The global steel and stainless steel manufacturing industry continues to experience steady growth, driven by increasing demand from construction, automotive, and industrial sectors. According to a 2023 market analysis by Mordor Intelligence, the global stainless steel market was valued at USD 105.6 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2028. This expansion is supported by rising infrastructure investments, particularly in emerging economies, and the growing preference for corrosion-resistant materials in consumer and industrial applications. In parallel, Grand View Research reported that the overall steel market was valued at over USD 1.4 trillion in 2022, with sustained demand from manufacturing and renewable energy infrastructure contributing to long-term market resilience. As innovation in alloy composition and production efficiency advances, a select group of manufacturers have emerged as leaders in both scale and technological capability—shaping the future of material science in metal production.

Top 9 Composition Of Steel And Stainless Steel Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 U.S. Steel

Domain Est. 1997

Website: ussteel.com

Key Highlights: We’re bringing industry-leading steelmaking talent and technology together to help customers solve, innovate and excel. Just one example: lighter, stronger ……

#2 North American Stainless

Domain Est. 1999 | Founded: 1990

Website: northamericanstainless.com

Key Highlights: Founded in 1990, North American Stainless (NAS) has undertaken several phases of expansion to become the largest, fully integrated stainless steel producer in ……

#3 SSINA

Domain Est. 1995

Website: ssina.com

Key Highlights: Designing stainless steel structures is now a lot easier! Stainless steel has a well-established track record for a wide range of structural applications—large ……

#4 Stainless Steel: Characteristics, Uses and Problems

Domain Est. 1997

Website: gsa.gov

Key Highlights: These guidelines provide general information on the characteristics and common uses of stainless steel and identifies typical problems associated with this ……

