The global computer board manufacturing industry is experiencing robust expansion, driven by rising demand for advanced electronics, embedded systems, and industrial automation. According to a 2023 report by Mordor Intelligence, the global printed circuit board (PCB) market—which forms the backbone of computer boards—was valued at USD 79.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2028. This growth is further amplified by increasing adoption of Internet of Things (IoT) devices, 5G infrastructure, and miniaturized computing solutions across sectors such as healthcare, automotive, and aerospace. Another analysis by Grand View Research estimates that the global motherboard market alone will register a CAGR of over 6.5% from 2023 to 2030, fueled by rising PC demand, gaming applications, and enterprise computing upgrades. As innovation accelerates and supply chains evolve, a select group of manufacturers have emerged as leaders in quality, scale, and technological advancement—shaping the future of computing hardware worldwide.

Top 10 Computer Board Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 TTM Technologies

Domain Est. 1995

Website: ttm.com

Key Highlights: TTM Technologies is an advanced Printed Circuit Board (PCB) manufacturer and a leading supplier in technology solutions….

#2 Summit Interconnect leads Complex Circuits and Rigid Flex PCB

Domain Est. 2016

Website: summitinterconnect.com

Key Highlights: Summit Interconnect is a manufacturer of advanced technology printed circuit boards focused on complex rigid, flex and rigid-flex PCBs….

#3 to American Standard Circuits

Domain Est. 1996

Website: asc-i.com

Key Highlights: Explore top-tier printed circuit board manufacturing with American Standard Circuits. Your USA-based solution for quality PCBs and circuit boards….

#4 Printed Circuit Board Manufacturer

Domain Est. 1998

Website: pcbnet.com

Key Highlights: Imagineering is a trusted printed circuit board manufacturer, offering precision PCB assembly, fabrication, & protoype services with quick turnaround….

#5 PCB Manufacturer, PCB Prototype & PCB Assembly

Domain Est. 2004

Website: rushpcb.com

Key Highlights: RUSH PCB is your one-stop shop for all types of PCBs – Printed Circuit Board Manufacturing, PCB Design, PCB Fabrication and Full Turnkey PCB Assemblies in the ……

#6 NCAB Group: Printed circuit boards

Domain Est. 2009

Website: ncabgroup.com

Key Highlights: A leading PCB producer, printed circuit boards, we produce PCBs for demanding customers in several industries – contact us!…

#7 China PCB Prototype & Fabrication Manufacturer

Domain Est. 2012

#8 AdvancedPCB

Domain Est. 2018

Website: advancedpcb.com

Key Highlights: Prototype to Production PCBs from AdvancedPCB. Choose us as your trusted PCB board manufacturer and circuit board manufacturer….

#9 PCBCart

Domain Est. 2005

Website: pcbcart.com

Key Highlights: Expert of PCB manufacturing, we proudly offer PCB making & assembly services with certified quality standards for all your needs. Free online quote!…

#10 OSH Park ~

Domain Est. 2011

Website: oshpark.com

Key Highlights: We produce high quality bare printed circuit boards, focused on the needs of prototyping, hobby design, and light production….

Expert Sourcing Insights for Computer Board

H2 2026 Market Trends for Computer Boards

The computer board market—including motherboards, single-board computers (SBCs), system-on-modules (SoMs), and embedded boards—is poised for significant evolution in H2 2026, driven by advancements in computing architecture, AI integration, and shifting industry demands. Key trends shaping the second half of 2026 include:

1. AI-Integrated Boards and Edge Inferencing Expansion

Computer boards are increasingly embedding AI acceleration capabilities directly into their architectures. In H2 2026, expect widespread adoption of boards featuring dedicated NPUs (Neural Processing Units) from vendors like Intel (with Meteor Lake-derived tech), AMD (Ryzen AI), and ARM-based SoCs (e.g., Qualcomm, MediaTek). Edge AI applications — from smart retail to autonomous drones — will drive demand for SBCs and compact embedded boards capable of real-time inferencing without cloud dependency.

2. Rise of RISC-V in Embedded and Industrial Applications

RISC-V-based computer boards will gain substantial market traction in H2 2026, particularly in industrial automation, IoT gateways, and defense systems. Open-source architecture appeals to developers seeking customization and freedom from licensing constraints. Companies like SiFive and Alibaba’s T-Head are enabling more powerful, scalable RISC-V SoMs, positioning them as viable alternatives to ARM and x86 in cost-sensitive and high-security applications.

