The global cotton and spandex fabric market is experiencing steady growth, driven by rising demand for comfortable, durable, and flexible textiles in apparel, activewear, and intimate wear. According to Grand View Research, the global spandex fiber market size was valued at USD 8.4 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. This growth is fueled by increasing consumer preference for stretchable fabrics in sportswear and fashion apparel, particularly in emerging economies. Additionally, cotton’s natural breathability and sustainability profile continue to bolster its dominance in blended fabric applications. With the textile industry placing greater emphasis on performance, comfort, and eco-conscious production, manufacturers combining cotton and spandex are well-positioned to meet evolving market demands. As competition intensifies, identifying leading players in this niche becomes crucial for brands and sourcing professionals aiming to secure high-quality, innovative fabric solutions.

Top 10 Cotton And Spandex Fabric Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Sportek International Inc.

Domain Est. 1997

Website: sportek.com

Key Highlights: The Largest Distributor of Premium Spandex Blends and Functional Fabrics for Activewear, Sportswear, and Swimwear….

#2 Spandex House Inc.

Domain Est. 1998

Website: spandexhouse.com

Key Highlights: spandex. Printed Spandex. Shop Now. Four way stretch poly. spandex. Cotton Lycra®. Shop Now. Four way stretch cotton lycra®….

#3 Spandex Fabric

Domain Est. 2001

Website: tvfinc.com

Key Highlights: TVF is a leading supplier of spandex fabric. Stretchable spandex fabric is used for a variety of apparel and athletic applications….

