The global DC/DC boost converter market is experiencing robust expansion, driven by rising demand for efficient power management solutions across automotive, industrial, and consumer electronics sectors. According to Mordor Intelligence, the global DC-DC converter market was valued at USD 11.03 billion in 2023 and is projected to reach USD 15.67 billion by 2029, growing at a CAGR of 6.04% during the forecast period. This growth is fueled by the increasing adoption of electric vehicles, renewable energy systems, and portable electronics—all of which rely heavily on high-efficiency DC/DC boost converters to step up voltage from low-power sources. As innovation in power density, thermal performance, and integration accelerates, manufacturers are competing to deliver compact, reliable, and energy-efficient solutions. In this evolving landscape, identifying the leading DC/DC boost converter manufacturers becomes critical for design engineers, procurement managers, and supply chain stakeholders aiming to align with top-tier performance and technological advancement.

Top 10 Convertisseur Dc/Dc Boost Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Top DC DC Converter Manufacturer

Domain Est. 2011

Website: minmaxpower.com

Key Highlights: MINMAX DC DC converter manufacturer has more than 30 years of professional experience in the field of isolated DC to DC converter module and has so far ……

#2 Cincon

Domain Est. 1998

Website: cincon.com

Key Highlights: Cincon Electronics is a leading manufacturer of DC/DC converters and AC/DC power supplies offering the high-quality and reliable power module solutions….

#3 DC

Domain Est. 2000

Website: xppower.com

Key Highlights: Choose from our extensive range of DC – DC Converters. High quality, in-house design. Approved for industrial, medical, defense & railway applications….

#4 DC

Domain Est. 1995

Website: diodes.com

Key Highlights: High-efficiency Buck converters for 5V to 2.5V rails with switching frequencies up to 2.2MHz. Boost converters operating from input voltages as low as 0.6V….

#5 DC

Domain Est. 1997

#6 DC-DC converters

Domain Est. 1999

Website: infineon.com

Key Highlights: Infineon’s DC-DC converters are designed for applications including AI and cloud servers, storage, routers and switches, telecom base stations, digital home ……

