The global copper metal sheeting market is experiencing steady expansion, driven by rising demand across construction, electrical, HVAC, and renewable energy sectors. According to Grand View Research, the global copper market was valued at USD 156.7 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth is fueled by copper’s unmatched thermal and electrical conductivity, corrosion resistance, and recyclability, making copper sheeting a critical material in sustainable infrastructure and industrial applications. Additionally, Mordor Intelligence projects increasing adoption of copper in photovoltaic systems and electric vehicle manufacturing, further amplifying demand for high-quality copper sheet products. As industries prioritize performance and durability, selecting reliable manufacturers becomes crucial. Below is a data-informed overview of the top 10 copper metal sheeting manufacturers leading innovation, scalability, and global supply.

Top 10 Copper Metal Sheeting Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Copperweld

Domain Est. 1998

Website: copperweld.com

Key Highlights: Copperweld is a bimetallic manufacturer specializing in power and grounding conductors for building construction, power grid, utilities, communications and ……

#2 Quality Copper and Brass Sheet Manufacturer

Domain Est. 1999

Website: thinmetalsales.com

Key Highlights: Thin Metal Sales is a copper and brass sheet supplier with many decades of experience providing high-quality materials for a range of manufacturing needs….

#3 Copper Metal Roofing & Siding

Domain Est. 2007

Website: copperroofingsupply.com

Key Highlights: We manufacturer copper siding and roofing panels. Whether you’re designing a timeless architectural masterpiece or enhancing your home’s curb appeal….

#4 Aviva Metals

Domain Est. 2017

Website: avivametals.com

Key Highlights: Aviva Metals is the leading manufacturer of bronze, brass & copper alloys. We keep a ready stock of of these metals in a variety of shapes & sizes….

#5 Copper Sheets

Domain Est. 1995

Website: kme.com

Key Highlights: KME offers sheets, plates and discs in a wide range of dimensions. Our copper piece-sheets and plates are manufactured entirely in-house, from casting all ……

#6 Farmers Copper, LTD.: Copper Metal Supplier

Domain Est. 1998

Website: farmerscopper.com

Key Highlights: Farmers’ Copper is a certified copper metal supplier stocking not only over 40 alloys of copper, but maintaining a very diverse inventory of other metals….

#7 Superior Non-Ferrous Metals Supplier

Domain Est. 1998

Website: southerncopper.com

Key Highlights: Welcome to Southern Copper, your premier distributor of raw non-ferrous metals. Our extensive product range includes high-quality copper sheets, plates, rods, ……

#8 Copper sheets

Domain Est. 1999

Website: coppermetal.com.br

Key Highlights: Coppermetal has a wide variety of sheets, bars, pipes and other solutions in metals so that your company’s production never stops. Check out our catalogs ……

#9 Copper Sheet and Plate Supplier and Distributor

Domain Est. 1999

Website: industrialmetalsupply.com

Key Highlights: Copper sheets and plates feature many unique properties, including excellent dimensional control and high crack resistance for a wide range of applications….

#10 Copper and Copper Alloys Metal Supplier

Domain Est. 2013

Website: thyssenkrupp-materials-na.com

Key Highlights: thyssenkrupp Materials NA is a leading supplier of copper metal products. We offer copper in a range of sizes and tempers, including wire, round bar, tube, ……

Expert Sourcing Insights for Copper Metal Sheeting

H2 2026 Market Trends Analysis: Copper Metal Sheeting

The global copper metal sheeting market in H2 2026 is poised for sustained growth, driven by robust demand across key end-use sectors, evolving supply dynamics, and accelerating technological and regulatory shifts. While facing persistent challenges related to raw material costs and supply chain resilience, the market is adapting through innovation and strategic sourcing.

1. Demand Drivers: Electrification & Sustainable Construction Lead Growth

* Electrification Boom: The dominant driver remains the global push towards electrification. Demand for high-conductivity copper sheeting in electric vehicles (EVs – battery packs, busbars, motors), renewable energy infrastructure (solar panel frames, inverter components, wind turbine generators), and grid modernization (transformers, switchgear) is exceptionally strong. H2 2026 will see continued ramp-up in EV production and renewable installations, particularly in Asia-Pacific (China, India) and Europe, directly boosting sheeting demand.

