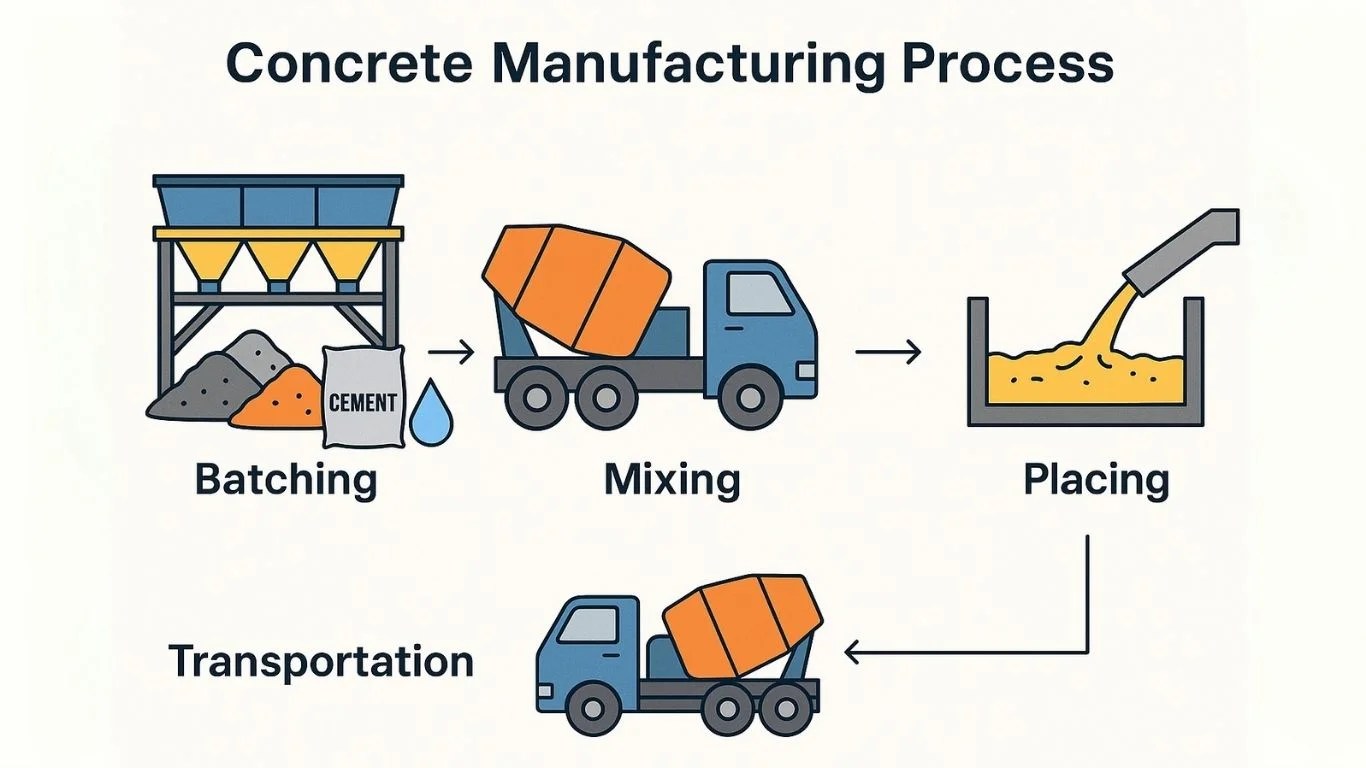

The global concrete mixer truck market is experiencing steady expansion, driven by rising infrastructure development and urbanization—particularly in emerging economies. According to Grand View Research, the global concrete mixer truck market size was valued at USD 7.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. This growth trajectory reflects increased demand for efficient ready-mix concrete transportation in large-scale construction projects across Asia-Pacific, North America, and the Middle East. As competition intensifies among equipment manufacturers, procurement teams and construction firms are placing greater emphasis on price transparency, total cost of ownership, and supplier reliability. In this landscape, identifying the top concrete truck manufacturers offering the best balance of affordability, performance, and durability has become critical. Based on production scale, market presence, and pricing competitiveness, we analyzed key players shaping the industry to bring you the top 10 concrete truck price manufacturers dominating the market today.