#7 Buck

Domain Est. 2000

Website: victronenergy.com

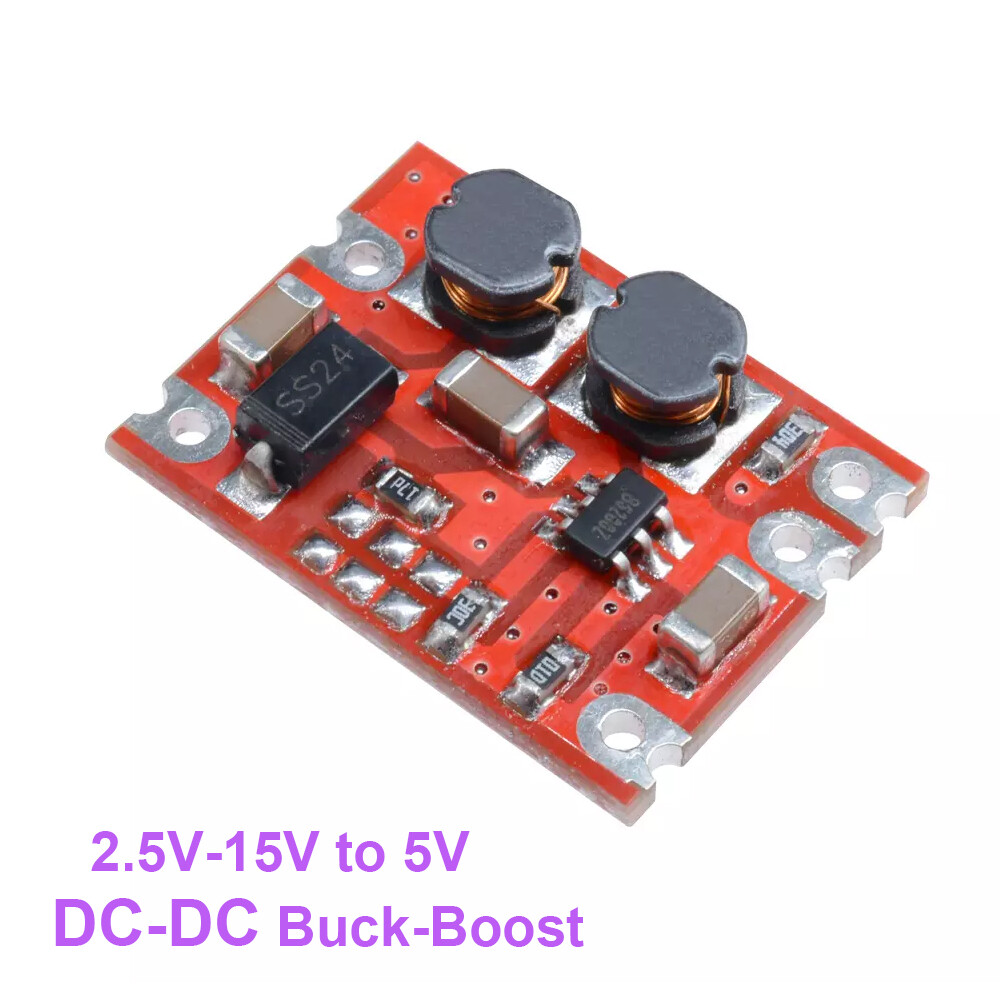

Key Highlights: The Buck-Boost DC-DC Converter is a DC-DC converter for charging a 12/24V service battery in vehicles with an intelligent dynamo….

#8 DC-DC Converters

Domain Est. 2001

Website: vicorpower.com

Key Highlights: Today’s most innovative companies trust Vicor to power their world-changing products. Explore DC-DC converter products, solutions and accessories….

#9 Products

Domain Est. 2008

Website: delta-americas.com

Key Highlights: Delta DC to DC converters are designed to provide reliable backup power for equipment with supply voltages different from that of the main battery backup system ……

#10 DC / DC Converters

Domain Est. 2014

Website: qorvo.com

Key Highlights: Qorvo offers a wide range of high power buck and buck-boost DC/DC converters and low power buck and boost DC/DC converters with input voltages from 2.7 to 40 V….

Expert Sourcing Insights for Convertisseur Dc/Dc Boost

H2: 2026 Market Trends for DC/DC Boost Converters

The global market for DC/DC boost converters is poised for significant transformation by 2026, driven by rapid advancements in power electronics, rising demand for energy-efficient solutions, and increasing adoption across key industries such as electric vehicles (EVs), renewable energy, consumer electronics, and industrial automation. As part of the broader power conversion market, DC/DC boost converters—devices that step up voltage from a lower input to a higher output—are expected to experience strong growth, with a compound annual growth rate (CAGR) projected between 6% and 8% through 2026.

1. Growing Demand in Electric Vehicles (EVs) and E-Mobility

One of the most influential drivers of the DC/DC boost converter market in 2026 is the continued expansion of the EV ecosystem. Boost converters play a critical role in EV powertrains by enabling efficient voltage step-up from low-voltage battery systems (e.g., 12V or 48V) to higher voltage levels required by motor drives and onboard electronics. With governments worldwide pushing for decarbonization and automakers accelerating EV production, the integration of high-efficiency, compact boost converters is becoming standard. Silicon Carbide (SiC) and Gallium Nitride (GaN)-based boost converters are gaining traction here due to their superior switching efficiency and thermal performance.