* Green Building & Architecture: Sustainability regulations (e.g., stricter building codes, ESG mandates) are significantly increasing demand for copper in construction. Its durability, recyclability (near 100%), and natural antimicrobial properties make copper sheeting highly desirable for roofing, cladding, and interior applications in high-performance, sustainable buildings. The aesthetic appeal of patinated copper continues to drive premium architectural projects.

* Industrial & HVAC Expansion: Steady growth in manufacturing, data centers (requiring efficient cooling), and commercial HVAC systems (heat exchangers, ductwork) provides a stable base demand for copper sheeting, particularly in emerging economies undergoing industrialization.

2. Supply & Cost Dynamics: Volatility Persists, Recycling Gains Prominence

* Copper Price Volatility: Prices are expected to remain elevated and volatile in H2 2026. Key factors include constrained mine supply growth (due to project delays, permitting challenges, and declining ore grades), strong industrial demand, and the impact of global monetary policy and geopolitical risks (e.g., supply chain disruptions, trade tensions). This volatility directly impacts sheeting manufacturing costs and pricing strategies.

* Supply Chain Resilience Focus: Manufacturers are actively diversifying sources of refined copper and investing in securing long-term supply contracts to mitigate risk. Nearshoring and regionalization trends continue, particularly in North America and Europe, driven by supply chain security concerns and potential incentives (e.g., US Inflation Reduction Act).

* Recycled Copper Importance: The use of secondary (recycled) copper in sheeting production is increasing significantly. This is driven by cost advantages (often lower than primary copper after processing), lower carbon footprint (crucial for ESG reporting), and growing customer demand for sustainable materials. H2 2026 will see enhanced recycling infrastructure and technology adoption to meet quality standards for sheeting applications.

3. Technological & Competitive Trends: Innovation and Differentiation

* Value-Added Processing: Competition is intensifying beyond commodity pricing. Leading producers are investing in advanced rolling, finishing (e.g., specialized textures, coatings for enhanced corrosion resistance or specific aesthetics), and precision cutting technologies to offer differentiated, higher-margin products tailored to specific applications (e.g., ultra-thin sheets for electronics, pre-patinated architectural sheets).

* Sustainability as a Core Competency: Environmental credentials are becoming a key differentiator. Producers are investing in:

* Low-Carbon Production: Transitioning to renewable energy for smelting and rolling operations.

* Transparency: Providing detailed Environmental Product Declarations (EPDs) and supply chain traceability.

* Circular Economy Models: Designing for recyclability and offering take-back programs.

* Digitalization: Increased use of digital platforms for supply chain management, demand forecasting, and customer interaction (e.g., online configurators for architectural projects).

4. Regional Outlook:

* Asia-Pacific: Remains the largest market, driven by China’s manufacturing base, infrastructure development, and EV production, alongside rapid growth in India and Southeast Asia. Intense competition but significant volume potential.

* North America: Strong growth driven by EV, renewable energy, and infrastructure investment (IRA). Focus on nearshoring and supply chain security. Demand for sustainable building materials is robust.

* Europe: Driven by stringent green building regulations, renewable energy targets, and industrial modernization. High focus on sustainability and recycled content. Potential for growth in retrofitting and renovation.

* Rest of World: Steady growth in Latin America (mining, construction) and the Middle East (mega-projects, cooling demands), though potentially more sensitive to commodity price swings.

Key Challenges for H2 2026:

* Persistent Cost Pressure: Fluctuating copper prices and energy costs squeeze margins, requiring efficient operations and strategic pricing.

* Supply Chain Disruptions: Geopolitical instability, logistical bottlenecks, and extreme weather events remain risks.

* Competition from Substitutes: While limited for core conductivity applications, aluminum and composites compete in some architectural and non-critical structural roles, particularly where weight or cost is paramount.

