The global contact lens market is experiencing steady expansion, driven by rising prevalence of vision impairments, increasing demand for cosmetic lenses, and advancements in lens materials and manufacturing technologies. According to a 2023 report by Mordor Intelligence, the market was valued at USD 12.3 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2028, reaching an estimated USD 17.2 billion by the end of the forecast period. This growth is further bolstered by the growing preference for daily disposable lenses, heightened focus on eye health, and rising disposable incomes in emerging economies. As innovation accelerates and consumer preferences shift toward convenience and comfort, a select group of manufacturers are leading the charge in product development, market share, and technological advancement. Here’s a data-driven look at the top 10 contact lens manufacturers shaping the future of vision correction worldwide.

Top 10 Contact Lens Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Edmund Optics: Optics Manufacturer & Supplier

Domain Est. 1999

Website: edmundoptics.com

Key Highlights: Edmund Optics has been a leading producer of optics, imaging, and laser optics for 80 years. Discover the latest optical and imaging technology….

#2 Manufacturers

Domain Est. 1996

Website: contactsdirect.com

Key Highlights: Free deliveryPrescription lenses are made by three companies: Bausch & Lomb, CooperVision, and Johnson & Johnson Vision Care. The major brands are Acuvue®, Soflens®, Air ……

#3 Art Optical Contact Lens, Inc.

Domain Est. 1997

Website: artoptical.com

Key Highlights: Intended for: · Myopia management · Up to -5.00D myopia correction · 1.50D astigmatism correction · Approved for overnight orthokeratology by the US FDA….

#4 About Us

Domain Est. 1998

Website: alcon.com

Key Highlights: We are one of the largest manufacturers of contact lenses and lens care products. Our Vision Care portfolio offers a broad range of daily disposable ……

#5 Contact Lens Manufacturers Association

Domain Est. 1999

Website: clma.net

Key Highlights: The Contact Lens Manufacturers Association (CLMA), organized in 1961, is made up of contact lens laboratories and material, solution and equipment ……

#6 Blanchard Contact Lenses

Domain Est. 2000

Website: blanchardlab.com

Key Highlights: Since its Foundation in 1986, BLANCHARD CONTACT LENS INC. has been supplying practitioners with unique soft and custom-made R.G.P. lenses….

#7 SynergEyes

Domain Est. 2003

Website: synergeyes.com

Key Highlights: SynergEyes is the provider of High Performance, Advanced Technology Specialty and Hybrid Contact Lenses For Astigmatism, Presbyopia and Keratoconus….

#8 Specialty and Gas Permeable Contact Lenses

Domain Est. 1995

Website: bausch.com

Key Highlights: A family of custom soft contact lenses that combine innovative lens features and technologies to address patients with vision needs beyond standard parameters….

#9 ABB Contact Lens

Domain Est. 1998

Website: abboptical.com

Key Highlights: We have over 50 years of experience in manufacturing gas permeable contact lenses, so you can count on our expertise to provide premium gas permeable lenses ……

#10 Johnson & Johnson Vision for Eye Care Professionals

Domain Est. 2017

Website: jnjvisionpro.com

Key Highlights: J&J Vision Pro, your go-to resource for eye care professionals. Access cutting-edge products, educational materials, and expert support in one platform….

Expert Sourcing Insights for Contact Lens

H2 2026 Market Trends Analysis for the Contact Lens Industry

The global contact lens market is poised for significant evolution in H2 2026, driven by technological advancements, shifting consumer preferences, and increasing competition. Key trends shaping the industry during this period include:

-

Dominance of Silicone Hydrogel and Ultra-Thin Materials: Silicone hydrogel lenses will maintain their stronghold, valued for superior oxygen permeability and comfort. H2 2026 will see the mainstream adoption of next-generation ultra-thin silicone hydrogel lenses (often <0.04mm), blurring the line between daily disposables and premium comfort. Expect continued innovation in material science to enhance wettability and resistance to lipid/protein deposits.

