The global composite tile roofing market is experiencing steady growth, driven by increasing demand for durable, energy-efficient, and aesthetically versatile roofing solutions. According to Grand View Research, the global roofing materials market was valued at USD 117.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030, with composite tiles gaining traction due to their superior weather resistance, lightweight design, and low maintenance. Similarly, Mordor Intelligence projects a CAGR of over 6% for the roofing materials market through 2028, citing urbanization, rising construction activities, and growing emphasis on sustainable building materials as key growth catalysts. Within this expanding landscape, composite tile roofing—crafted from engineered blends of recycled polymers, rubber, and additives—has emerged as a high-performance alternative to traditional clay, concrete, and slate. This report identifies the top 9 composite tile roofing manufacturers shaping the industry through innovation, product longevity, and environmental stewardship.

Top 9 Composite Tile Roofing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 GAF Roofing

Domain Est. 1996

Website: gaf.com

Key Highlights: As North America’s largest roofing manufacturer, GAF is an industry leader that produces quality, innovative roofing materials….

#2 Atlas Roofing Shingles, Underlayments & Ventilation Homepage …

Domain Est. 1996

Website: atlasroofing.com

Key Highlights: Shingles with Core4® Technology lead the industry with the highest wind and impact ratings, overall strength and durability….

#3 DECRA Metal Roofing: #1 Stone

Domain Est. 1999

Website: decra.com

Key Highlights: DECRA Metal Roofing is the #1 stone-coated steel manufacturer for residential and commercial roofing backed by a lifetime warranty to guarantee protection….

#4 BORAL Residential Roof Products

Domain Est. 2015

Website: roofle.com

Key Highlights: Boral Roofing is the nation’s largest manufacturer of sustainable, durable and affordable clay, concrete, stone coated steel and composite slate and shake roof ……

#5 Eagle Roofing

Domain Est. 1995

Website: eagleroofing.com

Key Highlights: We provide our customers with high quality concrete tile roof products that are aesthetically beautiful, durable and environmentally friendly….

#6 Owens Corning

Domain Est. 1996

Website: owenscorning.com

Key Highlights: Owens Corning has solutions for your building & remodeling needs. Browse through roofing products, insulation, shingles, asphalt, composites solutions, ……

#7 Enviroshake®

Domain Est. 2000

Website: enviroshake.com

Key Highlights: Authentic cedar-shake look with enhanced durability. Composite cedar shake roofing built for harsh weather and backed by a lifetime warranty….

#8 Composite Roofing: Traditional and Authentic

Domain Est. 2009

Website: quarrix.com

Key Highlights: Quarrix Composite Roofing provides the same beautiful look as traditional clay and concrete tiles but with the benefits of a lightweight synthetic roof tile ……

#9 BRAVA Roof Tile

Domain Est. 2016

Website: bravarooftile.com

Key Highlights: Brava Roof Tile manufactures the best synthetic slate, cedar shake, & Spanish roofing tiles with a 50-year warranty. See why composite roof tile is better!…

Expert Sourcing Insights for Composite Tile Roofing

2026 Market Trends for Composite Tile Roofing

The composite tile roofing market is poised for significant evolution by 2026, driven by shifting consumer preferences, technological advancements, and increasing environmental awareness. Here’s an analysis of the key trends expected to shape the industry:

1. Accelerated Demand for Sustainable and Eco-Friendly Materials

By 2026, sustainability will be a primary driver in roofing material selection. Composite tiles—often made from recycled materials such as rubber, plastics, and wood fibers—will gain favor due to their low environmental impact. Homeowners and builders will increasingly prioritize products with certifications like EPDs (Environmental Product Declarations) and Cradle-to-Cradle, pushing manufacturers to improve transparency and reduce carbon footprints. Additionally, recyclability at end-of-life will become a key selling point.

