The global containerized oil storage market is experiencing steady growth, driven by increasing energy demand, infrastructure development in remote locations, and the need for flexible, portable storage solutions in the oil and gas sector. According to a report by Mordor Intelligence, the global petroleum storage tank market was valued at USD 14.8 billion in 2022 and is projected to grow at a CAGR of 4.2% from 2023 to 2028. Similarly, Grand View Research highlights expanding offshore drilling activities and rising investments in midstream infrastructure as key drivers, with the global oil and gas storage market expected to grow significantly over the next decade. As demand for modular, rapidly deployable, and compliant storage solutions rises—especially in emerging markets and challenging terrains—containerized oil storage systems have emerged as a critical component in the energy supply chain. This surge has led to the proliferation of manufacturers offering innovative, ISO-compliant, and environmentally safe storage units. The following list highlights the top 10 container oil storage manufacturers leading this evolution through technological advancement, scalability, and global reach.

Top 10 Container Oil Storage Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1

Domain Est. 2001

Website: acotainers.com

Key Highlights: We manufacture industrial, specialty, and transportation tanks, along with material handling containers in various capacities. With over 50 years of….

#2 MERIDIAN® Manufacturing

Domain Est. 2006

Website: meridianmfg.com

Key Highlights: Meridian® manufactures SmoothWall bins, augers, conveyors, stainless steel tanks, fuel tanks, and more for the ag, industrial, and energy sectors….

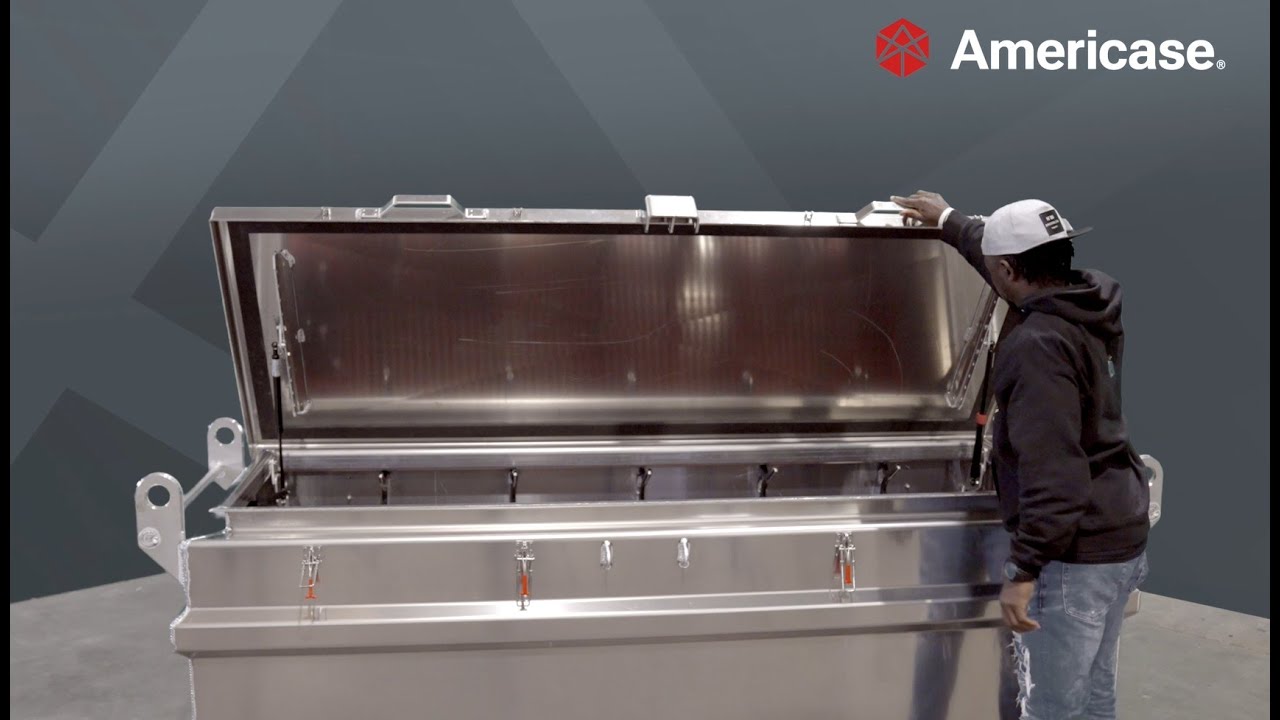

#3 Americase

Domain Est. 1996

Website: americase.com

Key Highlights: At Americase, our team believes companies of all industries deserve containers customized to solve their unique problems through smart, practical thinking….

