The global industrial disk and cutting tool market has experienced steady expansion, driven by rising demand across construction, metal fabrication, and automotive sectors. According to Grand View Research, the global abrasive market size was valued at USD 51.7 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. A key contributor to this growth is the increasing adoption of high-performance cutting solutions, including concave disks, which offer precision, faster cutting speeds, and extended tool life. As manufacturers seek greater efficiency and safety in material processing, demand for advanced concave grinding and cutting disks continues to rise—particularly in Asia Pacific, where industrialization and infrastructure development are accelerating. This growing market landscape has positioned several manufacturers as leaders in innovation, quality, and global reach. Based on production capacity, technological advancements, and market presence, the following six companies stand out as the top concave disk manufacturers shaping the future of industrial cutting solutions.

Top 6 Concave Disk Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

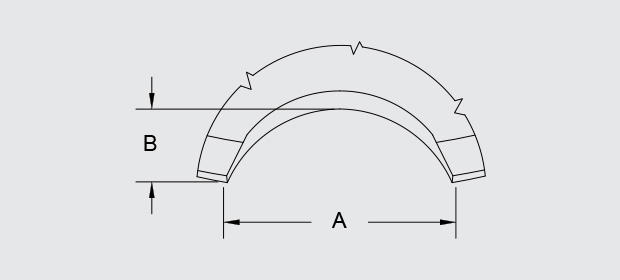

#1 Concave disc – notched

Domain Est. 2001

Website: forgesdeniaux.com

Key Highlights: Forges de Niaux is a company committed to serve the farmers. We develop and manufacture durable disc blades for soil working. SITEMAP. Home · Niaux 200 ……

#2 Norwest Concave

Domain Est. 2003

Website: norwest-mfg.com

Key Highlights: Norwest Manufacturing sells aftermarket Norwest Concave parts for agriculture. See all available products at Norwest.com….

#3 Savini Wheels

Domain Est. 2005

Website: saviniwheels.com

Key Highlights: Step Lip Concave. The SL (Step Lip Concave) configuration utilizes a center disk that is 1” smaller in diameter to reduce weight, unsprung mass, and improve ……

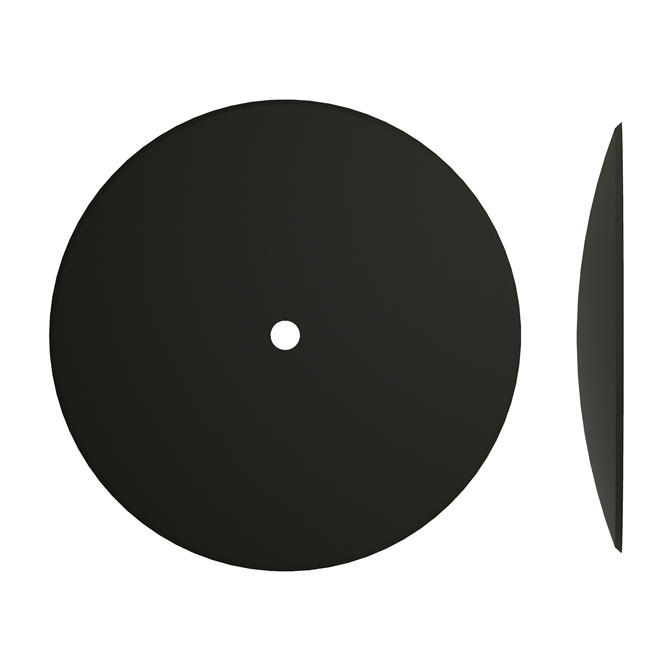

#4 Plain Concave Discs

Domain Est. 2007

Website: ingersolltillage.com

Key Highlights: Discs for tilling and inverting the soil. The patented DuraFace process is a special surface coating that yields a disc nearly as hard as tungsten carbide….

#5 CONCAVE DISC

Domain Est. 2008

Website: adjditec.com

Key Highlights: CONCAVE DISC The concave disc is a type of optical element that curves inward. Let me know if you’d like me to elaborate on any specific aspects of concave….

#6 Concave discs/accessories buy online

Domain Est. 2021

Website: granit-parts.us

Key Highlights: Concave discs/accessories ✓ Top service ✓ 8500000 products ✓ Overnight delivery ✓ Individual customer care → Buy original parts now!…

Expert Sourcing Insights for Concave Disk

H2 2026 Market Trends for Concave Disks

As of mid-2026, the concave disk market is experiencing a period of transformation characterized by consolidation, technological refinement, and shifting demand dynamics. Driven by advancements in manufacturing, evolving agricultural practices, and supply chain recalibrations, the market is adapting to meet the needs of modern, precision-driven farming. Below are the key trends shaping the concave disk sector in H2 2026:

1. Increased Adoption in Precision Agriculture

Concave disks are seeing growing integration into precision farming systems. Farmers are increasingly pairing concave disk harrows and tillage tools with GPS-guided tractors and variable-rate technology (VRT). This enables optimized soil preparation with reduced fuel consumption and minimized soil compaction. Smart concave disks equipped with sensors for real-time soil feedback are emerging, particularly in North America and Western Europe, allowing for adaptive tillage depth and pressure control.

