The global commercial vacuum cleaners market is experiencing steady growth, driven by increasing demand for efficient cleaning solutions across hospitality, healthcare, education, and retail sectors. According to Grand View Research, the global industrial and commercial vacuum cleaners market was valued at USD 3.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by rising hygiene standards, stricter regulatory requirements, and the expansion of commercial infrastructure worldwide. Additionally, advancements in vacuum technology—such as HEPA filtration, cordless operation, and IoT-enabled maintenance tracking—are reshaping product offerings and enhancing operational efficiency. As demand intensifies, a select group of manufacturers have emerged as industry leaders, combining innovation, reliability, and global reach to dominate the commercial cleaning equipment landscape. Here’s a data-driven look at the top 10 commercial vacuum cleaner manufacturers shaping the future of facility maintenance.

Top 10 Commercial Vacuums Cleaners Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Commercial & Industrial Vacuums

Domain Est. 1995

Website: tennantco.com

Key Highlights: Choose from our comprehensive selection of professional grade upright, backpack, wet-dry and canister industrial vacuum cleaners….

#2 Commercial Cleaning Equipment

Domain Est. 1996

Website: kaercher.com

Key Highlights: The World’s Largest Manufacturer of Cleaning Machines: Pressure Washers, Vacuums, Sweepers, Scrubbers, Steam Cleaners and Carpet Cleaners. Find a Local Dealer….

#3 – Ruwac USA: Leading Industrial Vacuum Systems

Domain Est. 1997

Website: ruwac.com

Key Highlights: This is the best brand in the red line. I’ve been working with vacuums for 30 years and I always like it because I can service my tools myself….

#4 Commercial and Industrial Floor Cleaning Equipment

Domain Est. 2005

Website: advance-us.com

Key Highlights: From commercial vacuums and carpet extractors to industrial sweepers and ride-on scrubbers, Advance is easy to operate and maintain….

#5 Industrial Wet and Dry Vacuum Cleaner Supplier

Domain Est. 2017

Website: cleanvacusa.com

Key Highlights: Shop industrial wet and dry vacuums built for heavy-duty cleaning. Perfect for warehouses & job sites. CleanVac USA delivers nationwide….

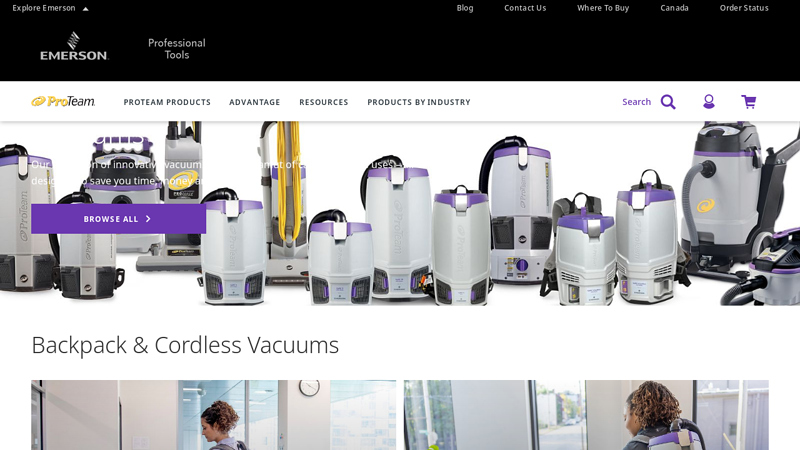

#6 Vacuums

Domain Est. 1995

Website: proteam.emerson.com

Key Highlights: $20 deliveryOur collection of innovative vacuums runs the gamut of categories and uses – all designed to save you time, money and effort….

#7 Nilfisk

Domain Est. 1997

Website: nilfisk.com

Key Highlights: Discover Nilfisk’s innovative cleaning equipment for homes and professionals. Trusted worldwide for performance, reliability, and sustainable solutions….

#8 Lindhaus USA

Domain Est. 1998

Website: lindhaususa.com

Key Highlights: Professional Cleaning Machines. Specialized in Scrubber driers, upright vacuums, vacuum cleaners and Air Purifiers for professional and domestic use….

#9 SEBO vacuum cleaners

Domain Est. 2002

Website: sebo.us

Key Highlights: SEBO vacuum cleaners, made in Germany, world’s best vacuum cleaners. · WORLD’S BEST VACUUM FOR A CLEAN AND HEALTHY HOME….