3. Miniaturization and Modular Design

Demand for compact, high-performance computing continues to grow. Boards such as COM-HPC, SMARC, and Qseven will see increased use in robotics, medical devices, and mobile edge computing. Modular designs will allow faster upgrades and easier maintenance, reducing time-to-market for OEMs. Expect tighter integration of CPU, memory, and I/O in smaller footprints, driven by advanced packaging technologies like chiplets and 3D stacking.

4. Enhanced Connectivity: Wi-Fi 7 and 5G/6G Readiness

H2 2026 will see computer boards incorporating Wi-Fi 7 (802.11be) as standard for high-throughput, low-latency applications. Additionally, boards targeting industrial IoT and smart infrastructure will feature integrated 5G NR and early 6G test capabilities. M.2 and PCIe-based expansion modules for mmWave and private network support will become common, enabling robust wireless deployment in factories and smart cities.

5. Sustainability and Long-Term Availability Focus

Environmental regulations and corporate ESG goals will push manufacturers toward eco-friendly materials, energy-efficient designs, and extended lifecycle support. Boards with 10+ year availability guarantees will be prioritized in industrial and transportation sectors. Recycling-friendly designs and lead-free manufacturing will become standard compliance requirements, especially in EU and North American markets.

6. Growth in AI-PC and Creator Boards

Consumer and prosumer markets will fuel demand for high-end motherboards optimized for AI workloads — supporting multi-GPU configurations, high-bandwidth memory (HBM), and advanced cooling solutions. Boards targeting content creators and developers will integrate Thunderbolt 5, PCIe 6.0, and support for large DDR5/LPDDR5X memory pools, enabling local AI model training and rendering.

