The global cosmetic packaging market is experiencing robust growth, driven by rising consumer demand for premium, sustainable, and innovative packaging solutions. According to a report by Mordor Intelligence, the market was valued at USD 33.87 billion in 2023 and is projected to reach USD 48.94 billion by 2029, growing at a CAGR of 6.37% over the forecast period. A key component within this segment is cosmetic tubes, widely used for creams, lotions, serums, and other personal care formulations due to their convenience, hygiene, and aesthetic versatility. With the surge in e-commerce, clean beauty trends, and eco-conscious consumerism, manufacturers are investing heavily in recyclable materials, airless technology, and lightweight designs. As demand intensifies, selecting the right manufacturing partner has become critical for brands aiming to balance performance, sustainability, and cost-efficiency. Based on market presence, innovation, global reach, and production capabilities, here are the top 9 cosmetic tube manufacturers shaping the industry’s future.

Top 9 Cosmetic Tube Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Neopac The Tube

Domain Est. 2003

Website: neopac.com

Key Highlights: Your local tube producer in the US · Your partner for pharmaceutical and cosmetic packaging · Your experts · Specialties in our range · Highest quality standards….

#2 ALLTUB

Domain Est. 2005

Website: alltub.com

Key Highlights: ALLTUB is the world’s leader in Aluminium squeeze tubes, Aerosol cans, Cartridges and Laminate for pharmaceutical, cosmetic, food and industrial products….

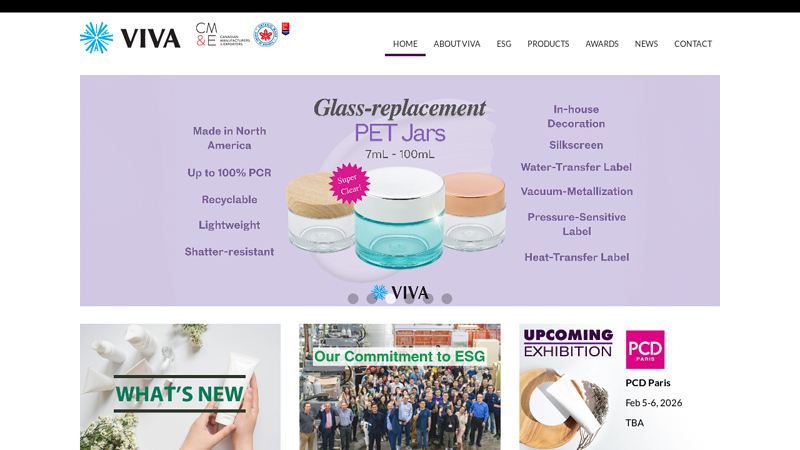

#3 Viva Healthcare

Domain Est. 2010

Website: viva-healthcare.com

Key Highlights: Viva is a global manufacturer of In-Mold-Labeled Tubes (IML Tubes) with ISO and BRC certified manufacturing operations in Canada, Poland and Hong Kong….

#4 Montebello Packaging

Domain Est. 1997

Website: montebellopkg.com

Key Highlights: Montebello Packaging designs and manufacture tubes that meet your exact requirements to your package apart from the competition….

#5 Auber Packaging

Domain Est. 2009

Website: cosmetic-tube.com

Key Highlights: Auber Packaging is a professional cosmetic packaging in China, providing cosmetic tubes, squeeze tubes, lotion tubes, lip gloss tubes, etc. Contact!…

#6 Metamorphosis Paper tube

Domain Est. 2010

Website: albea-group.com

Key Highlights: Metamorphosis, the first carton-based cosmetic tube, where plastic is reduced and replaced with a bio-based and certified paper-like material….

#7 Citus Kalix

Domain Est. 2011

Website: citus-kalix.fr

Key Highlights: Filling machines and cartoning for health and beauty applications. Turn to us for tube filling, lipstick molding, jar- and bottle filling and mascara filling….

#8 Cosmetic Tubes

Domain Est. 2019

Website: impackedpackaging.com

Key Highlights: Browse cosmetic tubes on Impacked’s primary packaging marketplace and sort by tube head, diameter, and shape to build the right solution for your product….