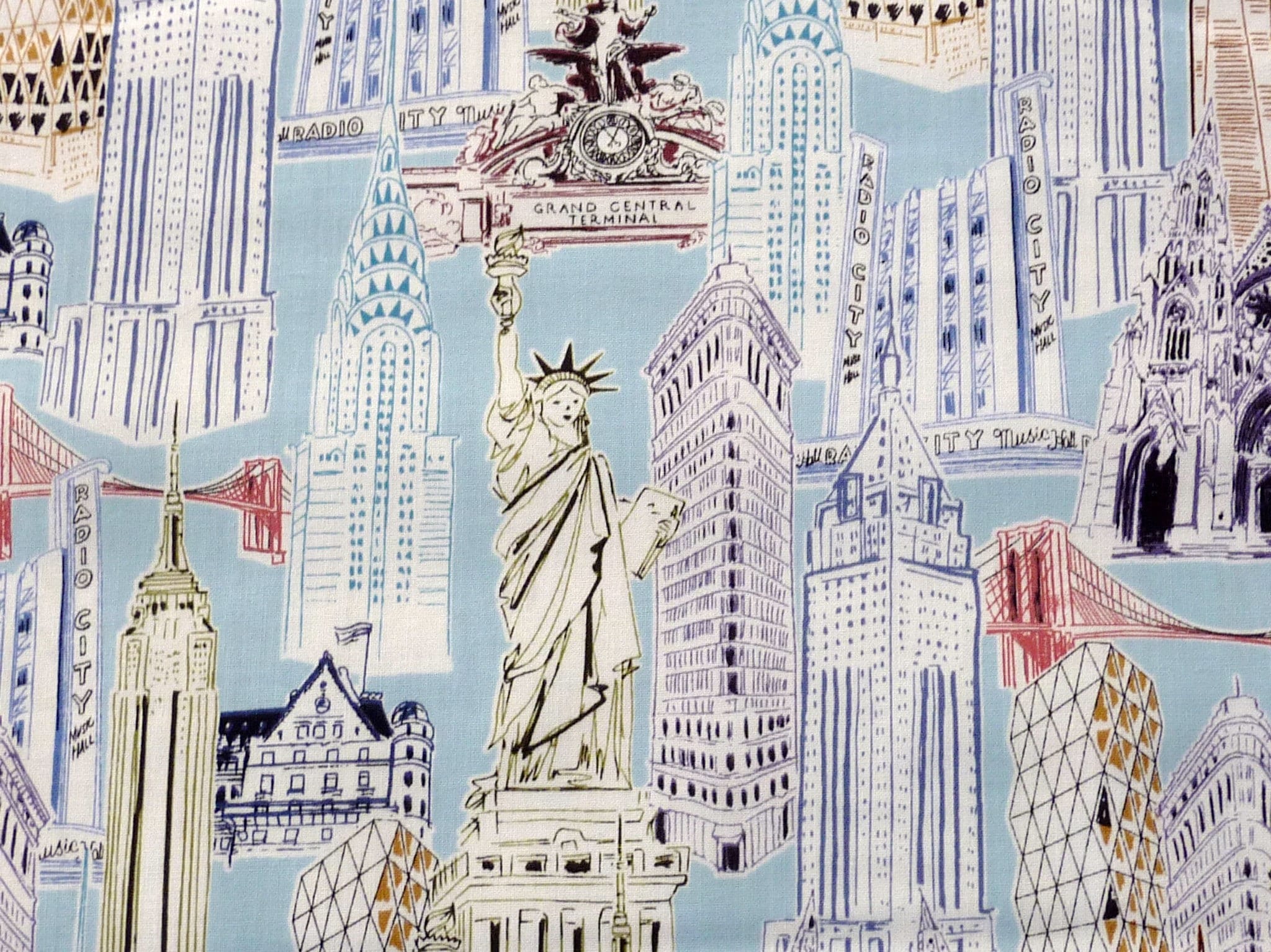

#4 Robert Kaufman Fabrics

Domain Est. 1997 | Founded: 1942

Website: robertkaufman.com

Key Highlights: Wholesale supplier of quality textiles and fabrics for quilting, fashion and manufacturing since 1942 … Cotton Spandex 190 GSM, Cotton Spandex Digital, Cotton ……

#5 cotton

Domain Est. 1998

Website: stonemountainfabric.com

Key Highlights: Free delivery over $75 21-day returnsOur showroom provide an exclusive collection of cotton spandex. All you need for your sewing experience….

#6 LYCRA®

Domain Est. 1999 | Founded: 1958

Website: lycra.com

Key Highlights: Since 1958, LYCRA® brand spandex (elastane) fiber has transformed the global textile industry to meet your need for comfort, fit and movement….

#7 Specializing in high quality Spandex fabric.

Domain Est. 2004

Website: spandexworld.com

Key Highlights: Spandex World offer one of the largest collections of high quality stretch fabrics. Start your next apparel project….

#8 Cotton Spandex Stretch Fabric

Domain Est. 2006

Website: pinecrestfabrics.com

Key Highlights: This stretch cotton spandex fabric is the ideal material for apparel, shirts, dresses, sportswear, and headbands! Call us at 844-827-4206 to learn more….

#9 Cotton Spandex Fabric

Domain Est. 2019

Website: icefabrics.com

Key Highlights: Free delivery over $100 14-day returnsStay stylish and comfortable with our most exquisite collection of cotton spandex fabric that is the perfect choice for all types of outfits….

#10 Best Organic Cotton

Domain Est. 2009

Website: californiatextilegroup.com

Key Highlights: Get the best organic cotton at California Textile Group. Our certified organic cotton fabric is soft and sustainable. Made to order when you order, ……

Expert Sourcing Insights for Cotton And Spandex Fabric

H2: 2026 Market Trends for Cotton and Spandex Fabric

The global market for cotton and spandex blended fabrics is poised for significant transformation by 2026, driven by shifting consumer preferences, technological advancements, and sustainability imperatives. This analysis explores key trends expected to shape the industry in the coming years.

1. Rising Demand for Comfort and Functionality

Cotton and spandex blends continue to dominate the apparel sector due to their optimal balance of softness, breathability, and stretch. By 2026, demand is projected to grow, particularly in activewear, athleisure, and loungewear segments. Consumers increasingly prioritize comfort in daily clothing, accelerating the adoption of flexible, durable fabrics that support active lifestyles.