Top 10 Concrete Truck Price Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Concrete Mixer Trucks

Domain Est. 2008

Website: ctmmixers.com

Key Highlights: Con-Tech Mixers outperform & outwork any concrete truck manufacturer in the area. See how our high-quality concrete mixers & parts keep your fleet running!…

#2 Concrete Mixer Truck

Domain Est. 2024

Website: sabsvtruck.com

Key Highlights: SABSV is a professional concrete mixer truck supplier and cement mixer truck manufacturer in China, dedicated to the production and sales of special vehicles….

#3 Cemen Tech

Domain Est. 1995

Website: cementech.com

Key Highlights: Cemen Tech’s mobile concrete mixers give you control over your concrete. Reduce waste, improve efficiency, save time and money on any project….

#4 Leading Supplier of Concrete & Building Materials

Domain Est. 1996

Website: cemexusa.com

Key Highlights: Trusted building materials supplier and concrete supplier, Cemex US delivers ready-mix concrete, aggregates, and sustainable solutions nationwide for ……

#5 Ready Mix Concrete

Domain Est. 1997

Website: gcc.com

Key Highlights: GCC can supply all of your concrete needs – from 1 cubic yard for your home to 50,000 cubic yards for a new highway. Using our own innovative, high-quality ……

#6 Ready Mixer

Domain Est. 2004

Website: readymixer.com

Key Highlights: At Ready Mixer, we specialize in small batch concrete machinery, offering mixing trailers, hoppers, concrete pumps and more designed for efficiency and ease of ……

#7 SRM Concrete

Domain Est. 2006

Website: smyrnareadymix.com

Key Highlights: SRM provides quality ready mix concrete and construction materials to our customers throughout sixteen states….