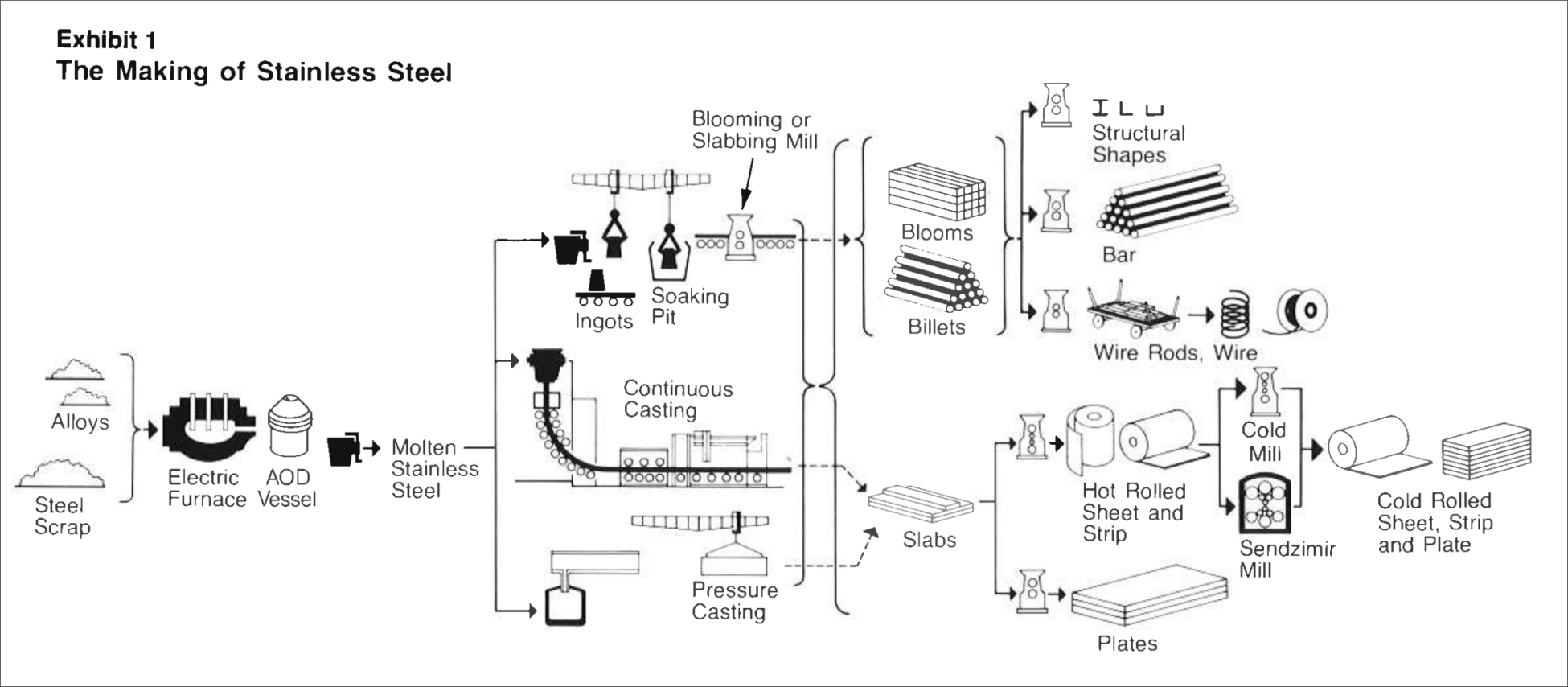

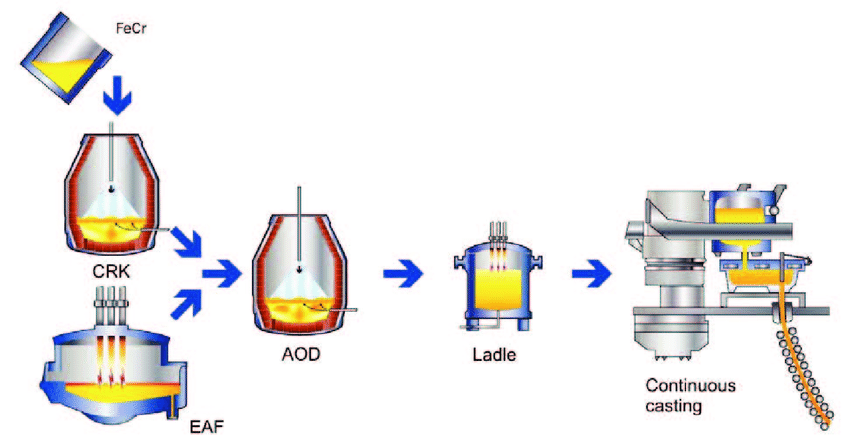

#5 Stainless Steel: How It Is Made

Domain Est. 1998

Website: norfolkiron.com

Key Highlights: The process of making stainless steel begins with extracting chromite (an iron chromium oxide) from underground mines. It is then crushed to produce a chromite ……

#6 of stainless steels

Domain Est. 2000

Website: worldstainless.org

Key Highlights: worldstainless.org is the most comprehensive site for anyone interested in stainless steels. You will find documentation on the properties, ……

#7 Stainless Steel Grades and Families: Explained

Domain Est. 2002

Website: unifiedalloys.com

Key Highlights: You’ll find various grades that help to describe specific properties of the alloy such as toughness, magnetism, corrosion resistance and alloy composition….

#8 What is Stainless Steel?

Domain Est. 2010

Website: aperam.com

Key Highlights: Steel is an alloy of iron and carbon. Stainless steels are steels containing at least 10.5% chromium, less than 1.2% carbon and other alloying elements….

#9 Steel material properties

Website: steelconstruction.info

Key Highlights: Steel derives its mechanical properties from a combination of chemical composition, heat treatment and manufacturing processes….

Expert Sourcing Insights for Composition Of Steel And Stainless Steel

H2: Projected Composition Trends in Steel and Stainless Steel for 2026

By 2026, the composition of steel and stainless steel is expected to undergo significant evolution, driven by advancements in materials science, sustainability mandates, and shifts in industrial demand. These changes are reshaping alloy formulations, production techniques, and material performance characteristics across global markets.

