The global wood furniture market continues to expand, driven by rising demand for sustainable and aesthetically appealing office and hospitality furnishings. According to Grand View Research, the global wooden furniture market was valued at USD 112.1 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. This growth is fueled by increasing investments in commercial infrastructure, a resurgence in hybrid workspaces requiring premium conference solutions, and a heightened preference for eco-friendly materials. As businesses prioritize functional elegance in meeting environments, conference wooden tables have emerged as key focal points in modern interiors. With demand on the rise, a select group of manufacturers have distinguished themselves through craftsmanship, innovation, and scalability. Based on production capabilities, market presence, and customer reviews, here are the top 8 conference wooden table manufacturers shaping the industry.

Top 8 Conference Wooden Table Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Nevers Industries

Domain Est. 1995

Website: nevers.com

Key Highlights: Nevers offers standard and custom conference furniture: tables, credenzas, and lecterns, crafted in the USA, for high-performance workspaces….

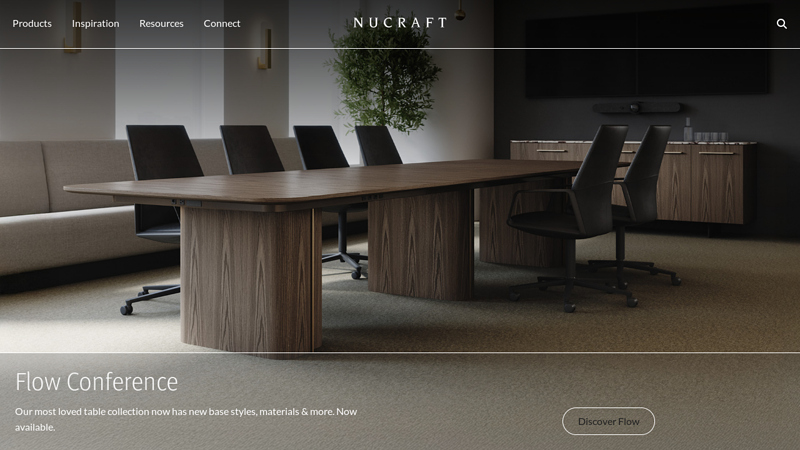

#2 Nucraft

Domain Est. 1995

Website: nucraft.com

Key Highlights: Through high quality craftsmanship, Nucraft’s beautiful tables and casegoods help create inspiring conference rooms, private offices, and training spaces….

#3 Conference Tables

Domain Est. 1997

Website: hon.com

Key Highlights: HON conference tables are made for so much more than meetings. HON conference tables come in the shapes, sizes and styles that help make any space work ……

#4 Modern Conference + Work Tables

Domain Est. 1997

Website: bludot.com

Key Highlights: 25–27 day deliveryCrafted for both form and function, our conference tables feature premium materials like solid wood, powder-coated steel, laminate, Forbo linoleum, and tempered ….

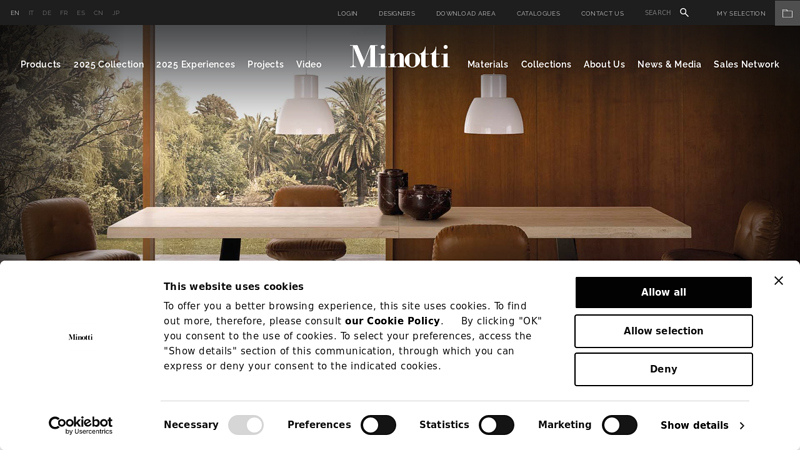

#5 Tables and Writing Desks

Domain Est. 1997

Website: minotti.com

Key Highlights: Tables and Writing Desks. Tables and Writing Desks · Libra “Table” · Linha Livre · Saki “Table” · Nico · Rayan · Diagramma “Writing Desk” · Brady “Dining” · Linha Fina….

