The global composite autoclave market is experiencing robust growth, driven by increasing demand for lightweight, high-strength materials in aerospace, defense, and automotive sectors. According to a 2023 report by Mordor Intelligence, the market was valued at USD 287 million in 2022 and is projected to reach USD 412 million by 2028, growing at a CAGR of 6.2% over the forecast period. This expansion is fueled by rising aircraft production rates, advancements in composite material technologies, and stringent fuel efficiency regulations. As manufacturers seek precision curing solutions to meet quality and scalability requirements, autoclave systems have become critical in composite manufacturing workflows. This growing demand has intensified competition among equipment suppliers, leading to rapid innovation in temperature control, pressure uniformity, and digital integration. Below, we highlight the top 10 composite autoclave manufacturers shaping this evolving landscape through technological leadership, global reach, and strategic partnerships.

Top 10 Composite Autoclave Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Thermoset Prepreg & Composite Material Manufacturer

Domain Est. 2016

Website: toraycma.com

Key Highlights: Toray is a producer of advanced composite materials, carbon fiber, and prepreg materials for aerospace and industrial markets. Contact us today to learn ……

#2 Aerovac

Domain Est. 1997

Website: aerovac.com

Key Highlights: Aerovac is a leading provider of process materials essential to composite manufacturing in Aerospace, Wind Energy, Marine, Motorsports and more….

#3 ASC Process Systems

Domain Est. 1999

Website: aschome.com

Key Highlights: Composite Curing ASC Process Systems is the world’s leading manufacturer of autoclaves and ovens for the aerospace, composites, nuclear, vulcanizing, and glass ……

#4 Composite Autoclaves

Domain Est. 1995

Website: bondtech.com

Key Highlights: Bondtech’s composite autoclave systems include the key components for efficiency, and adhere to all ASME Boiler and Pressure Vessel Code standards….

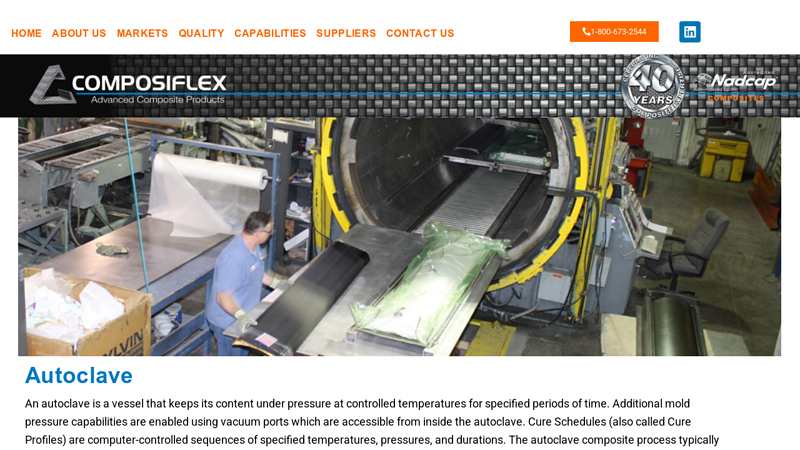

#5 Autoclave Composite

Domain Est. 1996

Website: composiflex.com

Key Highlights: Composiflex uses our autoclave to process a wide variety of composite parts. It allows for a controlled, repeatable, and monitored production process….

#6 Composites Autoclaves

Domain Est. 1996

Website: olmar.com

Key Highlights: We manufacture fully bespoke composite autoclaves, providing our customers with the highest quality and ensuring maximum performance in each cycle of its ……

#7 Advanced composite materials for the global market, USA

Domain Est. 2010

Website: shdcomposites.com

Key Highlights: We offer a wide range of composite tooling and component prepregs suitable for autoclave, press and oven curing. Using our product selector guide you can ……

#8 Autoclaves Composites (laboratories, universities etc.)

Domain Est. 2017

Website: aeroform-composites.com

Key Highlights: Aeroform designs and manufactures a complete range of standard composite autoclaves dedicated to the production of high-performance composite parts….

#9 Composite Resources

Domain Est. 2020

Website: cr.rebuildmanufacturing.com

Key Highlights: At Re:Build Composite Resources, we are creating composite solutions tailored for a variety of industries. Learn more about our cutting-edge capabilities….

#10 Composite Autoclave Systems

Domain Est. 2022

Website: vertisaautoclave.com

Key Highlights: Discover advanced composite autoclave systems for precision curing. Ensure strength, durability, and efficiency with Vertisa Autoclave solutions….

