The U.S. cosmetic manufacturing industry has experienced robust growth, driven by rising consumer demand for natural, organic, and clean-label beauty products, as well as increasing investments in research and development. According to a 2023 report by Grand View Research, the U.S. cosmetics market size was valued at USD 47.8 billion and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is further fueled by the surge in e-commerce, influencer marketing, and the personalization of beauty products. Mordor Intelligence also projects steady expansion, citing innovation in sustainable packaging and active ingredients as key drivers reshaping the competitive landscape. As the industry evolves, a select group of manufacturers are leading the way in quality, compliance, and scalability. Below is a data-informed look at the top 10 cosmetic manufacturers in the U.S. that are shaping the future of beauty.

Top 10 Cosmetic Usa Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Private Label Skin Care Manufacturer, Cosmetic Solutions …

Domain Est. 1997

Website: naturalskincare.com

Key Highlights: Cosmetic industry leader in private label skincare, innovation, formulation, contract manufacturing of skin care, hair care, body care and OTC….

#2 Columbia Cosmetics

Domain Est. 1998

Website: columbiacosmetics.com

Key Highlights: Explore top makeup & skin care manufacturers offering white label cosmetics & private label solutions. Discover beauty products & cosmetics development….

#3 Top Makeup & Skincare Contract Manufacturer, USA

Domain Est. 2005

Website: newlookcosmetics.com

Key Highlights: At New Look Cosmetics, we offer formulation and contract manufacturing services for a full range of products for the face, eyes, lips, body and more….

#4 Beauty Manufacturing Solutions Corp

Domain Est. 2006

Website: beautymanufacture.com

Key Highlights: BMSC is a leading US manufacturer of innovative cosmetic, beauty, and personal care products and a top competitor in the industry. We have set ourselves apart ……

#5 Cosmetic Contract Manufacturing & Private Labeling

Domain Est. 2014

Website: tropicallabs.com

Key Highlights: Create standout products with a top cosmetic private label manufacturer in the USA. Start fast with low MOQs and full-service support. Get started now!…

#6 Cosmopak

Domain Est. 2000

Website: cosmopak.com

Key Highlights: Specializing in color cosmetics, skincare, and body care, we offer customized packaging, full product development turnkey service, and stylish accessories….

#7 Colorlab Private Label Cosmetics & Manufacturing

Domain Est. 2007

Website: colorlabprivatelabel.com

Key Highlights: Create your own private label cosmetics line or hire us for custom cosmetic manufacturing. We can help you start a new business or grow an existing one….

#8 Dynamic Blending

Domain Est. 2015

Website: dynamicblending.com

Key Highlights: We are dedicated to our clients and collaborate with partner brands to deliver the most innovative global cosmetic manufacturing solutions available….

#9 SBLC Cosmetics

Domain Est. 2020

Website: sblcomp.com

Key Highlights: We are your one-stop-shop for bringing cosmetic products to market. From private label and formulation development to custom packaging, brand development, ……

#10 Best Cosmetic Manufacturer

Domain Est. 2018

Website: mpluscosmetics.com

Key Highlights: MPlus Cosmetics is your trusted cosmetic manufacturer, specializing in the production of high-quality cosmetics. Explore innovative solutions today!…

Expert Sourcing Insights for Cosmetic Usa

2026 Market Trends for the Cosmetic Industry in the USA

The U.S. cosmetic industry is poised for significant transformation by 2026, driven by evolving consumer preferences, technological innovation, regulatory shifts, and sustainability imperatives. This analysis explores the key market trends expected to shape the cosmetics landscape in the United States over the coming years.

Rising Demand for Clean and Sustainable Beauty

Consumers are increasingly prioritizing “clean beauty” — products free from harmful chemicals, parabens, sulfates, and synthetic fragrances. By 2026, transparency in ingredient sourcing and manufacturing processes will be a competitive necessity. Brands that emphasize eco-friendly packaging, carbon neutrality, and cruelty-free certification are expected to gain substantial market share. The U.S. Environmental Protection Agency (EPA) and advocacy groups are pushing for stricter labeling regulations, which will further accelerate the shift toward sustainable beauty solutions.