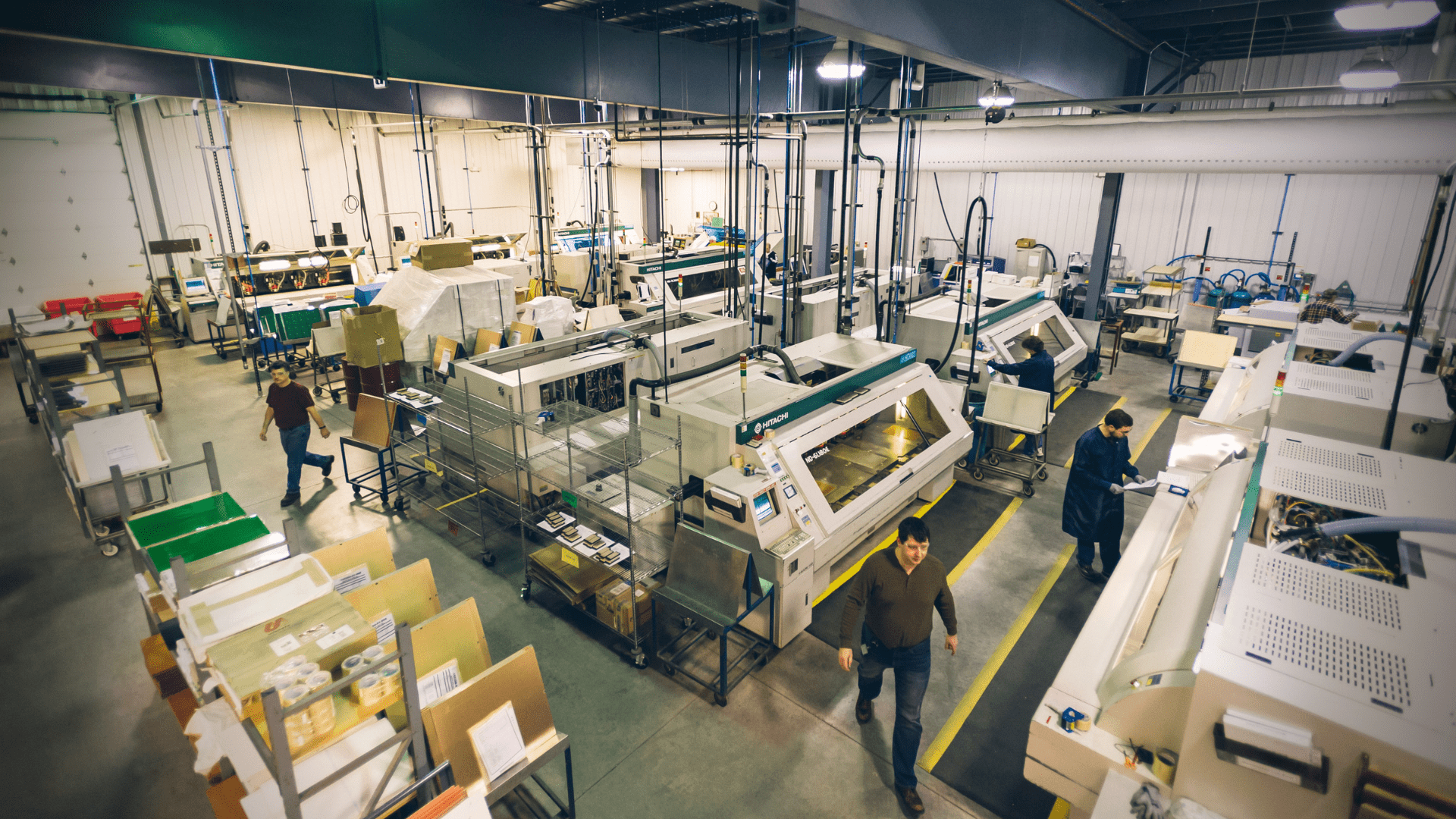

7. Supply Chain Resilience and Regional Manufacturing

Geopolitical factors and past disruptions will continue influencing board production. In H2 2026, expect increased localization of manufacturing in India, Vietnam, and Eastern Europe. This shift supports faster delivery, reduced tariffs, and improved resilience. Dual-sourcing strategies and onshoring of critical components (e.g., power management ICs) will be standard among top-tier board suppliers.

Conclusion

H2 2026 will mark a transformative phase for the computer board market, characterized by intelligence at the edge, architectural diversification, and sustainability. Innovation will be concentrated not only in performance but also in adaptability, security, and lifecycle management. Companies that embrace modular, AI-ready, and energy-efficient designs will lead the next wave of computing infrastructure, both in consumer and industrial domains.

Common Pitfalls in Sourcing Computer Boards: Quality and Intellectual Property Risks

Sourcing computer boards—whether for consumer electronics, industrial systems, or embedded applications—presents several critical challenges, particularly concerning quality assurance and intellectual property (IP) protection. Falling into common traps can lead to product failures, legal exposure, and reputational damage. Below are key pitfalls to avoid:

Poor Quality Control and Inconsistent Manufacturing

Many suppliers, especially in low-cost regions, may lack rigorous quality management systems. This can result in computer boards with inconsistent performance, high failure rates, or non-compliance with industry standards (e.g., IPC, RoHS). Buyers often discover issues only after mass production, leading to costly recalls or delays.

Mitigation: Require ISO 9001 certification, conduct on-site audits, and implement third-party inspection protocols (e.g., AQL sampling). Demand detailed test reports and functional validation data before full-scale production.

Use of Counterfeit or Substandard Components

Unscrupulous suppliers may use counterfeit ICs, recycled parts, or components that do not meet datasheet specifications. These components can degrade over time, cause intermittent failures, or pose safety risks.

Mitigation: Specify authorized distributors for critical components, require material declarations (e.g., via BOM traceability), and use independent labs for component authenticity testing.

Lack of Design and Manufacturing Documentation

Suppliers may withhold critical documentation such as schematics, Gerber files, or test procedures. This not only impedes troubleshooting but can also signal IP retention or potential cloning risks.

Mitigation: Contractually require full documentation transfer upon delivery. Ensure agreements specify that all design work is “work for hire” and owned by the buyer.

Intellectual Property Infringement Risks

Sourced boards may inadvertently—or intentionally—infringe on third-party patents, trademarks, or copyrighted firmware. This is especially common with reference designs or cloned modules. The buyer, not the supplier, often bears legal liability in such cases.

Mitigation: Conduct IP due diligence on designs and components. Include IP indemnification clauses in supplier contracts and require certifications of originality.

Hidden IP Ownership in Reference Designs

Many computer boards are based on third-party reference designs (e.g., from SoC vendors like Intel or NXP). While these may be licensed for use, the fine print can restrict commercialization, modification, or require royalty payments.

Mitigation: Review reference design licenses thoroughly. Ensure your supplier has proper rights to use and transfer the design, and confirm your own intended use is permitted.

Inadequate Testing and Validation Procedures

Suppliers may perform only basic functionality checks, missing latent defects such as thermal stress failures, EMI issues, or power integrity problems that emerge in real-world use.

Mitigation: Define comprehensive test requirements in the procurement contract, including environmental stress testing, burn-in procedures, and compliance with relevant EMC/safety standards.

Supplier Lock-In Due to Customization

Highly customized boards can create dependency on a single supplier, especially if they control unique tooling, firmware, or design files. This limits negotiation power and increases risk if the supplier fails or increases prices.