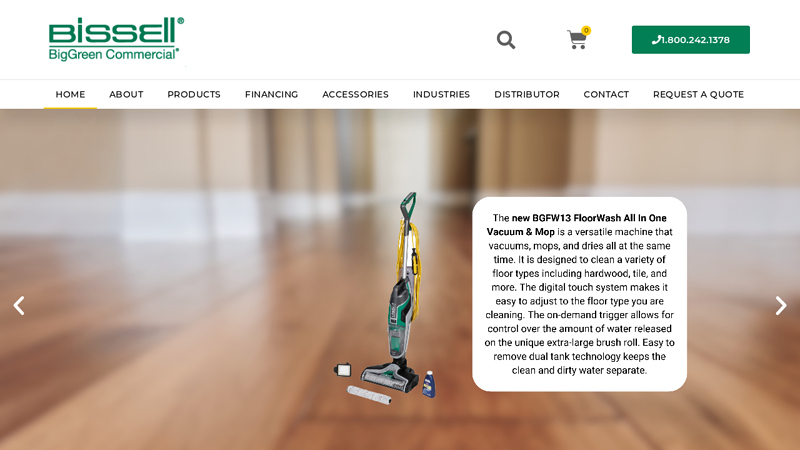

#10 Bissell Big Green Commercial

Domain Est. 2011

Website: bissellcommercial.com

Key Highlights: Bissell Big Green Commercial offers branded Bissell carpet cleaners, upright vacuum cleaners, and more to commercial clients throughout the U.S…..

Expert Sourcing Insights for Commercial Vacuums Cleaners

H2: 2026 Market Trends for Commercial Vacuum Cleaners

The commercial vacuum cleaner market is poised for significant transformation by 2026, driven by technological innovation, evolving hygiene standards, and shifting workplace dynamics. Key trends shaping the industry include the rise of smart and connected cleaning devices, increased demand for sustainability, growth in facility automation, and expansion in high-traffic service sectors.

-

Adoption of Smart and IoT-Enabled Vacuums

By 2026, a growing number of commercial facilities—including offices, hospitals, and airports—are expected to adopt vacuum cleaners equipped with Internet of Things (IoT) technology. These smart vacuums offer real-time performance monitoring, predictive maintenance alerts, and integration with facility management systems. Brands are increasingly embedding sensors and cloud connectivity to enhance operational efficiency and reduce downtime. -

Emphasis on Sustainability and Energy Efficiency

Environmental regulations and corporate sustainability goals are pushing manufacturers to develop eco-friendly commercial vacuums. By 2026, demand is projected to rise for models with energy-efficient motors, recyclable materials, and low-emission filtration systems (e.g., HEPA filters). Battery-powered cordless vacuums with long-life lithium-ion batteries will gain traction, reducing reliance on disposable parts and minimizing carbon footprint. -

Growth in Automation and Robotics

Autonomous vacuum robots are transitioning from niche to mainstream in large-scale commercial environments. By 2026, advancements in AI navigation, obstacle detection, and multi-floor mapping will make robotic vacuums more viable for malls, hotels, and warehouses. These systems lower labor costs and enable 24/7 cleaning operations, particularly in regions facing labor shortages. -

Heightened Hygiene Standards Post-Pandemic

Although the immediate crisis has subsided, the heightened awareness of indoor air quality and surface sanitation persists. Commercial vacuums with advanced filtration (e.g., medical-grade HEPA) and antimicrobial components will remain in demand, especially in healthcare, education, and hospitality sectors. -

Expansion in Emerging Markets

Growth in commercial infrastructure across Asia-Pacific, Latin America, and the Middle East will drive market expansion. Rising investments in retail, healthcare, and transportation hubs in countries like India, Brazil, and Saudi Arabia will increase demand for durable, high-performance commercial vacuums. Localized manufacturing and distribution partnerships are expected to emerge. -

Shift Toward Rental and Servicing Models

By 2026, an increasing number of businesses will opt for vacuum-as-a-service (VaaS) or rental models, particularly in the SME segment. These models reduce upfront costs and include maintenance, upgrades, and recycling, aligning with circular economy principles and offering predictable operational expenses.

In conclusion, the 2026 commercial vacuum cleaner market will be defined by intelligence, sustainability, and service-centric offerings. Companies that innovate in automation, connectivity, and eco-design will lead the competitive landscape, meeting the evolving needs of modern commercial environments.

