The global copper pipe nipple market is experiencing steady growth, driven by rising demand in plumbing, HVAC, and industrial applications. According to Mordor Intelligence, the global copper pipes and tubes market was valued at USD 67.8 billion in 2023 and is projected to grow at a CAGR of 4.5% from 2024 to 2029, with copper pipe nipples representing a critical component in fluid conveyance systems. This expansion is fueled by increased infrastructure development, stringent building codes favoring corrosion-resistant materials, and the ongoing shift toward energy-efficient systems in commercial and residential construction. As demand intensifies, the competitive landscape has evolved, with manufacturers focusing on precision engineering, material quality, and compliance with ASTM and ASME standards. In this data-driven context, identifying the leading copper pipe nipple manufacturers provides key insights into innovation, reliability, and market responsiveness across global supply chains.

Top 10 Copper Pipe Nipple Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Mueller Industries

Domain Est. 1996

Website: muellerindustries.com

Key Highlights: Mueller Industries, Inc. is an industrial manufacturer that specializes in copper and copper alloy manufacturing while also producing goods made from aluminum, ……

#2 cello_index

Domain Est. 2012

Website: celloproducts.com

Key Highlights: Cello Products Inc. is the premier copper solder fittings manufacturer in North America and is one of the only cast brass fittings producers….

#3 Industrial Tubes,Industrial Pipes, Industrial Pipes and Tubes, Pipes …

Domain Est. 2002

Website: mehtatubes.com

Key Highlights: Mehta Tubes Limited is a leading manufacturer of superior copper and copper alloy tube, copper bar, copper pipe, copper rod and copper strip….

#4 Cerro Flow Products

Domain Est. 1996

Website: cerro.com

Key Highlights: Welcome to Cerro Flow Products LLC®. We manufacture world-class copper tube and supply fittings for the Plumbing, HVAC/Refrigeration, and Industrial markets….

#5 Fittings

Domain Est. 1996

Website: nibco.com

Key Highlights: We offer metal and plastic fittings for industrial, commercial, mechanical, fire protection, and residential flow-control systems….

#6 Quality Pipe Products

Domain Est. 2002

Website: qualitypipe.com

Key Highlights: Quality Pipe has one of the largest inventories of pipe nipples in the United States. Special end finishes and non-stock finishes are available….

#7 Great Lakes Copper Ltd.

Domain Est. 2010 | Founded: 1958

Website: glcopper.com

Key Highlights: Welcome to Great Lakes Copper Ltd. Manufacturing copper tube for the plumbing, refrigeration and industrial markets since 1958….

#8 Farmers Copper, LTD.: Copper Metal Supplier

Domain Est. 1998

Website: farmerscopper.com

Key Highlights: Farmers’ Copper is a certified copper metal supplier stocking not only over 40 alloys of copper, but maintaining a very diverse inventory of other metals….

#9 Streamline Your System

Domain Est. 2013

Website: muellerstreamline.com

Key Highlights: From tubing and fittings to line sets, valves, and more, trust your piping systems to the proven performance and reliability of the industry leader….

#10 NDL Industries

Domain Est. 2024

Website: ndlindustries.com

Key Highlights: NDL Industries manufactures HVAC-R, CO2 Refrigeration, and Hydronics products that exceed and outperform industry standards….

Expert Sourcing Insights for Copper Pipe Nipple

H2: Projected Market Trends for Copper Pipe Nipples in 2026

The global market for copper pipe nipples is anticipated to experience steady growth by 2026, driven by several key trends across industries and regions. As essential components in plumbing, HVAC (Heating, Ventilation, and Air Conditioning), and industrial piping systems, copper pipe nipples benefit from broader construction and infrastructure development trends. Below are the primary factors shaping the 2026 market landscape:

-

Increased Infrastructure Investment

Governments worldwide, particularly in emerging economies in Asia-Pacific, Africa, and Latin America, are prioritizing infrastructure upgrades and urbanization projects. These initiatives are boosting demand for reliable plumbing materials, with copper pipe nipples favored for their durability, corrosion resistance, and compatibility with existing systems. -

Sustainability and Green Building Standards

The growing emphasis on sustainable construction and energy efficiency is reinforcing the use of copper in building systems. Copper is 100% recyclable and contributes to LEED (Leadership in Energy and Environmental Design) certification. As green building codes become more widespread, demand for copper components—including nipples—is expected to rise. -

Growth in Residential and Commercial Construction

The housing sector, especially in countries like India, Indonesia, and the United States, is witnessing a rebound post-pandemic, with increased construction of residential and commercial properties. This growth directly translates into higher demand for plumbing fittings, including copper pipe nipples. -

Technological Advancements and Product Innovation

Manufacturers are investing in precision manufacturing and automated production to improve consistency and reduce costs. Additionally, there is a trend toward developing lead-free and low-lead copper alloys to comply with environmental regulations such as the U.S. Safe Drinking Water Act. These innovations enhance product safety and market appeal. -

