The global copper clad laminate (CCL) market is experiencing robust growth, driven by rising demand for printed circuit boards (PCBs) across electronics, automotive, telecommunications, and consumer goods industries. According to a report by Grand View Research, the global copper clad laminate market size was valued at USD 13.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This growth is fueled by increasing adoption of high-frequency and high-speed materials in 5G infrastructure, electric vehicles, and advanced computing systems. Additionally, Mordor Intelligence projects steady market expansion, underpinned by technological advancements and regional manufacturing shifts toward Asia-Pacific, particularly China and Taiwan, which dominate both production and consumption. As demand for miniaturized, high-performance electronics intensifies, the role of leading CCL manufacturers in innovating thermally efficient, low-loss materials becomes increasingly critical. The following list highlights the top nine copper clad laminate manufacturers shaping the industry through scale, R&D investment, and strategic market positioning.

Top 9 Copper Clad Laminates Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Isola Group: Copper

Domain Est. 1999

Website: isola-group.com

Key Highlights: We specialize in creating laminate and prepreg materials for the kind of technology that all of us use every day, all over the world….

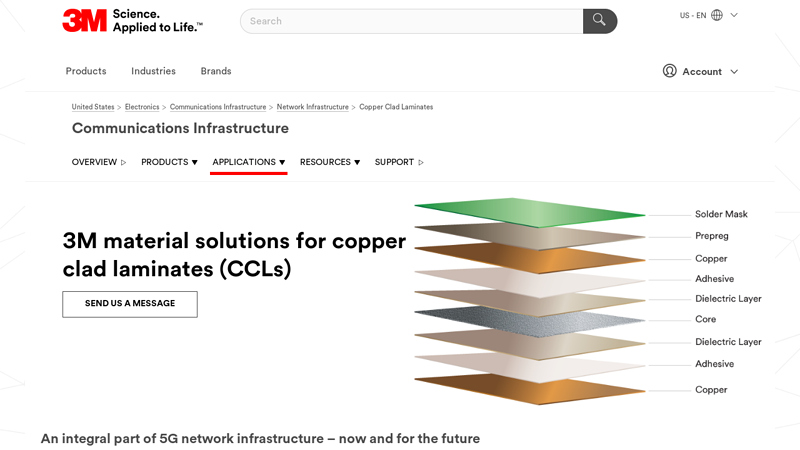

#2 5G Solutions for Copper Clad Laminates (CCLs)

Domain Est. 1988

Website: 3m.com

Key Highlights: 3M’s 5G material solutions for copper clad laminates (CCLs) are an integral part of helping enable 5G network infrastructure for now and into the future….

#3 CCL(Copper Clad Laminate) | Products

Domain Est. 1995

Website: agc.com

Key Highlights: AGC develops and manufactures a full range of RF and Digital Materials, including thermoset and thermoplastic copper clad laminates and prepreg / bondply ……

#4 Copper Clad

Domain Est. 1996

Website: currentcomposites.com

Key Highlights: Our copper-clad laminates provide the perfect combination of electrical conductivity and structural integrity, designed to meet the diverse needs of industries….

#5 Homepage

Domain Est. 1998

Website: emctw.com

Key Highlights: Career. Career ; Copper Clad Laminates. EMC is currently among Top 10 laminators in the world in providing the advanced base materials. ; Investors. Shareholder ……

#6 Copper

Domain Est. 2008

Website: chukoh.com

Key Highlights: CHUKOH FLO™ copper clad laminates are products made by laminating fluoroplastic impregnated glass cloth or fluoroplastic film, and then heat-fusing ……