#4 Klinge™ Corporation

Domain Est. 1997

Website: klingecorp.com

Key Highlights: We offer a variety of transport refrigeration and freezer containers, including Dual Reefer Systems, Explosion-Proof Reefers, Tank Container Reefers, Offshore ……

#5 Oil Transfer Equipment

Domain Est. 2000

Website: oilsafe.com

Key Highlights: Color-coded range of OILSAFE containers and accessories to reduce contamination. OilSafe Color-Coded Transfer Containers are preferred by leading companies ……

#6 Spectrum Oil Containers, Lubricant Storage

Domain Est. 2005

Website: tricocorp.com

Key Highlights: The Spectrum Oil Containers line of products provide a simple, easy-to-use and error-free solution to identify, store, transport and dispense lubricants….

#7 LBC Tank Terminals

Domain Est. 2005

Website: lbctt.com

Key Highlights: As a leading international and independent liquid bulk storage company, we form an integral part of our customers’ supply chains….

#8 OilSafe/Transfer Bulk Storage System

Domain Est. 2006

Website: oilsafesystem.com

Key Highlights: Reduce mess, improve efficiency! OilSafe’s color-coded bulk storage keeps workplaces clean & compliant. Learn More!…

#9 Oil Storage & Transfer Containers

Domain Est. 2008

Website: lelubricants.com

Key Highlights: Sealable, reusable oil storage containers are the solution to prevent contamination. They make lubricant storage and handling easy, efficient and clean….

#10 Used Cooking Oil Containers

Domain Est. 2011

Website: mahoneyes.com

Key Highlights: Standard cooking oil systems include bulk containers to store the used cooking oil. These containers are leak-proof and highly durable with accessible, easy to ……

Expert Sourcing Insights for Container Oil Storage

H2: Market Trends for Container Oil Storage in 2026

The container oil storage market is poised for notable transformation by 2026, shaped by evolving energy dynamics, technological advancements, and shifting global trade patterns. This analysis explores the key trends expected to define the sector during this period.

1. Rising Demand for Modular and Mobile Storage Solutions

As oil producers and distributors seek greater logistical flexibility, demand for containerized oil storage solutions is projected to grow. These modular units, often converted from ISO shipping containers, offer rapid deployment, scalability, and ease of transportation—especially in remote or temporary operational environments such as offshore platforms, mining sites, and emergency response zones. By 2026, advancements in materials and sealing technologies will enhance their durability and safety, making them a preferred choice for decentralized storage.

2. Integration of IoT and Smart Monitoring Systems

Digitalization will play a central role in the modernization of container oil storage. By 2026, most new container storage units are expected to be equipped with IoT-enabled sensors that monitor temperature, pressure, fill levels, and leak detection in real time. These systems improve operational efficiency, reduce spill risks, and support predictive maintenance. Integration with cloud-based platforms will allow fleet managers to remotely oversee multiple storage units across global supply chains.

3. Focus on Sustainability and Environmental Compliance

Environmental regulations are tightening worldwide, particularly concerning oil storage and spill prevention. In response, manufacturers will increasingly adopt eco-friendly materials, double-walled containment systems, and spill-proof designs in container storage units. Additionally, the trend toward circular economy principles will promote the reuse and recycling of retired shipping containers for oil storage, reducing carbon footprint and supporting ESG (Environmental, Social, and Governance) objectives.

4. Growth in Emerging Markets

Regions such as Africa, Southeast Asia, and Latin America are expected to see rising investments in oil infrastructure, driven by energy demand and exploration activities. Container oil storage offers a cost-effective and rapidly deployable solution in these markets, where traditional fixed-tank infrastructure may be lacking. By 2026, local partnerships and regional distribution hubs are likely to expand, catering to this growing demand.

5. Strategic Role in Energy Transition and Hybrid Applications

While the long-term shift toward renewables continues, oil remains critical for transportation and industrial applications through 2026. Container storage units are increasingly being adapted for hybrid use—storing not only crude and refined oil but also biofuels and hydrogen blends. This versatility enhances their relevance in transitional energy systems and supports decarbonization efforts.

6. Supply Chain Resilience and Geopolitical Factors

Ongoing geopolitical tensions and supply chain disruptions have underscored the need for resilient energy logistics. Containerized oil storage enables strategic stockpiling and rapid redistribution, serving as a buffer against supply shocks. Military and governmental agencies are expected to increase procurement of secure, mobile storage units by 2026, further boosting market growth.

Conclusion

By 2026, the container oil storage market will be characterized by innovation, sustainability, and adaptability. Driven by digital integration, regulatory pressures, and global energy needs, container-based solutions will emerge as a key enabler of efficient and resilient oil logistics across diverse sectors and geographies.

