The global combustion leak detector market is experiencing robust growth, driven by increasing industrial safety regulations, rising demand for preventive maintenance in oil & gas, chemical processing, and power generation facilities, and advancements in gas sensing technologies. According to a report by Mordor Intelligence, the global combustible gas detector market was valued at USD 2.21 billion in 2023 and is projected to reach USD 3.14 billion by 2029, growing at a CAGR of approximately 6.0% during the forecast period. Similarly, Grand View Research estimates the broader gas detection market to expand at a CAGR of 6.8% from 2023 to 2030, underscoring the heightened emphasis on workplace safety and environmental compliance. As operational safety becomes a top priority across high-risk industries, the role of reliable combustion leak detectors has become increasingly critical—fueling innovation and competition among key players. In this evolving landscape, eight manufacturers have emerged as leaders, combining technological precision, global reach, and comprehensive application support to set the standard in leak detection solutions.

Top 8 Combustion Leak Detector Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 INFICON

Domain Est. 1995

Website: inficon.com

Key Highlights: INFICON is a leading provider of innovative instrumentation, critical sensor technologies, and Smart Manufacturing/Industry 4.0 software solutions….

#2 Combustion leak detector

Domain Est. 1996

#3 33195000

Domain Est. 1996

Website: sykes-pickavant.com

Key Highlights: It works by sampling coolant and revealing the presence of exhaust gases via chemical reaction, making it a trusted asset for accurate, rapid engine diagnosis….

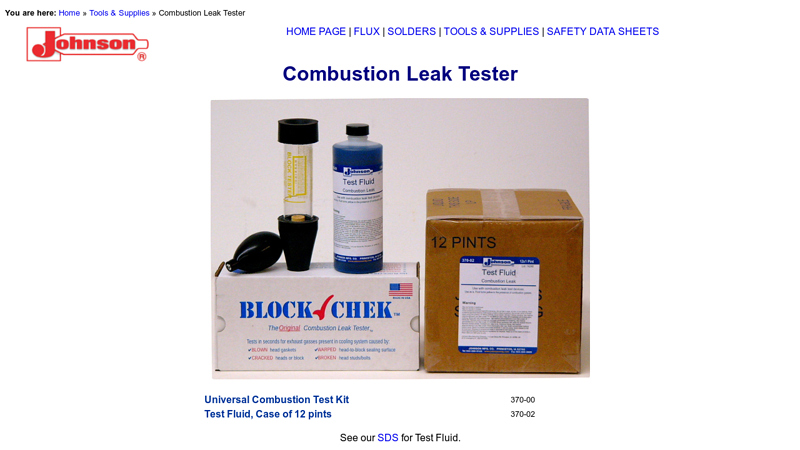

#4 Combustion Leak Tester

Domain Est. 1997

Website: johnsonmfg.com

Key Highlights: Combustion Leak Tester. 370-00. Universal Combustion Test Kit, 370-00. Test Fluid, Case of 12 pints ……

#5 Combustion Testers and Analyzers

Domain Est. 1997

Website: fieldpiece.com

Key Highlights: Fieldpiece has brought our world-class engineering to the heating market. See our full line of combustion analyzers, CO detectors, and combustion testers….

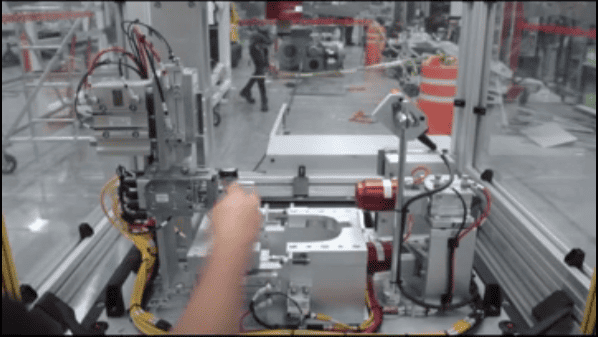

#6 Combustion Engine (ICE) Leak Detector

Domain Est. 1997

Website: intertechdevelopment.com

Key Highlights: The InterTech M1075 Mass Flow Leak Detector controls the test cycle and minimizes cycle time while meeting 10% GR&R. Test cell is interfaced with a robot for ……

#7 COMBUSTION GAS LEAK DETECTOR SET

Domain Est. 2000

Website: jbmcamp.com

Key Highlights: CO2 COMBUSTION LEAK DETECTOR This tool is designed to check for the leaks between combustion and cooling system of water-cooled engines….