-

Acceleration of the Daily Disposable Revolution: Daily disposables will solidify their position as the dominant modality, capturing over 65% of the global market volume. H2 2026 will be characterized by:

- Affordability Push: Increased competition, especially from value-oriented brands and direct-to-consumer (DTC) players, will drive prices down, making dailies more accessible.

- Sustainability Focus: Major manufacturers will launch more prominent initiatives addressing environmental concerns (e.g., improved packaging recyclability, take-back programs, development of more biodegradable materials), becoming a key differentiator.

- Expansion of Presbyopia Solutions: Growth in daily disposable multifocal and extended depth of focus (EDOF) lenses will cater to the aging population seeking convenience and clear vision at all distances.

-

Rise of Premiumization and Niche Solutions:

- Enhanced Performance: Premium lenses focusing on specific benefits like superior hydration (using advanced wetting agents like PVP or hyaluronic acid), reduced dryness (especially in low-humidity environments or for digital device users), and optimized optics for night vision will gain traction.

- Cosmetic Lenses Resurgence: Colored and cosmetic lenses (including light enhancement and subtle “circle lens” effects popular in Asia) will experience growth, driven by fashion trends and social media influence, with a focus on natural-looking results and safety.

- Specialty Lenses: Growth in custom scleral lenses for complex conditions (keratoconus, severe dry eye) and orthokeratology (Ortho-K) lenses for myopia management will continue, supported by technological improvements and increased awareness.

-

Digital Transformation and Ecosystem Integration:

- DTC Model Maturation: Established DTC brands (e.g., Hubble, Lens.com) and new entrants will leverage data analytics and personalized marketing. Subscription models will become highly refined, often bundled with eye health tracking apps.

- AI-Powered Personalization: AI algorithms will be increasingly used for virtual try-ons (for cosmetic lenses), personalized lens recommendations based on lifestyle and eye data, and predictive analytics for subscription replenishment.

- Telehealth Integration: Seamless integration between tele-optometry consultations, prescription renewals, and direct lens ordering will become standard, enhancing convenience. Partnerships between lens manufacturers, DTC platforms, and telehealth providers will deepen.

-

Intensifying Competition and Market Consolidation:

- Pharma & Consumer Giants: Large players (Alcon, Johnson & Johnson Vision, CooperVision) will leverage their R&D power and global distribution to launch innovative products and counter DTC pricing pressure. Expect strategic acquisitions of smaller tech or DTC companies.

- DTC Pressure: Aggressive pricing and marketing from DTC brands will continue to challenge traditional distribution channels and push incumbents to innovate and offer more value.

- Regional Players: Strong regional players (e.g., in Asia) will expand their footprint, particularly in the daily disposable and cosmetic segments.

-

Focus on Eye Health and Myopia Management:

- Myopia Control: H2 2026 will see significant growth in soft contact lenses specifically designed for slowing myopia progression in children and young adults (e.g., CooperVision’s MiSight, Johnson & Johnson’s ACUVUE* Abiliti™). Awareness campaigns and pediatric optometry adoption will be key drivers.

- Holistic Eye Care: Marketing and product development will increasingly emphasize the link between lens wear and overall eye health, promoting hydration, protection from blue light (through lens materials or coatings), and regular eye exams.

-

Sustainability as a Core Imperative: Environmental impact will move from a secondary concern to a primary strategic focus. Expect:

- Reduced Packaging: Further minimization of plastic use in blister packs and secondary packaging.

- Recycling Infrastructure: Expansion of dedicated contact lens and blister pack recycling programs (e.g., Bausch + Lomb’s ONE by ONE program).

- Material Innovation: Increased R&D investment into bio-based or more readily biodegradable lens materials, though widespread commercialization may still be beyond H2 2026.

