The global corrugated fiberglass market is experiencing steady growth, driven by increasing demand for lightweight, durable, and weather-resistant roofing and cladding solutions across industrial, commercial, and agricultural sectors. According to Grand View Research, the global fiberglass market size was valued at USD 90.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030, with corrugated fiberglass panels representing a significant segment due to their widespread use in sustainable construction and natural lighting applications. Similarly, Mordor Intelligence projects a CAGR of over 5% for the fiberglass market through 2028, citing rising infrastructure development and the shift toward energy-efficient building materials as key growth enablers. As demand surges, particularly in emerging economies and regions with high exposure to harsh weather conditions, a select group of manufacturers has emerged as leaders in innovation, scale, and product reliability. Below is a curated list of the top 10 corrugated fiberglass manufacturers shaping the industry landscape.

Top 10 Corrugated Fiberglass Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Corrugated Fiberglass Roof Sheets

Domain Est. 2015

Website: stabilitamerica.com

Key Highlights: Stabilit America Inc. is a leading North American manufacturer of fiberglass reinforced panels (FRP) and polycarbonate sheets, with over 65 ……

#2 Dipcraft

Domain Est. 1997

Website: dipcraft.com

Key Highlights: Dipcraft Manufacturing has been a national leader in fiberglass building panels. We specialize in high-quality customer service and developing custom solutions….

#3 Large Selection of Corrugated Fiberglass Panels In Stock at ePlastics

Domain Est. 1998

Website: eplastics.com

Key Highlights: 2–5 day delivery 30-day returnsePlastics offers heavy-duty commercial grade fiberglass sheets that are available in either flat or corrugated. We have the largest FRP stock in the …

#4 iqnection, Author at PVC Sheets

Domain Est. 1999

Website: hfmfgcorp.com

Key Highlights: At the base of the oval is line art of corrugated plastic sheeting, the staple product of H&F Manufacturing. The original, familiar logo consisted of simple ……

#5 Corrugated Fiberglass

Domain Est. 2000

Website: fiberglassfabricators.com

Key Highlights: Use our thorough list of fiberglass fabricators and suppliers in Corrugated Fiberglass to examine and sort top fiberglass fabricators with previews of ads ……

#6 Corrugated Fiberglass Roofing

Domain Est. 2002

Website: corrugatedmetal.com

Key Highlights: These Corrugated Fiberglass panels are strong, durable, shatter resistant and will not rust, rot, scale or mildew….

#7 Corrugated Fiberglass Roofing and Skylight Panels

Domain Est. 2015

Website: westernstatesmetalroofing.com

Key Highlights: Corrugated fiberglass roofing and skylight panels are commonly used for greenhouses, patios, carports, and roofs. Immediate availability and delivery….

#8 MFG Construction and Water Products

Domain Est. 2017

Website: mfgcwp.com

Key Highlights: MFG CWP offers an extensive range of fiberglass concrete forms that consistently outperform comparative steel, wood, cardboard, Styrofoam or plastic ……

#9 6 Oz Corrugated Fiberglass

Domain Est. 2020

Website: roofing4us.com

Key Highlights: In stock $745 deliveryThis fiberglass reinforced panel is manufactured with a nominal thickness of 0.050″ +-10%. Light transmission of these panels average 85-90%….

#10 Fiberglass Corrugated Panels

Domain Est. 1996

Expert Sourcing Insights for Corrugated Fiberglass

H2: 2026 Market Trends for Corrugated Fiberglass

The global corrugated fiberglass market is projected to experience steady growth and transformation by 2026, driven by advancements in material technology, rising demand in construction and industrial sectors, and a growing emphasis on sustainable building solutions. Key trends shaping the market include:

-

Increased Demand in Construction and Roofing Applications

Corrugated fiberglass continues to gain popularity in residential, commercial, and agricultural roofing due to its lightweight, high strength-to-weight ratio, and excellent light transmission properties. By 2026, expanding infrastructure development in emerging economies—particularly in Asia-Pacific and Latin America—will drive significant demand for durable, cost-effective roofing alternatives, positioning corrugated fiberglass as a preferred choice over traditional materials like metal or concrete. -

Growth in Green and Energy-Efficient Buildings

With increasing global focus on energy efficiency and sustainable construction, corrugated fiberglass is being integrated into daylighting systems and green building designs. Its translucent nature allows natural light to penetrate industrial and commercial spaces, reducing reliance on artificial lighting and lowering energy consumption. Regulatory support for eco-friendly building materials is expected to further boost market adoption. -

Technological Advancements and Product Innovation

Manufacturers are investing in R&D to improve the UV resistance, impact strength, and thermal stability of corrugated fiberglass panels. Innovations such as anti-condensation coatings, fire-retardant additives, and multi-wall designs are enhancing product performance and expanding application potential, particularly in harsh climates and high-safety environments. -