Common Pitfalls When Sourcing Commercial Vacuum Cleaners: Quality and Intellectual Property Concerns

Logistics & Compliance Guide for Commercial Vacuum Cleaners

Product Classification and HS Code

Commercial vacuum cleaners are typically classified under the Harmonized System (HS) Code 8508, which covers “Vacuum cleaners, with or without motors.” Accurate classification is critical for import/export operations, as it determines applicable tariffs, taxes, and regulatory requirements across international borders.

Import/Export Regulations

When shipping commercial vacuum cleaners internationally, compliance with both origin and destination country regulations is essential. Key considerations include:

- Documentation: Commercial invoice, packing list, bill of lading/airway bill, and certificate of origin.

- Customs Declarations: Ensure correct valuation, country of origin, and product specifications.

- Restricted Destinations: Some countries may restrict or ban certain electrical appliances based on safety or environmental standards.

Electrical and Safety Compliance

Commercial vacuum cleaners must meet electrical safety standards in the target market. Common certifications include:

– UL (Underwriters Laboratories) – Required in the U.S. for electrical safety.

– CE Marking – Mandatory for sale in the European Economic Area (EEA), indicating compliance with health, safety, and environmental protection standards.

– UKCA Marking – Required for the UK market post-Brexit.

– RCM (Regulatory Compliance Mark) – Required in Australia and New Zealand.

Manufacturers and distributors must ensure that products are tested and certified by accredited laboratories.

Energy Efficiency and Environmental Regulations

Many regions enforce energy efficiency standards for electrical appliances:

– Energy Star (U.S. and Canada): Voluntary program indicating energy-efficient performance.

– EU Ecodesign Directive: Sets energy efficiency and environmental performance requirements for vacuum cleaners sold in the EU.

– Proposition 65 (California): Requires warning labels if the product contains chemicals known to cause cancer or reproductive harm.

Packaging and Labeling Requirements

Proper packaging and labeling are crucial for logistics and regulatory compliance:

– Multilingual Labeling: Required in regions like the EU and Canada.

– Product Markings: Include voltage, power rating, model number, manufacturer details, and safety certifications.

– Sustainable Packaging: Increasingly mandated or encouraged to reduce environmental impact.

Transportation and Shipping

Commercial vacuum cleaners are generally classified as non-hazardous goods, but proper handling is still required:

– Freight Class (NMFC): In North America, vacuum cleaners typically fall under NMFC 150, based on density and handling.

– Containerization: Suitable for both FCL (Full Container Load) and LCL (Less than Container Load) shipping.

– Damage Prevention: Use durable packaging with adequate cushioning to prevent damage during transit.

Warranty and After-Sales Compliance

- Warranty Documentation: Must comply with local consumer protection laws (e.g., 2-year legal warranty in the EU).

- Repair and Recycling Services: Required in some jurisdictions under extended producer responsibility (EPR) laws.

- Product Registration: May be required for warranty validation or recall tracking.

Product Recalls and Incident Reporting

Companies must establish a compliance protocol to address potential safety issues:

– CPSC (U.S. Consumer Product Safety Commission): Mandatory reporting of defects or incidents.

– RAPEX (EU Rapid Exchange System): Notification system for dangerous non-food products.

– Recall Procedures: Have a logistics plan for retrieving and replacing non-compliant units.

Conclusion

Successfully managing the logistics and compliance of commercial vacuum cleaners requires attention to classification, safety standards, environmental regulations, and efficient supply chain practices. Staying up-to-date with evolving international requirements ensures market access and protects brand reputation.

Conclusion: Sourcing Commercial Vacuum Cleaners

In conclusion, sourcing commercial vacuum cleaners requires a strategic approach that balances performance, durability, cost-efficiency, and specific operational needs. Commercial environments—ranging from offices and healthcare facilities to hospitality and industrial spaces—demand cleaning equipment designed for frequent, heavy-duty use. By clearly assessing cleaning requirements, evaluating key features such as suction power, filtration systems (e.g., HEPA), ease of maintenance, noise levels, and maneuverability, organizations can select vacuums that enhance cleaning efficiency and promote a healthier indoor environment.

Additionally, partnering with reputable suppliers, considering lifecycle costs over initial price, and exploring service and warranty options are critical for long-term satisfaction. Investing in the right commercial vacuum cleaner not only improves cleaning outcomes but also reduces downtime, maintenance expenses, and total cost of ownership. Ultimately, a well-informed sourcing decision supports operational excellence, sustainability goals, and a cleaner, more professional space for occupants.