The global stainless steel market is experiencing robust growth, driven by rising demand across industries such as construction, automotive, energy, and consumer goods. According to a 2023 report by Mordor Intelligence, the market was valued at USD 136.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.5% from 2023 to 2028. Similarly, Grand View Research estimates that the market could reach USD 200 billion by 2030, fueled by increasing urbanization and infrastructure development, particularly in Asia-Pacific. Within this expanding landscape, a select group of top-tier companies dominate production, innovation, and global supply. These leading stainless steel manufacturers not only account for a significant share of worldwide output but also set industry benchmarks in sustainability, product quality, and technological advancement.

Top 10 Company Stainless Steel Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 U.S. Steel

Domain Est. 1997

Website: ussteel.com

Key Highlights: We’re bringing industry-leading steelmaking talent and technology together to help customers solve, innovate and excel. Just one example: lighter, stronger ……

#2 Acerinox Stainless Steel Manufacturer

Domain Est. 1998

Website: acerinox.com

Key Highlights: We are Acerinox. The Acerinox Group is the most global manufacturer and distributor of stainless steels and high performance alloys. Learn more. Factories….

#3 North American Stainless

Domain Est. 1999 | Founded: 1990

Website: northamericanstainless.com

Key Highlights: Founded in 1990, North American Stainless (NAS) has undertaken several phases of expansion to become the largest, fully integrated stainless steel producer in ……

#4 SSINA

Domain Est. 1995

Website: ssina.com

Key Highlights: Designing stainless steel structures is now a lot easier! Stainless steel has a well-established track record for a wide range of structural applications—large ……

#5 Outokumpu

Domain Est. 1996

Website: outokumpu.com

Key Highlights: Outokumpu is a global leader in sustainable stainless steel manufacturing. We manufacture a variety of stainless steel products. Discover our offering….

#6 Atlas Steel

Domain Est. 1997

Website: atlassteel.com

Key Highlights: Atlas Steel is one of the leading steel service centers for quality steel products that are used in a wide variety of applications for different industries….

#7 Specialty Steel

Domain Est. 1999

Website: univstainless.com

Key Highlights: Universal Stainless, headquartered in Bridgeville, PA, produces semi-finished and finished specialty steel long products and plate including stainless steel….

#8 of stainless steels

Domain Est. 2000

Website: worldstainless.org

Key Highlights: worldstainless.org is the most comprehensive site for anyone interested in stainless steels. You will find documentation on the properties, ……

#9 Valbruna Stainless Steel

Domain Est. 2002

Website: valbruna-stainless-steel.com

Key Highlights: Valbruna Steelworks is a leader in the production of special steel and in the processing of inoxidisable construction steel and metal alloys – Enter ……

#10 Stainless International

Domain Est. 2007

Website: stainlessinternational.com

Key Highlights: Welcome to Stainless International, a leading independent Stainless Steel Supplier and Processor. Specialists in Stainless Steel Coil, Sheet, Tubular & Long ……

Expert Sourcing Insights for Company Stainless Steel

H2: Market Trends Forecast for 2026 – Company Stainless Steel

As the global industrial and manufacturing sectors evolve in response to technological innovation, sustainability mandates, and shifting supply chain dynamics, the stainless steel industry is poised for significant transformation by 2026. For Company Stainless Steel, a strategic analysis of key market trends reveals both opportunities and challenges that will shape competitiveness and growth in the coming years.