* Regulatory Compliance: Navigating increasingly complex environmental, safety, and trade regulations across different regions.

Conclusion:

H2 2026 presents a dynamic landscape for the copper metal sheeting market. While cost and supply chain challenges persist, the fundamental demand drivers – particularly electrification and sustainable construction – are powerful and structural. Success will favor producers who can secure reliable, cost-effective copper supply (leveraging recycling), invest in value-added processing and sustainability credentials, navigate regional complexities, and build resilient supply chains. The market is moving beyond a commodity play towards one where innovation, sustainability, and customer-specific solutions determine competitive advantage.

Common Pitfalls When Sourcing Copper Metal Sheeting (Quality, IP)

Sourcing copper metal sheeting involves navigating several potential challenges related to material quality and intellectual property (IP) concerns. Avoiding these pitfalls is essential for ensuring product performance, compliance, and supply chain integrity.

Inadequate Verification of Material Quality

One of the most frequent issues is assuming supplier-provided specifications without independent verification. Buyers may receive material that falls short in purity (e.g., less than 99.9% Cu), mechanical properties, or surface finish. This can lead to premature corrosion, poor conductivity, or difficulties in fabrication. Always request certified mill test reports (MTRs) and consider third-party lab testing for critical applications.

Misunderstanding Copper Grades and Standards

Copper sheeting comes in various grades (e.g., C11000 – electrolytic tough pitch, C10100 – oxygen-free electronic) with distinct properties. Sourcing the wrong grade due to unfamiliarity with ASTM, ISO, or EN standards can result in performance failures. Ensure clear specification of required standards (e.g., ASTM B152) and confirm grade compatibility with the intended application.

Overlooking Surface Finish and Tolerances

Surface imperfections such as scratches, pits, or oxide discoloration can impact both aesthetic and functional performance—especially in architectural or electronic applications. Similarly, failing to define thickness, flatness, and dimensional tolerances can lead to fit and manufacturing issues. Clearly define surface requirements (e.g., ASTM B706) and tolerance classes in purchase agreements.

Supply Chain Transparency and Material Origin

Opaque supply chains increase the risk of receiving recycled or substandard copper that doesn’t meet specifications. Unverified sources may also involve unethical mining practices or conflict materials. Demand full material traceability and prefer suppliers with documented chain-of-custody practices and certifications (e.g., LME-approved, conflict-free sourcing).

Intellectual Property Infringement Risks

When sourcing custom-rolled, patterned, or coated copper sheeting (e.g., architectural designs, patented antimicrobial treatments), there is a risk of inadvertently using IP-protected processes or designs. Using such materials without proper licensing can expose the buyer to legal action. Conduct due diligence on proprietary finishes or patterns and obtain written confirmation of IP compliance from suppliers.

Inconsistent Coating or Treatment Application

For sheeting with protective or functional coatings (e.g., lacquers, anti-tarnish, or hydrophobic treatments), uneven or poorly adhered coatings can compromise performance. Variability between batches is common with unqualified suppliers. Require detailed specifications for coating weight, adhesion testing (e.g., ASTM D3359), and batch consistency guarantees.

Failure to Audit Suppliers and Production Facilities

Relying solely on documentation without on-site audits increases the risk of non-compliance. Some suppliers may outsource production to unvetted mills, leading to quality deviations. Conduct supplier audits to verify manufacturing processes, quality control systems, and adherence to environmental and safety standards.

Addressing these pitfalls through rigorous specifications, supplier vetting, and quality assurance protocols ensures reliable sourcing of copper metal sheeting that meets both technical and legal requirements.

