The global computer system manufacturing industry continues to evolve amid rising demand for high-performance computing, remote work infrastructure, and advancements in AI and cloud technologies. According to a 2023 report by Mordor Intelligence, the global computer hardware market is projected to grow at a CAGR of approximately 5.8% from 2023 to 2028, driven by increased enterprise digitization and consumer demand for efficient, compact, and powerful computing devices. This growth is further supported by expanding investments in data centers and the proliferation of edge computing. As market dynamics shift, a handful of manufacturers have maintained dominant positions through innovation, scalability, and global supply chain integration. Based on market share, revenue performance, and technological influence, the following nine companies represent the industry leaders shaping the future of computing—delivering everything from consumer laptops to enterprise-grade servers.

Top 9 Computer System Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 System Manufacturers

Domain Est. 1986

Website: intel.com

Key Highlights: Select System Manufacturer. Acer; Acxxel; Advice IT Infinite Co., Ltd. Aftershock; Alienware; Apple; ASUS or ASUSTek; Averatec (Trigem); BenQ; Cisco; CISNet/ZT ……

#2 Portwell

Domain Est. 1996

Website: portwell.com

Key Highlights: Portwell designs and manufactures industrial-grade computer systems, including SBCs, embedded systems, network and security appliances, and more….

#3 Micron Technology

Domain Est. 1994

Website: micron.com

Key Highlights: Explore Micron Technology, leading in semiconductors with a broad range of performance-enhancing memory and storage solutions….

#4 Industrial Computers, Panel PCs, Medical Computers

Domain Est. 2010

Website: teguar.com

Key Highlights: Teguar’s rugged industrial computers are built to withstand harsh environments. Shop our range of rugged, fanless, and waterproof PCs, monitors, and tablets ……

#5 Taiwan Semiconductor Manufacturing Company Limited

Domain Est. 1993 | Founded: 1987

Website: tsmc.com

Key Highlights: TSMC has been the world’s dedicated semiconductor foundry since 1987, and we support a thriving ecosystem of global customers and partners with the ……

#6 to CDW

Domain Est. 1994

Website: cdw.com

Key Highlights: Hardware · Computers · Computer Accessories · Computer Monitors & Displays · Cables · Electronics · Networking · Printers & Supplies · Storage & Hard Drives ……

