The compressed wood bricks market is experiencing robust growth, driven by rising demand for sustainable and efficient biomass fuels across residential, commercial, and industrial applications. According to Grand View Research, the global biomass briquettes market size was valued at USD 7.2 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030, fueled by increasing adoption of clean energy alternatives and stringent environmental regulations. Similarly, Mordor Intelligence forecasts sustained market expansion, attributing growth to advancements in densification technology and growing investments in renewable heating solutions, particularly in Europe and North America. As demand surges, a select group of manufacturers has emerged as leaders in producing high-density, low-emission wood bricks, setting benchmarks in quality, scalability, and sustainability. Here’s a data-backed look at the top nine compressed wood bricks manufacturers shaping the future of biomass energy.

Top 9 Compressed Wood Bricks Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 RUF Briquetting Systems

Domain Est. 2007

Website: ruf-briquetter.com

Key Highlights: A RUF briquetting system turns your waste into revenue. RUF Briquetters use hydraulic pressure to create dense, high quality bricks out of metal, wood, and ……

#2 Wood Bricks & Coal

Domain Est. 2005

Website: btpellet.com

Key Highlights: Enviro-Bricks are manufactured from 100% kiln dried hardwood lumber sawdust and compressed with 24,000 lbs pressure making them twice as dense as cordwood….

#3 Bio Blocks

Domain Est. 2009

#4 GrenHeat // Product Information

Domain Est. 2009

Website: grenheat.com

Key Highlights: Wood bricks are an extremely dry, 100% wood product. Use only in a well maintained stove or fireplace. GrenHeat bricks expand slightly when burned. Do not ……

#5 EnviroBrick

Domain Est. 2013

#6 Enviro

Domain Est. 2014

Website: envirobrick.net

Key Highlights: Enviro-Bricks are a consistent size for easier storage than cordwood. 1 ton of Enviro-Bricks = one cord of wood. 1 ton of Enviro-Bricks = 1 42”x42”x48” skid….

#7 Bricks & Blocks

Domain Est. 2017

Website: bringthepellets.com

Key Highlights: These bricks are a great alternative to firewood. Delivered to you on pallets made up of 50 – 40-pound packages. Store the pallet in your garage, shed or ……

#8 Sierra Energy Logs

Domain Est. 2019

Website: sierraenergylogs.com

Key Highlights: Energy Logs are made entirely of wood by-products from sawmills, and are a much cleaner burning fuel than traditional firewood….

#9 Envi 8 Blocks

Domain Est. 2024

Website: biomasfuels.com

Key Highlights: Manufactured in the USA by Bio-Diversity, these compressed wood fuel bricks are made entirely from 100% recycled hardwood sawdust and shavings—without any ……

Expert Sourcing Insights for Compressed Wood Bricks

H2: 2026 Market Trends for Compressed Wood Bricks

The global market for compressed wood bricks is poised for significant growth and transformation by 2026, driven by increasing demand for sustainable energy alternatives, advancements in biomass technology, and supportive environmental policies. H2 analysis of the compressed wood bricks sector reveals key trends across production, demand, regional dynamics, and sustainability.

-

Rising Demand for Renewable Heating Solutions

Compressed wood bricks are gaining traction as a clean-burning, renewable alternative to traditional firewood and fossil fuels. With growing consumer awareness of carbon emissions and air pollution, households and commercial facilities in Europe, North America, and parts of Asia are increasingly adopting wood bricks for residential heating and small-scale industrial applications. Their high calorific value, low moisture content (<10%), and consistent burn rate make them superior to raw firewood. -