2. Sustainability and Eco-Conscious Production

Environmental concerns are reshaping textile manufacturing. In 2026, brands will likely emphasize sustainable sourcing of cotton (e.g., organic or BCI-certified) and invest in recycled spandex or biodegradable elastane alternatives. Circular fashion initiatives and reduced water/energy consumption in production will be key differentiators for leading suppliers.

3. Technological Innovation in Fabric Engineering

Advancements in textile technology are enhancing the performance of cotton-spandex blends. Innovations such as moisture-wicking finishes, antimicrobial treatments, and improved stretch recovery are expected to become standard. Smart textiles integrating sensors or temperature regulation may also begin entering niche markets by 2026.

4. Growth in Emerging Markets

Asia-Pacific, particularly India and Southeast Asia, will remain pivotal in both production and consumption. Rising disposable incomes and urbanization in countries like Indonesia, Vietnam, and Bangladesh will fuel local demand. Simultaneously, these regions will expand export-oriented manufacturing, supported by cost-effective labor and evolving textile infrastructure.

5. Supply Chain Resilience and Regionalization

Post-pandemic disruptions and geopolitical tensions have prompted a shift toward regional supply chains. By 2026, nearshoring and onshoring trends in North America and Europe may increase regional cotton-spandex production, reducing dependency on distant suppliers and improving delivery timelines.

6. Regulatory Pressures and Compliance

Stricter environmental regulations, especially in the EU and North America, will influence fabric composition and labeling. Compliance with chemical usage standards (e.g., REACH, ZDHC) and transparency in supply chains will become mandatory, pushing manufacturers toward cleaner production methods.

7. E-Commerce and Customization Trends

The growth of online retail will continue to impact how cotton-spandex fabrics are marketed and sold. Direct-to-consumer brands leveraging digital platforms will demand smaller, more agile production runs and customized fabric solutions, encouraging flexible manufacturing models.

In conclusion, the 2026 market for cotton and spandex fabric will be defined by innovation, sustainability, and responsiveness to consumer needs. Companies that invest in eco-friendly practices, technological integration, and resilient supply chains will be best positioned to capture growth in this dynamic sector.

Common Pitfalls When Sourcing Cotton and Spandex Fabric (Quality & Intellectual Property)

Sourcing cotton and spandex fabric can be cost-effective and efficient, but buyers often encounter critical challenges related to quality consistency and intellectual property (IP) risks. Being aware of these pitfalls helps mitigate supply chain disruptions, legal issues, and reputational damage.

Inconsistent Fabric Quality

One of the most frequent issues in sourcing cotton and spandex blends is variability in fabric quality. Factors such as cotton grade, spandex filament count, dyeing processes, and finishing techniques can differ significantly between batches—especially when sourcing from multiple suppliers or lower-cost regions. This inconsistency can lead to poor fit, shrinkage, pilling, or color fading in the final garment, impacting customer satisfaction and brand reputation.

Unverified Fiber Content and Composition Claims

Suppliers may overstate cotton content or underreport spandex percentages to reduce costs. Mislabeling fabric composition not only violates textile regulations (e.g., FTC rules in the U.S. or EU labeling requirements) but can also compromise product performance. Always request independent lab testing (e.g., via SGS or Intertek) to verify fiber content and ensure compliance.

Lack of Quality Control Standards

Many suppliers, particularly smaller mills, lack robust quality assurance systems. Without standardized testing for tensile strength, elongation, recovery, colorfastness, and pilling resistance, buyers risk receiving subpar fabric. Establish clear QC benchmarks and conduct regular factory audits to ensure adherence.

Poor Dyeing and Finishing Processes

Inadequate dyeing techniques can result in shade variations, poor colorfastness, or chemical residues (e.g., formaldehyde or APEOs). Similarly, improper finishing may compromise the fabric’s softness, stretch recovery, or moisture-wicking properties. Ensure suppliers follow environmentally safe and consistent dyeing protocols, ideally certified by standards like OEKO-TEX® or bluesign®.