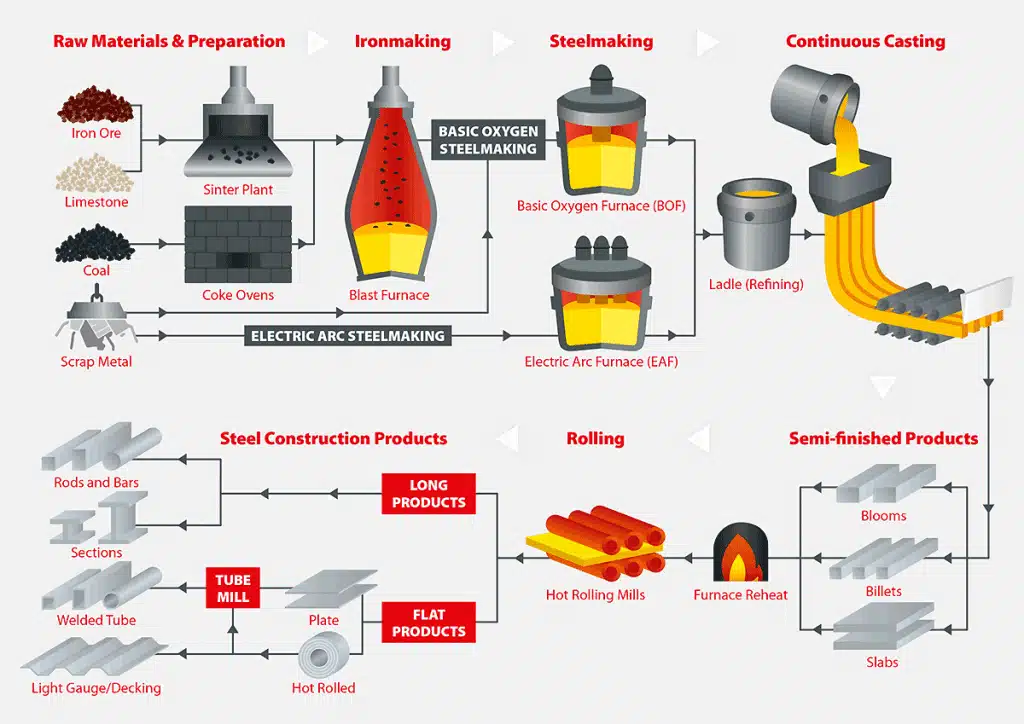

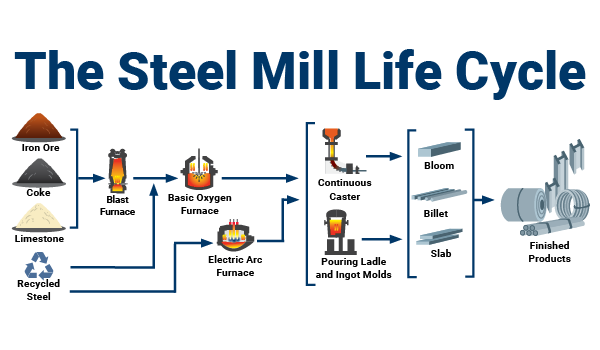

1. Shift Toward Low-Carbon and Recycled Steel Content

Environmental regulations and carbon neutrality goals are pushing steel producers to refine the composition of conventional carbon steel. By 2026, there will be a marked increase in the use of recycled scrap in primary steelmaking, particularly in electric arc furnace (EAF) production. This trend is altering the typical composition by introducing trace elements from mixed scrap sources, necessitating improved refining processes to maintain consistency. Additionally, green steel initiatives—utilizing hydrogen-based direct reduced iron (DRI)—are influencing base iron purity, reducing reliance on coal-derived carbon and lowering sulfur and phosphorus residuals.

2. Optimization of Carbon and Alloying Elements in Structural Steels

In carbon and low-alloy steels, producers are fine-tuning carbon content (typically 0.05–0.25%) in tandem with microalloying elements such as niobium, vanadium, and titanium. These adjustments enhance strength-to-weight ratios, supporting lightweighting in automotive and construction sectors. By 2026, advanced high-strength steels (AHSS) will increasingly dominate, featuring tailored compositions that balance formability, weldability, and durability.

