The global cooling tower market is experiencing robust growth, driven by increasing industrialization, rising energy demand, and expanding infrastructure in sectors such as power generation, oil & gas, and HVAC. According to a 2023 report by Mordor Intelligence, the market was valued at USD 2.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2029. Similarly, Grand View Research estimates that the market size reached USD 3.1 billion in 2023 and is expected to expand at a CAGR of 6.2% over the next decade, fueled by technological advancements and a growing emphasis on energy-efficient cooling solutions. As demand surges, leading manufacturers are innovating with sustainable materials, modular designs, and smart monitoring systems to enhance performance and reduce environmental impact. In this dynamic landscape, identifying the top players becomes critical for businesses seeking reliable, high-efficiency cooling solutions. Here, we present a data-driven overview of the top 10 cooling tower manufacturers shaping the future of thermal management.

Top 10 Cooloing Tower Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Revolutionary Cooling Tower Technology

Domain Est. 2017

Website: towertechusa.com

Key Highlights: Tower Tech is the leader for modular cooling towers in industrial applications. Our towers are the strongest and most efficient on the market….

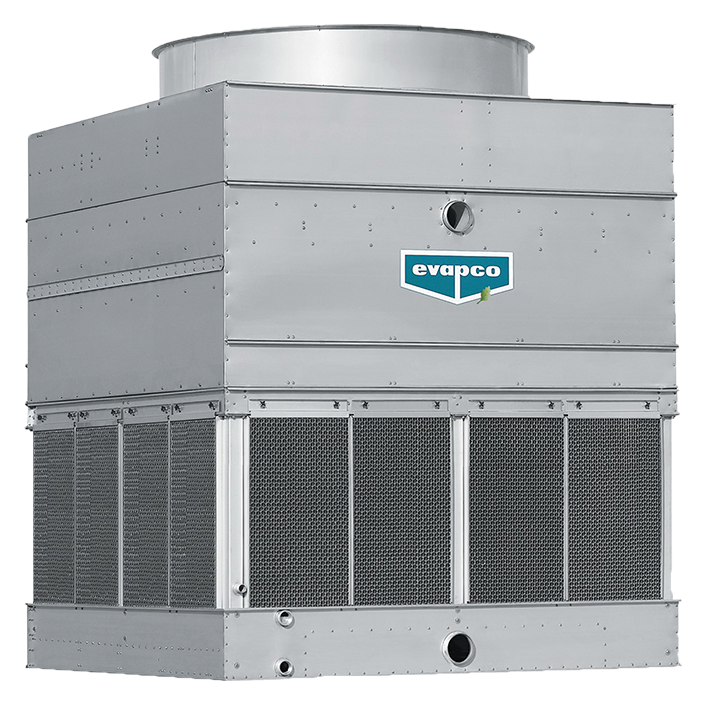

#2 EVAPCO Page

Domain Est. 1996

Website: evapco.com

Key Highlights: We offer an extensive selection of products for Commercial HVAC, Industrial Refrigeration, Power Generation and Industrial Process. Search Our Products….

#3

Domain Est. 1999

Website: coolingtowersystems.com

Key Highlights: We are the oldest, full service fiberglass cooling tower manufacturer in business today. All CTS cooling towers are designed, engineered and tested by our own ……

#4 REYMSA

Domain Est. 2002

Website: reymsa.com

Key Highlights: Leaders in the manufacturing of cooling towers with over 55 years of experience providing solutions for the HVAC and industrial markets. About ……

#5 Cooling Tower Manufacturers

Domain Est. 2003

Website: cooling-towers.net

Key Highlights: Easily locate cooling tower manufacturers on this site that provide products which will require little maintenance costs and downtime in the long term….

#6 Cooling Towers and Cooling Tower Parts

Domain Est. 2005

Website: spxcooling.com

Key Highlights: SPX Cooling Tech, LLC is a leading global manufacturer of cooling towers, evaporative fluid coolers, evaporative condensers and air cooled heat exchangers….