Intellectual Property Infringement Risks

When sourcing custom-designed or performance-enhanced fabrics (e.g., branded spandex like Lycra®), unauthorized use of protected technologies is a serious concern. Some suppliers may claim to offer “Lycra-like” fibers but use counterfeit or unlicensed elastane, exposing buyers to IP litigation. Always verify brand-protected content through licensing documentation and supplier certifications.

Failure to Protect Original Designs and Specifications

If you develop proprietary fabric constructions or finishes, failing to secure non-disclosure agreements (NDAs) or design patents can lead to IP theft. Suppliers may replicate your fabric for competitors without legal recourse. Protect your innovations through legal contracts and monitor production closely.

Supply Chain Transparency Gaps

Lack of visibility into raw material sourcing—especially cotton origin—can expose brands to reputational risks related to unethical labor practices or environmental harm (e.g., cotton from regions with forced labor concerns). Demand traceability and certifications like BCI (Better Cotton Initiative), Organic Cotton, or Fair Trade to ensure responsible sourcing.

Overlooking Minimum Order Quantities and Sampling

Rushing into bulk orders without proper sampling and fit testing can amplify quality issues. Always request pre-production samples and conduct wear trials. Be cautious of suppliers pushing high MOQs that limit flexibility and increase risk if fabric fails specifications.

By proactively addressing these pitfalls—through stringent vetting, testing, legal safeguards, and transparent partnerships—buyers can source high-quality, compliant cotton and spandex fabrics while protecting their brand and intellectual property.

Logistics & Compliance Guide for Cotton and Spandex Fabric

Overview

Cotton and spandex fabric is a widely used textile blend in the apparel and home textile industries. It combines the natural comfort and breathability of cotton with the elasticity and durability of spandex (also known as elastane or Lycra®). Due to its global production and trade, shipping and compliance requirements must be carefully managed to ensure smooth import/export operations and adherence to international regulations.

1. Classification and Harmonized System (HS) Codes

Proper classification under the Harmonized System (HS) is essential for customs clearance and determining applicable tariffs.

- Typical HS Code for Cotton and Spandex Fabric (Blended):

- 5516.33 – Woven fabrics of artificial staple fibers, containing ≥ 85% artificial staple by weight; or

- 5208.43 / 5209.43 – Cotton fabrics containing < 85% cotton, mixed with synthetic fibers (e.g., spandex).

- 5407.92 / 5408.22 – Woven fabrics containing elastomeric yarn (spandex), often used for stretchable textiles.

Note: Final classification depends on fiber content, weight, weave type (knit vs. woven), and country-specific tariff schedules. Always confirm with local customs authorities.

2. Import/Export Documentation

Standard documentation is required to ensure compliance and facilitate customs clearance:

- Commercial Invoice – Details product description, value, quantity, buyer/seller info. Must reflect accurate fiber content.

- Packing List – Specifies number of rolls, weight, dimensions, and packaging type.

- Bill of Lading (B/L) or Air Waybill (AWB) – Transport document issued by carrier.

- Certificate of Origin – Required to claim preferential tariffs under trade agreements (e.g., USMCA, RCEP, EU GSP).

- Textile Declaration – Some countries require a statement of fiber composition (e.g., “95% Cotton, 5% Spandex”).

- Phytosanitary Certificate – Rarely required for cotton fabric, but may be needed if raw cotton is involved in production.

3. Labeling and Fiber Content Regulations

Many countries mandate accurate labeling of fiber content for consumer protection:

- USA (FTC – Federal Trade Commission):

- Requires disclosure of fiber composition on labels (e.g., “95% Cotton, 5% Spandex”).

- Labels must be durable and attached to the product.

- EU (Textile Regulation (EU) No 1007/2011):

- Mandates clear labeling of fiber names and percentages.

- Use of trade names (e.g., “Lycra®”) is allowed only if the generic name “elastane” is also listed.

- Canada (Textile Labelling Act):

- Requires bilingual (English/French) labels with fiber content by weight.

4. Environmental and Chemical Compliance

Cotton and spandex fabrics may be subject to chemical restrictions due to dyes, finishes, and processing agents.