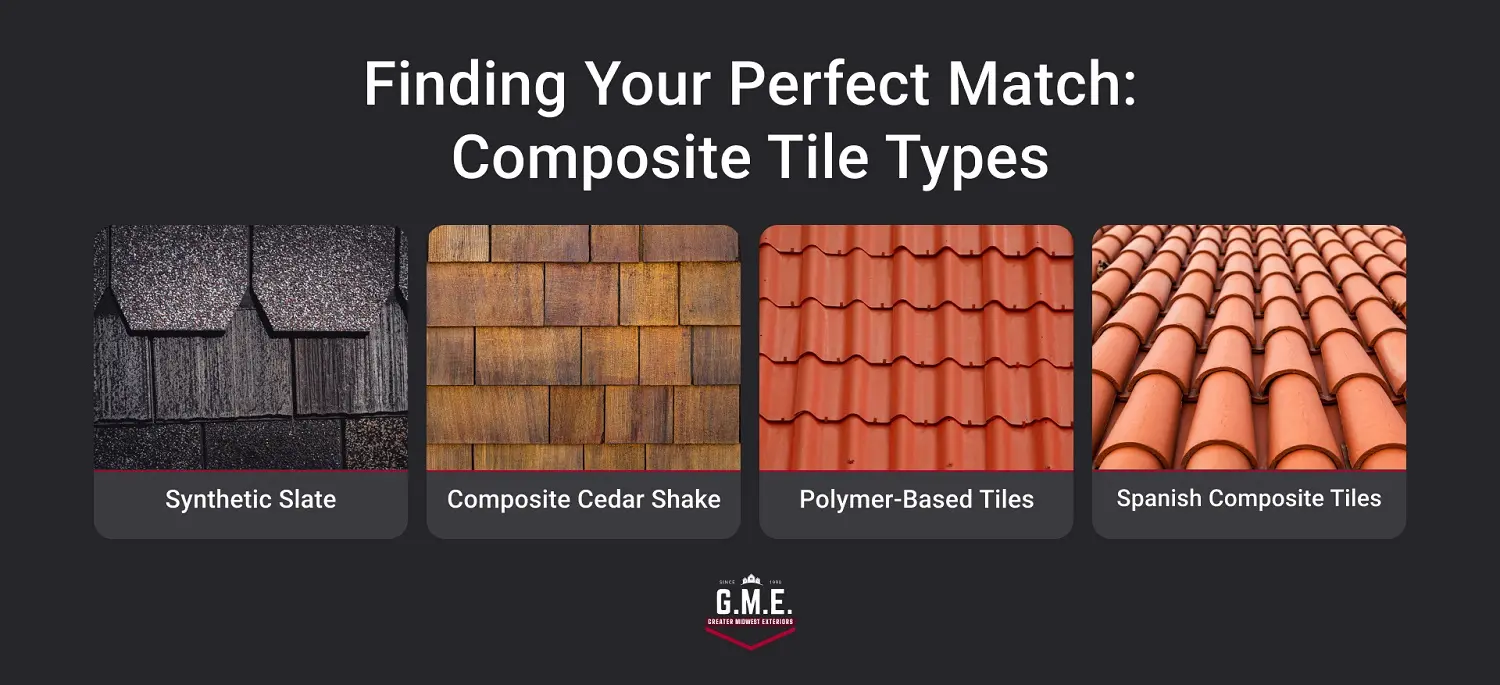

2. Growth in Residential and Luxury Markets

Composite tile roofing will see strong adoption in high-end residential construction, particularly in regions prone to extreme weather. Its ability to mimic premium materials like clay, slate, and wood shakes—without their weight or cost—will make it a preferred choice for homeowners seeking aesthetic appeal with durability. Coastal and wildfire-prone areas in the U.S., Australia, and Southern Europe will see particularly high demand due to the material’s resilience.

3. Technological Advancements in Material Performance

By 2026, manufacturers will enhance composite tile technology to offer improved fire resistance, impact ratings (Class 4), and superior UV protection. Innovations such as integrated solar-ready designs and reflective pigments to reduce heat absorption (cool roofing) will become more prevalent, aligning with energy efficiency standards and net-zero building goals.

4. Rising Influence of Code Compliance and Insurance Incentives

Building codes in hurricane- and fire-prone zones will increasingly favor impact- and fire-resistant roofing. Composite tiles that meet stringent standards like Miami-Dade County NOA requirements or California’s Chapter 7A wildfire regulations will benefit from regulatory tailwinds. Insurance discounts for durable roofing materials will also encourage consumer adoption, improving ROI perception.

5. Expansion of the Retrofit and Remodeling Segment

With the weight of traditional tile being a structural limitation in retrofit projects, lightweight composite tiles will dominate the re-roofing market. Their ease of installation and compatibility with existing roof structures will make them ideal for aging housing stock upgrades, especially in North America and Western Europe.

