The global copper nickel pipe market is experiencing steady growth, driven by rising demand across marine, offshore, and desalination industries due to the material’s exceptional corrosion resistance and durability in saline environments. According to Grand View Research, the global copper alloys market—of which copper nickel pipes are a key segment—was valued at USD 24.1 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth is further supported by increasing infrastructure investments and stricter environmental regulations favoring long-life, low-maintenance materials. Additionally, Mordor Intelligence forecasts continued demand momentum, particularly in Asia-Pacific and the Middle East, where desalination plant construction and offshore energy projects are on the rise. As industries prioritize reliability and efficiency in fluid transport systems, copper nickel pipes have emerged as a critical component—spurring innovation and competition among leading manufacturers worldwide.

Top 10 Copper Nickel Pipe Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Copper

Domain Est. 2003

Website: metalsinc.com

Key Highlights: Arbor Metals TM offers a wide range of copper-nickel alloys and copper-nickel alloy products. Contact our sales team for a quote on copper-nickel alloy ……

#2 Cubex Tubings Limited

Domain Est. 2006

Website: cubextubings.com

Key Highlights: Cubex Tubings Ltd, a domestic manufacturer of copper and copper alloy products has been growing and building its business over the past 40 years….

#3 Copper Nickel Pipes Manufacturer and Supplier

Domain Est. 2007

Website: shshihang.com

Key Highlights: Shanghai Shihang is a leading copper nickel pipes and fittings manufacturer and supplier for its valued clients. Copper nickel pipes also named as cupro nickel ……

#4 SMI Copper

Domain Est. 2011

Website: smicopper.com

Key Highlights: We are one of the largest manufacturer, exporter & supplier of a wide range of Copper & Copper Nickel based alloys in various forms in a semi finished or ……

#5 Sunflex Metal Industries

Domain Est. 2018

Website: sunflexmetal.net

Key Highlights: Sunflex Metal Industries is a Leading Manufacturer of Copper,Copper Nickel & Brass in the form of Pipe Fittings, Pipes & Tubes, Sheets & Plates, Flanges, Round ……

#6 Copper

Domain Est. 1995

Website: copper.org

Key Highlights: Copper-nickel alloys are available in a wide variety of product forms and fittings. The ductilities of the alloys ensure that they can be readily fabricated….

#7 Copper Nickel Pipe

Domain Est. 1998

Website: farmerscopper.com

Key Highlights: Farmer’s Copper Ltd. maintains a broad inventory of Copper Nickel, also known as cupro nickel, C70600 (90/10) and C71500 (70/30) in pipe form….

#8 copper

Domain Est. 1999

Website: alaskancopper.com

Key Highlights: Alaskan Copper & Brass Company is a distributor of aluminum, stainless steel, copper, copper nickel, brass bronze, and other corrosion-resistant alloys….

#9 C70600 Copper Nickel Tube & Pipe Supplier

Domain Est. 2001

Website: hillmanbrass.com

Key Highlights: C70600 90/10 Copper-Nickel (also known as CuproNickel) is an alloy with 90% copper and 10% Nickel. C70600 90/10 is known for its good bending characteristics….

#10 SitindustrieMarine Copper nickel pipes and fitting packages for …

Domain Est. 2004

Website: sitindustriemarine.com

Key Highlights: Seamless and welded copper nickel butt weld fittings. Plants work under the ISO 9001:2015 system certified by TUV SAARLAND…

Expert Sourcing Insights for Copper Nickel Pipe

H2: Projected Market Trends for Copper Nickel Pipe in 2026

The global copper nickel (Cu-Ni) pipe market is poised for strategic growth and transformation by 2026, driven by rising industrial demand, sustainability imperatives, and advancements in marine and offshore technologies. This analysis outlines key trends expected to shape the market in the coming years.

1. Increasing Demand in Marine and Offshore Applications

Copper nickel pipes—particularly alloys such as 90/10 (Cu-10Ni) and 70/30 (Cu-30Ni)—are highly valued for their excellent resistance to seawater corrosion, biofouling, and high-pressure environments. By 2026, the expansion of offshore oil & gas platforms, subsea infrastructure, and desalination plants—especially in regions like the Middle East, Southeast Asia, and West Africa—is expected to significantly boost demand. Additionally, growing investments in offshore wind farms will drive the need for reliable piping systems in cooling and hydraulic applications, further supporting market growth.