#8 Bacharach is now part of MSAsafety.com

Domain Est. 2004

Website: us.msasafety.com

Key Highlights: Bacharach is now part of MSAsafety.com. MSA Bacharach Solutions: HVAC/R Solutions. View Details. MSA Bacharach Products: Detection & Monitoring….

Expert Sourcing Insights for Combustion Leak Detector

H2: 2026 Market Trends for Combustion Leak Detectors

The global market for combustion leak detectors is poised for significant evolution by 2026, driven by tightening safety regulations, technological innovation, and increasing industrial automation. As industries prioritize operational safety and environmental compliance, the demand for reliable and efficient combustion leak detection systems continues to grow. Below are key trends shaping the combustion leak detector market in 2026:

-

Regulatory Push for Safety and Emissions Control

Governments and regulatory bodies worldwide are enforcing stricter safety and environmental standards, particularly in oil & gas, chemical processing, and power generation sectors. By 2026, regulations such as the U.S. Environmental Protection Agency (EPA) Methane Rule and EU Industrial Emissions Directive are expected to mandate continuous monitoring of combustible gases like methane, propane, and hydrogen. This regulatory landscape is accelerating adoption of advanced combustion leak detectors to prevent explosions, ensure worker safety, and reduce greenhouse gas emissions. -

Adoption of Smart and Wireless Detection Systems

The integration of IoT (Internet of Things) and wireless communication technologies is transforming combustion leak detectors into intelligent, networked devices. By 2026, market leaders are increasingly offering cloud-connected detectors that provide real-time monitoring, remote diagnostics, and predictive maintenance capabilities. These smart systems enhance operational efficiency and reduce downtime, making them particularly attractive for large-scale industrial facilities and remote operations. -

Growth in Oil & Gas and Petrochemical Sectors

The upstream, midstream, and downstream segments of the oil and gas industry remain the largest end-users of combustion leak detectors. With ongoing investments in LNG (liquefied natural gas) infrastructure, shale gas exploration, and refinery expansions—especially in North America, the Middle East, and Asia-Pacific—the demand for high-performance leak detection is rising. Combustion detectors are being deployed more extensively in wellheads, compressor stations, and processing plants to mitigate explosion risks. -

Technological Advancements in Sensor Technology

Innovations in sensor design—such as enhanced infrared (IR) sensors, catalytic bead sensors with poison resistance, and laser-based detection—are improving accuracy, response time, and longevity. In 2026, next-generation detectors offer better selectivity, lower false alarm rates, and the ability to detect multiple gases simultaneously. These advancements support safer operations in complex industrial environments and align with the industry’s push toward predictive safety analytics. -

Increased Focus on Hydrogen Economy Infrastructure

As the global energy transition accelerates, hydrogen is emerging as a key clean fuel. However, hydrogen is highly combustible and prone to leaks due to its small molecular size. By 2026, the expansion of hydrogen production, storage, and distribution infrastructure is driving demand for specialized combustion leak detectors capable of detecting hydrogen at low concentrations. This represents a growing niche within the broader market. -

Rising Demand in Emerging Economies

Rapid industrialization in countries such as India, Indonesia, and Brazil is increasing the need for industrial safety systems. Government initiatives to improve workplace safety and reduce industrial accidents are promoting the adoption of combustion leak detectors in manufacturing, utilities, and construction sectors. Local manufacturing and partnerships with global suppliers are helping to expand market access in these regions. -

Sustainability and Green Compliance Reporting

Companies are under growing pressure from investors and consumers to demonstrate environmental stewardship. Combustion leak detectors play a crucial role in quantifying fugitive emissions, supporting sustainability reporting, and achieving ESG (Environmental, Social, and Governance) goals. By 2026, integrated data logging and emissions analytics features in leak detectors are becoming standard, enabling organizations to track and report compliance metrics effectively. -

Consolidation and Strategic Partnerships

The market is witnessing increased M&A activity and strategic collaborations among technology providers, sensor manufacturers, and industrial safety firms. These alliances aim to deliver comprehensive safety solutions combining hardware, software, and service support. Such consolidation enhances innovation and accelerates time-to-market for advanced detection systems.