Personalization Through Technology

Advancements in artificial intelligence (AI), augmented reality (AR), and data analytics are revolutionizing how consumers interact with cosmetic products. By 2026, personalized skincare and makeup regimens—based on skin type, genetic data, and lifestyle—will become mainstream. Virtual try-on tools and AI-powered skin analysis apps offered by retailers and brands like Sephora, Ulta, and emerging DTC (direct-to-consumer) startups will enhance customer engagement and reduce product returns. Custom-blended foundations and serums, produced on-demand via in-store or at-home devices, will redefine mass customization.

Inclusivity and Diversity in Product Offerings

The demand for inclusive beauty continues to grow, with consumers expecting broad shade ranges, gender-neutral products, and marketing that reflects diverse ethnicities, ages, and gender identities. By 2026, brands that fail to embrace inclusivity risk losing relevance. Major players like Fenty Beauty have set a precedent, and this trend is expected to expand across all categories—from foundation to hair care. Expansion into underserved markets, including mature skin tones and adaptive cosmetics for people with disabilities, will open new growth opportunities.

Growth of the Men’s Grooming Segment

The male cosmetics and skincare market is experiencing rapid expansion, fueled by shifting social norms and increased self-care awareness among men. By 2026, the U.S. men’s grooming sector is projected to surpass $20 billion, with strong growth in anti-aging products, facial serums, and color cosmetics. Brands are launching targeted marketing campaigns and product lines tailored specifically to men, often emphasizing functionality, minimalism, and natural ingredients.

Regulatory and Ingredient Transparency

The U.S. is moving toward stronger cosmetic regulations, with the passage of the Modernization of Cosmetics Regulation Act (MoCRA) in 2022 setting the stage for sweeping changes. By 2026, full compliance with MoCRA—mandating Good Manufacturing Practices (GMP), adverse event reporting, and facility registration—will be required. This will increase operational costs for smaller brands but enhance consumer trust. Additionally, demand for third-party certifications (e.g., EWG Verified, USDA Organic) will rise as consumers seek assurance about product safety.

E-Commerce and Direct-to-Consumer Dominance

Online sales will continue to dominate cosmetic distribution, with e-commerce platforms and brand-owned websites accounting for over 40% of total sales by 2026. Subscription models, social commerce via Instagram and TikTok, and influencer-led product launches will drive digital engagement. The integration of shoppable content and live streaming will blur the lines between entertainment and retail, particularly among Gen Z and millennial consumers.

Mental Wellness and Beauty Synergy

The convergence of beauty and wellness—often termed “beauty-from-within” or “mindful beauty”—will gain momentum. By 2026, more consumers will seek cosmetics that support mental well-being, such as products with calming scents (e.g., CBD-infused skincare) or mindfulness-driven branding. Supplements targeting skin health, like collagen and biotin, will increasingly be marketed alongside topical products, reflecting a holistic approach to beauty.

Conclusion

The U.S. cosmetic market in 2026 will be defined by innovation, responsibility, and personalization. Brands that invest in clean formulations, digital experiences, inclusivity, and regulatory compliance will lead the industry. As consumer consciousness evolves, the definition of beauty will expand beyond aesthetics to encompass health, sustainability, and authenticity.

Common Pitfalls When Sourcing Cosmetics from the USA: Quality and Intellectual Property Concerns

Sourcing cosmetics from the USA can offer access to innovative products and reputable manufacturers, but it also comes with significant risks if not carefully managed. Two of the most critical areas where businesses stumble are quality assurance and intellectual property (IP) protection.

1. Quality Control and Regulatory Compliance

One of the biggest pitfalls in sourcing cosmetics from the USA is assuming that all products automatically meet high-quality standards. While the U.S. has strong regulatory oversight through the FDA, the cosmetics industry is less strictly regulated compared to pharmaceuticals.

