The global colored die market is witnessing steady expansion, driven by rising demand across toy, gaming, and educational sectors. According to Grand View Research, the global dice market size was valued at USD 1.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is fueled by the increasing popularity of tabletop games, role-playing games (RPGs), and the expanding e-commerce landscape that facilitates niche product distribution. As consumer preferences shift toward high-quality, aesthetically diverse, and customizable gaming components, manufacturers are innovating with vibrant color palettes, unique materials, and precision engineering. In this competitive landscape, a select group of producers has emerged as leaders in colored die manufacturing—combining craftsmanship, scalability, and design innovation to meet evolving market demands. Here’s a look at the top 9 colored die manufacturers shaping the industry today.

Top 9 Colored Die Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Sharples

Domain Est. 1997

Website: sharplesdie.com

Key Highlights: Sharples is a leading laser die manufacturer. We produce laser dies and related tooling using CNC bending, water-jet cutting, and lasers. Our renowned level ……

#2 RotoMetrics

Domain Est. 1998

Website: maxcessintl.com

Key Highlights: RotoMetrics, a Maxcess brand, is the leading manufacturer of state-of-the-art rotary dies, flexible dies, print cylinders, and other rotary tooling ……

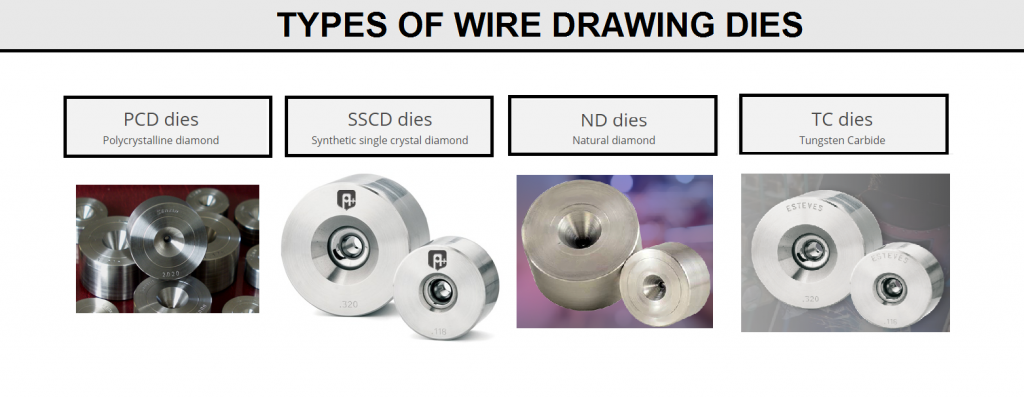

#3 Wire Drawing Dies Manufacturer

Domain Est. 2000

Website: sancliff.com

Key Highlights: Specializing in innovative Round & Shaped wire dies in TC PCD NC, Optical Fiber Coating & Coloring dies, Robust Strength Member Dies & the finest Ammunition ……

#4 Cutting Dies

Domain Est. 2014

Website: photocentricgroup.com

Key Highlights: Made from carbon steel, our cutting dies are strong, durable and reusable. Colour options available. We can apply colour coating to the die. Deep etch. The ……

#5 Dies

Domain Est. 1995

Website: hubbell.com

Key Highlights: Stainless Steel W Die Kit for Aluminum Connectors #8 AWG-350 kcmil (11 Sets). Color coded for crimping YA-A and YS-A types of connectors. Brand:Burndy….

#6 Custom Die Cutting – Gaskets, Thermal Pads, Absorbers

Domain Est. 1996

Website: nedc.com

Key Highlights: NEDC offers custom die cutting to a wide array of customers. We custom die-cut thermal pads, absorbers, epoxy films, and gaskets….

#7 Abbey Color: Where People Come to Dye

Domain Est. 1998

Website: abbeycolor.com

Key Highlights: Abbey Color Incorporated manufactures dyes, colorants, stains, and reagents from its Philadelphia facility to serve industries worldwide….

#8 United Die Company

Domain Est. 2010

Website: udico.co

Key Highlights: United Die Company founded 1940. Custom Tungsten Carbide Solutions. Our standard tungsten carbide dies and tooling can be customized to your specifications….

#9 Die Hard Dice

Domain Est. 2015

Website: dieharddice.com

Key Highlights: Dress for your best quest, with epic DND dice from the least unloved dice shop! 23000+ five-star reviews! Dazzling dice sets designed by gamers for gamers….