Logistics & Compliance Guide for Copper Metal Sheeting

Overview

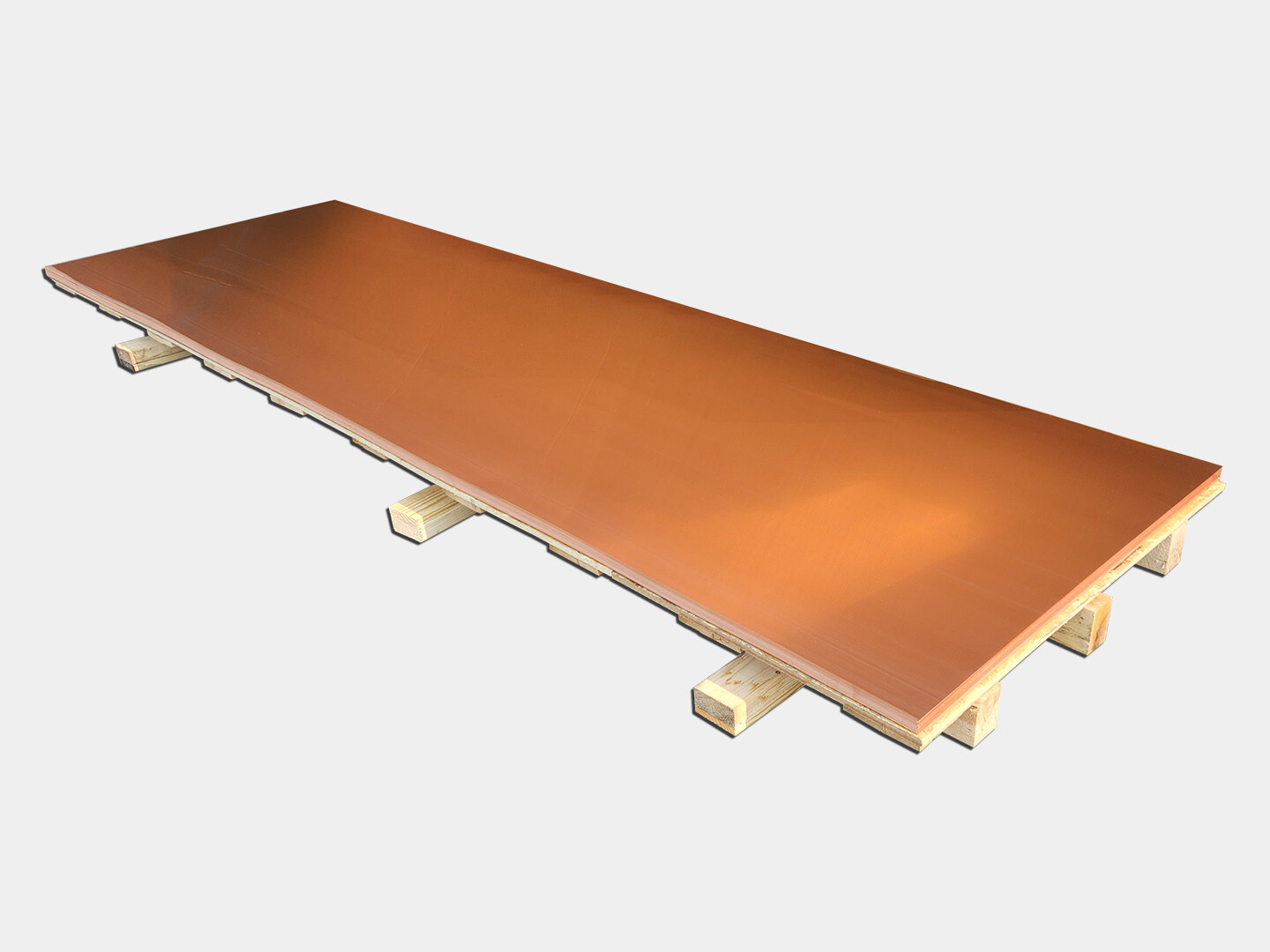

Copper metal sheeting is widely used in construction, roofing, electrical applications, and decorative design due to its durability, conductivity, and aesthetic appeal. Proper logistics and compliance management are essential to ensure safe handling, regulatory adherence, and timely delivery. This guide outlines key considerations for transporting and managing copper sheeting in accordance with international, national, and industry standards.