#6 Enwork

Domain Est. 2004

Website: enwork.com

Key Highlights: Explore conference furniture, desking, open plan workspaces, seating and more. Enwork is known for delivering innovative design for the modern office….

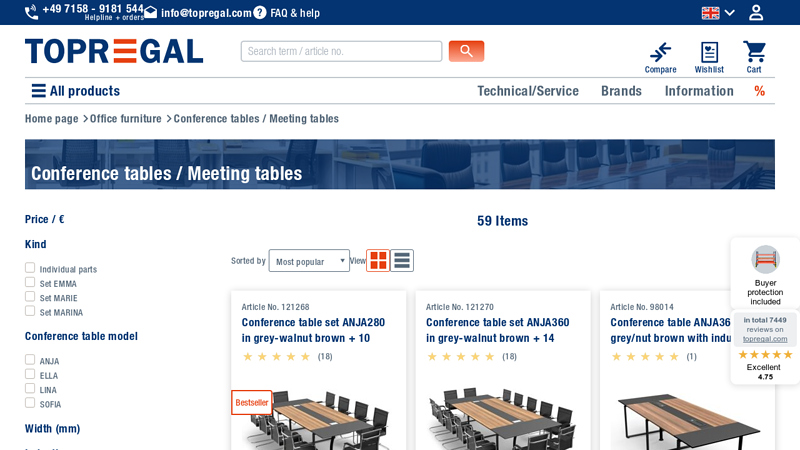

#7 Conference tables / meeting tables

Domain Est. 2008

Website: topregal.com

Key Highlights: Order conference tables as a set with chairs, integrated cable duct and induction charging panel at a great price!…

#8 Paul Downs Cabinetmakers

Domain Est. 2009

Website: custom-conference-tables.com

Key Highlights: We build conference tables that can seat 18 to 22 meeting participants comfortably and add an element of beauty to your conference room….

Expert Sourcing Insights for Conference Wooden Table

H2: Analysis of 2026 Market Trends for Conference Wooden Tables

Rising Demand for Sustainable and Eco-Friendly Materials

By 2026, sustainability remains a dominant driver in the office furniture sector, including conference wooden tables. Consumers and businesses alike are prioritizing eco-conscious procurement, favoring sustainably sourced hardwoods such as FSC-certified oak, walnut, and bamboo. Manufacturers are responding by integrating low-impact production methods, non-toxic finishes, and circular design principles—such as modular or recyclable components—to meet green building standards like LEED and BREEAM.

Integration of Smart Technology in Wooden Conference Tables

The convergence of traditional craftsmanship with modern technology is shaping the 2026 market. Conference wooden tables increasingly feature built-in wireless charging pads, USB-C ports, and embedded audio-visual systems. High-end models may include sensor-integrated surfaces for touch controls or compatibility with AI-powered meeting assistants. These smart functionalities enhance user experience without compromising the natural aesthetic of wood, appealing to hybrid workspaces that demand seamless connectivity.

Growth in Hybrid Workspaces and Flexible Office Design

The proliferation of hybrid work models continues to influence office layouts, increasing demand for versatile conference furniture. In 2026, wooden conference tables are being designed for adaptability—offering extendable surfaces, modular sections, and easy reconfiguration. This flexibility supports dynamic meeting environments, from executive boardrooms to collaborative huddle spaces, while maintaining the warmth and professionalism associated with wood.