Expert Sourcing Insights for Composite Autoclave

H2: 2026 Market Trends for Composite Autoclaves

The composite autoclave market is poised for significant evolution by 2026, driven by strong demand from key end-use industries, technological advancements, and a growing emphasis on efficiency and sustainability. Here’s an analysis of the key trends shaping the market:

1. Sustained Aerospace Dominance with Increased Demand

- The aerospace sector will remain the primary driver of composite autoclave demand in 2026. The continued production ramp-up of commercial aircraft (e.g., Boeing 737 MAX, Airbus A320neo family) and next-generation programs (e.g., potential new widebody developments) will sustain demand for large-scale autoclaves.

- Increased use of composites in primary and secondary aircraft structures—including wings, fuselages, and empennages—will necessitate high-performance autoclaves capable of curing large, complex parts with tight tolerances.

- Defense and space applications (e.g., UAVs, satellites, launch vehicles) will also contribute significantly, particularly in North America and Europe.

2. Expansion in Non-Aerospace Sectors

- Automotive: Growth in electric vehicles (EVs) and high-performance automotive applications will drive demand for autoclaves capable of producing lightweight composite components (e.g., chassis, body panels). While out-of-autoclave (OOA) processes are gaining traction, autoclaves will still be essential for premium and structural parts.

- Wind Energy: As turbine blades grow longer and more efficient, the need for large autoclaves or specialized vacuum-assisted processes increases. Though OOA and infusion dominate blade manufacturing, autoclaves are used for prototyping, high-performance blade segments, and repair.

- Industrial and Sporting Goods: High-end applications in robotics, medical devices, and premium sporting goods (e.g., bicycles, tennis rackets) will continue to rely on autoclave-cured composites for superior performance and consistency.

3. Technological Advancements and Automation

- Digitalization and IoT Integration: By 2026, smart autoclaves equipped with IoT sensors, real-time monitoring, and predictive maintenance will dominate new installations. These systems enhance process control, reduce scrap rates, and improve traceability—critical for aerospace certification.

- Energy Efficiency Improvements: Manufacturers will focus on reducing energy consumption through advanced insulation, optimized heating/cooling cycles, and heat recovery systems. This aligns with global sustainability goals and reduces operational costs.

- Hybrid and Alternative Curing Technologies: While traditional autoclaves remain essential, hybrid systems combining autoclave pressure with microwave or induction heating may emerge for niche applications, offering faster cycle times.

4. Regional Market Shifts and Localization

- Asia-Pacific Growth: China, India, and Southeast Asia will see accelerated market growth due to expanding aerospace manufacturing (e.g., COMAC, local defense programs) and automotive electrification. Local production of autoclaves and partnerships with global OEMs will increase.

- Supply Chain Resilience: Post-pandemic and geopolitical tensions will push companies to regionalize composite manufacturing, leading to new autoclave installations in strategic regions to reduce dependency on single supply chains.

5. Sustainability and Regulatory Pressures

- Environmental regulations will push for lower emissions and energy-efficient autoclave operations. Manufacturers will adopt greener materials (e.g., bio-based resins) that still require autoclave curing.

- Recycling of thermoset composites remains a challenge, but advancements may influence autoclave design for repair and remanufacturing processes.

6. Market Consolidation and Innovation

- The market may see consolidation among autoclave manufacturers as competition increases and customers demand integrated solutions (e.g., turnkey systems with software, tooling, and training).

- Innovation in large-format autoclaves (e.g., for single-piece fuselage sections) and modular, scalable designs will cater to evolving production needs.

Conclusion

By 2026, the composite autoclave market will be characterized by robust demand from aerospace, emerging opportunities in automotive and energy, and a strong push toward smarter, more efficient, and sustainable manufacturing. While alternative curing methods will grow, autoclaves will remain indispensable for high-performance, mission-critical composite components. Companies that invest in digital integration, energy efficiency, and regional market expansion will be best positioned to lead in this dynamic landscape.

Common Pitfalls in Sourcing Composite Autoclaves: Quality and Intellectual Property Concerns

Sourcing composite autoclaves—critical equipment for curing high-performance composite materials—requires careful evaluation beyond just price and delivery timelines. Two major areas where companies often encounter significant pitfalls are quality assurance and intellectual property (IP) protection. Failure to address these can result in production delays, compromised product performance, legal disputes, or loss of competitive advantage.