2. Material Innovation and Durability Focus

Manufacturers are investing heavily in advanced materials to extend product lifespan and reduce maintenance. High-strength boron steel and ceramic-coated disk blades are becoming standard in premium models. These materials offer superior wear resistance, especially in abrasive soil conditions common in regions like the Great Plains (USA) and the Pampas (Argentina). This trend is reducing total cost of ownership and enhancing sustainability by cutting replacement frequency.

3. Demand Shift Toward Conservation and Minimum Tillage

With global emphasis on soil health and carbon sequestration, there is a noticeable shift from intensive tillage to conservation practices. Concave disks are being redesigned for strip-till and zone-till applications, allowing residue management while minimizing soil disturbance. This aligns with government incentives in the EU (under the Common Agricultural Policy) and the U.S. (via USDA conservation programs), boosting demand for specialized, low-impact concave disk configurations.

4. Consolidation Among OEMs and Aftermarket Suppliers

The market is undergoing consolidation, with larger agricultural equipment manufacturers acquiring niche disk harrow producers to expand their tillage portfolios. Simultaneously, the aftermarket segment is thriving due to rising repair and retrofitting needs. Independent suppliers are capitalizing on this by offering compatible, cost-effective concave disk replacements, especially in emerging markets like India, Brazil, and Ukraine.

5. Supply Chain Resilience and Regionalization

Post-pandemic and geopolitical disruptions have led to a strategic shift toward regional production. Major manufacturers are establishing localized fabrication hubs to reduce dependency on global logistics and mitigate tariff risks. For example, European OEMs are increasing production in Eastern Europe, while U.S. brands are expanding manufacturing in Mexico. This regionalization is improving delivery times and supporting customization for local soil types.

6. Sustainability and Circular Economy Initiatives

Environmental regulations are pushing manufacturers to adopt greener practices. Recyclable materials, modular designs for easy repair, and end-of-life recycling programs are becoming more common. Some companies are introducing leasing or trade-in programs to promote equipment reuse, reducing waste and appealing to eco-conscious farmers.

7. Growth in Emerging Markets

Demand in developing agricultural economies is rising due to mechanization efforts and government subsidies. In Southeast Asia and Sub-Saharan Africa, compact and affordable concave disk models tailored for smallholder farms are gaining traction. These markets represent significant growth potential, though challenges remain in distribution and farmer training.

Conclusion

H2 2026 marks a pivotal phase for the concave disk market, where innovation, sustainability, and digital integration are defining competitive advantage. While traditional applications remain strong, the future lies in smart, durable, and environmentally aligned solutions. Stakeholders who invest in R&D, localized manufacturing, and farmer education are best positioned to capture value in this evolving landscape.

Common Pitfalls Sourcing Concave Disks (Quality, IP)

Sourcing concave disks—particularly for specialized applications in optics, precision engineering, or consumer products—can present significant challenges related to both quality assurance and intellectual property (IP) protection. Failing to address these issues can result in product failure, legal exposure, and reputational damage. Below are the most common pitfalls to avoid:

Quality-Related Pitfalls

Inconsistent Surface Precision

Concave disks require tight tolerances in curvature, surface smoothness (e.g., λ/4 or better), and dimensional accuracy. A common pitfall is sourcing from suppliers who lack proper metrology equipment (e.g., interferometers, profilometers), leading to inconsistent curvature or surface defects that compromise optical or mechanical performance.

Material Defects and Inadequate Specifications

Low-quality materials—such as optically non-uniform glass, impure metals, or poorly formulated polymers—can lead to internal stresses, birefringence, or warping. Buyers often fail to specify material grades, thermal stability, or coating requirements, resulting in disks that degrade under operating conditions.

Poor or Inconsistent Coatings

For optical or wear-resistant applications, coatings (e.g., anti-reflective, protective layers) are critical. Suppliers may apply coatings unevenly or use substandard processes, reducing performance and lifespan. Lack of coating adhesion testing or environmental resistance validation is a frequent oversight.

Insufficient Quality Control Documentation

Many suppliers, especially in low-cost regions, provide minimal or falsified quality documentation. Relying on visual inspection alone or accepting generic certificates without traceable test data (e.g., interferometry maps, spectrophotometry reports) increases the risk of non-compliant parts entering production.

Intellectual Property (IP)-Related Pitfalls

Unprotected Designs and Reverse Engineering Risks

Sharing detailed CAD files or specifications with potential suppliers without non-disclosure agreements (NDAs) or IP clauses exposes proprietary designs. Unscrupulous manufacturers may reverse engineer the disk and produce or sell unauthorized copies, especially in regions with weak IP enforcement.

Lack of IP Ownership Clauses in Contracts

Procurement agreements often omit clear language assigning IP rights for custom-designed disks. This can lead to disputes over who owns tooling, molds, or design modifications—potentially allowing the supplier to reuse the design for competitors.