Rising Competition from Alternative Materials

Despite growth, the market faces competition from alternative roofing materials such as polycarbonate sheets and coated metal panels. However, corrugated fiberglass maintains a competitive edge due to its lower cost, ease of installation, and superior insulating properties. Market players are focusing on differentiation through customization and improved longevity to retain market share. -

Regional Market Dynamics

The Asia-Pacific region is expected to dominate the market by 2026, fueled by rapid urbanization, industrialization, and government support for infrastructure projects in countries like India, China, and Indonesia. North America and Europe will see moderate growth, driven by retrofitting and renovation activities, along with compliance with green building standards. -

Supply Chain and Raw Material Volatility

The market may face challenges related to fluctuating raw material prices, particularly for glass fibers and resins. Geopolitical tensions and supply chain disruptions could impact production costs. As a result, companies are exploring localized sourcing and recycling initiatives to mitigate risks and improve sustainability.

In conclusion, the corrugated fiberglass market is poised for robust growth by 2026, supported by strong fundamentals in construction and industrial applications. Strategic innovation, sustainability integration, and regional expansion will be critical for stakeholders aiming to capitalize on emerging opportunities in this evolving landscape.

Common Pitfalls Sourcing Corrugated Fiberglass (Quality, IP)

Sourcing corrugated fiberglass can be tricky, especially when balancing cost, performance, and legal compliance. Overlooking key quality and intellectual property (IP) factors can lead to project failures, safety hazards, and legal disputes. Below are the most common pitfalls to avoid:

Poor Material Quality and Inconsistent Specifications

One of the biggest risks is receiving substandard material that doesn’t meet technical or environmental requirements. Key issues include:

- Inconsistent Resin Content: Low resin-to-glass ratio results in brittle sheets prone to cracking and reduced UV resistance.

- Thin or Uneven Laminate: Uneven thickness compromises structural integrity and light transmission, especially under load or thermal stress.

- Poor UV Protection: Inadequate or poorly bonded UV-resistant top layer leads to rapid yellowing, brittleness, and reduced lifespan.

- Off-Brand or Recycled Materials: Suppliers may use recycled or off-spec fiberglass to cut costs, leading to unpredictable performance and shorter service life.

Always demand product certifications, third-party test reports (e.g., ASTM, ISO), and request material samples for independent evaluation.

Misrepresentation of Performance Claims

Suppliers often exaggerate performance metrics such as:

- Light Transmission: Claiming high transparency without accounting for long-term degradation due to UV exposure.

- Fire Resistance: Labeling products as “fire-retardant” without meeting recognized standards like UL 94 or ASTM E84.

- Load-Bearing Capacity: Overstating structural performance, which can lead to roof collapses or safety risks.

Verify claims with independent testing data and ensure compliance with regional building codes.

Intellectual Property (IP) Infringement

Corrugated fiberglass profiles and manufacturing processes may be protected by patents or design rights. Risks include:

- Copying Branded Profiles: Sourcing sheets that replicate patented corrugation patterns (e.g., specific wave profiles or interlocking edges) without licensing can lead to IP lawsuits.

- Use of Proprietary Resin Formulations: Some high-performance resins are trademarked or patented. Unauthorized use may violate IP rights.

- Counterfeit Products: Suppliers may falsely label generic products as equivalents to well-known brands (e.g., “like Palram” or “compatible with Suntuf”), potentially infringing trademarks.

Always conduct due diligence on supplier legitimacy and request documentation proving the product’s design freedom to operate.

Lack of Traceability and Compliance Documentation

Many suppliers, especially in global markets, fail to provide:

- Material Safety Data Sheets (MSDS/SDS)

- Certificates of Conformance (CoC)

- Test Reports for Fire, UV, and Mechanical Performance

- Origin and Chain-of-Custody Documentation

Without these, compliance with local regulations (e.g., building codes, environmental standards) becomes uncertain, and liability risks increase.

Inadequate Warranty and Support

Low-cost suppliers often offer weak or non-transferable warranties that exclude common failure modes like delamination or UV degradation. Ensure warranty terms clearly cover:

- Duration (e.g., 10-year UV protection)

- Conditions (weather, installation)

- Claim process and replacement policy

Conclusion

To mitigate these pitfalls, work with reputable suppliers, demand full technical and compliance documentation, verify patents and trademarks, and conduct sample testing before large-scale procurement. Prioritizing quality and IP compliance upfront prevents costly delays, safety issues, and legal exposure down the line.