Expert Sourcing Insights for Colored Die

H2: 2026 Market Trends for Colored Dyes

By 2026, the global colored dyes market is poised for significant transformation driven by sustainability mandates, technological innovation, and shifting consumer preferences. Here’s a breakdown of key trends shaping the industry:

1. Sustainability and Regulatory Pressure Intensify

Environmental regulations will reach a critical inflection point by 2026. The European Union’s Green Deal and REACH restrictions, along with similar policies in North America and parts of Asia, are phasing out hazardous azo dyes and promoting circular economy practices. This regulatory push is accelerating the shift toward bio-based, non-toxic, and biodegradable dyes. Demand for certifications like Oeko-Tex, GOTS, and Bluesign will become standard, especially in the textile and apparel sectors.

2. Rise of Natural and Plant-Based Dyes

Consumer demand for eco-friendly products is fueling strong growth in natural dyes derived from plants, algae, and food waste. Innovations in extraction and stability—such as microencapsulation and enzyme-assisted dyeing—are overcoming historical limitations like poor colorfastness and scalability. By 2026, natural dyes are expected to grow at a CAGR exceeding 8%, with companies investing in sustainable sourcing and supply chain transparency to meet green branding goals.

3. Digitalization and Precision Dyeing Technologies

Adoption of digital printing and smart dyeing systems will expand significantly. These technologies reduce water consumption by up to 95% and minimize chemical waste compared to traditional methods. AI-driven color matching and IoT-enabled process monitoring improve batch consistency and reduce energy use. By 2026, digital textile printing is projected to capture over 15% of the global textile dye market, particularly in fast fashion and custom apparel.

4. Circular Economy and Dye Recycling

Closed-loop dye recovery systems will gain traction, especially in industrial clusters in India, China, and Turkey. Advanced filtration and membrane technologies enable the reuse of dye effluents, reducing environmental impact and operational costs. Brands are increasingly partnering with chemical suppliers to develop dyes designed for recyclability, aligning with extended producer responsibility (EPR) frameworks.

5. Shift in End-Use Applications

Beyond textiles, growth areas include sustainable packaging (e.g., biodegradable films), eco-friendly inks for 3D printing, and specialty dyes for electronics and biomedical applications. The automotive and interior design sectors are adopting low-VOC, UV-stable dyes for eco-conscious interiors. Meanwhile, demand in conventional sectors like leather and paper will stabilize or decline due to substitution and regulatory constraints.

6. Supply Chain Resilience and Regionalization

Geopolitical tensions and pandemic-era disruptions have prompted companies to diversify dye sourcing. There will be increased investment in regional production hubs—particularly in Southeast Asia and Eastern Europe—to reduce dependency on single suppliers. This trend supports shorter supply chains and faster time-to-market for sustainable dye solutions.

Conclusion

By 2026, the colored dyes market will be defined by eco-innovation, digital integration, and regulatory compliance. Companies that prioritize sustainable chemistry, invest in green technologies, and ensure supply chain transparency will lead the market. The transition from conventional to responsible dyeing is no longer optional—it’s a competitive imperative driven by policy, planet, and consumer demand.

Common Pitfalls Sourcing Colored Die (Quality, IP)

Sourcing colored die, especially in the semiconductor and electronics industries, presents several critical challenges related to quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to significant financial, legal, and operational consequences. Below are key pitfalls to avoid:

Poor Quality Control and Inconsistent Color Matching

One of the most frequent issues is inadequate quality control from suppliers, resulting in inconsistent coloration across batches. Colored die are often used for identification, sorting, or aesthetic purposes, and color variation can compromise traceability and brand integrity. Additionally, some suppliers may use substandard dyes or coating processes that degrade under thermal or environmental stress, leading to delamination, fading, or contamination of surrounding components.

Lack of Traceability and Material Certification

Many suppliers fail to provide full traceability or material certifications for the dyes and encapsulation materials used. This absence makes it difficult to verify compliance with industry standards (e.g., RoHS, REACH) or to troubleshoot field failures. Without proper documentation, manufacturers risk introducing hazardous substances into their supply chain or facing regulatory non-compliance.

Intellectual Property (IP) Risks and Unauthorized Replication

Sourcing colored die from unverified or offshore suppliers increases the risk of IP infringement. Some manufacturers may unknowingly obtain die that replicate proprietary designs, logos, or patented technologies. Furthermore, suppliers in regions with weak IP enforcement may reverse-engineer and resell proprietary colored die, leading to counterfeit products entering the market and damaging brand reputation.

Inadequate Testing and Reliability Data

Suppliers may not conduct rigorous reliability testing—such as thermal cycling, humidity exposure, or adhesion testing—on colored die. Without this data, integrators face unknown failure risks in end applications, particularly in automotive, medical, or aerospace environments where long-term reliability is crucial.