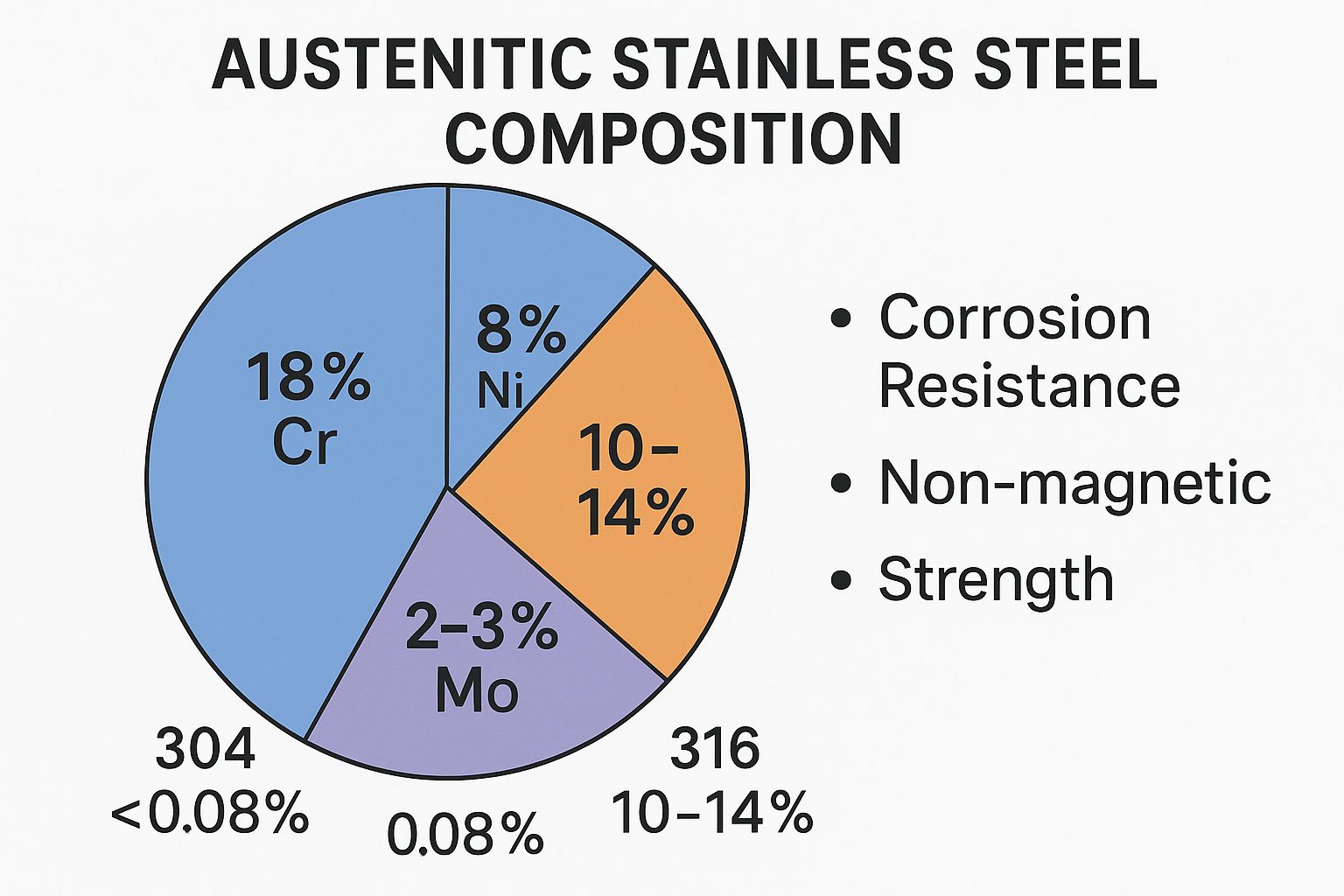

3. Evolution in Stainless Steel Compositions

Stainless steel formulations are seeing strategic changes to reduce dependency on expensive or geopolitically sensitive elements like nickel and molybdenum. Key trends include:

- Growth of 200-Series and Nickel-Substituted Alloys: Manganese and nitrogen are being used to stabilize austenitic structures in place of nickel, especially in emerging markets. Alloys such as 201 and 204Cu are gaining traction in consumer goods and infrastructure.