Common Pitfalls When Sourcing Containerized Oil Storage (Quality, IP)

Sourcing containerized oil storage solutions—whether for fuel, lubricants, or other petroleum products—requires careful attention to both quality assurance and intellectual property (IP) considerations. Overlooking these aspects can lead to operational failures, legal disputes, or financial losses. Below are key pitfalls to avoid:

Quality-Related Pitfalls

1. Inadequate Material Specifications

A common mistake is failing to clearly define and verify the materials used in construction (e.g., steel grade, lining type, corrosion resistance). Substandard materials can lead to leaks, contamination, or premature failure—especially when storing aggressive or high-temperature oils.

2. Lack of Certification and Compliance Verification

Procuring units without proper certification (e.g., ISO, API, ADR, or local regulatory standards) risks non-compliance with safety and environmental regulations. Always verify test reports, pressure ratings, and third-party inspection documentation before purchase.

3. Poor Workmanship and Fabrication Standards

Containerized tanks involve complex modifications (piping, pumps, sensors). Inconsistent welding, improper sealing, or faulty integration of components can compromise integrity. Conduct site audits or require factory acceptance tests (FAT) to assess build quality.

4. Insufficient Testing and Validation

Relying solely on supplier claims without independent hydrostatic, leak, or performance testing increases risk. Ensure units undergo rigorous pre-shipment inspections and functional testing under simulated operational conditions.

5. Inappropriate Design for Intended Use

Containers designed for water or chemicals may not suit oil storage due to differences in viscosity, vapor pressure, or flammability. Confirm design compatibility with the specific oil type, temperature range, and operational cycle (e.g., frequent filling/emptying).

Intellectual Property (IP)-Related Pitfalls

1. Unlicensed or Infringing Designs

Some suppliers may use patented tank configurations, control systems, or safety mechanisms without authorization. Sourcing such units exposes the buyer to legal liability, seizure of goods, or injunctions, especially in regulated markets.

2. Lack of IP Clarity in Custom Solutions

When commissioning custom containerized storage, failure to define IP ownership in contracts can result in disputes. Clarify whether design innovations, software, or engineering belong to the buyer, supplier, or are jointly owned.

3. Reverse-Engineered or Copycat Products

Low-cost suppliers may replicate proprietary systems without innovation. These copies often lack reliability and support, and may breach IP rights. Perform due diligence on the supplier’s design origins and innovation claims.

4. Undefined Use Rights for Embedded Software

Modern oil storage containers often include monitoring or control software. Without proper licensing, buyers may be restricted in deployment, updates, or integration—impacting long-term usability and scalability.

5. Inadequate Protection of Buyer’s Own IP

If the buyer provides specifications, logos, or integration requirements, ensure confidentiality agreements (NDAs) and IP clauses prevent unauthorized use or replication by the supplier.

Mitigation Strategies

- Conduct thorough supplier vetting, including site visits and reference checks.

- Require full documentation: material test reports, certifications, design drawings, and IP disclaimers.

- Engage independent inspectors for quality validation.

- Include robust IP and liability clauses in procurement contracts.

- Consult legal and technical experts during the sourcing process.

Avoiding these pitfalls ensures reliable, compliant, and legally secure containerized oil storage solutions.

Logistics & Compliance Guide for Container Oil Storage

Overview of Container Oil Storage

Container oil storage involves the use of standardized intermodal containers—typically 20-foot or 40-foot units—modified for the safe storage and transport of various types of oils, including crude oil, refined petroleum products, lubricants, and biofuels. These containers are often fitted with internal tanks (flexible or rigid), valves, pumps, and monitoring systems. This method offers flexibility, scalability, and cost-efficiency, especially for temporary or mobile storage needs. However, it also requires strict adherence to logistics protocols and regulatory compliance to ensure environmental protection, workplace safety, and legal operation.

Regulatory Compliance Requirements

International and National Regulations

Container oil storage must comply with a range of international and national regulations depending on the jurisdiction and type of oil stored. Key regulatory frameworks include:

– IMDG Code (International Maritime Dangerous Goods): Governs the safe transport of dangerous goods, including flammable and combustible oils, by sea.

– ADR Regulations (Europe): Sets rules for the road transport of dangerous goods.

– 49 CFR (USA): Regulated by the U.S. Department of Transportation (DOT), covering hazardous materials transportation, including storage in containers.

– EPA Regulations (USA): Includes SPCC (Spill Prevention, Control, and Countermeasure) and RCRA (Resource Conservation and Recovery Act) requirements for oil storage and spill prevention.

– REACH & CLP Regulations (EU): For chemical classification, labeling, and safe handling.

Environmental Compliance

Environmental protection is a critical aspect of oil storage. Compliance measures include:

– Spill Containment: Secondary containment systems (e.g., bunds or spill pallets) must be used to capture leaks or spills. The containment should hold at least 110% of the largest container’s capacity.