#9 A global leading company supplying cosmetic tubes

Domain Est. 2022

Website: albea-tubes.com

Key Highlights: Albéa provides cosmetic tubes in all types of materials, shapes and sizes, equipped with applicators for makeup and personal care….

Expert Sourcing Insights for Cosmetic Tube

H2: 2026 Market Trends for Cosmetic Tubes

The global cosmetic tube market in 2026 is poised for significant evolution, driven by sustainability imperatives, technological advancements, shifting consumer preferences, and regulatory pressures. Key trends shaping the landscape include:

1. Sustainability as the Dominant Driver:

* Material Innovation: Heavy investment in mono-material (especially PE/PP) and recyclable tubes (aluminum, certified paperboard laminates) will accelerate. Brands will prioritize designs with high post-consumer recycled (PCR) content (plastic, aluminum).

* Refillable & Reusable Systems: Expect wider adoption of refill pouches for rigid outer tubes and modular systems (e.g., replaceable inner liners), moving beyond niche luxury into mainstream segments.

* Biodegradable/Compostable Options: While facing performance and infrastructure challenges, certified compostable tubes (e.g., PLA blends, cellulose-based) will gain traction in specific eco-conscious product lines, supported by clearer labeling (e.g., TÜV OK Compost HOME).

* Lightweighting: Continued focus on reducing material use per tube without compromising protection or user experience.

2. Enhanced Functionality & User Experience:

* Precision Application: Tubes with integrated applicators (brushes, sponges, ball-tips) for serums, foundations, and skincare will become more sophisticated and hygienic (e.g., sealed tips).

* Smart & Connected Packaging: Integration of NFC/QR codes for authentication, ingredient transparency, usage tracking, refill reminders, and direct brand engagement will increase, particularly in premium segments.

* Improved Dispensing: Focus on complete product evacuation (e.g., advanced laminated structures, optimized shoulder designs, collapsible formats) to minimize waste and enhance value perception.

3. Material & Structural Shifts:

* Aluminum Resurgence: Aluminum tubes will gain significant market share due to infinite recyclability, superior barrier properties (especially for sensitive actives), and premium aesthetics, challenging traditional plastic dominance.

* Paper-Based Laminates Growth: Rigid paperboard laminated tubes (using FSC-certified paper) will expand, particularly for hand creams, body lotions, and lower-viscosity products, appealing to eco-conscious consumers.

* Advanced Laminates: High-barrier, thin-wall laminated plastic tubes (PE/Alu/PE, PE/PET) will remain crucial for oxygen/moisture-sensitive formulations, with ongoing improvements in recyclability and PCR content.

4. Design & Aesthetic Evolution:

* Minimalist & Premium Aesthetics: Clean lines, matte finishes, subtle textures, and sophisticated color palettes will dominate, reflecting a move towards “quiet luxury” and sustainability.

* Customization & Differentiation: Brands will leverage advanced printing (digital, offset), embossing, and unique shapes/sizes to stand out on shelves and online, even within sustainable constraints.

* Transparency: Increased use of see-through or translucent materials (where formulation stability allows) to showcase the product color/texture.

5. Regulatory & Supply Chain Pressures:

* Extended Producer Responsibility (EPR): Stricter global EPR schemes will force brands and converters to design for recyclability, report usage, and fund recycling, accelerating sustainable innovation.

* Plastic Tax Compliance: Manufacturers will proactively shift formulations and materials to avoid impending or existing plastic taxes (e.g., UK, EU).

* Supply Chain Resilience: Focus on regional sourcing and vertical integration to mitigate geopolitical risks and ensure material availability, especially for critical components and PCR resins.

6. Market Dynamics:

* Consolidation & Collaboration: Increased M&A among tube manufacturers and deeper collaboration between brands, converters, and raw material suppliers to develop innovative, scalable sustainable solutions.

* Growth in Asia-Pacific: This region will remain the fastest-growing market due to rising disposable incomes, expanding beauty markets (especially skincare), and increasing environmental awareness driving demand for advanced packaging.