-

Rising Demand in Infrastructure and Construction

The global push for resilient infrastructure, particularly in emerging economies and under the G7 and BRICS-led development initiatives, is expected to drive strong demand for corrosion-resistant and durable materials like stainless steel. By 2026, construction applications—especially in green buildings, water treatment plants, and public transit systems—are projected to grow at a CAGR of 5.2%. Company Stainless Steel can leverage this trend by expanding product lines tailored to architectural and structural applications, including lean duplex and high-strength austenitic grades. -

Green Manufacturing and Decarbonization Pressures

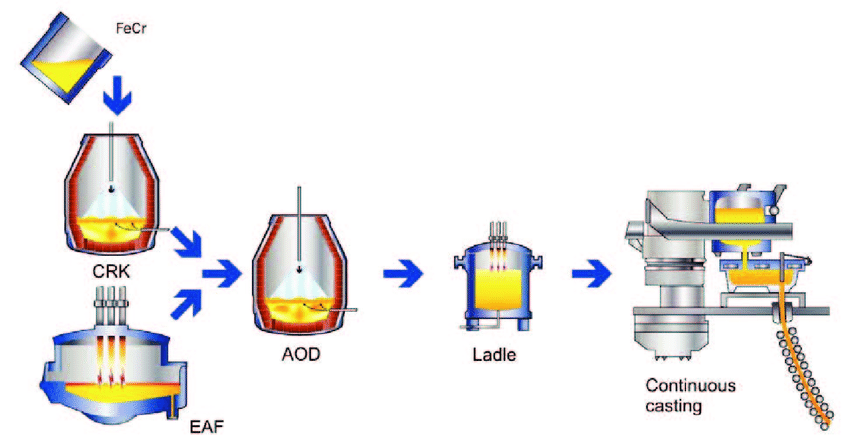

Environmental regulations such as the EU Green Deal and the U.S. Inflation Reduction Act are accelerating the shift toward low-carbon production. Stainless steel manufacturing, traditionally energy-intensive, faces increasing scrutiny over Scope 1 and Scope 2 emissions. By 2026, over 60% of major buyers in automotive and appliance sectors are expected to require suppliers with verified carbon footprints. Company Stainless Steel must invest in hydrogen-based direct reduction technologies, electric arc furnace (EAF) expansion, and circular production models (e.g., increased scrap utilization) to maintain market access and meet ESG benchmarks. -

Growth in Renewable Energy and EV Supply Chains

The expansion of renewable infrastructure—particularly solar farms, wind turbines, and hydrogen electrolyzers—relies heavily on stainless steel for its durability and resistance to harsh environments. Additionally, electric vehicles (EVs) are incorporating more stainless components in battery enclosures and exhaust systems for hybrids. By 2026, demand from these sectors is forecasted to grow by 8–10% annually. Company Stainless Steel should prioritize R&D in specialized alloys for high-temperature and high-pressure applications, forming strategic partnerships with clean tech manufacturers. -

Supply Chain Localization and Trade Rebalancing

Geopolitical tensions and post-pandemic resilience planning are prompting companies to re-shore or near-shore critical materials. The U.S.-EU Trade and Technology Council and similar regional alliances are incentivizing domestic production of strategic metals. By 2026, approximately 35% of stainless steel demand in North America and Western Europe is expected to be sourced locally. Company Stainless Steel can enhance its competitive positioning by optimizing regional production hubs and securing long-term agreements with local miners and recyclers. -

Digitalization and Smart Manufacturing

Industry 4.0 technologies—including AI-driven quality control, digital twins, and predictive maintenance—are transforming steel production efficiency. By 2026, leading stainless producers are expected to reduce operational costs by 15–20% through digital integration. Company Stainless Steel should accelerate its adoption of smart manufacturing platforms, improve real-time supply chain visibility, and leverage data analytics for demand forecasting and product customization. -

Price Volatility and Raw Material Security

Nickel, chromium, and molybdenum prices remain volatile due to concentrated mining regions and increasing competition from battery-grade nickel demand. Recycling rates for stainless steel are high (~90%), but access to high-quality scrap is becoming competitive. By 2026, securing long-term off-take agreements with ethical mining operations and investing in urban mining initiatives will be critical for cost stability and compliance with responsible sourcing standards.