6. Consolidation and Innovation Among Key Players

The market will see strategic consolidation as major players acquire niche composite manufacturers to expand product portfolios. Companies like DaVinci Roofscapes, Eagle Roofing, and CertainTeed will invest heavily in R&D to differentiate through color longevity, dimensional stability, and installation efficiency, including interlocking systems that reduce labor costs.

7. Regional Market Diversification

While North America remains a dominant market, growth in Asia-Pacific (especially Japan and Australia) and parts of Latin America will accelerate due to urbanization and climate resilience needs. Localized production facilities may emerge to reduce transportation emissions and tariffs, supporting regional supply chains.

In conclusion, by 2026, the composite tile roofing market will be defined by sustainability, performance, and aesthetic versatility. As climate challenges intensify and building standards evolve, composite tiles will transition from a niche alternative to a mainstream solution in both new construction and renovation projects.

Common Pitfalls When Sourcing Composite Tile Roofing (Quality & Intellectual Property)

Sourcing composite tile roofing presents unique challenges, particularly concerning material quality and intellectual property (IP) protection. Overlooking these areas can lead to product failure, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Inadequate Quality Control and Material Verification

Many suppliers claim high performance, but without rigorous vetting, buyers risk receiving substandard products. Composite tiles often blend polymers, resins, and fillers, and variations in composition can drastically affect durability, UV resistance, and fire performance. Buyers may receive tiles that fade prematurely, crack under thermal stress, or fail impact tests—especially if the manufacturer cuts corners on raw material quality or curing processes.

Best Practice: Request third-party test certifications (e.g., ASTM, UL, FM) and conduct independent lab testing of samples. Audit manufacturing facilities to verify quality control procedures and raw material sourcing.

Misrepresentation of Performance Claims

Suppliers may exaggerate product lifespan, wind uplift resistance, or energy efficiency without substantiating data. Terms like “lifetime warranty” or “hurricane-proof” can be misleading if not backed by real-world testing or conditional coverage.

Best Practice: Scrutinize warranty terms and demand performance data from accredited testing labs. Compare claims with industry benchmarks and review independent product reviews or case studies.

Intellectual Property Infringement Risks

Composite tile designs—especially those mimicking natural materials like slate or wood—are often protected by design patents, trademarks, or trade dress rights. Sourcing from manufacturers that replicate patented profiles or branding infringes IP and exposes the buyer to legal liability, shipment seizures, or forced product recalls.

Best Practice: Conduct due diligence on the supplier’s design origins. Require documentation proving the designs are either licensed, in the public domain, or independently developed. Include IP indemnification clauses in supply agreements.

Lack of Transparency in Supply Chain

Opaque supply chains can conceal the use of counterfeit materials, unlicensed production, or unauthorized subcontracting. This not only affects quality but also increases the risk of unknowingly distributing IP-infringing products.

Best Practice: Map the full production chain, from raw material suppliers to final assembly. Insist on transparency and conduct regular audits to ensure compliance with quality and IP standards.

Overlooking Long-Term Support and Warranty Enforcement

Even with a quality product, poor after-sales support or ambiguous warranty enforcement can undermine value. Some suppliers disappear or refuse claims when issues arise years later.

Best Practice: Evaluate the supplier’s financial stability and track record for honoring warranties. Prefer suppliers with regional service networks and clear, enforceable warranty terms.

By proactively addressing these pitfalls, buyers can ensure they procure durable, compliant composite tile roofing that meets both performance expectations and legal requirements.

Logistics & Compliance Guide for Composite Tile Roofing

Overview

Composite tile roofing combines the durability and aesthetic appeal of traditional roofing materials with enhanced performance characteristics such as impact resistance, lighter weight, and sustainability. Proper logistics and compliance management are essential to ensure timely delivery, regulatory adherence, and successful installation. This guide outlines best practices for handling, transporting, storing, and complying with relevant standards for composite tile roofing systems.

Material Handling and Packaging

- Packaging Standards: Composite tiles are typically shipped in secured bundles on wooden pallets, wrapped in weather-resistant film to prevent moisture damage during transit.

- Forklift Accessibility: Ensure pallets are designed for forklift access on multiple sides to facilitate unloading at job sites or warehouses.

- Edge Protection: Use corner boards or edge protectors to prevent chipping and cracking during handling.

