The global sublimation printing market is experiencing robust growth, driven by rising demand for personalized products, advancements in digital printing technologies, and widespread adoption across industries such as apparel, signage, and home décor. According to Grand View Research, the global dye-sublimation printer market size was valued at USD 3.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth trajectory reflects increased investment in industrial and commercial-grade sublimation solutions, particularly in regions with expanding manufacturing and textile sectors. As businesses prioritize high-speed, durable, and color-accurate printing, commercial sublimation printer manufacturers are innovating rapidly to meet evolving customer demands. In this competitive landscape, nine key players have emerged as leaders, combining technological expertise, extensive product portfolios, and global reach to dominate the market.

Top 9 Commercial Sublimation Printer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

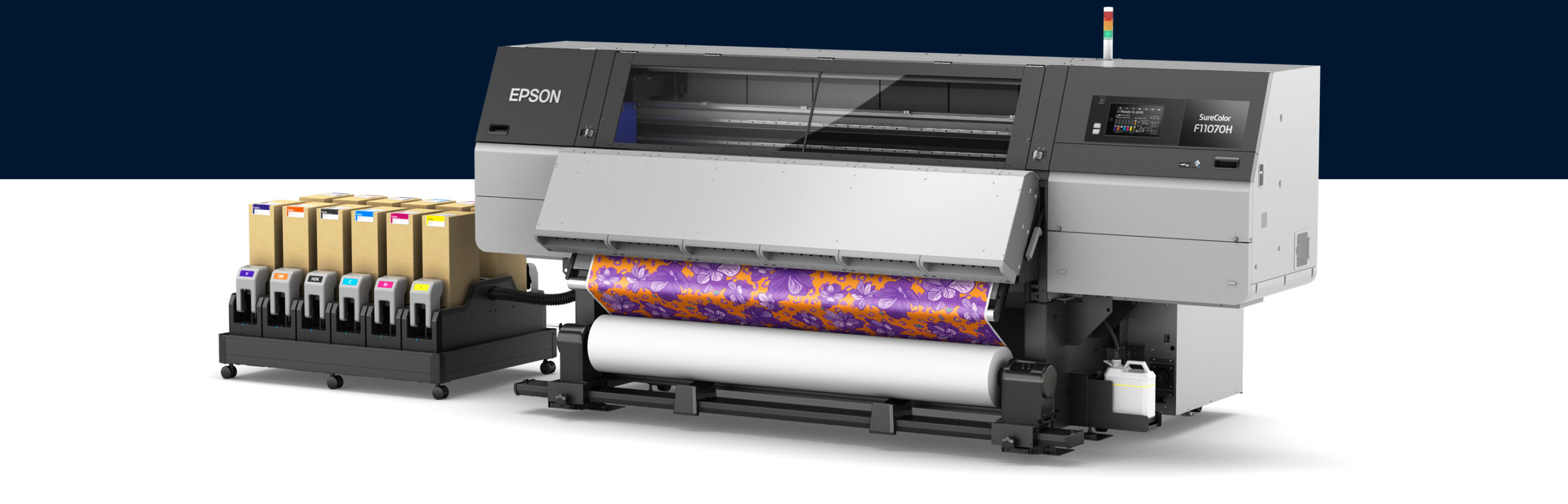

#1 Industrial Dye Sublimation Printers

Domain Est. 1991

Website: epson.com

Key Highlights: Epson SureColor dye-sublimation printers help your business maximize sellable output with enhanced performance, consistent quality and reduced downtime….

#2 Dye sublimation printers

Domain Est. 2000

Website: brother-usa.com

Key Highlights: Learn about dye sublimation printers on Brother-USA.com. Ideal for printing t-shirts, home decor, fashion, sportswear, & more.Missing: commercial manufacturer…

#3 ColDesi, Inc. Make Your Own Customized Products

Domain Est. 2010

Website: coldesi.com

Key Highlights: Leading provider of customized products equipment. Including: commercial embroidery machines, direct-to-garment printers, and more….