- Rise of Lean Duplex Stainless Steels: Grades like LDX 2101 and 2304 offer balanced ferritic-austenitic microstructures with reduced nickel and molybdenum content, delivering high corrosion resistance at lower cost—ideal for chemical processing and desalination plants.

- Increased Use of High-Performance Ferritic and Martensitic Grades: Driven by automotive exhaust systems and renewable energy applications, ferritic stainless steels (e.g., 441, 444) with enhanced chromium (17–20%) and controlled niobium/titanium additions are growing in use.

4. Integration of Digital Alloy Design and AI-Driven Composition Modeling

By 2026, artificial intelligence and machine learning are being deployed to predict optimal steel compositions for specific applications. This enables real-time adjustments in alloying ratios, minimizing waste and improving mechanical properties. Digital twins of metallurgical processes allow for precise control over stainless steel compositions, particularly in managing chromium (typically 10.5–30%), nickel, nitrogen, and minor elements like copper or silicon for targeted corrosion resistance and formability.

5. Regulatory and Traceability-Driven Composition Transparency

Global supply chains are demanding greater transparency in material composition due to environmental, social, and governance (ESG) criteria. By 2026, blockchain-enabled traceability systems will provide detailed composition histories—from ore source to final product—ensuring compliance with standards such as ISO 20178 for recycled content and EN 10088 for stainless steel grades.

In conclusion, the 2026 landscape for steel and stainless steel composition reflects a convergence of sustainability, performance optimization, and digital innovation. The chemical makeup of these materials will continue to adapt, prioritizing efficiency, recyclability, and resilience in a rapidly changing industrial ecosystem.

Common Pitfalls in Sourcing Composition of Steel and Stainless Steel (Quality, IP)

Sourcing accurate and reliable information about the composition of steel and stainless steel is critical for ensuring product quality, regulatory compliance, and preserving intellectual property (IP). Missteps in this process can lead to material failures, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Inadequate Specification of Material Grades and Standards

One of the most frequent pitfalls is failing to clearly define the required steel or stainless steel grade and referencing outdated or incorrect international standards (e.g., ASTM, EN, ISO, JIS). Suppliers may provide materials that technically meet a standard but do not fulfill the intended performance requirements due to variations in allowable elemental ranges. Always specify exact grades (e.g., 304L, 316Ti, S355J2) and the governing standard revision to avoid ambiguity.

Overlooking Trace Elements and Residuals

While major alloying elements (e.g., Cr, Ni, Mo in stainless steel) are typically well-documented, trace elements (e.g., Co, Ti, Nb) and residuals (e.g., Pb, Sn, As) are often overlooked. These can significantly affect material properties such as weldability, corrosion resistance, and mechanical strength. Ensure sourcing documentation includes full compositional data, including residual element limits, especially for critical applications like aerospace or medical devices.

Relying on Supplier Self-Certification Without Verification

Accepting mill test certificates (MTCs) or certificates of conformance (CoC) at face value without independent verification is risky. Some suppliers may provide falsified or inaccurate documentation. Implement third-party testing (e.g., OES – Optical Emission Spectrometry) for critical components to validate composition and detect potential discrepancies or material substitutions.

Ignoring Heat-to-Heat Variability

Even within the same grade, composition can vary between production heats. Assuming uniformity across batches without reviewing heat-specific test reports can lead to inconsistent product performance. Require heat-specific material certifications and maintain traceability from raw material to final product.

Intellectual Property Exposure During Material Disclosure

When sourcing custom or proprietary alloys, there is a risk of IP leakage if composition details are shared without proper safeguards. Unprotected disclosure to suppliers or third parties can result in reverse engineering or unauthorized replication. Use non-disclosure agreements (NDAs), limit data sharing to need-to-know parties, and consider disclosing only performance specifications rather than exact compositions when possible.