-

Lack of Pre-Market Approval: The FDA does not require pre-market approval for most cosmetic products (except color additives). This means manufacturers can release products without prior government review, increasing the risk of inconsistent quality or unsafe formulations.

-

Mislabeling and Ingredient Transparency: Some suppliers may mislabel ingredients or fail to disclose all components, especially in private-label products. This can lead to non-compliance with international regulations or allergic reactions in consumers.

-

GMP Non-Compliance: Not all U.S. manufacturers adhere to Good Manufacturing Practices (GMP). Sourcing from facilities without proper GMP certification increases the risk of contamination, batch inconsistencies, and product recalls.

-

Counterfeit or Substandard Raw Materials: Even in the U.S., some manufacturers may cut costs by using substandard or counterfeit raw ingredients, compromising product efficacy and safety.

2. Intellectual Property Risks

Intellectual property issues are often overlooked during sourcing but can have serious legal and financial consequences.

-

Unauthorized Use of Formulations: Some U.S. suppliers may use proprietary formulations developed by other brands or fail to secure proper licensing. Sourcing such products can expose your business to infringement claims.

-

Trademark and Branding Infringement: Private-label or white-label products may inadvertently use logos, names, or packaging designs that infringe on existing trademarks. This is especially risky when selling globally, where trademark laws vary.

-

Weak Contractual Protections: Many sourcing agreements fail to include clear IP clauses, leaving buyers without ownership rights to custom formulations, packaging designs, or branding developed during collaboration.

-

Reverse Engineering and Copying: Once you share your product specifications or designs with a U.S. manufacturer, there’s a risk they may replicate and sell your product to competitors, particularly if non-disclosure agreements (NDAs) or exclusivity clauses are absent.

Mitigation Strategies

To avoid these pitfalls:

– Conduct thorough due diligence on suppliers, including facility audits and GMP certifications.

– Request product testing reports (e.g., microbial, stability, and safety testing).

– Ensure full ingredient disclosure and compliance with target market regulations.

– Use legally binding contracts that clearly define IP ownership and confidentiality.

– Register trademarks and patents in relevant markets before launching sourced products.

By proactively addressing quality and IP concerns, businesses can safely leverage the innovation and reliability of U.S. cosmetic manufacturers while minimizing risk.

Logistics & Compliance Guide for Cosmetics in the USA

Regulatory Oversight and Key Agencies

The U.S. cosmetic industry is primarily regulated by the Food and Drug Administration (FDA) under the Federal Food, Drug, and Cosmetic Act (FD&C Act). Unlike drugs, cosmetics do not require pre-market approval, but manufacturers and distributors must ensure products are safe and properly labeled. The FDA enforces regulations related to product safety, labeling, ingredient disclosure, and good manufacturing practices (GMP). Additionally, the Federal Trade Commission (FTC) monitors advertising claims to prevent deceptive marketing.

Product Registration and Facility Listing

While cosmetic products themselves do not need FDA approval, manufacturers and distributors are required to register their facilities through the FDA’s Voluntary Cosmetic Registration Program (VCRP). Although participation is voluntary, it is strongly recommended to demonstrate regulatory compliance. Facilities that manufacture, package, or hold cosmetics for sale in the U.S. must submit facility registration and product formulation statements. Failure to comply may result in delays or enforcement actions during inspections.

Ingredient Safety and Labeling Requirements

All cosmetic ingredients must be safe for their intended use under labeled or customary conditions. The FDA maintains a list of prohibited and restricted ingredients (e.g., chloroform, mercury compounds). Labels must include the product identity, net quantity, ingredient list (using INCI names), name and place of business, and any required warning statements. Fragrance allergens do not require individual disclosure under U.S. rules, but transparency is encouraged. Ensure all claims (e.g., “dermatologist tested,” “hypoallergenic”) are substantiated.