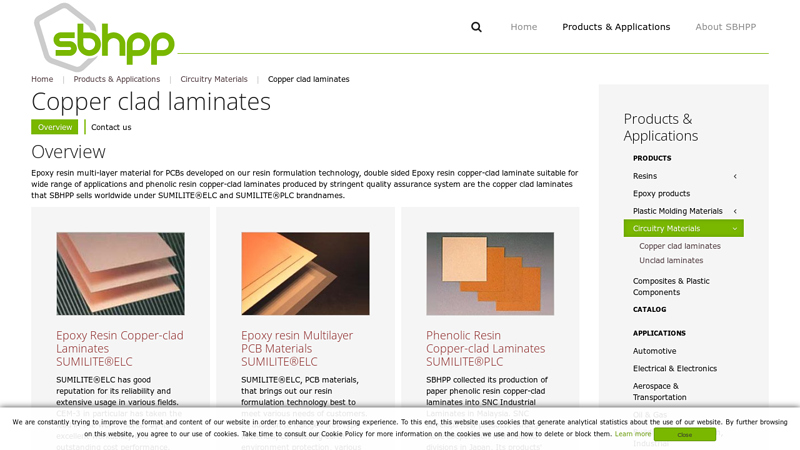

#7 Copper clad laminates

Domain Est. 2013

Website: sbhpp.com

Key Highlights: Double sided Epoxy resin copper-clad laminate suitable for wide range of applications and phenolic resin copper-clad laminates produced by stringent quality ……

#8 Ventec International Group

Domain Est. 2016

Website: ventec-group.com

Key Highlights: A Taiwan Stock Exchange listed company, Ventec International Group (VIG) is a world leader in the production of high quality, high performance copper clad ……

#9 Introduction of copper clad laminate

Domain Est. 2016

Website: en.dekgf.com

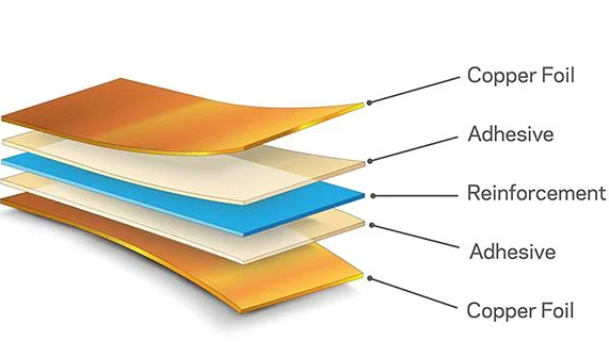

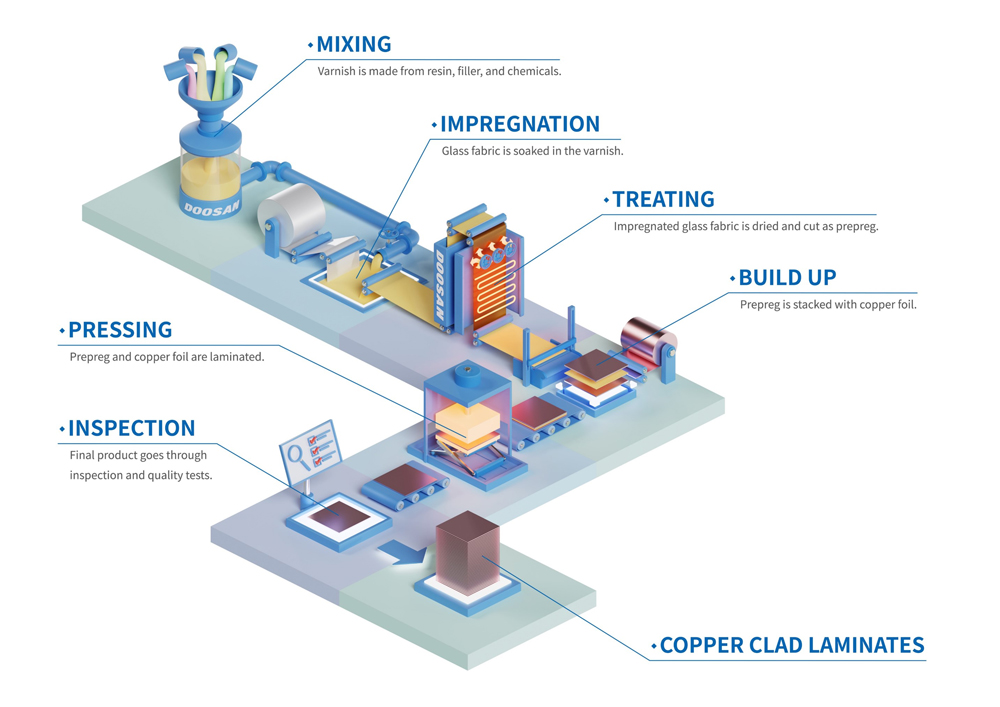

Key Highlights: Copper Clad Laminate (Copper Clad Laminate,CCL) is a plate-shaped material made by impregnating electronic glass fiber cloth or other reinforcing materials ……

