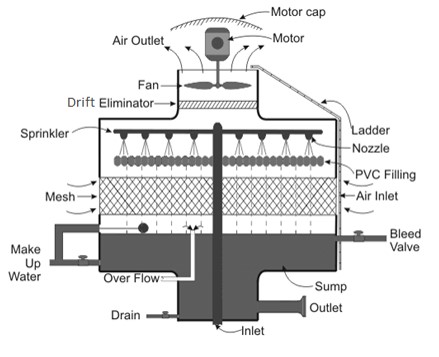

The global cooling tower market is experiencing steady expansion, driven by rising industrialization, increasing demand for efficient thermal management systems, and growing infrastructure development. According to Grand View Research, the market was valued at USD 2.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. Similarly, Mordor Intelligence forecasts a CAGR of approximately 4.8% over the same period, citing heightened adoption in power generation, HVAC, and chemical processing industries. As competition intensifies among cooling tower manufacturers, differentiating factors extend beyond basic design—reliability, efficiency, and long-term performance now hinge on the integration of eight key components. These elements, from fill media and fans to water distribution systems and drift eliminators, collectively determine a unit’s thermal efficiency, energy consumption, and maintenance requirements. Understanding these components is essential for stakeholders evaluating system performance and total cost of ownership in an increasingly data-driven industrial landscape.

Top 8 Components Of Cooling Tower Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Cooling Tower Manufacturers