Shift Toward Biophilic and Wellness-Oriented Interiors

Biophilic design principles are gaining traction in commercial interiors, with wooden conference tables playing a central role. Natural materials like wood are proven to reduce stress and improve cognitive function, making them ideal for high-performance meeting environments. By 2026, designers are selecting wooden tables not only for their visual appeal but also for their contribution to occupant well-being, often pairing them with natural lighting, indoor greenery, and acoustic wood elements.

Regional Market Expansion and Customization Demand

North America and Europe remain key markets, but Asia-Pacific is witnessing accelerated growth due to expanding corporate infrastructure and rising investments in premium office spaces. In 2026, customization is a major trend—clients seek bespoke dimensions, unique wood grains, branding inlays, and tailored finishes. This demand is supported by digital design platforms and AI-driven configurators that allow buyers to visualize and order personalized tables online.

Challenges: Supply Chain and Cost Volatility

Despite positive trends, the wooden conference table market faces challenges related to raw material scarcity, fluctuating timber prices, and supply chain disruptions. Climate-related impacts on forestry and global trade policies may affect availability. Manufacturers are mitigating risks through vertical integration, alternative wood composites, and regional sourcing strategies to ensure consistent quality and delivery timelines.

Conclusion

The 2026 market for conference wooden tables reflects a balance between tradition and innovation. As businesses seek sustainable, technologically enhanced, and human-centric workspaces, wooden conference tables are evolving into sophisticated centerpieces of modern offices. Success in this market will depend on agility in design, commitment to sustainability, and the ability to merge timeless craftsmanship with digital functionality.

Common Pitfalls When Sourcing Conference Wooden Tables (Quality and Intellectual Property)

Sourcing conference wooden tables, especially for large-scale or commercial use, involves navigating several potential pitfalls related to both product quality and intellectual property (IP) rights. Overlooking these aspects can lead to compromised durability, poor aesthetics, legal risks, and reputational damage. Below are the key issues to watch for:

Overlooking Wood Quality and Sourcing Transparency

One of the most frequent mistakes is failing to verify the type, grade, and origin of the wood used. Low-grade or improperly dried timber can lead to warping, cracking, or discoloration over time. Suppliers may claim to use solid hardwood but deliver veneers over particleboard. Always request documentation on wood species, moisture content, and sourcing practices to ensure durability and sustainability.

Inadequate Finish and Surface Protection

A poorly applied or substandard finish can drastically reduce the lifespan of a wooden conference table. Tables exposed to frequent use require durable finishes—such as catalyzed lacquer or UV-cured coatings—that resist scratches, stains, and moisture. Sourcing tables without verifying the finish specifications often results in premature wear and high maintenance costs.

Ignoring Structural Integrity and Joinery Techniques

The strength and longevity of a conference table depend heavily on construction methods. Cheaply sourced tables may use staples, nails, or weak adhesives instead of proper mortise-and-tenon or dovetail joints. This compromises stability, especially for large tables. Always inspect or request details about joinery, frame materials, and reinforcement to avoid sagging or wobbling.

Assuming Compliance with Environmental and Safety Standards

Many wooden products, especially those treated with finishes or adhesives, must comply with environmental regulations such as CARB (California Air Resources Board) or FSC (Forest Stewardship Council) certification. Sourcing without confirming compliance can result in legal issues or health hazards due to off-gassing of formaldehyde and VOCs.

Failing to Verify Intellectual Property Rights

Replicating or sourcing tables that mimic iconic designer furniture—such as Eames, Saarinen, or Wegner pieces—poses serious IP risks. Even if a design appears generic, many high-end wooden tables are protected by design patents or copyrights. Sourcing counterfeit or unlicensed copies can lead to cease-and-desist letters, product seizure, or litigation, particularly in markets with strong IP enforcement.