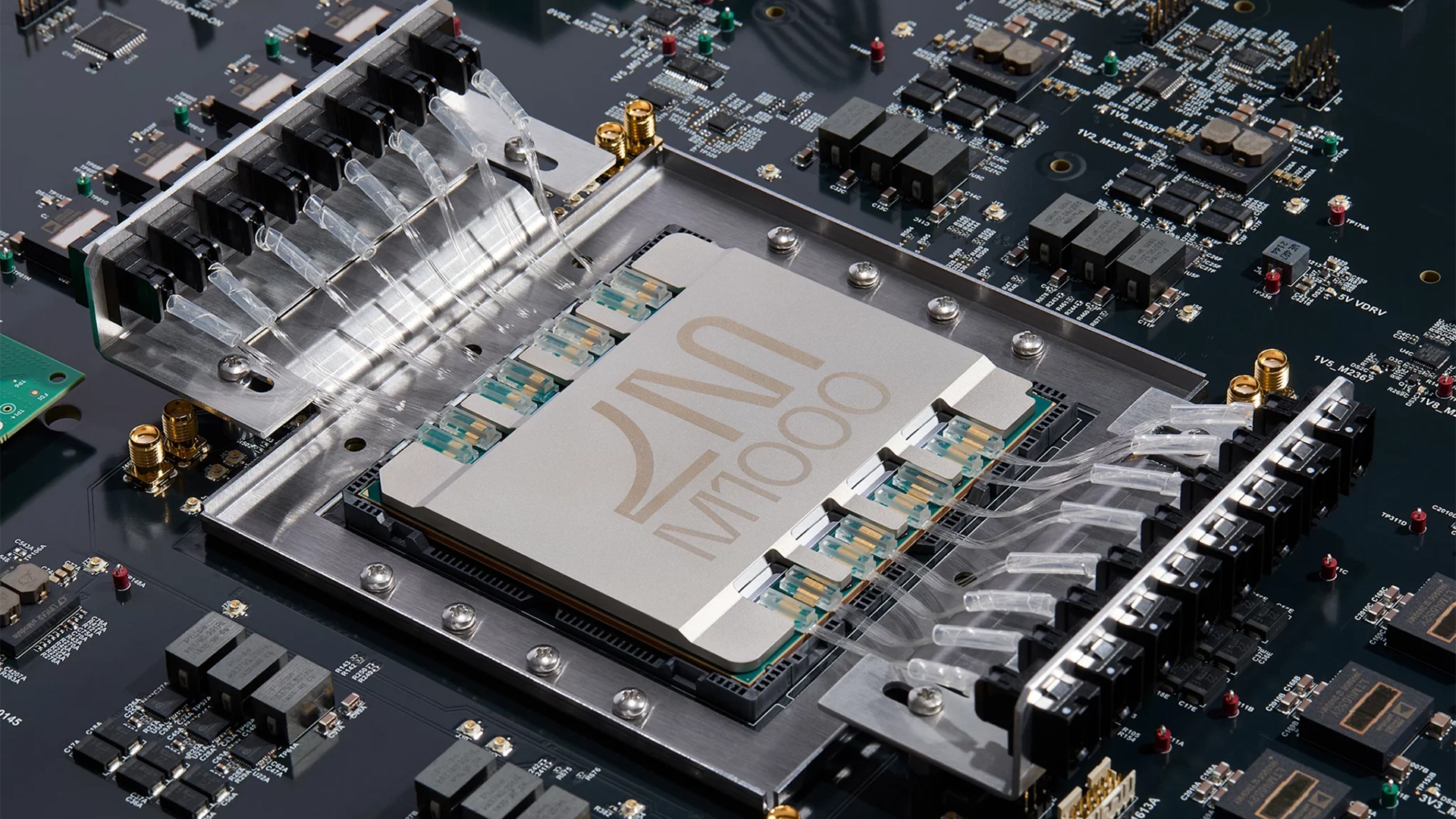

#7 Lightmatter®

Domain Est. 2012

Website: lightmatter.co

Key Highlights: Rethinking the limits of AI, Lightmatter merges photonics and computing to build a future where speed, efficiency, and intelligence converge….

#8 Oxide Computer Company

Website: oxide.computer

Key Highlights: That’s why we built the Oxide Cloud Computer. · Our system delivers all the hardware and software you need to run your own cloud, designed together end-to-end, ……

#9 AMD ׀ together we advance_AI

Website: amd.com

Key Highlights: AMD delivers leadership high-performance and adaptive computing solutions to advance data center AI, AI PCs, intelligent edge devices, gaming, & beyond….

Expert Sourcing Insights for Computer System

2026 Market Trends for Computer Systems

Growth in AI-Integrated Computer Systems

By 2026, artificial intelligence (AI) will be deeply embedded in computer system architectures, from consumer laptops to enterprise servers. AI accelerators such as GPUs, NPUs (Neural Processing Units), and TPUs (Tensor Processing Units) will become standard components, enabling on-device machine learning and real-time data processing. Major chipmakers like NVIDIA, AMD, and Intel are expected to dominate this space, with increasing competition from custom silicon developed by tech giants such as Apple, Google, and Amazon.

The integration of AI will enhance system performance, power efficiency, and user experience through features like predictive task management, intelligent resource allocation, and adaptive security protocols. This trend will drive demand for hybrid computing models, combining cloud and edge AI processing.