Domain Est. 2003

Website: cooling-towers.net

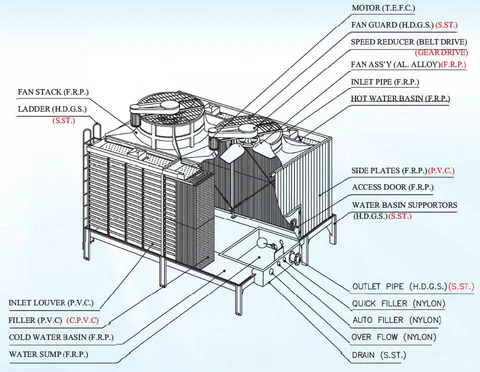

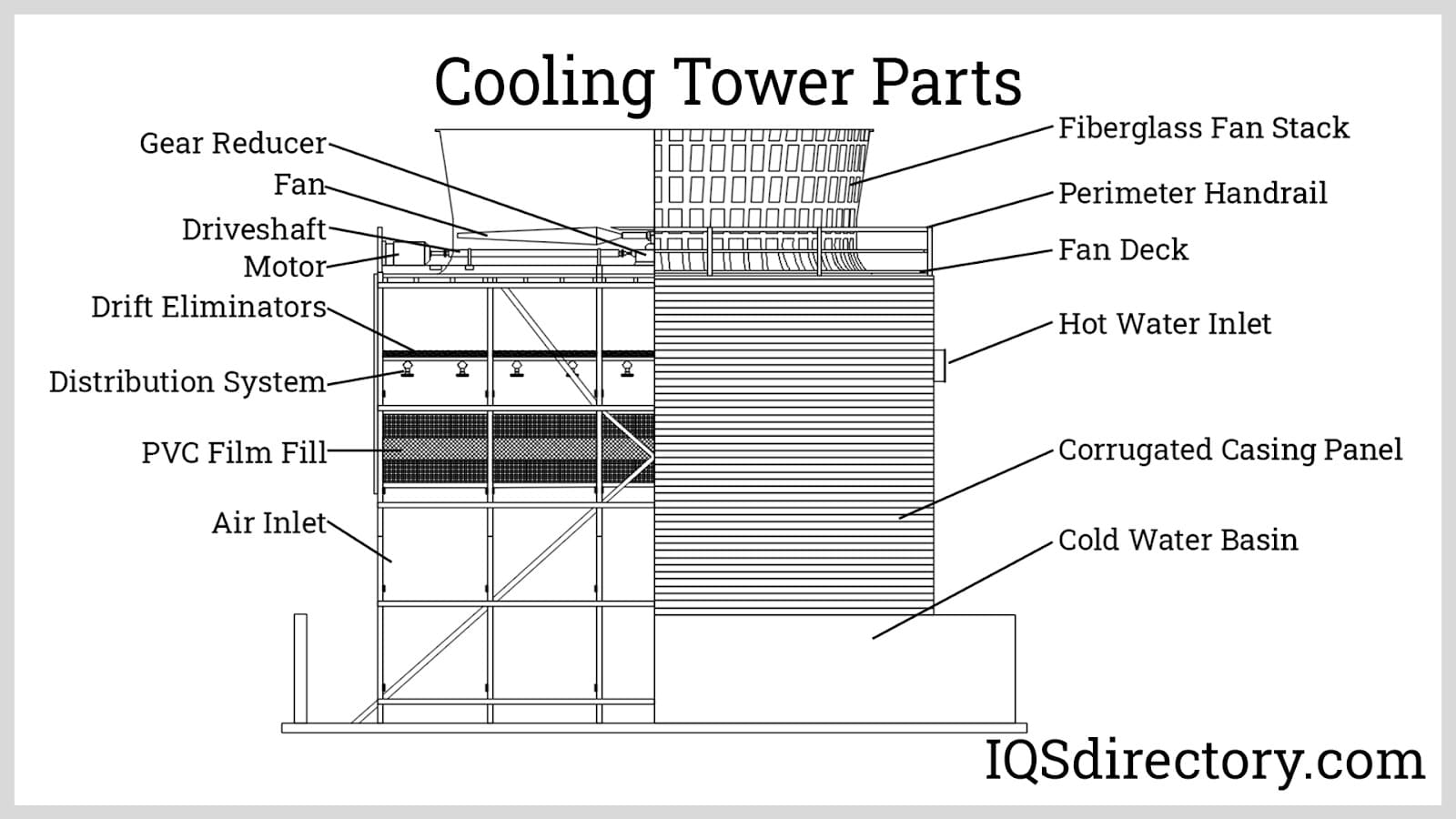

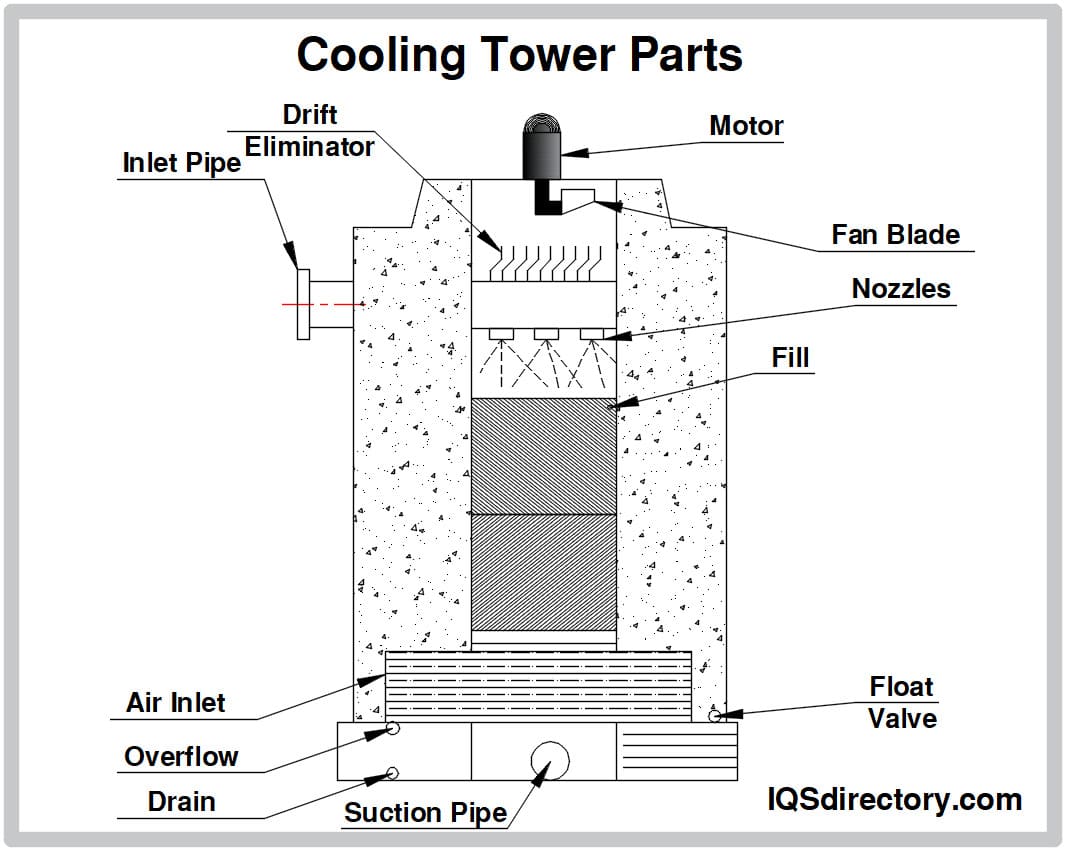

Key Highlights: Equipment Components Cooling towers generally comprise several key components, including a wet deck, air inlet and outlet ports, intake louvers, a cool water ……

#2 Cooling Towers and Cooling Tower Parts

Domain Est. 2005

Website: spxcooling.com

Key Highlights: SPX Cooling Tech, LLC is a leading global manufacturer of cooling towers, evaporative fluid coolers, evaporative condensers and air cooled heat exchangers….

#3 EvapTech Page

Domain Est. 2005

Website: evaptechinc.com

Key Highlights: EvapTech® is a premier cooling tower designer, manufacturer and contractor providing Research Powered Solutions for customer needs in the power generation ……

#4

Domain Est. 1999

Website: coolingtowersystems.com

Key Highlights: Cooling Tower Systems has manufactured cooling tower lines and related equipment for over 40 years, with five different models in production- one to meet every ……

#5 Cooling Tower Components & Solutions

Domain Est. 2000

Website: brentwoodindustries.com

Key Highlights: Explore expertly engineered cooling tower components and solutions built on a comprehensive polymer knowledge and superior customer service….

#6 Cooling Tower Depot

Domain Est. 2005

Website: coolingtowerdepot.com

Key Highlights: Welcome to the only online warehouse for cooling-tower parts. Cooling Tower Depot® makes it quick and easy to find the parts you need for your cooling tower….

#7 Parts

Domain Est. 2013

Website: mwcooling.com

Key Highlights: We manufacture and supply high-quality cooling tower components to clients all over the world, including more than 85 companies in the U.S. and 110 ……

#8 Which Components are Installed By Cooling Tower Manufac…

Domain Est. 2018

Website: coolingtowertech.mystrikingly.com

Key Highlights: The list of components includes cold water basin, fills, cooling tower structure, drift eliminators, cooling tower fans, cooling tower louvers, water ……