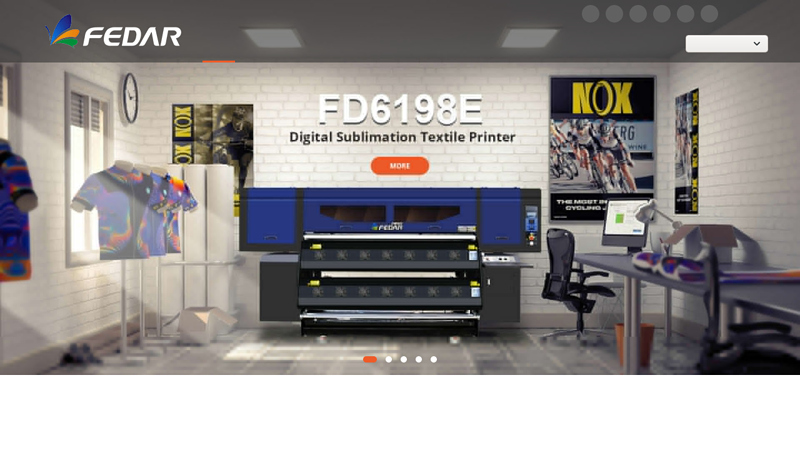

#4 Fedar Sublimation Printer,Fedar Textile Printer

Domain Est. 2019

Website: fedar.net

Key Highlights: China Manufacturer Fedar Printer is committed to developing a series of mature products, such as fedar transfer paper printer and fedar lnkjet printer….

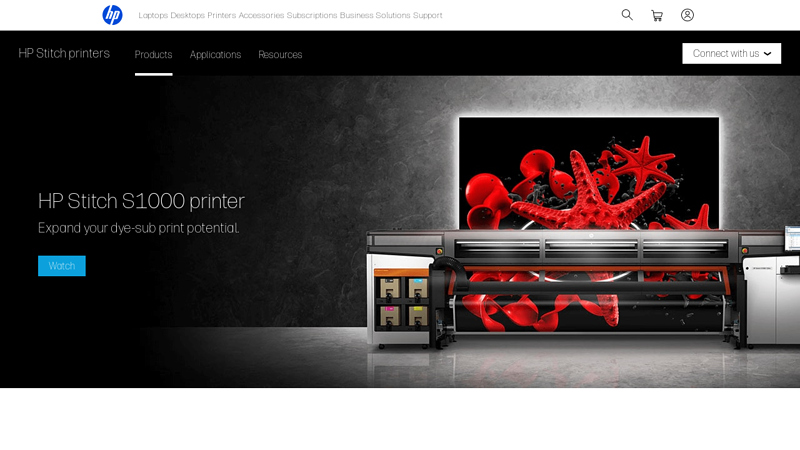

#5 HP Stitch S1000 Fabric and Textile Dye Sublimation Printer

Domain Est. 1986

Website: hp.com

Key Highlights: HP Stitch S1000 is ideal for soft signage and interior décor markets. With this super-wide dye-sub printer you can handle large volumes and demanding ……

#6 Electronics for Imaging

Domain Est. 1989

Website: efi.com

Key Highlights: Superior image quality, production-level printing, and even more print capabilities make the EFI™ Pro 30f+ flatbed LED printer the one you’ve always wanted….

#7 Textile & Garment Printers

Domain Est. 1996

Website: rolanddga.com

Key Highlights: TY-300 Direct-to-Film Commercial Printer. The best-in-class direct-to-film printer for bringing your boldest ideas to Life on custom apparel and textiles. 30 ……

#8 HiTi Digital

Domain Est. 1999

Website: hiti.com

Key Highlights: HiTi’s dye-sub photo printers are the first choice for over 100,000 studios and 2 million industry professional photographers worldwide. More. Personal Printing ……

#9 JPPlus: Engraving, Sublimation, Heat Transfer & UV-LED

Domain Est. 2005

Website: jpplus.com

Key Highlights: Johnson Plastics Plus is your home for products and equipment for laser and rotary engraving, sublimation, heat transfer printing and UV-LED printing….