Conclusion for H2 2026: The contact lens market in the second half of 2026 will be defined by the consolidation of daily disposables, driven by affordability and convenience, alongside a strong counter-trend of premiumization focused on performance, health, and personalization. Digital channels and DTC models will be fully integrated, forcing traditional players to adapt. Sustainability and myopia management will be critical growth vectors and key differentiators. Success will belong to companies that can balance innovation in materials and technology with compelling value propositions, seamless digital experiences, and demonstrable commitment to environmental responsibility and long-term eye health.

Common Pitfalls When Sourcing Contact Lenses: Quality and Intellectual Property Risks

Sourcing contact lenses, especially from international or third-party suppliers, involves significant risks related to product quality and intellectual property (IP) infringement. Failing to address these pitfalls can result in regulatory non-compliance, consumer harm, legal action, and reputational damage. Below are key challenges to be aware of:

Quality Control Issues

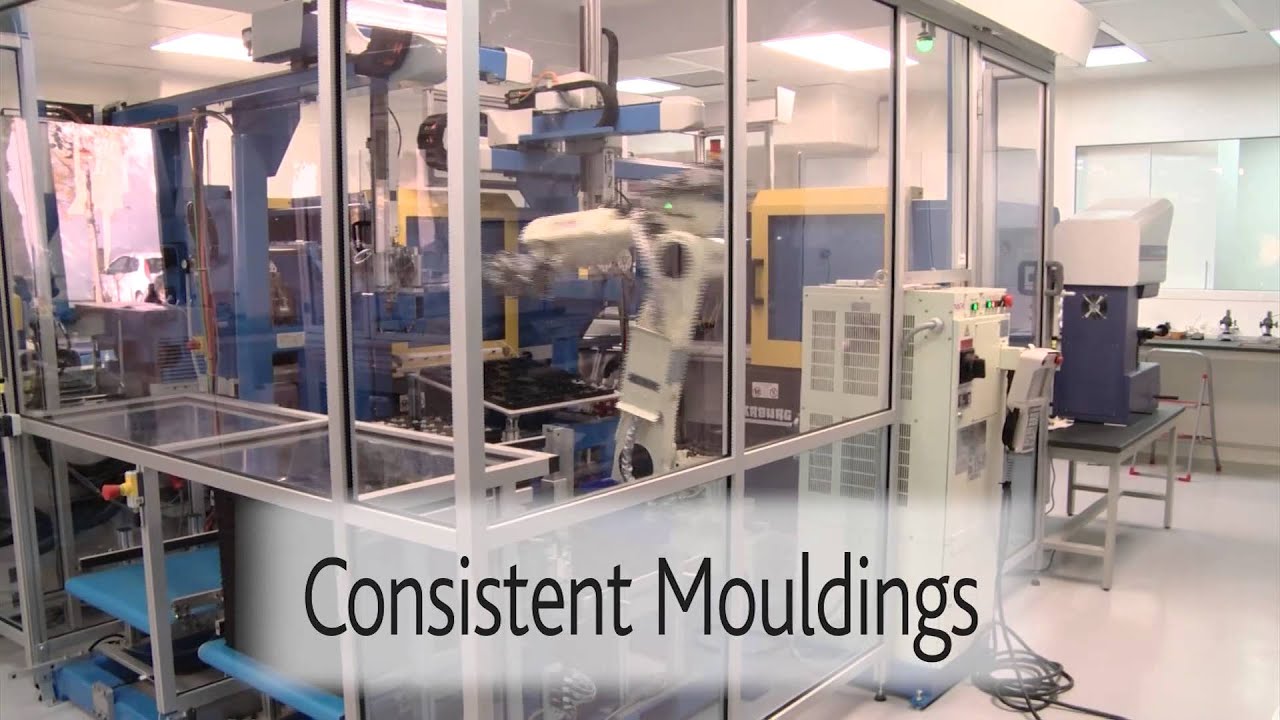

One of the most critical concerns when sourcing contact lenses is ensuring consistent product quality. Poor quality lenses can lead to serious eye health complications, including infections, corneal abrasions, and even vision loss.