Overlooking Supply Chain Transparency

Relying on intermediaries or brokers without direct access to the original die manufacturer obscures the supply chain. This lack of transparency complicates quality audits, increases lead times, and heightens the risk of receiving counterfeit or diverted components.

Failure to Establish IP Agreements

Companies often neglect to formalize IP ownership and usage rights in procurement contracts. This oversight can result in disputes over design rights, especially when custom colors or markings are involved. Clear contractual terms are essential to protect proprietary information and ensure exclusive use of custom-colored solutions.

To mitigate these risks, buyers should conduct thorough supplier qualification, demand detailed material and test reports, perform on-site audits when possible, and include strong IP and quality clauses in supply agreements.

Logistics & Compliance Guide for Colored Die

Overview

This guide outlines the logistics and compliance requirements for handling, transporting, storing, and disposing of colored die used in manufacturing, quality control, or testing processes. Colored die may contain chemical dyes or pigments requiring specific handling protocols to ensure safety, regulatory compliance, and environmental responsibility.

Regulatory Classification

Colored die formulations vary by composition. Determine if the die is classified as hazardous under relevant regulations such as:

– OSHA Hazard Communication Standard (HCS)

– EPA Resource Conservation and Recovery Act (RCRA)

– Globally Harmonized System of Classification and Labelling of Chemicals (GHS)

Check Safety Data Sheets (SDS) for each product to confirm classification, including flammability, toxicity, and environmental hazards.

Storage Requirements

Store colored die in original, labeled containers in a cool, dry, well-ventilated area. Follow these guidelines:

– Keep away from direct sunlight, heat sources, and incompatible materials (e.g., strong oxidizers).

– Use spill containment trays or secondary containment to prevent leaks.

– Ensure storage areas are secure and accessible only to trained personnel.

– Segregate flammable die formulations in approved flammable storage cabinets if required.

Handling Procedures

Always use personal protective equipment (PPE) when handling colored die, including:

– Chemical-resistant gloves (e.g., nitrile or neoprene)

– Safety goggles or face shield

– Lab coat or protective clothing

Avoid skin contact and inhalation of vapors or mists. Use in well-ventilated areas or with local exhaust ventilation.

Transportation Guidelines

When shipping colored die, comply with:

– DOT (Department of Transportation) 49 CFR regulations for hazardous materials, if applicable

– IATA/ICAO rules for air transport

– Proper packaging: Use UN-certified containers, seal tightly, and include absorbent material if liquid

– Label packages with appropriate hazard labels, proper shipping name, UN number, and shipper information

– Provide shipping papers and SDS with each shipment

Spill Response

In case of a spill:

– Evacuate non-essential personnel

– Wear appropriate PPE

– Contain spill using absorbent pads, sand, or spill kits

– Collect contaminated material and place in a labeled hazardous waste container

– Decontaminate affected surfaces per site procedures

– Report spills per internal policy and regulatory requirements (e.g., state environmental agencies)

Waste Disposal

Dispose of used or expired colored die and contaminated materials in accordance with local, state, and federal regulations:

– Classify waste based on SDS and testing (if required)

– Store waste in compatible, labeled containers

– Use licensed hazardous waste disposal contractors where applicable

– Maintain documentation of waste manifests and disposal records for at least three years

Training & Documentation

Ensure all personnel involved in handling colored die receive:

– Hazard communication training

– Spill response and emergency procedures training

– Site-specific handling and storage protocols

Maintain up-to-date SDS files, training records, and compliance documentation for audits and inspections.

Emergency Contacts

Keep accessible:

– SDS for all colored die products

– Internal emergency response team contact

– Local fire department, poison control, and environmental agency numbers

– Spill response and first aid procedures posted in work areas

Revision History

This guide should be reviewed annually or when new die products, regulations, or processes are introduced. Update as necessary to maintain compliance and safety.

Conclusion for Sourcing Colored Die

After a thorough evaluation of potential suppliers, material options, color consistency, quality standards, and cost implications, sourcing colored die requires a balanced approach that prioritizes both quality and cost-efficiency. The selected supplier should demonstrate consistent color accuracy, use durable and stable materials, and adhere to industry standards for dimensional tolerances and performance. Additionally, factors such as minimum order quantities, lead times, and scalability must align with production demands.

It is recommended to partner with a supplier that offers certification of compliance, strong quality control processes, and the capability for customization if needed. Pilot testing of sample batches is essential to verify color fastness, uniformity, and compatibility with the intended application. Ultimately, establishing a reliable supply chain for colored die will support product consistency, enhance brand identity through accurate color representation, and contribute to overall manufacturing efficiency.

Ongoing supplier performance monitoring and periodic reevaluation will ensure long-term success and adaptability to future demands.