The global crankshaft main bearings market is experiencing steady growth, driven by rising automotive production, increased demand for heavy-duty vehicles, and a growing emphasis on engine performance and durability. According to Grand View Research, the global engine bearings market was valued at USD 3.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. This growth is further supported by advancements in bearing materials and the expanding aftermarket for commercial and passenger vehicle maintenance. Mordor Intelligence also highlights continued demand in emerging economies, where industrialization and infrastructure development are fueling the need for reliable internal combustion engines. As engine efficiency becomes a critical performance metric, the role of high-precision crankshaft main bearings has become increasingly vital—placing leading manufacturers at the forefront of innovation and quality. In this competitive landscape, ten companies stand out for their technological expertise, global footprint, and consistent product reliability.

Top 10 Crankshaft Main Bearing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Glyco

Domain Est. 2019

Website: drivparts.com

Key Highlights: Glyco is a global leader in engine bearing technology, offering an extensive range of bearings and materials, backed by leading German technology….

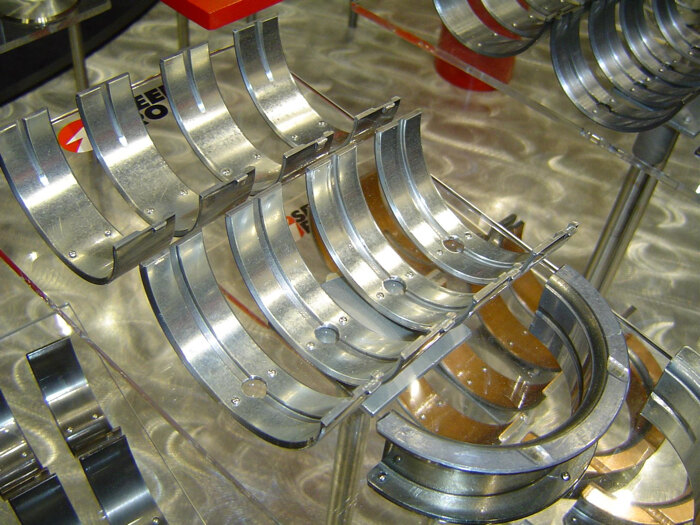

#2 Bearings for crankshaft applications

Domain Est. 1996

Website: skf.com

Key Highlights: We have developed crankshaft bearings with special surface treatment to enhance wear resistance. The heat-treated rings provide better dimensional stability at ……

#3 Bearings Rod & Main

Domain Est. 1998

Website: enginetech.com

Key Highlights: Enginetech crankshaft kits help you build better engines, faster. Our crankshaft kits go through a strict QC inspection. Each crankshaft casting is handled ……

#4 King Engine Bearings

Domain Est. 1999

Website: kingbearings.com

Key Highlights: Engine bearings for automobiles, light to heavy duty trucks, marine, aviation, standby power and other types of internal combustion engines….

#5 MAHLE Aftermarket North America

Domain Est. 2000

Website: mahle-aftermarket.com

Key Highlights: CLEVITE Engine Bearings boasts an extensive line of high performance and competition race engine bearing applications….