- Substandard Materials: Suppliers may use inferior hydrogel or silicone hydrogel materials that do not meet biocompatibility or oxygen permeability standards, increasing the risk of eye irritation and hypoxia.

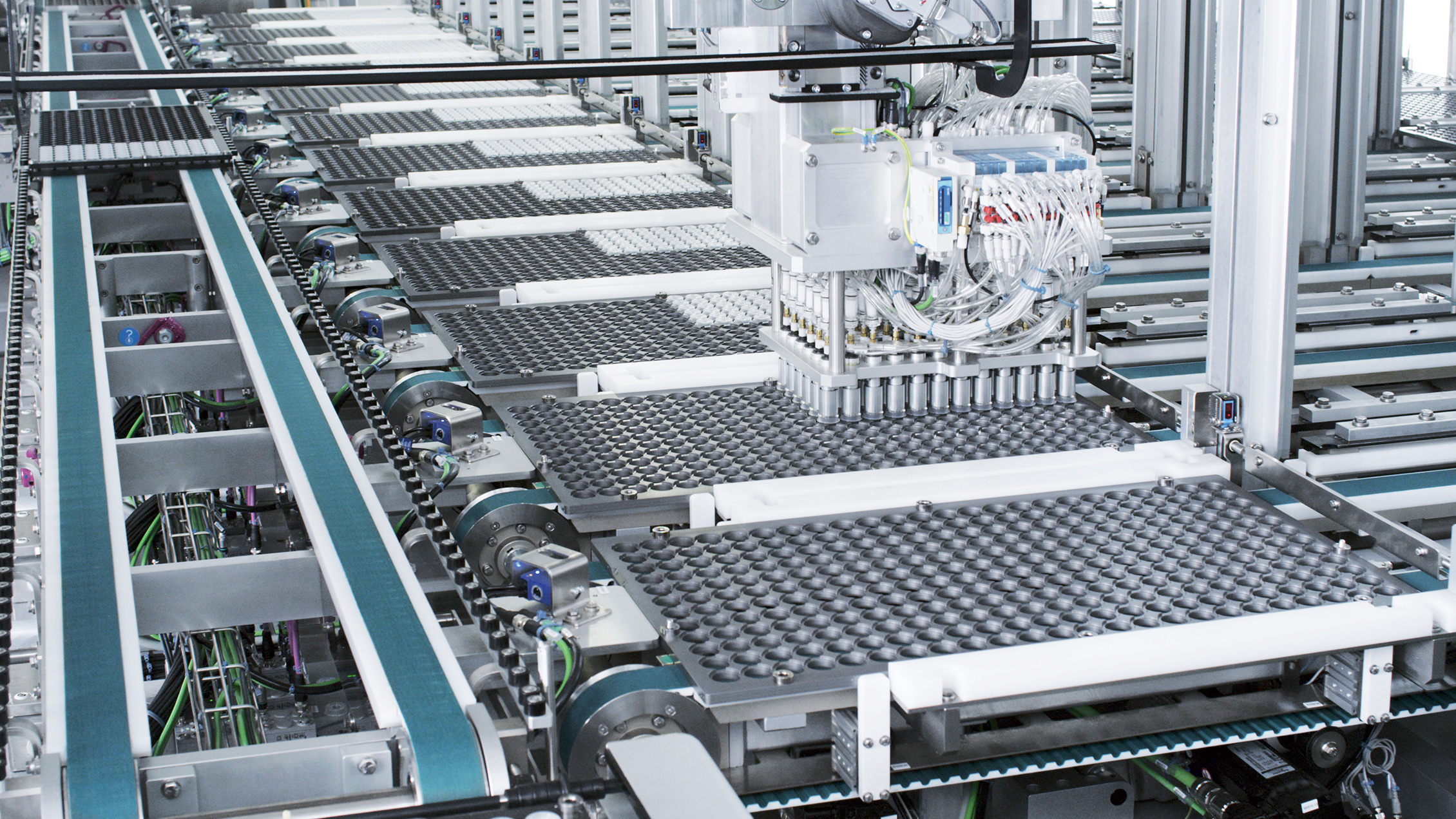