2. Growth in Water Desalination Projects

With increasing water scarcity concerns globally, desalination capacity is expanding rapidly. Copper nickel pipes are a preferred material in seawater reverse osmosis (SWRO) plants due to their durability and resistance to pitting and crevice corrosion. Countries such as Saudi Arabia, UAE, and Australia are investing heavily in new desalination facilities, which will directly influence demand for Cu-Ni piping systems through 2026.

3. Sustainability and Green Infrastructure Initiatives

Environmental regulations and the shift toward sustainable infrastructure are favoring materials with long service life and recyclability. Copper nickel pipes, being fully recyclable and energy-efficient over their lifecycle, align well with green building standards and ESG (Environmental, Social, and Governance) goals. This trend is expected to increase adoption in eco-conscious industrial and municipal projects.

4. Supply Chain and Raw Material Volatility

Copper and nickel prices remain subject to geopolitical tensions, mining output fluctuations, and demand from electric vehicle (EV) batteries (especially for nickel). By 2026, manufacturers may face cost volatility, prompting greater interest in alternative alloys, material optimization, and recycling programs to mitigate input cost risks.

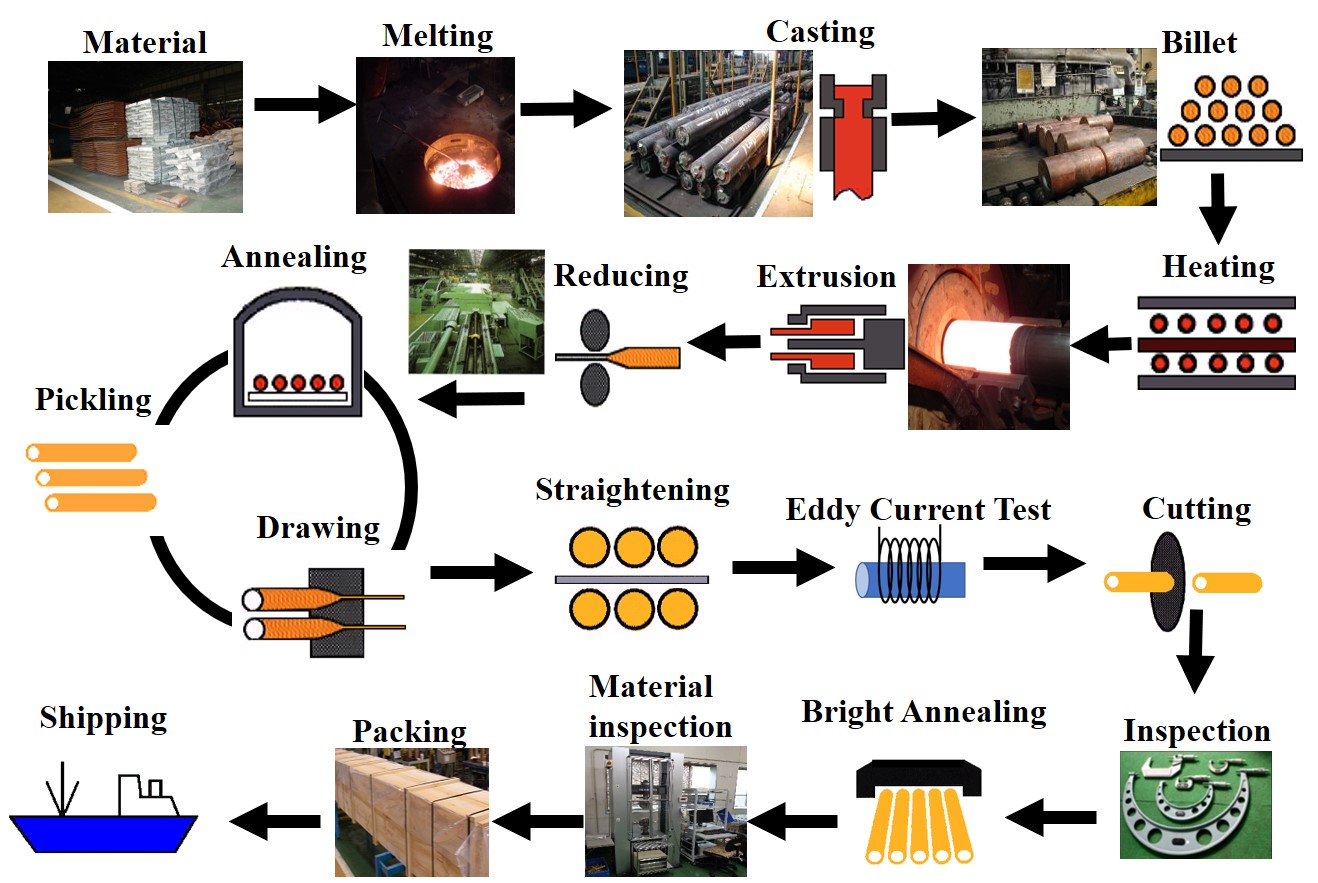

5. Technological Advancements and Product Innovation

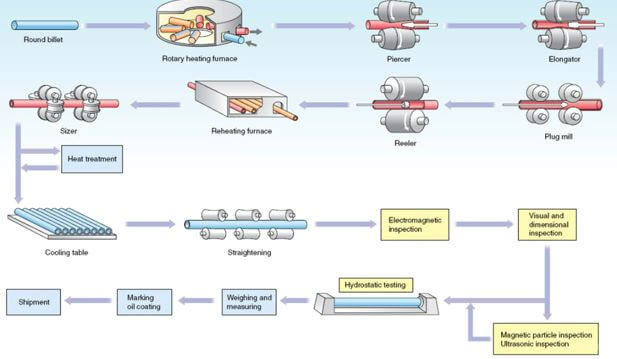

Manufacturers are investing in advanced manufacturing techniques such as precision extrusion and automated welding to improve the performance and consistency of Cu-Ni pipes. Additionally, research into hybrid coatings and nano-enhanced surfaces could extend service life and reduce maintenance costs, particularly in aggressive environments.

6. Regional Market Dynamics

Asia-Pacific is expected to dominate the Cu-Ni pipe market by 2026, led by China, India, and South Korea, due to rapid industrialization and infrastructure development. Europe will maintain steady demand, supported by aging infrastructure upgrades and offshore renewable projects. The Americas, particularly Brazil and the U.S., will see growth in offshore oil & gas and desalination sectors.