Quality-Related Pitfalls

One of the most frequent challenges in sourcing composite autoclaves is ensuring consistent, reliable quality that meets stringent aerospace, defense, or industrial standards. Key pitfalls include:

-

Inadequate Pressure and Temperature Uniformity: Many low-cost or unproven manufacturers fail to guarantee the tight temperature and pressure tolerances required for aerospace-grade composites. Non-uniform curing environments can lead to material defects, delamination, or inconsistent mechanical properties in final parts.

-

Substandard Materials and Construction: Autoclaves operate under high pressure (often exceeding 100 psi) and elevated temperatures (up to 750°F/400°C). Sourcing from suppliers using inferior vessel materials, seals, or control systems risks safety hazards, frequent maintenance, and shortened equipment lifespan.

-

Insufficient Certification and Testing Documentation: Reputable suppliers provide ASME U and UV stamps, pressure vessel certifications, and comprehensive factory acceptance testing (FAT) reports. Omitting these due to cost-cutting or lack of compliance can delay regulatory approvals and jeopardize production timelines.

-

Poorly Integrated Control Systems: Advanced autoclaves require precise programmable logic controllers (PLCs) and data logging for traceability. Sourcing units with outdated or proprietary control software can lead to integration issues with existing manufacturing execution systems (MES) or difficulties in audit compliance.

Intellectual Property (IP) Risks

Composite manufacturing often involves proprietary processes, tooling designs, and material formulations. When sourcing autoclaves—especially custom or semi-custom systems—companies face several IP-related risks:

-

Lack of IP Clauses in Contracts: Standard procurement agreements may not explicitly assign ownership of custom design modifications, control software enhancements, or process-specific adaptations. This ambiguity can lead to disputes, especially if the supplier reuses designs for competing clients.

-

Unauthorized Access to Process Data: Connected or smart autoclaves may collect sensitive operational data (e.g., cure cycles, ramp rates, vacuum profiles). Without robust data ownership and confidentiality clauses, suppliers could access or monetize this information.

-

Reverse Engineering and Design Replication: When sourcing from offshore or lower-tier manufacturers, there’s a risk that critical design features—such as specialized heating elements, door mechanisms, or internal fixtures—could be reverse-engineered and sold to competitors.

-

Use of Third-Party Components with Licensing Issues: Some suppliers integrate third-party software or sensors that may have restrictive licenses or lack transferability, potentially exposing the buyer to compliance risks or future licensing fees.

To mitigate these pitfalls, organizations should conduct rigorous supplier audits, include strong IP protection clauses in contracts, insist on full FAT and documentation, and consider partnering with established, certified manufacturers with proven track records in high-integrity composite processing.

Logistics & Compliance Guide for Composite Autoclave

Overview

This guide outlines the essential logistics and compliance considerations for the transportation, installation, operation, and maintenance of composite autoclaves. These high-pressure, high-temperature systems are critical in aerospace, defense, and advanced manufacturing sectors and require stringent adherence to safety, environmental, and regulatory standards.

Regulatory Compliance

International & National Standards

Composite autoclaves must comply with a range of international and national regulations, including:

– ASME Boiler and Pressure Vessel Code (BPVC), Section VIII: Mandatory for pressure vessel design, fabrication, and inspection in the U.S. and widely adopted globally.

– Pressure Equipment Directive (PED) 2014/68/EU: Required for autoclaves placed on the European market; classification depends on volume, pressure, and fluid group.

– OSHA Standards (29 CFR 1910): Governs workplace safety, including pressure systems and confined space entry in the U.S.

– ATEX Directive 2014/34/EU: Applicable if the autoclave operates in potentially explosive atmospheres (e.g., volatile resin outgassing).

– ISO 9001 & AS9100: Quality management standards, especially critical in aerospace manufacturing.

Environmental & Emissions Compliance

- VOC Emissions Control: Autoclave outgassing may release volatile organic compounds; compliance with local air quality regulations (e.g., U.S. EPA NESHAP, EU Industrial Emissions Directive) is required.

- Waste Handling: Resin traps, filters, and contaminated materials must be disposed of in accordance with hazardous waste regulations (e.g., RCRA in the U.S.).

- Energy Efficiency Standards: Facilities may need to meet regional energy performance benchmarks (e.g., EU Ecodesign Directive).