- REACH (EU):

- Regulates use of Substances of Very High Concern (SVHCs).

- Ensure azo dyes, formaldehyde, and phthalates are within permissible limits.

- OEKO-TEX® Standard 100:

- Voluntary certification indicating fabric is free from harmful substances.

- Often required by retailers and brands.

- Proposition 65 (California, USA):

- Requires warning labels if fabric contains chemicals known to cause cancer or reproductive harm.

5. Customs Duties and Trade Agreements

Tariff rates vary by destination and fabric composition:

- MFN (Most Favored Nation) Rates: Apply if no trade agreement is in place.

- Preferential Tariffs: Available under agreements like:

- USMCA (U.S.-Mexico-Canada)

- EU GSP (Generalized System of Preferences)

- RCEP (Regional Comprehensive Economic Partnership)

- Rules of Origin: To qualify for preferential treatment, fabric must meet origin criteria (e.g., change in tariff classification or regional value content).

6. Logistics and Packaging Considerations

- Roll Packaging: Fabrics are typically shipped in rolls (wrapped in polyethylene or kraft paper).

- Palletization: Rolls should be securely stacked and strapped to wooden or plastic pallets.

- Moisture Protection: Use moisture barriers to prevent mildew during ocean freight.

- Labeling: Include SKU, batch number, fiber content, and handling instructions (e.g., “This Side Up”).

- Incoterms®: Clearly define responsibilities (e.g., FOB, CIF, DDP) in sales contracts.

7. Restricted or Prohibited Substances

Ensure compliance with bans on:

– Forced or Child Labor: Especially relevant for cotton sourced from high-risk regions (e.g., Xinjiang, China).

– U.S. Withhold Release Orders (WROs) may block shipments containing cotton from forced labor regions.

– Endangered Species Dyes: Some natural dyes may be restricted under CITES.

8. Sustainability and Traceability

Increasing demand for ethical sourcing:

– BCI (Better Cotton Initiative): Certification for sustainable cotton farming.

– GRS (Global Recycled Standard): Required if recycled cotton or spandex is used.

– Higg Index: Used by brands to assess environmental and social performance.

9. Country-Specific Requirements

- United States: CBP enforces strict textile rules; use of accurate HTSUS codes is critical.

- European Union: Requires EUDR (EU Deforestation Regulation) for traceability; may impact cotton sourcing.

- China: Requires CCC Mark for certain end-products; fabric may need CIQ inspection.

- India: Export documents must include details under the Textile Export Policy.

10. Best Practices

- Verify all regulatory requirements with local customs brokers or legal counsel.

- Maintain records of certifications, test reports, and origin documentation for at least 5 years.

- Conduct regular audits of supply chain for compliance with labor and environmental standards.

- Use pre-shipment inspections to avoid customs delays or rejections.

By adhering to this logistics and compliance guide, businesses can ensure smooth international trade of cotton and spandex fabric while meeting legal, environmental, and market requirements.

In conclusion, sourcing cotton and spandex fabric requires a strategic approach that balances quality, cost, sustainability, and reliability. Cotton offers natural comfort, breathability, and biodegradability, while spandex provides essential stretch and durability, making their blend ideal for a wide range of apparel, from activewear to casual clothing. When sourcing these fabrics, it is crucial to partner with reputable suppliers who adhere to ethical labor practices and environmental standards, especially as consumer demand for sustainable and transparent supply chains continues to grow.

Factors such as fabric composition ratios, minimum order quantities, lead times, and certifications (e.g., GOTS, OEKO-TEX, or BCI) should be carefully evaluated to ensure alignment with brand values and production needs. Additionally, considering regional sourcing advantages—such as cotton availability in countries like India, the USA, or Brazil, and advanced textile manufacturing in China, Turkey, or Bangladesh—can optimize cost and logistics.

Ultimately, a well-informed sourcing strategy that prioritizes quality, sustainability, and long-term supplier relationships will not only enhance product performance and customer satisfaction but also support responsible and resilient supply chain operations in the evolving textile industry.