Expert Sourcing Insights for Copper Clad Laminates

H2: Market Trends for Copper Clad Laminates in 2026

The global Copper Clad Laminate (CCL) market is poised for significant transformation by 2026, driven by rapid advancements in electronics, increasing demand for high-performance materials, and evolving sustainability standards. As a foundational material in printed circuit boards (PCBs), CCL performance directly impacts the efficiency, durability, and miniaturization of electronic devices. The following analysis outlines the key market trends expected to shape the CCL industry in 2026.

1. Rising Demand from High-Speed and High-Frequency Applications

With the ongoing rollout of 5G networks, the expansion of data centers, and the proliferation of high-speed communication devices, there is a growing need for low-loss, high-frequency CCL materials. By 2026, the market is expected to see increased adoption of modified epoxy, polyimide, and PTFE-based CCLs that offer superior signal integrity and thermal stability. These materials are critical for base stations, server backplanes, and automotive radars, pushing manufacturers to innovate in dielectric properties and low Df (dissipation factor) formulations.

2. Growth in Automotive Electronics and EVs

The electric vehicle (EV) and advanced driver-assistance systems (ADAS) markets are major growth drivers for high-reliability CCLs. Automotive-grade CCLs must withstand extreme temperatures, mechanical stress, and long operational lifespans. By 2026, demand for halogen-free, high-Tg (glass transition temperature), and thermally conductive CCLs is projected to rise significantly. Integration of power electronics and lightweighting trends will further spur demand for metal-based CCLs, such as aluminum and copper core laminates.

3. Expansion of HDI and Flexible PCBs

Miniaturization of consumer electronics—smartphones, wearables, and IoT devices—will continue to fuel demand for high-density interconnect (HDI) and flexible CCLs. In 2026, ultra-thin CCLs with improved dimensional stability and adhesion will be essential for next-generation foldable displays and compact medical devices. Flexible CCLs based on polyimide and liquid crystal polymer (LCP) are expected to gain traction due to their bendability and performance in dynamic environments.

4. Shift Toward Eco-Friendly and Halogen-Free Materials

Environmental regulations and corporate sustainability goals are accelerating the shift toward eco-conscious CCL production. By 2026, halogen-free CCLs are expected to dominate new product introductions, particularly in Europe and North America, in compliance with RoHS and REACH directives. Manufacturers are investing in bio-based resins and recyclable substrates to reduce carbon footprints and meet ESG (Environmental, Social, and Governance) benchmarks.

5. Regional Supply Chain Reconfiguration

Geopolitical tensions and supply chain disruptions have prompted a reevaluation of CCL manufacturing geography. While Asia-Pacific—led by China, Japan, and South Korea—remains the largest producer and consumer of CCLs, North America and Europe are investing in localized production to reduce dependency on imports. By 2026, onshoring initiatives supported by government incentives (e.g., U.S. CHIPS and Science Act) may lead to new CCL fabrication facilities in strategic regions.

6. Technological Innovation and Material Diversification

Innovation in resin systems and reinforcement materials will be a key competitive differentiator. Expect growth in hybrid CCLs combining glass fabric, aramid fibers, and nano-fillers to enhance mechanical strength and thermal management. Additionally, R&D in ultra-low-profile copper foils and embedded passive components will enable thinner, more efficient PCB architectures.

Conclusion

By 2026, the Copper Clad Laminate market will be shaped by technological sophistication, sustainability imperatives, and sector-specific demands from telecommunications, automotive, and consumer electronics. Companies that invest in high-performance, environmentally responsible, and application-tailored CCL solutions will be best positioned to capture market share in this dynamic landscape.