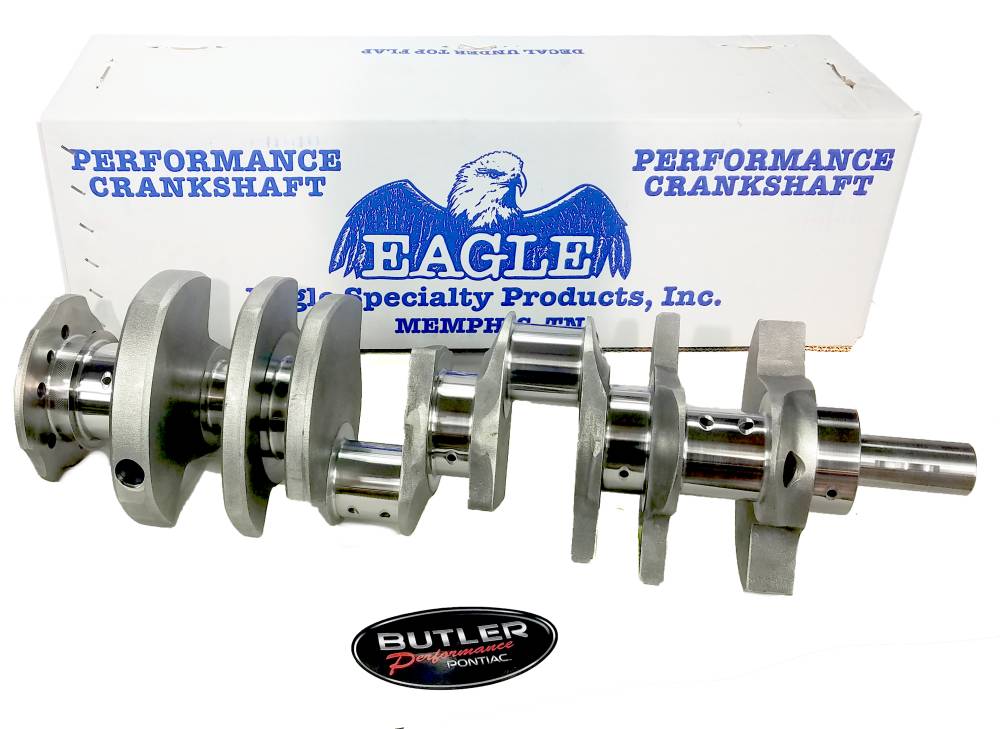

#6 Eagle Specialty Products

Domain Est. 2000

Website: eaglerod.com

Key Highlights: Eagle Specialty Products produces high-strength connecting rods and crankshafts for racing engines. We also provide full rotating assembles including crank, ……

#7 Engine Bearings

Domain Est. 2005

Website: kmpbrand.com

Key Highlights: KMP Brand premium engine bearings; main, conrod, thrust, camshaft, & end bearings compatible with brands like John Deere®, Cummins® & Caterpillar®…

#8 – ACL Race Series

Domain Est. 2009

Website: aclraceseries.com

Key Highlights: ACL Race Series performance engine bearings are recognized as a premier brand throughout the motorsports world. Race Series rod and main bearings are ……

#9 High

Domain Est. 2023

Website: kingenginebuilders.com

Key Highlights: High-performance engine bearings for racing and OE-replacement. Shop King for the performance and reliability trusted by builders and racers worldwide….

#10 Daido Metal Engine Bearings Racing & Performance Aftermarket

Domain Est. 2023

Website: daidoenginebearings.com

Key Highlights: Daido Metal is the only aftermarket bearing supplier to obtain international quality standards specifically for the design and production of engine bearings and ……

Expert Sourcing Insights for Crankshaft Main Bearing

H2: 2026 Market Trends for Crankshaft Main Bearings

The global crankshaft main bearing market is poised for significant transformation by 2026, shaped by technological advancements, evolving engine designs, and shifting automotive demand. Key trends driving the market include the continued demand for internal combustion engines (ICEs) in emerging markets, the integration of lightweight and high-performance materials, and the impact of hybrid vehicle adoption.

-

Sustained Demand in Emerging Economies

Despite the global push toward electrification, ICE vehicles remain dominant in regions such as Southeast Asia, India, and Africa due to infrastructure limitations and cost considerations. This sustained reliance on ICEs will support steady demand for crankshaft main bearings, especially in commercial vehicles and industrial machinery, creating growth opportunities for manufacturers targeting these markets. -

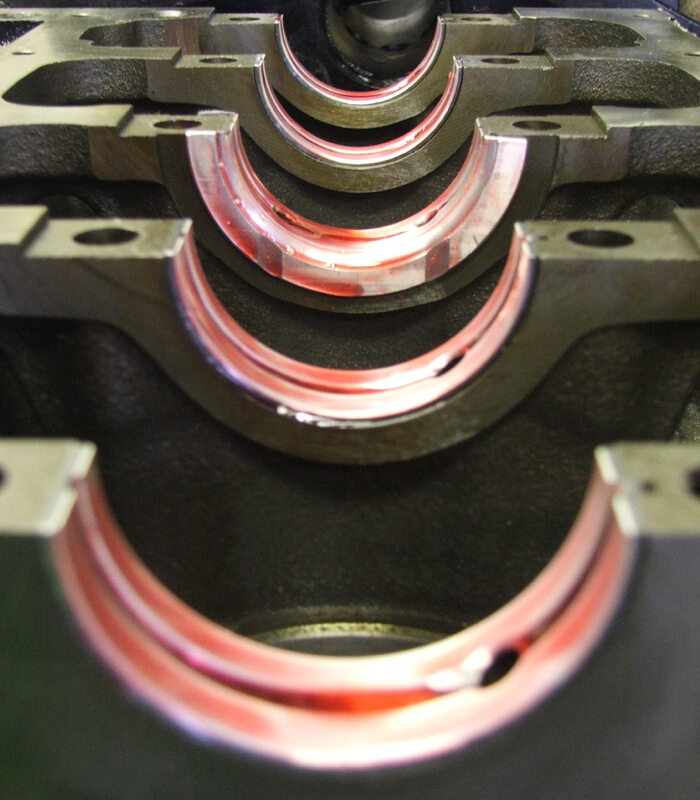

Material Innovation and Performance Enhancement

By 2026, manufacturers are increasingly adopting advanced tri-metal and bi-metal bearing materials incorporating copper-lead, aluminum-tin, and polymer composites. These materials offer improved load capacity, reduced friction, and enhanced thermal conductivity—critical for high-efficiency and turbocharged engines. R&D efforts are focused on nano-coatings and surface treatments to extend bearing life and reliability under extreme conditions. -