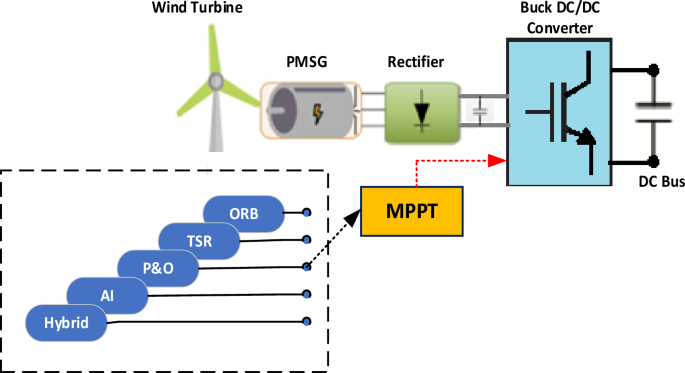

2. Integration in Renewable Energy Systems

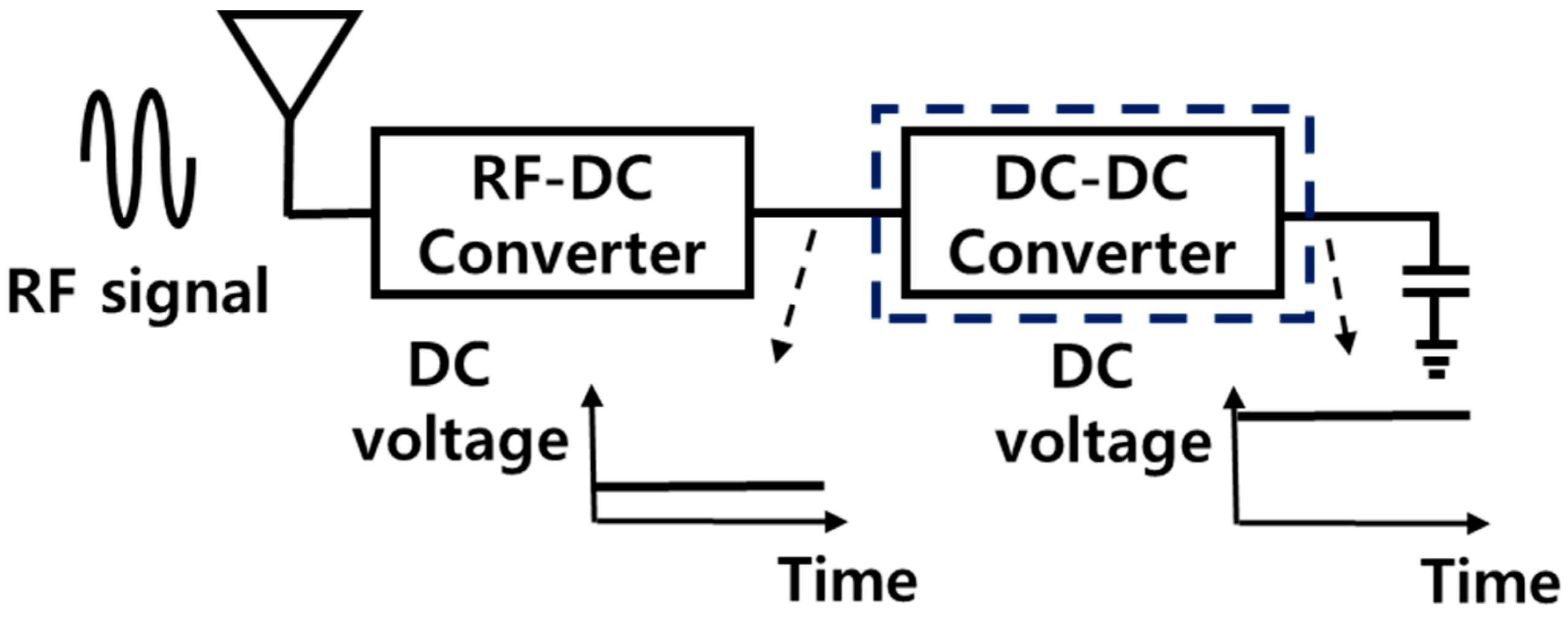

Renewable energy installations, particularly solar photovoltaic (PV) systems and energy storage solutions, are increasingly reliant on DC/DC boost converters to manage variable input voltages and maximize power extraction. By 2026, the trend toward modular and smart solar inverters will further fuel demand for high-efficiency boost topologies. Maximum Power Point Tracking (MPPT) algorithms integrated into boost converters ensure optimal performance, making them indispensable in off-grid and grid-tied solar applications.

3. Miniaturization and High Power Density

A key trend in 2026 is the push toward miniaturization without sacrificing performance. End-users across consumer electronics, telecommunications, and aerospace sectors demand compact, lightweight power solutions. Boost converters are being redesigned with advanced packaging, planar magnetics, and multi-chip modules (MCMs) to achieve higher power density. This evolution supports wearable technology, IoT devices, and portable medical equipment, where space and efficiency are critical.

4. Advancements in Semiconductor Technology

Wide-bandgap (WBG) semiconductors like GaN and SiC are revolutionizing DC/DC boost converter design. In 2026, these materials dominate high-performance applications due to their ability to operate at higher frequencies, temperatures, and voltages—leading to smaller magnetics, reduced losses, and improved overall efficiency. The falling cost of WBG devices will make them more accessible, enabling broader adoption beyond niche markets.

5. Smart and Digital Power Management

The integration of digital control in boost converters is a defining trend for 2026. Digital DC/DC converters with embedded microcontrollers or PMBus (Power Management Bus) interfaces allow real-time monitoring, adaptive control, and predictive maintenance. In data centers and telecom infrastructure, this enables dynamic voltage scaling and improved energy management, aligning with global sustainability goals.