Good Manufacturing Practices (GMP)

While the U.S. does not enforce mandatory GMP regulations for cosmetics, following the International Cooperation on Cosmetics Regulation (ICCR) or ISO 22716 guidelines is considered a best practice. GMP adherence helps ensure product consistency, purity, and safety. Key practices include supplier qualification, contamination control, proper documentation, batch record maintenance, and employee training. GMP compliance may be reviewed during FDA inspections or in response to consumer complaints.

Importation and Customs Clearance

Cosmetic products imported into the U.S. are subject to FDA screening at ports of entry. Importers must ensure products comply with FDA regulations before arrival. The FDA may detain non-compliant shipments due to misbranding, adulteration, or undeclared ingredients. Key documentation includes the product label, ingredient list, and evidence of facility registration. The U.S. Customs and Border Protection (CBP) oversees tariff classification and duties, while the FDA confirms regulatory compliance.

Adverse Event Reporting and Recalls

Cosmetic firms are encouraged, though not currently mandated by federal law, to report serious adverse events to the FDA under the Cosmetic Adverse Event Reporting System (CAERS). However, the Modernization of Cosmetics Regulation Act (MoCRA) of 2022 now requires mandatory reporting of serious adverse events starting in 2024. Companies must establish procedures to evaluate and report such events. In cases of product contamination, mislabeling, or safety concerns, firms may initiate voluntary recalls coordinated with the FDA.

MoCRA Compliance Overview

The Modernization of Cosmetics Regulation Act (MoCRA), enacted in December 2022, introduces significant updates to U.S. cosmetic regulation. Key requirements include mandatory facility registration and product listing, GMP compliance (enforceable by FDA), mandatory adverse event reporting, fragrance allergen labeling (within two years of FDA guidance), and safety substantiation for products. Companies must prepare for phased implementation deadlines beginning in 2023–2025.

