The global coreless motor market is experiencing robust growth, driven by rising demand for high-efficiency, lightweight, and compact motor solutions across industries such as medical devices, robotics, aerospace, and consumer electronics. According to a 2023 report by Mordor Intelligence, the global coreless motor market was valued at approximately USD 2.1 billion and is projected to grow at a compound annual growth rate (CAGR) of over 7.5% from 2024 to 2029. This expansion is fueled by technological advancements in precision motion control and the increasing adoption of automation in industrial and healthcare applications. Grand View Research further supports this trend, highlighting the surge in miniaturized electromechanical systems and the critical role of coreless motors in enabling high torque-to-inertia ratios and faster response times. As innovation accelerates, a select group of manufacturers has emerged at the forefront of design, performance, and application-specific engineering—setting the standard for the next generation of motion solutions. The following eight companies represent the leading coreless motor manufacturers shaping this dynamic landscape.

Top 8 Coreless Motor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Shenzhen Power Motor Industrial Co., Ltd.

Domain Est. 2000

Website: power-motor.com

Key Highlights: Power Motor is an electric motor company that specializes in providing AC universal motors, brushed DC motors, brushless DC electric motors & gearbox motors ……

#2 Coreless Motors

Domain Est. 1998

Website: en.tricore.com.tw

Key Highlights: Coreless motors are high-performance motors that are widely used in a variety of applications, including medical devices, robotics, aerospace, and consumer ……

#3 MABUCHI MOTOR CO., LTD.

Domain Est. 2004

Website: mabuchi-motor.com

Key Highlights: We create motive power, to make the world revolve. Actuating Your Dreams MABUCHI MOTOR · PRODUCTS · PICK UP · NEWS….

#4 High Quality China Micro DC Motor Supplier Factory

Domain Est. 2006

Website: ttmotor.com

Key Highlights: We have a strong R & D team and manufacturing capabilities, with professional brush motor and brushless motor production lines….

#5 Brushless DC Motors and Drivers

Domain Est. 2008

Website: moonsindustries.com

Key Highlights: MOONS’ slotless and coreless series drive is specially developed for MOONS’ slotless and coreless series products, users can achieve fast motor drive through ……

#6 Assun Motor

Domain Est. 2012

Website: assunmotor.com

Key Highlights: Assun driving systems are designed for precision, reliability and efficiency. Our coreless systems allow for compact designs and low electricity consumption….

#7 Company Profile・Map

Domain Est. 2017

Website: cls-motor.com

Key Highlights: Development, manufacture and sales of Coreless brushless DC motors, AC servo motors, gear-in motors, IC fan motors, linear motors, small generators and their ……