7. Competitive Landscape and Strategic Alliances

The market is becoming increasingly competitive, with key players such as Wieland, Outokumpu, Sandvik, and Mega Tubes focusing on expanding production capacity, geographic reach, and technical support services. Strategic partnerships with engineering firms and EPC (Engineering, Procurement, and Construction) contractors are expected to grow, ensuring integration of Cu-Ni solutions early in project design phases.

Conclusion

By 2026, the copper nickel pipe market will be shaped by resilient demand in marine, energy, and water treatment sectors, tempered by material cost challenges and sustainability pressures. Companies that innovate in product performance, supply chain resilience, and environmental stewardship are likely to gain a competitive edge in this specialized but vital segment of the industrial piping market.

Common Pitfalls Sourcing Copper Nickel Pipe (Quality, IP)

Sourcing Copper Nickel (Cu-Ni) pipe requires careful attention to ensure material integrity, compliance, and long-term performance—especially in demanding applications like marine, offshore, and chemical processing. Overlooking key aspects can lead to premature failure, safety hazards, and costly replacements. Below are critical pitfalls to avoid, focusing on quality and international standards (IP).

Inadequate Material Certification and Traceability

One of the most significant risks is accepting pipes without proper documentation. Reputable suppliers must provide Mill Test Certificates (MTCs) compliant with ISO 10456 or ASTM B466/B467 (for seamless and welded Cu-Ni pipes). These certificates should confirm chemical composition, mechanical properties, and heat treatment. Lack of traceability (heat number, batch details) makes it impossible to verify authenticity or investigate failures, potentially compromising project integrity.