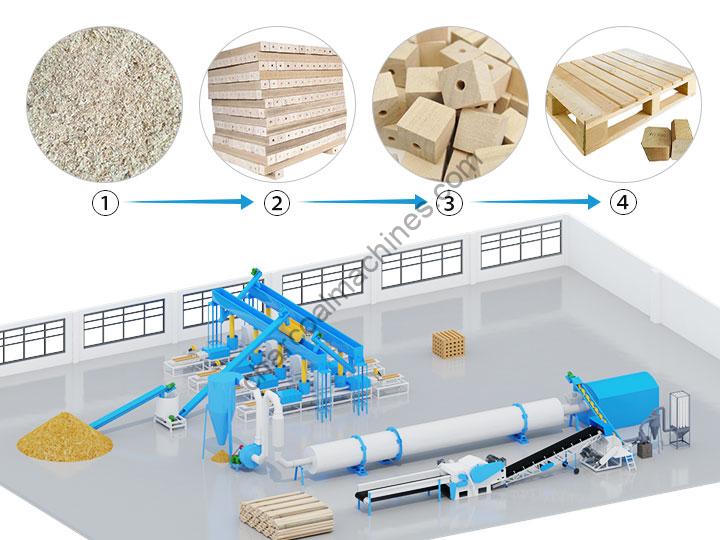

Expansion of Production Capacity

Manufacturers are investing heavily in upgrading production lines to meet rising demand. By 2026, increased automation, improved densification technologies, and use of waste wood (e.g., sawdust, wood shavings) are expected to boost efficiency and reduce production costs. Emerging markets in Eastern Europe, Southeast Asia, and South America are developing new production facilities, leveraging abundant forest residues and favorable feedstock availability. -

Regulatory Support and Carbon Incentives

Government policies aimed at reducing carbon footprints—such as the European Green Deal, U.S. Inflation Reduction Act, and national bioenergy mandates—are creating strong tailwinds. In several countries, compressed wood bricks qualify for renewable energy subsidies and carbon credit programs. By 2026, stricter emissions standards for residential heating appliances will likely favor cleaner fuels like wood bricks over traditional logs. -

Urban Adoption and E-Commerce Growth

Urban consumers are increasingly purchasing compressed wood bricks online for use in fireplaces, stoves, and outdoor heating. E-commerce platforms are expanding product accessibility, with value-added offerings such as eco-certified, FSC-labeled, or low-emission bricks. Subscription models and bundled delivery services are emerging, especially in cold-climate regions like Scandinavia and Canada. -

Competition and Market Consolidation

While the market remains fragmented, consolidation is expected by 2026 as larger biomass energy companies acquire regional producers to achieve economies of scale. This trend will enhance supply chain reliability and brand recognition. However, competition from alternative biomass fuels (e.g., wood pellets) persists, though wood bricks maintain a niche due to their convenience, longer burn time, and lower storage volume. -

Sustainability and Certification Trends

Environmental concerns around deforestation and supply chain transparency are pushing the industry toward third-party certifications (e.g., ENplus, DINplus). Producers are adopting blockchain and QR-code traceability systems to verify sustainable sourcing, appealing to eco-conscious buyers. By 2026, sustainability credentials will be a key differentiator in premium market segments. -

Challenges: Feedstock Volatility and Logistics

Despite growth, the sector faces challenges. Fluctuations in wood waste supply due to construction cycles or competing industries (e.g., paper, particleboard) can affect raw material costs. Additionally, transportation logistics—particularly for bulky, low-density fuels—remain a cost concern. Innovations in densification and modular packaging are expected to mitigate these issues by 2026.

Conclusion

By 2026, the compressed wood bricks market is projected to experience steady growth, with a compound annual growth rate (CAGR) of approximately 6–8% globally. Driven by eco-awareness, policy support, and product innovation, H2 trends indicate a shift toward higher efficiency, greater sustainability, and broader market penetration—positioning compressed wood bricks as a key player in the decentralized renewable heating landscape.

Common Pitfalls When Sourcing Compressed Wood Bricks (Quality and Intellectual Property)

Sourcing compressed wood bricks can be cost-effective and sustainable, but businesses often encounter significant challenges related to quality consistency and intellectual property (IP) issues. Being aware of these pitfalls helps in selecting reliable suppliers and avoiding legal or operational setbacks.