Overlooking Design Authenticity and Licensing

Some suppliers offer “inspired by” versions of designer tables, but without proper licensing, these can still infringe on IP rights. Brands like Herman Miller, Vitra, or Cassina actively protect their designs. Always confirm whether the supplier holds legitimate licensing agreements or whether the design is in the public domain before procurement.

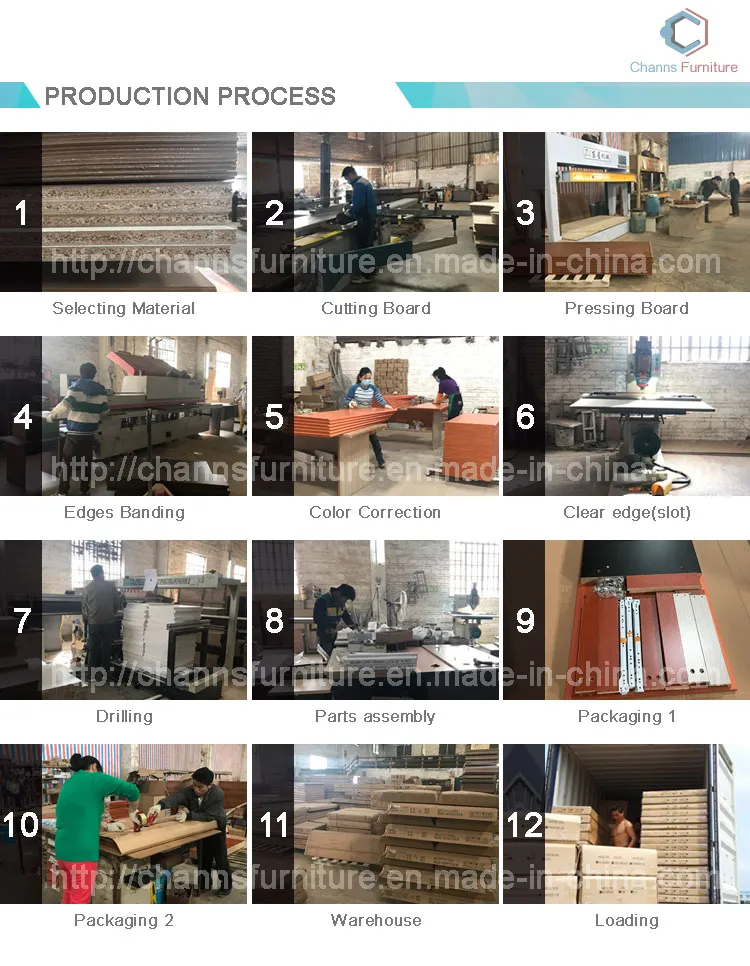

Skipping Prototypes and On-Site Quality Checks

Relying solely on catalogs or online images can be misleading. Without reviewing a physical sample or prototype, buyers risk receiving tables with inconsistent grain matching, poor edge banding, or misaligned components. Conducting in-person quality inspections or third-party audits helps catch defects before mass production.

Underestimating Logistics and Assembly Challenges

Large wooden conference tables are prone to damage during shipping if not properly packed. Poor crating or lack of climate-controlled transport can lead to dents, warping, or finish damage. Additionally, tables requiring complex on-site assembly may face delays or increased labor costs if instructions or hardware are inadequate.

Choosing Price Over Value

Opting for the lowest bid often leads to compromised materials, craftsmanship, and after-sales support. While cost is a factor, investing in higher-quality, ethically sourced, and legally compliant tables reduces long-term expenses related to repairs, replacements, and legal disputes.

By proactively addressing these pitfalls—through due diligence, supplier vetting, and legal review—organizations can ensure they source conference wooden tables that are both high in quality and free from intellectual property complications.

Logistics & Compliance Guide for Conference Wooden Table

Product Classification and HS Code

Identify the Harmonized System (HS) code for the conference wooden table to ensure accurate customs declaration. Typical classification falls under Chapter 44 (Wood and Wood Products), specifically HS 4421.90 (Other articles of wood) or HS 9403.60 (Furniture of wood, other than seats). Confirm the exact code based on design, materials, and country-specific tariff schedules.