Non-Compliance with International Standards (IP)

Procuring pipes that don’t meet recognized international standards (IP) is a major pitfall. Using substandard or non-compliant materials—such as those conforming only to vague or obsolete specifications—can result in poor corrosion resistance and mechanical strength. Ensure compliance with:

– ASTM B466 (Seamless Copper-Nickel Pipe, 90/10 or 70/30)

– ASTM B467 (Welded Copper-Nickel Pipe)

– EN 12451 (European standard for CuNi 90/10 and 70/30 tubes)

Pipes not meeting these standards may fail under high chloride or high-velocity conditions typical in seawater systems.

Poor Quality Control in Manufacturing

Low-quality manufacturing processes can introduce defects such as:

– Inconsistent wall thickness

– Surface cracks, pitting, or inclusions

– Poor weld integrity (for welded pipes)

These flaws compromise pressure ratings and corrosion resistance. Always verify that the manufacturer follows ISO 9001 quality management systems and conducts non-destructive testing (NDT) like hydrostatic testing, eddy current, or ultrasonic inspection.

Incorrect Alloy Selection

Mistaking 90/10 Cu-Ni for 70/30 Cu-Ni (or vice versa) based on cost or availability can lead to performance issues. While both offer excellent seawater resistance, 70/30 Cu-Ni provides superior strength and erosion resistance in high-velocity flows. Using the wrong alloy may result in accelerated erosion-corrosion, especially in piping systems with pumps or sharp bends.

Inadequate Surface Finish and Cleanliness

Contaminated or poorly finished surfaces reduce corrosion resistance. Pipes should be free of oil, grease, scale, and iron particles (which can cause galvanic corrosion). Ensure the supplier provides cleaned and passivated pipes, particularly critical in oxygenated seawater applications where biofouling and microbiologically influenced corrosion (MIC) are concerns.

Ignoring Supply Chain Risks

Sourcing from unreliable or uncertified suppliers increases the risk of counterfeit or reworked material. Always audit suppliers, verify their certifications, and consider third-party inspection (e.g., SGS, BV) before shipment. Unethical practices such as relabeling lower-grade materials can undermine system reliability.

Failure to Specify Required Testing

Never assume standard testing is sufficient. Clearly specify required tests in procurement documents:

– Hydrostatic pressure testing per ASTM E213

– Eddy current or ultrasonic testing for flaws

– Intergranular corrosion testing (e.g., ASTM G28 for Cu-Ni alloys)

Omitting these requirements may result in undetected defects that manifest in service.

By proactively addressing these pitfalls—ensuring compliance with international standards, verifying quality documentation, and selecting the correct alloy with robust testing—you can secure reliable, long-lasting Copper Nickel piping systems.

H2: Logistics & Compliance Guide for Copper Nickel Pipe

Copper nickel (Cu-Ni) pipes are widely used in marine, offshore, desalination, and chemical processing industries due to their excellent corrosion resistance, particularly in seawater environments. Proper logistics and compliance management are essential to ensure the safe, efficient, and legally compliant transportation, storage, and use of copper nickel pipes. This guide outlines key considerations across the supply chain.

H2: 1. Packaging and Handling Requirements

- Protective Packaging: Copper nickel pipes must be protected against mechanical damage, corrosion, and contamination. Use waterproof wrapping, plastic end caps, and wooden cradles to prevent dents and scratches.

- Coil or Straight Pipe Handling: For coiled pipes, ensure proper spooling and strapping. For straight lengths, use padded supports and avoid direct ground contact.

- Lifting Procedures: Use slings or lifting clamps designed for piping; avoid using chains or cables that can damage the surface.

- Labeling: Clearly label each bundle or package with product specifications, alloy type (e.g., 90/10 or 70/30 Cu-Ni), dimensions, heat number, and handling instructions.

H2: 2. Transportation Logistics

- Mode of Transport: Suitable for road, rail, sea, and air freight. Sea freight is common for international shipments; ensure containers are sealed and moisture-controlled.

- Marine Transport Precautions: Avoid prolonged exposure to saltwater spray. Use desiccants and vapor corrosion inhibitors (VCIs) inside containers.

- Stacking Limits: Adhere to manufacturer stacking guidelines to avoid deformation. Never exceed load limits on transport vehicles.