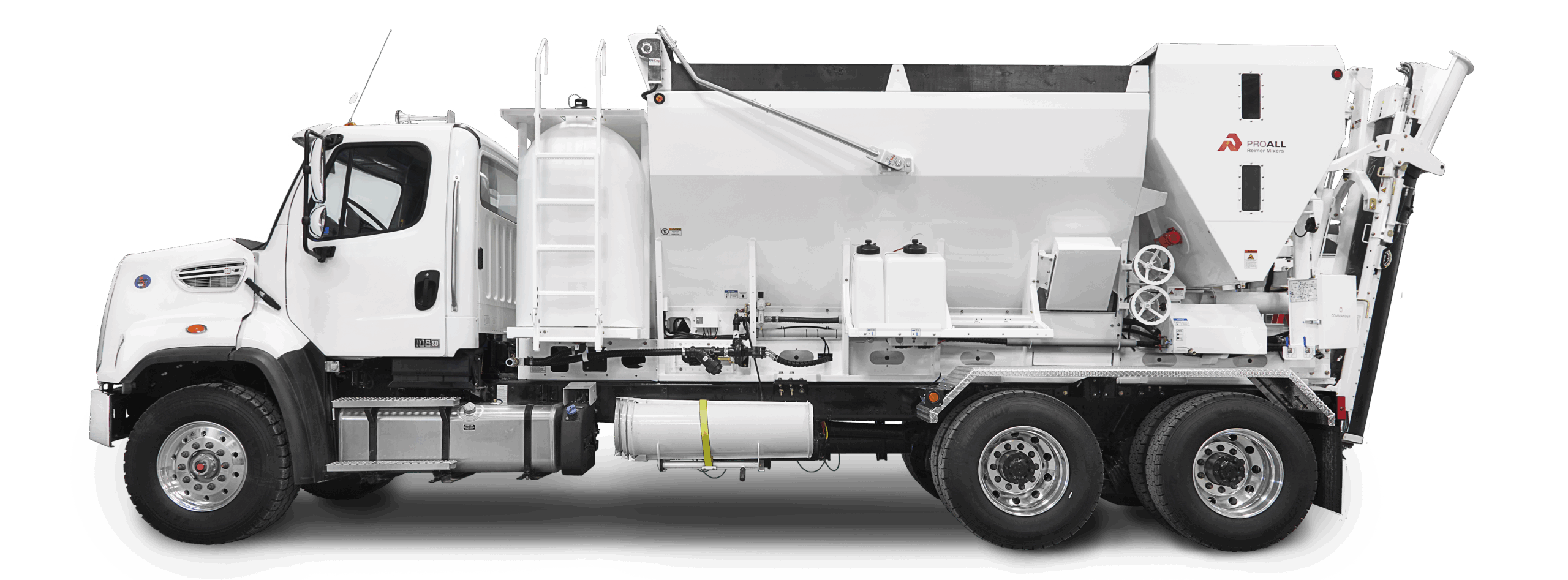

#8 Innovative Volumetric Concrete Mixer Trucks

Domain Est. 2013

Website: proallinc.com

Key Highlights: A ProAll volumetric mixer is revolutionary construction equipment engineered to mix different types of concrete to exacting specifications – right at the ……

#9 Concrete Mixer Truck Suppliers

Domain Est. 2017

Website: qinglingisuzu.com

Key Highlights: Concrete Mixer Trucks are vocational trucks designed with mixing drums, mixing blades, power systems, and other equipment for transporting concrete….

#10 AJAX Self Loading Concrete Mixers

Domain Est. 2019

Website: ajax-engg.com

Key Highlights: A compact powerhouse for your concrete needs. This self-loading concrete mixer combines efficiency with agility, ensuring smooth and precise concrete mixing….

Expert Sourcing Insights for Concrete Truck Price

2026 Market Trends Forecast for Concrete Truck Prices

The price of concrete mixer trucks in 2026 is expected to be shaped by a confluence of macroeconomic, regulatory, technological, and industry-specific forces. While precise pricing is difficult to predict, several key trends will exert upward and downward pressure, leading to a complex and dynamic market.

Rising Input Costs and Supply Chain Pressures

Material and component costs will continue to influence truck pricing significantly in 2026. Steel, aluminum, and rubber remain primary inputs for chassis and drum manufacturing, and volatility in global commodity markets — driven by geopolitical tensions, trade policies, and energy prices — could sustain elevated input costs. Additionally, semiconductor shortages and supply chain bottlenecks, though improved from 2020–2022 peaks, may persist intermittently, particularly affecting electronic control systems and telematics packages. Manufacturers may pass these costs onto buyers, contributing to price increases.

Regulatory and Emissions Standards Driving Technological Investment

By 2026, tightening environmental regulations — especially in North America and Europe — will accelerate the adoption of low- and zero-emission technologies. Stricter EPA and Euro VII compliance requirements will push manufacturers to invest heavily in alternative fuel systems such as electric, hydrogen fuel cell, and natural gas-powered chassis. While battery-electric concrete trucks are still in early commercial adoption, increasing incentives and urban emissions zones will boost demand. These advanced powertrains come with substantial upfront costs, likely making hybrid and electric models 30–50% more expensive than conventional diesel trucks, thus elevating the average market price.

Labor and Manufacturing Efficiency Challenges

Labor shortages in skilled manufacturing and truck assembly remain a concern. Wage inflation and difficulties in recruitment may increase production costs. However, automation and digital manufacturing improvements could partially offset these pressures. OEMs investing in smart factories and modular designs may achieve better economies of scale, helping to moderate price growth. Still, labor cost increases are expected to contribute modestly to overall price hikes.

Demand-Side Dynamics in Construction and Infrastructure

Government infrastructure spending, particularly under long-term programs like the U.S. Infrastructure Investment and Jobs Act, will sustain strong demand for concrete trucks through 2026. Urban development, bridge rehabilitation, and renewable energy projects (e.g., wind and solar farms) will drive fleet expansion and replacement cycles. High demand in a constrained supply environment could support higher pricing power for manufacturers. Conversely, a potential economic slowdown or interest rate volatility could dampen private construction activity, creating pockets of price competition.

Technological Integration and Value-Added Features

Concrete trucks in 2026 will increasingly include advanced telematics, predictive maintenance systems, load monitoring sensors, and driver-assist technologies. These features improve operational efficiency and reduce downtime but add to the base price. Fleet operators willing to pay a premium for data-driven insights and compliance tools will drive demand for high-spec models, pushing the market average upward. The trend toward “smart fleets” will make mid-to-high-tier configurations more common, supporting price resilience.