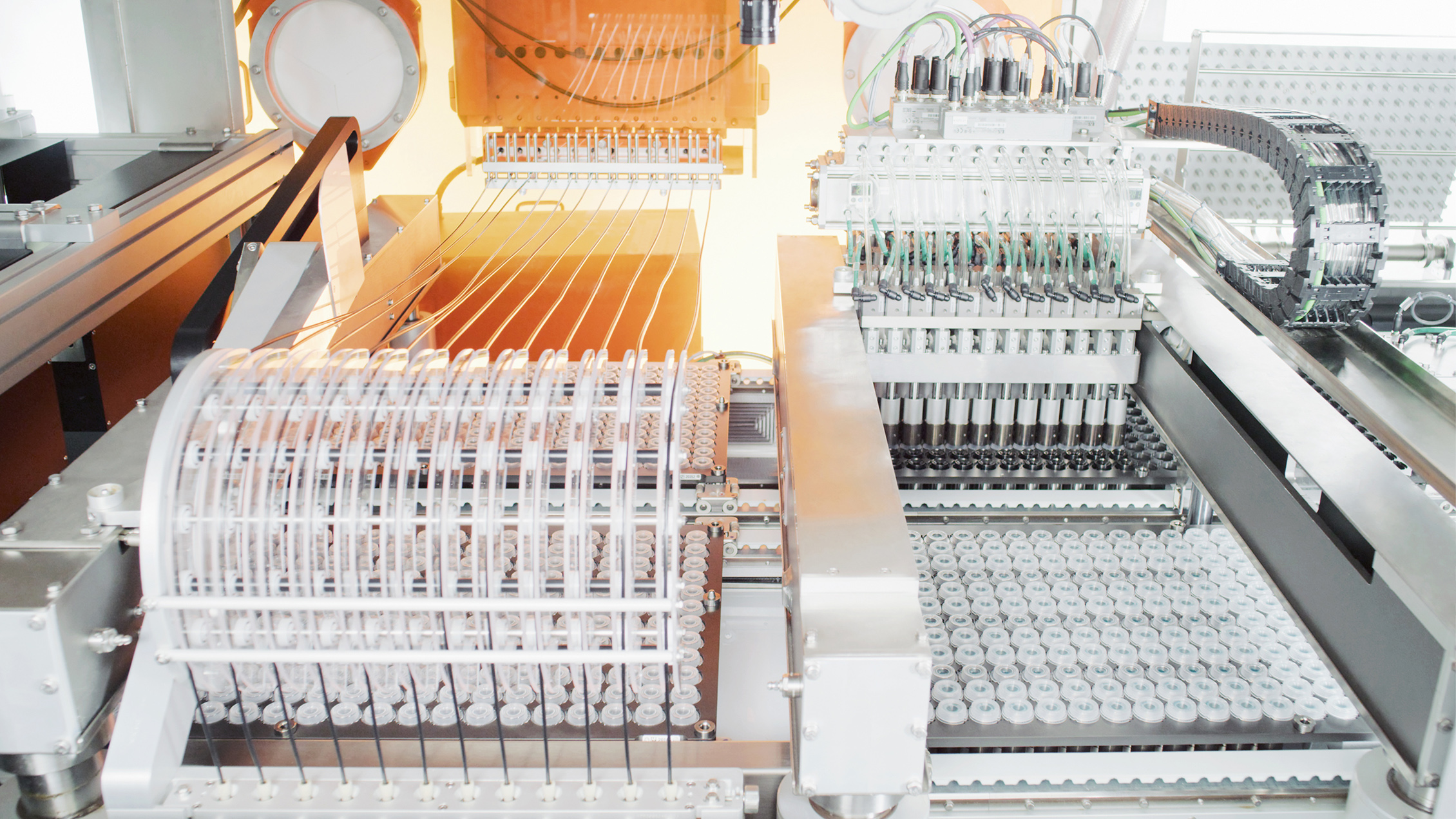

- Inconsistent Manufacturing Processes: Lack of standardized production controls can result in variations in lens thickness, curvature, and diameter, leading to improper fit and discomfort.

