The global commercial radiator market is experiencing robust growth, driven by increasing demand for energy-efficient heating solutions in residential, commercial, and industrial buildings. According to a report by Grand View Research, the global HVAC market size was valued at over USD 150 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of around 6.5% from 2024 to 2030, with radiators representing a significant segment of this expansion. Similarly, Mordor Intelligence forecasts sustained growth in the heating equipment market, citing urbanization, rising construction activities, and stricter energy regulations as key drivers—particularly across Europe and North America where hydronic heating systems are widely adopted. As sustainability and thermal efficiency become central to building design, leading commercial radiator manufacturers are innovating with advanced materials, smart integration, and low-carbon technologies. In this evolving landscape, identifying the top manufacturers becomes crucial for specifiers, contractors, and facility managers aiming to balance performance, reliability, and compliance. The following list highlights the top 10 commercial radiator manufacturers based on market presence, product innovation, energy efficiency standards, and global reach.

Top 10 Commercial Radiator Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Active Radiator: Heavy

Domain Est. 1999

Website: activeradiator.com

Key Highlights: We manufacture aftermarket heat exchange products for heavy-duty trucks & buses & off-road industrial equipment. We also clean, repair, recore, and more!…

#2 Roppel Industries

Domain Est. 2021

Website: roppelind.com

Key Highlights: Roppel Industries is a full-service provider of radiator products and industrial heat exchange solutions and repair services….

#3 PWR Advanced Cooling Technology

Website: pwr.com.au

Key Highlights: PWR group, including our Australian, US and UK sites provide design, manufacture, full system integration and testing of cooling systems for the defence sector….

#4 Performance Radiator®

Domain Est. 1996

Website: performanceradiator.com

Key Highlights: Selling quality OE replacement radiators, condensers, mirrors, heaters, fans, and fuel tanks for your gas, diesel, or hybrid car or truck today….

#5 1800

Domain Est. 1996

Website: 1800radiator.com

Key Highlights: 1-800-Radiator offers more complete A/C Kits. 1-800-Radiator is open on Saturdays. 1-800-Radiator offers statistically better parts with no brand preference or ……

#6 BGR Radiator

Domain Est. 2004

Website: bgrradiator.com

Key Highlights: BGR offers a comprehensive catalog of lasting-quality radiators, generators, and cooling systems, which we deliver and install quickly and professionally….

#7 American Radiator

Domain Est. 2009

#8 Premium Radiators and Heat Exchangers

Domain Est. 2010

Website: dolphinradiator.com

Key Highlights: Dolphin Heat Exchangers USA provides the best aftermarket radiators and heat exchangers in the market. With over 38 years of experience in producing high ……

#9 Tata Toyo Radiator

Domain Est. 2014

Website: tataautocomp.com

Key Highlights: The company has manufacturing capacity of over 3.67 million units per annum. With newly developed stacked plate oil coolers and two wheeler radiators, the ……

#10 Steel panel radiators for heating, buy panel radiators LEMAX

Domain Est. 2016

Website: lemax-radiator.com

Key Highlights: LEMAX panel radiators made of steel are distinguished by their simplicity of installation and low inertia: they quickly warm up and cool down, providing an ……

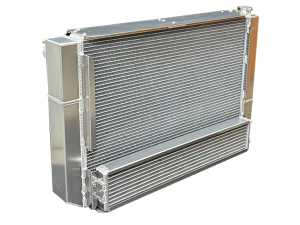

Expert Sourcing Insights for Commercial Radiator

H2: 2026 Market Trends for Commercial Radiators

The global commercial radiator market is poised for transformative growth and innovation by 2026, driven by evolving energy regulations, technological advancements, and shifting consumer preferences toward sustainability and energy efficiency. This analysis explores key trends expected to shape the commercial radiator industry in 2026 under the H2 framework, focusing on High Efficiency, Hybrid Systems, Human-Centric Design, and High-Tech Integration.

1. High Efficiency: Demand for Energy-Optimized Solutions

By 2026, energy efficiency will remain a top priority in commercial building design. With stricter energy performance standards being implemented across North America, Europe, and parts of Asia-Pacific (e.g., EU Energy Performance of Buildings Directive), commercial radiators are being redesigned to maximize heat output with minimal energy input.

- Condensing Boiler Compatibility: Radiators are increasingly engineered to operate efficiently with low-temperature heating systems, such as condensing boilers and district heating networks.

- Improved Heat Transfer Materials: Use of aluminum and hybrid steel-aluminum constructions will grow, offering faster heat response and better thermal conductivity.

- Regulatory Influence: Building certifications like LEED, BREEAM, and local green building codes will push developers to adopt high-efficiency radiators, boosting market demand.

2. Hybrid Systems: Integration with Renewable and Smart HVAC Technologies

The integration of commercial radiators into hybrid heating systems is a major trend. By 2026, radiators will often function as part of a broader, decentralized HVAC ecosystem combining traditional hydronic heating with renewable energy sources.