6. Regional Growth and Supply Chain Shifts

Asia-Pacific remains the largest market for DC/DC boost converters, driven by robust electronics manufacturing in China, South Korea, and India. However, geopolitical factors and supply chain resilience concerns are prompting diversification. North America and Europe are investing in local semiconductor production, which could reshape sourcing strategies by 2026 and benefit regional converter manufacturers focused on high-reliability and automotive-grade products.

7. Sustainability and Regulatory Pressures

Environmental regulations, such as the EU’s Ecodesign Directive and U.S. energy efficiency standards, are pushing manufacturers to develop ultra-efficient boost converters. By 2026, compliance with Tier-2 and future Tier-3 efficiency benchmarks will be mandatory in many applications, accelerating innovation in soft-switching topologies (e.g., resonant and quasi-resonant boost converters) and low-loss component design.

Conclusion:

By 2026, the DC/DC boost converter market will be defined by innovation in materials, integration of digital intelligence, and expansion into high-growth sectors like EVs and renewables. Companies that leverage advanced semiconductor technologies, focus on system-level efficiency, and adapt to regional regulatory landscapes will be best positioned to capitalize on these evolving trends. The shift toward smarter, smaller, and more sustainable power conversion solutions will solidify the boost converter’s role as a cornerstone of modern electronic systems.

Common Pitfalls in Sourcing DC/DC Boost Converters (Quality and IP)

Sourcing DC/DC boost converters—especially for industrial, automotive, or medical applications—can be fraught with challenges related to both component quality and intellectual property (IP) protection. Below are key pitfalls to avoid.

Compromised Quality from Unverified Suppliers

One of the most prevalent issues is procuring boost converters from suppliers without proper quality certifications. Counterfeit or substandard components may appear identical to genuine parts but fail prematurely under load, exhibit poor efficiency, or lack thermal stability. Always verify that suppliers comply with standards such as ISO 9001, AEC-Q100 (for automotive), or IEC 60601 (for medical devices). Relying solely on price as a selection criterion often leads to reliability issues in the field.

Lack of Traceability and Data Sheets

Inadequate documentation is a red flag. Reputable manufacturers provide full datasheets, application notes, test reports, and traceability codes. Sourcing from vendors who cannot provide complete technical documentation increases the risk of using obsolete or reverse-engineered parts, which may not meet performance or safety benchmarks.

IP Infringement Risks with Cloned Designs

Using reverse-engineered or cloned DC/DC boost converter modules can expose your company to intellectual property litigation. Some manufacturers in certain regions produce near-identical copies of patented topologies, control algorithms, or packaging designs. Even if the part functions adequately, incorporating such components into your product may lead to legal disputes, product recalls, or import bans.

Inadequate Protection Features

Low-cost boost converters often omit critical protection mechanisms such as over-voltage protection (OVP), over-current protection (OCP), and thermal shutdown. These omissions can compromise system reliability and safety. Always validate that the converter includes necessary protection features for your application environment.

Poor Thermal and EMI Performance

Inadequately designed converters may not meet electromagnetic interference (EMI) requirements or fail under sustained thermal loads. This is particularly critical in compact or high-density designs. Verify EMI compliance (e.g., CE, FCC) and review thermal performance data under real-world operating conditions.

Conclusion

To mitigate these risks, work only with authorized distributors or directly with established semiconductor manufacturers. Conduct thorough due diligence, including sample testing, IP landscape reviews, and supply chain audits. Investing in quality and IP-safe components upfront prevents costly failures and legal complications down the line.

Logistics & Compliance Guide for DC/DC Boost Converters

Overview

DC/DC boost converters are electronic devices that step up a lower input voltage to a higher output voltage. Proper logistics and compliance management is essential to ensure safe handling, regulatory approval, and successful global distribution. This guide outlines key considerations for transporting and complying with international standards for DC/DC boost converters.

Regulatory Compliance Requirements

Electrical Safety Standards

DC/DC boost converters must comply with region-specific safety standards to ensure user protection and product reliability. Key certifications include:

– UL 62368-1 (North America): Covers audio/video, information, and communication technology equipment, including power supplies.

– IEC 62368-1 (International): The global equivalent of UL 62368-1, widely adopted in Europe, Asia, and other regions.

– EN 62368-1 (European Union): Mandatory for CE marking; ensures compliance with EU safety directives.

Manufacturers must obtain certification from accredited testing laboratories and maintain technical documentation for market surveillance.