Conclusion for 2026: The cosmetic tube market in 2026 will be fundamentally reshaped by the imperative of circularity. Success will belong to players who seamlessly integrate sustainability (recyclable, refillable, PCR content), functionality (smart features, precise application), and design (premium aesthetics) while navigating complex regulatory landscapes. Aluminum and advanced recyclable plastics/paper laminates will challenge traditional plastic dominance, and innovation will be driven by collaboration across the value chain. The tube will transform from a simple container into a sophisticated, sustainable, and interactive component of the brand experience.

Common Pitfalls When Sourcing Cosmetic Tubes (Quality, IP)

Sourcing cosmetic tubes involves more than just finding a low price—overlooking critical quality and intellectual property (IP) factors can lead to product failures, legal disputes, and brand damage. Below are key pitfalls to avoid:

Poor Material Quality and Compatibility

Selecting tubes made from substandard or incompatible materials can compromise product integrity. Low-grade plastics or laminates may leach chemicals into cosmetics, cause discoloration, or degrade over time. Always verify material safety data sheets (MSDS), ensure compliance with FDA or EU cosmetic regulations, and conduct compatibility testing with your formula.

Inadequate Barrier Properties

Cosmetic tubes must protect contents from oxygen, moisture, and light to maintain shelf life. Inferior barrier layers in laminated tubes (e.g., aluminum or EVOH) can result in product spoilage or oxidation. Confirm the tube structure meets your product’s preservation needs through barrier performance testing.

Inconsistent Manufacturing Tolerances

Variations in tube dimensions, nozzle size, or sealing quality can disrupt filling lines or cause leakage. Poor quality control leads to high rejection rates during production. Require suppliers to provide process capability (Cp/Cpk) data and conduct production audits.

Lack of Regulatory Compliance

Using non-compliant inks, adhesives, or recycled materials can violate regional regulations (e.g., EU REACH, FDA 21 CFR). Ensure full material disclosure and obtain certifications such as ISO 22716 (GMP), ISO 9001, and relevant food-grade or cosmetic-grade approvals.

Intellectual Property Infringement

Sourcing generic or “copycat” tube designs risks violating patents or trademarks. Many tube features—such as closure mechanisms, dispensing systems, or ergonomic shapes—are protected. Conduct IP due diligence and obtain written assurance from suppliers that designs do not infringe existing patents.

Unauthorized Design Replication

Suppliers may reuse your custom tooling or design for other clients, diluting brand exclusivity. Protect your designs by securing IP ownership in contracts, using proprietary molds, and including non-disclosure and non-compete clauses.

Insufficient Packaging Validation

Tubes may pass initial inspection but fail under real-world conditions (e.g., drop tests, pressure changes during shipping). Require ISTA-certified packaging validation and batch sampling to ensure long-term performance.

Hidden Costs from Quality Failures

Low upfront pricing often comes with hidden costs—rework, recalls, or customer complaints due to quality issues. Factor in total cost of ownership, including quality audits, testing, and potential liability.

Avoiding these pitfalls requires thorough due diligence, strong supplier vetting, and clear contractual protections—ensuring your cosmetic tube enhances, rather than undermines, your brand’s reputation.

Logistics & Compliance Guide for Cosmetic Tube

Overview

This guide provides essential information on the logistics and regulatory compliance considerations for manufacturing, transporting, and selling cosmetic tubes—commonly used packaging for creams, lotions, gels, and ointments in the cosmetics industry. Adhering to these guidelines ensures product safety, regulatory approval, and efficient supply chain operations.

Regulatory Compliance

Global Cosmetic Regulations

Cosmetic tubes must comply with regional and international cosmetic regulations. Key regulatory frameworks include:

– EU (EC) No 1223/2009: Requires compliance with safety assessments, ingredient labeling (INCI names), responsible person designation, and notification via the Cosmetic Products Notification Portal (CPNP).

– U.S. FDA (Federal Food, Drug, and Cosmetic Act): Mandates proper labeling, GMP adherence, and registration of manufacturing facilities. Color additives require pre-market approval.

– China (NMPA Regulations): Requires product备案 (filing) or registration, ingredient safety data, and often animal testing for certain products (though reforms are ongoing).

– Canada (Cosmetic Regulations under the Food and Drugs Act): Requires notification within 10 days of sale, proper labeling, and ingredient disclosure via the Cosmetic Notification System (CNS).