Transportation & Logistics

Pre-Shipment Preparation

- Crating & Packaging: Autoclaves must be securely crated with vibration dampeners and moisture barriers. Large vessels may require custom transport frames.

- Route Survey: For oversized loads, conduct route analysis to ensure bridge clearances, road weight limits, and turning radii are adequate.

- Export Controls: Verify if the equipment or its technology is subject to export regulations (e.g., ITAR, EAR) due to aerospace applications.

Shipping Requirements

- Mode of Transport:

- Sea Freight: Most common for international shipments; requires weatherproofing and proper stowage.

- Overland Transport: Use heavy-haul trailers with permits for oversized loads.

- Air Freight: Rare due to size and cost; only for modular or disassembled components.

- Documentation: Include packing lists, certificates of conformity (ASME/PED), bill of lading, insurance, and export/import permits.

Customs & Import Clearance

- HS Code Classification: Typically under 8419.89 (other reaction vessels, tanks, etc.).

- Duties & Tariffs: Vary by country; check local trade agreements.

- Inspection Requirements: Some countries require pre-shipment inspections or local certification (e.g., CRN in Canada).

Installation & Site Preparation

Facility Requirements

- Structural Support: Confirm floor load capacity (autoclaves can weigh 10+ tons). Reinforcement may be required.

- Utility Connections:

- High-capacity electrical supply (typically 480V, 3-phase).

- Compressed air (for controls and safety systems).

- Water cooling lines (if equipped).

- Exhaust ducting to fume abatement system.

- Clearance & Access: Maintain minimum 3 ft (1 m) clearance on all sides for maintenance and safety.

Commissioning & Certification

- Third-Party Inspection: Required by ASME and PED; involves hydrostatic testing and documentation review.

- Operational Qualification (OQ): Validate temperature, pressure, and vacuum uniformity per process specifications.

- Safety System Checks: Verify emergency shutdown, pressure relief valves, and interlock functions.

Operational Compliance

Personnel Training & Certification

- Operators must be trained in:

- Safe loading/unloading procedures.

- Emergency response (e.g., overpressure, fire).

- Use of personal protective equipment (PPE).

- Maintain training records in accordance with OSHA and quality standards.

Maintenance & Inspections

- Routine Checks: Daily visual inspections, weekly valve tests, monthly safety system verification.

- Periodic Inspections:

- Internal/external vessel inspection every 2–5 years (per ASME NB-23).

- Pressure relief valve testing annually.

- Recordkeeping: Maintain logs of repairs, inspections, and modifications for audit purposes.

Documentation & Audits

- Required documentation includes:

- ASME Data Report (R Stamp).

- EU Declaration of Conformity (CE Marking).

- Process validation records.

- Maintenance logs and non-conformance reports.

- Prepare for internal, customer, and regulatory audits (e.g., FAA, EASA, NADCAP).

Decommissioning & Disposal

- Decommissioning Plan: Includes depressurization, cleaning, and safe removal of hazardous residues.

- Recycling/Scrap: Pressure vessels should be rendered inoperable (e.g., cutting) before scrapping.

- Environmental Disposal: Follow local regulations for metal recycling and hazardous material handling.

Conclusion

Compliance and logistics for composite autoclaves span the entire lifecycle—from design and shipping to operation and decommissioning. Adherence to technical standards, environmental regulations, and safety protocols ensures operational integrity, legal compliance, and personnel safety. Establish a cross-functional team (engineering, EHS, quality, logistics) to manage these requirements effectively.

Conclusion for Sourcing Composite Autoclaves

Sourcing a composite autoclave is a critical decision that directly impacts the quality, efficiency, and scalability of composite manufacturing operations. After evaluating key factors such as technical specifications, capacity requirements, energy efficiency, automation capabilities, supplier reputation, and total cost of ownership, it becomes evident that a well-informed procurement strategy is essential.

The ideal autoclave should align with current production needs while accommodating future growth, ensuring compatibility with specific composite materials and curing processes. Partnering with experienced and reputable suppliers who offer comprehensive service support, training, and maintenance is equally important to ensure long-term reliability and performance.

In conclusion, a strategic approach to sourcing composite autoclaves—balancing upfront investment with operational efficiency and lifecycle support—will enhance manufacturing capabilities, improve product consistency, and provide a competitive advantage in high-performance industries such as aerospace, automotive, and defense. Careful due diligence during the selection process will yield significant returns in productivity, part quality, and overall operational success.