Conclusion

By 2026, the combustion leak detector market is expected to experience robust growth, fueled by regulatory mandates, technological innovation, and expanding industrial applications. The shift toward intelligent, connected, and hydrogen-ready detection systems will define the competitive landscape. Stakeholders who invest in R&D, compliance alignment, and digital integration are likely to lead the market in this pivotal phase of industrial safety evolution.

When sourcing a Combustion Leak Detector that uses hydrogen (H₂) as a tracer gas—commonly known as a Hydrogen Leak Detector or H₂ Sniffer—there are several common pitfalls related to quality and intellectual property (IP) that organizations should be aware of, especially in industries like automotive, HVAC, aerospace, and energy. Below is a breakdown of these pitfalls and how to mitigate them:

🔍 1. Quality Pitfalls

a. Poor Sensor Accuracy & Sensitivity

- Pitfall: Low-cost detectors may use inferior hydrogen sensors with poor sensitivity (e.g., >10 ppm detection limit), missing micro-leaks critical in sealed systems (e.g., fuel cells, refrigeration).

- Impact: False negatives, undetected leaks, safety risks, system inefficiency.

- Mitigation:

- Specify detectors with <5 ppm sensitivity.

- Require third-party calibration certificates (e.g., NIST-traceable).

- Prefer electrochemical or catalytic bead sensors with drift compensation.

b. Lack of Selectivity (Cross-Sensitivity)

- Pitfall: Some sensors react to non-target gases (e.g., CO, methane, alcohol vapors), causing false positives.

- Impact: Wasted time troubleshooting non-existent leaks; reduced operator trust.

- Mitigation:

- Choose detectors with high H₂ selectivity (e.g., membrane-filtered sensors).

- Test in environments with common interferents before deployment.

c. Inadequate Build Quality & Durability

- Pitfall: Units from unknown manufacturers may use substandard materials (e.g., brittle probes, weak housings), failing in field conditions.

- Impact: Short device lifespan, frequent repairs, downtime.

- Mitigation:

- Look for IP65 or higher ingress protection.

- Require compliance with IEC 61010 (safety) and ISO 9001 (quality management).

d. Poor Calibration & Maintenance Support

- Pitfall: Vendors may not offer accessible calibration services or spare parts, especially outside their home region.

- Impact: Detector drifts out of spec; becomes unreliable over time.

- Mitigation:

- Confirm local service centers or in-house calibration capability.

- Choose brands with long-term support history.

e. Inaccurate Leak Quantification

- Pitfall: Some devices only give qualitative “beep” feedback, not quantitative leak rate (e.g., cc/min or g/year).

- Impact: Cannot prioritize repairs or meet regulatory reporting.

- Mitigation:

- Require digital readout with leak rate estimation.

- Ensure device supports H₂/N₂ mix (typically 5% H₂ / 95% N₂) traceability.

💡 2. Intellectual Property (IP) Pitfalls

a. Use of Counterfeit or Cloned Technology

- Pitfall: Some low-cost detectors copy patented sensor designs or software algorithms from reputable brands (e.g., Bacharach, INFICON, Pfeiffer).

- Impact: Legal exposure, poor performance, no firmware updates.

- Mitigation:

- Source from authorized distributors.

- Verify patent numbers on product documentation.

- Perform due diligence on OEMs—avoid “white label” products with unclear origins.

b. Proprietary Software & Data Lock-In

- Pitfall: Some detectors use closed software that limits data export or requires expensive licenses for reporting.

- Impact: Inability to integrate with CMMS or generate compliance reports.

- Mitigation:

- Require open data formats (CSV, JSON) and API access.

- Prefer devices with Bluetooth/Wi-Fi and mobile apps that allow data extraction.

c. Firmware & Algorithm Limitations

- Pitfall: Vendors may hide or obfuscate calibration algorithms, making it impossible to verify or audit performance.

- Impact: Lack of transparency, inability to validate accuracy.

- Mitigation:

- Require technical documentation on detection methodology.

- Demand firmware update policy and security patches.

d. IP in Tracer Gas Mixtures

- Pitfall: While H₂/N₂ mix is standard, some vendors promote proprietary blends with additives (e.g., odorants, stabilizers) protected by patents.

- Impact: Vendor lock-in, higher consumable costs.

- Mitigation:

- Stick to standard 5% H₂ / 95% N₂ (non-flammable, widely available).

- Avoid proprietary gas blends unless absolutely necessary.

