to partner with experienced fabricators who possess advanced capabilities in cutting, bending, welding, and finishing, along with strict quality control processes.

Careful evaluation of potential suppliers—considering their technical expertise, certifications, capacity, and willingness to collaborate—helps mitigate risks and ensures consistent output. Additionally, clear communication of design specifications, material grades, tolerances, and finishing requirements is critical to achieving the desired results.

Ultimately, investing time in selecting the right fabrication partner not only enhances product performance and durability but also supports innovation, reduces production delays, and improves overall cost-efficiency. With the right approach, sourcing custom aluminum fabrication can deliver high-value, precision-engineered components that meet both technical and business objectives.