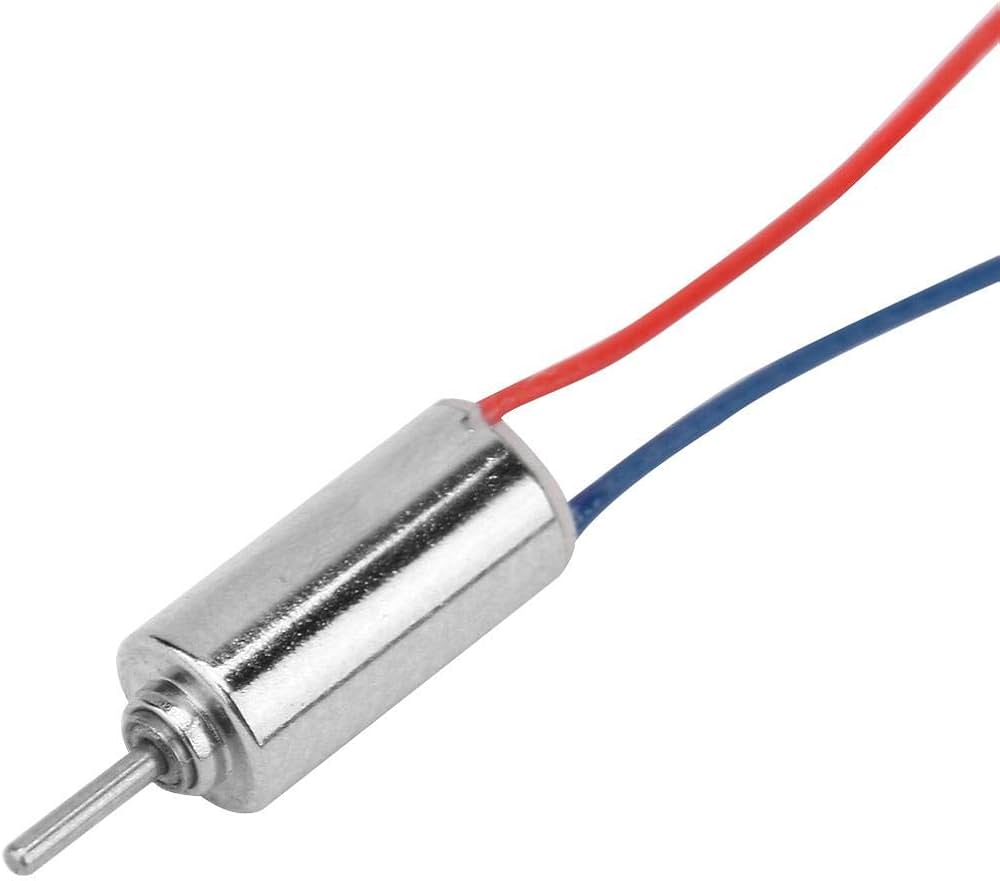

#8 Coreless Motor

Domain Est. 2019

Website: coreless-motor.com

Key Highlights: We specialize in manufacturing coreless motors hollow cup motors. Brushed motors include diameter: 12mm, 13mm, 15mm, 16mm, 17mm, 20mm, 22mm, 24mm, 25mm, 26mm ……

Expert Sourcing Insights for Coreless Motor

H2: 2026 Market Trends for Coreless Motors

The global coreless motor market is poised for significant transformation and growth by 2026, driven by technological advancements, rising demand in high-precision industries, and the increasing adoption of automation and miniaturized systems. These trends are shaping the trajectory of coreless motor applications across key sectors such as medical devices, robotics, aerospace, consumer electronics, and industrial automation.

1. Surge in Medical Device Applications

Coreless motors are becoming increasingly integral to medical technologies due to their compact size, high efficiency, and precise control. By 2026, the growing demand for minimally invasive surgical tools, wearable medical devices (e.g., insulin pumps and portable ventilators), and robotic-assisted surgery systems is expected to drive market expansion. The absence of an iron core reduces inertia and allows for faster response times—critical attributes in life-support and diagnostic equipment.

2. Growth in Robotics and Automation

The proliferation of service robots, collaborative robots (cobots), and autonomous mobile robots (AMRs) in manufacturing, logistics, and healthcare is fueling demand for coreless motors. These motors offer superior torque-to-inertia ratios and smoother operation, making them ideal for applications requiring fine motion control. By 2026, the integration of AI and IoT in smart factories is projected to accelerate the adoption of coreless motors in precision-driven robotic joints and actuators.

3. Advancements in Electric Mobility and Drones

Coreless motors are gaining traction in niche electric mobility segments, including electric scooters, personal mobility devices, and drone propulsion systems. Their lightweight construction and high power density contribute to improved energy efficiency and longer operational life. In the drone market, particularly for delivery and surveillance drones, coreless motors enhance maneuverability and battery performance—key factors in the competitive drone landscape expected to expand through 2026.

4. Miniaturization and Consumer Electronics Demand

As consumer electronics continue to trend toward smaller, lighter, and more powerful devices, coreless motors are being used in applications such as smartphone autofocus mechanisms, haptic feedback systems, and folding mechanisms in foldable devices. The push for enhanced user experience in wearables and smart home devices will further increase demand for compact, high-performance motors.

5. Technological Innovations and Material Improvements

Ongoing R&D in magnet materials (e.g., neodymium-iron-boron), winding techniques, and motor design are enhancing the efficiency and thermal performance of coreless motors. Innovations such as 3D winding and additive manufacturing are enabling more customized and optimized motor configurations. By 2026, these technological leaps are expected to reduce production costs and broaden application possibilities.