Logistics & Compliance Guide for Corrugated Fiberglass

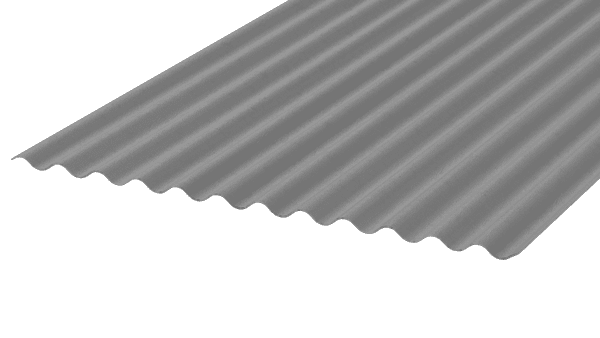

Overview of Corrugated Fiberglass

Corrugated fiberglass, also known as fiberglass-reinforced plastic (FRP) panels, is a lightweight, durable, and weather-resistant material commonly used in roofing, glazing, and industrial enclosures. Its unique physical and chemical properties necessitate specific handling, transportation, and compliance considerations throughout the supply chain.

Packaging and Handling Requirements

Proper packaging is essential to prevent damage during transit. Corrugated fiberglass sheets should be bundled securely using strapping or banding, with protective edge guards and corner protectors to prevent chipping or cracking. Sheets must be stored and handled horizontally on flat, stable surfaces to avoid warping. Workers should wear cut-resistant gloves and eye protection when handling panels due to sharp edges.

Storage Conditions

Store corrugated fiberglass in a dry, well-ventilated area, protected from direct sunlight and extreme temperatures. UV exposure over prolonged periods can degrade the material unless UV-protected coatings are applied. Panels should be kept off the ground using wooden pallets or skids and covered with opaque, breathable tarpaulins to prevent dust accumulation and moisture condensation.

Transportation Guidelines

Use enclosed or covered trailers for transportation to shield panels from weather and debris. When loaded, sheets must be secured to prevent shifting, and load overhang should comply with local road regulations. Avoid stacking heavy materials on top of fiberglass loads to prevent breakage. For international shipments, ensure packaging meets ISPM 15 standards if wooden skids are used.

Regulatory Compliance

Corrugated fiberglass generally does not fall under hazardous materials regulations (e.g., DOT, ADR, IATA) during transport, as it is non-toxic and non-flammable under normal conditions. However, manufacturers must provide a Safety Data Sheet (SDS) in accordance with OSHA’s Hazard Communication Standard (HCS) and REACH/GHS requirements in the EU, detailing handling precautions and disposal methods.

Environmental and Disposal Regulations

End-of-life corrugated fiberglass is not biodegradable and may require special handling. Incineration should be avoided due to potential release of harmful fumes. Recycling options are limited but available through specialized composite recyclers. Disposal must comply with local environmental regulations, such as EPA guidelines in the U.S. or WEEE directives in Europe, where applicable.

Import/Export Documentation

For cross-border shipments, ensure accurate Harmonized System (HS) code classification—typically under 3925.30 (plates, sheets, film, foil, strip of non-cellular plastics, reinforced) or 7019.90 (glass wool and articles thereof). Required documents include commercial invoices, packing lists, certificates of origin, and conformity assessments if entering regulated markets (e.g., CE marking in the EU).

Quality Assurance and Traceability

Maintain traceability through batch numbering and quality control documentation. Regular inspections should verify panel dimensions, UV resistance, and structural integrity prior to shipment. Compliance with ISO 9001 and product-specific standards (e.g., ASTM C444 for fiber-reinforced plastic panels) supports supply chain credibility.

Emergency Response and Incident Management

In the event of breakage or accidental release, clean up debris using mechanical means (e.g., brooms, vacuums with HEPA filters). Avoid dry sweeping to minimize airborne fibers. Personnel should wear appropriate PPE, including respirators if dust is generated. Report any significant transportation incidents per local and federal requirements.

Training and Worker Safety

Provide comprehensive training for warehouse and logistics staff on safe handling, storage, and emergency procedures. Emphasize the risks of skin and respiratory irritation from fiberglass dust and ensure access to SDS and first-aid measures. Regular safety audits help maintain compliance with OSHA, EU-OSHA, or equivalent national standards.

Conclusion for Sourcing Corrugated Fiberglass

Sourcing corrugated fiberglass requires a strategic approach that balances quality, cost, durability, and supplier reliability. As a lightweight, corrosion-resistant, and UV-stable material, corrugated fiberglass is ideal for roofing, wall cladding, and glazing applications in both industrial and residential settings. When sourcing, it is essential to partner with reputable suppliers who adhere to industry standards and provide consistent product quality.

Key considerations include evaluating the fiberglass formulation (such as UV-protected or flame-retardant variants), ensuring dimensional accuracy, and confirming compliance with local building codes. Additionally, factors such as lead times, logistics, and after-sales support play a crucial role in maintaining project timelines and minimizing disruptions.

By conducting thorough market research, requesting samples, and comparing multiple vendors, organizations can secure a reliable supply of high-performance corrugated fiberglass that meets technical requirements and offers long-term value. Ultimately, a well-informed sourcing strategy ensures durability, safety, and cost-efficiency in end-use applications.