#7 EvapTech Page

Domain Est. 2005

Website: evaptechinc.com

Key Highlights: EvapTech® is a premier cooling tower designer, manufacturer and contractor providing Research Powered Solutions for customer needs in the power generation ……

#8 Decsa: Cooling Towers

Domain Est. 2015

Website: en.decsasrl.com

Key Highlights: Decsa represents one of the leading manufacturers of open circuit and closed cooling towers, evaporative coolers and evaporative condensers for all kinds of ……

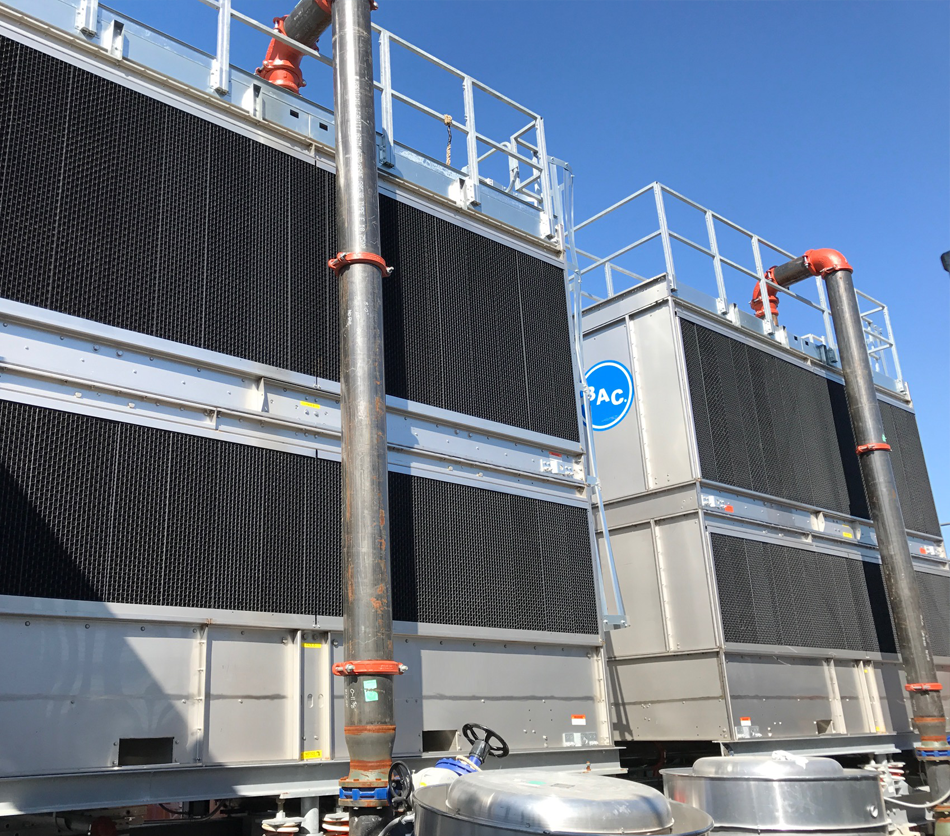

#9 Baltimore Aircoil Company

Domain Est. 1998

Website: baltimoreaircoil.com

Key Highlights: BAC is proud to be the world’s cooling partner. Choose your location here….

#10 Cooling Tower Depot

Domain Est. 2005

Website: coolingtowerdepot.com

Key Highlights: Cooling Tower Depot is a leading cooling tower manufacturing company, offering new cooling towers, major rebuilding and overhaul and inspection services….

Expert Sourcing Insights for Cooloing Tower

H2: 2026 Market Trends for Cooling Towers

As the global industrial and commercial sectors evolve in response to environmental regulations, technological advancements, and shifting energy dynamics, the cooling tower market is poised for significant transformation by 2026. Driven by sustainability imperatives and digital innovation, key trends are shaping the future of cooling tower systems across industries such as power generation, HVAC, manufacturing, and data centers.