- Inadequate Sterilization: Improper or inconsistent sterilization processes can introduce microbial contamination, posing severe health risks to end users.

- Lack of Regulatory Compliance: Sourced lenses may not comply with regulatory requirements such as FDA (U.S.), CE marking (Europe), or other local medical device regulations, making them illegal to sell in target markets.

Intellectual Property Infringement

Contact lenses are often protected by patents, trademarks, and design rights. Sourcing generic or unbranded lenses without proper due diligence can inadvertently lead to IP violations.

- Patent Infringement: Many lens technologies (e.g., moisture retention, UV protection, aspheric designs) are covered by active patents. Sourcing lenses that replicate these features without licensing can result in costly litigation.

- Trademark Violations: Using brand names, logos, or packaging that mimics well-known brands (e.g., Acuvue, Air Optix) – even subtly – can lead to legal action for trademark infringement.

- Design Patent Infringement: The shape, texture, or packaging design of contact lenses may be protected. Copying these aesthetic elements can violate design rights.

- Gray Market and Counterfeit Goods: Sourcing from unauthorized distributors may result in counterfeit or gray market products that infringe on IP and lack quality assurance.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct thorough supplier audits and request certifications (e.g., ISO 13485 for medical devices).

– Verify regulatory approvals in the target market.

– Perform independent product testing for safety and performance.

– Consult legal experts to conduct IP clearance searches before launching sourced products.

– Use written contracts that include quality guarantees and IP indemnification clauses.

Proactively addressing quality and IP concerns ensures compliance, protects consumers, and safeguards the business from legal and financial exposure.

Logistics & Compliance Guide for Contact Lenses

Regulatory Classification and Approval

Contact lenses are classified as medical devices and are subject to stringent regulations. In the United States, the Food and Drug Administration (FDA) regulates contact lenses under 21 CFR Part 886. They are typically categorized as Class II devices, requiring a 510(k) premarket notification unless exempt. Manufacturers and distributors must ensure that all lenses are FDA-cleared or approved before being marketed. Similar regulatory bodies, such as Health Canada, the European Medicines Agency (EMA), and the Medicines and Healthcare products Regulatory Agency (MHRA) in the UK, enforce comparable standards in their respective regions.

Prescription Requirement and Sales Restrictions

Contact lenses are considered prescription medical devices in most jurisdictions. In the U.S., the Fairness to Contact Lens Consumers Act (2003) mandates that consumers must have a valid prescription to purchase contact lenses. Sellers must verify prescriptions before dispensing lenses, and prescribers are required to provide patients with a copy of their prescription upon request. Online retailers must implement processes to confirm prescription validity, often involving direct verification with the prescribing eye care professional.

Labeling and Packaging Compliance

All contact lenses must be labeled in accordance with regulatory requirements. Labels must include the brand name, power (diopter), base curve, diameter, material composition, expiration date, and lot number. Packaging must be sterile and tamper-evident. In the U.S., labeling must comply with FDA 21 CFR 801, including directions for use, warnings, and contraindications. The European Union requires CE marking and adherence to the EU Medical Device Regulation (MDR) 2017/745 for labeling and traceability.