Failing to Address Regulatory and Compliance Requirements

Different industries have strict regulations regarding material composition (e.g., RoHS, REACH, FDA). Sourcing steel without verifying compliance with these regulations can result in product recalls or legal penalties. Ensure suppliers provide documentation confirming adherence to relevant regulatory limits on restricted substances.

Misunderstanding the Difference Between Nominal and Actual Composition

Nominal compositions are general guidelines, while actual compositions vary within standard tolerances. Design assumptions based solely on nominal values can lead to performance issues. Always obtain actual test results for the supplied material, particularly when tight tolerances or specific properties are required.

Conclusion

Avoiding these pitfalls requires clear specifications, rigorous documentation, independent verification, and robust IP protection measures. Proactive management of steel and stainless steel composition during sourcing ensures material integrity, regulatory compliance, and protection of proprietary information.

Logistics & Compliance Guide for Composition of Steel and Stainless Steel

Understanding the composition of steel and stainless steel is essential for ensuring regulatory compliance, safe handling, proper transportation, and quality control across the supply chain. This guide outlines key considerations for logistics and compliance related to the chemical composition, international standards, labeling, and documentation for steel and stainless steel products.

Chemical Composition Overview

Steel is an alloy primarily composed of iron and carbon, with carbon content typically ranging from 0.02% to 2.1% by weight. Additional alloying elements such as manganese, chromium, nickel, molybdenum, and vanadium may be added to enhance specific properties.

Stainless steel is a subset of steel known for its corrosion resistance, primarily due to the presence of at least 10.5% chromium. This forms a passive chromium oxide layer on the surface, protecting the metal from rust and oxidation.

Common types of stainless steel and their typical composition include:

- Austenitic (e.g., 304, 316): High chromium (16–26%) and nickel (6–22%), with good formability and corrosion resistance.

- Ferritic (e.g., 430): Moderate chromium (10.5–27%), low carbon, magnetic, and moderate corrosion resistance.

- Martensitic (e.g., 410, 420): Moderate chromium (11.5–18%), higher carbon, magnetic, and can be hardened by heat treatment.

- Duplex (e.g., 2205): Mixed microstructure with ~22% chromium, ~5% nickel, and ~3% molybdenum, offering high strength and excellent corrosion resistance.

International Standards and Specifications

To ensure compliance, steel and stainless steel compositions must conform to recognized international standards. Key standards include:

- ASTM International (USA):

- ASTM A240: Standard specification for chromium and chromium-nickel stainless steel plate, sheet, and strip.

-

ASTM A36: Standard for carbon structural steel.

-

EN Standards (Europe):

- EN 10088: Stainless steels — Technical delivery conditions.

-

EN 10025: Hot-rolled products of structural steels.

-

ISO Standards:

- ISO 15510: Stainless steels — Chemical composition.

-

ISO 4948: Classification of steels.

-

JIS (Japan):

- JIS G 4304: Stainless steel hot-rolled plates, sheets, and strips.

Manufacturers and logistics providers must ensure that material test reports (MTRs) or mill certificates are provided, confirming compliance with the specified standard and chemical composition.

Regulatory Compliance and Hazard Communication

Steel and stainless steel are generally not classified as hazardous materials under transport regulations (e.g., UN Model Regulations, ADR, IATA, IMDG) when in solid, bulk form. However, compliance requirements may arise in the following areas:

-

REACH (EU Regulation on Chemicals):

Steel products are generally exempt, but suppliers must declare any Substances of Very High Concern (SVHC) present above threshold levels (0.1% w/w). Chromium(VI) compounds may be of concern in specific processing stages but are not typically present in finished stainless steel. -

RoHS (Restriction of Hazardous Substances):

Applies to electrical and electronic equipment. Steel components must not contain restricted substances such as lead, cadmium, or mercury above permissible limits. -

Conflict Minerals (U.S. Dodd-Frank Act Section 1502):

While steel primarily contains iron, chromium, and nickel, companies should assess supply chains for the use of conflict minerals, especially if cobalt or tungsten is used in specialty alloys. -

TSCA (Toxic Substances Control Act – USA):

Requires reporting if certain chemical substances are present. Processed steel is generally compliant, but documentation may be needed for imported goods.