Expert Sourcing Insights for Components Of Cooling Tower

H2: 2026 Market Trends for Components of Cooling Towers

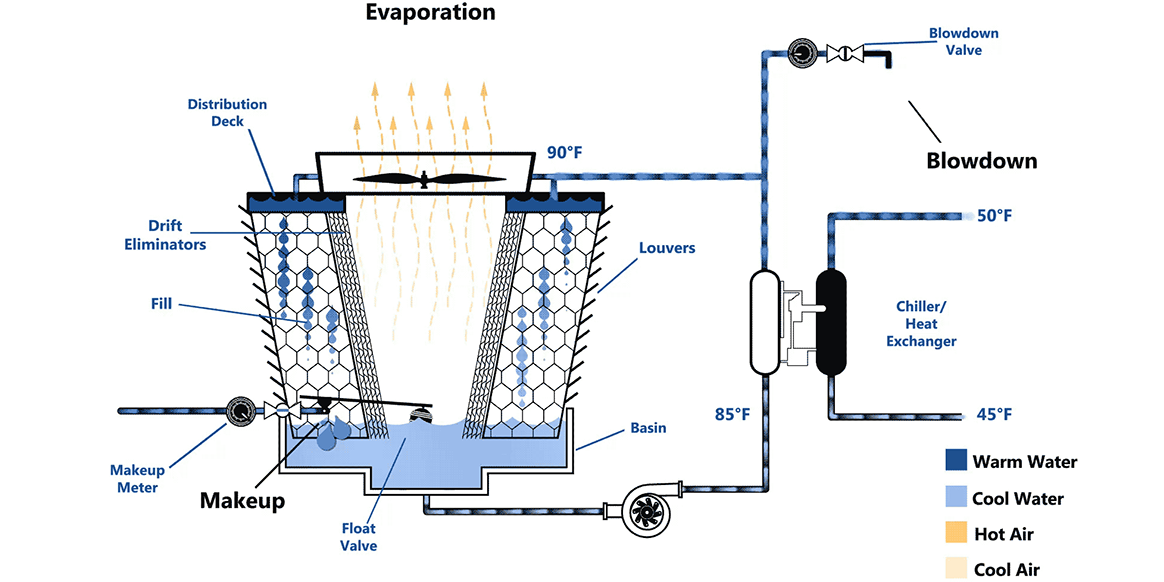

The global cooling tower components market is projected to experience significant transformation by 2026, driven by technological advancements, increasing industrialization, and a heightened focus on energy efficiency and sustainability. Key components—including fill media, drift eliminators, fans, motors, nozzles, basins, and structural materials—are witnessing evolving demand patterns influenced by regional infrastructure development, environmental regulations, and digital integration. Below are the major trends expected to shape the cooling tower components market in 2026:

-

Rise in Demand for High-Efficiency Fill Media

By 2026, film and splash fill media made from chemically resistant, anti-microbial materials such as PVC and polypropylene will dominate the market. Manufacturers are focusing on developing non-clogging, high-thermal-efficiency fills to meet stringent water conservation and performance requirements in power plants, HVAC systems, and industrial processing. -

Growth in Energy-Efficient Fan and Motor Systems

Variable frequency drives (VFDs) and premium-efficiency motors are becoming standard in cooling tower installations. The trend toward energy conservation is pushing demand for axial fans with aerodynamic blade designs and corrosion-resistant alloys. In 2026, smart fan systems integrated with IoT-based monitoring will enable predictive maintenance and dynamic speed control, reducing operational costs. -

Advancements in Drift Eliminator Technology

With growing scrutiny on water loss and environmental pollution, high-performance drift eliminators that reduce droplet emissions to less than 0.001% of circulation flow are gaining traction. Modular, low-pressure-drop designs using advanced polymers will be widely adopted in sensitive environments such as data centers and pharmaceutical facilities. -

Smart Nozzles and Automated Water Distribution

Uniform water distribution is critical for maximizing heat transfer efficiency. In 2026, self-cleaning, clog-resistant nozzles with adjustable flow patterns will be in high demand. Integration with control systems allows real-time adjustments based on thermal load, contributing to water and energy savings. -

Shift Toward Modular and Pre-Fabricated Components

To reduce installation time and costs, especially in large-scale industrial and renewable energy projects, modular cooling tower components made from fiber-reinforced polymers (FRP) and stainless steel are expected to grow. These components offer durability, ease of transport, and resistance to harsh environments. -

Increased Adoption of Sustainable and Corrosion-Resistant Materials

Environmental regulations are pushing manufacturers to replace galvanized steel with corrosion-resistant composites and stainless steel. Recyclable materials and bio-based polymers are being explored to reduce the carbon footprint of cooling tower components, aligning with global ESG goals. -

Digitalization and Predictive Maintenance Solutions

By 2026, IoT-enabled sensors embedded in key components (e.g., motors, basins, fans) will allow real-time monitoring of temperature, vibration, water quality, and structural integrity. Cloud-based analytics platforms will enable predictive maintenance, minimizing downtime and extending component lifecycle. -

Regional Market Dynamics

Asia-Pacific will remain the fastest-growing market due to expanding industrial infrastructure in China, India, and Southeast Asia. North America and Europe will focus on retrofitting aging cooling systems with energy-efficient components to comply with green building standards such as LEED and BREEAM. -

Impact of Renewable Energy and Data Centers

The rapid expansion of solar thermal plants, geothermal systems, and hyperscale data centers is creating new demand for compact, high-performance cooling tower components. These applications require specialized materials and designs suited for continuous operation and minimal water use. -

Regulatory and Water Scarcity Pressures

Governments worldwide are implementing stricter regulations on water usage and thermal discharge. This is accelerating the adoption of closed-circuit cooling towers and hybrid systems, which rely on advanced components for optimal performance with reduced water consumption.