✅ Best Practices When Sourcing

| Area | Recommendation |

|——|—————-|

| Supplier Vetting | Prefer established brands with global support (e.g., INFICON, Bacharach, Testo, GD Instruments). |

| Testing | Conduct side-by-side field testing with known leak standards. |

| Compliance | Ensure CE, ATEX (if used in explosive environments), and RoHS certification. |

| Training | Include operator training to avoid misuse (e.g., incorrect gas mix, probe handling). |

| Total Cost of Ownership | Factor in calibration, consumables (filters, sensors), and repair costs. |

🚨 Red Flags to Watch For

- No datasheet or vague technical specs.

- Claims of “ultra-sensitive” without independent validation.

- No serial numbers or calibration logs.

- Unusually low price compared to market leaders.

- No clear warranty or return policy.

Conclusion

Using H₂-based combustion leak detection is highly effective for pinpointing micro-leaks, but sourcing decisions must go beyond price. Quality ensures reliability and safety; IP awareness protects against legal and operational risks. Invest in transparent, reputable suppliers with verifiable technology and long-term support.

Always conduct a supplier audit, request reference installations, and validate performance under real-world conditions before large-scale procurement.

Logistics & Compliance Guide for Hydrogen (H2)-Based Combustion Leak Detector

This guide outlines key logistics and compliance considerations for the safe handling, transport, storage, and use of hydrogen (H2)-based combustion leak detectors. These devices utilize hydrogen as a tracer gas to detect minute leaks in industrial systems (e.g., HVAC, refrigeration, fuel systems, and vacuum systems). While highly effective, hydrogen requires careful management due to its flammability and regulatory requirements.

1. Overview of H2-Based Leak Detectors

- Function: Emits a controlled mixture of hydrogen (typically 5% H₂ in nitrogen, often referred to as “forming gas”) to trace leaks via sensitive detection probes.

- Common Gas Mix: 5% H₂ / 95% N₂ (non-pyrophoric and safe when handled properly).

- Advantages: Non-toxic, non-flammable at 5% concentration in air, high sensitivity, environmentally benign.

2. Regulatory Compliance

A. International Regulations

- UN Model Regulations (UN Recommendations on the Transport of Dangerous Goods):

- UN 1049: Hydrogen, compressed – Class 2.1 (Flammable Gas).

- Exemption for 5% H₂/N₂ mix: Mixtures ≤8% H₂ in inert gas (e.g., nitrogen) may be non-regulated for transport under certain conditions (e.g., small cylinders, low pressure).

-

Check: TDG (Transport of Dangerous Goods) exemptions in IATA, IMDG, ADR.

-

IATA (Air Transport):

- Packaging Instruction 200: Exemption for small quantities of non-flammable, non-toxic gases.

-

5% H₂/N₂ in cylinders ≤50 mL water capacity and ≤120 kPa pressure may be exempt as “not restricted” (check current IATA DGR, Section 2.8 and Special Provision A154).

-

IMDG Code (Sea Transport):

- Exemptions under 2.10 for low-pressure non-flammable gas mixtures.

-

Verify cylinder size and pressure thresholds.

-

ADR (Road Transport in Europe):

- Exemption under ADR 1.1.3.6 for non-flammable gases with small water capacity cylinders (<1 L) and low pressure.

B. Regional Regulations

- USA (DOT PHMSA):

- 49 CFR: 5% H₂/N₂ may be exempt from hazardous materials regulations if total hydrogen content is <1.4 kg and in cylinders ≤50 mL at ≤200 psi.

-

Always verify with current 49 CFR §173.306a (compressed gases in cylinders).

-

Canada (TDG Regulations):

- Exemption under Class 2.2 (Non-flammable gases) if H₂ ≤8% and in small containers.

-

Use of “Limited Quantity” or “Consumer Commodity” labels may apply.

-

EU (CLP/GHS):

- H₂/N₂ mix (5%) labeled as non-hazardous if below flammability limits.

- Safety Data Sheet (SDS) still required (Section 14: Transport Information).

3. Logistics & Transport Guidelines

A. Packaging & Labeling

- Use UN-certified cylinders with pressure relief devices.

- Label with:

- Gas composition (e.g., “5% H₂ / 95% N₂”)

- Manufacturer info

- Exemption markings if applicable (e.g., “Not Restricted”, “Consumer Commodity”)

- Avoid unmarked or refillable cylinders unless certified.

B. Storage

- Store in well-ventilated, dry, cool areas away from ignition sources.

- Keep upright and secured to prevent tipping.