Inconsistent Raw Material Quality

One of the most frequent quality issues arises from inconsistent raw materials. Suppliers may use varying wood sources—such as sawdust, wood chips, or recycled lumber—without strict controls. This variation affects moisture content, density, and combustion efficiency. Low-quality feedstock can introduce contaminants like glue, paint, or metal, leading to poor burning performance and emissions.

Lack of Standardized Production Processes

Without adherence to international or industry standards (e.g., ENplus, DIN 51731), compressed wood bricks can vary widely in dimensions, calorific value, and ash content. Suppliers may lack proper certification or fail to conduct routine quality testing, resulting in batches that underperform in heating applications or damage equipment like stoves and boilers.

Inadequate Moisture Content Control

Moisture content above 10% significantly reduces the energy efficiency of wood bricks and increases smoke output. Poor drying practices or improper storage during production and shipping can lead to high moisture levels. Buyers may receive bricks that are prone to mold or fail to ignite easily, undermining their reliability as a fuel source.

Misleading or Absent Certifications

Some suppliers falsely claim compliance with environmental or quality certifications (e.g., FSC, PEFC, or carbon-neutral labels) without proper documentation. This not only misleads buyers about sustainability but may expose them to greenwashing accusations or regulatory penalties, especially in eco-conscious markets.

Intellectual Property Infringement Risks

When sourcing proprietary wood brick formulations or patented production technologies—especially from manufacturers in regions with weak IP enforcement—buyers risk inadvertently supporting or becoming liable for IP violations. For example, a supplier may use a patented densification process or additive formula without licensing, exposing downstream users to legal challenges if the IP holder takes action.

Supply Chain Opacity and Traceability Gaps

A lack of transparency in the supply chain makes it difficult to verify the origin of raw materials and production methods. This opacity increases the risk of unintentionally sourcing from deforested or illegal logging areas, leading to reputational damage and non-compliance with import regulations like the EU Timber Regulation (EUTR).

Poor Packaging and Handling Leading to Damage

Wood bricks are susceptible to breakage and moisture absorption if not properly packaged. Suppliers may use inadequate wrapping or palletization, leading to crumbling bricks upon arrival. This increases waste and handling costs, reducing the effective value of the purchase.

Overlooking Long-Term Supplier Reliability

Focusing solely on initial pricing may lead businesses to partner with suppliers lacking the infrastructure for consistent long-term production. Seasonal fluctuations, lack of scalability, or financial instability can disrupt supply, especially during peak heating seasons.

By addressing these quality and IP-related pitfalls proactively—through supplier audits, clear contracts, third-party testing, and due diligence on technology origins—buyers can ensure a reliable, legal, and high-performing supply of compressed wood bricks.

Logistics & Compliance Guide for Compressed Wood Bricks

Compressed wood bricks are a sustainable biomass fuel made from compacted sawdust or wood waste. While environmentally beneficial, their international and domestic transport requires careful attention to logistics and regulatory compliance. This guide outlines key considerations for safe, legal, and efficient handling.

Classification and Documentation

Compressed wood bricks are typically classified as solid biofuels or biomass pellets under international trade systems. Correct classification is essential for customs clearance and regulatory compliance.

- HS Code: Commonly classified under HS 4401.39 (Wood in chips or particles, fuel wood in logs, in billets, in rods, in particles or in similar forms). Confirm with local customs authorities, as codes may vary by country and wood source.

- Commercial Invoice: Must clearly state product description (e.g., “Compressed Wood Bricks, 100% hardwood waste, no additives”), net/gross weight, origin, and value.

- Packing List: Include number of bricks per bag, total bags per pallet, pallet dimensions, and stacking instructions.

- Certificate of Origin: Often required for tariff determination and trade agreements.

- Phytosanitary Certificate: May be required depending on destination country, especially if raw material is untreated or originates from regulated zones.

Packaging and Handling

Proper packaging ensures product integrity and safety during transit.

- Moisture Protection: Use moisture-resistant packaging (e.g., polypropylene bags with inner liners) to prevent degradation and mold.