Hybrid Vehicle Influence

The rise of hybrid electric vehicles (HEVs) presents a dual impact. While full battery-electric vehicles (BEVs) eliminate the need for crankshaft bearings, HEVs still rely on internal combustion engines, maintaining demand for high-quality main bearings. Additionally, the stop-start functionality and variable engine loads in hybrids impose unique stress on bearings, driving demand for more durable and adaptive bearing solutions. -

Consolidation and Vertical Integration

The market is witnessing increased consolidation among Tier-1 suppliers, with major players such as Federal-Mogul (Tenneco), Mahle, and NSK expanding their bearing portfolios through acquisitions and in-house manufacturing. Vertical integration allows for tighter quality control and faster innovation cycles, giving leading suppliers a competitive edge. -

Focus on Sustainability and Circular Economy

Environmental regulations are pushing manufacturers to adopt recyclable materials and energy-efficient production processes. By 2026, the industry is expected to see greater use of recycled metals and eco-friendly lubricants compatible with modern bearings. Remanufactured engine components, including bearings, are also gaining traction in the aftermarket, driven by cost and sustainability considerations. -

Digitalization and Predictive Maintenance

Integration of IoT and sensor technologies in engine systems enables real-time monitoring of bearing performance. This shift supports predictive maintenance models, reducing unplanned downtime and extending component life. OEMs and fleet operators are increasingly investing in smart engine solutions, influencing bearing design for compatibility with diagnostic systems.

In conclusion, while the long-term outlook for crankshaft main bearings faces challenges from full electrification, the 2026 market remains robust due to hybrid adoption, material innovation, and strong demand in developing regions. Companies that invest in advanced materials, sustainable practices, and digital integration are likely to lead the market in this transitional period.

Common Pitfalls Sourcing Crankshaft Main Bearings (Quality, IP)

Sourcing crankshaft main bearings involves critical considerations beyond just dimensions and price. Overlooking key quality and intellectual property (IP) aspects can lead to engine failure, warranty claims, and legal risks. Below are common pitfalls to avoid:

Poor Material and Manufacturing Quality

Low-cost bearings may use substandard materials or imprecise manufacturing processes, leading to inadequate load capacity, poor fatigue resistance, or insufficient embeddability. Bearings with inconsistent wall thickness or improper anti-friction coatings can result in oil clearance issues and premature wear. Always verify compliance with OEM specifications (e.g., ASTM, ISO, or manufacturer standards) and request material certifications or test reports from suppliers.

Inadequate Surface Finish and Coating

The surface finish and overlay coatings (e.g., lead-tin, aluminum, or polymer-based) are crucial for reducing friction and preventing galling. Inferior coatings may peel or degrade quickly under high loads and temperatures. Ensure the supplier specifies coating type, thickness, and adherence to OEM performance benchmarks.

Non-Conformance to OEM Specifications

Many aftermarket bearings claim “OEM equivalent” status without rigorous validation. Differences in design, metallurgy, or performance can compromise engine reliability. Avoid generic parts unless they are certified to meet or exceed original equipment manufacturer (OEM) engineering requirements. Request documentation proving equivalence, such as dyno testing or material analysis.

Intellectual Property (IP) Infringement Risks

Sourcing counterfeit or cloned bearings that replicate OEM designs and trademarks constitutes IP infringement. These products often bypass quality controls and may lack traceability. Purchasing such components exposes buyers to legal liability and supply chain disruptions. Always source from authorized distributors or reputable manufacturers with proper licensing agreements.

Lack of Traceability and Documentation

Reputable bearings should come with batch traceability, material certifications, and compliance documentation. Suppliers who cannot provide these raise red flags about quality control and authenticity. Traceability is essential for warranty claims and failure analysis.

Overlooking Application-Specific Requirements

Main bearings are engineered for specific engine models, operating conditions, and load profiles. Using a bearing designed for a different application—even if dimensionally similar—can lead to catastrophic engine failure. Confirm exact compatibility with your engine make, model, and serial number before procurement.