Expert Sourcing Insights for Commercial Sublimation Printer

2026 Market Trends for Commercial Sublimation Printers

The commercial sublimation printer market is poised for substantial evolution by 2026, driven by technological advancements, shifting consumer demands, and expanding applications across industries. As businesses increasingly seek efficient, high-quality, and sustainable printing solutions, sublimation technology is emerging as a preferred choice in textiles, promotional products, signage, and personalized manufacturing. This analysis explores the key trends shaping the commercial sublimation printer market in 2026.

Growing Demand in Textile and Apparel Industries

By 2026, the textile and apparel sector will remain a dominant driver of commercial sublimation printing adoption. The rise of fast fashion and on-demand production models is pushing manufacturers toward digital sublimation due to its ability to produce vibrant, durable prints on synthetic fabrics like polyester. Custom sportswear, athleisure, and branded uniforms are particularly benefiting from sublimation’s scalability and design flexibility. Moreover, advancements in fabric compatibility are enabling sublimation on a broader range of materials, further expanding market reach.

Expansion into Home and Interior Decor

The home décor and interior design market is experiencing a surge in sublimation printing applications. In 2026, commercial sublimation printers are increasingly used to produce custom wall art, curtains, cushions, and furniture surfaces. Consumers’ growing preference for personalized living spaces is fueling demand for short-run, customizable décor items. Sublimation offers high-resolution, fade-resistant prints ideal for these applications, making it a competitive alternative to traditional printing methods.

Technological Advancements Enhancing Efficiency

In 2026, commercial sublimation printers are expected to feature significant technological upgrades. Key developments include faster print speeds, improved ink formulations for higher color accuracy, and enhanced printhead durability. Integration with AI-driven design software and automated workflows enables seamless production, reducing labor costs and minimizing errors. Additionally, IoT-enabled printers allow remote monitoring and predictive maintenance, improving operational efficiency for print service providers.

Sustainability as a Competitive Advantage

Environmental concerns are shaping purchasing decisions across industries. By 2026, sustainability will be a critical differentiator in the sublimation market. Unlike traditional printing methods, sublimation is waterless and produces minimal waste, aligning with eco-conscious business practices. Manufacturers are responding by developing biodegradable sublimation papers and low-energy curing systems. Certification standards and green labeling are expected to gain importance, influencing buyer preferences.

Growth in On-Demand and Print-on-Demand (POD) Models

The rise of e-commerce and direct-to-consumer (DTC) brands is accelerating the adoption of print-on-demand services. In 2026, commercial sublimation printers are central to POD operations due to their ability to produce single-item runs economically. Platforms offering custom phone cases, mugs, and apparel rely heavily on sublimation for quick turnaround. As inventory-free models become mainstream, sublimation’s role in enabling agile, low-risk production will expand.

Regional Market Developments

While North America and Europe continue to lead in sublimation technology adoption, the Asia-Pacific region is expected to see the fastest growth by 2026. Countries like China, India, and Vietnam are investing heavily in digital textile printing infrastructure. Government initiatives promoting digital manufacturing and domestic production are creating favorable conditions for sublimation printer deployment. Meanwhile, Latin America and the Middle East are emerging as niche markets, driven by rising disposable incomes and demand for customized products.

Competitive Landscape and Innovation

The commercial sublimation printer market in 2026 will be marked by intense competition among key players such as Epson, Sawgrass, Mimaki, and Roland DG. Companies are differentiating themselves through bundled solutions—combining printers, inks, software, and substrates. Open-platform systems allowing third-party inks are gaining traction, offering cost savings and flexibility. Additionally, partnerships with e-commerce platforms and design marketplaces are enabling broader market access for smaller print businesses.

Conclusion

By 2026, the commercial sublimation printer market will be shaped by innovation, sustainability, and the growing demand for customization. As industries from fashion to home décor embrace digital transformation, sublimation technology will play a pivotal role in enabling agile, high-quality, and environmentally responsible production. Businesses that leverage these trends—through technological investment, eco-friendly practices, and strategic market positioning—are likely to gain a competitive edge in the evolving landscape.