Storage and Transportation Conditions

Contact lenses must be stored and transported under controlled conditions to maintain sterility and efficacy. Most lenses are stored in buffered saline solution within sealed, sterile packaging. Temperature control is critical—storage and shipping environments should generally be maintained between 15°C and 30°C (59°F–86°F), avoiding freezing or excessive heat. Cold chain logistics may be required for certain lens solutions or specialty lenses. Proper packaging must prevent physical damage and contamination during transit.

Import and Export Regulations

International shipping of contact lenses requires compliance with both exporting and importing country regulations. Exporters must ensure lenses meet destination country standards (e.g., CE marking for EU, Health Canada authorization). Importers must provide documentation such as certificates of conformity, FDA registration (for U.S. imports), and commercial invoices. Customs brokers may be required to handle medical device classifications and tariffs. Restrictions may apply on quantity, prescription validation, and licensing of importers.

Recordkeeping and Traceability

Manufacturers, distributors, and retailers must maintain detailed records for traceability and audit purposes. Required documentation includes batch/lot numbers, distribution records, prescription verification logs, adverse event reports, and inventory management. Under FDA’s Unique Device Identification (UDI) system, contact lenses must carry a UDI code on the label and packaging to facilitate tracking throughout the supply chain. EU MDR also enforces UDI requirements for enhanced post-market surveillance.

Adverse Event Reporting and Post-Market Surveillance

Companies must establish systems for monitoring and reporting adverse events related to contact lens use. In the U.S., manufacturers and importers are required to report device-related deaths, serious injuries, and malfunctions to the FDA via the MedWatch program (Form FDA 3500A). In the EU, incidents must be reported through Eudamed under the MDR. Post-market surveillance plans must be in place to collect and analyze safety data, enabling timely corrective actions such as recalls or labeling updates.

Return and Recall Procedures

Due to their sterile and prescription nature, contact lenses are generally non-returnable for hygiene and safety reasons, unless defective or misshipped. A clear return policy compliant with local regulations must be communicated to consumers. In case of product defects or safety concerns, a formal recall procedure must be executed. Recalls must be classified (I, II, or III in the U.S.) and reported to regulatory authorities. Effective communication with distributors, retailers, and consumers is essential, along with coordination of product retrieval and corrective measures.

Training and Staff Compliance

Personnel involved in the logistics, sales, and distribution of contact lenses must be trained in relevant regulations, handling procedures, and ethical standards. This includes understanding prescription verification protocols, data privacy (e.g., HIPAA in the U.S.), and proper storage practices. Ongoing training ensures compliance with evolving regulations and reduces the risk of violations that could lead to fines, product seizures, or license revocation.

Environmental and Disposal Considerations

While contact lenses themselves are not typically hazardous waste, their disposal contributes to microplastic pollution. Companies are encouraged to promote responsible disposal practices and explore eco-friendly packaging. Used lens solution and blister packs should be disposed of according to local waste regulations. Some organizations offer take-back or recycling programs for contact lens packaging, aligning with sustainability goals and corporate social responsibility.

Conclusion: Sourcing Contact Lens Manufacturers

Sourcing contact lens manufacturers requires a strategic approach that balances quality, regulatory compliance, cost-efficiency, and innovation. After thorough evaluation of potential suppliers, it is evident that partnering with manufacturers who adhere to international quality standards—such as ISO 13485 and FDA or CE certifications—is essential to ensure product safety and market access. Countries like China, Germany, South Korea, and the United States host reputable manufacturers with varying strengths in customization, R&D capabilities, and production scale.

Key considerations include verifying a manufacturer’s experience in producing the desired lens types (e.g., daily disposables, toric, or colored lenses), assessing supply chain reliability, and evaluating their capacity to scale production as demand grows. Additionally, strong communication, intellectual property protection, and ethical manufacturing practices are critical for building a sustainable long-term partnership.

In conclusion, successful sourcing hinges on due diligence, clear specifications, and ongoing quality assurance. Selecting a manufacturer that aligns with both technical requirements and business values will not only ensure high-quality products but also support brand reputation and regulatory compliance in competitive eye care markets.