Relying Solely on Price as a Decision Factor

The lowest-cost option often compromises on quality, durability, and IP compliance. The cost of engine downtime, repairs, or liability far exceeds initial savings. Invest in high-quality, legally compliant bearings from trusted suppliers to ensure long-term reliability and avoid costly failures.

Logistics & Compliance Guide for Crankshaft Main Bearing

Product Classification and HS Code

Crankshaft main bearings are typically classified under HS (Harmonized System) code 8483.30, which covers “Parts suitable for use solely or principally with the engines of heading 8407 or 8408.” Accurate classification is essential for customs declaration, duty calculation, and import/export compliance. Confirm the exact HS code with local customs authorities, as minor variations may exist by country.

Packaging and Labeling Requirements

Use robust, anti-corrosion packaging such as vacuum-sealed plastic or coated cardboard boxes to protect bearings from moisture and physical damage. Label each package with:

– Part number and bearing specifications (e.g., size, material)

– Batch or serial number

– Manufacturer name and country of origin

– Handling symbols (e.g., “Fragile,” “Keep Dry”)

– Compliance marks (e.g., CE, RoHS if applicable)

Ensure labels are durable and legible in the language(s) of the destination country.

Shipping and Transportation

Ship via temperature-controlled and humidity-regulated transport to prevent degradation. Use standard containerized freight (air, sea, or ground) with shock-absorbing pallets. Avoid exposure to extreme temperatures and direct sunlight. For international shipments, provide detailed shipping documents including commercial invoice, packing list, and bill of lading. Consider using tracked and insured logistics providers.

Import/Export Documentation

Prepare and retain the following documents:

– Commercial Invoice (with full product description and value)

– Packing List

– Certificate of Origin

– Bill of Lading or Air Waybill

– Export Declaration (if required)

– Import License (for countries with restrictions on automotive parts)

Ensure all documents match and are accurately completed to avoid customs delays.

Regulatory Compliance

Ensure main bearings comply with destination country regulations:

– RoHS (EU): Restriction of hazardous substances; confirm lead, cadmium, and other restricted materials are within limits.

– REACH (EU): Registration, Evaluation, Authorization of Chemicals; declare SVHCs if present above threshold.

– EPA / DOT (USA): No specific emissions rules for bearings, but general import safety standards apply.

– China CCC: Not typically required for bearings, but verify with local agents.

Maintain compliance documentation for audits.

Quality and Certification Standards

Main bearings should conform to recognized standards such as:

– ISO 9001 (Quality Management)

– IATF 16949 (Automotive Quality Management)

– SAE or DIN specifications for bearing dimensions and materials

Provide test reports or certificates of conformance (CoC) upon request.

Storage and Handling

Store in a clean, dry environment with stable temperature (10–25°C) and low humidity (<60% RH). Keep bearings in original packaging until use. Rotate stock using FIFO (First In, First Out) to prevent aging. Handle with clean gloves to avoid contamination.

Environmental and Disposal Guidelines

Used crankshaft bearings may contain metal alloys subject to environmental regulations. Dispose of through certified metal recycling programs in compliance with local waste laws (e.g., WEEE in the EU). Do not incinerate or landfill unless permitted.

Record Keeping and Traceability

Maintain records of:

– Manufacturing batch details

– Testing and inspection results

– Shipment tracking and delivery confirmation

– Compliance certifications

Retention period: minimum 5 years or as required by local regulations. Full traceability supports recalls and compliance audits.

Risk Mitigation and Contingency

Identify risks such as supply chain disruption, customs delays, or non-compliance penalties. Mitigation strategies include:

– Dual sourcing of packaging or logistics providers

– Pre-clearance with customs brokers

– Regular compliance training for logistics staff

– Use of Incoterms (e.g., DDP, FOB) clearly defined in contracts

Conclusion for Sourcing Crankshaft Main Bearings

In conclusion, sourcing crankshaft main bearings requires a strategic approach that balances quality, cost, and reliability. Selecting the right supplier involves thorough evaluation of material specifications, manufacturing standards (such as ISO or OEM compliance), and the supplier’s track record for consistency and delivery performance. Opting for high-quality bearings from reputable manufacturers ensures improved engine durability, reduced risk of failure, and long-term cost savings through enhanced performance and lower maintenance requirements.

Additionally, factors such as lead times, inventory availability, and technical support play a crucial role in maintaining smooth operations, especially in OEM production or aftermarket distribution. Engaging in long-term partnerships with trusted suppliers, conducting regular quality audits, and staying informed about advancements in bearing technology further strengthen the sourcing strategy.

Ultimately, effective sourcing of crankshaft main bearings not only supports optimal engine functionality but also contributes to overall customer satisfaction and operational efficiency in automotive and industrial applications.