1. Increased Emphasis on Energy Efficiency and Water Conservation

With growing concerns over climate change and resource scarcity, cooling tower manufacturers and end-users are prioritizing high-efficiency designs. Closed-circuit cooling towers and hybrid systems are gaining traction due to their reduced water consumption and lower evaporation losses. By 2026, regulatory pressures—especially in water-stressed regions—are expected to accelerate the adoption of water-saving technologies, including advanced drift eliminators and smart water treatment systems that extend cycles of concentration.

2. Integration of IoT and Predictive Maintenance

The Industrial Internet of Things (IIoT) is revolutionizing cooling tower operations. Smart sensors monitoring temperature, flow rates, water quality, and equipment health are enabling real-time diagnostics and predictive maintenance. By 2026, a majority of new installations in industrial and commercial facilities are expected to feature connected cooling towers, reducing downtime and optimizing performance. AI-driven analytics will allow operators to anticipate scaling, corrosion, and microbial growth, enhancing system longevity and efficiency.

3. Shift Toward Sustainable and Low-Carbon Materials

Environmental regulations such as the Kigali Amendment and local emissions standards are pushing the industry toward greener alternatives. Manufacturers are increasingly using recyclable composite materials instead of traditional galvanized steel or wood, reducing lifecycle emissions. Additionally, cooling towers designed for integration with renewable energy sources (e.g., solar-assisted cooling in HVAC systems) are expected to see broader adoption by 2026, particularly in emerging markets.

4. Growth in Data Center and Telecom Infrastructure Demand

The global expansion of 5G networks and cloud computing is driving unprecedented demand for reliable thermal management. Data centers, which account for a significant portion of electricity use, require highly efficient cooling solutions. By 2026, adiabatic and evaporative cooling towers are projected to become standard in new hyperscale data centers, especially in regions with favorable climatic conditions, due to their superior energy efficiency compared to traditional mechanical chillers.

5. Regional Market Diversification and Regulatory Influence

While North America and Europe lead in adopting advanced cooling technologies due to strict environmental standards, Asia-Pacific—particularly India and Southeast Asia—is expected to witness the highest growth rate by 2026. Rapid industrialization, urbanization, and increasing investments in power and chemical plants are fueling demand. However, regional variations in water availability and environmental policies will influence technology preferences, with dry and hybrid cooling solutions gaining popularity in arid regions.

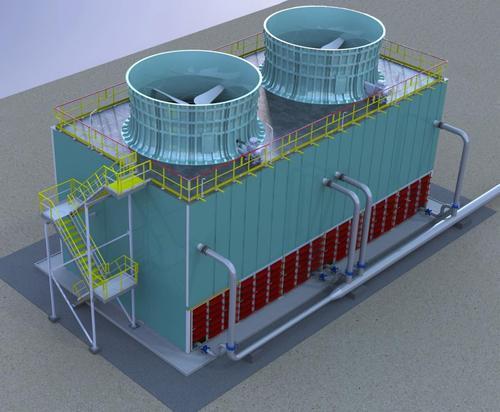

6. Rise of Modular and Packaged Cooling Solutions

To reduce installation time and costs, especially in fast-growing infrastructure projects, modular and factory-assembled cooling towers are becoming more prevalent. These pre-engineered systems offer scalability and ease of maintenance, making them ideal for industries requiring rapid deployment. By 2026, the market share of modular cooling towers is expected to grow significantly, particularly in the renewable energy and microgrid sectors.

In conclusion, by 2026, the cooling tower market will be defined by smarter, more sustainable, and highly efficient systems. The convergence of digitalization, environmental regulation, and evolving industrial needs will drive innovation, positioning cooling towers not just as heat dissipation units, but as integral components of intelligent, resource-optimized infrastructure.