- Temperature & Humidity: Maintain stable conditions; high humidity can promote surface oxidation, especially if protective coatings are compromised.

H2: 3. Storage and Inventory Management

- Indoor Storage: Store in a dry, well-ventilated warehouse. If outdoor storage is unavoidable, elevate pipes off the ground and cover with UV-resistant, breathable tarpaulins.

- Segregation: Keep copper nickel pipes separate from carbon steel or other metals to prevent galvanic corrosion.

- Inventory Tracking: Use barcode or RFID systems to track heat numbers, certifications, and expiry dates of protective coatings.

H2: 4. Regulatory and Compliance Standards

- Material Certification: Ensure pipes are supplied with Mill Test Certificates (MTCs) compliant with standards such as:

- ASTM B466 (Seamless Copper-Nickel Pipe)

- ASTM B467 (Welded Copper-Nickel Pipe)

- EN 12451 (European standard for CuNi 90/10 and 70/30 tubes)

- REACH & RoHS Compliance: Confirm that the alloy composition complies with EU regulations regarding hazardous substances.

- Customs Documentation: Provide accurate Harmonized System (HS) codes (e.g., 7411.10 for copper nickel pipes) and import/export licenses where required.

- Country-Specific Regulations: Comply with local building codes, pressure vessel regulations (e.g., ASME B31.3), and marine classification society rules (e.g., DNV, ABS, LR).

H2: 5. Environmental, Health, and Safety (EHS) Considerations

- Dust & Fumes: During cutting or welding, use local exhaust ventilation and PPE (respirators, gloves, goggles) to protect against copper fumes.

- Waste Management: Recycle swarf and offcuts through certified metal recyclers; do not dispose of in general waste.

- Spill Control: In case of oil or protective coating leaks, follow spill response protocols to prevent soil/water contamination.

H2: 6. Quality Assurance and Inspection

- Pre-Shipment Inspection: Conduct dimensional checks, visual inspection, and non-destructive testing (e.g., eddy current, hydrostatic testing) as per purchase specifications.

- Third-Party Verification: Engage independent inspectors (e.g., SGS, Bureau Veritas) for high-value or critical applications.

- Traceability: Maintain full documentation from raw material to final product for audit and compliance purposes.

H2: 7. Import/Export and Trade Compliance

- Export Controls: Verify if copper nickel pipes are subject to dual-use regulations, especially for defense or nuclear applications.

- Sanctions Screening: Confirm that end-users and destinations are not under international trade sanctions.

- Incoterms Clarity: Clearly define responsibilities using standard Incoterms (e.g., FOB, CIF, DDP) in contracts.

H2: Conclusion

Effective logistics and compliance for copper nickel pipe require coordination across packaging, transport, storage, and regulatory domains. Adherence to international standards, proper documentation, and proactive risk management ensure timely delivery, regulatory approval, and end-user satisfaction. Always consult with material suppliers, freight specialists, and compliance officers to align with evolving global requirements.

Conclusion for Sourcing Copper Nickel Pipe

In conclusion, sourcing copper-nickel pipes requires a strategic approach that balances quality, cost, reliability, and compliance with industry standards. Copper-nickel alloys, particularly C70600 (90/10) and C71500 (70/30), are highly valued for their excellent resistance to corrosion, particularly in marine and seawater applications, making them essential in industries such as offshore, desalination, power generation, and shipbuilding.

When sourcing these materials, it is crucial to partner with reputable suppliers or manufacturers who adhere to international standards such as ASTM B466, ASME SB466, or equivalent specifications. Key considerations include material certification, mechanical and chemical properties, dimensional accuracy, and traceability. Additionally, lead times, logistical capabilities, and technical support should be evaluated to ensure seamless project integration.

While copper-nickel pipes may have a higher initial cost compared to other materials, their long-term durability, low maintenance requirements, and resistance to biofouling often result in lower total cost of ownership. Therefore, prioritizing quality and supplier credibility over short-term savings is essential for optimal performance and system longevity.

In summary, a well-structured sourcing strategy—grounded in technical requirements, supplier vetting, and lifecycle value—will ensure the reliable and efficient procurement of copper-nickel pipes for critical engineering applications.