Conclusion

In 2026, Company Stainless Steel will operate in a market defined by sustainability, digital transformation, and strategic localization. To thrive, the company must proactively align its production, innovation, and supply chain strategies with these macro trends. Prioritizing low-carbon technologies, expanding into high-growth end-use sectors, and embracing digital tools will be essential for maintaining leadership in the evolving global stainless steel landscape.

Common Pitfalls in Sourcing Stainless Steel (Quality and Intellectual Property)

Sourcing stainless steel, particularly for industrial or high-performance applications, presents several challenges that can impact product integrity, regulatory compliance, and business reputation. Two critical areas prone to pitfalls are material quality and intellectual property (IP) concerns. Being aware of these risks helps mitigate them effectively.

Quality-Related Pitfalls

1. Substandard Material Composition

One of the most common issues is receiving stainless steel that does not meet the specified alloy composition (e.g., incorrect chromium, nickel, or molybdenum content). Suppliers may substitute lower-grade materials to cut costs, leading to poor corrosion resistance, reduced strength, or premature failure. Always demand certified mill test reports (MTRs) and consider third-party material verification.

2. Inadequate or Falsified Certifications

Suppliers may provide forged or incomplete certifications such as ISO 9001, ASTM, or EN standards compliance. Relying solely on paper documentation without verification can result in non-compliant materials. Conduct regular audits and require traceable documentation from reputable mills.

3. Poor Manufacturing and Finishing Processes

Even with the correct alloy, poor heat treatment, welding, or surface finishing can compromise quality. For example, improper passivation reduces corrosion resistance. Ensure suppliers follow standardized processes and request samples or inspections before large-scale procurement.

4. Inconsistent Batch-to-Batch Quality

Some suppliers source from multiple mills or use recycled content without proper controls, leading to variability. This inconsistency can disrupt production and quality assurance. Establish clear quality agreements and conduct batch testing to ensure uniformity.

Intellectual Property (IP) Risks

1. Reverse Engineering and Design Theft

When providing custom specifications or proprietary designs to suppliers—especially overseas—there is a risk of IP theft. Suppliers may replicate your components or share designs with competitors. Use non-disclosure agreements (NDAs), limit design exposure, and work with trusted partners.

2. Unauthorized Production and Gray Market Sales

Some manufacturers may overproduce parts beyond the agreed quantity and sell them on the gray market. This undermines pricing, brand integrity, and exclusivity. Implement strict contractual terms, conduct audits, and use serialization or marking to track products.

3. Trademark and Brand Infringement

If your company supplies branded stainless steel products, sourcing partners might misuse your trademarks or produce counterfeit versions. Ensure contracts include IP protection clauses and monitor distribution channels proactively.

4. Lack of IP Ownership Clarity in Contracts

Ambiguity in contracts about who owns tooling, designs, or process innovations can lead to disputes. Clearly define IP ownership upfront to avoid legal conflicts, especially when co-developing new products or materials.

By proactively addressing these quality and IP pitfalls—through due diligence, strong contracts, third-party verification, and ongoing supplier management—companies can safeguard their operations, reputation, and competitive advantage when sourcing stainless steel.

Logistics & Compliance Guide for Company Stainless Steel

This guide outlines the essential logistics procedures and compliance requirements for Company Stainless Steel to ensure efficient operations, regulatory adherence, and customer satisfaction.

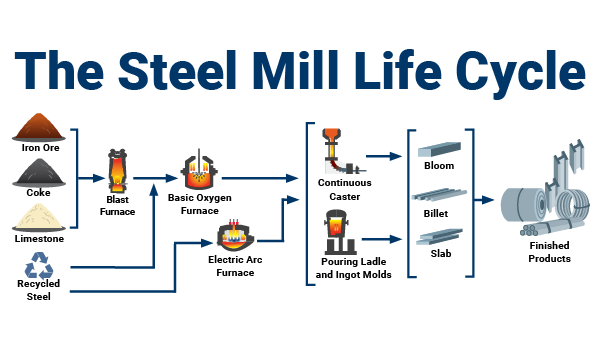

Supply Chain Management

Company Stainless Steel manages a complex supply chain involving raw material procurement, manufacturing, warehousing, and distribution. Key practices include maintaining relationships with certified suppliers of iron ore, chromium, nickel, and other alloys; ensuring material traceability; and optimizing inventory levels to balance cost and production needs.