Common Pitfalls Sourcing Copper Clad Laminates (Quality, IP)

Sourcing Copper Clad Laminates (CCLs) is critical for reliable PCB manufacturing. Overlooking key quality and intellectual property (IP) aspects can lead to significant downstream issues. Below are common pitfalls to avoid:

Inadequate Material Specification and Verification

One of the most frequent pitfalls is failing to define and verify precise CCL specifications. Engineers may rely on generic descriptions or assume equivalent performance across brands. This can result in sourcing materials that don’t meet electrical, thermal, or mechanical requirements—especially for high-frequency, high-power, or harsh-environment applications. Always specify dielectric constant (Dk), dissipation factor (Df), glass transition temperature (Tg), coefficient of thermal expansion (CTE), and copper roughness. Verify compliance through supplier datasheets and independent testing when necessary.

Overlooking Supply Chain Transparency and Traceability

Many buyers source CCLs without verifying the full supply chain, exposing themselves to counterfeit or substandard materials. Unreliable distributors may rebrand or mix batches, leading to inconsistent quality. Lack of traceability also complicates root-cause analysis during field failures. Ensure suppliers provide batch traceability, certification (e.g., UL, IPC), and direct relationships with original manufacturers like Isola, Panasonic, or Rogers.

Ignoring Intellectual Property Risks

Using proprietary CCL materials (e.g., Rogers RO4000® or Isola I-Tera®) without proper licensing or authorization can lead to IP infringement. Some high-performance laminates are protected by patents or usage agreements, and unauthorized use—even if technically feasible—can result in legal action or supply cutoff. Always confirm that your use case complies with the material’s IP terms and obtain necessary licenses, particularly in commercial or high-volume production.

Prioritizing Cost Over Performance and Long-Term Reliability

Opting for the lowest-cost CCL can compromise product reliability. Cheap alternatives may use lower-grade resin systems or inconsistent copper cladding, increasing risks of delamination, signal loss, or PCB failure under thermal cycling. While cost is important, evaluate total cost of ownership—factoring in yield rates, field returns, and warranty claims—rather than upfront price alone.

Insufficient Qualification of Alternative or Second-Source Materials

When qualifying substitute CCLs, teams often perform minimal testing, assuming datasheet parity ensures interchangeability. However, subtle differences in resin formulation or glass weave style can impact drillability, impedance control, or moisture absorption. Thoroughly qualify second sources through prototyping and environmental stress testing to avoid manufacturing defects or performance drift.

Underestimating Environmental and Regulatory Compliance

CCLs must comply with regional regulations like RoHS, REACH, and IPC-4101 standards. Sourcing non-compliant materials—even inadvertently—can halt production or lead to market access issues. Confirm that suppliers provide up-to-date compliance documentation and that materials are suitable for the intended application environment (e.g., lead-free assembly compatibility).

Avoiding these pitfalls requires diligence in supplier selection, clear technical specifications, and awareness of both material performance and legal considerations. Engaging with reputable suppliers and conducting thorough due diligence protects both product quality and intellectual property integrity.

Logistics & Compliance Guide for Copper Clad Laminates (CCL)

Copper Clad Laminates (CCL) are essential raw materials in printed circuit board (PCB) manufacturing. Due to their specialized nature, handling, shipping, and regulatory compliance require careful attention. This guide outlines key considerations for the safe and compliant logistics of CCLs.

Regulatory Compliance

Copper Clad Laminates are generally non-hazardous under international transport regulations if they contain no hazardous resins or additives. However, compliance must be verified based on specific composition.

- GHS/SDS Requirements: A Safety Data Sheet (SDS) compliant with the Globally Harmonized System (GHS) must be available. The SDS should specify the resin type (e.g., epoxy, polyimide), copper foil characteristics, and any hazardous components.

- REACH & RoHS Compliance: Ensure CCLs comply with EU regulations:

- RoHS (Restriction of Hazardous Substances): Confirm absence of restricted substances (e.g., lead, cadmium, mercury) above allowable thresholds.

- REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals): Verify that all chemical substances in the laminate are registered and do not require authorization.