- Stackability: Palletize bricks securely using stretch wrap or strapping. Standard pallet sizes (e.g., EUR/EPAL or GMA) facilitate handling.

- Labeling: Clearly label each package with product name, net weight, batch number, manufacturer details, and handling instructions (e.g., “Keep Dry,” “Protect from Moisture”).

- Load Securing: Use dunnage and blocking in containers or trucks to prevent shifting during transport.

Transportation Modes

Choose transport methods based on volume, distance, and destination.

- Road Transport: Ideal for regional distribution. Ensure vehicles are covered to protect against rain and moisture. Avoid open trailers unless properly tarped.

- Rail Transport: Cost-effective for large volumes over long distances. Confirm carrier experience with biomass fuels.

- Maritime Shipping: Common for international export. Use dry, well-ventilated containers. Monitor humidity to prevent condensation. Consider container desiccants.

- FCL (Full Container Load): Recommended to minimize contamination risk.

- LCL (Less than Container Load): Only use if properly sealed and palletized to avoid mixing with moisture-sensitive or odorous goods.

Storage Requirements

Improper storage can lead to moisture absorption, mold growth, or spontaneous combustion.

- Indoor Storage: Store in a dry, well-ventilated warehouse off the ground (on pallets).

- Outdoor Storage: If unavoidable, cover with waterproof tarps and elevate pallets. Avoid direct ground contact.

- Ventilation: Ensure airflow to prevent heat buildup, especially in large stacks.

- Fire Safety: Keep away from ignition sources. Have fire extinguishers (Class A) available. Monitor for spontaneous combustion in large piles.

Regulatory Compliance

Compliance varies significantly by country and region. Key areas include:

- Import Restrictions: Some countries restrict wood product imports due to invasive species or pest concerns (e.g., EU ISPM 15 regulations).

- ISPM 15: While compressed wood bricks are generally exempt from wood packaging material rules (e.g., pallets must be heat-treated), verify if the product itself is subject to phytosanitary controls.

- Environmental Regulations: Confirm compliance with local emissions and fuel standards (e.g., ENplus certification for biomass fuels in Europe).

- Customs Duties and Taxes: Research applicable tariffs based on HS code and trade agreements (e.g., USMCA, EU preferential tariffs).

Environmental and Sustainability Considerations

- Chain of Custody: Maintain documentation proving sustainable sourcing (e.g., FSC or PEFC certification if applicable).

- Carbon Reporting: Some markets require carbon footprint declarations for biofuels. Track emissions from production to delivery.

- Waste Disposal: Packaging waste (e.g., plastic bags) must be disposed of or recycled according to local regulations.

Risk Management

- Insurance: Ensure cargo is insured against moisture damage, fire, and transit loss.

- Quality Control: Conduct moisture content testing (ideally <10%) before shipment to ensure performance and safety.

- Supplier Verification: Source from reputable manufacturers with consistent quality and compliance records.

Summary

Successful logistics and compliance for compressed wood bricks depend on accurate classification, proper packaging, moisture control, and adherence to international and local regulations. Proactive documentation, secure transportation, and safe storage practices are critical to delivering a high-quality product while minimizing risks. Always consult with customs brokers, freight forwarders, and regulatory bodies in both exporting and importing countries to ensure full compliance.

In conclusion, sourcing compressed wood bricks presents a sustainable, cost-effective, and efficient alternative to traditional fuel sources. These briquettes offer high energy density, low moisture content, and minimal emissions, making them an environmentally responsible choice for heating and industrial applications. Their production utilizes waste wood materials, contributing to waste reduction and promoting circular economy practices. When sourcing compressed wood bricks, it is essential to consider factors such as quality standards, supply chain reliability, certifications (such as ENplus or equivalent), and transportation logistics to ensure consistent performance and sustainability. By partnering with reputable suppliers and conducting thorough due diligence, businesses and consumers can secure a reliable, eco-friendly fuel source that supports long-term energy and environmental goals.