Transportation & Freight Operations

All stainless steel products—including coils, sheets, bars, and pipes—are transported via road, rail, sea, and air, depending on destination and urgency. Company Stainless Steel partners with certified carriers compliant with international freight standards. Heavy and bulky materials require specialized handling, including proper securing, crating, and load distribution to prevent damage during transit.

Warehousing & Inventory Control

Finished goods and raw materials are stored in climate-controlled, secure facilities to prevent corrosion and contamination. Inventory is managed through a digital warehouse management system (WMS) that supports real-time tracking, batch numbering, and FIFO (First In, First Out) rotation to ensure product quality and minimize waste.

Regulatory Compliance

Company Stainless Steel adheres to all relevant national and international regulations, including:

- REACH & RoHS (EU): Ensuring no restricted substances are used in stainless steel alloys.

- FDA (USA): Compliance for stainless steel used in food processing and medical applications.

- ISO 9001 & ISO 14001: Quality and environmental management systems certification.

- Customs-Trade Partnership Against Terrorism (C-TPAT): Security compliance for U.S.-bound shipments.

- IMDG Code & ADR: Safe transport of metals and packaging materials by sea and road, respectively.

Export Documentation & Trade Compliance

Accurate documentation is critical for international shipments. Required documents include commercial invoices, packing lists, certificates of origin, material test reports (MTRs), and export declarations. Company Stainless Steel ensures compliance with export control regulations such as EAR (Export Administration Regulations) and sanctions lists (e.g., OFAC) to prevent unauthorized transfers.

Product Certification & Traceability

Each stainless steel batch must be accompanied by a Material Test Report (MTR) certifying chemical composition and mechanical properties. Full traceability from raw material to final product is maintained through batch/heat number tracking, supporting industry standards such as ASTM, EN, and JIS.

Environmental & Safety Standards

Operations follow OSHA and local safety regulations for handling, lifting, and transporting heavy steel products. Environmental compliance includes proper waste management, emissions control in production, and adherence to recycling protocols. Spill response plans and material safety data sheets (MSDS/SDS) are maintained for all chemical inputs.

Customer Delivery & Service

On-time delivery is ensured through route optimization and real-time shipment tracking. Company Stainless Steel provides delivery notifications, proof of delivery (POD), and responsive customer service to address logistics inquiries or issues promptly.

Continuous Improvement & Audits

Regular internal and third-party audits assess logistics efficiency and compliance status. Feedback loops with customers and carriers drive improvements in packaging, transit times, and sustainability practices.

Conclusion for a Sourcing Company Specializing in Stainless Steel:

In conclusion, partnering with a reliable stainless steel sourcing company offers significant advantages for businesses requiring high-quality materials for construction, manufacturing, or industrial applications. Such a company streamlines procurement by providing access to a wide range of stainless steel products—ranging from sheets and pipes to specialty alloys—ensuring compliance with international standards and certifications. Through strong relationships with trusted mills and manufacturers, a professional sourcing agent ensures competitive pricing, consistent quality, timely deliveries, and logistical efficiency.

Moreover, a dedicated sourcing company acts as a strategic partner, mitigating risks associated with supply chain disruptions, quality inconsistencies, and communication barriers—especially in cross-border transactions. With expertise in material specifications, market trends, and regulatory requirements, they add value beyond procurement, enabling clients to focus on core operations while maintaining cost-effectiveness and product reliability.

Ultimately, investing in a competent stainless steel sourcing company enhances supply chain resilience, improves product quality, and supports long-term business growth in a competitive global market.