Expansion of Edge Computing Infrastructure

Edge computing will see accelerated adoption by 2026, driven by the need for low-latency processing in IoT, autonomous vehicles, smart cities, and industrial automation. Computer systems will increasingly be deployed closer to data sources, reducing reliance on centralized cloud data centers. This shift will lead to a surge in compact, high-performance edge servers and ruggedized computing devices designed for harsh environments.

Market leaders such as Dell, HPE, and Lenovo are expected to offer modular, scalable edge solutions, while semiconductor firms will optimize chips for thermal efficiency and real-time computation. The convergence of 5G/6G networks and edge computing will further enable seamless data transfer and responsiveness.

Advancements in Quantum-Inspired Classical Computing

While fully functional quantum computers may still be in development, 2026 will witness significant progress in quantum-inspired algorithms and systems running on classical hardware. These systems will solve complex optimization problems in logistics, finance, and drug discovery more efficiently than traditional computers.

Companies like IBM, Microsoft, and startups in the quantum ecosystem will offer hybrid computing platforms, integrating quantum-like solvers within classical data centers. This will expand the capabilities of existing computer systems without requiring full quantum infrastructure.

Rise of Sustainable and Energy-Efficient Designs

Sustainability will become a critical factor in computer system design by 2026. With increasing regulatory pressure and environmental awareness, manufacturers will prioritize energy-efficient components, recyclable materials, and longer product lifecycles. Data centers will adopt advanced liquid cooling, AI-driven power management, and renewable energy integration.

The EU’s energy labeling for servers and similar initiatives globally will push vendors to meet stricter efficiency standards. Additionally, modular designs allowing component upgrades—rather than full system replacements—will gain traction, reducing electronic waste.

Increased Adoption of RISC-V and Open Architectures

The RISC-V open instruction set architecture (ISA) will gain momentum in 2026, challenging the dominance of x86 and ARM in certain segments. Its flexibility and lack of licensing fees make it attractive for custom silicon in embedded systems, AI accelerators, and government or defense applications seeking supply chain independence.

Major players like SiFive, Alibaba, and Qualcomm are investing heavily in RISC-V ecosystems. By 2026, we can expect to see RISC-V-based processors in consumer electronics, network equipment, and specialized computing appliances, fostering innovation and reducing vendor lock-in.

Enhanced Cybersecurity Through Hardware-Level Integration

As cyber threats grow in sophistication, computer systems in 2026 will incorporate security directly into hardware. Features like hardware-based root of trust, secure enclaves, and real-time threat detection chips will become standard. Technologies such as Intel’s TDX, AMD’s SEV, and Apple’s Secure Enclave will evolve to provide stronger isolation and encryption.

Zero-trust architectures will be supported at the firmware and silicon levels, ensuring secure boot, runtime integrity, and confidential computing. Governments and enterprises will mandate hardware-level security for critical infrastructure, accelerating adoption across the industry.

Conclusion

The computer system landscape in 2026 will be defined by intelligence, efficiency, decentralization, and security. AI integration, edge computing, sustainable design, open architectures, and enhanced security will shape the next generation of systems. Organizations and consumers alike will benefit from faster, smarter, and more resilient computing platforms, setting the stage for further technological breakthroughs in the following decade.

Common Pitfalls in Sourcing Computer Systems: Quality and Intellectual Property Concerns

When sourcing computer systems—whether hardware, software, or integrated solutions—organizations often face critical challenges related to quality assurance and intellectual property (IP) protection. Overlooking these areas can lead to security vulnerabilities, compliance risks, financial loss, and reputational damage. Below are key pitfalls to avoid:

Inadequate Vendor Due Diligence

Failing to thoroughly assess a vendor’s reputation, track record, and technical capabilities can result in substandard systems. Organizations may unknowingly partner with suppliers lacking proper quality controls, certifications (e.g., ISO 9001), or sustainable support structures. This increases the risk of receiving defective components, unreliable software, or systems that fail to meet performance expectations.