Packaging and Palletization

Use sturdy, recyclable packaging to protect the table during transit. Wrap tabletop and legs in bubble wrap or edge protectors; secure components in a corrugated cardboard box or wooden crate. Palletize using standard EUR/ISO pallets (e.g., 1200 x 800 mm or 48” x 40”) and secure with stretch wrap or strapping. Label each pallet with handling instructions (e.g., “Fragile,” “This Side Up”).

Shipping and Transportation

Choose between air, sea, or ground freight based on cost, urgency, and volume. For international shipments, sea freight is typically cost-effective for bulk orders. Ensure carriers are compliant with international transport regulations (e.g., IMDG for sea, IATA for air if applicable). Provide accurate weight, dimensions, and freight class for rate calculation and load planning.

Import/Export Documentation

Prepare essential documents: Commercial Invoice, Packing List, Bill of Lading (or Air Waybill), and Certificate of Origin. Include detailed product descriptions, material composition (e.g., solid wood, engineered wood), country of manufacture, and declared value. For certain markets, additional documents like a Phytosanitary Certificate may be required to prove wood treatment.

Wood and Forestry Regulations

Comply with international wood import restrictions to prevent the spread of pests and illegal logging. Ensure the timber is sourced from sustainably managed forests. Provide documentation such as FSC (Forest Stewardship Council) or PEFC certification if applicable. Adhere to the U.S. Lacey Act, EU Timber Regulation (EUTR), or other regional requirements mandating legal sourcing.

Phytosanitary Requirements

For raw or untreated wood components, a Phytosanitary Certificate issued by the national plant protection organization is often required. This certifies that the wood has been treated to meet International Standards for Phytosanitary Measures No. 15 (ISPM 15) if used in packaging (e.g., wooden crates or pallets). Heat-treated wood packaging must bear the official ISPM 15 mark.

Product Safety and Standards

Ensure the table meets safety and quality standards in the destination market. In the EU, comply with REACH regulations (restrictions on hazardous substances) and EN 1725 (safety requirements for domestic tables). In the U.S., follow CPSIA guidelines if accessible to children, and general consumer product safety standards under the Consumer Product Safety Commission (CPSC).

Labeling and Marking

Label products and packaging with required information: product name, model number, country of origin, material content, care instructions, and compliance marks (e.g., CE mark for EU, FSC label if certified). Include barcodes or RFID tags if required by the distributor or retailer.

Customs Clearance and Duties

Work with a licensed customs broker to facilitate clearance. Accurately declare the product’s value, origin, and HS code to avoid delays or penalties. Be aware of applicable import duties, VAT, or anti-dumping taxes that may affect final landed cost. Maintain records for at least five years for audit purposes.

End-of-Life and Environmental Compliance

Design for disassembly and recyclability. Comply with waste directives such as the EU Waste Framework Directive, which promotes reuse and responsible disposal. Provide take-back or recycling information if required by local regulations or corporate sustainability policies.

Conclusion for Sourcing Conference Wooden Tables:

After thorough research, evaluation of suppliers, and consideration of quality, cost, sustainability, and design requirements, sourcing conference wooden tables has proven to be a strategic decision that balances aesthetics, durability, and functionality. By partnering with reputable manufacturers and prioritizing sustainably sourced wood, we ensure not only a professional and elegant appearance for our meeting spaces but also a commitment to environmental responsibility. The selected tables meet ergonomic standards, support modern conferencing needs (including cable management and modular configurations), and offer long-term value through durability and timeless design. This procurement aligns with our organizational values, enhances workplace efficiency, and contributes to a productive and inspiring environment for all users. Moving forward, continued supplier collaboration and periodic assessments will ensure ongoing satisfaction and adaptability to future needs.