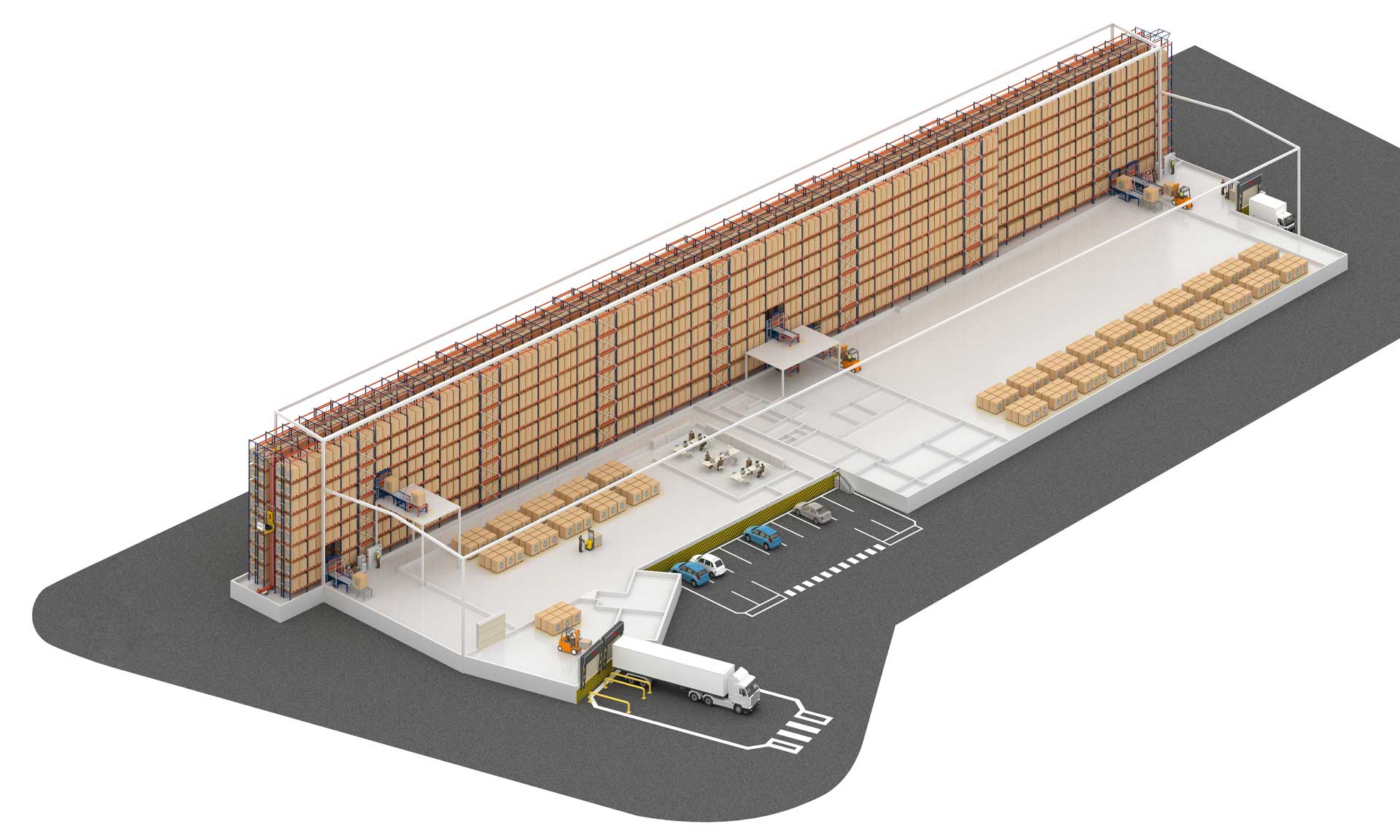

Distribution and Supply Chain Considerations

Effective logistics include temperature control (for sensitive formulations), secure packaging, and inventory management to prevent counterfeiting and expiration. Distributors should maintain traceability through batch coding and retain documentation for recalls. Partnering with FDA-compliant warehousing and logistics providers helps ensure storage conditions meet product requirements. E-commerce sellers must also comply with state-level sales tax and labeling laws.

State-Level Regulations and Prop 65

In addition to federal rules, certain states impose additional requirements. California’s Proposition 65 mandates warnings for products containing chemicals known to cause cancer or reproductive harm (e.g., lead, formaldehyde). If a cosmetic contains listed substances above safe harbor levels, a clear warning label is required for California sales. Other states may have restrictions on specific ingredients (e.g., PFAS bans in Maine, California).

Recordkeeping and Audit Preparedness

Maintain comprehensive records including ingredient specifications, safety assessments, manufacturing logs, adverse event reports, and labeling approvals. Under MoCRA, records must be retained for six years. The FDA has authority to inspect facilities and records without advance notice. Regular internal audits help identify compliance gaps and prepare for regulatory scrutiny. Digital documentation systems can enhance traceability and response efficiency.

Conclusion: Sourcing Cosmetic Manufacturers in the USA

Sourcing cosmetic manufacturers in the USA offers numerous advantages for brands seeking quality, compliance, and operational transparency. American manufacturers are known for their adherence to strict regulatory standards set by the FDA, use of high-quality ingredients, and commitment to ethical and sustainable practices. Additionally, domestic production reduces supply chain risks, shortens lead times, and allows for greater collaboration and oversight throughout the manufacturing process.

When selecting a U.S.-based cosmetic manufacturer, it is essential to consider factors such as production capabilities, certifications (e.g., cGMP, FDA-registered), experience in your product niche, minimum order quantities (MOQs), and willingness to offer private label or custom formulation services. Conducting thorough due diligence, requesting samples, and visiting facilities when possible can further ensure a successful partnership.

Ultimately, sourcing within the USA supports faster time-to-market, enhances brand credibility, and aligns with growing consumer demand for locally made, safe, and transparent beauty products. For startups and established brands alike, partnering with a reliable U.S. cosmetic manufacturer is a strategic move toward building a trustworthy, scalable, and compliant beauty business.