Poorly Defined Quality Requirements

Without clear, measurable quality specifications in procurement contracts, suppliers may deliver systems that technically meet basic criteria but fall short in reliability, scalability, or maintainability. Ambiguity in requirements regarding performance benchmarks, uptime guarantees, or defect resolution timelines can lead to disputes and costly post-deployment fixes.

Use of Counterfeit or Substandard Components

In global supply chains, especially with third-party or offshore manufacturers, there’s a risk of receiving counterfeit hardware (e.g., fake CPUs, memory modules) or components that do not meet industry standards. These parts can compromise system stability, create security backdoors, and void warranties.

Insufficient Testing and Validation

Skipping or minimizing independent testing—such as functional testing, stress testing, or security audits—before deployment may allow critical flaws to go undetected. This is particularly risky in regulated industries (e.g., healthcare, finance) where system failures can have legal and safety implications.

Overlooking Intellectual Property Ownership

Many sourcing agreements fail to explicitly define who owns the IP in custom-developed software or system configurations. Without clear contractual terms, organizations may not retain full rights to modify, distribute, or maintain the system, leaving them dependent on the vendor and vulnerable to licensing disputes.

Use of Unlicensed or Infringing Software

Suppliers may bundle unlicensed third-party software or use open-source code in violation of its license (e.g., GPL violations). This exposes the buyer to legal liability, compliance audits, and forced system overhauls. Verifying software provenance and licensing compliance is essential.

Inadequate Protection of Sensitive Data and Code

During development or integration, sensitive system designs, configuration data, or proprietary algorithms may be shared with external vendors. Without proper non-disclosure agreements (NDAs) and data security protocols, there’s a risk of IP theft or unauthorized reuse by the vendor in other projects.

Failure to Secure Source Code Access

For custom systems, not securing the right to access or escrow the source code can be disastrous if the vendor goes out of business or refuses support. Without source code availability, long-term maintenance, updates, and security patching become impossible.

Ignoring Open-Source License Obligations

When vendors incorporate open-source software, buyers may inherit obligations such as public code disclosure or license compatibility requirements. Failing to audit open-source usage can lead to unintended IP exposure or legal action from open-source communities.

Lack of Ongoing Support and Maintenance Clarity

Even a high-quality system degrades without proper support. Vague service-level agreements (SLAs) or unclear maintenance responsibilities can result in delayed patches, unresolved bugs, and increased technical debt—ultimately undermining system quality over time.

Avoiding these pitfalls requires proactive risk management, detailed contractual agreements, and continuous oversight throughout the sourcing lifecycle. Organizations should engage cross-functional teams—including legal, IT, procurement, and compliance—to ensure both quality and IP integrity are safeguarded.

Logistics & Compliance Guide for Computer Systems

This guide outlines the key logistics and compliance considerations for the acquisition, deployment, operation, and decommissioning of computer systems within regulated or enterprise environments. Adherence to these principles ensures operational efficiency, data integrity, and regulatory compliance.

System Acquisition and Procurement

Ensure all computer systems are procured in alignment with organizational policies and regulatory requirements. Key actions include:

- Define system requirements based on intended use, data sensitivity, and compliance standards (e.g., FDA 21 CFR Part 11, GDPR, HIPAA).

- Conduct vendor assessments to verify product reliability, support capabilities, and regulatory compliance.

- Document procurement justifications and maintain audit trails for all purchase decisions.

- Verify that hardware and software meet security, compatibility, and performance specifications.

Installation and Deployment

Deploy computer systems using a controlled and documented process to ensure consistency and compliance.

- Follow a predefined installation protocol, including system configuration, network integration, and access control setup.

- Perform installation qualification (IQ) to verify system components are correctly installed and documented.

- Implement secure configurations per organizational baselines (e.g., CIS benchmarks).

- Restrict administrative access and use role-based permissions from the outset.

Validation and Documentation

Validated systems are critical in regulated industries to ensure accuracy, reliability, and consistent performance.

- Execute a validation lifecycle: IQ (Installation Qualification), OQ (Operational Qualification), and PQ (Performance Qualification).