Supply Chain Transparency and Gray Market Leakage

Sourcing through intermediaries or unverified sub-suppliers increases the risk of IP leakage. Components may be diverted to the gray market or overproduced without authorization, diluting market exclusivity and brand value.

Failure to Verify Supplier IP Compliance

Some suppliers use patented processes or materials without proper licensing. Buyers may inadvertently infringe third-party IP by sourcing from such vendors, exposing themselves to legal liability even if unintentional.

Mitigation Strategies

To avoid these pitfalls:

– Conduct rigorous supplier audits, including on-site quality system reviews.

– Require detailed material and process certifications.

– Use legally binding NDAs and contracts specifying IP ownership.

– Limit technical data shared and use watermarked or obfuscated design files during evaluation.

– Work with suppliers in jurisdictions with strong IP protections when possible.

– Implement traceability and batch tracking in supply agreements.

Proactively addressing both quality and IP concerns ensures reliable performance and protects long-term innovation value when sourcing concave disks.

Logistics & Compliance Guide for Concave Disk

Product Classification and Regulatory Requirements

Concave disks used in agricultural or industrial machinery may be classified under various Harmonized System (HS) codes depending on material composition, size, and intended use—common codes include 8432.40 (soil-working machinery parts) or 7326.90 (other articles of iron or steel). Confirm the specific HS code with your customs broker to ensure accurate tariff application. These components are typically not subject to stringent regulatory oversight unless part of a larger controlled machine system. However, compliance with material safety standards (e.g., REACH in the EU, RoHS for restricted substances) may be required depending on the destination market.

Packaging and Handling Specifications

Package concave disks securely in robust, corrugated cardboard or wooden crates to prevent deformation or edge damage during transit. Use internal dividers or foam padding to avoid metal-to-metal contact. Clearly label each package with handling instructions such as “Fragile – Sharp Edges” and “This Side Up.” For bulk shipments, stack crates on standard pallets (e.g., EUR/EPAL or GMA) and secure with strapping or stretch wrap. Include a packing list inside and affixed externally, detailing item description, quantity, weight, and batch/lot number.

Export Documentation

Prepare the following documents for international shipments:

– Commercial Invoice (including full product description, unit price, total value, Incoterms®)

– Packing List (itemized by package with gross/net weights)

– Bill of Lading (for sea freight) or Air Waybill (for air freight)

– Certificate of Origin (if required for tariff preferences)

Ensure all documents accurately describe the product as “Concave Disk – Replacement Part for Agricultural Equipment” to avoid customs delays. Use Incoterms® 2020 clearly (e.g., FOB, EXW, or DAP) to define responsibility for logistics and risk transfer.

Transportation and Freight Considerations

Due to their weight and shape, concave disks are typically shipped via full container load (FCL) sea freight for cost efficiency on large orders, or air freight for urgent, low-volume deliveries. Confirm carrier-specific limitations for heavy or oddly shaped cargo. Use freight forwarders experienced in industrial parts logistics to coordinate pickup, customs clearance, and final delivery. For domestic or regional transport, flatbed trucks or enclosed vans with tie-down points are recommended.

Import Compliance and Duties

Import duties vary by country and are based on the declared HS code and product value. Verify duty rates and any import restrictions with local customs authorities in the destination country. Some jurisdictions may require conformity assessments or technical documentation. Maintain records of compliance for at least five years to support audit readiness. Engage a licensed customs broker to handle clearance, especially for first-time shipments.

Environmental and Safety Compliance

Ensure manufacturing processes and materials comply with environmental regulations such as EPA standards (USA) or ELV (End-of-Life Vehicles Directive in the EU) if applicable. Provide Safety Data Sheets (SDS) if the disks are coated with oils or chemical treatments. Discourage improper disposal; recommend recycling through metal scrap channels in accordance with local waste management laws.

Recordkeeping and Audits

Maintain digital copies of all logistics and compliance documents for a minimum of five years. Implement a traceability system using batch numbers or serial tags to support recalls or quality investigations. Conduct annual internal audits of export processes to ensure ongoing compliance with international trade laws, including sanctions and embargoes (e.g., OFAC, EU restrictive measures).

Conclusion for Sourcing Concave Disks

In conclusion, sourcing concave disks requires a comprehensive evaluation of technical specifications, material quality, supplier reliability, and cost-efficiency. The unique curvature of concave disks makes them essential for specific industrial applications such as agricultural equipment, soil tillage, road construction, and material processing, where effective soil penetration, debris clearing, and durability are critical.

When sourcing these components, it is vital to partner with reputable suppliers who adhere to international quality standards and can provide consistent product performance. Factors such as disk thickness, diameter, material composition (typically high-carbon or boron steel), and surface treatment (e.g., heat treatment or coating) significantly influence longevity and operational efficiency.

Additionally, considering lead times, customization capabilities, and logistical support ensures seamless integration into manufacturing or maintenance workflows. An optimized sourcing strategy not only reduces downtime and maintenance costs but also enhances overall equipment performance.

Ultimately, a well-informed procurement approach—balancing quality, cost, and service—will ensure reliable supply and operational success when sourcing concave disks for demanding industrial environments.