- TSCA (USA): Confirm compliance with the U.S. Toxic Substances Control Act, especially for imported CCLs.

- Country-Specific Regulations: Check for local restrictions in the destination country (e.g., China RoHS, South Korea K-REACH).

Packaging Standards

Proper packaging prevents physical damage and environmental degradation during transit.

- Moisture Protection: CCLs are sensitive to moisture. Use vacuum-sealed plastic bags with desiccants, especially for moisture-absorbent substrates like FR-4.

- Rigid Outer Packaging: Stack laminates in sturdy cardboard or wooden crates. Use edge protectors and interleaving paper to prevent surface scratches.

- Labeling: Clearly label packages with:

- Product name and specifications (e.g., thickness, resin type, copper weight)

- Handling instructions (e.g., “Fragile,” “Keep Dry,” “This Side Up”)

- Lot number and manufacturing date

- Compliance marks (e.g., RoHS logo if applicable)

Storage Conditions

Improper storage can degrade CCL quality and compromise PCB performance.

- Temperature: Store in a climate-controlled environment between 15°C and 25°C (59°F to 77°F).

- Humidity: Maintain relative humidity below 60%. High humidity can cause delamination or moisture absorption.

- Shelf Life: Most CCLs have a shelf life of 6–12 months from production. Monitor expiration dates and practice FIFO (First In, First Out) inventory management.

- Orientation: Store panels vertically to avoid warping or deformation.

Transportation Guidelines

Ensure safe and efficient movement from manufacturer to end user.

- Non-Hazardous Classification: Most CCLs are classified as non-hazardous goods. Confirm with SDS before shipping.

- Mode of Transport: Suitable for air, sea, and land freight. For air transport, ensure packaging meets IATA requirements for non-dangerous goods.

- Shock and Vibration Protection: Use cushioned pallets and secure loads to prevent shifting during transit.

- Documentation: Include commercial invoice, packing list, bill of lading, and SDS. For international shipments, provide certificates of compliance (e.g., RoHS, REACH).

Handling Procedures

Minimize damage during loading, unloading, and internal movement.

- Use Proper Equipment: Handle with forklifts or vacuum lifters; avoid dragging or dropping panels.

- Clean Environment: Process in low-dust areas to prevent contamination before PCB fabrication.

- Personal Protective Equipment (PPE): Operators should wear gloves to prevent oil transfer and safety glasses when cutting or handling sharp edges.

End-of-Life & Recycling

Address environmental responsibilities for scrap and obsolete CCLs.

- Recycling Options: Copper and substrate materials (e.g., epoxy-glass) can be separated and recycled through specialized e-waste processors.

- Waste Disposal: Follow local regulations for industrial waste. Do not incinerate halogen-containing laminates (e.g., FR-4) without proper emissions controls.

- WEEE Compliance: In the EU, ensure alignment with Waste Electrical and Electronic Equipment (WEEE) directives for end-of-life management.

Adhering to this logistics and compliance framework ensures the integrity of Copper Clad Laminates throughout the supply chain while meeting global regulatory standards.

In conclusion, sourcing copper clad laminates (CCL) requires a comprehensive evaluation of several key factors to ensure optimal performance, reliability, and cost-effectiveness in electronic manufacturing. Critical considerations include the desired electrical, thermal, and mechanical properties of the laminate—such as dielectric constant, dissipation factor, thermal conductivity, and glass transition temperature—aligned with the end application, whether it be consumer electronics, telecommunications, automotive, or high-frequency PCBs.

Supplier reliability, quality certifications (e.g., ISO, UL), and consistency in material specifications are paramount to maintaining production integrity. Additionally, assessing total supply chain stability, lead times, pricing, and availability of environmentally compliant or halogen-free materials supports sustainable and resilient operations.

Ultimately, strategic sourcing of copper clad laminates involves balancing performance requirements with cost and supply chain efficiency. Establishing strong partnerships with reputable suppliers, staying informed about emerging materials and technologies, and conducting thorough qualification testing will enable manufacturers to make informed decisions and maintain a competitive edge in the rapidly evolving electronics industry.