– Stormwater Management: Prevent oil-contaminated runoff by ensuring storage areas are impermeable and equipped with oil-water separators if needed.

– Waste Oil Disposal: Used or contaminated oil must be managed as hazardous waste under applicable laws, with proper documentation and licensed disposal.

Safety and Fire Regulations

- Fire Codes: Storage facilities must comply with fire safety codes (e.g., NFPA 30 in the U.S.) that specify separation distances, fire suppression systems, and signage.

- Explosion Protection: In areas with flammable vapors, use of explosion-proof equipment and ventilation is required.

- Personal Protective Equipment (PPE): Workers must wear appropriate PPE, including gloves, goggles, and flame-resistant clothing.

Logistics Planning and Execution

Site Selection and Layout

- Location: Choose sites with easy access for transport vehicles, minimal environmental risk, and compliance with zoning laws.

- Ground Preparation: Ensure the ground is level, stable, and impermeable (e.g., concrete or asphalt) to prevent container settling and environmental contamination.

- Security: Implement fencing, lighting, surveillance, and access control to prevent unauthorized entry and theft.

Container Specifications and Modifications

- Tank Containers (ISO Tanks): Use DOT/UN-certified tanks designed for liquid transport. Ensure tanks are compatible with the stored oil (e.g., stainless steel for corrosive oils).

- Intermediate Bulk Containers (IBCs) in 20ft frames: Suitable for smaller volumes. Must be UN-rated and properly secured.

- Ventilation and Pressure Relief: Tanks must have functional pressure/vacuum relief valves.

- Labeling and Marking: Clearly mark containers with contents, hazard class, UN number, and emergency contact information.

Transportation and Handling

- Load Securing: Containers must be properly secured on trucks, railcars, or ships using twist locks and lashing systems.

- Route Planning: Avoid densely populated areas and ecologically sensitive zones when transporting oil by road or rail.

- Driver Training: Personnel must be trained in handling hazardous materials (e.g., Hazmat certification in the U.S.).

- Temperature Control: For oils with high pour points or volatility, use insulated or heated containers.

Documentation and Recordkeeping

- Safety Data Sheets (SDS): Maintain up-to-date SDS for all stored oils.

- Transport Documents: Include shipping manifests, dangerous goods declarations, and emergency response information.

- Inspection Logs: Regularly inspect containers for corrosion, leaks, and structural integrity. Keep logs for audits.

- Compliance Certificates: Retain proof of tank certification, SPCC plans, and waste disposal manifests.

Emergency Preparedness and Response

- Spill Response Plan: Develop and implement a site-specific spill response plan, including containment, cleanup procedures, and reporting protocols.

- Emergency Equipment: Keep spill kits, absorbents, fire extinguishers, and eye wash stations on-site.

- Reporting Obligations: Report spills exceeding regulatory thresholds (e.g., 42 gallons of oil into navigable waters in the U.S.) to environmental agencies immediately.

- Drills and Training: Conduct regular emergency drills and train personnel on spill response and evacuation procedures.

Inspection, Maintenance, and Decommissioning

- Routine Inspections: Conduct monthly visual inspections and annual professional assessments of tanks and containment systems.

- Maintenance Schedule: Replace seals, valves, and hoses as needed; clean tanks to prevent sludge buildup.

- Decommissioning: When retiring a container, fully empty and clean it using licensed waste handlers. Document the process and dispose of or recycle the container responsibly.

Conclusion

Effective container oil storage requires a proactive approach to logistics and strict adherence to compliance standards. By integrating proper planning, regulatory knowledge, safety systems, and environmental safeguards, organizations can ensure safe, legal, and efficient operations. Regular training, documentation, and emergency preparedness are essential components of a robust container oil storage program.

Conclusion: Sourcing Container Oil Storage

Sourcing containerized oil storage presents a practical, cost-effective, and flexible solution for businesses requiring efficient and scalable storage options. Repurposed shipping containers offer durability, mobility, and ease of transportation, making them ideal for both temporary and long-term oil storage needs across diverse environments—including remote locations, construction sites, and industrial facilities. With proper modification—such as corrosion resistance, sealing, safety compliance (e.g., API, OSHA, or local regulations), and integration of monitoring systems—shipping containers can be transformed into secure and reliable oil containment units.

Additionally, containerized storage supports sustainability goals by reusing existing materials and reducing the environmental footprint compared to traditional concrete or steel tanks. When sourcing, it is essential to evaluate suppliers based on quality standards, customization capabilities, certifications, and after-sales support to ensure compliance and operational safety.

In summary, container oil storage solutions offer a strategic advantage in terms of scalability, logistical efficiency, and cost savings. As industries continue to demand agile and adaptable infrastructure, sourcing modified shipping containers for oil storage proves to be a forward-thinking and economically sound decision.