Mitigation: Design for manufacturability (DFM) with multiple qualified suppliers in mind. Ensure all tools, firmware source code, and design files are delivered and transferable.

By proactively addressing these quality and IP-related pitfalls, organizations can reduce risk, ensure product reliability, and protect their competitive advantage when sourcing computer boards.

Logistics & Compliance Guide for Computer Boards

Overview

This guide outlines the essential logistics and compliance considerations for the safe transportation, handling, and regulatory adherence of computer boards—ranging from motherboards and graphics cards to single-board computers and industrial control boards. Adhering to these guidelines ensures product integrity, regulatory compliance, and supply chain efficiency.

Packaging Requirements

Computer boards must be protected from electrostatic discharge (ESD), physical impact, moisture, and contamination. Use anti-static bags (e.g., metallized shielding bags) for individual boards, enclosed in rigid corrugated boxes with cushioning (e.g., foam inserts or bubble wrap). Clearly label packages with “Fragile,” “ESD Sensitive,” and “Do Not Stack” indicators. Avoid overpacking to prevent compression damage.

Temperature and Humidity Controls

Store and transport computer boards within a controlled environment: 10°C to 30°C (50°F to 86°F) and 30% to 60% relative humidity. Avoid condensation during temperature transitions. Use climate-controlled vehicles for long-distance or extreme climate shipments. Monitor conditions using data loggers when necessary.

Electrostatic Discharge (ESD) Protection

Implement ESD-safe practices throughout the logistics chain. Use grounded workstations, ESD-safe packaging, wrist straps, and conductive floor mats in handling areas. All personnel must be trained in ESD prevention. Transport vehicles should minimize static buildup through proper flooring and grounding.

Transportation Modes and Handling

Use reliable carriers experienced in handling high-value electronics. Prefer air freight for urgent international shipments and ground transport for regional distribution. Ensure secure loading to prevent shifting, and avoid exposure to vibration and shock. Use pallets with edge protectors for bulk shipments and clearly mark load-bearing limits.

Regulatory Compliance

Ensure computer boards meet regional and international regulatory standards. Key compliance areas include:

– RoHS (Restriction of Hazardous Substances) – EU and other jurisdictions restrict lead, mercury, cadmium, and other harmful materials.

– REACH – Registration, Evaluation, Authorization, and Restriction of Chemicals (EU).

– WEEE – Waste Electrical and Electronic Equipment directives for end-of-life recycling.

– FCC Part 15 (USA) – Electromagnetic interference (EMI) compliance for digital devices.

– IEC 62368-1 – Safety standard for audio/video and information technology equipment.

Maintain up-to-date declarations of conformity and technical documentation.

Import/Export Documentation

Prepare accurate shipping documents including commercial invoices, packing lists, and bills of lading. Classify computer boards under the correct Harmonized System (HS) code (typically 8473.30 or 8542.31, depending on function). Comply with export control regulations such as the U.S. Export Administration Regulations (EAR) and dual-use item controls (e.g., Wassenaar Arrangement).

Labeling and Marking

Each package must display: product identifiers, serial or batch numbers, ESD warning symbols, handling instructions, country of origin, and compliance marks (e.g., CE, FCC, RoHS). Barcodes or QR codes should link to traceability data for inventory and recall management.

Reverse Logistics and Returns

Establish a clear process for handling defective, returned, or end-of-life computer boards. Use designated RMA (Return Merchandise Authorization) procedures. Inspect returned boards in ESD-safe environments. Segregate non-compliant or hazardous units for proper recycling or disposal per local regulations.

Training and Audits

Provide regular training for logistics and warehouse staff on ESD safety, handling protocols, and compliance requirements. Conduct audits of storage conditions, packaging integrity, and documentation accuracy to ensure ongoing compliance and identify improvement areas.

Emergency Response

In the event of damage, spillage, or exposure to extreme conditions, isolate affected units and assess for safety and functionality. Notify compliance and quality teams immediately. Maintain incident logs and implement corrective actions to prevent recurrence.

Conclusion for Sourcing Computer Boards

In conclusion, sourcing computer boards requires a strategic approach that balances cost, quality, reliability, and scalability. Careful evaluation of suppliers, thorough assessment of technical specifications, and consideration of long-term support and compatibility are essential to ensure the successful integration of computer boards into end applications. By prioritizing reputable manufacturers, adhering to industry standards, and leveraging supply chain best practices, organizations can mitigate risks related to performance, lead times, and obsolescence. Ultimately, effective sourcing not only supports operational efficiency but also enhances product innovation and competitive advantage in an increasingly technology-driven market.