Packaging Material Safety

- Ensure all materials (e.g., laminated aluminum, PE, PP, or recyclable composites) are food-grade or approved for cosmetic contact.

- Confirm compliance with REACH (EU) and FDA 21 CFR for extractables and leachables.

- Avoid substances restricted under regulations like California Prop 65 or EU Annexes (e.g., certain phthalates, heavy metals).

Labeling Requirements

- Include product name, net quantity, ingredient list (INCI), manufacturer/distributor details, batch number, and expiration date or Period After Opening (PAO) symbol.

- Labels must be legible, indelible, and affixed securely to the tube or its packaging.

- Multilingual labeling may be required for export markets.

Manufacturing & Quality Control

Good Manufacturing Practices (GMP)

- Follow ISO 22716 or equivalent GMP standards to ensure hygiene, contamination control, and process validation.

- Implement quality checks for tube sealing, printing accuracy, and dimensional consistency.

- Maintain traceability with batch coding and lot tracking.

Sustainability & Eco-Compliance

- Comply with packaging waste directives such as EU Packaging and Packaging Waste Directive (PPWD) and extended producer responsibility (EPR) schemes.

- Use recyclable or biodegradable tube materials where possible.

- Label recyclability clearly (e.g., “Recycle Tube Cap” or “Tubes with PE Layer – Check Local Recycling”).

Logistics & Transportation

Packaging & Palletization

- Use protective secondary packaging (corrugated boxes, shrink wrap) to prevent damage during transit.

- Optimize stacking and load stability; follow ISTA or ASTM standards for drop and compression testing.

- Clearly label shipments with handling instructions (e.g., “Fragile,” “This Way Up”).

Cold Chain & Environmental Controls

- For temperature-sensitive formulations, ensure tubes are compatible with cold chain logistics.

- Monitor exposure to extreme temperatures or humidity, which can affect tube integrity or product stability.

International Shipping Documentation

- Prepare commercial invoice, packing list, certificate of origin, and material safety data sheet (MSDS) if required.

- For air freight, verify compliance with IATA regulations—cosmetic tubes are generally permitted as non-hazardous goods unless containing flammable ingredients.

Import/Export Compliance

- Verify tariff classifications (HS Code, commonly 3304.99 for filled cosmetic tubes).

- Ensure compliance with destination country’s import regulations, including product registration, labeling, and customs duties.

- Use authorized agents or customs brokers where required (e.g., FDA U.S. Agent, EU Responsible Person).

End-of-Life & Environmental Responsibility

Take-Back & Recycling Programs

- Participate in or establish take-back schemes in alignment with local regulations.

- Partner with recycling organizations to improve tube recyclability (e.g., Terracycle programs).

Environmental Claims

- Avoid unsubstantiated claims such as “biodegradable” or “eco-friendly” unless backed by certification (e.g., TÜV OK Compost, FSC).

- Follow FTC Green Guides (U.S.) or EU Green Claims guidelines for truthful environmental marketing.

Conclusion

Successfully managing the logistics and compliance of cosmetic tubes requires a proactive, integrated approach across regulatory, environmental, and supply chain functions. Staying updated with evolving regulations and investing in sustainable packaging solutions will enhance market access and brand reputation.

Conclusion for Sourcing Cosmetic Tubes

In conclusion, sourcing cosmetic tubes requires a strategic approach that balances quality, cost, sustainability, and supplier reliability. The choice of material—such as laminated plastic, aluminum, or recyclable PE—should align with the product formulation, brand values, and environmental goals. It is essential to partner with reputable manufacturers who adhere to international standards, offer customization options, and provide consistent quality control.

Additionally, lead times, minimum order quantities (MOQs), and logistics must be carefully evaluated to ensure timely delivery and inventory efficiency. As consumer demand for eco-friendly packaging grows, prioritizing sustainable and recyclable tube solutions can enhance brand image and market competitiveness.

Ultimately, a thorough evaluation of technical specifications, supplier capabilities, and long-term scalability will ensure the successful sourcing of cosmetic tubes that meet both performance requirements and brand objectives.