- Heat Pump Synergy: As heat pumps become central to decarbonization strategies, radiators will be optimized for use with these systems, requiring larger surface areas or enhanced convective elements to compensate for lower water temperatures.

- Solar Thermal and District Heating Integration: Especially in urban and multi-tenant commercial buildings, radiators will be designed to interface with centralized solar thermal loops or district heating grids.

- Modular and Scalable Designs: Radiators will support plug-and-play installation in hybrid heating infrastructures, enabling flexible retrofitting in existing commercial real estate.

3. Human-Centric Design: Focus on Comfort, Aesthetics, and Indoor Air Quality

In 2026, commercial radiators will increasingly be seen not just as functional units but as contributors to occupant well-being and architectural aesthetics.

- Thermal Comfort Optimization: Advanced modeling and zoning will allow for precise temperature control in offices, retail spaces, and healthcare facilities, minimizing cold spots and drafts.

- Sleek and Customizable Designs: Architects and building owners will prioritize radiators with minimalist profiles, customizable finishes (e.g., color-matching, textured coatings), and integration into interior design schemes.

- Low Dust Emission and Hygiene: With heightened awareness of indoor air quality post-pandemic, radiators with smooth surfaces and reduced convection turbulence will gain favor to minimize dust circulation—especially in schools, hospitals, and laboratories.

4. High-Tech Integration: Smart Radiators and IoT Connectivity

Digitization will transform traditional radiators into intelligent components of smart building management systems.

- Smart Valves and Controls: By 2026, a growing share of commercial radiators will be equipped with wireless thermostatic radiator valves (TRVs) connected to building automation systems (BAS), enabling room-by-room temperature control and occupancy-based scheduling.

- IoT and Predictive Maintenance: Sensor-integrated radiators will monitor performance metrics (flow rate, temperature differential, pressure drops), sending data to cloud platforms for predictive maintenance and energy analytics.

- Integration with BIM and Digital Twins: During construction and facility management, radiators will be embedded in Building Information Modeling (BIM) systems, allowing for real-time monitoring and lifecycle management.

Conclusion

The 2026 commercial radiator market will be defined by a convergence of sustainability, intelligence, and design sophistication. As buildings strive for net-zero emissions and smarter operations, radiators will evolve from passive heating elements into active, connected components of high-performance commercial environments. Manufacturers who embrace H2 trends—focusing on high efficiency, hybrid compatibility, human-centric design, and high-tech integration—will lead the market in innovation and adoption.

Common Pitfalls When Sourcing Commercial Radiators (Quality, IP)

Sourcing commercial radiators involves more than just selecting a size or design—overlooking critical quality and intellectual property (IP) aspects can lead to performance issues, safety risks, and legal exposure. Below are key pitfalls to avoid:

Poor Material Quality and Build Standards

Many suppliers offer radiators that appear cost-effective but use substandard materials such as thin-gauge steel or inferior aluminum alloys. This compromises heat transfer efficiency, durability, and resistance to corrosion, especially in high-demand commercial environments. Always verify material specifications, certifications (e.g., ISO 9001), and conduct independent quality audits when possible.

Misrepresented IP Protection and Design Infringement

Some manufacturers replicate patented radiator designs, particularly in premium or designer models. Sourcing from such suppliers exposes your project or business to IP litigation. Always confirm that the supplier owns the design rights or holds valid licensing agreements, and request documentation proving IP compliance.

Inadequate or Falsified Performance Data

Suppliers may exaggerate heat output (BTU/Watt) ratings or use unrealistic test conditions to make their products appear more efficient. This leads to undersized systems and occupant discomfort. Insist on performance data certified by independent bodies (e.g., Eurovent, AHRI) and verify testing standards used.

Lack of Certification for Safety and Compliance

Commercial installations require adherence to regional safety and efficiency regulations (e.g., CE marking, UKCA, Energy Star). Sourcing radiators without proper certification may result in failed inspections or non-compliance penalties. Ensure all products meet local building codes and carry necessary compliance labels.

Inconsistent Manufacturing and Quality Control

Suppliers with weak quality control may deliver inconsistent products—even within the same batch. This affects fit, finish, and performance. Prioritize manufacturers with documented quality assurance processes and request samples before placing bulk orders.

Hidden Costs from Poor Long-Term Reliability

Low upfront pricing often masks future costs related to maintenance, premature failure, or inefficient operation. Radiators with poor welds, weak valves, or inadequate coatings may require early replacement. Evaluate total cost of ownership, not just initial purchase price.

Failure to Verify Supply Chain Transparency

Complex supply chains can obscure the origin of components and labor practices. This increases risks related to counterfeit parts, ethical sourcing, and supply disruption. Demand transparency in sourcing and manufacturing locations, and consider on-site factory audits.