Common Pitfalls in Sourcing Cooling Towers: Quality and Intellectual Property (IP) Risks

Sourcing cooling towers, especially from international or lower-cost suppliers, presents several critical challenges related to quality assurance and intellectual property protection. Overlooking these pitfalls can lead to operational inefficiencies, safety hazards, and legal complications.

Poor Quality Control and Substandard Materials

One of the most frequent issues when sourcing cooling towers is receiving units manufactured with substandard materials or inconsistent quality control. Some suppliers may use inferior-grade metals, non-compliant fill media, or undersized components to reduce costs. This compromises structural integrity, thermal performance, and corrosion resistance, leading to premature failure, increased maintenance costs, and unplanned downtime. Without rigorous inspection and adherence to international standards (e.g., CTI, ISO), buyers risk installing equipment that fails to meet performance specifications or safety requirements.

Lack of Compliance with Industry Standards

Many low-cost suppliers do not fully comply with recognized industry standards such as those from the Cooling Technology Institute (CTI), ASME, or local regulatory bodies. Non-compliant cooling towers may lack proper certification, third-party testing, or documentation, increasing liability risks. Buyers may unknowingly install equipment that does not meet environmental, noise, or safety regulations, potentially resulting in fines or forced shutdowns.

Inadequate Design and Engineering Support

Some sourced cooling towers are based on copied or reverse-engineered designs lacking proper engineering validation. This can result in inefficient airflow, poor water distribution, or structural weaknesses under load. Without access to original engineering data or performance guarantees, end users face uncertainty about long-term reliability and may incur costly retrofitting expenses.

Intellectual Property (IP) Infringement

A significant but often overlooked risk is the potential for IP violations. Some manufacturers produce cooling towers that closely mimic patented designs, proprietary technologies, or trademarked features of established brands without authorization. Purchasing such equipment—even unknowingly—can expose buyers to legal liability, particularly in regions with strong IP enforcement. Additionally, using counterfeit or cloned equipment may void warranties and complicate future service or spare parts procurement.

Limited Traceability and Documentation

Sourced cooling towers may lack comprehensive documentation, including material test reports (MTRs), fabrication records, or as-built drawings. This absence makes it difficult to verify compliance, conduct root cause analysis during failures, or support insurance and warranty claims. Poor traceability also complicates maintenance and replacement efforts over the equipment’s lifecycle.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct thorough supplier audits and request third-party certifications.

– Require detailed engineering documentation and performance guarantees.

– Include IP indemnification clauses in procurement contracts.

– Partner with reputable suppliers and consider original equipment manufacturers (OEMs) over generic clones.

– Engage independent inspection services during manufacturing and before shipment.

Proactively addressing quality and IP concerns ensures reliable, compliant, and legally sound cooling tower installations.

Logistics & Compliance Guide for Cooling Towers

Overview

Cooling towers are critical components in HVAC, industrial processes, and power generation systems, responsible for rejecting waste heat through the evaporation of water. Proper logistics and compliance are essential to ensure safe, efficient, and legally sound installation, operation, and maintenance of cooling towers.

Regulatory Compliance

Environmental Regulations

- EPA Guidelines (U.S.): Adhere to Clean Air Act (CAA) and Clean Water Act (CWA) requirements. Cooling towers may release water vapor and require permits if discharging wastewater.

- Local Discharge Permits: Obtain permits for blowdown water discharge; ensure compliance with local water quality standards.

- Chemical Usage Reporting: Register and report use of water treatment chemicals (e.g., biocides, corrosion inhibitors) under EPA’s Toxic Substances Control Act (TSCA) or equivalent local regulations.

Health and Safety Standards

- OSHA Regulations (U.S.): Comply with workplace safety standards, including fall protection, confined space entry, and hazard communication (HazCom) for chemical handling.

- Legionella Control: Follow ASHRAE Standard 188 and OSHA recommendations for Legionella risk management. Implement water treatment and monitoring programs to prevent Legionnaires’ disease.