In conclusion, the 2026 market for cooling tower components will be characterized by innovation in materials, energy efficiency, and digital integration. Stakeholders across manufacturing, energy, and infrastructure sectors must adapt to these trends to remain competitive and compliant in an increasingly sustainable and technology-driven landscape.

Common Pitfalls in Sourcing Components of Cooling Towers (Quality, IP)

Sourcing components for cooling towers involves critical decisions that impact system efficiency, longevity, and compliance. Overlooking quality and intellectual property (IP) considerations can lead to significant operational and legal risks. Below are common pitfalls to avoid:

Poor Quality Control and Substandard Materials

One of the most frequent issues is sourcing components made from inferior materials or manufactured without stringent quality assurance. Cooling tower parts—such as fill media, drift eliminators, fan systems, and basins—are exposed to harsh environmental conditions, including moisture, UV radiation, and chemical treatments. Using low-grade plastics, non-corrosion-resistant metals, or poorly fabricated parts can result in premature failure, increased maintenance costs, and reduced cooling efficiency. Always verify supplier certifications (e.g., ISO 9001), request material test reports, and conduct third-party inspections when possible.

Inadequate Compliance with International Standards

Many suppliers, particularly in cost-driven markets, may not adhere to international standards such as ISO, ASHRAE, or CTI (Cooling Technology Institute) guidelines. Components that do not meet these benchmarks may fail under operational stress or not deliver the promised thermal performance. Ensure that all sourced components carry proper certifications and are tested according to recognized industry protocols.

Intellectual Property (IP) Infringement

Sourcing components from unauthorized or counterfeit manufacturers poses serious IP risks. Some suppliers replicate patented designs—such as high-efficiency fill patterns or proprietary fan blade geometries—without licensing. Purchasing such components may expose your organization to legal liability, product recalls, and reputational damage. Always verify that suppliers are authorized distributors or original equipment manufacturers (OEMs) and request documentation proving IP compliance.

Lack of Traceability and Documentation

Poor documentation, missing batch numbers, or absence of traceability can hinder maintenance, warranty claims, and compliance audits. Without proper records, identifying the source of a defective component becomes difficult, especially during system failures. Insist on full traceability, including material certifications, manufacturing dates, and compliance statements.

Overlooking Long-Term Support and Spare Parts Availability

Some suppliers offer attractive upfront pricing but lack the infrastructure for long-term technical support or spare parts supply. This can lead to extended downtime when replacements are needed. Evaluate the supplier’s service network, spare parts inventory, and responsiveness before committing.

Failure to Conduct Site-Specific Compatibility Checks

Cooling tower components must be compatible with local environmental conditions (e.g., salty air in coastal areas, high dust levels, or extreme temperatures). Using generic or non-adapted parts can drastically reduce performance and lifespan. Engage engineering experts to assess component suitability for the specific operating environment.

Avoiding these pitfalls requires due diligence, supplier vetting, and a focus on total cost of ownership rather than initial price. Prioritizing quality and IP integrity ensures reliable, compliant, and efficient cooling tower operations.

Logistics & Compliance Guide for Components of Cooling Towers

Overview of Cooling Tower Components

Cooling towers consist of various critical components, each with specific handling, transportation, and regulatory considerations. These include fill media, drift eliminators, fans and motors, nozzles, basins, structural frames, pumps, and control systems. Understanding the logistics and compliance requirements for these components ensures timely delivery, regulatory adherence, and safe installation.

Packaging and Handling Requirements

Each component must be packaged to prevent damage during transit. Fill media, often made of PVC or film, should be shrink-wrapped and palletized with protective corner boards. Drift eliminators and nozzles require individual boxing to avoid deformation. Structural steel frames and basins may need custom crating. Motors and electrical components must be sealed against moisture. Handling instructions should emphasize avoiding stacking, exposure to sunlight, and physical impact.