Packaging, Labeling, and Marking

Proper packaging and labeling are critical for logistics efficiency and regulatory compliance:

- Marking Requirements:

Steel and stainless steel products should be clearly marked with: - Grade designation (e.g., 304, 316, S355J2)

- Heat or batch number

- Manufacturer’s name or trademark

-

Applicable standard (e.g., ASTM A240)

-

Packaging:

- Bundled or palletized to prevent damage during transit.

- Use of protective coatings or wraps to prevent corrosion, especially for stainless steel exposed to humid environments.

-

Desiccants may be included in enclosed packaging to control moisture.

-

Labeling for International Shipments:

- Include HS (Harmonized System) codes (e.g., 7219 for stainless steel flat-rolled products).

- Provide detailed product descriptions, country of origin, and net/gross weight.

Documentation and Traceability

Maintaining accurate documentation supports compliance and traceability:

-

Material Test Reports (MTRs):

Must include chemical composition (verified by spectrographic analysis), mechanical properties, heat treatment, and compliance with relevant standards. -

Certificates of Conformance (CoC):

Issued by the manufacturer to confirm that products meet specified requirements. -

Customs Documentation:

- Commercial invoice

- Packing list

- Bill of lading or air waybill

-

Certificate of origin (required for preferential tariffs under trade agreements)

-

Traceability Systems:

Implement batch/heat traceability to enable recall or audit responses if compliance issues arise.

Handling, Storage, and Transportation

Proper logistics practices help preserve material integrity and ensure safety:

-

Segregation:

Store stainless steel separately from carbon steel to avoid cross-contamination (e.g., iron particles embedding into stainless steel, leading to rust). -

Environmental Controls:

- Avoid prolonged exposure to salt, chlorides, or acidic environments.

-

Store in dry, covered areas with adequate ventilation.

-

Transportation Precautions:

- Use non-metallic separators (e.g., wood, plastic) between layers.

- Secure loads to prevent shifting during transit.

- Protect from moisture using waterproof covers or sealed containers.

Environmental and Sustainability Compliance

Increasing emphasis is being placed on sustainable sourcing and recycling:

-

Recyclability:

Steel and stainless steel are 100% recyclable. Logistics providers should support closed-loop recycling systems. -

Carbon Footprint Reporting:

Under initiatives like the EU Green Deal or Carbon Border Adjustment Mechanism (CBAM), importers may need to report embedded carbon emissions in steel products. -

Eco-Declarations:

Environmental Product Declarations (EPDs) may be required for construction or infrastructure projects.

Conclusion

Compliance in the logistics of steel and stainless steel hinges on accurate knowledge of material composition, adherence to international standards, proper documentation, and careful handling. By following this guide, stakeholders can ensure regulatory alignment, reduce risks, and support efficient, sustainable supply chains.

Conclusion on the Sourcing of Composition of Steel and Stainless Steel:

The composition of steel and stainless steel plays a critical role in determining their mechanical properties, corrosion resistance, and suitability for various industrial applications. Sourcing accurate and reliable compositional data is essential for ensuring material quality, compliance with international standards (such as ASTM, AISI, ISO, and EN), and consistency in manufacturing processes.

For carbon steel, the primary elements of concern include iron, carbon, manganese, and trace amounts of silicon, sulfur, and phosphorus. In contrast, stainless steel contains a significant proportion of chromium (typically over 10.5%) and often includes nickel, molybdenum, and other alloying elements to enhance corrosion resistance and performance under extreme conditions.

Reliable sources for compositional information include certified mill test reports (MTRs), material safety data sheets (MSDS), supplier specifications, and standardized reference databases. Direct communication with reputable suppliers and third-party material testing (e.g., spectrographic analysis) further ensures authenticity and traceability.

In conclusion, effective sourcing of steel and stainless steel composition relies on collaboration with trustworthy suppliers, adherence to established standards, and verification through documented evidence and testing. This ensures the right material selection, supports quality control, and mitigates risks in engineering and construction projects.