- Labeling: Each bundle must be clearly labeled with product type, color, batch number, quantity, and handling instructions (e.g., “This Side Up,” “Do Not Stack”).

Transportation and Delivery

- Load Securing: Secure pallets with straps or chains to prevent shifting during transit. Avoid overloading to prevent tile breakage.

- Weather Protection: Cover loads with tarps if transporting in open trucks, especially in rain, snow, or high-humidity conditions.

- Route Planning: Plan delivery routes to avoid unpaved or uneven roads that could damage tiles due to vibration or impact.

- Delivery Verification: Inspect deliveries upon arrival for visible damage, moisture exposure, or missing items. Document and report discrepancies immediately to the supplier.

On-Site Storage

- Elevated Platforms: Store pallets on level, elevated platforms (e.g., wooden skids) to prevent ground moisture absorption and pest infestation.

- Covered Storage: Keep tiles under a temporary shelter or covered area, avoiding direct exposure to rain, snow, or prolonged UV sunlight.

- Stacking Limits: Do not exceed the manufacturer’s recommended stacking height (typically 2–3 pallets) to avoid crushing lower layers.

- Ventilation: Allow airflow around stored materials to reduce condensation and warping risks.

Regulatory and Compliance Standards

- Building Codes: Ensure composite tiles comply with local building codes, including wind uplift, fire resistance (Class A, B, or C), and seismic requirements.

- ICC-ES Evaluation Reports: Verify the product has an ICC-ES (International Code Council Evaluation Service) report confirming code compliance for structural, fire, and durability performance.

- Fire Ratings: Confirm tiles meet ASTM E108 or UL 790 standards for fire spread and burning characteristics.

- Wind Resistance: Check compliance with ASTM D3161 or ASTM D7158 for wind uplift resistance, especially in high-wind zones.

- Environmental Regulations: Adhere to EPA and local environmental guidelines for emissions during manufacturing and disposal. Look for products with Environmental Product Declarations (EPDs) or Health Product Declarations (HPDs) if required for green building certifications.

Installation Compliance

- Manufacturer Guidelines: Follow the manufacturer’s installation manual precisely for underlayment, fastening patterns, and flashing details.

- Permitting: Obtain necessary permits before installation begins. Inspections may be required at underlayment, flashings, and final completion stages.

- Workforce Certification: Use installers certified or trained by the manufacturer to ensure warranty validity and code compliance.

- Safety Standards: Comply with OSHA regulations for fall protection, ladder safety, and personal protective equipment (PPE) during installation.

Sustainability and Recycling

- Recycled Content: Many composite tiles incorporate recycled materials (e.g., rubber, plastics, wood fibers). Confirm percentages for LEED or other green building credits.

- End-of-Life Disposal: Check local regulations for disposal or recycling options. Some manufacturers offer take-back programs.

- Energy Efficiency: Consider tiles with solar reflectance (SRI) ratings to meet energy code requirements (e.g., Title 24 in California).

Documentation and Recordkeeping

- Maintain copies of:

- Product data sheets

- Warranty documentation

- ICC-ES reports

- Delivery receipts and inspection reports

- Installation certifications

- As-built drawings and inspection approvals

Conclusion

Effective logistics and compliance management for composite tile roofing ensures product integrity, regulatory adherence, and long-term performance. By following these guidelines, contractors, distributors, and project managers can minimize risks, avoid delays, and deliver high-quality roofing solutions that meet both code and client expectations. Always consult the specific manufacturer’s recommendations and local jurisdiction requirements for project-specific compliance.

In conclusion, sourcing composite tile roofing presents a strategic balance between performance, sustainability, and cost-efficiency. Composite tiles offer exceptional durability, resisting impacts, extreme weather, and fading better than many traditional materials. Their lightweight nature simplifies transportation and installation, reducing labor costs and structural requirements. Environmentally, many composite tiles incorporate recycled materials and are themselves recyclable, supporting green building initiatives. When sourcing, it is essential to evaluate suppliers based on material quality, manufacturing standards, certifications, and warranty offerings to ensure long-term value. Additionally, considering regional climate conditions and local building codes will guide optimal product selection. Overall, with proper due diligence in sourcing, composite tile roofing emerges as a reliable, aesthetically versatile, and sustainable choice for both residential and commercial projects.