- Maintain a complete system validation package, including requirements, test scripts, results, and approval records.

- Document all system configurations, changes, and user roles in a controlled system inventory.

- Retain documentation for the required retention period as per regulatory or company policy.

Access Control and User Management

Secure access to computer systems to protect data integrity and prevent unauthorized use.

- Implement strong authentication mechanisms (e.g., multi-factor authentication).

- Assign user access based on job function using the principle of least privilege.

- Conduct regular access reviews and deactivate accounts for terminated or transferred personnel.

- Log all login attempts, access changes, and critical system operations.

Change Control and Maintenance

All modifications to computer systems must be managed through a formal change control process.

- Submit change requests for any software updates, patches, hardware changes, or configuration adjustments.

- Assess risks associated with changes and conduct impact analysis.

- Test changes in a non-production environment before deployment.

- Approve, document, and communicate all changes through the change control board or designated authority.

Data Integrity and Backup Procedures

Ensure data generated or managed by computer systems remains accurate, complete, and secure.

- Implement automated, encrypted backups according to a defined schedule.

- Store backups offsite or in a secure cloud environment with access controls.

- Regularly test backup restoration to ensure recoverability.

- Enforce audit trails for data creation, modification, and deletion (where applicable).

Security and Cybersecurity Measures

Protect computer systems from internal and external threats through proactive security controls.

- Install and maintain up-to-date antivirus, firewalls, and intrusion detection systems.

- Apply security patches promptly based on risk assessment.

- Conduct periodic vulnerability scans and penetration testing.

- Train users on cybersecurity awareness and phishing prevention.

Training and Competency

Ensure users and administrators are trained and competent in using and managing computer systems.

- Provide role-specific training for system operation, data entry, and compliance requirements.

- Document training completion and maintain records in personnel files.

- Re-train users after major system changes or as part of periodic refreshers.

Monitoring and Audit Readiness

Maintain systems in a continuous state of compliance through monitoring and audit preparation.

- Enable system logging and routinely review logs for suspicious activity.

- Conduct internal audits of computer systems to verify compliance with policies and regulations.

- Prepare audit trails and documentation for regulatory inspections or third-party reviews.

- Address audit findings promptly through corrective and preventive actions (CAPA).

Decommissioning and Disposal

Safely retire computer systems at end-of-life while preserving data and meeting compliance obligations.

- Archive or transfer data according to data retention policies.

- Validate data integrity before archiving or migration.

- Perform secure data wiping or physical destruction of storage media.

- Document decommissioning activities and update system inventories.

Regulatory and Industry Standards

Align computer system practices with applicable regulations and standards, such as:

- 21 CFR Part 11 (Electronic Records; Electronic Signatures – FDA)

- EU GMP Annex 11 (Computerized Systems)

- ISO/IEC 27001 (Information Security Management)

- GDPR (General Data Protection Regulation)

- HIPAA (Health Insurance Portability and Accountability Act)

Ensure ongoing compliance through periodic assessments, policy updates, and staff training.

Conclusion

Effective logistics and compliance management of computer systems ensures operational reliability, data integrity, and adherence to legal and regulatory frameworks. Organizations must implement structured processes for system lifecycle management, supported by documentation, training, and continuous monitoring.

In conclusion, sourcing computer system manufacturers requires a strategic approach that balances cost, quality, reliability, and scalability. By conducting thorough market research, evaluating potential suppliers based on technical capabilities, production capacity, certifications, and compliance standards, businesses can identify manufacturers that align with their operational and strategic goals. Establishing strong partnerships with reputable manufacturers—whether domestic or international—ensures consistent product quality, timely delivery, and long-term supply chain resilience. Additionally, ongoing performance monitoring and clear communication are critical to maintaining a successful sourcing relationship. Ultimately, a well-executed manufacturer sourcing strategy enhances competitiveness, supports innovation, and drives business growth in the dynamic technology landscape.