Conclusion: Moderate Price Escalation with Technology Premium

Overall, concrete truck prices in 2026 are projected to rise moderately — likely in the range of 3–6% annually — driven by regulatory shifts, material costs, and technological advancements. While traditional diesel models may see stable pricing due to mature technology, the growing share of alternative-fuel and high-tech variants will pull the average market price higher. Buyers should anticipate a bifurcated market: cost-conscious operators opting for reliable diesel models, and forward-looking fleets investing in premium, sustainable, and connected trucks.

Common Pitfalls When Sourcing Concrete Truck Prices (Quality, IP)

Sourcing concrete trucks involves more than just comparing price tags. Buyers often overlook critical factors related to quality and intellectual property (IP), which can lead to long-term operational, legal, and financial challenges. Below are common pitfalls to watch for.

Overlooking Build Quality and Materials

One of the most frequent mistakes is focusing solely on upfront cost while ignoring the construction quality of the concrete truck. Low-priced models may use substandard steel, inferior drum linings, or outdated hydraulic systems. This can result in frequent breakdowns, higher maintenance costs, and shorter vehicle lifespan. Always verify the materials used, inspect weld quality, and request third-party certifications.

Ignoring OEM vs. Copycat Manufacturers

Many suppliers, especially in emerging markets, offer “budget-friendly” concrete trucks that replicate designs from well-known original equipment manufacturers (OEMs). While these may appear similar, they often lack proper engineering validation and can infringe on intellectual property rights. Purchasing such vehicles risks legal complications and may void insurance or warranty coverage.

Falling for Misrepresented Technical Specifications

Some suppliers exaggerate key specs like drum capacity, mixing efficiency, chassis strength, or pump output. Buyers who don’t verify these claims through independent testing or documentation may end up with underperforming equipment. Always request performance test reports and cross-check specifications with industry standards.

Neglecting After-Sales Support and Spare Parts Availability

A low initial price can be deceptive if spare parts are hard to source or service networks are limited. Trucks with proprietary designs or cloned IP may not have standardized components, making repairs costly and time-consuming. Confirm the availability of parts and technical support in your region before purchase.

Overlooking Intellectual Property Infringement Risks

Using a concrete truck that copies patented designs—such as unique drum geometry, hydraulic layouts, or control systems—can expose buyers to IP litigation. Even unintentional use of infringing equipment may lead to fines or forced decommissioning. Ensure suppliers can provide IP clearance documentation or proof of licensing.

Skipping Factory Audits and Production Verification

Remote sourcing without on-site inspections increases the risk of receiving counterfeit or poorly assembled units. Conducting factory audits helps verify production capabilities, quality control processes, and adherence to design specifications. It also provides insight into whether the manufacturer respects IP laws.

Failing to Secure Proper Documentation and Compliance

Ensure all trucks come with valid certifications (e.g., ISO, CE, or local road compliance) and that technical drawings and manuals are provided. Missing or falsified documentation can hinder registration, operation, or resale—and may indicate IP violations.

Conclusion

When sourcing concrete trucks, prioritizing price over quality and IP integrity can lead to significant operational setbacks and legal exposure. Due diligence in verifying manufacturer credibility, technical accuracy, and intellectual property compliance is essential for a sound investment.

Logistics & Compliance Guide for Concrete Truck Pricing

Understanding the logistics and compliance aspects involved in pricing concrete trucks is essential for accurate cost estimation, legal adherence, and efficient operations. This guide outlines key considerations that influence pricing and ensure regulatory compliance throughout the procurement, transportation, and deployment process.

Regulatory Compliance and Permits

Concrete trucks are specialized heavy vehicles subject to federal, state, and local regulations. Compliance directly impacts pricing due to legal requirements and operational constraints:

-

DOT and FMCSA Regulations (U.S.): Federal Motor Carrier Safety Administration (FMCSA) rules govern vehicle weight, driver qualifications, and hours of service. Non-compliance can lead to fines and delays, increasing total costs.