Common Pitfalls When Sourcing a Commercial Sublimation Printer: Quality and Intellectual Property Risks

Logistics & Compliance Guide for Commercial Sublimation Printer

Shipping and Handling

Commercial sublimation printers are precision equipment that require careful packaging and handling during shipping. Use original packaging whenever possible, or a double-walled box with ample cushioning (such as foam inserts or bubble wrap) to protect the print head, rollers, and control panel. Ensure the printer is securely fastened inside the box to prevent movement. Always ship with the print head in the home position and use any provided transit locks or protective tapes. Label packages as “Fragile” and “This Side Up” to alert carriers. For international shipments, consider air freight for speed and reduced handling, or sea freight for cost efficiency with extended lead times.

Import and Export Regulations

Before shipping a commercial sublimation printer across borders, verify compliance with the import and export regulations of both origin and destination countries. Obtain the correct Harmonized System (HS) code—typically under 8443.32 or 8443.59 for digital printers. Prepare a commercial invoice, packing list, and bill of lading or air waybill. Some regions may require import licenses, conformity certifications (e.g., CE, FCC, RoHS), or additional documentation for electronics. Check for trade restrictions or sanctions affecting the destination country. Engage a licensed customs broker if needed to facilitate smooth clearance and avoid delays or penalties.

Electrical and Safety Compliance

Ensure the sublimation printer meets electrical safety standards for the target market. In the U.S., compliance with FCC Part 15 (electromagnetic interference) and UL/ETL listing is required. In the EU, CE marking under the Low Voltage Directive (LVD) and Electromagnetic Compatibility (EMC) Directive is mandatory. Confirm voltage compatibility (e.g., 110V vs. 220V) and include appropriate power cords or transformers. Provide safety documentation such as user manuals with warnings for high-temperature components, ink handling, and ventilation requirements. Avoid shipping with full ink cartridges to reduce leakage risk.

Environmental and Chemical Regulations

Sublimation printers use specialized inks that may be classified as hazardous materials under transportation regulations (e.g., IATA for air, IMDG for sea). Check ink Safety Data Sheets (SDS) to determine if inks are flammable or contain restricted substances. When shipping inks separately or with the printer, comply with UN packaging standards (e.g., UN3082 for environmentally hazardous liquids). Adhere to REACH (EU) and TSCA (U.S.) regulations for chemical registration and reporting. Dispose of packaging and waste materials according to local environmental laws.

Warranty and Service Logistics

Clearly communicate warranty terms, including coverage duration, parts, and labor. Provide multilingual support documentation and access to technical service centers in key markets. Establish a logistics plan for spare parts distribution—especially print heads, rollers, and ink systems—to minimize downtime. For international customers, partner with local service providers or distributors who can perform maintenance and repairs. Maintain an inventory of critical components to support quick turnaround on warranty claims.

Documentation and Labeling Requirements

Accurate documentation is essential for compliance and customer use. Include product labels with model number, serial number, voltage, manufacturer details, and compliance marks (CE, FCC, etc.). Ship with user manuals, quick-start guides, and regulatory leaflets in the local language. Provide electronic copies via QR code or URL to reduce printed material. Ensure all labeling adheres to regional requirements—for example, energy labeling may be needed in the EU under Ecodesign directives.

End-of-Life and Recycling Compliance

Plan for responsible end-of-life management. Comply with WEEE (Waste Electrical and Electronic Equipment) Directive in the EU, which requires producers to register and fund recycling programs. In the U.S., follow state-specific e-waste laws. Design printers with recyclable materials and modular components to support repair and reuse. Offer take-back programs or partner with certified e-waste recyclers. Inform customers about proper disposal options and include recycling symbols on product and packaging.

In conclusion, sourcing a commercial sublimation printer requires careful consideration of several key factors including print quality, production speed, machine durability, ink and media compatibility, technical support, and total cost of ownership. Businesses should assess their specific output needs, volume requirements, and long-term growth plans to select a printer that offers scalability and reliability. Conducting thorough market research, comparing reputable brands, and evaluating after-sales service are essential steps in making an informed investment. Ultimately, choosing the right commercial sublimation printer will enhance operational efficiency, ensure high-quality results, and support sustainable growth in competitive markets such as apparel, signage, and customized merchandise.