Regional Market Dynamics

While North America and Europe maintain mature markets with steady replacement demand, the Asia-Pacific region—especially China and India—is expected to be the fastest-growing market due to rapid urbanization and industrial expansion. Local production and reduced import dependency are also contributing to regional market resilience. -

Fluctuating Copper Prices and Supply Chain Considerations

Copper prices remain volatile due to geopolitical factors, mining output, and global demand for electric vehicles and renewable energy systems. This volatility may impact the cost structure of copper pipe nipples, prompting some buyers to explore alternatives. However, the performance advantages of copper continue to support its market position. -

Competition from Alternative Materials

Although copper remains a preferred material in critical applications, it faces competition from plastic (e.g., PEX, CPVC) and stainless-steel fittings, especially in cost-sensitive markets. However, copper’s superior thermal conductivity, longevity, and fire resistance ensure sustained demand in high-performance sectors.

In conclusion, the copper pipe nipple market in 2026 is poised for moderate but stable growth, supported by infrastructure development, regulatory standards, and technological improvements. While challenges such as material cost fluctuations and competition exist, copper’s inherent advantages are expected to maintain its relevance in key industrial and construction applications.

Common Pitfalls When Sourcing Copper Pipe Nipples (Quality and IP)

When sourcing copper pipe nipples—short lengths of pipe with male threads on both ends—buyers often encounter challenges related to quality inconsistencies and intellectual property (IP) concerns. Being aware of these pitfalls can help ensure reliable performance and legal compliance.

Poor Material Quality and Non-Compliance

One of the most frequent issues is receiving copper pipe nipples made from substandard or non-compliant materials. Some suppliers may use recycled or off-spec copper alloys that do not meet ASTM B88 or other relevant standards for potable water systems. This can lead to premature corrosion, leaks, and contamination risks. Additionally, improper wall thickness or dimensional inaccuracies can compromise system integrity and lead to joint failures.

Inadequate Thread Quality and Dimensional Tolerances

Low-quality nipples often feature poorly cut or inconsistent threads, either too shallow or misaligned. This makes installation difficult and increases the risk of cross-threading or leaks. Non-uniform lengths or out-of-tolerance diameters can also prevent proper fitting assembly, especially in high-pressure or critical applications.

Misrepresentation of Certifications and Standards

Some suppliers falsely claim compliance with international standards such as ASTM, ASME, or NSF/ANSI 61 for drinking water. Without proper third-party certification or verifiable test reports, buyers may unknowingly install non-compliant products. Always request documentation and consider independent testing for critical projects.

Intellectual Property (IP) Infringement Risks

Sourcing from manufacturers in regions with lax IP enforcement can expose buyers to counterfeit or imitation products. These may replicate branded designs or packaging, violating trademarks or patented features. Purchasing such items—even unknowingly—can result in legal liability, supply chain disruptions, and reputational damage.

Lack of Traceability and Supplier Transparency

Many low-cost suppliers provide little to no traceability regarding raw material sources or manufacturing processes. This opacity makes it difficult to verify quality claims or respond to failures. Reputable suppliers should offer mill test reports, batch numbers, and clear documentation.

Conclusion

To avoid these pitfalls, conduct thorough due diligence on suppliers, require certified materials and test reports, and consider engaging third-party inspection services. Prioritizing quality and IP compliance not only ensures system reliability but also mitigates legal and operational risks.