-

Weight and Axle Load Limits: Concrete trucks must comply with bridge formula laws. Exceeding weight limits requires special permits, which add to operational expenses and influence pricing.

-

Environmental Regulations: Emissions standards (e.g., EPA Tier 4) affect truck specifications and costs. Trucks meeting stricter environmental rules may have higher upfront prices but lower long-term compliance risks.

-

Operator Licensing: Drivers require a Commercial Driver’s License (CDL) with appropriate endorsements (e.g., tanker, hazardous materials for certain additives), impacting labor costs factored into pricing models.

Transportation and Delivery Logistics

The movement of concrete trucks—whether as new purchases or deployed units—requires careful logistical planning, which can influence final pricing:

-

Freight and Shipping Costs: Transporting a new or used concrete truck over long distances incurs freight charges. Costs vary by distance, route accessibility, and carrier availability.

-

Route Planning and Restrictions: Urban areas may restrict heavy vehicle access during certain hours. Routes with low bridges or weak infrastructure require detours, increasing fuel and time costs.

-

Just-in-Time Delivery Demands: Concrete plants often require precise scheduling. Trucks with GPS tracking, real-time monitoring, and scheduling software may command higher prices due to enhanced logistics efficiency.

Safety and Insurance Requirements

Safety compliance and risk management are critical in determining total ownership and operational costs:

-

Vehicle Inspections (e.g., CVSA): Regular safety inspections are mandatory. Trucks with documented compliance history may have higher resale or lease value.

-

Insurance Premiums: Insurance for concrete trucks covers liability, cargo, and equipment damage. Premiums depend on compliance history, vehicle age, and operating region—directly influencing total cost of ownership.

-

OSHA and Jobsite Safety: On construction sites, trucks must comply with OSHA standards for safe operation near workers, chutes, and mixing equipment. Non-compliance can result in project delays and penalties.

Import/Export Compliance (International Transactions)

When sourcing concrete trucks from overseas, additional compliance factors affect pricing:

-

Customs Duties and Tariffs: Importing trucks may incur tariffs based on classification (e.g., HS Code 8704 for dump trucks or specialized vehicles). These costs are passed on to the buyer.

-

Certification Requirements: Vehicles must meet local standards (e.g., CE marking in Europe, DOT in the U.S.). Retrofitting or certification processes add cost.

-

Documentation and Clearance: Bills of lading, certificates of origin, and conformity assessments are required. Delays in customs increase holding and demurrage charges.

Maintenance and Operational Compliance

Ongoing compliance affects long-term pricing and truck valuation:

-

Scheduled Maintenance Logs: Trucks with complete maintenance records are valued higher. Neglecting service schedules increases breakdown risks and downtime costs.

-

Adherence to Manufacturer Guidelines: Using approved parts and fluids ensures warranty validity and compliance with emissions systems, avoiding costly repairs or violations.

-

Telematics and Monitoring: GPS and fleet management systems support compliance with fuel usage, idle time, and route optimization—contributing to lower operating costs and better pricing over time.

Conclusion

Pricing a concrete truck involves more than the initial purchase cost. Logistics and compliance—spanning regulations, transportation, safety, insurance, and maintenance—significantly influence total cost of ownership. Buyers and operators must account for these factors to ensure accurate budgeting, legal compliance, and operational efficiency in the concrete delivery industry.

Conclusion on Sourcing Concrete Truck Prices

Sourcing concrete truck prices requires a comprehensive evaluation of several factors including brand reputation, truck capacity, chassis type, regional market conditions, new versus used options, and after-sales support. Prices can vary significantly—ranging from approximately $80,000 for a basic used model to over $250,000 for a new, high-capacity truck with advanced features. Direct engagement with manufacturers, authorized dealers, and industry suppliers, along with participation in auctions or online marketplaces, can yield competitive pricing and favorable terms.

Additionally, considering long-term operational costs such as maintenance, fuel efficiency, and durability is crucial in making a cost-effective decision. Obtaining multiple quotes, negotiating based on volume or repeat business, and exploring financing or leasing options can further optimize procurement outcomes. Ultimately, the best sourcing strategy balances upfront investment with total cost of ownership, ensuring reliability, performance, and return on investment for your concrete operations.