6. Regional Market Dynamics

Asia-Pacific, led by China, Japan, and South Korea, is anticipated to dominate the coreless motor market by 2026 due to robust manufacturing ecosystems and strong investments in automation and electronics. North America and Europe will remain key markets, driven by advancements in medical technology and aerospace applications. Localized production and supply chain resilience will become strategic priorities amid geopolitical and logistical uncertainties.

7. Sustainability and Energy Efficiency Regulations

Global emphasis on energy efficiency and carbon reduction is influencing motor design standards. Coreless motors, with their minimal energy loss and high efficiency, align well with regulatory trends promoting sustainable technologies. By 2026, stricter energy performance standards in industrial and consumer sectors are expected to boost the adoption of coreless motors over traditional iron-core alternatives.

Conclusion

By 2026, the coreless motor market is projected to experience robust growth, underpinned by demand for precision, efficiency, and miniaturization across high-tech industries. Companies that invest in innovation, expand into emerging applications, and adapt to regional regulatory environments will be best positioned to capitalize on these evolving market dynamics.

Common Pitfalls When Sourcing Coreless Motors (Quality, IP)

Sourcing coreless motors presents unique challenges due to their specialized construction and high-performance applications. Overlooking key aspects related to quality and intellectual property (IP) can lead to significant risks, including product failure, legal issues, and reputational damage.

Poor Quality Control and Inconsistent Performance

Coreless motors are precision components with tight tolerances. Many suppliers, especially low-cost manufacturers, lack rigorous quality control systems, leading to inconsistent performance, premature wear, or outright failure. Issues such as brush wear, coil misalignment, or imbalanced rotors can drastically reduce motor lifespan and reliability. Without proper testing and traceability, these defects may go undetected until deployment, resulting in field failures and costly recalls.

Lack of Compliance with IP and Certification Standards

A major pitfall is sourcing from suppliers who infringe on patented designs or use counterfeit components. Coreless motor technology often involves proprietary winding techniques, magnetic materials, or commutation systems protected by IP rights. Purchasing from unauthorized or unverified sources risks legal exposure and undermines innovation. Additionally, many applications require certifications (e.g., ISO, CE, RoHS), and non-compliant motors may fail regulatory scrutiny, delaying product launches or leading to market withdrawal.

Inadequate Documentation and Traceability

Reliable suppliers provide full technical documentation, test reports, and traceability for materials and manufacturing processes. However, many vendors offer minimal or falsified documentation, making it difficult to validate performance claims or troubleshoot issues. This lack of transparency complicates quality assurance and can void warranties or liability protections.

Misrepresentation of IP Ratings (Ingress Protection)

While “IP” commonly refers to intellectual property, in motor specifications, it also denotes Ingress Protection ratings (e.g., IP54, IP67). A frequent sourcing pitfall is accepting claimed IP ratings without independent verification. Some suppliers exaggerate or falsify these ratings, leading to motor failure in harsh environments due to dust or moisture ingress. Always validate IP claims through third-party testing or certified test reports.

Supply Chain Opacity and Component Sourcing

Coreless motors often use rare-earth magnets and specialized wire materials. Unethical or unverified suppliers may source materials from conflict zones or non-compliant facilities, posing ESG (Environmental, Social, and Governance) risks. Lack of supply chain transparency can also lead to counterfeit components or inconsistent material quality, impacting motor performance and longevity.

To mitigate these pitfalls, conduct thorough due diligence: audit suppliers, demand certified test data, verify IP rights and compliance, and ensure clear contractual protections for quality and intellectual property.

Logistics & Compliance Guide for Coreless Motors

Overview

Coreless motors are compact, high-efficiency electric motors commonly used in precision applications such as medical devices, robotics, drones, and consumer electronics. Due to their design and components—including rare earth magnets, copper windings, and electronic control elements—special attention must be paid to logistics handling and regulatory compliance during international shipping and distribution.

Packaging & Handling

- Anti-static Packaging: Coreless motors are sensitive to electrostatic discharge (ESD). Use conductive or static-dissipative packaging materials to prevent damage.

- Shock and Vibration Protection: Employ cushioning materials (e.g., foam inserts, bubble wrap) to protect internal components during transit.