Logistics & Compliance Guide for Copper Pipe Nipple

Product Overview

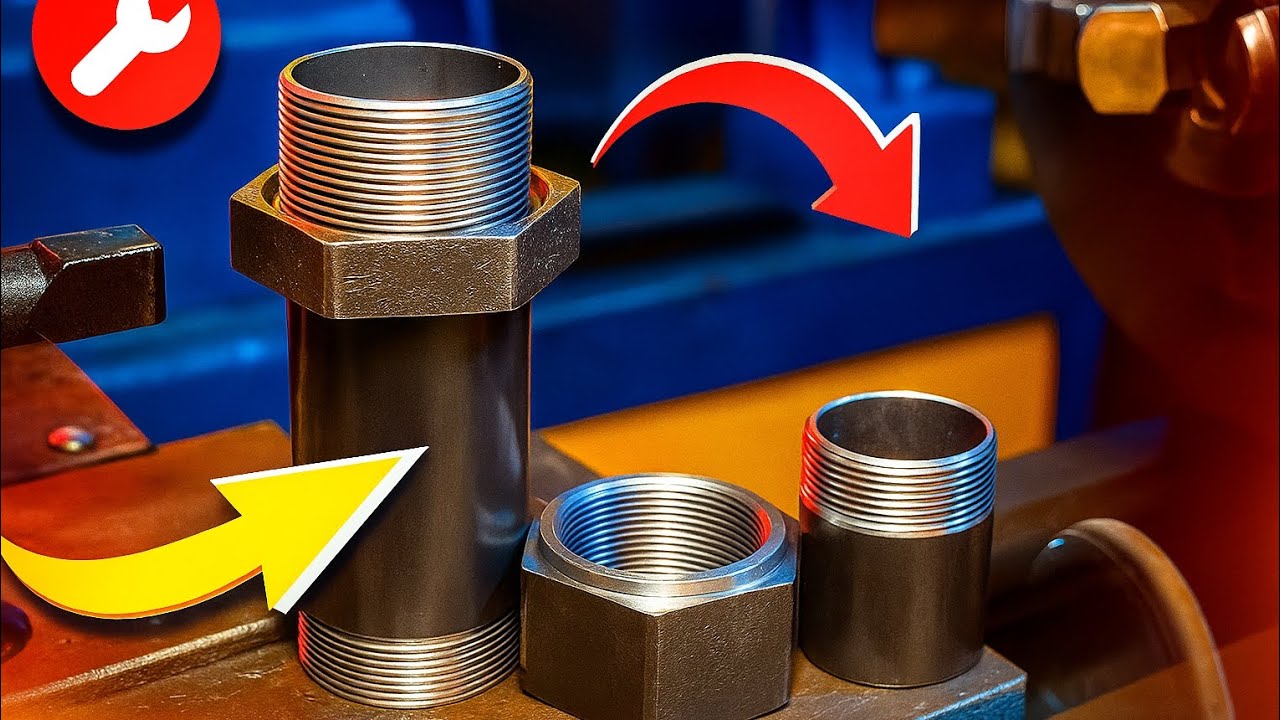

Copper pipe nipples are short sections of rigid copper tubing with male threads on both ends, used to connect pipes, fittings, or valves in plumbing, HVAC, and industrial systems. They are commonly made from ASTM B88 or ASTM B42 seamless copper tube, with standard types including Type K, L, and M, differing in wall thickness and pressure rating.

International Shipping Considerations

When shipping copper pipe nipples globally, key logistics factors include packaging, mode of transport, and customs documentation. Products should be securely bundled with protective end caps to prevent thread damage. Sea freight is typically cost-effective for bulk shipments, while air freight suits urgent, low-volume orders. Required documentation includes commercial invoices, packing lists, and bills of lading. Importers must verify Incoterms (e.g., FOB, CIF) to clarify responsibilities for shipping and insurance.

Regulatory Compliance Requirements

Copper pipe nipples must comply with regional plumbing and construction standards. In the U.S., they should meet ASTM B88 and be certified by organizations such as NSF/ANSI 61 for potable water applications. In the European Union, compliance with EN 1057 and CE marking is mandatory. Canada requires compliance with CSA B506. Always confirm country-specific standards, as some regions may require additional testing or certification for lead content and pressure ratings.

Environmental and Safety Regulations

Copper products are generally non-hazardous but are subject to environmental regulations regarding material sourcing and recyclability. The U.S. Safe Drinking Water Act limits lead content in wetted surfaces to <0.25% (lead-free standard). Manufacturers and importers must ensure compliance with RoHS (Restriction of Hazardous Substances) in applicable markets. Proper handling procedures should be followed to avoid exposure to metal dust during cutting or threading operations.

Customs Classification and Duties

Copper pipe nipples are typically classified under HS Code 7411.21 (Threaded fittings of copper) in most countries. Import duties vary by region; for example, U.S. tariffs may apply under HTSUS 7411.21.0000, while EU importers face customs duties based on CN code 7411 21 00. Accurate classification is essential to avoid delays and overpayment. Free trade agreements (e.g., USMCA, CETA) may reduce or eliminate duties for eligible shipments.

Quality Assurance and Documentation

Suppliers should provide mill test certificates, material compliance statements, and product specifications. Quality checks should include dimensional accuracy, thread integrity, and surface finish. Maintain traceability through batch/lot numbers. For regulated applications, retain documentation for audits, including conformity assessments and third-party certifications (e.g., NSF, WRAS in the UK).

Storage and Handling Recommendations

Store copper pipe nipples in a dry, indoor environment to prevent oxidation and corrosion. Use palletized stacking with protective wrapping. Avoid direct contact with dissimilar metals to prevent galvanic corrosion. During handling, use gloves to minimize surface contamination. Rotate stock using FIFO (First In, First Out) to ensure older inventory is used first.

In conclusion, sourcing copper pipe nipples requires careful consideration of quality standards, material specifications, supplier reliability, and cost-efficiency. It is essential to partner with reputable suppliers who adhere to industry standards such as ASTM B88 or ASME B16.18 to ensure durability, leak resistance, and compliance with plumbing and HVAC requirements. Evaluating factors such as lead content (e.g., compliance with lead-free regulations), dimensional accuracy, and availability of required sizes and thread types will contribute to a successful procurement process. Additionally, considering long-term supply chain stability, pricing competitiveness, and delivery timelines will help in establishing a reliable sourcing strategy. Ultimately, a well-planned approach to sourcing copper pipe nipples ensures system integrity, regulatory compliance, and operational efficiency in plumbing and industrial applications.