- PPE Requirements: Ensure personnel use appropriate personal protective equipment (PPE) when handling chemicals or performing maintenance.

Industry Standards and Codes

- ASME and ASTM Standards: Follow material and fabrication standards for structural components.

- ASHRAE Guidelines: Comply with ASHRAE Standard 188 (Legionellosis Risk Management) and ASHRAE Guideline 12 (Managing Building Water Systems for Health and Safety).

- Local Building Codes: Verify compliance with fire safety, noise control, and setback requirements.

Transportation and Installation Logistics

Pre-Transportation Planning

- Site Assessment: Evaluate access routes, crane availability, and foundation requirements. Ensure structural compatibility with the cooling tower’s weight and dimensions.

- Permits: Secure transportation permits for oversized loads if applicable.

- Packaging and Protection: Use weather-resistant packaging and secure bracing to prevent damage during transit.

Shipping and Handling

- Mode of Transport: Choose appropriate transport (flatbed truck, freight container) based on tower size and site location.

- Handling Equipment: Use certified rigging and lifting gear. Follow manufacturer guidelines for lifting points and load distribution.

- Documentation: Maintain shipping manifests, bills of lading, and import/export documentation for international shipments.

On-Site Installation

- Foundation Preparation: Ensure level, reinforced concrete pads meet manufacturer specifications.

- Assembly: Follow approved erection procedures. Seal joints and align components to prevent leaks and vibration.

- Commissioning: Conduct performance testing, water balancing, and safety checks prior to operation.

Maintenance and Operational Compliance

Routine Maintenance

- Water Treatment: Maintain proper chemical balance, conduct regular testing for pH, conductivity, and microbial content.

- Inspection Schedule: Perform biannual inspections of fill media, drift eliminators, fans, and motors.

- Record Keeping: Maintain logs of maintenance, water tests, chemical usage, and repairs for audits and regulatory reporting.

Reporting and Documentation

- Regulatory Filings: Submit required environmental reports (e.g., discharge monitoring reports).

- Incident Reporting: Report Legionella detections or chemical spills to relevant authorities immediately.

- Compliance Audits: Conduct annual internal or third-party audits to verify adherence to standards.

Decommissioning and Disposal

End-of-Life Procedures

- System Flushing: Drain and flush the system to remove chemicals and biofilm.

- Material Recycling: Separate and recycle metal, plastic, and wood components as per local waste regulations.

- Hazardous Waste Disposal: Dispose of contaminated fill media or chemical residues through licensed hazardous waste handlers.

Documentation and Certification

- Decommissioning Report: Document the process, including waste manifests and environmental clearance.

- Site Restoration: Restore the installation area to meet environmental and safety standards.

Conclusion

Effective logistics and compliance management for cooling towers ensures operational efficiency, regulatory adherence, and protection of public health and the environment. Always consult local regulations, industry standards, and manufacturer guidelines to maintain full compliance throughout the cooling tower’s lifecycle.

Conclusion for Sourcing a Cooling Tower:

Sourcing a cooling tower is a critical decision that directly impacts the efficiency, reliability, and long-term operational costs of industrial and commercial HVAC systems. A thorough evaluation of project requirements—including thermal capacity, space constraints, water quality, energy efficiency, environmental conditions, and maintenance accessibility—is essential to selecting the right type and size of cooling tower.

Key considerations such as initial investment versus lifecycle costs, material durability (e.g., fiberglass, galvanized steel, or stainless steel), noise levels, water and energy consumption, and compliance with environmental regulations should guide the procurement process. Partnering with reputable suppliers who offer proven product performance, technical support, and after-sales service further ensures optimal system integration and reliability.

Ultimately, a well-sourced cooling tower not only meets current cooling demands but also provides scalability, sustainability, and cost-effective operation over its service life. Conducting comprehensive market research, obtaining multiple quotations, and performing due diligence on vendor credentials will lead to an informed decision that supports long-term operational success.