Transportation and Shipping Considerations

Transportation mode depends on component size and weight. Large structural sections and basins typically require flatbed trucks or containerized ocean freight for international shipments. Air freight may be used for urgent, smaller parts such as control panels or sensors. Route planning must accommodate oversized loads, including bridge clearances and weight restrictions. Proper securing using straps, dunnage, and load locks is critical to prevent shifting.

Import/Export Compliance and Documentation

International shipments require compliance with export controls, customs regulations, and trade agreements. Essential documentation includes commercial invoices, packing lists, bill of lading, and certificates of origin. Components containing electrical systems may be subject to ITAR or EAR regulations if they include dual-use technologies. Exporters must classify items using Harmonized System (HS) codes—e.g., 8418.99 for cooling towers and related parts.

Regulatory Standards and Certifications

Cooling tower components must meet industry-specific standards to ensure safety and performance. Fill media and drift eliminators should comply with ATC-105 or CTI STD-201 for flame spread and material integrity. Electrical components must adhere to IEC, UL, or CE standards depending on the destination market. Structural components may require certification to ISO 9001 (quality management) or ISO 14001 (environmental management).

Environmental and Safety Regulations

Transport and storage of cooling tower components must comply with environmental regulations, particularly for materials like PVC or treated wood. Volatile organic compounds (VOCs) from adhesives or coatings may be regulated under REACH (EU) or TSCA (USA). Workers involved in handling must follow OSHA or local occupational safety guidelines, including use of PPE when dealing with sharp or heavy parts.

Import Duties and Tariff Classifications

Accurate tariff classification ensures correct duty assessment. For example, plastic fill media may fall under HS code 3926.30, while metal structural components could be classified under 7308.90. Importers should consult local customs authorities or use binding tariff information (BTI) to avoid classification disputes. Free trade agreements (e.g., USMCA, RCEP) may reduce or eliminate duties for eligible shipments.

On-Site Receiving and Storage Protocols

Upon delivery, components should be inspected for damage and verified against packing lists. Storage areas must be dry, level, and protected from weather. Fill media and plastic parts should be stored away from direct sunlight to prevent UV degradation. Heavy components like basins should be supported uniformly to avoid warping. A first-in, first-out (FIFO) inventory system helps manage material shelf life, especially for lubricants or sealants.

End-of-Life and Recycling Compliance

End-of-life components, particularly plastics and metals, must be disposed of or recycled in accordance with local environmental laws. The EU’s WEEE directive applies to electrical control systems, requiring proper take-back and recycling. In the U.S., EPA regulations govern disposal of materials containing hazardous substances. Manufacturers should provide product take-back programs or recycling guidance to support compliance.

Recordkeeping and Audit Preparedness

Maintain detailed records of all logistics and compliance activities, including shipping documents, customs filings, certifications, and inspection reports. These records support audits by customs, environmental agencies, or quality auditors. Digital tracking systems can enhance transparency and traceability across the supply chain, reducing compliance risks.

Conclusion for Sourcing Components of a Cooling Tower

In conclusion, the successful sourcing of cooling tower components requires a comprehensive strategy that balances quality, cost, reliability, and long-term performance. Selecting reputable suppliers with proven expertise in manufacturing and supplying cooling tower parts—such as fans, fill media, drift eliminators, pumps, motors, and structural materials—is critical to ensuring system efficiency and durability. Factors such as material compatibility, environmental conditions, energy efficiency, and compliance with industry standards must be carefully evaluated during the procurement process.

Moreover, establishing strong supplier relationships, considering lead times, and incorporating lifecycle cost analysis rather than focusing solely on upfront pricing contribute to sustainable operations and reduced maintenance expenses. As cooling towers play a vital role in industrial and HVAC systems, investing in high-quality, well-sourced components ultimately enhances thermal performance, operational safety, and overall system longevity. Therefore, a strategic and informed sourcing approach is essential for optimizing cooling tower functionality and supporting reliable industrial processes.