Overlooking After-Sales Support and Warranty Terms

Weak warranty coverage or unresponsive technical support can leave you stranded if issues arise post-installation. Confirm warranty duration, what it covers, and the supplier’s service responsiveness before finalizing procurement.

Avoiding these pitfalls requires due diligence, clear specifications, and partnerships with reputable, transparent suppliers who prioritize quality and IP integrity.

Logistics & Compliance Guide for Commercial Radiator

Overview

This guide outlines the logistics and compliance considerations for the transportation, storage, installation, and regulatory adherence of commercial radiator units. Adhering to these standards ensures safe, efficient operations and legal compliance across supply chains and end-use installations.

Product Classification & Handling

Commercial radiators are heavy, fragile, and often made from metal alloys (e.g., aluminum, steel). They must be classified correctly for shipping based on weight, dimensions, and material composition. Use of protective packaging—corner guards, stretch wrap, and wooden pallets—is required to prevent surface damage and structural deformation during transit.

Packaging & Labeling Requirements

- Secure radiators on standardized pallets using strapping or shrink wrap.

- Label each unit with:

- Product model and serial number

- Weight and dimensions

- “Fragile – Handle with Care”

- Orientation arrows (if applicable)

- Manufacturer and compliance markings

- Include shipping documentation listing hazardous materials (if any coatings or fluids are present).

Transportation & Freight

- Use freight carriers experienced in handling industrial HVAC equipment.

- For international shipments, comply with Incoterms (e.g., FOB, CIF) clearly defined in contracts.

- Ensure load stability during transit; secure cargo with load bars or nets in container/truck.

- Monitor temperature and humidity during transport, especially for coated or painted finishes.

Import/Export Compliance

- Verify HS Code: Typically 7322.11 or 7322.19 (for radiators of iron or steel). Confirm with local customs authority.

- Obtain necessary export licenses if shipping to restricted regions.

- Prepare commercial invoice, packing list, bill of lading, and certificate of origin.

- Comply with destination country regulations (e.g., CE marking in EU, NRCan in Canada, DOE standards in the U.S.).

Regulatory Standards & Certifications

- Energy Efficiency: Comply with regional standards such as:

- U.S. Department of Energy (DOE) efficiency regulations

- EU Ecodesign Directive (ErP) for heating products

- Safety & Construction:

- Conform to ASME, ASTM, or EN standards for pressure and material integrity

- CE marking (Europe), UKCA (UK), or CSA (North America) where applicable

- Environmental Compliance:

- Verify absence of restricted substances per RoHS (EU) or TSCA (U.S.)

- Follow REACH regulations for chemical components in coatings or seals

Storage & Inventory Management

- Store radiators in dry, indoor environments to prevent corrosion.

- Elevate pallets off the floor to avoid moisture absorption.

- Rotate stock using FIFO (First In, First Out) to minimize obsolescence.

- Maintain inventory logs with batch numbers and compliance documentation.

Installation & Site Compliance

- Ensure installation follows local building codes and HVAC regulations.

- Verify system pressure and temperature compatibility with radiator specifications.

- Provide installers with manufacturer’s instructions, including safety warnings and maintenance schedules.

- In commercial buildings, comply with fire safety codes (e.g., clearances from combustible materials).

Documentation & Traceability

Maintain a compliance dossier for each batch, including:

– Material test reports (MTRs)

– Certificates of conformity (CoC)

– Test reports for pressure and leak resistance

– Warranty and service manuals

– Records of inspections and quality control checks

Returns & End-of-Life Management

- Establish a returns process for damaged or non-conforming units, including inspection and root cause analysis.

- Follow WEEE (Waste Electrical and Electronic Equipment) directives in applicable regions for disposal/recycling.

- Promote take-back programs or recycling partnerships for metal recovery.

Conclusion

Effective logistics and compliance management for commercial radiators reduces risk, ensures regulatory adherence, and enhances customer satisfaction. Regular audits, staff training, and supplier coordination are essential for maintaining standards across the product lifecycle.

Conclusion for Sourcing Commercial Radiators:

Sourcing commercial radiators requires a strategic approach that balances performance, cost-efficiency, durability, and supplier reliability. After evaluating various suppliers, product specifications, and market options, it is evident that selecting the right radiator involves careful consideration of heating requirements, building infrastructure, energy efficiency standards, and long-term maintenance needs.

Partnering with reputable suppliers who offer certified, high-quality products and strong after-sales support ensures reliable system performance and reduces lifecycle costs. Additionally, prioritizing energy-efficient and sustainably manufactured radiators supports environmental goals and regulatory compliance.

In conclusion, a successful sourcing decision for commercial radiators hinges on thorough due diligence, clear technical specifications, and a focus on total cost of ownership rather than upfront price alone. Implementing a well-structured procurement process will lead to optimal thermal comfort, operational efficiency, and long-term value for commercial projects.