- Segregate from oxidizers and flammable materials.

- Maximum storage temperature: <50°C (122°F).

- Use dedicated gas cabinets if storing multiple units.

C. Transportation

- Air (Passenger/Cargo Aircraft): Confirm with airline; most 5% H₂/N₂ detectors qualify as non-restricted if within exemption limits.

- Ground (Truck/Car):

- Secure cylinders to prevent movement.

- No smoking in vehicle.

- Carry SDS and exemption documentation.

- Courier Services (e.g., FedEx, UPS):

- Declare as “Non-hazardous” if compliant with exemption criteria.

- Provide supporting documentation (SDS, test reports).

4. On-Site Use & Safety

A. Ventilation

- Use in well-ventilated areas to prevent accumulation.

- Avoid confined spaces unless monitored with H₂ sensors.

B. Ignition Sources

- No open flames, sparks, or hot surfaces near operation.

- Use intrinsically safe equipment in hazardous zones.

C. Leak Detection Protocol

- Inspect hoses, regulators, and connections before use.

- Use only manufacturer-recommended accessories.

- Shut off gas when not in use.

D. Emergency Procedures

- Leak: Evacuate area, ventilate, eliminate ignition sources.

- Fire: Use dry chemical or CO₂ extinguishers. Do not use water on gas fires.

- Exposure: H₂ is non-toxic but can displace oxygen in confined spaces (risk of asphyxiation).

5. Training & Documentation

A. Personnel Training

- Operators must be trained in:

- Safe handling of gas cylinders

- Leak detector operation

- Emergency response

- Regulatory exemptions

B. Required Documents

- Safety Data Sheet (SDS) – Always available.

- Transport Exemption Letter – From manufacturer or regulatory body.

- Inspection Logs – For cylinders and detectors.

- Training Records – For compliance audits.

6. Disposal & Recycling

- Empty cylinders: Return to supplier or certified gas recycler.

- Never vent large quantities of H₂/N₂ in confined spaces.

- Follow local regulations for disposal of electronic components.

7. Manufacturer Recommendations

- Always follow the user manual and compliance statements from the detector manufacturer (e.g., INFICON, Bacharach, Pfeiffer).

- Use only approved gas cartridges (e.g., disposable 5% H₂/N₂ pods).

8. Compliance Checklist

| Item | Status |

|——|——–|

| Gas mix ≤8% H₂ in inert gas | ✅ |

| Cylinders <50 mL and <200 psi | ✅ |

| SDS on file | ✅ |

| Proper labeling (non-hazardous if exempt) | ✅ |

| Storage in ventilated area | ✅ |

| Staff trained | ✅ |

| Emergency procedures posted | ✅ |

Conclusion

Hydrogen-based combustion leak detectors using 5% H₂/N₂ are safe and effective when handled properly. Most fall under transport exemptions due to low hydrogen concentration, but compliance depends on cylinder size, pressure, and local regulations. Always verify with the latest regulatory texts and consult with your EHS (Environment, Health & Safety) team.

Pro Tip: Use pre-filled, disposable hydrogen cartridges instead of refillable cylinders to simplify compliance and reduce risk.

References:

– IATA Dangerous Goods Regulations (latest edition)

– 49 CFR (U.S. DOT)

– ADR 2023 (European Agreement)

– UN Model Regulations, 22nd Revised Edition

– Manufacturer SDS and compliance documentation

For site-specific compliance, consult a certified dangerous goods safety advisor (DGSA).

Conclusion for Sourcing a Combustion Leak Detector

After a thorough evaluation of available options, sourcing a combustion leak detector is a critical step in ensuring safety, compliance, and operational efficiency in environments where combustible gases are present. The selection process should prioritize accuracy, reliability, response time, and ease of use, while also considering factors such as sensor technology (e.g., catalytic bead, infrared, or semiconductor), durability, and maintenance requirements.

Choosing a detector that meets recognized industry standards (such as UL, CSA, or ATEX certifications) ensures compliance with safety regulations and provides confidence in performance. Additionally, evaluating total cost of ownership—including initial purchase price, calibration needs, and sensor lifespan—will contribute to a cost-effective and sustainable solution.

In conclusion, investing in a high-quality combustion leak detector from a reputable supplier not only protects personnel and facilities from potential hazards but also enhances operational continuity and regulatory compliance. A well-sourced detector is an essential component of any comprehensive gas safety strategy.