Electromagnetic Compatibility (EMC)

Boost converters can generate electromagnetic interference (EMI). Compliance with EMC directives is required:

– FCC Part 15 (USA): Regulates unintentional radiators.

– CISPR 32 / EN 55032 (EU and global): Specifies limits for conducted and radiated emissions.

– ICES-003 (Canada): Similar to FCC, required for market access.

EMC testing must be performed in certified labs, and results documented in the Declaration of Conformity.

RoHS and REACH Compliance (EU)

- RoHS (Restriction of Hazardous Substances): Prohibits the use of lead, mercury, cadmium, and other hazardous materials in electrical equipment.

- REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals): Requires disclosure of Substances of Very High Concern (SVHC).

Suppliers must provide material declarations and compliance certificates.

WEEE Directive (EU)

The Waste Electrical and Electronic Equipment (WEE) Directive mandates proper recycling and disposal. Producers must register with national WEEE authorities and label products with the crossed-out wheelie bin symbol.

Packaging and Labeling Requirements

Packaging Standards

- Use anti-static packaging to prevent electrostatic discharge (ESD) damage.

- Include cushioning materials to protect against vibration and mechanical shock during transit.

- Seal in moisture-resistant bags if stored or shipped in humid environments.

Labeling

Each unit or package must include:

– Manufacturer name and address

– Model and part number

– Input/output voltage and current ratings

– Safety certification marks (e.g., CE, UL, FCC)

– RoHS compliance symbol (if applicable)

– WEEE symbol (for EU markets)

Transportation and Logistics

Shipping Classification

DC/DC boost converters are generally classified as electronic components and are not regulated as hazardous materials unless they contain batteries. However:

– Lithium-based capacitors or backup batteries may trigger IATA/IMDG/DOT regulations.

– Always verify with Material Safety Data Sheets (MSDS/SDS) if included components are regulated.

Export Controls

- EAR (Export Administration Regulations – USA): Some high-power or military-spec boost converters may be subject to export licensing requirements under ECCN 3A001 or similar.

- REACH & SCIP Database (EU): Notify the presence of SVHCs above threshold in articles placed on the EU market.

Ensure proper Harmonized System (HS) codes are used for customs clearance (e.g., 8504.40 for DC/DC converters).

Storage and Handling

Environmental Conditions

- Store in a dry, temperature-controlled environment (typically 5°C to 40°C).

- Avoid condensation and exposure to corrosive gases.

- Relative humidity should remain below 60% unless specified otherwise by the manufacturer.

Electrostatic Discharge (ESD) Precautions

- Handle in ESD-protected areas (EPA) using grounded wrist straps and conductive flooring.

- Use ESD-safe containers, trays, and tools during assembly and transport.

Documentation and Record Keeping

Maintain the following documentation for compliance audits:

– Test reports (safety, EMC, environmental)

– Certificates of Conformity (CoC)

– RoHS and REACH compliance declarations

– Bill of Materials (BOM) with substance data

– Export licenses (if applicable)

– Technical construction file (for CE marking)

Retention period: Minimum 10 years for EU compliance; consult local regulations for other regions.

Conclusion

Compliance and logistics for DC/DC boost converters require a proactive approach to regulatory standards, packaging, transportation, and documentation. Adhering to international requirements ensures market access, reduces legal risk, and enhances product reliability across the supply chain. Regularly review updates to standards and consult with compliance experts when entering new markets.

Conclusion for Sourcing DC/DC Boost Converters

In conclusion, sourcing DC/DC boost converters requires a careful evaluation of technical specifications, application requirements, supplier reliability, and cost-effectiveness. Key parameters such as input/output voltage ranges, current capacity, efficiency, switching frequency, package size, and thermal performance must align with the end application—whether it’s in consumer electronics, industrial systems, automotive, or renewable energy.

Prioritizing reputable manufacturers (such as Texas Instruments, Analog Devices, Maxim Integrated, or ROHM) ensures high quality, reliability, and access to comprehensive technical support. Additionally, considering availability, lead times, and compliance with industry standards (e.g., RoHS, AEC-Q100 for automotive use) is essential for smooth integration into production.

Utilizing authorized distributors (e.g., Digi-Key, Mouser, Farnell) helps mitigate the risk of counterfeit components while providing flexible purchasing options and reliable logistics.

Ultimately, a strategic sourcing approach that balances performance, reliability, cost, and supply chain stability will ensure the successful integration of DC/DC boost converters into your design, supporting long-term product performance and market competitiveness.