- Moisture Control: Include desiccant packs and moisture-barrier bags if shipping to humid environments or over long durations.

- Labeling: Clearly label packages as “Fragile,” “ESD Sensitive,” and “Do Not Drop.” Include orientation arrows to prevent improper stacking.

Shipping & Transportation

- Temperature Control: Avoid exposure to extreme temperatures (>60°C or <−20°C) which can demagnetize rare earth magnets or degrade insulation.

- Air Transport Regulations: Lithium-based batteries are often used with coreless motors in integrated systems. If shipped together, comply with IATA Dangerous Goods Regulations (DGR) for lithium batteries.

- Ground & Sea Freight: Ensure compliance with IMDG Code (for sea) and ADR (for road in Europe) if motors contain hazardous components or are part of battery-powered assemblies.

- Documentation: Provide accurate commercial invoices, packing lists, and material declarations (e.g., bill of materials) for customs clearance.

Regulatory Compliance

- RoHS (EU): Ensure motors comply with Restriction of Hazardous Substances (RoHS 2 – 2011/65/EU), particularly regarding lead, cadmium, mercury, and certain flame retardants.

- REACH (EU): Declare compliance with REACH regulations, including SVHC (Substances of Very High Concern) if applicable.

- Conflict Minerals (U.S. Dodd-Frank Act): Disclose the use of tin, tantalum, tungsten, and gold (3TG) if sourced from conflict-affected regions.

- WEEE (EU): Mark products with the “crossed-out wheeled bin” symbol and ensure end-of-life take-back compliance where applicable.

- FCC/CE Marking: If the motor includes integrated electronics or generates electromagnetic interference (EMI), ensure compliance with FCC (USA) and CE-EMC directives (EU).

Export Controls

- EAR (U.S. Export Administration Regulations): Determine if coreless motors meet criteria under ECCN 3A002 (motors for guidance or control) which may require export licenses.

- ITAR (if applicable): Verify if motors are used in defense-related applications; some precision motors may fall under ITAR control.

- Dual-Use Items: Be aware that high-performance coreless motors may be classified as dual-use goods under international regimes (e.g., Wassenaar Arrangement).

Import Considerations

- HS Code Classification: Use appropriate HS codes (e.g., 8501.30 or 8501.40 for small DC motors) to determine tariffs and import requirements.

- Country-Specific Regulations: Check local requirements in destination countries (e.g., China CCC, Korea KC, India BIS) for electrical safety and EMC.

- Customs Valuation: Ensure accurate declared value to avoid delays or penalties.

Sustainability & End-of-Life

- Recycling Instructions: Provide guidance for proper disposal and recycling, especially for neodymium magnets and copper content.

- Environmental Declarations: Offer Environmental Product Declarations (EPD) or material compliance certificates (e.g., RoHS, REACH) upon request.

Summary

Proper logistics and compliance management for coreless motors ensures safe delivery, regulatory adherence, and market access. Emphasize ESD-safe handling, accurate classification, and proactive documentation to minimize risk across the supply chain.

Conclusion for Sourcing Coreless Motors

After a comprehensive evaluation of technical requirements, supplier capabilities, cost considerations, and lead times, sourcing coreless motors presents a viable and advantageous solution for applications requiring high efficiency, rapid response, compact size, and minimal inertia. The absence of an iron core reduces weight and eliminates cogging, enabling smoother operation and improved controllability—ideal for precision applications in medical devices, robotics, aerospace, and consumer electronics.

Key findings from the sourcing analysis indicate that while coreless motors may have a higher initial cost compared to traditional iron-core motors, their long-term performance benefits, energy efficiency, and reliability justify the investment. Several capable suppliers have been identified globally, offering a range of customization options, certifications, and scalable production capacity. However, due diligence is required to ensure quality consistency, adherence to technical specifications, and supply chain resilience.

In conclusion, the decision to source coreless motors should be based on a balanced approach that aligns performance needs with cost, volume requirements, and supplier reliability. Establishing strong partnerships with qualified manufacturers, along with clear communication of technical and quality expectations, will be critical to the successful integration and long-term performance of coreless motors in end-use applications.