Classification and Identification

Copper metal sheeting is typically categorized under HS Code 7409 (Flat-rolled products of copper, of a thickness exceeding 0.15 mm). Accurate classification ensures correct customs declaration and tariff application. Ensure product specifications—including alloy composition, thickness, width, temper, and finish—are documented to meet import/export requirements.

Packaging and Handling

Copper sheets must be packaged to prevent scratching, oxidation, and physical damage. Standard practices include:

– Wrapping in moisture-resistant paper or plastic film

– Use of wooden pallets or cradles for structural support

– Separation between sheets with interleaving paper or foam

– Secure strapping to prevent shifting during transit

Handle with clean gloves to avoid surface contamination. Avoid dragging or dropping to prevent edge deformation.

Transportation Requirements

Copper sheeting can be shipped by sea, air, or land. Key considerations include:

– Marine shipping: Use dry, ventilated containers; avoid exposure to saltwater or high humidity

– Overland transport: Cover with waterproof tarps; secure loads to prevent movement

– Air freight: Limited due to weight; typically reserved for urgent, high-value shipments

Ensure vehicles and containers are free from corrosive residues or contaminants.

Storage Conditions

Store copper sheets in a dry, indoor environment with controlled humidity to prevent tarnishing. Elevate pallets off the floor and away from direct contact with concrete. Avoid storage near galvanized or aluminum materials to prevent galvanic corrosion. Rotate stock using FIFO (First In, First Out) principles.

Regulatory Compliance

Compliance with environmental, safety, and trade regulations is critical:

– REACH (EU): Ensure no restricted substances are present in coatings or alloys

– RoHS (EU): Applies if copper is used in electrical/electronic components

– TSCA (USA): Confirm compliance with chemical substance regulations

– Customs Documentation: Provide commercial invoices, packing lists, certificates of origin, and material test reports (MTRs) as needed

Export Controls and Duties

Copper may be subject to export controls or tariffs depending on destination:

– Monitor U.S. Bureau of Industry and Security (BIS) and EU export regulations

– Some countries impose export taxes or require licenses for raw copper

– Free Trade Agreements (e.g., USMCA, EU-UK) may reduce duties—verify origin criteria

Environmental and Safety Considerations

- Copper is recyclable and generally non-hazardous, but machining generates combustible dust—follow OSHA or local safety standards

- Waste oils or coatings on recycled copper may be regulated—classify waste properly

- Use SDS (Safety Data Sheets) for any surface treatments or protective coatings applied

Documentation and Traceability

Maintain traceability from mill to end-user:

– Include heat/lot numbers on shipping documents

– Retain material test reports verifying chemical and mechanical properties

– Use barcodes or RFID tags for inventory tracking when possible

Inspection and Quality Assurance

Conduct pre-shipment inspections to verify:

– Dimensions and tolerances

– Surface quality (free from cracks, dents, or oxidation)

– Compliance with ASTM B370 (Standard Specification for Copper Sheet and Strip for Building Construction) or other relevant standards

Risk Mitigation

- Insure shipments against theft, damage, and delay

- Partner with logistics providers experienced in metal handling

- Monitor geopolitical and market factors affecting copper pricing and availability

Conclusion

Effective logistics and compliance for copper metal sheeting require attention to detail in packaging, documentation, and regulatory adherence. By following this guide, businesses can ensure safe, efficient, and lawful movement of copper products across global supply chains.

In conclusion, sourcing copper metal sheeting requires careful consideration of several key factors including material grade, thickness, dimensions, supplier reliability, cost, and intended application. Whether for architectural, electrical, industrial, or artistic purposes, ensuring the copper meets industry standards (such as ASTM B152) is essential for performance and longevity. Evaluating both domestic and international suppliers can offer competitive pricing and availability, while maintaining strong quality control and ethical sourcing practices. Additionally, factoring in lead times, shipping logistics, and environmental sustainability contributes to a more efficient and responsible procurement process. Ultimately, a well-informed sourcing strategy ensures access to high-quality copper sheeting that meets technical requirements and supports project success.